Since its inception in 2009, Bitcoin has proven its resilience, surviving early skepticism and market volatility. By 2016, people began to think of it less as “nerd money” and more as a currency to be used, and its price began to reflect this sentiment. So, what was the price of Bitcoin in 2016? Bitcoin started the year at $430.72 on 1 January and closed at $963.74 on 31 December, achieving a remarkable 123.8% increase. The first half of the year saw low volatility and steady prices; however, in late May, the price began to rise, reaching $700 in mid-June. It then dropped back to the $600 range, staying there until November, and then Bitcoin surged past $700, $800, and $900, and by the end of the year, it got closer to $1,000, a milestone it finally surpassed in early 2017. In the table below, you'll find detailed data on Bitcoin's daily prices throughout 2016. We've included the opening and closing prices, the day's lowest price, and the trading volume for each day. The table allows you to track Bitcoin's performance over time, explore its price fluctuations throughout the year, and summarize all the data on Bitcoin's price in 2016.

| DATE | OPEN | HIGH | LOW | CLOSE | VOLUME |

|---|---|---|---|---|---|

| December 31 2016 | $960.63 | $963.74 | $947.24 | $963.74 | 99,135,104 |

| December 30 2016 | $972.54 | $972.54 | $934.83 | $961.24 | 187,474,000 |

| December 29 2016 | $975.13 | $979.40 | $954.50 | $973.50 | 199,320,000 |

| December 28 2016 | $934.83 | $975.92 | $934.83 | $975.92 | 236,630,000 |

| December 27 2016 | $908.35 | $940.05 | $904.26 | $933.20 | 167,308,000 |

| December 26 2016 | $896.91 | $913.18 | $896.90 | $907.61 | 123,771,000 |

| December 25 2016 | $899.65 | $899.65 | $862.42 | $896.18 | 143,664,992 |

| December 24 2016 | $922.18 | $923.48 | $886.34 | $898.82 | 137,727,008 |

| December 23 2016 | $864.89 | $925.12 | $864.68 | $921.98 | 275,564,000 |

| December 22 2016 | $834.18 | $875.78 | $834.15 | $864.54 | 200,027,008 |

| December 21 2016 | $800.64 | $834.28 | $799.41 | $834.28 | 155,576,000 |

| December 20 2016 | $792.25 | $801.34 | $791.50 | $800.88 | 99,629,296 |

| December 19 2016 | $790.69 | $793.61 | $790.32 | $792.71 | 74,886,400 |

| December 18 2016 | $791.01 | $794.74 | $788.03 | $790.53 | 60,524,400 |

| December 17 2016 | $785.17 | $792.51 | $784.86 | $790.83 | 78,989,800 |

| December 16 2016 | $778.96 | $785.03 | $778.96 | $784.91 | 83,608,200 |

| December 15 2016 | $780.07 | $781.44 | $777.80 | $778.09 | 81,580,096 |

| December 14 2016 | $780.01 | $782.03 | $776.84 | $781.48 | 75,979,000 |

| December 13 2016 | $780.65 | $788.46 | $777.96 | $780.56 | 81,645,600 |

| December 12 2016 | $770.04 | $781.92 | $770.04 | $780.09 | 76,571,000 |

| December 11 2016 | $774.75 | $774.80 | $765.41 | $769.73 | 57,313,400 |

| December 10 2016 | $773.02 | $777.09 | $772.91 | $774.65 | 53,843,100 |

| December 09 2016 | $769.94 | $774.53 | $769.65 | $772.79 | 68,705,296 |

| December 08 2016 | $768.08 | $774.70 | $765.95 | $770.81 | 80,111,904 |

| December 07 2016 | $764.21 | $771.54 | $759.75 | $768.13 | 96,426,096 |

| December 06 2016 | $758.72 | $765.62 | $758.72 | $764.22 | 116,218,000 |

| December 05 2016 | $773.39 | $773.47 | $751.71 | $758.70 | 106,363,000 |

| December 04 2016 | $771.64 | $773.87 | $768.16 | $773.87 | 60,557,900 |

| December 03 2016 | $778.25 | $778.25 | $764.86 | $771.16 | 69,547,296 |

| December 02 2016 | $757.55 | $781.30 | $757.55 | $777.94 | 127,605,000 |

| December 01 2016 | $746.05 | $758.28 | $746.05 | $756.77 | 80,461,904 |

| November 30 2016 | $736.28 | $747.93 | $736.27 | $745.69 | 84,070,800 |

| November 29 2016 | $736.33 | $737.47 | $734.56 | $735.60 | 68,511,104 |

| November 28 2016 | $732.48 | $738.01 | $732.48 | $735.81 | 61,888,600 |

| November 27 2016 | $735.44 | $739.02 | $731.09 | $732.04 | 52,601,800 |

| November 26 2016 | $741.51 | $742.21 | $729.63 | $735.38 | 54,962,700 |

| November 25 2016 | $740.44 | $741.65 | $734.59 | $741.65 | 67,807,600 |

| November 24 2016 | $744.62 | $746.83 | $733.49 | $740.29 | 85,919,296 |

| November 23 2016 | $751.74 | $752.25 | $738.92 | $744.59 | 76,543,800 |

| November 22 2016 | $739.64 | $753.87 | $736.53 | $751.35 | 129,906,000 |

| November 21 2016 | $731.27 | $741.72 | $730.51 | $739.25 | 60,802,400 |

| November 20 2016 | $751.88 | $755.48 | $717.94 | $731.03 | 154,116,000 |

| November 19 2016 | $751.83 | $756.24 | $744.47 | $751.62 | 110,608,000 |

| November 18 2016 | $740.71 | $752.88 | $736.89 | $751.59 | 87,363,104 |

| November 17 2016 | $744.88 | $755.65 | $739.51 | $740.98 | 108,579,000 |

| November 16 2016 | $711.17 | $747.62 | $709.04 | $744.20 | 141,294,000 |

| November 15 2016 | $705.79 | $715.72 | $705.26 | $711.62 | 72,038,496 |

| November 14 2016 | $702.00 | $706.28 | $699.81 | $705.02 | 62,993,000 |

| November 13 2016 | $705.20 | $705.26 | $687.32 | $702.03 | 80,318,096 |

