Every game where players can win money from each other always ends the same way — one player gets all the money while everyone else goes bankrupt. That is because the money we’re using in those games mimics the fiat currencies we use in real life, and they both encourage monopolies and runaway success, and if the losers think that’s not fair, the only thing they can do is flip the table and start a riot. Cryptocurrencies provide more equal opportunities for success than any other form of money in history, but they still need crusaders like Dustin Trammell who will strive to fix their flaws and spread the word of them around. Who is Dustin Trammell? He is one of the earliest adopters of Bitcoin, who got into it after reading the whitepaper and emailing Satoshi Nakamoto directly about it, and he continued the discussion by providing feedback, bug reports, and software improvement ideas. Trammell also mined Bitcoin in its early days and received BTC directly from Satoshi. He currently acts as the co-founder of Trammell Ventures, a venture capital firm focused on cybersecurity, Bitcoin, and blockchain technology.

Monopoly, a Game Where Cheating Is a Мust

Monopoly is the ideal game to understand why fiat is unfair and why any system based on it is fundamentally broken, but on the surface, it looks like the most boring game ever. Players take turns rolling dice, going around the board, getting money, buying land, building houses and hotels on that land, and paying each other rent when they visit the other person’s property. The vast majority of Monopoly games end with players getting bored to tears and giving up, while the rest end in a riot because someone tried to cheat. The latter outcome seems much closer to what the makers of Monopoly had in mind, seeing how there is no rule that forbids cheating or punishes cheaters, and there is even a hint that players are supposed to gang up on others and bully them.

The rule suggests that players can make alliances

If players can make an alliance to help each other, then they can obviously make one to bully others, such as by stealing their money and land through sleight of hand, and they can even gang up on the weakest player to make him quit. There is no authority that can stop this bullying or even enforce the rules of the game except the Bank, represented by one of the players that hands out money, and the Bank can also secretly or openly favor or bully others. It’s total anarchy at the Monopoly board, and the sobering part of Monopoly rules is that there is no reward for playing fair. Those who try to play fair will either have the most boring night of their lives (if others play fair as well) or will be victimized by the experience (if one or more players bully them).

Monopoly Money Creates Victims

The core issue with Monopoly is that its money turns anyone who tries to earn it fairly into a victim that becomes a part of a permanent underclass. The victims rely on dice rolls to get small sums of money every once in a while, but those same dice rolls can take money away from them or waste their time, leaving them struggling to make ends meet and in a constant fear of bankruptcy. On the other hand, a bully can get rich quickly, buy up the land, and stack his properties on it, turning in-game real estate into a source of income that relies on a constant supply of victims that have to go into debt and work overtime just to pay rent, with any random expense possibly bankrupting them. The danger of debt and bankruptcy keeps the victims in check. They dutifully wait for their turn, roll the dice, go around in circles, pay their fines, scrounge up some money to buy a house, and never stop to wonder if the game is rigged against them. Even if they did, what are they supposed to do? So, they keep themselves busy and start believing that, as long as they follow the rules and don’t try to cheat or bully anyone, they just need to be patient and work hard, and everything will turn out fine. That is never the case, and all it takes is a string of unfortunate events for them to end up penniless and out of the game. However, it can happen that a bully decides to openly cheat, at which point the victims suddenly realize the game is rigged, flip the table, and start a riot.

