For people looking to spend their Bitcoin on everyday expenses, A Bitcoin card can be loaded with Bitcoin from your wallet and is accepted everywhere Visa is accepted, meaning you can use your Bitcoin to pay for rent, groceries, flights, hotels, etc. without the merchant converting the crypto into Fiat. We offer a range of cards, including prepaid cards, virtual debit cards, plastic cards, and metal cards, each tailored to your specific needs.

To help you get started, we’ve created a detailed step-by-step guide on depositing cryptocurrency into your Plasbit wallet, purchasing a plastic debit card, and funding it directly from your wallet.

PlasBit Bitcoin Card | Step-by-Step Guide

With this easy step-by-step guide, you can get started with our Bitcoin card within no time. Simply follow the steps below to start living entirely on crypto.

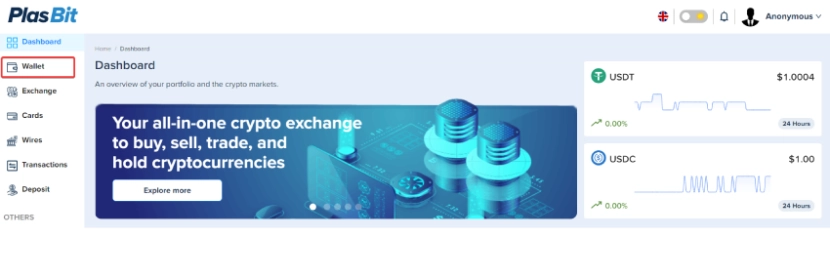

Step 1 - Log in to your PlasBit Dashboard

To log in to your PlasBit Dashboard, you will need an account first. If you don’t have a PlasBit account yet, you can easily sign up for one here.

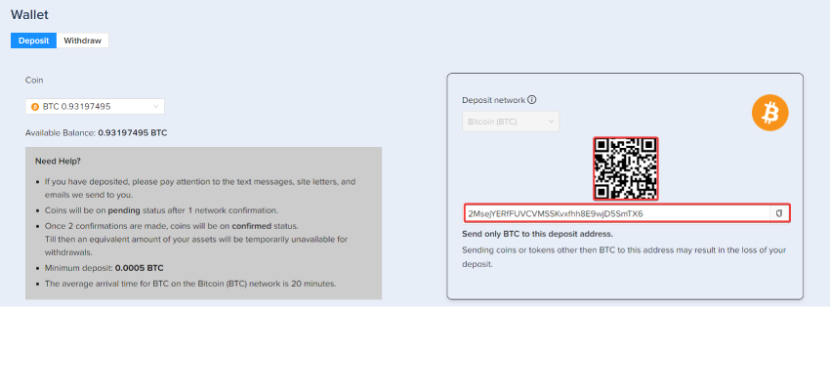

Step 2 - Navigate to the Wallet section and Deposit Bitcoin.

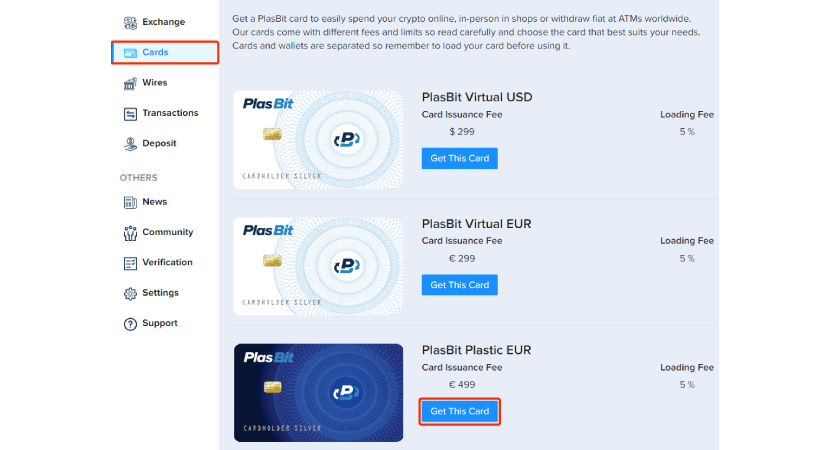

Step 3 - Head Over To The Card Section, select the crypto card of your choice and click "Get This Card"