| November 12 2016 | $716.75 | $717.15 | $704.04 | $705.05 | 64,622,500 |

| November 11 2016 | $715.56 | $718.32 | $714.41 | $716.41 | 63,119,700 |

| November 10 2016 | $722.84 | $723.02 | $711.21 | $715.53 | 68,807,800 |

| November 09 2016 | $709.83 | $740.05 | $708.61 | $723.27 | 132,429,000 |

| November 08 2016 | $703.09 | $712.99 | $702.39 | $709.85 | 79,660,800 |

| November 07 2016 | $710.74 | $710.74 | $699.90 | $703.13 | 65,047,100 |

| November 06 2016 | $703.81 | $714.26 | $699.56 | $711.52 | 59,902,200 |

| November 05 2016 | $703.53 | $707.51 | $697.74 | $703.42 | 53,752,300 |

| November 04 2016 | $689.12 | $706.93 | $685.56 | $703.24 | 99,907,696 |

| November 03 2016 | $742.35 | $745.77 | $678.16 | $688.70 | 172,808,000 |

| November 02 2016 | $730.07 | $740.83 | $722.35 | $740.83 | 84,865,200 |

| November 01 2016 | $701.34 | $736.45 | $701.34 | $729.79 | 130,527,000 |

| October 31 2016 | $702.64 | $709.29 | $691.68 | $700.97 | 97,064,400 |

| October 30 2016 | $714.12 | $714.12 | $696.48 | $701.86 | 100,665,000 |

| October 29 2016 | $690.29 | $720.40 | $690.05 | $714.48 | 134,760,992 |

| October 28 2016 | $688.00 | $690.44 | $684.16 | $689.65 | 81,145,504 |

| October 27 2016 | $678.21 | $688.59 | $678.04 | $688.31 | 96,105,296 |

| October 26 2016 | $657.68 | $679.73 | $657.68 | $678.30 | 88,877,104 |

| October 25 2016 | $654.00 | $664.42 | $653.70 | $657.59 | 90,378,800 |

| October 24 2016 | $657.16 | $657.25 | $652.60 | $653.76 | 62,218,200 |

| October 23 2016 | $657.62 | $661.13 | $653.89 | $657.07 | 54,474,600 |

| October 22 2016 | $633.14 | $658.20 | $632.85 | $657.29 | 78,556,496 |

| October 21 2016 | $630.83 | $634.09 | $630.69 | $632.83 | 55,951,000 |

| October 20 2016 | $630.66 | $631.92 | $628.26 | $630.86 | 56,957,300 |

| October 19 2016 | $638.13 | $638.87 | $628.01 | $630.52 | 69,381,696 |

| October 18 2016 | $639.41 | $640.74 | $636.00 | $637.96 | 65,546,700 |

| October 17 2016 | $641.82 | $642.33 | $638.66 | $639.19 | 58,063,600 |

| October 16 2016 | $639.08 | $642.90 | $638.90 | $641.63 | 40,298,100 |

| October 15 2016 | $640.31 | $642.10 | $637.39 | $638.65 | 39,035,400 |

| October 14 2016 | $637.01 | $641.29 | $637.01 | $640.38 | 58,144,600 |

| October 13 2016 | $636.03 | $638.83 | $635.03 | $636.79 | 61,620,700 |

| October 12 2016 | $640.87 | $641.34 | $635.97 | $636.19 | 92,370,200 |

| October 11 2016 | $619.24 | $642.08 | $618.50 | $641.07 | 103,590,000 |

| October 10 2016 | $616.82 | $621.32 | $616.20 | $618.99 | 67,481,104 |

| October 09 2016 | $619.17 | $619.20 | $616.61 | $616.75 | 39,243,400 |

| October 08 2016 | $617.34 | $619.85 | $617.34 | $619.11 | 42,345,900 |

| October 07 2016 | $612.61 | $617.91 | $611.82 | $617.12 | 64,071,400 |

| October 06 2016 | $612.47 | $613.82 | $611.47 | $613.02 | 56,812,100 |

| October 05 2016 | $610.22 | $613.81 | $609.62 | $612.51 | 68,077,504 |

| October 04 2016 | $612.05 | $612.05 | $609.48 | $610.20 | 49,801,600 |

| October 03 2016 | $610.97 | $612.57 | $610.46 | $612.13 | 46,798,300 |

| October 02 2016 | $613.95 | $614.01 | $609.68 | $610.89 | 39,249,800 |

| October 01 2016 | $609.93 | $615.24 | $609.93 | $613.98 | 56,357,000 |

| September 30 2016 | $605.72 | $609.74 | $604.14 | $609.74 | 56,122,400 |

| September 29 2016 | $605.02 | $606.82 | $604.85 | $605.69 | 55,658,600 |

| September 28 2016 | $606.24 | $606.59 | $604.61 | $604.73 | 48,722,600 |

| September 27 2016 | $608.02 | $608.25 | $604.11 | $606.17 | 49,422,400 |

| September 26 2016 | $600.81 | $608.14 | $600.35 | $608.04 | 59,153,800 |

| September 25 2016 | $602.75 | $603.38 | $599.71 | $600.83 | 33,977,800 |

| September 24 2016 | $602.96 | $604.58 | $602.05 | $602.63 | 35,359,500 |

| September 23 2016 | $596.20 | $603.21 | $595.79 | $602.84 | 51,067,000 |

| September 22 2016 | $597.28 | $598.49 | $596.21 | $596.30 | 67,085,300 |

| September 21 2016 | $603.59 | $603.59 | $595.88 | $597.15 | 82,776,200 |

| September 20 2016 | $609.25 | $609.53 | $607.94 | $608.31 | 72,710,896 |

| September 19 2016 | $609.87 | $610.93 | $608.27 | $609.23 | 54,796,400 |

| September 18 2016 | $606.28 | $610.16 | $605.86 | $609.87 | 48,679,400 |

| September 17 2016 | $607.22 | $607.86 | $605.19 | $605.98 | 37,140,300 |

| September 16 2016 | $607.25 | $609.26 | $606.74 | $606.97 | 64,963,400 |

| September 15 2016 | $610.59 | $611.09 | $607.16 | $607.16 | 59,464,600 |

| September 14 2016 | $608.84 | $611.95 | $608.41 | $610.68 | 47,877,700 |

| September 13 2016 | $608.03 | $611.19 | $606.93 | $609.24 | 86,920,600 |

| September 12 2016 | $607.01 | $608.46 | $605.41 | $608.24 | 72,812,304 |

| September 11 2016 | $623.42 | $628.82 | $600.51 | $606.72 | 73,610,800 |

| September 10 2016 | $622.93 | $625.10 | $622.40 | $623.51 | 45,016,800 |

| September 09 2016 | $626.35 | $626.83 | $620.26 | $622.86 | 64,550,200 |

| September 08 2016 | $614.64 | $628.77 | $613.84 | $626.32 | 86,713,000 |

