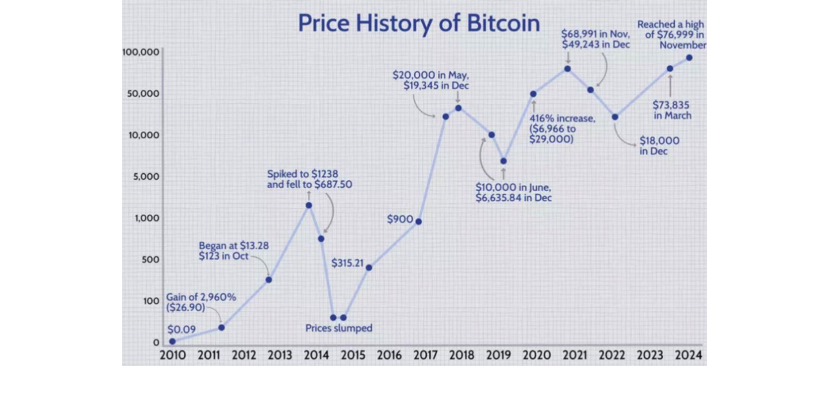

The elusive Satoshi Nakamoto came up with the concepts behind Bitcoin in 2008. 2009 marked the end of Bitcoin's prehistory and the beginning of the early years of its history. In 2010, its initial value was $0.10 andInvestors started considering Bitcoin as a way to store value, and its price increased to over $100 in 2011. Towards the end of the year, it crashed, making it the first drop in value, but in 2012 its value almost trebled. So, what was the price of Bitcoin in 2012? The price started at $4.72 on January 2012 and by the end of the year its value reached to $13.45 and 2012 was pretty much uneventful year for Bitcoin as far as macro news although it did rise in price and showed a steady climb also in the following year.

In the table below, you’ll find detailed data on Bitcoin’s daily prices throughout 2012. For each day, we’ve included the opening and closing prices, the day’s lowest price, and the trading volume. This allows you to track Bitcoin’s performance over time and explore its price fluctuations throughout the year. This summarize the entire data of Bitcoin’s price in 2012.

