It’s only after disaster strikes that we become aware of what just happened and start having visions of doom. That’s what happened worldwide after the 2008 financial crisis that made palpable the similarity between fractional reserve banking powered by fiat and a pyramid scheme. One person in particular was vocal about spelling fiat’s doom and announcing Bitcoin’s bright future, and his name is Pierre Rochard. Who is Pierre Rochard? He is a prominent Bitcoin advocate, researcher, and software developer who has been active in the space since 2013. He co-founded the Satoshi Nakamoto Institute in 2014, founded and developed Lightning Power, a Bitcoin L2 product, and strongly supports Bitcoin’s decentralized governance. He co-hosts the Noded Bitcoin Podcast and has held key roles, including Bitcoin Strategist and Product Manager at Kraken and VP of Research at Riot. Rochard is widely recognized as an authority on Bitcoin investment and strategy.

What Does a Fiat Doomsayer Think?

Pierre started building his clout in the Bitcoin community with his Satoshi Nakamoto Institute website, a Texas nonprofit organization founded in November 2013. The website serves as a public library containing all the notable writings related to Bitcoin, such as the Bitcoin whitepaper. Other writings include Pierre’s own works that focus on spelling fiat’s doom, but his articles are optimistic instead of alarmist, and he sees Bitcoin as the best possible form of money. The very first document uploaded to the website was Pierre’s text titled “Working and Saving are Revolutionary Acts,” written in December 2012.

The text argues that trying to peacefully end the US Federal Reserve is a waste of time and energy. People should instead, as the title indicates, work and save their money, invest in innovators, and then insure themselves, their loved ones, and their property to hedge their life against disasters. In Pierre’s opinion, that will lead to capital accumulation at insurance companies, and they will start becoming a form of small private government for their customers, providing them with services that are otherwise provided only by big government, such as courts and firefighting. If they can also avoid joining academia, politics, and pyramid schemes while finding a fulfilling career, they would lead a much healthier life. My PlasBit dudes and I discussed this, and they told me that his view of insurance companies is naive at best and delusional at worst, if he actually believes it.

Ode to the HODLers

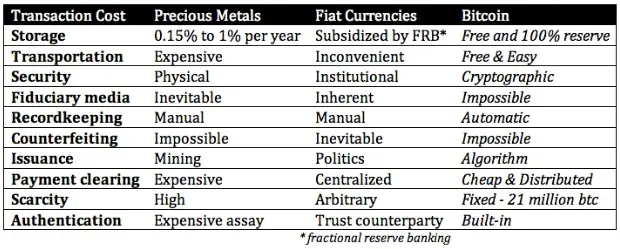

In his February 2013 article, “End the Fed: Hoard Bitcoins,” Pierre expanded his idea of a healthy revolution. He admitted that he used to think precious metals would replace fiat, but he saw that precious metals are way too expensive to move around and that only Bitcoin has lower transaction costs, which makes it the best way to undermine fiat. He recommends HODLing Bitcoin to keep its price high and drive media attention and user adoption until fiat becomes hyperinflationary and interest rates expressed in fiat become oppressive. HODLers should then invest their Bitcoin in productive assets.

The gist of the above table is that Bitcoin is to fiat what fiat is to precious metals

Fiat, the Original Shitcoin

Also in February 2013, Pierre wrote “Fractional Reserve Banking is Obsolete,” in which he explained that there is no need for the people to fight for the reform of the monetary system because now they can use Bitcoin, and they can finally prove whether or not fiat needs to be constantly hyperinflated to stimulate economic growth. In Pierre’s opinion, fractional reserve banking is a failed concept because it fuels speculation. He believes that fiat can collapse at any moment, and even when it works as intended, it can cause depressions, manias, and crises.

Everyone Will Use Fiat To Buy Bitcoin

Pierre wrote “The Bitcoin Central Bank's Perfect Monetary Policy” in December 2013, where he praised Bitcoin’s feature of requiring 100% ownership of Bitcoins before spending them, which prevents fractional reserve banking. According to Pierre, Bitcoin is so superior to fiat that it’s only a matter of time before it becomes the global currency, it’s just that Bitcoin is adopted in waves. Pierre thinks that BTC’s value will continue to rise as people overcome their biases, exchange their fiat for Bitcoin in swathes, and HODL it, pumping its price even higher.