Cryptocurrencies Allow for a Victimless Society

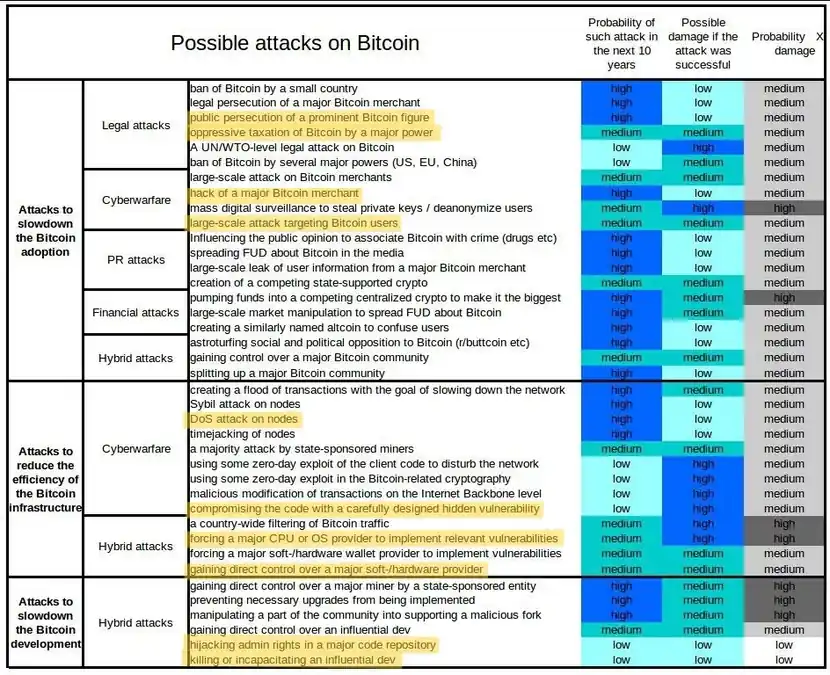

A real-life society is more complex than the one in Monopoly because it has more nuanced laws and rules that are better enforced, but the ultimate outcome is still a permanent underclass of victims who have little to no say in how the financial system is set up. If they realize it and start rioting on a big enough scale, the entire system crashes, and it takes a few years of turmoil before it is rebooted and the game starts over, possibly with a few updated rules to keep the victims happier and less likely to rebel. That cycle has arguably happened countless times throughout history, but now there is a chance to avoid it altogether thanks to cryptocurrencies. While cryptocurrencies have their flaws, and they too can create bullies and victims, they represent the possibility of the creation of a new kind of society, one where money isn’t controlled by a central bank or a government. Instead of relying on real estate or cheating, cryptocurrencies reward knowledge and timely information, and anyone can get them alone or as part of their own team. For example, anyone can look at the Bitcoin source code and see potential problems coming years before they happen. The Bitcoin community on Reddit did just that and came up with a list of 39 ways Bitcoin can be attacked, ranging from government bans to filtering of BTC traffic.

Bitcoin has many flaws, but they are openly discussed

We at PlasBit had a discussion on the same topic and reached a consensus on which attacks are the most likely, indicated with the yellow highlight in the image above. If I had to pick one, I’d put my money on the denial-of-service attack on nodes, especially that coming from internet-of-things devices in Asia, which I think are already involved in some devastating DoS attacks. If China wanted to launch a competitor to BTC, that would be the perfect way to cripple Bitcoin and nudge users to switch over without raising suspicion. Anyone can start a similar discussion on crypto weaknesses and possibly figure out a vulnerability in BTC that will make them rich or make everyone else bankrupt. Now that jogs the brain, doesn’t it? Those who find flaws in cryptocurrency code can also decide to help fix them for the betterment of the cryptocurrency and the people who are using it. Fixing cryptocurrencies can be as simple as discussing them to point out the obvious details that might have been missed or misunderstood by others. The cypherpunk mailing list, which was organized by Eric Hughes, has shown that intelligent discussions by observant participants are a gold mine of useful ideas, leading to the creation of actually usable products and services even decades later, though it takes time to sift through the content and eliminate noise. That’s where Dustin Trammell comes into the picture, as he is one of the first people to have used Bitcoin, not to profit off of it, but to fix its flaws and spread it far and wide as possible.

What Did Dustin Trammel Discover? Early VoIP Research and Business Insights

Dustin Trammel lives in Austin, Texas, and describes himself as “Information Security Research Scientist turned Entrepreneur and Venture Capitalist.” He started his crusade for fair cryptocurrencies in 2005 by working for Citadel and Sipera Systems, two companies that wanted to know the vulnerabilities in their protocols and software that enabled voice calls over the internet (VoIP). He relished in tearing apart those protocols and products in between attending hacking conferences such as BlackHat and DefCon in Las Vegas, where he occasionally spoke on VoIP weaknesses. In his “Does backwards compatibility stifle innovation and progress” blog post from 2005, he wrote that the VoIP industry struggles with innovating because every new product or protocol has to maintain backwards compatibility and account for legacy hardware, software, the (likely outdated and poorly maintained) infrastructure, and even some users’ unique devices, which slows innovation down to a crawl.