| DATE | OPEN | HIGH | LOW | CLOSE |

|---|---|---|---|---|

| December 31 2012 | $13.45 | $13.45 | $13.45 | $13.45 |

| December 30 2012 | $13.40 | $13.40 | $13.40 | $13.40 |

| December 29 2012 | $13.42 | $13.42 | $13.42 | $13.42 |

| December 28 2012 | $13.42 | $13.42 | $13.42 | $13.42 |

| December 27 2012 | $13.47 | $13.47 | $13.47 | $13.47 |

| December 26 2012 | $13.35 | $13.35 | $13.35 | $13.35 |

| December 25 2012 | $13.38 | $13.38 | $13.38 | $13.38 |

| December 24 2012 | $13.31 | $13.31 | $13.31 | $13.31 |

| December 23 2012 | $13.37 | $13.37 | $13.37 | $13.37 |

| December 22 2012 | $13.50 | $13.50 | $13.50 | $13.50 |

| December 21 2012 | $13.52 | $13.52 | $13.52 | $13.52 |

| December 20 2012 | $13.60 | $13.60 | $13.60 | $13.60 |

| December 19 2012 | $13.30 | $13.30 | $13.30 | $13.30 |

| December 18 2012 | $13.25 | $13.25 | $13.25 | $13.25 |

| December 17 2012 | $13.30 | $13.30 | $13.30 | $13.30 |

| December 16 2012 | $13.49 | $13.49 | $13.49 | $13.49 |

| December 15 2012 | $13.60 | $13.60 | $13.60 | $13.60 |

| December 14 2012 | $13.70 | $13.70 | $13.70 | $13.70 |

| December 13 2012 | $13.70 | $13.70 | $13.70 | $13.70 |

| December 12 2012 | $13.56 | $13.56 | $13.56 | $13.56 |

| December 11 2012 | $13.43 | $13.43 | $13.43 | $13.43 |

| December 10 2012 | $13.39 | $13.39 | $13.39 | $13.39 |

| December 09 2012 | $13.42 | $13.42 | $13.42 | $13.42 |

| December 08 2012 | $13.50 | $13.50 | $13.50 | $13.50 |

| December 07 2012 | $13.30 | $13.30 | $13.30 | $13.30 |

| December 06 2012 | $13.38 | $13.38 | $13.38 | $13.38 |

| December 05 2012 | $13.41 | $13.41 | $13.41 | $13.41 |

| December 04 2012 | $12.68 | $12.68 | $12.68 | $12.68 |

| December 03 2012 | $12.50 | $12.50 | $12.50 | $12.50 |

| December 02 2012 | $12.56 | $12.56 | $12.56 | $12.56 |

| December 01 2012 | $12.57 | $12.57 | $12.57 | $12.57 |

| November 30 2012 | $12.45 | $12.45 | $12.45 | $12.45 |

| November 29 2012 | $12.35 | $12.35 | $12.35 | $12.35 |

| November 28 2012 | $12.20 | $12.20 | $12.20 | $12.20 |

| November 27 2012 | $12.25 | $12.25 | $12.25 | $12.25 |

| November 26 2012 | $12.48 | $12.48 | $12.48 | $12.48 |

| November 25 2012 | $12.41 | $12.41 | $12.41 | $12.41 |

| November 24 2012 | $12.35 | $12.35 | $12.35 | $12.35 |

| November 23 2012 | $12.42 | $12.42 | $12.42 | $12.42 |

| November 22 2012 | $11.77 | $11.77 | $11.77 | $11.77 |

| November 21 2012 | $11.73 | $11.73 | $11.73 | $11.73 |

| November 20 2012 | $11.80 | $11.80 | $11.80 | $11.80 |

| November 19 2012 | $11.65 | $11.65 | $11.65 | $11.65 |

| November 18 2012 | $11.79 | $11.79 | $11.79 | $11.79 |

| November 17 2012 | $11.75 | $11.75 | $11.75 | $11.75 |

| November 16 2012 | $11.20 | $11.20 | $11.20 | $11.20 |

| November 15 2012 | $10.95 | $10.95 | $10.95 | $10.95 |

| November 14 2012 | $10.95 | $10.95 | $10.95 | $10.95 |

| November 13 2012 | $11.01 | $11.01 | $11.01 | $11.01 |

| November 12 2012 | $10.87 | $10.87 | $10.87 | $10.87 |

| November 11 2012 | $10.89 | $10.89 | $10.89 | $10.89 |

| November 10 2012 | $10.82 | $10.82 | $10.82 | $10.82 |