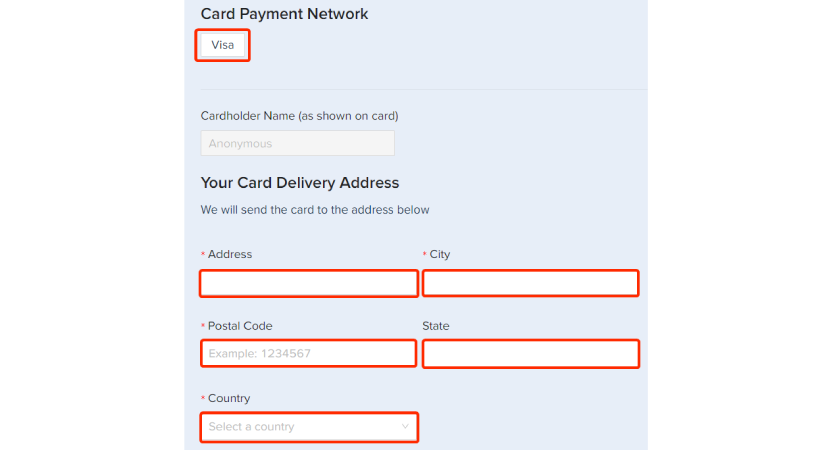

Step 4 - Fill in your Personal Details.

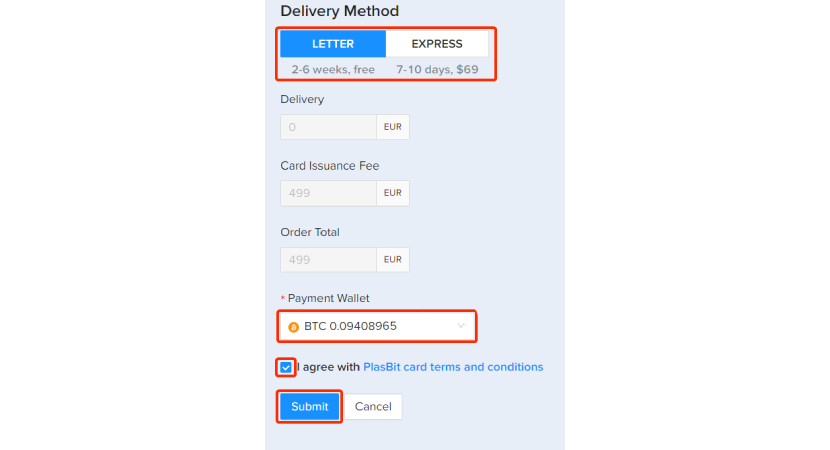

Step 5 - Select your preferred delivery method and select Bitcoin wallet as the payment wallet and click "Submit"

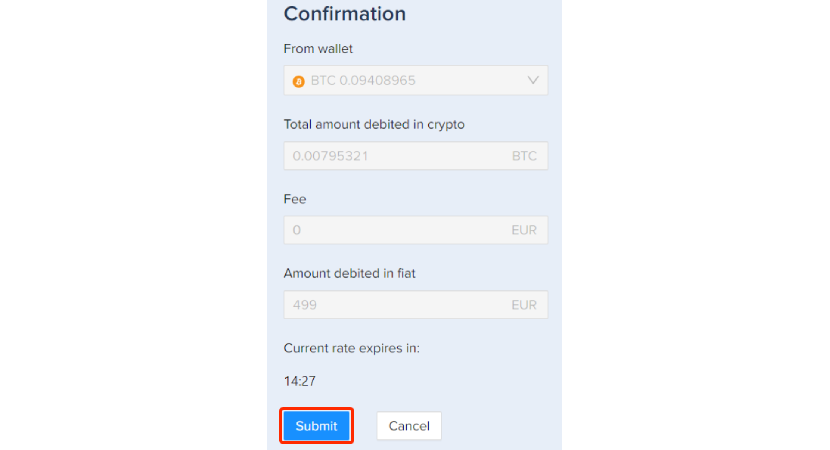

Step 6 - Ensure you entered all your details correctly, and confirm your order by clicking Submit.

Step 7 – Wait For The Card Confirmation. You will get an email regarding the status of your order.

