In this guide, we'll explore Who accepts cryptocurrency as payment? and take a look at the top companies that accept cryptocurrency, discuss the pros and cons of paying with crypto, provide a solution for transactions with companies yet to adopt crypto, and examine the causes behind the growing trend of companies accepting digital currencies.

List of Companies that Accept Cryptocurrency

Who accepts cryptocurrency as payment? Let's start with a curated list of major companies across various industries that have embraced the use of cryptocurrencies for transactions:

Microsoft:

Microsoft, a true technology behemoth, is pioneering in embracing cryptocurrency payments. With a forward-thinking approach, Microsoft has positioned itself at the front of digital innovation, offering a seamless avenue to purchase digital content and services using Bitcoin. This strategic move underscores Microsoft's commitment to staying on the cutting edge of technological advancements. It showcases its dedication to providing customers with a flexible and diversified range of payment options. Microsoft integrates cryptocurrency into its ecosystem, aligning with the growing global digital finance trend. It sets a precedent for other industry leaders, illustrating the transformative potential of embracing decentralized forms of currency in digital commerce.

Overstock:

Overstock has emerged as a pioneer in adopting cryptocurrencies, marking a significant milestone in integrating decentralized digital assets into mainstream commerce. Going beyond the conventional norms of online transactions, Overstock has embraced Bitcoin as a legitimate and widely accepted payment method. This progressive approach extends beyond acknowledging digital currencies, as Overstock allows customers to utilize Bitcoin across a diverse spectrum of products – from stylish furniture to cutting-edge electronics. By doing so, Overstock recognizes the transformative potential of cryptocurrencies in reshaping traditional financial landscapes and provides its customer base with a decentralized and secure payment alternative. This bold move positions Overstock as a trailblazer in the evolving realm of e-commerce, setting the stage for a new era where the seamless integration of cryptocurrencies becomes a hallmark of progressive and customer-centric retail practices.

Whole Foods:

Whole Foods, a renowned grocery chain under the ownership of Amazon, has embraced digital currency transactions through its strategic partnership with payment processor Flexa. This collaboration has enabled Whole Foods to integrate Bitcoin payments into its repertoire of accepted methods, presenting customers with an innovative and decentralized way to settle bills for groceries and everyday essentials. This bold move aligns with the growing trend of cryptocurrency adoption and signifies the extension of digital currencies into mainstream consumer experiences. Whole Foods' commitment to diversifying payment options reflects a forward-thinking approach within the retail sector and underscores Amazon's influence in driving innovation across its subsidiaries. As customers navigate the aisles for their daily needs, the acceptance of Bitcoin at Whole Foods exemplifies the evolution of traditional brick-and-mortar businesses into dynamic hubs that cater to the preferences and demands of a digitally connected consumer base.

Tesla:

Tesla, led by the visionary entrepreneur Elon Musk, propelled the automotive industry into digital finance by announcing the acceptance of Bitcoin payments for their electric vehicles. This strategic decision marked a significant milestone, positioning Tesla at the forefront of companies embracing decentralized forms of currency. By integrating Bitcoin as a payment method, Tesla aligned itself with the evolving financial landscape and catered to a burgeoning consumer base interested in digital assets. Elon Musk's influence in the tech and business realms and Tesla's reputation for innovation brought widespread attention to the convergence of cutting-edge technology and traditional industries. The acceptance of Bitcoin for purchasing electric vehicles signaled a departure from conventional payment methods, demonstrating Tesla's commitment to pushing the borders of what is possible in the intersection of technology, finance, and automotive excellence.

Expedia:

Expedia has positioned itself as a trailblazer by wholeheartedly embracing cryptocurrencies for hotel bookings. This strategic move signifies a pivotal shift in how travelers plan and pay for accommodations, as Expedia now offers customers the option to use Bitcoin as a means of payment seamlessly. By incorporating this decentralized currency into its platform, Expedia not only stays ahead of the curve in technological advancements but also provides a novel layer of convenience and choice for a global community of travelers. This evolution aligns with the increasing demand for flexible and borderless payment methods, particularly in an industry where international transactions are commonplace. Expedia's integration of cryptocurrency into its booking process reflects a dedication to meeting the diverse needs of its customers, offering a forward-thinking and inclusive approach to travel planning that mirrors the growing influence of digital currencies in shaping the future of global commerce.