What Does a Bitcoin Strategist Do?

Pierre Rochard is commonly described in news articles as “Kraken’s Bitcoin Strategist,” which to me sounded like one of those fake job titles people give themselves to have a sense of importance. I couldn’t recall anyone in the cryptocurrency industry having that title, so I got a hunch that it’s more related to traditional finance. I asked around the PlasBit office, and we discussed who is Pierre Rochard because I knew they’d give me a straight answer, and sure enough, they told me my hunch was right.

Traditional financial institutions, such as hedge funds, employ analysts whose job is to predict how markets will move based on available information and logical trends, but the institutions sometimes hold back crucial information so that those analysts get people to invest their money in a way that makes those institutions maximum profit. Those analysts are called “strategists,” and when the public loses trust in them, they’re replaced by other strategists to keep the scheme going. My mind went to one analyst who was mercilessly mocked on online forums for being constantly wrong in his predictions, Jim Cramer. I looked through his bio and found that he hinted at this in his 2006 interview, saying that hedge funds are notorious for spreading “new truths” as a quick way to make money, and adding that it’s possible to manipulate the market with as little as $5 million. My PlasBit dudes told me that his main income comes from hosting “Mad Money,” one of the biggest financial shows in the US, and he doesn’t have any skin in the game when it comes to the companies he’s referring to. They also said he can be wrong without feeling the pain, so nobody should blindly trust him. I still think he is worth mentioning because his methods and narratives seem to have a lot in common with strategists, it’s just that he goes over the top.

I wasn’t sure if that was who is Pierre Rochard playing or how it related to Bitcoin, so I decided to dig deeper. First, I wanted to confirm that Pierre was indeed employed by Kraken as a strategist. Though Kraken doesn’t have a full list of its nearly 3,000 employees available online, I did find official press releases that present Pierre as one of the employees, yet how they refer to him changed over time.

Pierre Gets Shunned and Shunted

| How Kraken press releases refer to Pierre Rochard | |

|---|---|

| March 2020 | Bitcoin Strategist |

| three in April 2020 | Lead Bitcoin Strategist, Bitcoin Strategist, Expert |

| two in June 2020 | Economist, Lead Bitcoin Strategist |

| October 2020 | Bitcoin Strategist |

| December 2020 | Lead Bitcoin Strategist |

| September 2021 | Bitcoin Product Manager |

| February 2022 | Bitcoin Product Manager |

Those changes are a bad sign. Based on my experience working in a corporate environment, when an employee’s job title changes often, it means the corporation is giving the employee an illusion of progress while paying him a pittance and feeding him empty promises to keep him around and boost the corporation’s reputation. There is not enough meaningful work or ways to meaningfully interact with coworkers for one such employee, who keeps himself busy with random tasks, but that ultimately takes a toll on his mental health as the truth sinks in and he starts feeling a deep sense of apathy. I personally know one corporate employee who tried to take their life after being shunned in a similar way, which their superiors casually ignored.

Note how Pierre’s title alternated between Strategist and Lead Strategist, which tells me Kraken shunted him between working alone and leading a team of strategists, and they were all obviously used to promote narratives that benefit Kraken. Seeing “economist” did strike me as odd, but researching who is Pierre Rochard revealed that he does have a master’s degree in accounting, so it’s at the very least a plausible title. As for calling Pierre an “expert,” that sounds like a subtle reminder that he’s useless because that’s not a job title nor a description of his role. The press releases are professionally written, and I’d say they went through at least one round of proofreading, so I’m pretty certain that Pierre’s titles were meticulously checked with the Kraken senior staff and that they correctly represent how the exchange saw him.

Pierre’s experiences page on LinkedIn tells his side of the story, showing that he built and managed a Bitcoin product February 2018–October 2019 before starting full-time work at Kraken October 2019–June 2022 as a product manager. If you compare that to the table above, you’ll see that something isn’t right because Pierre was only mentioned as a Product Manager nearly two years after being hired. The experiences page doesn’t mention anything about being a strategist, economist, or expert, revealing that he’s not proud of being in those roles and he doesn’t want to remember them, and to me it’s logical that’s because he wasn’t hired to do them.