Companies who are already entrenched in the VoIP business have their own interests and most likely make money by providing their customers with a workaround for some systemic problem, which means they aren’t interested in upgrades or new solutions and will likely push against them. Dustin reasoned that email providers face a similar situation, though in their case it’s because they use the insecure SMTP protocol that allows spam. If someone proposed a new email protocol that got rid of spam, email providers would no longer be able to sell their anti-spam services and products, so it would be in their interest to smother the proposal or buy out the startup that’s developing it. He added that creators of antivirus solutions are in a similar situation, having zero interest in figuring out how to stop viruses in the first place. All we need for progress, he concluded, is an individual or a company that is willing to do its thing and innovate without selling out.

Dustin Advocates for Full Disclosure of Software Vulnerabilities

If there is no use arguing with entrenched businesses to change their ways, be they in the VoIP, email, or antivirus industry, what can a single person do to start their own crusade to change the system? One possibility is to essentially tear apart the flawed protocol or product until the vendor responsible for it decides to fix it, which can be done by just talking about their flaws. In his 2007 blog post on the topic, Dustin proposed two different approaches when it comes to dealing with software vulnerabilities as a researcher who discovered one or more of them:

- keep them secret

- reveal them to everyone (full disclosure)

What if We Keep Software Vulnerabilities Secret?

In 2018, Mark Zuckerberg famously said, “Security is not a problem you ever fully solve.” He was referring to the fact that Facebook only spent money on upgrading the security of the platform when security breaches caused several hacking and privacy scandals. Soon after, Mark dropped Facebook’s “move fast and break things” motto and stopped pretending that Facebook doesn’t have issues and that not talking about them will minimize their importance. Dustin came to the same conclusion, writing in his post that keeping vulnerabilities secret doesn’t work because it encourages inaction. It’s only when inaction starts hurting the vendor’s bottom line that it will act and fix the vulnerabilities, but before that it might even act against people trying to remedy or fix them. Some researchers have tried to carefully warn vendors about the flaws in their products and systems, but they would either be ignored or even threatened with legal action by the vendor for doing so. They could try to do what Dustin and others call “responsible disclosure,” which means warning the vendor a few days or weeks before warning the public, but there is no guarantee that that approach would work.

What if We Fully Disclose Software Vulnerabilities?

For Dustin, full disclosure is the only way to deal with software vulnerabilities. Publicly revealing every flaw in some product, protocol, or part of the infrastructure attracts media attention and forces businesses who profit off of those flaws to either fix them or deal with angry and rebellious users exploiting those flaws for themselves or leaving the business. He argued that it also leads to healthy peer review of the flaws, which is why open source software is, in his opinion, much more secure than the proprietary alternatives. In some areas, such as cryptography, the experts will only accept full disclosure and will not even consider any proprietary code or a product that is kept secret. In another of his blog posts from 2007, Dustin compared the systemic vulnerabilities in the information security industry with those in the war on drugs, writing that there is no incentive for those in power to fix them in either case. A device or software product that prevents intrusion into a network is essentially policing users who want to access that network, which is close to how a government polices drug users who want access to something rather than addressing the underlying problems. In Dustin’s opinion, both cases are where government legislation can shift the cost of exploitation to vendors from users, who I might add are just victims. In my opinion, such fair legislation will never happen because governments often create rules and laws that benefit bullies rather than victims.

How Dustin Started His Bitcoin Crusade

As Dustin explained on the Stephan Livera podcast in 2021, he was a member of the cypherpunk cryptography mailing list when Satoshi announced the Bitcoin project on it. Dustin skimmed through the Bitcoin whitepaper and downloaded the client, which looked fine but had a quirky interface. At that time, the Bitcoin client did not have mining enabled by default, and out of sheer curiosity Dustin enabled it on a few of his computers to see how to mine and to send some BTC to himself. Whenever it was started, the client would boot up and search for its peers. Dustin said it would produce only one result, which was presumably Satoshi. That makes Satoshi the first node on the BTC network and Dustin the second, and their email exchange corroborates that story because it does not mention any other node on the BTC network at that time. Dustin had no idea Bitcoin would grow as big as it did. He considered BTC a novelty that was the perfect gift to be handed out by the thousands at hacking conferences and speaking events, so that’s what he did at his expense. Dustin even bought physical tokens that looked like golden and silver coins and gifted those as well at renaissance fairs where he cosplayed as a druid. The coins had a scratch-off surface on the reverse side with access information to a Bitcoin wallet with some BTC in it, again at his expense. Some coins were never spent, making them valuable collector's items. There is no indication that Dustin had ulterior motives for doing it, and I got the impression that it was his Bitcoin crusade that he thoroughly enjoyed.