*Delivery time depends on the method you chose: standard delivery takes between 2 to 6 weeks, and express delivery takes between 7 to 10 days.

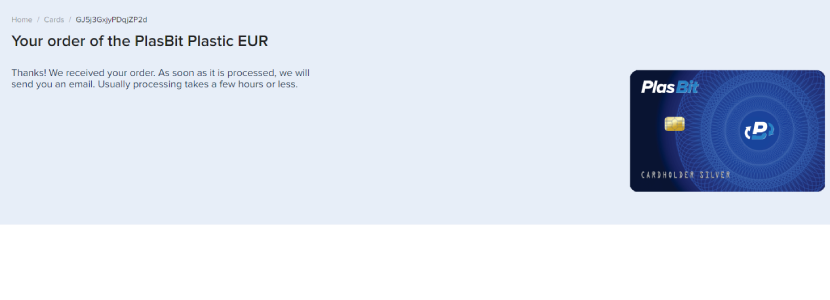

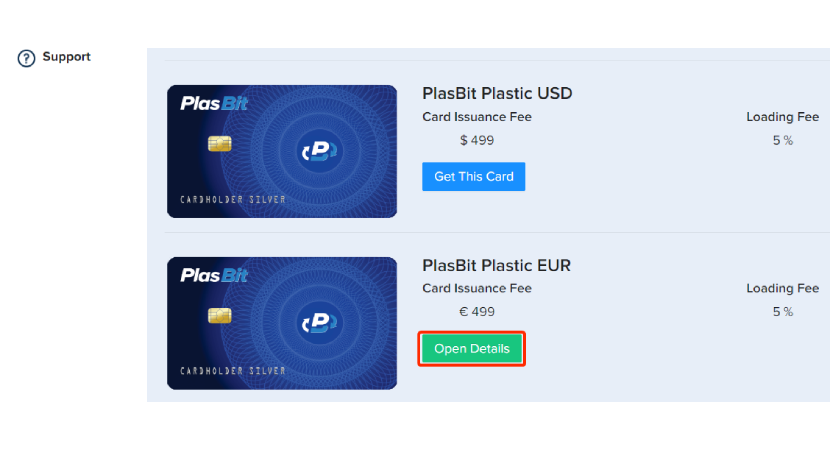

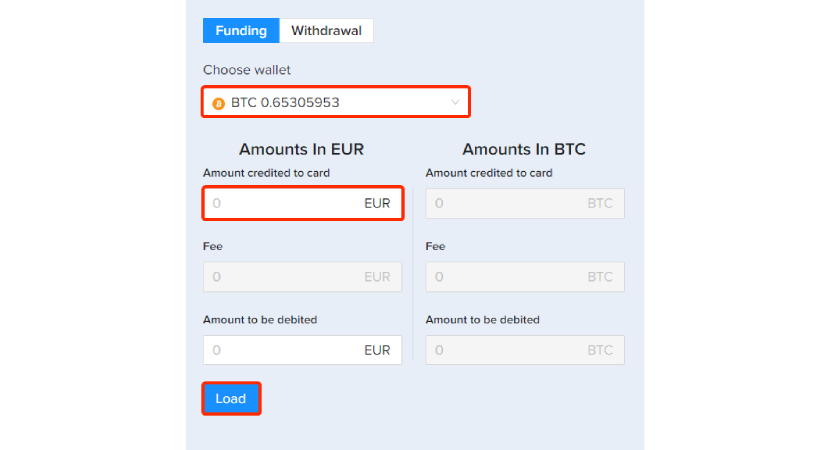

Step 8 – Load Funds Onto The Card

Once you have received your crypto card, go to the ‘’Cards’’ section and click on the ‘’Open Details’’ button.

Navigate to the Funding tab and choose the wallet you want to use for loading your card and press the Load button.