| September 07 2016 | $610.57 | $614.55 | $608.51 | $614.54 | 75,032,400 |

| September 06 2016 | $606.51 | $610.83 | $605.09 | $610.44 | 78,529,104 |

| September 05 2016 | $608.99 | $609.06 | $602.24 | $606.59 | 82,446,800 |

| September 04 2016 | $598.59 | $611.84 | $596.85 | $608.63 | 97,942,896 |

| September 03 2016 | $575.56 | $599.50 | $574.06 | $598.21 | 159,014,000 |

| September 02 2016 | $572.41 | $575.64 | $570.81 | $575.54 | 79,910,800 |

| September 01 2016 | $575.55 | $576.31 | $571.81 | $572.30 | 76,923,400 |

| August 31 2016 | $577.59 | $577.86 | $573.64 | $575.47 | 75,840,896 |

| August 30 2016 | $574.11 | $578.36 | $574.11 | $577.50 | 70,342,400 |

| August 29 2016 | $574.07 | $576.28 | $573.47 | $574.11 | 110,398,000 |

| August 28 2016 | $569.83 | $574.04 | $569.74 | $573.91 | 86,301,600 |

| August 27 2016 | $579.45 | $579.85 | $568.63 | $569.95 | 59,698,300 |

| August 26 2016 | $577.75 | $580.62 | $576.86 | $579.65 | 48,856,800 |

| August 25 2016 | $580.18 | $580.45 | $575.17 | $577.76 | 136,130,000 |

| August 24 2016 | $583.41 | $583.59 | $579.86 | $580.18 | 56,328,200 |

| August 23 2016 | $586.77 | $589.47 | $581.63 | $583.42 | 85,349,200 |

| August 22 2016 | $581.31 | $588.45 | $580.59 | $586.75 | 72,844,000 |

| August 21 2016 | $581.94 | $584.16 | $580.22 | $581.31 | 38,299,400 |

| August 20 2016 | $576.08 | $582.82 | $575.46 | $581.70 | 45,301,400 |

| August 19 2016 | $574.34 | $578.24 | $574.18 | $575.63 | 50,631,600 |

| August 18 2016 | $573.71 | $577.79 | $573.43 | $574.32 | 59,896,600 |

| August 17 2016 | $577.76 | $580.89 | $571.43 | $573.22 | 54,443,000 |

| August 16 2016 | $567.24 | $581.74 | $566.72 | $577.44 | 58,405,200 |

| August 15 2016 | $570.49 | $573.58 | $563.24 | $567.24 | 57,262,300 |

| August 14 2016 | $585.59 | $585.67 | $564.78 | $570.47 | 60,851,100 |

| August 13 2016 | $587.36 | $589.77 | $584.98 | $585.59 | 43,563,000 |

| August 12 2016 | $588.80 | $589.91 | $583.81 | $587.56 | 69,218,000 |

| August 11 2016 | $592.12 | $597.54 | $589.12 | $589.12 | 74,514,400 |

| August 10 2016 | $587.65 | $599.98 | $586.37 | $592.10 | 102,905,000 |

| August 09 2016 | $591.04 | $591.09 | $584.79 | $587.80 | 92,228,096 |

| August 08 2016 | $592.74 | $592.99 | $588.05 | $591.05 | 61,194,100 |

| August 07 2016 | $587.77 | $597.51 | $586.82 | $592.69 | 82,398,400 |

| August 06 2016 | $575.03 | $588.40 | $569.47 | $587.78 | 80,797,296 |

| August 05 2016 | $578.28 | $578.28 | $569.98 | $575.04 | 66,127,900 |

| August 04 2016 | $566.33 | $579.50 | $565.78 | $578.29 | 125,292,000 |

| August 03 2016 | $548.66 | $573.36 | $541.55 | $566.36 | 207,982,000 |

| August 02 2016 | $606.40 | $612.85 | $531.33 | $547.47 | 330,932,992 |

| August 01 2016 | $624.60 | $626.12 | $605.88 | $606.27 | 121,887,000 |

| July 31 2016 | $655.10 | $655.29 | $624.37 | $624.68 | 110,818,000 |

| July 30 2016 | $657.01 | $658.22 | $654.21 | $655.05 | 38,456,100 |

| July 29 2016 | $655.11 | $657.80 | $654.79 | $656.99 | 60,703,500 |

| July 28 2016 | $654.49 | $657.60 | $654.49 | $655.04 | 86,428,400 |

| July 27 2016 | $651.63 | $657.46 | $648.45 | $654.35 | 147,460,992 |

| July 26 2016 | $654.23 | $656.23 | $645.88 | $651.78 | 225,135,008 |

| July 25 2016 | $661.26 | $661.83 | $653.40 | $654.10 | 78,176,496 |

| July 24 2016 | $655.41 | $663.11 | $652.79 | $661.29 | 118,184,000 |

| July 23 2016 | $650.73 | $656.37 | $648.52 | $655.56 | 69,532,200 |

| July 22 2016 | $664.92 | $666.58 | $646.72 | $650.62 | 134,169,000 |

| July 21 2016 | $665.23 | $666.22 | $660.42 | $665.01 | 60,491,800 |

| July 20 2016 | $672.81 | $672.93 | $663.36 | $665.69 | 94,636,400 |

| July 19 2016 | $672.74 | $673.28 | $667.63 | $672.86 | 61,203,300 |

| July 18 2016 | $679.81 | $681.56 | $668.63 | $673.11 | 69,465,000 |

| July 17 2016 | $661.99 | $682.37 | $661.99 | $679.46 | 74,407,904 |

| July 16 2016 | $663.78 | $666.46 | $659.33 | $660.77 | 50,330,200 |

| July 15 2016 | $659.17 | $667.08 | $659.04 | $663.26 | 81,673,104 |

| July 14 2016 | $652.92 | $662.90 | $652.92 | $658.08 | 98,511,400 |

| July 13 2016 | $664.80 | $668.70 | $654.47 | $654.47 | 131,449,000 |

| July 12 2016 | $648.28 | $675.26 | $646.78 | $664.55 | 138,172,992 |

| July 11 2016 | $648.48 | $659.63 | $644.98 | $647.66 | 107,910,000 |

| July 10 2016 | $650.60 | $652.29 | $641.26 | $649.36 | 102,532,000 |

| July 09 2016 | $666.38 | $666.38 | $633.40 | $650.96 | 180,536,000 |

| July 08 2016 | $640.69 | $666.71 | $636.47 | $666.52 | 141,970,000 |

| July 07 2016 | $678.09 | $682.43 | $611.83 | $640.56 | 258,091,008 |

| July 06 2016 | $670.42 | $681.90 | $670.42 | $677.33 | 134,960,992 |

| July 05 2016 | $683.21 | $683.49 | $665.07 | $670.63 | 130,476,000 |

| July 04 2016 | $658.80 | $683.66 | $650.51 | $683.66 | 92,008,400 |

| July 03 2016 | $704.97 | $704.97 | $649.01 | $658.66 | 129,512,000 |

| July 02 2016 | $676.73 | $703.70 | $676.40 | $703.70 | 112,354,000 |

