Bitcoin's creator envisioned a digital currency to replace fiat for everyday transactions so people could escape the traditional banking system. What can be more essential than buying food? Yet, in most places, you still can’t pay for groceries directly with crypto. So you would think that in 2025, you would be able to pay with crypto pretty much everywhere, but that’s not the case. If you want to buy food with crypto, we will give you a way so you will know how to buy food with crypto, it’s a straightforward process where you deposit crypto to your wallet, use it to buy one of our crypto cards, then load it with the crypto, connect the card to your Apple or Google Pay, and pay with your card in any restaurant or food venue you choose. The crypto card becomes an alternative to cash in every place where they take card payments, and it can also be used to withdraw cash from an ATM. This article will show you how to load your card and give you an example of how you can use crypto at restaurants and other food outlets.

Buying Food with Crypto

Using a crypto card is an indirect way to buy food with crypto. You load your card with crypto, but the balance on your card is in fiat currency (EUR or USD). Your card acts like any other card in the Visa or Mastercard circuit, and you can use it to buy goods in physical stores, groceries, or order takeaways. When you pay with the card or use Apple or Google Pay linked to the card, the merchant has no way of knowing your card was loaded from your crypto wallet, they just see a regular card payment.

Using a Crypto Card at Food Festivals

Food festivals around the world are a major attraction for visitors and residents. You can use your crypto card to pay for food at one of the many stalls without any issue or use an ATM before you go. Having cash is advisable because not all vendors may accept card payments. However, it is common for many modern events, especially those like the Salon du Chocolat in France or the Pizzafest in Italy, to have some vendors that accept card payments. Other parts of the world may be different, for instance, in China, Alipay and WeChat Pay are widely accepted, and you can link your crypto card to these apps, although there might be some limitations or occasional glitches with foreign cards. It is still a good idea to use your crypto card to withdraw cash, especially smaller bills (1s, 5s, 10s RMB), as some vendors might not accept foreign cards.

Restaurants and Food Outlets That Accept Crypto

According to research articles published in 2024, You can also pay for food directly with crypto in many outlets, either at the counter or from their website. Some of those listed below are franchise chains, and not all their outlets accept crypto as direct payment, but some do. Several food businesses and restaurants now accept cryptocurrency as a form of payment. Here are some notable examples showing how to buy food with crypto.

- Pubkey, the Manhattan bar and restaurant that became famous across the US when Trump paid with Bitcoin. In September 2024, during his second presidential campaign, Donald Trump used Bitcoin to pay for burgers and beers he bought for patrons of PubKey ahead of a Long Island campaign rally. The news made the front page of papers like the New York Post, which quoted the ex-president (now president-elect) saying, "I just made the first transaction in Bitcoin," to roars of approval from the crypto-loving crowd. The photo opportunity happened a week before Trump gave a speech on cryptocurrency.

- FlameStone American Grill and Beachwood Seafood Kitchen & Bar - These restaurants, owned by Nick Pappas, have been accepting Bitcoin since 2014. They also accept Ethereum and other altcoins like Dogecoin. Payments are made using a payment platform's mobile app, which converts the cryptocurrencies into Bitcoin for the restaurant.

- Burger King – Venezuela is the only place on the planet where you can walk into a Birger King outlet and use Bitcoin to pay for a burger. The initial plan was to cover dozens of store, but it is unclear how many location actually accept direct crypto payment. Burger King in Venezuela also accept Dash, Binance Coin, Litecoin, and Tether. In Germany, Lieferando, a delivery service that can bring Burger King products to you, accepts Bitcoin, in a way, if you order Burger King takeways via Lieferando you can use Bitcoin as a payment form. However, you cannot use crypto to pay in any of their outlets in Germany.

- KFC Canada introduced a "Bitcoin Bucket" that could be purchased with Bitcoin. The bucket was a limited-time offer processed by a payment platform and delivered directly to the customer's home.

- Whole Foods, owned by Amazon, accepts Bitcoin, Litecoin, and the Gemini dollar through an app allowing customers to buy groceries using these cryptocurrencies.

- Pizza Hut - In Venezuela, Pizza Hut accepts Bitcoin as a form of payment for pizzas, pasta, wings, and desserts.

- Pex Peppers, a hot sauce brand, accepts Bitcoin for online orders of their products.

Venues That Did Accept Crypto and Now Do Not

There were food chains that used to take crypto as a direct payment relying on the Bakkt consumer payment platform. In March 2023, they stopped accepting crypto when Bakkt closed their consumer app to concentrate on B2B business. For instance:

- Starbucks allowed customers to pay with Bitcoin through a partnership with Bakkt using their app to convert the cryptocurrency into fiat currency, which was then credited to Starbucks' account. You paid directly with crypto; they received cash.