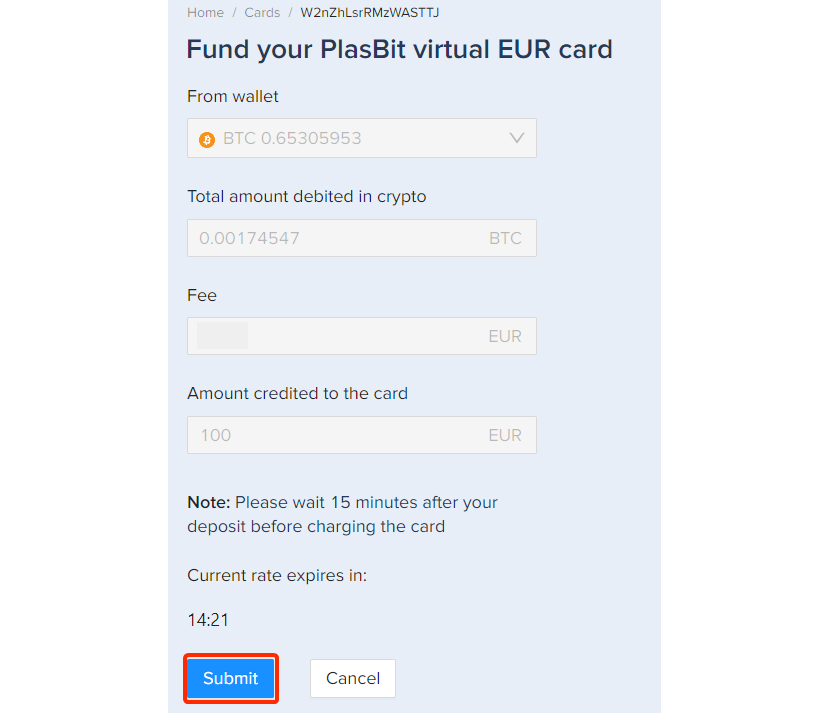

Click ‘’Submit’’ once you have verified the amount is correct.

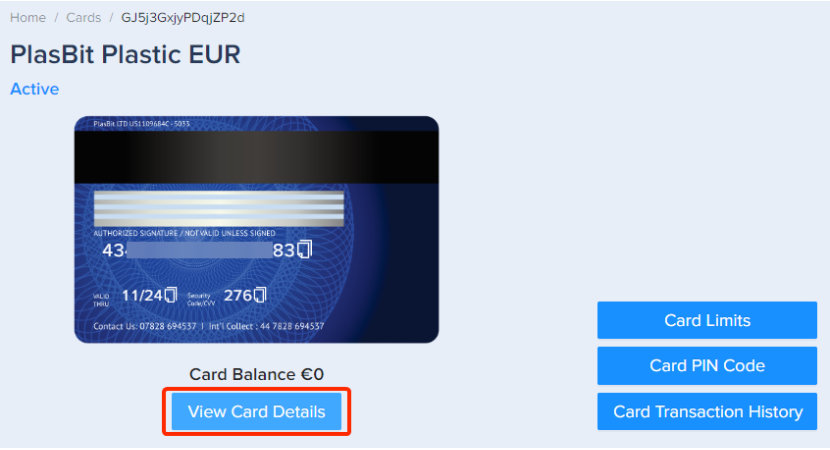

Step 9 – Get Your PlasBit Card Details

Whenever you wish to view your PlasBit Card details, you can simply do this by pressing the ‘’View Card Details’’ button you will see the card number, expiry date, and CVV.

As our PlasBit Bitcoin cards have varying limits, fees, and issuance fees, we strongly recommend checking out this page before ordering a prepaid Bitcoin virtual or physical card.

What Types of Crypto Cards Do We Offer?

We provide four distinct types of Crytpo cards to suit your needs: prepaid, virtual, plastic, and metal. Each card type comes with unique features, fees, limits, and issuance costs.

Prepaid Cards

Prepaid cards are single-use, disposable virtual cards denominated in USD. They allow you to securely spend a predetermined amount, helping you manage expenses while reducing the risk of fraud and overspending. These cards are available in denominations ranging from $20 to $1,000. They can also be linked to Apple Pay and Google Pay, enabling seamless transactions both online and in physical stores.

Virtual Cards

Virtual cards are designed for online spending, allowing you to use your Crytpo at e-commerce stores, booking platforms, and other digital merchants. Unlike prepaid cards, they are reloadable, providing ongoing convenience. However, they cannot be connected to Apple Pay or Google Pay, so they are not accepted in physical stores.