Dustin made a brilliant marketing move by sharing BTC in an organic way

What Are Dustin Trammell Satoshi Emails? The Revelation of Satoshi’s BTC Plans

Cypherpunk mailing lists with hundreds of participants were lively but chaotic, and few could stand the drama surrounding them. On the other hand, mailing lists with a handful of people were more relaxed and casual. Dustin and Satoshi found each other in one such casual mailing list where expectations were low before having a private email conversation about this new thing called Bitcoin. What are Dustin Trammell Satoshi emails? It is an email exchange between Satoshi Nakamoto and Dustin Trammell that spanned January 12–25, 2009. Their discussions delved into the initial release of Bitcoin v0.1, covering topics such as software performance, transaction processes, security measures, and potential applications. Trammell provided feedback on the software's functionality and user experience, while Satoshi addressed these observations and outlined plans for future improvements. In the email exchange, Satoshi revealed his plans for Bitcoin. He imagined that it could be used to prevent spam altogether by setting a BTC price on an email address before any email could be sent to it, but he also mentioned that BTC could eventually be used to buy digital subscriptions or as a currency in video games. Satoshi even offered to send Dustin 25 BTC, which he accepted. In return, Dustin ran some tests on the Bitcoin client by sending himself some BTC from different IP addresses.

Is Dustin Trammell Satoshi? No, Unless He Has a Split Personality

After Bitcoin became a household name, rumors started swirling that Dustin was Satoshi. He could ignore those rumors only so long before having to address them. Is Dustin Trammell Satoshi? No, according to an article posted by him in November 2013, he claims that his email with Satoshi is proof he can't be Bitcoin's creator unless he has some sort of Fight Club-esque split personality. Dustin explains that he was simply a security researcher, a fan of cryptography as well as a Libertarian, which naturally drew him to reading Bitcoin's whitepaper when it was first posted by Satoshi. In that same text, Dustin Trammell puts an end to the speculation that he was involved with Silk Road. He does admit to sending 1,000 BTC to a wallet, but he says it was a Mt. Gox wallet that he funded so that he could trade on the platform. The speculation came from two Israeli researchers who made a flow analysis of BTC across wallets to find the identity of a large funding source of Silk Road but wrongly identified the owners of those wallets.

What Is Dustin Trammell Block 286? A Piece of Bitcoin History

To further cement the idea that he is not Satoshi, Dustin ran his own flow analysis of BTC, pointing to a certain early block. What is Dustin Trammell block 286? It is a block that funded the address used to send 25 BTC, which Satoshi probably mined, to Dustin Trammell on January 14, 2009. The block is referenced in a September 2022 post by Dustin as evidence that he is not Satoshi, pointing out that he was the recipient of the coins, not the miner. Dustin was reluctant to get involved in the BTC drama because for him Bitcoin was not about making money. He got involved in testing the BTC network right after Satoshi, and promoted BTC because he felt the project deserved it and because he is a crusader who enjoys taking up challenges and will fight for them all alone, if that’s what it takes.

Nobody Holds a Monopoly on Our Future

In the Stephan Livera podcast, Dustin mentioned that in 2020 the US government printed 25% of all USD in existence. That massive influx of fiat into the global financial system affected all USD savings, which might not have been devalued 25% overnight, but they certainly lost a good chunk of their value in the following years. None of us had any say in it, yet we all felt it because we’re all a part of the fiat financial system that is designed to make us victims who live to serve bullies. It feels like there is a global awakening coming in which the entire victim underclass will realize this, flip the table, and start a riot, and it was due in 2020 only to be stopped by the pandemic lockdown measures, but I think there’s now an alternative future for those smart enough to see it. What I discovered writing for PlasBit is that there are principled individuals and companies in the crypto industry fighting their own crusades, and that’s exactly what the industry needs to change the society for the better. We at PlasBit are outspoken, self-reliant, self-funded, and we will absolutely not stop, just like Dustin refused to stop sharing BTC. Having people like Dustin and companies like PlasBit around is crucial to making sure nobody holds a monopoly on our future, be it through fiat or any other means.