- Quiznos, a fast-food chain, accepted Bitcoin payments through the Bakkt payment gateway. This arrangement was available at select locations, particularly in Denver, Colorado. Customers paying with Bitcoin could receive incentives such as $15 worth of Bitcoin.

Venues That Accept Crypto Indirectly

There are third party providers that sell you gift cards for many restaurant chains in the US (e.g., Buffalo Wild Wings, Burger King, Chili, Carrabba's Italian Grill, McDonald's) and allow you to pay using Bitcoin, however the restaurants do not accept direct crypto payments. You can also top up your Uber Eats account or buy McDonald's gift cards using Bitcoin, although these businesses do not accept direct crypto payments.

How To Buy Food With Crypto: A Step-By-Step Guide

You can buy food indirectly with cryptocurrency by loading our cards with crypto from your wallet, which will automatically be converted into the fiat currency of your choice. Just follow the steps below.

Step 1 – Login To Your Plasbit Dashboard

Go to the wallet section.

Step 2 – Deposit your crypto.

Deposit the crypto of your choice. Our wallets accept several cryptocurrencies. The example in the image below shows Bitcoin, but you can deposit Ethereum, Litecoin, Tether, USD Coin, and other crypto

Step 3 – The Card Section

Head over to The Card Section. Select the Crypto card in your preferred currency, USD or EUR, and order the card by clicking "Get This Card". The image below shows a EUR-based virtual card.

Step 4 – Chose how to pay for the card

Choose the crypto wallet you want as the payment wallet to buy the card. The image below indicates a Euro-based virtual card purchased from your Bitcoin wallet.

Step 5 – Wait For the Card Confirmation.

You will receive an email notification once your crypto card has been successfully issued.

Step 6 – Card issued

You will receive an email once your virtual card has been successfully issued.

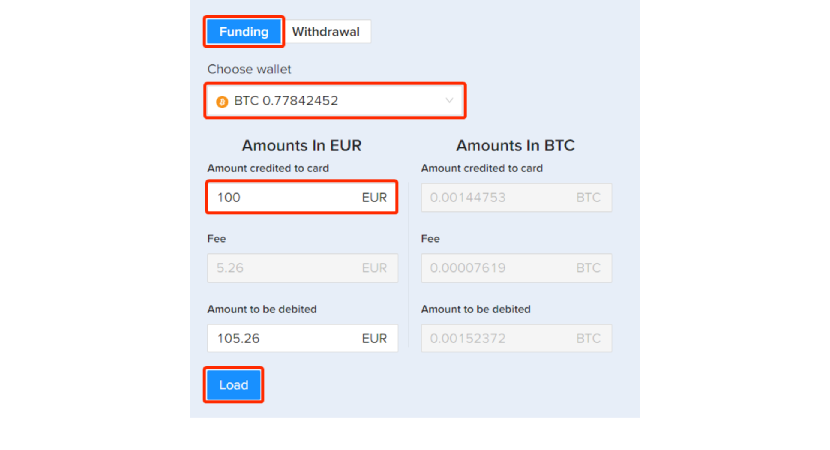

Step 7 – Load your card.

Revisit the "Cards" section and click the "Open Details" button. Navigate to the "Funding" tab and deposit the amount you wish from the crypto wallet you want to pay with, then press the "Load" button and press "Submit".

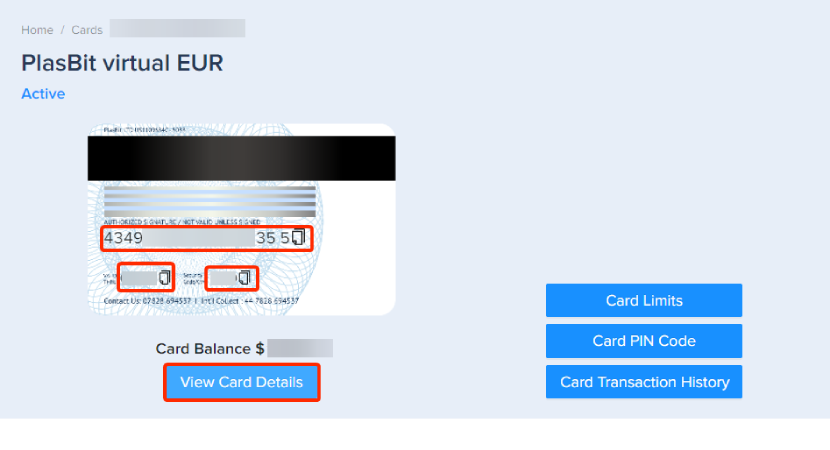

Step 8 – Get your card details

Press the "View Card Details" button to access the card details, including the card number, expiry date, and CVV.