Plastic and Metal Cards

Our plastic and metal cards are physical debit cards ideal for purchases and ATM withdrawals. While both cards offer convenience for in-store and online transactions, the metal card stands out with higher spending limits and no exchange fees, offering premium functionality. The metal card also features a durable, high-quality design, providing an elevated user experience compared to the plastic option.

Living Your Life on Crytpo

Nowadays, it is possible to live your life entirely on Crytpo. Not only is this possible, but it also comes with many benefits. If you are a freelancer, whether you are working from home or a digital nomad, you could ask to be paid directly in Bitcoin, removing unnecessary fees and delays from the equation regarding your payments.

The problem comes when you need to spend the crypto you have earned on expenses such as rent, groceries, food, transportation, etc. A Bitcoin card helps you do so. As mentioned before, our card is accepted everywhere a Visa card is accepted. It can even be used to withdraw funds from your crypto wallets directly from ATMs. Skipping the need for a Bitcoin ATM can be hard to find sometimes (you might have a regular ATM below your apartment, but a Bitcoin ATM can be up to a half-hour drive in some places) and has relatively high fees.

Even if you are working on a paycheck, you can set aside a portion of your salary and buy some Bitcoin with it. Unlike the money in your bank account, which may lose value due to inflation, Bitcoin has the potential to grow in value over time, and you can keep it as a sort of savings account or use a card to spend it whenever you want.

Bitcoin debit and credit cards can help you escape the rat race as you don’t need to rely on third parties anymore and are in full control over your savings and spending. With no more reliance on third parties, you are in the custody of your crypto holdings, and by using a Bitcoin card, you can easily access it anywhere in the world and spend it just like fiat currencies.

Not only do you save money on precious currency conversion fees, but also time, as you don’t have to wait hours or even days for your (cross-border) transactions to come through.

Differences Between Virtual and Physical Crypto Cards

Virtual and physical crypto cards allow users to easily access their cryptocurrency holdings and spend them in traditional financial systems. The Bitcoin debit cards are accepted wherever their issuing financial institutions (American Express, Visa, or MasterCard) are, either online or in person.

Physical Bitcoin Card

A physical Bitcoin card is a tangible card that users can carry around in their wallets. This type of Bitcoin card functions similarly to a traditional debit card and is often backed by a major financial institution like Visa or MasterCard.

These physical cards can be used anywhere that accepts the standard bank card they are issued in. Additionally, some of them allow users to withdraw funds from ATMs. The tangibility provides users with a physical representation of their funds, something most people prefer for their everyday groceries and other expenditures.

| Pros | Cons |

|---|---|

| Widely accepted, usable in any virtual or physical store or ATM | They take a few days to arrive by mail and often cannot be used instantly |

| The tangibility of a physical card | They can be lost or stolen |

| Usable for everyday purchases like dining out, ordering food and groceries, and at gas stations | Physical plastic cards come with environmental costs |

Virtual Bitcoin Card

Virtual Bitcoin cards are fully digital. This means that they do not exist in any physical form. Typically, these virtual Bitcoin debit cards are issued promptly after having submitted your banking and identity documents to their online issuers.

All virtual Bitcoin cards require you to submit personal information. For this reason, there is no such thing as no-KYC virtual crypto debit cards, as far as our Plasbit experts are concerned.

| Pros | Cons |

|---|---|

| Often issued instantly after approval | As there is no physical form, virtual cards cannot be used in-store unless Apple Pay or Google Pay is supported |

| Without any physical card to lose or steal, the fraud risk is reduced significantly | People might prefer the look and feel of a physical Bitcoin debit card |

| No environmental costs are involved in issuing a virtual Bitcoin prepaid debit card | Sometimes not accepted in online stores, gambling, trading, and crypto platforms |

| Usable for digital subscriptions like Spotify, YouTube Premium, and Netflix | Although a virtual Bitcoin card cannot be stolen, its details can be obtained by hackers or other cybercriminals |

| Ideal for digital nomads and others who don’t have a fixed residential address to deliver a physical Bitcoin card to |

The History of Bitcoin Adoption

In August 2008, the domain name Bitcoin.org was registered, and in October of the same year, a new electronic cash system that’s fully peer-to-peer, with no trusted third party, was announced on the metzdowd.com cryptography mailing list.

Bitcoin was first introduced to the public in 2009 by an anonymous developer or group of developers under the name Satoshi Nakamoto ever since, it has become the most popular and largest cryptocurrency by market capitalization.