Pierre’s Clout Gets Stolen

Kraken knew who is Pierre Rochard and hired him under false pretenses, telling him his work at Kraken will lead to worldwide Bitcoin adoption, that they want to build a long-term relationship with him, and that they will develop and improve his product. To Pierre, that must have sounded like a dream come true. After he was hired, Kraken put him on ice, gave him inconsequential roles, and used his presence to build hype for its upcoming product, to steal the clout he’s made for himself in the Bitcoin community, and to steal the users he’s attracted with his own product. Pierre grew to regret his decision, even going so far as to delete his ”Why I’m joining Kraken” article on Medium, of which only the first paragraph remains as a blurb on Muck Rack.

The article link results in HTTP error 410 (deleted by author)

This is damning proof of Kraken’s treachery. The exchange expertly and savagely manipulated Pierre, exploiting his naive desire to build something genuinely useful to the Bitcoin community. All his effort in building his product didn’t just go to waste, but it was stolen by a corporation, and there was nothing he could do about it except bitterly regret his decision and patiently wait for a chance to manage the product, seeing it as a chance to at least do something positive and redeem himself in the eyes of the community.

Pierre’s Product Idea Gets Hijacked

The product Pierre made before joining Kraken was called Lightning Power, and it was an Excel plugin for Bitcoin’s Lightning Network (LN). I can imagine Kraken telling Pierre that an Excel plugin is fine as a prototype, but that they want to scale his product worldwide, so they need some time to redo it from the ground up, and in the meantime he can hang around and do some webinars for Kraken. I’m sure that Pierre was not suspicious of that arrangement at first, and that when Kraken gave him the role of a Strategist, he gladly accepted it to tell the kind of fiat doom stories he was passionate about.

By the time Pierre realized what was happening and that he was kept at Kraken just so that the exchange could claim, “We’ve got a great product coming thanks to this amazing thing made by Pierre Rochard,” it was too late, and he had already signed an NDA anyway. The most devious part of that plan was that Kraken knew anyone associated with them lost their pristine reputation in the Bitcoin community. By hiring Pierre, Kraken forever tainted his reputation and made it so nobody would ever believe a word he says because “he could be speaking on behalf of Kraken,” eliminating Pierre as a potential competitor.

That neatly explains why Pierre’s titles change so much and why he stuck around, and it also reveals that Kraken, despite trying to appear like a modern cryptocurrency exchange, is a typical corporation with all the corporate backstabbing underneath the fresh coat of paint. So, what product did Kraken make? I haven’t used it, and I don’t have any insider information, but what is shown in public will be enough.

Tell Me Lies, Tell Me Sweet Little Lies

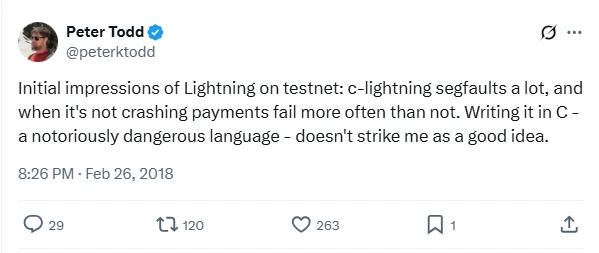

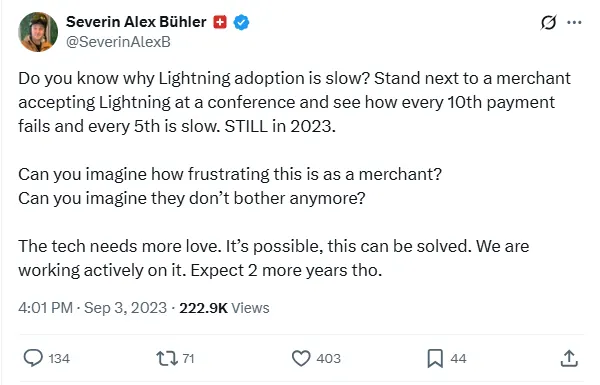

In a March 2022 article, Kraken announced an integration of Bitcoin’s Lightning Network. The article featured Pierre, who is referred to as “Bitcoin product manager,” who praised the integration and urged people to get their fiat into it because of low fees, a fully featured API, and instant transaction processing, calling the integration “very reliable.” There is only one problem — Lightning Network, as originally envisioned, is not a reliable payment method and will never come close to being as reliable as debit cards, no matter what workarounds are used.