AT&T:

AT&T, a telecommunications giant, has seamlessly integrated cryptocurrency payments into its billing system. This strategic move positions AT&T as a frontrunner among traditional non-tech sectors adopting the transformative capabilities of digital currencies. By allowing consumers to pay their bills using Bitcoin, AT&T demonstrates a commitment to innovation and acknowledges the evolving landscape of financial transactions. This integration goes beyond the conventional realms of telecommunications, highlighting the increasing adaptability of cryptocurrency in diverse industries. AT&T's foray into accepting Bitcoin payments caters to a tech-savvy customer base. It symbolizes a broader shift towards the mainstream acceptance of decentralized forms of currency, signaling a significant step forward in the ongoing digital revolution within traditional sectors.

KFC:

In a bold and experimental move, some branches of the globally popular fast-food chain have opened their doors to Bitcoin transactions, enabling customers to savor their favorite meals with the decentralized currency. This dynamic initiative demonstrates KFC's willingness to explore emerging technologies and highlights cryptocurrency's adaptability in catering to diverse consumer preferences. Integrating Bitcoin as a payment method at select KFC locations signals a departure from traditional transaction modes within the fast-food sector, showcasing an openness to embrace the evolving financial landscape. As the fast-food giant adopts this innovative approach, it sets a precedent for the industry, emphasizing the potential for decentralized currencies to become integral components of the everyday purchasing experience, even in sectors traditionally associated with quick and convenient transactions.

Subway:

Subway, a fast-food giant renowned for its diverse menu of sandwiches, has embarked on a journey into cryptocurrency payments. Subway has explored Bitcoin payments at select locations, underscoring the company's commitment to staying abreast of technological advancements. This strategic initiative reflects a forward-thinking approach, providing customers with an additional avenue to engage in digital currency transactions. The sandwich chain's foray into cryptocurrency payments aligns with the growing trend of decentralized financial systems and represents a departure from traditional payment methods within the fast-food industry. By offering this innovative payment option at certain locations, Subway caters to tech-savvy consumers. It contributes to the broader conversation surrounding the integration of digital currencies into everyday transactions, highlighting the evolving landscape of global commerce in the 21st century.

PayPal:

PayPal, a major online payment platform, has firmly embraced cryptocurrencies. While not a traditional retail entity, PayPal has become a trailblazer by integrating cryptocurrency transactions into its platform. This strategic move lets you buy, sell, and hold cryptocurrencies directly through your PayPal accounts. This innovation represents a substantial departure from conventional payment methods, underlining PayPal's recognition of the transformative potential of digital currencies. By allowing you to use cryptocurrencies seamlessly, PayPal caters to the increasing demand for diverse financial services and plays a pivotal role in shaping online payments. This integration positions PayPal at the forefront of financial technology, reflecting a forward-thinking approach that resonates with the dynamic nature of the modern digital economy.

Starbucks:

The coffee giant Starbucks has delved into exploring cryptocurrency payments, marking a notable intersection between the world of coffee and cutting-edge financial technology. While not yet available globally, specific Starbucks locations have ventured into accepting Bitcoin as an experimental payment option. This forward-thinking initiative provides coffee enthusiasts a tech-forward and alternative way to indulge in their favorite brew. By embracing the integration of cryptocurrency payments, Starbucks not only taps into the evolving preferences of its customer base but also positions itself at the forefront of the intersection between traditional retail and the burgeoning digital financial landscape. Although in the experimental phase, Starbucks's potential expansion of cryptocurrency acceptance highlights a broader trend within the retail industry, where major players actively consider digital currencies' role in shaping consumer transactions' future. As Starbucks navigates this innovative path, it sets the stage for a dynamic and tech-savvy approach to the intersection of retail and financial technology.