| November 09 2012 | $10.93 | $10.93 | $10.93 | $10.93 |

| November 08 2012 | $10.92 | $10.92 | $10.92 | $10.92 |

| November 07 2012 | $10.90 | $10.90 | $10.90 | $10.90 |

| November 06 2012 | $10.75 | $10.75 | $10.75 | $10.75 |

| November 05 2012 | $10.80 | $10.80 | $10.80 | $10.80 |

| November 04 2012 | $10.64 | $10.64 | $10.64 | $10.64 |

| November 03 2012 | $10.47 | $10.47 | $10.47 | $10.47 |

| November 02 2012 | $10.57 | $10.57 | $10.57 | $10.57 |

| November 01 2012 | $11.20 | $11.20 | $11.20 | $11.20 |

| October 31 2012 | $10.89 | $10.89 | $10.89 | $10.89 |

| October 30 2012 | $10.60 | $10.60 | $10.60 | $10.60 |

| October 29 2012 | $10.70 | $10.70 | $10.70 | $10.70 |

| October 28 2012 | $10.26 | $10.26 | $10.26 | $10.26 |

| October 27 2012 | $10.17 | $10.17 | $10.17 | $10.17 |

| October 26 2012 | $10.86 | $10.86 | $10.86 | $10.86 |

| October 25 2012 | $11.65 | $11.65 | $11.65 | $11.65 |

| October 24 2012 | $11.65 | $11.65 | $11.65 | $11.65 |

| October 23 2012 | $11.71 | $11.71 | $11.71 | $11.71 |

| October 22 2012 | $11.63 | $11.63 | $11.63 | $11.63 |

| October 21 2012 | $11.74 | $11.74 | $11.74 | $11.74 |

| October 20 2012 | $11.74 | $11.74 | $11.74 | $11.74 |

| October 19 2012 | $11.94 | $11.94 | $11.94 | $11.94 |

| October 18 2012 | $11.81 | $11.81 | $11.81 | $11.81 |

| October 17 2012 | $11.85 | $11.85 | $11.85 | $11.85 |

| October 16 2012 | $11.84 | $11.84 | $11.84 | $11.84 |

| October 15 2012 | $11.74 | $11.74 | $11.74 | $11.74 |

| October 14 2012 | $11.86 | $11.86 | $11.86 | $11.86 |

| October 13 2012 | $12.00 | $12.00 | $12.00 | $12.00 |

| October 12 2012 | $12.03 | $12.03 | $12.03 | $12.03 |

| October 11 2012 | $12.12 | $12.12 | $12.12 | $12.12 |

| October 10 2012 | $11.90 | $11.90 | $11.90 | $11.90 |

| October 09 2012 | $11.78 | $11.78 | $11.78 | $11.78 |

| October 08 2012 | $11.80 | $11.80 | $11.80 | $11.80 |

| October 07 2012 | $12.51 | $12.51 | $12.51 | $12.51 |

| October 06 2012 | $12.69 | $12.69 | $12.69 | $12.69 |

| October 05 2012 | $12.85 | $12.85 | $12.85 | $12.85 |

| October 04 2012 | $12.89 | $12.89 | $12.89 | $12.89 |

| October 03 2012 | $12.84 | $12.84 | $12.84 | $12.84 |

| October 02 2012 | $12.40 | $12.40 | $12.40 | $12.40 |

| October 01 2012 | $12.40 | $12.40 | $12.40 | $12.40 |

| September 30 2012 | $12.36 | $12.36 | $12.36 | $12.36 |

| September 29 2012 | $12.39 | $12.39 | $12.39 | $12.39 |

| September 28 2012 | $12.31 | $12.31 | $12.31 | $12.31 |

| September 27 2012 | $12.27 | $12.27 | $12.27 | $12.27 |

| September 26 2012 | $12.20 | $12.20 | $12.20 | $12.20 |

| September 25 2012 | $12.10 | $12.10 | $12.10 | $12.10 |

| September 24 2012 | $12.19 | $12.19 | $12.19 | $12.19 |

| September 23 2012 | $12.24 | $12.24 | $12.24 | $12.24 |

| September 22 2012 | $12.37 | $12.37 | $12.37 | $12.37 |

| September 21 2012 | $12.28 | $12.28 | $12.28 | $12.28 |

| September 20 2012 | $12.57 | $12.57 | $12.57 | $12.57 |

| September 19 2012 | $12.25 | $12.25 | $12.25 | $12.25 |