On the third of January 2009, the first Bitcoin block, also called the Genesis Block or Block 0, was mined. It contained the text: ‘’The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.’’

Overstock.com was one of the earliest adopters of Bitcoin as one of the first major retailers globally to accept the world’s first cryptocurrency as a form of payment. The site and its managing company began accepting Bitcoin as early as January 2014 and used Coinbase to process its transactions.

Other early Bitcoin adopters were so-called Black markets like the dark web Silk Road. On these Black markets, illicit goods were traded, such as drugs, which users could buy and sell almost fully anonymously.

Overstock’s CEO, Patrick Byrne, has been pro-Bitcoin from the beginning and has called it a ‘’tool for freedom’’ many times.

Since Overstock started to accept Bitcoin payments, many other companies followed suit, such as Microsoft, Starbucks, PayPal, AMC, Newegg, and AT&T. This changed the general public image of Bitcoin, as many first thought it was a currency only used for illegal dark web marketplace transactions.

Although the Bitcoin community cheers whenever a new company starts to accept Bitcoin payments, the overall sentiment indicates that they rather want Bitcoin to be something for the people rather than corporations.

This makes sense in that it is great to be able to pay in Bitcoin for certain goods and services, but it can go Southways whenever companies start to hoard the digital token and increase its price significantly.

The Impact of Bitcoin on the Global Economy

Many people have been wondering about the impact of Bitcoin on the global economy. Luckily, our experts have done extensive research and will provide you with proof that there’s simply no denying the meteoric rise of Bitcoin and other cryptocurrencies.

Firstly, a significant amount of individuals turn to Bitcoin as a potential hedge against inflation and by means of long-term investment. Added to this, according to recent predictions made by cryptocurrency analysts, the global crypto market is estimated to grow from $50 billion in 2024 to over $70 billion in 2028. Yearly, it is estimated that the market will compound at a rate of about 8%.

The price of Bitcoin has been influenced by supply and demand as well as growing market sentiments over the years accordingly:

| Year | Price of 1 Bitcoin (BTC) |

|---|---|

| 2010 | $0.10 to $0.20 |

| 2011 | $1.00 to $29.60 |

| 2013 | $13.00 to $1,000 |

| 2017 | $1,000 to $19,188 |

| 2019 | $6,612 to over $10,000 |

| 2020 | $7,161 to $28,993 |

| 2021 | $40,000 to $69,000 |

Bitcoin (BTC) reached an all-time high of $73,737,94 in March 2024, right after the next halving was announced. With the numbers being this high, we can no longer ignore the massive influence Bitcoin and cryptocurrency in general, have on the global economy.

Bitcoin and other cryptocurrencies have established themselves as inflation-hedging assets, whilst fiat currencies have only lost value in the last couple of years.

Did Bitcoin Make the Change it Sought to Make?

One question that keeps arising from members within the Bitcoin community is ‘’Did Bitcoin make the change it sought to make in the first place?’’ The short answer to this question is ‘’Yes, it did.’’ The main reason for this is that the original Bitcoin Whitepaper stated that its main vision was to enable people to transfer money directly to another with the speed of an e-mail without relying on banks.

Although many Bitcoin community members still keep their digital asset holdings on crypto exchange accounts, a large part of them already mainly conduct peer-to-peer transactions using their hardware and cold wallets, such as their Ledger, Trezor, and SafeKey devices.

Another indication that Bitcoin is definitely paving the way to completing its original vision is the fact that Decentralized Finance (DeFi) is becoming increasingly popular among community members and traditional finance (TradFi) companies.

Decentralized Finance can be described as an emerging peer-to-peer financial payment system that utilizes blockchain technology and digital tokens to enable people and corporations to transact directly with each other.

Just like with Bitcoin, the core concept of Decentralized Finance (DeFi) is to remove third parties like banks and other financial institutions from the financial system, allowing individuals to conduct transactions directly and thereby reducing costs and transaction times.

Decentralized Finance works through peer-to-peer financial networks, security protocols, connectivity, software, and hardware advancements and uses blockchain technologies to reduce the need for these intermediaries.