Newegg:

Newegg, a leading retailer, has taken a significant stride by wholeheartedly embracing cryptocurrency payments. Catering to the tech-savvy consumer base, Newegg allows customers to seamlessly purchase a diverse array of tech products, integrating Bitcoin as a payment method. This strategic integration underscores the adaptability of digital currencies within the electronics retail sector, marking a departure from traditional payment methods. By incorporating cryptocurrency transactions into its platform, Newegg aligns itself with the evolving financial landscape and caters to a growing demographic of consumers interested in utilizing decentralized forms of currency for their tech purchases. As the demand for innovative and secure payment options continues to rise, Newegg's commitment to embracing cryptocurrency payments positions it as a pioneer in the intersection of e-commerce and the transformative capabilities of digital currencies, setting a precedent for the future of online electronics retail.

Dell:

Dell, a stalwart in the tech industry, has positioned itself as a trailblazer by accepting Bitcoin as a payment option for its extensive range of products, encompassing laptops, desktops, and other electronic devices. This strategic move showcases Dell's commitment to staying at the forefront of technological advancements and exemplifies the company's recognition of the rapidly evolving landscape of digital finance. Dell caters to a tech-savvy demographic seeking alternative and decentralized payment methods by allowing customers to use Bitcoin for their tech purchases. This integration reflects a broader industry trend where major tech players are actively participating in adopting digital currencies, contributing to the growing acceptance of cryptocurrencies in mainstream commerce. Dell's proactive approach positions it as a leader in adapting to the changing dynamics of consumer preferences, signaling a significant step towards the increasing integration of digital currencies in purchasing electronic goods.

Shopify:

Shopify, a major online retail platform, has solidified its commitment to innovation by seamlessly empowering merchants to integrate crypto payments into their online stores. This strategic initiative goes beyond the traditional payment methods, allowing businesses of diverse scales and industries to offer their customers the option to pay with digital currencies. Shopify's adoption of cryptocurrency payments aligns with consumers' evolving preferences seeking diverse and decentralized transaction options. By providing this functionality, Shopify not only stays ahead of the curve in technological advancements but also positions itself as a facilitator for businesses looking to embrace the transformative potential of digital currencies. This strategic integration not only enhances the shopping experience for customers but also signifies a broader trend where major e-commerce platforms play an important role in shaping digital finance, creating a more inclusive and dynamic environment for online transactions.

Burger King:

Burger King, an iconic player in the industry, is experimenting with integrating cryptocurrency payments, specifically Bitcoin, at select locations. This bold initiative reflects the fast-food giant's willingness to explore emerging technologies and adapt to changing consumer preferences. While not yet globally implemented, exploring Bitcoin transactions at Burger King signifies a broader trend within the fast-food industry, where major players actively consider adopting digital currencies. This tech-forward approach caters to a digitally engaged consumer base and adds convenience and choice to the fast-food transaction process. As Burger King navigates this experimental path, it stands as proof of the ongoing convergence of traditional sectors with the transformative capabilities of cryptocurrencies, showcasing the potential for digital currencies to reshape even the most established and ubiquitous aspects of consumer culture.

Norwegian Air:

Norwegian Air, a prominent player in the European airline industry, has embraced the adoption of cryptocurrency payments, specifically Bitcoin, for flight bookings. This pioneering move underscores Norwegian Air's commitment to technological advancements and signifies the growing acceptance of digital currencies within the travel sector. By allowing customers to utilize Bitcoin for their flight reservations, Norwegian Air caters to the preferences of a tech-savvy and globally connected traveler base. This strategic adoption of cryptocurrency payments in the airline industry represents a departure from conventional modes of transactions, highlighting a new era where decentralized currencies play a role in facilitating international travel. As Norwegian Air takes flight into this innovative realm, it sets a precedent for other airlines, showcasing the potential for digital currencies to redefine how we approach and engage with essential services, even within the historically traditional domain of air travel.