| July 01 2016 | $672.52 | $686.15 | $669.59 | $676.30 | 134,431,008 |

| June 30 2016 | $640.59 | $675.40 | $636.61 | $673.34 | 138,980,000 |

| June 29 2016 | $644.12 | $644.68 | $628.28 | $639.89 | 142,456,000 |

| June 28 2016 | $658.10 | $659.25 | $637.77 | $647.00 | 138,384,992 |

| June 27 2016 | $629.35 | $655.28 | $620.52 | $655.28 | 122,134,000 |

| June 26 2016 | $665.93 | $665.98 | $616.93 | $629.37 | 109,225,000 |

| June 25 2016 | $665.28 | $691.73 | $646.56 | $665.12 | 126,656,000 |

| June 24 2016 | $625.58 | $681.73 | $625.27 | $665.30 | 224,316,992 |

| June 23 2016 | $597.44 | $629.33 | $558.14 | $623.98 | 253,462,000 |

| June 22 2016 | $665.92 | $678.67 | $587.48 | $596.12 | 266,392,992 |

| June 21 2016 | $735.88 | $735.88 | $639.07 | $666.65 | 309,944,000 |

| June 20 2016 | $763.93 | $764.08 | $732.73 | $737.23 | 174,511,008 |

| June 19 2016 | $756.69 | $766.62 | $745.63 | $763.78 | 136,184,992 |

| June 18 2016 | $748.76 | $777.99 | $733.93 | $756.23 | 252,718,000 |

| June 17 2016 | $768.49 | $775.36 | $716.56 | $748.91 | 363,320,992 |

| June 16 2016 | $696.52 | $773.72 | $696.52 | $766.31 | 271,633,984 |

| June 15 2016 | $685.69 | $696.30 | $672.56 | $694.47 | 99,223,800 |

| June 14 2016 | $704.50 | $704.50 | $662.80 | $685.56 | 186,694,000 |

| June 13 2016 | $671.65 | $716.00 | $664.49 | $704.38 | 243,295,008 |

| June 12 2016 | $609.68 | $684.84 | $607.04 | $672.78 | 277,084,992 |

| June 11 2016 | $578.67 | $607.12 | $578.67 | $606.73 | 82,357,000 |

| June 10 2016 | $575.84 | $579.13 | $573.33 | $577.47 | 66,991,900 |

| June 09 2016 | $582.20 | $582.20 | $570.95 | $574.63 | 71,301,000 |

| June 08 2016 | $577.17 | $582.84 | $573.13 | $581.65 | 80,265,800 |

| June 07 2016 | $585.45 | $590.26 | $567.51 | $576.60 | 107,770,000 |

| June 06 2016 | $574.60 | $586.47 | $574.60 | $585.54 | 72,138,896 |

| June 05 2016 | $573.31 | $582.81 | $569.18 | $574.98 | 68,874,096 |

| June 04 2016 | $569.71 | $590.13 | $564.24 | $572.73 | 94,925,296 |

| June 03 2016 | $537.68 | $574.64 | $536.92 | $569.19 | 122,020,000 |

| June 02 2016 | $536.52 | $540.35 | $533.08 | $537.97 | 60,378,200 |

| June 01 2016 | $531.11 | $543.08 | $525.64 | $536.92 | 86,061,800 |

| May 31 2016 | $534.19 | $546.62 | $520.66 | $531.39 | 138,450,000 |

| May 30 2016 | $528.47 | $544.35 | $522.96 | $533.86 | 87,958,704 |

| May 29 2016 | $527.48 | $553.96 | $512.18 | $526.23 | 148,736,992 |

| May 28 2016 | $473.03 | $533.47 | $472.70 | $530.04 | 181,199,008 |

| May 27 2016 | $453.52 | $478.15 | $453.52 | $473.46 | 164,780,992 |

| May 26 2016 | $449.67 | $453.64 | $447.90 | $453.38 | 65,203,800 |

| May 25 2016 | $446.06 | $450.30 | $446.06 | $449.60 | 65,231,000 |

| May 24 2016 | $444.29 | $447.10 | $443.93 | $445.98 | 65,783,100 |

| May 23 2016 | $439.35 | $444.35 | $438.82 | $444.16 | 50,582,500 |

| May 22 2016 | $443.22 | $443.43 | $439.04 | $439.32 | 39,657,600 |

| May 21 2016 | $442.97 | $443.78 | $441.71 | $443.19 | 42,762,300 |

| May 20 2016 | $437.79 | $444.05 | $437.39 | $442.68 | 81,987,904 |

| May 19 2016 | $454.52 | $454.63 | $438.72 | $438.72 | 96,027,400 |

| May 18 2016 | $453.69 | $456.00 | $453.30 | $454.62 | 86,850,096 |

| May 17 2016 | $454.01 | $455.07 | $453.61 | $453.78 | 64,100,300 |

| May 16 2016 | $457.59 | $458.20 | $452.95 | $454.16 | 59,171,500 |

| May 15 2016 | $455.76 | $458.69 | $455.46 | $457.57 | 28,514,000 |

| May 14 2016 | $455.82 | $456.84 | $454.79 | $455.67 | 37,209,000 |

| May 13 2016 | $454.85 | $457.06 | $453.45 | $455.67 | 60,845,000 |

| May 12 2016 | $452.45 | $454.95 | $449.25 | $454.77 | 59,849,300 |

| May 11 2016 | $450.86 | $454.58 | $450.86 | $452.73 | 50,605,200 |

| May 10 2016 | $460.52 | $461.93 | $448.95 | $450.90 | 58,956,100 |

| May 09 2016 | $458.21 | $462.48 | $456.53 | $460.48 | 55,493,100 |

| May 08 2016 | $458.43 | $459.42 | $455.98 | $458.55 | 40,315,000 |

| May 07 2016 | $459.64 | $460.68 | $457.32 | $458.54 | 38,364,500 |

| May 06 2016 | $447.94 | $461.38 | $447.07 | $459.60 | 72,796,800 |

| May 05 2016 | $446.71 | $448.51 | $445.88 | $447.98 | 50,440,800 |

| May 04 2016 | $450.18 | $450.38 | $445.63 | $446.72 | 50,407,300 |

| May 03 2016 | $444.73 | $451.10 | $442.62 | $450.30 | 59,366,400 |

| May 02 2016 | $451.93 | $452.45 | $441.78 | $444.67 | 92,127,000 |

| May 01 2016 | $448.48 | $452.48 | $447.93 | $451.88 | 40,660,100 |

| April 30 2016 | $455.18 | $455.59 | $447.70 | $448.32 | 69,322,600 |

| April 29 2016 | $449.41 | $455.38 | $446.02 | $455.10 | 49,258,500 |

| April 28 2016 | $445.04 | $449.55 | $436.65 | $449.01 | 74,064,704 |

| April 27 2016 | $466.26 | $467.08 | $444.13 | $444.69 | 93,564,896 |

| April 26 2016 | $461.65 | $467.97 | $461.62 | $466.09 | 78,971,904 |

| April 25 2016 | $459.12 | $466.62 | $453.59 | $461.43 | 87,091,800 |

| April 24 2016 | $450.56 | $460.15 | $448.93 | $458.56 | 68,198,400 |