The reason is that LN was envisioned by its two inventors, Thaddeus Dryja and Joseph Poon, as a peer-to-peer network for micropayments in Bitcoin, something like P2P money sharing that avoids using the Bitcoin blockchain, but P2P financial transactions in a network filled with anonymous nodes, some of which are hostile and intentionally sabotage other nodes, are prone to failure. I’ll let the two explain it:

The gist of that video is that liquidity is a huge problem for Lightning Network, and the only way it can reliably work is if it is highly centralized around a small number of trusted and “like really rich” nodes that the authorities will automatically consider money transmitters and ask them to follow various banking regulations. To me, that 2015 video is an outright confession that Lightning Network can’t reliably work as they envisioned unless it becomes more like a traditional financial system, defeating the entire purpose of using Bitcoin or joining a P2P network while also going against the “down with the old system” narrative. Three years after that conference, Lightning Network was still having reliability issues, no matter how many devs tried to fix it.

Peter Todd reported a failure rate of over 50% on LN

LN user numbers are an absolute confirmation of what I’m saying. In 2022, Lightning Network reached the peak of its adoption with 19,000 nodes, followed by a sudden 20% drop in late April 2022, which is about a month after the Kraken announcement, indicating that Kraken wasn’t actually using LN for payment processing and that the exchange was in fact siphoning users away from LN by giving them a reliable service that used something else.

Users who stubbornly refused to leave Lightning Network did their best to fix it on their own, as they were experiencing so much frustration with payment failures that they were willing to go out and find other node operators in person to arrange an LN payment. One Lightning Network user, Alex, a Swiss cryptocurrency enthusiast, ran his own node and had to seek out complete strangers and tell them that he holds Bitcoin, which is unbelievably risky, until he found a willing node operator, and he still experienced a 10% failure rate on LN.

Might as well pay people in cash or dentalia shells

Common sense and Alex’s experience tell us that LN’s network topography, meaning which nodes connect to each other, is a dice roll, and that you have to deanonymize yourself and find others willing to do the same and then build a trust-based relationship with them to get the best out of LN, at which point you don’t need Bitcoin or LN at all. The lesson here is that anyone advertising or praising Lightning Network is running some sort of scheme, and the biggest telltale sign that it’s a scam is when you hear that Lightning Network works reliably.

So, if not LN, what did Kraken use? I’d bet money that Kraken built an in-house payment processing system that uses conventional financial methods while making it appear like it’s using LN. Since nobody owns the Bitcoin patent, Kraken can claim whatever it wants about LN, and there are no punishments for outrageous claims or lies. Even if Kraken somehow started getting negative press because of it, the exchange can ultimately lay the blame on Pierre.

What Is the Connection of Pierre Rochard to Riot Platforms?

After his Kraken debacle, Pierre became more publicly involved in defining Bitcoin’s long-term strategy, such as building Bitcoin-driven infrastructure platforms. For that, he joined Riot Platforms. What is the connection of Pierre Rochard to Riot? Pierre is the former Vice President of Research at Riot Platforms, a Bitcoin mining company he joined in 2019 as an advisor. His current role includes sharing his extensive knowledge on Bitcoin with the company, researching Bitcoin protocol improvements and network history, and informing policymakers on the value of proof-of-work mining. The company has Bitcoin mining operations and a data center in central Texas, and electrical switchgear engineering and fabrication operations in Denver, Colorado.

What Was the Pierre Rochard Trump Spat?