Now you are all set and can use your crypto card.

Step 9 - Add the card to your Apple or Google Pay.

We have prepared two guides to help you add your Plasbit card to Apple Pay or Google Pay.

1) This is the guide for Apple Pay

2) This is the guide for Google Pay

Step 10 - You're all set

Now, you can tap at any store that accepts credit cards.

Crypto and NFT-themed Restaurant

Several restaurants around the world have incorporated crypto and NFT themes into their operations; they are at the forefront of integrating cryptocurrency and NFTs into the dining experience, offering unique themes, payment options, and exclusive perks for NFT holders.

Welly's Food Restaurant

Based in Italy, Welly's is a burger restaurant associated with the Shiba Inu cryptocurrency. The restaurant has rebranded itself with a Shiba Inu theme, adopting the Shiba Inu dog as its official mascot and updating its logo and overall branding to reflect its image. Welly’s accepts Shiba Inu's native cryptocurrency, SHIB, as a payment method and integrates it into its transaction system. The restaurant is governed and powered by the Shiba Inu community through the Doggy DAO, which allows the ShibArmy to have a voice in the direction of the business. It includes decisions on the deployment of new stores and other business strategies. The restaurant contributes to burning SHIB tokens through various methods, such as a percentage from franchise fees and company net profits. This mechanism helps reduce the circulating supply of SHIB and is seen as a utility for the Shiba Inu ecosystem.

The Flyfish Club

The Flyfish Club is a private dining club in New York City, it utilizes NFTs in an innovative and utility-based manner to manage access and membership. To join the Flyfish Club, individuals must purchase an NFT as their membership token. These NFTs are sold on the blockchain using Ethereum, and the sales generated approximately $14 million to $14.8 million before the club's opening. There are two levels of membership NFTs: the "Flyfish" token and the "Flyfish Omakase" (or "Flyfish EE") token. The NFT acts as a digital certificate, enabling seamless verification of membership status. Members must connect their wallets to the reservation system to prove ownership of the NFT and gain entry to the club. Members can sell or lease them to others. It creates a secondary market where NFTs can be traded, and members can profit from reselling their tokens. Every time an NFT is sold, a 10% fee is deducted and goes to the VCR Group, the founders of the Flyfish Club. The NFT provides an additional revenue stream for the club. NFT holders gain access to various exclusive benefits, including gourmet and social events, a private dining room, an outdoor area, a cocktail lounge, and a Japanese-style omakase room. Members also receive annual membership dues of $500 and a $500 credit for food and beverages within the club.

Crypto Street Restaurant

Crypto Street Restaurant, in Clearwater Beach, Florida, features a menu with dishes named after popular cryptocurrencies. It aims to promote cryptocurrency usage among its customers and has a crypto-centered theme. Located at Residence Inn by Marriott Hotel, the restaurant features a purely crypto-centered menu. The idea behind the menu is Hispanic and American food, with names of food items dedicated to crypto and Hispano-American cuisine. A few items on the menu are the cocktail named 'Shiba shrimp', 'crypto-cuban' sandwiches, 'DeFi caesar' salad, 'bitcoin and split', and 'nutty-protocol' salad. The restaurant decor contains Bitcoin and Ethereum elements, with the walls depicting a rocket launching for the moon, popular in the "to the moon" meme in crypto culture. Statements made by SpaceX and Tesla owner Elon Musk, who tweeted publicly about his support for Dogecoin, also dons the wall.

Lion’s Milk Café

Lion's Milk Café showcases NFTs on its screens and has a rotating NFT exhibit inside the shop. The cafe accepts payments in cryptocurrency, and NFT inspires the entire decor. The cafe hosts many crypto events and activities while accepting online and in-person payments made with cryptocurrency. Located in Brooklyn, New York, the cafe is ideal for crypto enthusiasts expecting to enjoy coffee. Their Twitter profile dons a Mutant Ape PFP from the Mutant Ape Yacht Club collection, an extension of the highly popular Bored Ape Yacht Club NFT. The cafe accepts cryptocurrency payments, although Ether is the least preferred due to the high transaction costs. The Lion Milk Café's NFT collection features 10,000 unique NFTs with a poly geometric design.

Other examples of NFT-themed restaurants

- Piya- This Thai-based restaurant, listed by Chef Bee, includes a private omakase dining room and a fast-casual area. It is designed for NFT enthusiasts and offers exclusive events and other membership perks for NFT holders.

- Goi Rolls - A Vietnamese blended food concept that offers physical rewards to holders of its NFT collection, listed on OpenSea. This restaurant uses NFTs to engage with customers and offer exclusive perks.

- Authentic Burger Boy - Known for its NFT-themed burgers, it includes components like the Fancy Boy, which features a classic character dressed formally. These NFTs serve as memberships, offering exclusive experiences.