| April 23 2016 | $445.86 | $450.28 | $444.33 | $450.28 | 50,485,400 |

| April 22 2016 | $449.69 | $449.81 | $444.15 | $445.74 | 58,804,400 |

| April 21 2016 | $441.42 | $450.55 | $440.95 | $449.43 | 68,204,704 |

| April 20 2016 | $435.32 | $443.05 | $434.41 | $441.39 | 72,890,096 |

| April 19 2016 | $428.70 | $436.02 | $428.10 | $435.51 | 52,810,500 |

| April 18 2016 | $427.61 | $429.27 | $427.09 | $428.59 | 55,670,900 |

| April 17 2016 | $430.64 | $431.37 | $426.08 | $427.40 | 52,125,900 |

| April 16 2016 | $429.58 | $432.63 | $428.98 | $430.57 | 39,392,800 |

| April 15 2016 | $424.43 | $429.93 | $424.43 | $429.71 | 54,801,500 |

| April 14 2016 | $423.94 | $425.37 | $423.01 | $424.28 | 45,281,000 |

| April 13 2016 | $425.63 | $426.66 | $422.92 | $423.73 | 69,060,400 |

| April 12 2016 | $422.84 | $427.28 | $422.84 | $425.19 | 70,728,800 |

| April 11 2016 | $421.87 | $422.74 | $420.53 | $422.48 | 50,747,500 |

| April 10 2016 | $419.59 | $422.44 | $419.26 | $421.56 | 73,478,600 |

| April 09 2016 | $420.81 | $420.89 | $416.52 | $419.41 | 49,792,700 |

| April 08 2016 | $422.91 | $425.36 | $419.64 | $420.35 | 63,454,700 |

| April 07 2016 | $423.62 | $423.66 | $420.52 | $422.75 | 57,858,600 |

| April 06 2016 | $424.28 | $424.53 | $422.73 | $423.41 | 59,091,000 |

| April 05 2016 | $421.02 | $424.26 | $420.61 | $424.03 | 60,718,000 |

| April 04 2016 | $421.30 | $422.34 | $419.60 | $421.44 | 50,634,300 |

| April 03 2016 | $421.17 | $421.58 | $419.70 | $420.90 | 38,053,700 |

| April 02 2016 | $418.42 | $422.08 | $418.42 | $420.87 | 45,681,200 |

| April 01 2016 | $416.76 | $418.17 | $415.83 | $417.96 | 51,235,700 |

| March 31 2016 | $415.26 | $418.37 | $415.26 | $416.73 | 60,215,200 |

| March 30 2016 | $416.83 | $416.83 | $412.50 | $414.82 | 66,034,100 |

| March 29 2016 | $424.30 | $426.20 | $412.68 | $416.52 | 75,411,504 |

| March 28 2016 | $426.55 | $426.86 | $423.29 | $424.23 | 68,522,800 |

| March 27 2016 | $418.14 | $428.80 | $417.71 | $426.77 | 71,229,400 |

| March 26 2016 | $417.37 | $418.99 | $416.26 | $417.95 | 44,650,400 |

| March 25 2016 | $416.51 | $418.08 | $415.56 | $417.18 | 52,560,000 |

| March 24 2016 | $418.42 | $418.68 | $415.49 | $416.39 | 68,346,704 |

| March 23 2016 | $418.16 | $419.27 | $417.36 | $418.04 | 61,444,200 |

| March 22 2016 | $413.13 | $418.38 | $412.53 | $418.09 | 66,813,300 |

| March 21 2016 | $413.42 | $413.42 | $410.38 | $413.31 | 61,655,400 |

| March 20 2016 | $410.40 | $414.63 | $410.40 | $413.76 | 45,947,900 |

| March 19 2016 | $409.27 | $410.98 | $407.23 | $410.44 | 58,423,000 |

| March 18 2016 | $420.55 | $420.55 | $406.14 | $409.55 | 104,940,000 |

| March 17 2016 | $417.89 | $421.00 | $417.89 | $420.62 | 83,528,600 |

| March 16 2016 | $416.89 | $417.69 | $415.91 | $417.01 | 65,185,800 |

| March 15 2016 | $416.39 | $418.13 | $414.99 | $416.83 | 66,781,700 |

| March 14 2016 | $414.20 | $416.68 | $414.20 | $416.44 | 95,259,400 |

| March 13 2016 | $411.65 | $416.60 | $411.64 | $414.07 | 74,322,800 |

| March 12 2016 | $421.61 | $421.80 | $410.09 | $411.62 | 92,712,896 |

| March 11 2016 | $417.24 | $423.93 | $417.01 | $421.69 | 73,969,696 |

| March 10 2016 | $414.74 | $417.51 | $413.25 | $417.13 | 81,022,896 |

| March 09 2016 | $413.89 | $416.03 | $411.61 | $414.86 | 70,012,304 |

| March 08 2016 | $414.47 | $416.24 | $411.09 | $413.97 | 70,311,696 |

| March 07 2016 | $407.76 | $415.92 | $406.31 | $414.32 | 85,762,400 |

| March 06 2016 | $400.53 | $411.91 | $395.78 | $407.71 | 91,212,496 |

| March 05 2016 | $410.78 | $411.26 | $394.04 | $400.57 | 135,384,992 |

| March 04 2016 | $421.84 | $425.18 | $410.94 | $410.94 | 90,856,096 |

| March 03 2016 | $423.91 | $425.37 | $419.41 | $421.65 | 100,484,000 |

| March 02 2016 | $435.13 | $435.92 | $423.99 | $423.99 | 74,955,296 |

| March 01 2016 | $437.92 | $439.65 | $432.32 | $435.12 | 74,895,800 |

| February 29 2016 | $433.44 | $441.51 | $431.69 | $437.70 | 60,694,700 |

| February 28 2016 | $432.57 | $435.68 | $423.82 | $433.50 | 53,033,400 |

| February 27 2016 | $432.84 | $434.23 | $428.10 | $432.52 | 41,893,600 |

| February 26 2016 | $424.63 | $432.15 | $421.62 | $432.15 | 61,486,000 |

| February 25 2016 | $425.04 | $427.72 | $420.42 | $424.54 | 70,798,000 |

| February 24 2016 | $420.96 | $425.55 | $413.91 | $424.96 | 67,743,696 |

| February 23 2016 | $438.26 | $439.86 | $417.82 | $420.74 | 85,244,896 |

| February 22 2016 | $438.99 | $439.05 | $432.92 | $437.75 | 85,385,200 |

| February 21 2016 | $437.77 | $448.05 | $429.08 | $438.80 | 89,820,704 |

| February 20 2016 | $421.60 | $441.98 | $421.60 | $437.16 | 93,992,096 |

| February 19 2016 | $422.73 | $423.10 | $417.60 | $420.79 | 55,711,300 |

| February 18 2016 | $416.57 | $426.00 | $415.64 | $422.37 | 76,752,600 |

| February 17 2016 | $407.66 | $421.17 | $406.78 | $416.32 | 83,193,600 |

| February 16 2016 | $401.43 | $408.95 | $401.43 | $407.49 | 73,093,104 |