Pros and Cons of Paying with Cryptocurrency

The decentralized and digitized nature of these digital currencies brings opportunities and challenges to the forefront. In exploring the pros and cons of paying with cryptocurrencies, we explore the key advantages and drawbacks of this innovative mode of financial exchange.

Pros of Paying with Cryptocurrency:

Decentralization:

Cryptocurrency transactions operate on decentralized blockchain networks, eliminating the need for a central authority like banks. This decentralization enhances security and reduces traditional financial institutions' control over transactions.

Global Transactions:

Cryptocurrencies facilitate international transactions with remarkable speed compared to traditional banking systems. Who accepts cryptocurrency as payment? Businesses and individuals who particularly benefit and are engaged in cross-border trade find it advantageous, as it eliminates the delays associated with traditional banking processes.

Lower Transaction Costs:

Cryptocurrency transactions typically involve lower fees compared to traditional payment methods. This is particularly advantageous for businesses and consumers conducting frequent transactions, contributing to cost savings over time.

Financial Inclusion:

Cryptocurrencies provide economic services to the unbanked and underbanked populations who may not have entry to traditional banking systems. This inclusivity aligns with the vision of democratizing financial services and fostering global economic participation.

Privacy and Security:

Cryptocurrencies offer enhanced privacy compared to traditional financial transactions. Users have greater control over their personal information, and blockchain technology ensures the security and immutability of transaction data, reducing the risk of identity theft.

Cons of Paying with Cryptocurrency:

Volatility:

The value of cryptocurrencies, especially well-known ones like Bitcoin, can be highly volatile. This volatility introduces uncertainty and can lead to fluctuations in the cost of goods and services, posing challenges for businesses and consumers.

Limited Acceptance:

Despite the growing acceptance of cryptocurrencies, many businesses still need to support cryptocurrency payments. This limits the practicality of using digital currencies for everyday transactions, as users may need to convert their holdings into traditional currency for certain purchases.

Security Concerns:

While blockchain technology is inherently secure, the broader cryptocurrency ecosystem is not immune to security concerns. Hacking and fraud incidents have occurred, leading to the loss of funds for some users. Ensuring the security of private keys and wallets is crucial to mitigating these risks. Ensuring the security of private keys and wallets is crucial for mitigating these risks, and using only reputable platforms with robust security measures helps secure your crypto assets. PlasBit ensures the security and privacy of our customers. We store all user cryptocurrencies offline in cold storage. We provide a secure environment for cryptocurrency transactions with robust measures like encryption, two-factor authentication, and regular penetration tests.

Regulatory Uncertainty:

The regulations surrounding cryptocurrencies are still evolving. This riskiness can create challenges for businesses and users as they navigate varying legal frameworks and changes in regulations that may impact the use and acceptance of cryptocurrencies. Use platforms that adhere to regulatory standards. We are a registered company in Poland (NIP 5214002884). With a crypto exchange license, we operate under the oversight of the Polish government and strict regulations set by the Ministry of Finance. PlasBit Sp z.o.o is licensed (REFERENCE NO. RDWW-533) to perform activities in the field of virtual currencies, ensuring transparency, legality, and the highest standards in our operations.

Lack of Chargebacks:

Cryptocurrency transactions are irreversible, meaning that once completed, they cannot be undone. While this feature enhances security by reducing the risk of chargeback fraud, it also means that you have limited recourse in the case of accidental or unauthorized transactions. This lack of recourse can be a drawback for consumers accustomed to the protections offered by traditional payment systems.