Insights on the Future of Bitcoin

Knowing Bitcoin’s price, volatility, and popularity, it is safe to say that value changes, news, scandals, and blockchain developments in the next couple of years will have a great impact. With experts debating the digital token’s decentralization, security, and scalability, Bitcoin’s widespread adoption is still somewhat held back.

Luckily, Bitcoin and blockchain developers are working overtime to find solutions for these problems and try to address any other concerns to make the cryptocurrency gain more traction. According to analysts, the adoption of cryptocurrency and Bitcoin has steadily increased over the years, mainly in economically challenged areas and amongst lower-income geographical locations.

Central and Southern Asia and the Oceana region are especially seeing rapid Bitcoin adoption in 2024, with high-income regions like the US enjoying a slight increase as well, most likely due to the approval of Bitcoin investment vehicles and instruments.

Future Bitcoin Price

Although it is very difficult to predict future Bitcoin prices, both short-term and long-term, our crypto experts have done their due diligence and analyzed multiple Bitcoin price prediction websites to come up with the most accurate future Bitcoin price figures possible.

According to both fundamental and technical analysis, the minimum cost of Bitcoin will be around $60,690.58, with $83,090.76 as the maximum price for 2024. In 2025, it is likely Bitcoin will be valued anywhere between $41,402.15 and $85,550.36, while 2026 has prices between $133,957 and $163,464 per Bitcoin in store for us, according to some crypto analysts.

For 2027, it is assumed that the BTC price will fluctuate between $204,087 and $233,219. The average price, according to experts, will be around $209,637. Based on the fundamental and technical analysis of crypto experts, the minimum and maximum Bitcoin price for 2028 will be $305,183 and $358,451, respectively.

Although it seems far-fetched to look five years or more in the future when it comes to Bitcoin and other cryptocurrency prices, some crypto experts and analysts went as far as to predict an estimated Bitcoin price of around $464,473 for 2029 and an average cost of $668,343 during 2030.

Bitcoin and Cryptocurrency Regulation

As per writing, many jurisdictions globally are working on rolling out regulations for stablecoins. These are fiat-backed digital tokens, often tied or pegged to the US dollar. The stances of global governance institutions, however, are still mixed, with the Financial Stability Board (FSB), Basel Committee on Banking Supervision (BCBS), and the International Organization of Securities Commissioners (IOSCO) all having different visions on how Bitcoin and other cryptocurrencies should be regulated.

Cryptocurrency is currently legal in 33 countries, partially banned in 17, and fully banned in 10. In twelve of the G20 countries, cryptocurrencies are legal, and Bitcoin regulation is under full consideration in all other G20 countries. Australia, the UK, Brazil, and South Korea, among others, are releasing new cryptocurrency and Bitcoin regulations this and upcoming year.

It is estimated that as much as 70% are in the process of making significant changes to their financial regulatory framework. Additionally, many countries are working on active central bank digital currency (CBDC) projects, indicating that the digitalization of money might happen sooner than expected.

For instance, PlasBit has been regulated by the Polish Ministry of Finance and has been licensed to perform activities in the field of virtual currencies under license number RDWW-650 since 2020.

Bitcoin Core Principles

According to crypto experts and analysts, Bitcoin undergoes certain ‘’4-year price cycles’’ that are affected by its halving event. If the digital asset continues to follow its familiar pattern, this will further validate its cyclical movements and allow savvy traders and investors to capitalize on its price movements and build wealth over time.

Following this logic, Bitcoin has had three 4-year cycles so far, and while past cycles don’t ensure future outcomes, the token’s core principles, like its decentralization, security, and scarcity, remain intact. This automatically results in Bitcoin’s core value proposition as a store of value and a hedge against inflation that remains intact as well.

When we look at the broad technological advancements Bitcoin and its underlying blockchain technology have brought to the world and can still bring, it seems evident that it is superior to fiat money systems and that the ever-growing Bitcoin community easily tackles any obstacles on the road to mass adoption, such as increasing block sizes, hard-forks, and core protocol changes.

Conclusion

Having outlined the history of Bitcoin adoption, the impact of Bitcoin on the global economy, and providing insights on its future, we can conclude that having a Bitcoin card can be quite handy. Whether you want a virtual or physical card, you can easily order one at Plasbit and start spending your crypto profits the easiest way possible.