| February 15 2016 | $407.57 | $410.38 | $397.75 | $400.19 | 74,070,496 |

| February 14 2016 | $392.93 | $407.23 | $392.93 | $407.23 | 74,469,800 |

| February 13 2016 | $384.64 | $391.86 | $384.64 | $391.86 | 61,911,700 |

| February 12 2016 | $379.69 | $384.95 | $379.60 | $384.26 | 67,042,800 |

| February 11 2016 | $382.11 | $383.13 | $376.40 | $379.65 | 74,375,600 |

| February 10 2016 | $376.15 | $385.48 | $375.78 | $381.65 | 85,130,896 |

| February 09 2016 | $373.42 | $377.25 | $372.90 | $376.03 | 55,318,500 |

| February 08 2016 | $376.76 | $379.88 | $373.33 | $373.45 | 47,671,100 |

| February 07 2016 | $376.51 | $380.87 | $374.90 | $376.62 | 37,076,300 |

| February 06 2016 | $386.59 | $386.63 | $372.39 | $376.52 | 49,249,300 |

| February 05 2016 | $388.90 | $391.09 | $385.57 | $386.55 | 43,825,000 |

| February 04 2016 | $370.17 | $391.61 | $369.99 | $389.59 | 69,285,504 |

| February 03 2016 | $374.65 | $374.95 | $368.05 | $369.95 | 45,933,400 |

| February 02 2016 | $372.92 | $375.88 | $372.92 | $374.45 | 40,378,700 |

| February 01 2016 | $369.35 | $378.07 | $367.96 | $373.06 | 51,656,700 |

| January 31 2016 | $378.29 | $380.35 | $367.84 | $368.77 | 37,894,300 |

| January 30 2016 | $378.87 | $380.92 | $376.49 | $378.26 | 30,284,400 |

| January 29 2016 | $380.11 | $384.38 | $365.45 | $379.47 | 86,125,296 |

| January 28 2016 | $395.15 | $395.50 | $379.74 | $380.29 | 59,247,900 |

| January 27 2016 | $392.44 | $396.84 | $391.78 | $394.97 | 47,424,400 |

| January 26 2016 | $392.00 | $397.77 | $390.58 | $392.15 | 58,147,000 |

| January 25 2016 | $402.32 | $402.32 | $388.55 | $391.73 | 59,062,400 |

| January 24 2016 | $388.10 | $405.49 | $387.51 | $402.97 | 54,824,800 |

| January 23 2016 | $382.43 | $394.54 | $381.98 | $387.49 | 56,247,400 |

| January 22 2016 | $409.75 | $410.41 | $375.28 | $382.49 | 91,546,600 |

| January 21 2016 | $419.63 | $422.88 | $406.30 | $410.26 | 68,338,000 |

| January 20 2016 | $379.74 | $425.27 | $376.60 | $420.23 | 121,720,000 |

| January 19 2016 | $387.03 | $387.73 | $378.97 | $380.15 | 46,819,800 |

| January 18 2016 | $381.73 | $388.10 | $376.67 | $387.17 | 54,403,900 |

| January 17 2016 | $387.15 | $390.97 | $380.09 | $382.30 | 45,319,600 |

| January 16 2016 | $365.07 | $390.56 | $354.91 | $387.54 | 120,352,000 |

| January 15 2016 | $430.26 | $430.26 | $364.33 | $364.33 | 153,351,008 |

| January 14 2016 | $432.29 | $433.32 | $427.85 | $430.31 | 43,945,500 |

| January 13 2016 | $434.67 | $435.19 | $424.44 | $432.37 | 173,888,000 |

| January 12 2016 | $448.18 | $448.18 | $435.69 | $435.69 | 115,607,000 |

| January 11 2016 | $448.70 | $450.66 | $443.86 | $448.43 | 40,450,000 |

| January 10 2016 | $448.24 | $448.31 | $440.35 | $447.99 | 35,995,900 |

| January 09 2016 | $453.38 | $454.64 | $446.89 | $447.61 | 32,278,000 |

| January 08 2016 | $457.54 | $462.93 | $447.94 | $453.23 | 56,993,000 |

| January 07 2016 | $430.01 | $458.77 | $429.08 | $458.05 | 87,562,200 |

| January 06 2016 | $431.86 | $431.86 | $426.34 | $429.11 | 34,042,500 |

| January 05 2016 | $433.07 | $434.18 | $429.68 | $431.96 | 34,522,600 |

| January 04 2016 | $430.06 | $434.52 | $429.08 | $433.09 | 38,477,500 |

| January 03 2016 | $433.58 | $433.74 | $424.71 | $430.01 | 39,633,800 |

| January 02 2016 | $434.62 | $436.06 | $431.87 | $433.44 | 30,096,600 |

| January 01 2016 | $430.72 | $436.25 | $427.52 | $434.33 | 36,278,900 |

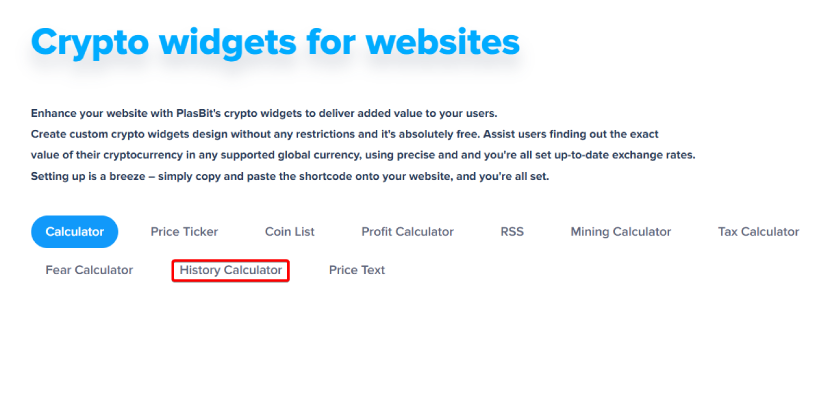

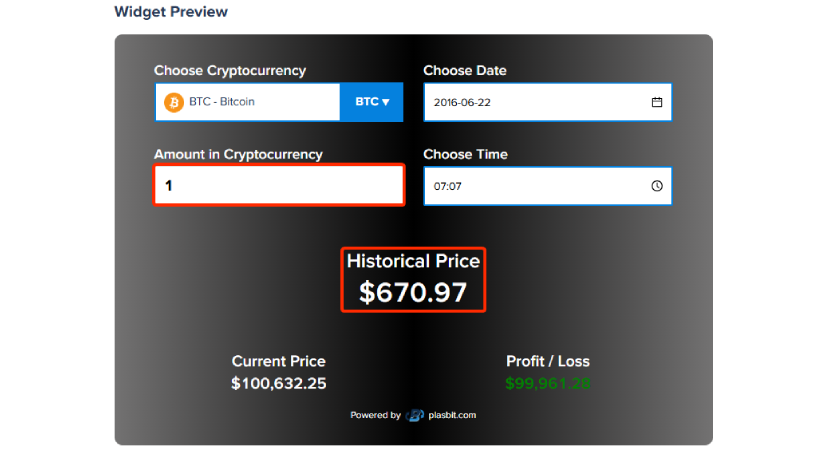

PlasBit historical calculator

The historical calculator is one of several widgets available as a resource on the Plasbit website. It can give you an instant assessment of the value of Bitcoin through time and the outcome of your investment if you have Bitcoin in your portfolio.

Step 1 – Go to the Plasbit Crypto History Calculator page.

To access the Crypto History Calculator, go to the Plasbit home page, scroll down to the footer, look for the 'Resources' heading on the right end of the screen, and select "Site Widgets."

You will access the Widget page, select History Calculator

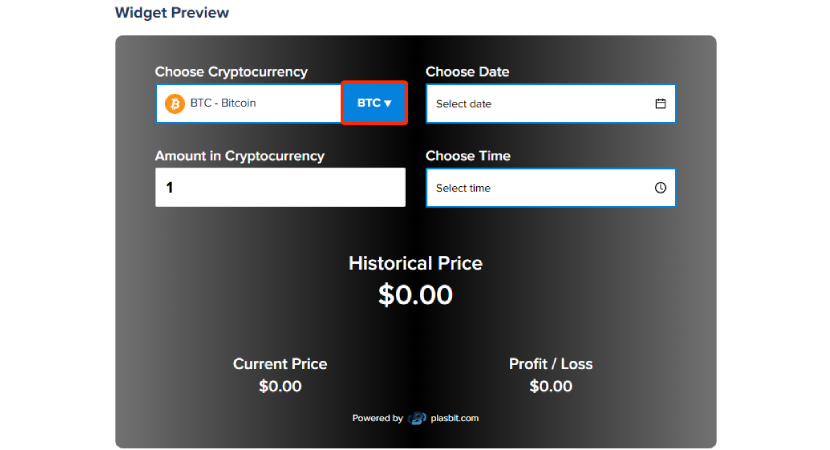

Step 2 – Select the cryptocurrency you want to check.

Once you have accessed the calculator, select the cryptocurrency you want to check; in this example, BTC (Bitcoin)

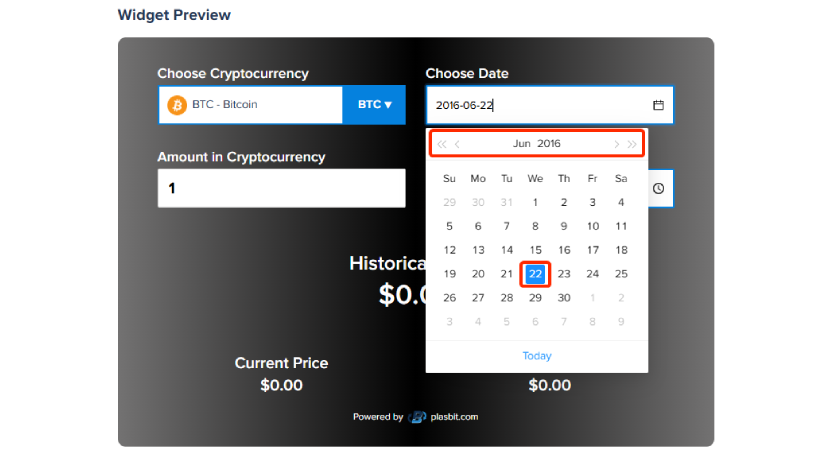

Step 3 - Choose the date

Click the month, the year, and the day in the input field to the right.

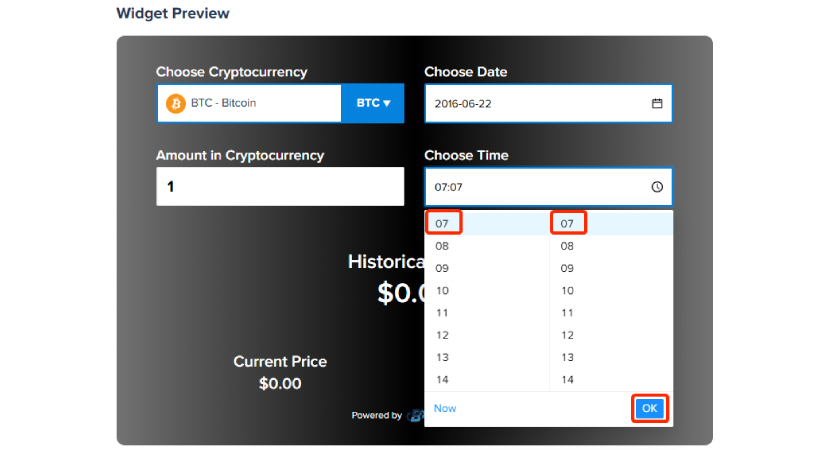

Step. 4 - Choose the time of the day.

Click "OK" to confirm your choice

Step 5 – Type the amount

Type the amount of Bitcoin you want to check in the input box on the left

In the image above, the example shows that the value of 1 Bitcoin on 22 June 2016 was $670.97; if you had bought one BTC on that day, the value of your investment on the day the screenshot was taken would be $101,632.25 if you had not sold it, the profit from your investment would be $99,961.28.