How to Pay With Crypto Using Debit Card

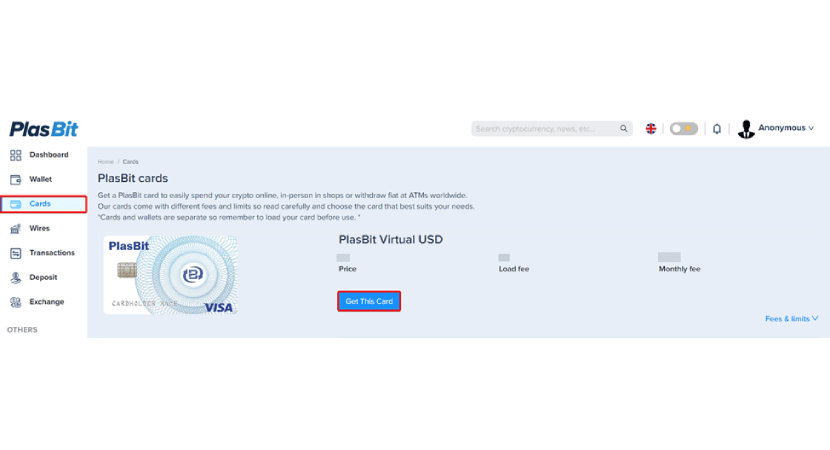

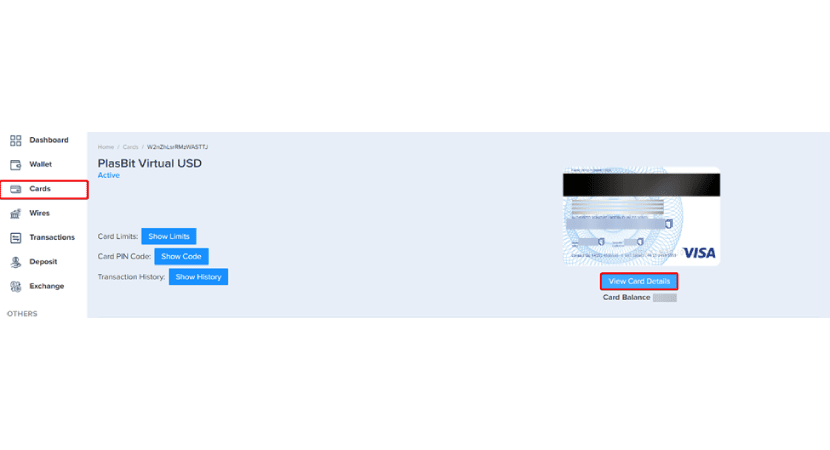

Proceed to the 'Cards' section to exchange your crypto to USD using PlasBit debit card:

1. Select your preferred card type—Virtual USD, Plastic USD, or Metal USD, each with its corresponding pricing and fees. Click 'Get This Card' to proceed.