| September 18 2012 | $11.89 | $11.89 | $11.89 | $11.89 |

| September 17 2012 | $11.87 | $11.87 | $11.87 | $11.87 |

| September 16 2012 | $11.75 | $11.75 | $11.75 | $11.75 |

| September 15 2012 | $11.67 | $11.67 | $11.67 | $11.67 |

| September 14 2012 | $11.40 | $11.40 | $11.40 | $11.40 |

| September 13 2012 | $11.36 | $11.36 | $11.36 | $11.36 |

| September 12 2012 | $11.33 | $11.33 | $11.33 | $11.33 |

| September 11 2012 | $11.17 | $11.17 | $11.17 | $11.17 |

| September 10 2012 | $11.02 | $11.02 | $11.02 | $11.02 |

| September 09 2012 | $11.04 | $11.04 | $11.04 | $11.04 |

| September 08 2012 | $11.00 | $11.00 | $11.00 | $11.00 |

| September 07 2012 | $11.18 | $11.18 | $11.18 | $11.18 |

| September 06 2012 | $11.00 | $11.00 | $11.00 | $11.00 |

| September 05 2012 | $10.38 | $10.38 | $10.38 | $10.38 |

| September 04 2012 | $10.53 | $10.53 | $10.53 | $10.53 |

| September 03 2012 | $10.20 | $10.20 | $10.20 | $10.20 |

| September 02 2012 | $9.97 | $9.97 | $9.97 | $9.97 |

| September 01 2012 | $10.16 | $10.16 | $10.16 | $10.16 |

| August 31 2012 | $10.78 | $10.78 | $10.78 | $10.78 |

| August 30 2012 | $10.92 | $10.92 | $10.92 | $10.92 |

| August 29 2012 | $10.94 | $10.94 | $10.94 | $10.94 |

| August 28 2012 | $10.95 | $10.95 | $10.95 | $10.95 |

| August 27 2012 | $10.61 | $10.61 | $10.61 | $10.61 |

| August 26 2012 | $10.52 | $10.52 | $10.52 | $10.52 |

| August 25 2012 | $10.60 | $10.60 | $10.60 | $10.60 |

| August 24 2012 | $10.10 | $10.10 | $10.10 | $10.10 |

| August 23 2012 | $9.81 | $9.81 | $9.81 | $9.81 |

| August 22 2012 | $9.92 | $9.92 | $9.92 | $9.92 |

| August 21 2012 | $10.10 | $10.10 | $10.10 | $10.10 |

| August 20 2012 | $8.00 | $8.00 | $8.00 | $8.00 |

| August 19 2012 | $11.61 | $11.61 | $11.61 | $11.61 |

| August 18 2012 | $11.58 | $11.58 | $11.58 | $11.58 |

| August 17 2012 | $13.50 | $13.50 | $13.50 | $13.50 |

| August 16 2012 | $13.25 | $13.25 | $13.25 | $13.25 |

| August 15 2012 | $12.19 | $12.19 | $12.19 | $12.19 |

| August 14 2012 | $12.04 | $12.04 | $12.04 | $12.04 |

| August 13 2012 | $11.62 | $11.62 | $11.62 | $11.62 |

| August 12 2012 | $11.51 | $11.51 | $11.51 | $11.51 |

| August 11 2012 | $11.39 | $11.39 | $11.39 | $11.39 |

| August 10 2012 | $11.06 | $11.06 | $11.06 | $11.06 |

| August 09 2012 | $11.06 | $11.06 | $11.06 | $11.06 |

| August 08 2012 | $11.10 | $11.10 | $11.10 | $11.10 |

| August 07 2012 | $10.86 | $10.86 | $10.86 | $10.86 |

| August 06 2012 | $10.87 | $10.87 | $10.87 | $10.87 |

| August 05 2012 | $10.98 | $10.98 | $10.98 | $10.98 |

| August 04 2012 | $10.97 | $10.97 | $10.97 | $10.97 |

| August 03 2012 | $10.53 | $10.53 | $10.53 | $10.53 |

| August 02 2012 | $9.55 | $9.55 | $9.55 | $9.55 |

| August 01 2012 | $9.35 | $9.35 | $9.35 | $9.35 |

| July 31 2012 | $9.10 | $9.10 | $9.10 | $9.10 |

| July 30 2012 | $8.71 | $8.71 | $8.71 | $8.71 |

| July 29 2012 | $8.89 | $8.89 | $8.89 | $8.89 |

| July 28 2012 | $8.90 | $8.90 | $8.90 | $8.90 |

| July 27 2012 | $8.90 | $8.90 | $8.90 | $8.90 |

| July 26 2012 | $8.80 | $8.80 | $8.80 | $8.80 |