Bitcoin and cryptocurrency market in 2016

In 2016, Bitcoin had a 123.8% rise in value from $430.72 on 1 January to $963.74 on 31 December. It also kept its dominant position in the cryptocurrency market despite an increased number of competitors. To understand what was the price of bitcoin in 2016, we have to discuss the crypto market in 2016 and what factors could have had a material influence on the market sentiment towards cryptocurrencies in general and specifically on Bitcoin.

Rising Bitcoin Hash Rate

The hash rate measures the total computing power used to process and validate Bitcoin transactions on the network. A higher hash rate means more miners (or stronger mining equipment) are participating. In January 2016, Bitcoin’s hash rate exceeded one exahash per second for the first time, meaning that the Bitcoin network collectively performed over 1 quintillion (i.e., one million of trillions) cryptographic calculations per second to solve the next block. The Bitcoin network became more secure because attacking the network would require enormous computational resources (and cost), making it impractical and expensive to attempt. It also becomes harder for any single entity to control over 50% of the network's mining power (51% attack). Surpassing 1 exahash per second reflected increasing interest in Bitcoin mining, likely due to growing awareness of Bitcoin's value and technological advancements in mining hardware.

Bitcoin Halving

Overall, the 2016 Bitcoin halving was a pivotal moment that showcased the resilience of the Bitcoin network, the adaptability of miners, and the growing recognition of Bitcoin's value in the broader financial landscape. On July 9, 2016, halving took place at block 420,000, reducing the block reward from 25 BTC to 12.5 BTC per block. In the lead-up to the halving, there was considerable speculation and anticipation, leading to increased volatility. The price of Bitcoin rose slightly before the event, with Bitcoin trading at about $583.11 a month before and around $650 at the time of the halving. However, there was a short-term correction immediately after the halving, followed by a significant surge. The 2016 halving contributed to a broader bullish trend in Bitcoin's price. The narrative of Bitcoin as a scarce and deflationary asset gained traction, attracting both institutional and retail investors. This period also saw the emergence of an 'ICO bubble' and increased acceptance of Bitcoin, which further drove up demand and prices. The reduction in block rewards presented a challenge for miners, particularly less efficient operations. However, the overall hash rate of the network continued to rise as more efficient miners adapted and consolidated their operations. This consolidation emphasized the survival of the fittest in the mining ecosystem. The halving reaffirmed Bitcoin's deflationary nature, boosting investor interest and reinforcing its value proposition as digital scarcity drove market demand.

What happened in 2016?

Several significant events influenced the crypto market in 2016, pushing investors towards alternative assets like cryptocurrencies:

· Chinese Stock Market Crash – The sharp sell-off in the Chinese stock market in early January 2016 created volatility in financial markets worldwide. The direct impact on crypto might not have been immediate, but the global economic uncertainty could have influenced investor sentiment and risk appetite, driving some investors to alternative assets.

· OPEC Oil Cut – In November 2016, OPEC agreed to cut oil extraction. Even though the direct correlation between oil prices and the crypto market is not strong, the overall economic confidence is affected by the stability and fluctuations in oil prices, pushing investors to explore alternative markets.

· Global Monetary Policy – Low interest rates and quantitative easing influenced the investors' appetite for higher-yielding assets.

· Brexit referendum – In 2016, the Brexit referendum in the UK created financial uncertainty, leading to sharp declines in traditional financial markets. The pound plummeted against the US dollar, and global equities experienced a substantial drop.

· The US election – Following Donald Trump's victory in 2016, Bitcoin's price surged, driven by optimism about deregulation and economic reform under the Trump administration, amongst other things.

· Institutional Adoption and Regulatory Developments – In 2016, institutional investors became interested in cryptocurrencies and introduced the first regulatory frameworks (e.g., BitLicence). These developments helped legitimize cryptocurrencies and attract more investors.

· Swiss Railway Allows Bitcoin Purchases – In November 2016, Swiss Federal Railways (SBB) upgraded ticket machines across the country to allow Bitcoin purchases, making it easy for users to buy BTC by scanning a QR code on their phone. This initiative marked a step toward mainstream acceptance, providing convenient access to Bitcoin and signaling growing institutional interest in Bitcoin.

· The Japanese Cabinet officially recognizes Bitcoin - In March 2016, The Japanese Cabinet officially recognized Bitcoin and other virtual currencies as having functions similar to real money, positioning Japan as a progressive leader in Bitcoin regulation. This move helped legitimize Bitcoin within the Japanese economy and fostered a supportive regulatory environment that influenced global cryptocurrency markets.

Market Capitalisation

The market capitalization of Bitcoin at the end of 2016 was approximately $17.23 billion, a significant increase compared to the end of 2015. Halving events contributed to the price increase due to a combination of a reduction in supply and an increase in demand. By the end of 2016, Bitcoin reached the value of $963.74, achieving a remarkable 123.8% increase, although it did not reach the peak reached in 2014before the substantial plunge in the same year.

Market Sentiment

The year 2016 was marked by increasing mainstream awareness and acceptance of Bitcoin. This growing interest and the subsequent price increase would have reinforced positive market sentiment. The lack of significant adverse events or regulatory crackdowns during this period also contributed to the optimistic outlook. Several key factors influenced Bitcoin's market sentiment:

· Online Interest and Social Media - The level of online interest, mainly measured by Google search queries and social media activity, positively impacted Bitcoin prices. Studies have shown that increased online interest and positive social media platform sentiment strongly correlate with higher Bitcoin prices.

· Market and Economic Factors - Bitcoin's price in 2016 was also influenced by its relationship with other financial markets. The S&P 500 index positively affected Bitcoin prices, indicating that Bitcoin was procyclical and followed the trends of broader financial markets during this period.

· Speculation and Sentiment - Speculation and investor sentiment were crucial drivers. Fear and greed among investors and the belief in Bitcoin's utility as a store of value and a hedge against inflation contributed to its price movements. The expectation of future price increases also played a significant role in determining demand and, consequently, prices.

· Lack of Major Negative Events - The absence of significant negative events, such as major hacks or stringent regulatory crackdowns, helped maintain a positive market sentiment throughout the year. This stability and growing mainstream awareness and acceptance supported the upward trend in Bitcoin's price.

Major investors in Bitcoin in 2016

In 2016, several prominent venture capital firms and investors were actively involved in funding Bitcoin and blockchain-related startups. These firms played a crucial role in funding and supporting the growth of Bitcoin and blockchain technology in 2016. The most notable were:

· Blockchain Capital - Invested in various blockchain companies, including BitGo, Coinbase, and Kraken. Blockchain Capital was one of the early VC firms focused on blockchain technology.

· Digital Currency Group (DCG) - Founded by Barry Silbert, DCG invested in over 75 companies in the Bitcoin space.

· AXA Strategic Ventures - Invested in Blockstream's $55 million Series A funding round, along with other investors like Digital Garage, Horizons Ventures, AME Cloud Ventures, Blockchain Capital, and FuturePerfect Ventures.

· Digital Garage - Also invested in Blockstream's $55 million Series A round, highlighting their interest in core Bitcoin infrastructure.

· Horizons Ventures - Participated in Blockstream's Series A funding, demonstrating their commitment to blockchain technology.

· AME Cloud Ventures - Invested in Blockstream's Series A round, contributing to the significant funding received by the company.

· Breyer Capital and General Catalyst Partners - Both firms were part of the $60 million fourth round of funding for Circle, a primary Bitcoin wallet and peer-to-peer payment service.

· IDG Capital Partners - Invested in Circle's $60 million funding round and other notable investors like Baidu, Sam Palmisano, and Glenn Hutchins.

· Venture Labo Investment and SBI Investment - Invested $27 million in bitFlyer's Series C round, a Japanese Bitcoin exchange.