- CamboFlare - This restaurant is working on launching its own token, Cambocoin, to ease the payment process and attract more people into the crypto space. It offers captivating offers to draw in customers.

Crypto Wallet As Bank Accounts

Nowadays, most people use crypto as an investment asset, however, once you have a Plasbit crypto card, crypto becomes what the original Bitcoin creators meant: a digital alternative to cash. Your crypto card is a card like any other; you can use it until you have spent the balance on the card and then put more money in it from your crypto wallet. The card works like any card associated with a bank account, so you can use it to pay bills, withdraw cash from an ATM, and make everyday purchases. The only difference is that you load your card from your crypto wallet. In a way, you turn the wallet into an alternative bank account.

Using a Crypto Wallet as a Bank Account

When you move from one country to another, opening a bank account in the new country could be a long-winded process. You can use your crypto card as an interim alternative while your first bank account in that country is sorted out. The alternative would be using cash, but that has disadvantages like the risk of being robbed or losing the funds. Nowadays, it is almost impossible to pay some bills using cash, and cash purchases above a specific amount lead to questions being asked. Using your crypto card avoids those questions.

Advantages of Using a Crypto Wallet as a Bank Account

Using a crypto wallet as a substitute or complement to a traditional bank account offers several significant advantages:

- Speed and Accessibility - Crypto wallets enable fast and efficient transactions, often processing cross-border payments in seconds, unlike traditional banking, which can take considerably longer. Also, transactions can be facilitated 24/7, 365 days a year, without the restrictions of banking holidays. Moreover, even online banking transactions are subject to banking hours in some countries.

- Cost - Crypto transactions typically involve lower fees than traditional payment methods, especially for international transfers, including reduced exchange rate fees and other transaction costs.

- Global Reach and Decentralization - Crypto wallets operate worldwide, allowing seamless cross-border transactions and enhanced accessibility to a broader range of financial institutions. This decentralization means users are not reliant on central authorities or banks to make transactions.

- Security - Cryptocurrencies use advanced encryption and security protocols to safeguard users' assets and personal information. This level of security reduces the risk of fraud and identity theft compared to traditional payment methods.

Disadvantages

Crypto wallets offer some unique advantages but also have significant disadvantages that make them less suitable for many users as a replacement for traditional bank accounts.

- Volatility and Price Fluctuations - Cryptocurrencies are known for their high price volatility, which means the value of your holdings can fluctuate wildly and rapidly. Therefore, they are unreliable for storing value or making everyday transactions, as the value could drop significantly in a short period.

- Security Risks - while crypto wallets offer a degree of security, they are not immune to risks. Users can lose access to their funds if they lose their private keys or their wallets are compromised by hacking, phishing, or other malicious activities. Unlike traditional banks, there is no way to reverse or cancel a cryptocurrency transaction once it has been sent.

- Regulatory Uncertainty - The regulatory status of cryptocurrencies is still unclear in many jurisdictions, which can lead to sudden regulatory changes that might affect the usability and value of your cryptocurrencies. This uncertainty can cause market-wide price drops and make it challenging to sell your cryptocurrencies.

- Lack of Consumer Protections - Unlike traditional banking, cryptocurrency transactions do not have the same level of consumer protection. There are no guarantees or insurance to protect your funds in case of a breach or fraudulent activities.

- High Transaction Fees and Gas Fees - While crypto transactions can be cheaper for cross-border payments, they often come with significant gas fees and network traffic costs, especially during high network congestion. These fees can make small transactions impractical. Using a Plasbit crypto card makes those small transactions feasible since you use the cash you loaded into your card from your crypto wallet in advance.

- Environmental Impact - The environmental impact of cryptocurrencies that use proof-of-work mining protocols, such as Bitcoin, is significant due to high energy consumption. Environmentally conscious users may be concerned.

- No Interest or Traditional Banking Services - Crypto wallets typically do not offer interest on holdings or other banking services such as loans, overdrafts, or credit cards. While some crypto services offer staking rewards, these are not equivalent to traditional banking services.

The Power of the Crypto Card

If you are wondering how to pay for food with crypto, a crypto card is the most flexible and widely accepted way. It is possible to use crypto directly in some venues or for online purchases, but, at the moment, those venues are few and geographically far between. Moreover, some venues that accept crypto for online or on-site purchases usually take a specific crypto or a small range of cryptocurrencies. A Plasbit crypto card loaded from your crypto wallet is a more flexible payment instrument since the wallet supports a wide range of currencies. Once you have loaded the card, you have a balance in one of two fiat currencies (EUR or USD), and you can then use it like any other card to make purchases and withdraw cash from ATMs worldwide.