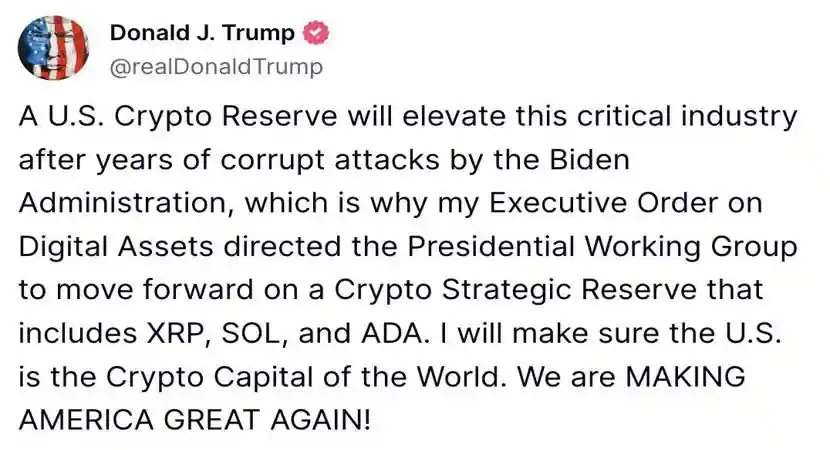

Pierre also became a public figure, commenting on the daily news, such as when Trump announced the Crypto Reserve. Trump is known for making outrageous and sometimes downright baffling statements that contradict what he said just yesterday, prompting people to respond with their hot takes, and that’s what Pierre did. What was the Pierre Rochard Trump spat? Pierre criticized Trump's Crypto Strategic Reserve after he announced on Truth Social that the reserve would include Bitcoin, Ethereum, XRP, Solana, and Cardano, arguing that altcoins would inevitably trend to zero relative to Bitcoin, making the reserve Bitcoin-only over time. Although Trump emphasized that Bitcoin and Ethereum would be the “heart of the reserve,” Rochard and many other Bitcoin purists called Trump’s plan a "shitcoin reserve."

I'm sure there is a logical explanation why Trump chose those cryptocurrencies

Trump announcements shouldn’t be taken seriously until he commits to them because he is a showman and knows how to distract from his real goals. What matters is his commitment to following through and acting on what he says.

What Did Pierre Rochard Say About XRP?

Behind some cryptocurrencies are powerful players who will spare no expense to gain the upper hand in the market. Those players will lobby for favorable laws, donate to politicians, and weasel their way into every power structure to achieve user base growth and market domination. One of those cryptocurrencies appears to be Ripple (XRP). What did Pierre Rochard say about XRP? Pierre claimed that Ripple Labs is the biggest obstacle to establishing a U.S. Strategic Bitcoin Reserve (SBR), accusing Ripple of spending millions to lobby against it and arguing that the company is pushing for central bank digital currencies (CBDCs) built on their network over Bitcoin. Rochard also said that Ripple previously attacked Bitcoin mining under the Biden administration and suggested that investing in XRP is equivalent to funding anti-Bitcoin lobbying.

What Is Pierre Rochard Doing Now?

After leaving Kraken, Pierre started following in the footsteps of his role model and long-term inspiration, Daniel Krawisz, a Bitcoin entrepreneur who popularized the idea that we should all invest in Bitcoin and invest using Bitcoin. Pierre had been following Daniel and his work for years, and out of the 25 oldest articles uploaded to the Satoshi Nakamoto Institute website, 4 were written by Pierre and 21 by Daniel. The gist of his philosophy can be found in the Coingeek interview Daniel gave in 2023, where he reveals that being an entrepreneur boils down to discovering new sources of income through one’s own actions while learning about the risks and accepting them. Pierre later started The Bitcoin Bond Company, a company that, in his words, “offers Bitcoin-backed financial products for institutional investors who want exposure to BTC” without HODLing it, and that lines up with the kind of entrepreneurship that Daniel was talking about. We briefly researched the company, but we couldn’t find anything legitimate about it, and we kept running into dead ends, so the consensus in the PlasBit office is that his company is totally fake.

El Salvador was a hot spot for Bitcoin evangelists during the four years Bitcoin was legal tender there

PlasBit as My Long-Term Crypto Partner

Researching Pierre Rochard was an emotional rollercoaster. I followed my intuition, patiently pieced together the clues I found, and reflected on my findings until a story emerged, and it struck me as both profoundly tragic and hopeful. Manipulation and envy are everywhere in the crypto industry, as Pierre undoubtedly experienced with Kraken that strung him along for almost three years just to bury his product and build hype for its product. Pierre chose the wrong partner and paid a steep price.

But, reading Daniel’s thoughts gave me hope that there is a better future for all of us, one that involves productive and fulfilling partnerships, and that it will come because of Bitcoin. It is truly not just a financial but a cultural force as well, reshaping how we interact with each other and how we seek out people for long-term partnerships. Bitcoin seems to bring out the best and the worst in people, making it very easy to judge their character, and I think it had the same effect on me. I was drawn to write for PlasBit because I was curious about Bitcoin, and I saw an exchange that was passionate about the right to digital privacy. For me, it’s not about the money but about learning and growing, and that is the only long-term Bitcoin strategy I need.