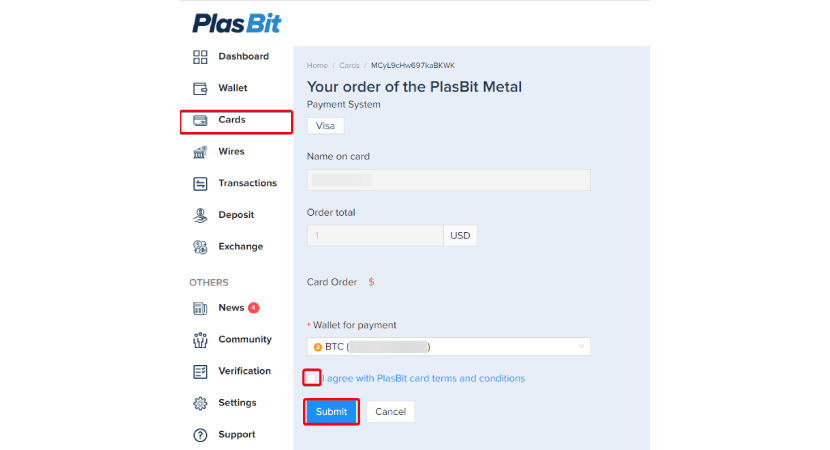

2. Confirm your payment details by entering your card name, agreeing to terms, and clicking 'Submit.'

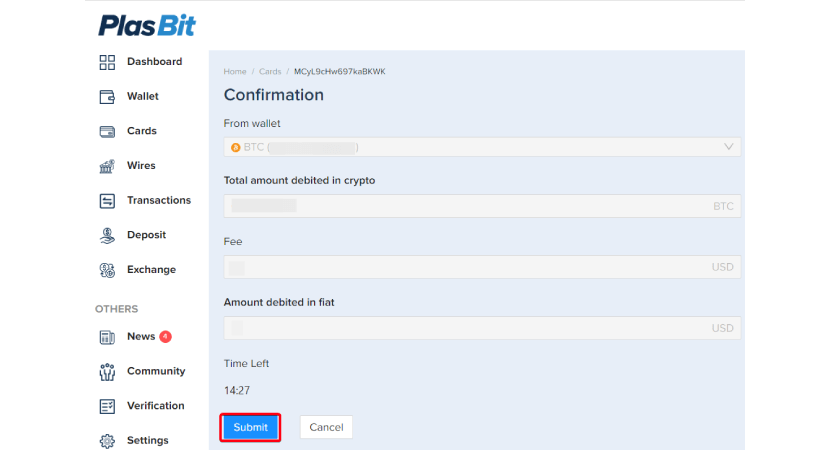

3. Review essential information such as wallet balance, total crypto debited, associated fees, and the fiat amount. Click 'Submit' once you've verified the details.

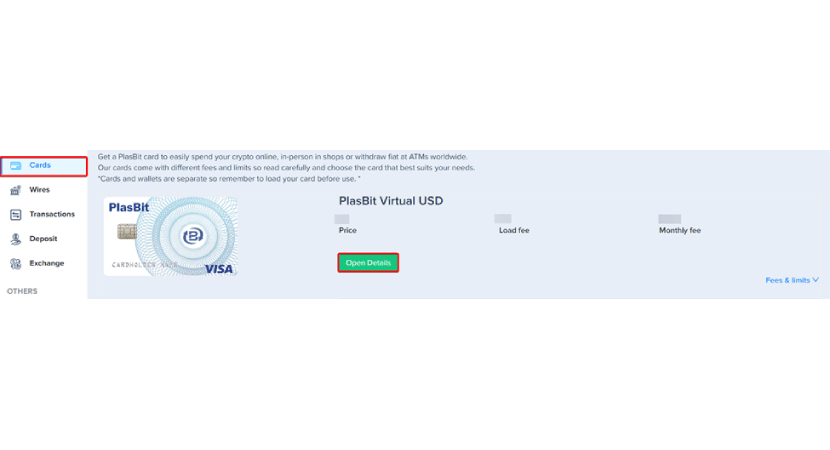

4. Choose the 'Open Details' button to review the specifics of your selected card meticulously.

5. This comprehensive view includes card details like limits, transaction history, validity, CVV, and signature (note: virtual cards used exclusively online may not have a PIN code).

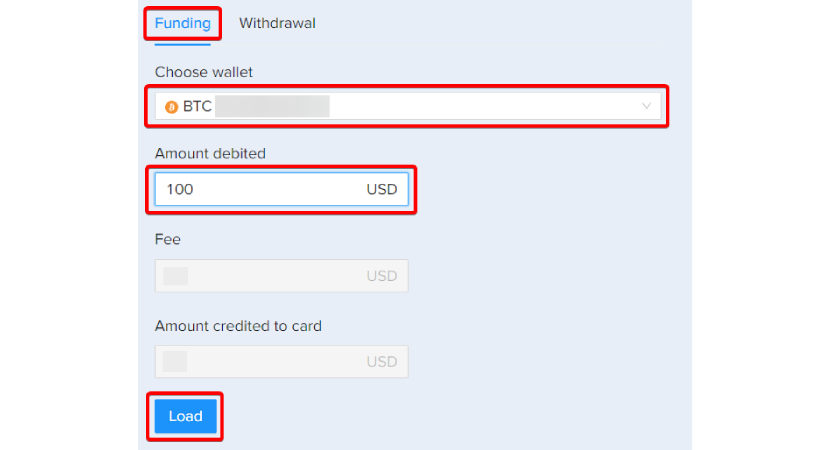

6. Choose to fund your debit card with USD through your chosen crypto wallet. Specify the amount, review associated fees, and observe the final amount to be received.