| July 25 2012 | $8.60 | $8.60 | $8.60 | $8.60 |

| July 24 2012 | $8.45 | $8.45 | $8.45 | $8.45 |

| July 23 2012 | $8.41 | $8.41 | $8.41 | $8.41 |

| July 22 2012 | $8.85 | $8.85 | $8.85 | $8.85 |

| July 21 2012 | $8.52 | $8.52 | $8.52 | $8.52 |

| July 20 2012 | $8.87 | $8.87 | $8.87 | $8.87 |

| July 19 2012 | $9.11 | $9.11 | $9.11 | $9.11 |

| July 18 2012 | $8.80 | $8.80 | $8.80 | $8.80 |

| July 17 2012 | $8.50 | $8.50 | $8.50 | $8.50 |

| July 16 2012 | $7.62 | $7.62 | $7.62 | $7.62 |

| July 15 2012 | $7.54 | $7.54 | $7.54 | $7.54 |

| July 14 2012 | $7.67 | $7.67 | $7.67 | $7.67 |

| July 13 2012 | $7.76 | $7.76 | $7.76 | $7.76 |

| July 12 2012 | $7.15 | $7.15 | $7.15 | $7.15 |

| July 11 2012 | $7.20 | $7.20 | $7.20 | $7.20 |

| July 10 2012 | $7.02 | $7.02 | $7.02 | $7.02 |

| July 09 2012 | $6.80 | $6.80 | $6.80 | $6.80 |

| July 08 2012 | $6.76 | $6.76 | $6.76 | $6.76 |

| July 07 2012 | $6.65 | $6.65 | $6.65 | $6.65 |

| July 06 2012 | $6.67 | $6.67 | $6.67 | $6.67 |

| July 05 2012 | $6.51 | $6.51 | $6.51 | $6.51 |

| July 04 2012 | $6.45 | $6.45 | $6.45 | $6.45 |

| July 03 2012 | $6.76 | $6.76 | $6.76 | $6.76 |

| July 02 2012 | $6.63 | $6.63 | $6.63 | $6.63 |

| July 01 2012 | $6.69 | $6.69 | $6.69 | $6.69 |

| June 30 2012 | $6.65 | $6.65 | $6.65 | $6.65 |

| June 29 2012 | $6.61 | $6.61 | $6.61 | $6.61 |

| June 28 2012 | $6.65 | $6.65 | $6.65 | $6.65 |

| June 27 2012 | $6.42 | $6.42 | $6.42 | $6.42 |

| June 26 2012 | $6.30 | $6.30 | $6.30 | $6.30 |

| June 25 2012 | $6.35 | $6.35 | $6.35 | $6.35 |

| June 24 2012 | $6.43 | $6.43 | $6.43 | $6.43 |

| June 23 2012 | $6.55 | $6.55 | $6.55 | $6.55 |

| June 22 2012 | $6.68 | $6.68 | $6.68 | $6.68 |

| June 21 2012 | $6.67 | $6.67 | $6.67 | $6.67 |

| June 20 2012 | $6.50 | $6.50 | $6.50 | $6.50 |

| June 19 2012 | $6.31 | $6.31 | $6.31 | $6.31 |

| June 18 2012 | $6.16 | $6.16 | $6.16 | $6.16 |

| June 17 2012 | $6.40 | $6.40 | $6.40 | $6.40 |

| June 16 2012 | $6.50 | $6.50 | $6.50 | $6.50 |

| June 15 2012 | $5.95 | $5.95 | $5.95 | $5.95 |

| June 14 2012 | $5.93 | $5.93 | $5.93 | $5.93 |

| June 13 2012 | $5.70 | $5.70 | $5.70 | $5.70 |

| June 12 2012 | $5.57 | $5.57 | $5.57 | $5.57 |

| June 11 2012 | $5.47 | $5.47 | $5.47 | $5.47 |

| June 10 2012 | $5.56 | $5.56 | $5.56 | $5.56 |

| June 09 2012 | $5.63 | $5.63 | $5.63 | $5.63 |

| June 08 2012 | $5.59 | $5.59 | $5.59 | $5.59 |

| June 07 2012 | $5.46 | $5.46 | $5.46 | $5.46 |

| June 06 2012 | $5.44 | $5.44 | $5.44 | $5.44 |

| June 05 2012 | $5.27 | $5.27 | $5.27 | $5.27 |

| June 04 2012 | $5.21 | $5.21 | $5.21 | $5.21 |

| June 03 2012 | $5.25 | $5.25 | $5.25 | $5.25 |

| June 02 2012 | $5.27 | $5.27 | $5.27 | $5.27 |

| June 01 2012 | $5.18 | $5.18 | $5.18 | $5.18 |

| May 31 2012 | $5.14 | $5.14 | $5.14 | $5.14 |

| May 30 2012 | $5.15 | $5.15 | $5.15 | $5.15 |

| May 29 2012 | $5.14 | $5.14 | $5.14 | $5.14 |

| May 28 2012 | $5.14 | $5.14 | $5.14 | $5.14 |

| May 27 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| May 26 2012 | $5.15 | $5.15 | $5.15 | $5.15 |