· Overstock.com - Provided $16 million in Series A funding to Bitt, a Caribbean-based Bitcoin exchange.

· Bitmain, Cumberland Mining, and FundersClub - Invested in Simplex's $7 million Series A round, supporting the Israeli wallet and payments solution.

· Andreessen Horowitz (a16z) - Although not exclusively focused on Bitcoin in 2016, a16z invested in the broader blockchain space, including companies like Coinbase. However, their significant crypto-focused investments became more prominent in later years.

· Pantera Capital - While primarily known for its investments starting in 2013, Pantera Capital continued to be active in the blockchain space in 2016.

Competition from other cryptocurrencies

In 2016, the cryptocurrency landscape was still in its early stages, but there were already some notable competitors and precursors to the broader altcoin market that would emerge later. Bitcoin was the clear leader, accounting for nearly 90% of the total market capitalization. Ethereum and Ripple were the most notable competitors, with other altcoins starting to emerge and laying the groundwork for the diverse cryptocurrency market that would follow.

Ethereum

Ethereum, founded by Vitalik Buterin, was launched in July 2015 but gained traction in 2016. It was one of the first major competitors to Bitcoin, offering a platform for decentralized applications (dApps) and smart contracts. Ethereum was the top-performing cryptocurrency in 2016, with a remarkable growth rate. At the beginning of 2016, it was trading around $0.96. By the end of January, its price had already doubled; by the summer, it had risen to nearly $20. Despite the DAO Hack, Ethereum's price stabilized around $11.50 by the end of the year, a staggering 1195% increase in value throughout 2016. In June 2016, the DAO (Decentralized Autonomous Organisation), a smart contract built on the Ethereum blockchain, was hacked, resulting in the theft of approximately $55M worth of Ether. This incident led to a hard fork in the Ethereum blockchain, creating Ethereum Classic, and had a temporary negative impact on Bitcoin's price as well.

Ripple (XRP)

Ripple, founded in 2012, was focused on solving the issues related to international transactions. By 2016, it had already partnered with central banks and financial institutions to provide a fast and cheap cross-border transaction solution. In the fourth quarter of 2016, XRP saw a substantial quarter-over-quarter average daily volume growth of 121%, indicating a positive sign of overall market health. This growth was partly attributed to the initial roll-out of Ripple's market-making incentives, which were introduced in February 2016. During the fourth quarter, market participants purchased $4.6 million of XRP directly from Ripple's registered and licensed money service businesses. These sales included restrictions to mitigate the risk of market instability due to large subsequent sales. Institutional investment was highlighted as a key differentiator for XRP, indicating its broader capital market potential. In June 2016, Ripple obtained a virtual currency license from the New York State Department of Financial Services, making it the fourth company to receive a BitLicense.

Market Dynamics

The total market capitalization of the top 100 cryptocurrencies was significantly lower in 2016 compared to later years, standing at about $5.2 billion by the end of 2016. This period marked the beginning of a rapid expansion in the cryptocurrency market, with Bitcoin's share gradually decreasing as other cryptocurrencies gained traction.

The Bitfinex Hack – A significant setback

The Bitfinex hack highlighted significant security lapses in the cryptocurrency exchange's systems and the complexities of recovering and prosecuting such large-scale cybercrimes. It also underscored the need for improved custodial solutions within the Bitcoin ecosystem.

The Hack

In August 2016, hackers infiltrated the Bitfinex cryptocurrency exchange based in Hong Kong. During the breach, approximately 119,756 Bitcoin were stolen, valued at around $72 million at the time of the hack. This amount represented about 0.8% of all Bitcoin in circulation. The hackers exploited a critical security flaw in Bitfinex's system. Bitfinex used a multi-signature security system provided by BitGo, where Bitfinex held two of the three necessary keys on the same device, and BitGo held the third key. This setup allowed the hackers to fully access Bitfinex's internal systems by compromising just one device. The hackers raised the daily transaction limit and executed 2,075 transactions to transfer the Bitcoin to a single wallet.

Immediate Aftermath and Bitfinex Response

The hack led to a significant drop in the value of Bitcoin, with prices plunging by about 20% to around $480 per Bitcoin. Bitfinex halted all Bitcoin withdrawals and trading immediately after discovering the breach. To mitigate the losses, Bitfinex distributed the financial burden across all its clients, reducing each account balance by 36%. Affected customers were issued BFX tokens equivalent to their losses, which could be redeemed for full value or traded for shares in iFinex, the parent company of Bitfinex. Within eight months, all BFX tokens were redeemed or traded, and customers who traded for shares also received Recovery Right Tokens (RRTs) for any future recovered funds. Despite the severity of the hack, Bitfinex continued to operate and worked with international authorities to recover the stolen funds. By 2018, the US government had recovered 27.66 BTC, a small fraction of the total stolen, which was converted to USD and distributed to RRT holders.

Identification and Prosecution of Hackers

In 2019, it was revealed that two Israeli brothers were partially responsible for the hack, though the main perpetrators were not identified until later. In February 2022, Ilya Lichtenstein and his wife, Heather Morgan (also known as Razzlekhan), were charged by the US Justice Department with conspiracy to launder the stolen Bitcoin. Lichtenstein admitted to the theft in August 2023, and both he and Morgan pleaded guilty to money laundering. Lichtenstein was sentenced to five years in prison for his role in the laundering scheme.

Recovery of Stolen Funds

In February 2022, the US government recovered and seized a significant portion of the stolen bitcoin, valued at approximately $3.6 billion at the time, by decrypting a file containing addresses and private keys associated with the stolen funds. This seizure marked the largest financial confiscation in the history of the Department of Justice.

Bitcoin in 2016: the 2014 setback forgotten.

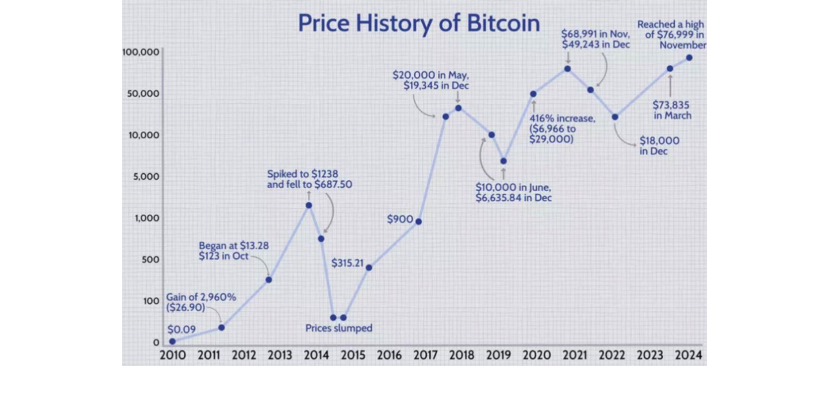

Irrespective of what was the price of Bitcoin in 2016, the year showed continuous growth, the trend continued in 2017 when it recovered the value it had at its peak in 2014 and continued growing, as you can see from the image below.

There will be an occasional fall in value, but there would not be a plunge similar to the one at the end of 2014 In 2016, Bitcoin maintained its overall dominant position in the crypto market, but the year saw the consolidation of competitors. Bitcoin will still be among the top 10 cryptocurrencies in market capitalization, but it will never represent 90% of the market as it did during that year. The decision of the Swiss Federal Railway company to accept payment in Bitcoin represented an important precedent for other major companies to experiment with accepting payment in Bitcoin, bringing the cryptocurrency closer to the goal of its creators to create a digital alternative to cash. The Japanese government's recognition of Bitcoin and other cryptocurrencies as having the function of real money again led to more ways to use it in everyday transactions. However, to this day, the best way to use crypto in everyday transactions remains a crypto card, a card like any other that is loaded from the content of your crypto wallet.