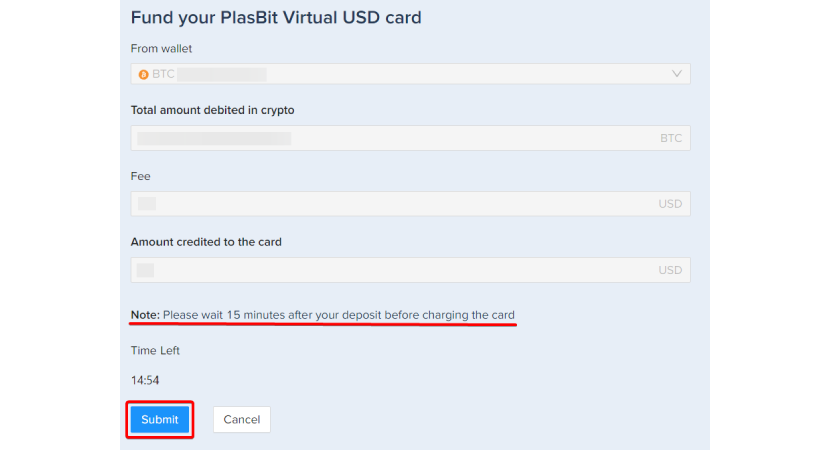

7. Observe the deduction of your crypto, automatic fee subtraction, and the display of the total amount your debit card will receive. After a final review, click submit.

8. Your debit card will be successfully loaded with funds; you can use your debit card like a traditional debit card. You are providing a seamless way to pay for goods and services to companies that don't accept cryptocurrencies.

.png)

Why Should Companies Accept Crypto as Payment?

The combination of cryptocurrency as a payment option holds immense business potential, offering many advantages compared to traditional point-of-sale (POS) systems. Let's study why companies should consider embracing cryptocurrencies for transactions.

Lower Transaction Fees:

One of the most enticing aspects of cryptocurrency transactions is the significantly lower associated fees. Unlike traditional payment methods that involve central intermediaries, cryptocurrencies operate on decentralized networks. This decentralized nature dramatically reduces transaction fees, benefiting businesses by reducing costs incurred with each transaction. Accepting crypto can be a game-changer for small businesses grappling with credit card processing fees. Reducing costs to less than 1 percent of the transaction value can substantially impact the bottom line, eliminating the need for imposing credit card purchase minimums on POS systems.

Merchant Protection:

The decentralized setup of cryptocurrencies provides an additional layer of protection for merchants. Unlike traditional payment methods susceptible to fraudulent chargebacks and various payment fraud schemes, cryptocurrency transactions operate similarly to cash. Once a transaction is completed, it is final, as no central authority can reverse charges. This inherent security feature shields merchants from the financial repercussions of fraudulent activities, fostering a more secure and trustworthy transaction environment.

Increased Sales Opportunities:

Embracing cryptocurrency as a payment method opens new doors for businesses, especially smaller enterprises. By accepting crypto, businesses can tap into a worldwide consumer base that was previously inaccessible. Cryptocurrencies' decentralized and borderless nature transcends geographical boundaries, enabling businesses to attract international buyers who may encounter difficulties with traditional payment methods. This expanded reach broadens the customer base and positions businesses to thrive globally.

Customer Convenience:

Providing customers with additional payment options enhances the overall shopping experience. Accepting cryptocurrency offers customers a convenient and modern way to make purchases. As the popularity of digital currencies grows, businesses that adapt to this trend demonstrate a commitment to meeting evolving consumer preferences. Moreover, using cryptocurrencies adds an extra layer of protection for customer information. With features like blockchain technology ensuring the security and immutability of transaction data, customers can feel more confident about the safety of their financial details.

What are the Risks of Accepting Crypto?

As businesses explore the prospect of accepting cryptocurrency as a form of payment, it is essential to acknowledge and navigate the potential risks of this innovative financial approach. Here are some key considerations regarding the risks of embracing cryptocurrency transactions:

Technical Barriers:

Accepting cryptocurrency introduces technical barriers that businesses, especially small enterprises, must face. Creating a digital wallet on a digital currency exchange, a prerequisite for cryptocurrency acceptance, can be technically challenging. The information-dense nature of the cryptocurrency field, coupled with its steep learning curve, poses a significant obstacle for small business owners unfamiliar with the technology. This complexity can deter businesses from entering crypto, highlighting the importance of user-friendly solutions for widespread adoption. Serge Beck, CEO and founder of blockchain company Optherium, notes that even with technical obstacles, the volatility of crypto values can encourage entrepreneurs to hold digital currencies.

Price Volatility:

The inherent volatility of cryptocurrency prices poses a considerable risk. Digital currencies, particularly Bitcoin, have experienced significant price fluctuations. For instance, Bitcoin's value skyrocketed to over $64,000 per coin in February 2021 before dropping to less than $28,500 in May 2023. This unpredictability can create challenges for businesses in terms of financial planning and introduces the need for swift and regular currency translation to mitigate the impact of market volatility. Areiel Wolanow, director of consulting firm Finserv Experts, emphasizes the importance of promptly translating cryptocurrency back into the local currency due to the volatile nature of digital currencies.

Security Issues:

Despite eliminating certain cyber threats associated with traditional payment methods, cryptocurrency transactions are not immune to security issues. While cryptocurrencies offer protection against stolen credit card numbers, the risk of cybercriminals gaining unauthorized access to users' digital wallets remains. Unlike fiat currencies, cryptocurrencies lack backing or insurance, making security measures crucial. Efforts are being made to address this, including introducing insurance for digital currency holdings and innovative wallet security solutions, such as biometric verification methods. Optherium employs a biometric verification method described by Serge Beck, which identifies users based on their facial structure to enhance wallet security and reduce theft risk.

Regulatory Uncertainty:

The regulatory landscape surrounding cryptocurrencies is dynamic and subject to change as lawmakers navigate the complexities of this emerging field. The absence of universal regulations creates uncertainty for businesses, making it challenging to anticipate and adapt to regulatory developments. Business owners must stay vigilant and be prepared to adjust their strategies in response to regulations. Classifying cryptocurrency as "property" or a "digital asset" by tax authorities adds a layer of complexity, requiring businesses to ensure compliance with tax obligations. Regulatory uncertainty is highlighted by the fact that cryptocurrencies are relatively new, and there is much uncertainty about how governments will address regulatory challenges. This uncertainty needs to be addressed for broader acceptance of cryptocurrency transactions.

Conclusion

Adapting cryptocurrency as a payment method by major companies across various industries signifies a shift in traditional financial transactions. With tech giants like Microsoft and innovative players such as Overstock leading the way, the acceptance of cryptocurrencies like Bitcoin has extended to diverse sectors, including telecommunications (AT&T), retail (Whole Foods, Starbucks), fast food (KFC, Burger King, Subway), and even the airline industry (Norwegian Air). This trend reflects an expanding recognition of the benefits associated with digital currencies, such as lower transaction fees, increased global transaction efficiency, and enhanced financial inclusion. While the pros of paying with cryptocurrency are evident, including decentralization, lower transaction costs, and financial inclusion, businesses contemplating this shift must also navigate potential challenges, including price volatility, security issues, technical barriers, and regulatory uncertainties. Nevertheless, as companies explore innovative solutions, integrating cryptocurrencies as a payment option aligns with evolving consumer preferences, providing a glimpse into the future of a more diverse and decentralized financial ecosystem. Who accepts cryptocurrency as payment? The answer is a growing list of influential companies reshaping how we engage in transactions across various sectors.