| May 25 2012 | $5.12 | $5.12 | $5.12 | $5.12 |

| May 24 2012 | $5.14 | $5.14 | $5.14 | $5.14 |

| May 23 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| May 22 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| May 21 2012 | $5.09 | $5.09 | $5.09 | $5.09 |

| May 20 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| May 19 2012 | $5.12 | $5.12 | $5.12 | $5.12 |

| May 18 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| May 17 2012 | $5.09 | $5.09 | $5.09 | $5.09 |

| May 16 2012 | $5.04 | $5.04 | $5.04 | $5.04 |

| May 15 2012 | $5.01 | $5.01 | $5.01 | $5.01 |

| May 14 2012 | $4.93 | $4.93 | $4.93 | $4.93 |

| May 13 2012 | $4.95 | $4.95 | $4.95 | $4.95 |

| May 12 2012 | $4.96 | $4.96 | $4.96 | $4.96 |

| May 11 2012 | $4.85 | $4.85 | $4.85 | $4.85 |

| May 10 2012 | $5.04 | $5.04 | $5.04 | $5.04 |

| May 09 2012 | $5.05 | $5.05 | $5.05 | $5.05 |

| May 08 2012 | $5.06 | $5.06 | $5.06 | $5.06 |

| May 07 2012 | $5.05 | $5.05 | $5.05 | $5.05 |

| May 06 2012 | $5.08 | $5.08 | $5.08 | $5.08 |

| May 05 2012 | $5.07 | $5.07 | $5.07 | $5.07 |

| May 04 2012 | $5.13 | $5.13 | $5.13 | $5.13 |

| May 03 2012 | $5.07 | $5.07 | $5.07 | $5.07 |

| May 02 2012 | $5.00 | $5.00 | $5.00 | $5.00 |

| May 01 2012 | $4.95 | $4.95 | $4.95 | $4.95 |

| April 30 2012 | $4.90 | $4.90 | $4.90 | $4.90 |

| April 29 2012 | $4.98 | $4.98 | $4.98 | $4.98 |

| April 28 2012 | $5.11 | $5.11 | $5.11 | $5.11 |

| April 27 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| April 26 2012 | $5.13 | $5.13 | $5.13 | $5.13 |

| April 25 2012 | $5.10 | $5.10 | $5.10 | $5.10 |

| April 24 2012 | $4.96 | $4.96 | $4.96 | $4.96 |

| April 23 2012 | $5.20 | $5.20 | $5.20 | $5.20 |

| April 22 2012 | $5.26 | $5.26 | $5.26 | $5.26 |

| April 21 2012 | $5.35 | $5.35 | $5.35 | $5.35 |

| April 20 2012 | $5.14 | $5.14 | $5.14 | $5.14 |

| April 19 2012 | $5.12 | $5.12 | $5.12 | $5.12 |

| April 18 2012 | $4.98 | $4.98 | $4.98 | $4.98 |

| April 17 2012 | $4.93 | $4.93 | $4.93 | $4.93 |

| April 16 2012 | $4.97 | $4.97 | $4.97 | $4.97 |

| April 15 2012 | $4.96 | $4.96 | $4.96 | $4.96 |

| April 14 2012 | $4.94 | $4.94 | $4.94 | $4.94 |

| April 13 2012 | $4.92 | $4.92 | $4.92 | $4.92 |

| April 12 2012 | $4.93 | $4.93 | $4.93 | $4.93 |

| April 11 2012 | $4.84 | $4.84 | $4.84 | $4.84 |

| April 10 2012 | $4.87 | $4.87 | $4.87 | $4.87 |

| April 09 2012 | $4.79 | $4.79 | $4.79 | $4.79 |

| April 08 2012 | $4.69 | $4.69 | $4.69 | $4.69 |

| April 07 2012 | $4.95 | $4.95 | $4.95 | $4.95 |

| April 06 2012 | $4.92 | $4.92 | $4.92 | $4.92 |

| April 05 2012 | $4.91 | $4.91 | $4.91 | $4.91 |

| April 04 2012 | $4.95 | $4.95 | $4.95 | $4.95 |

| April 03 2012 | $4.97 | $4.97 | $4.97 | $4.97 |

| April 02 2012 | $4.83 | $4.83 | $4.83 | $4.83 |

| April 01 2012 | $4.91 | $4.91 | $4.91 | $4.91 |

| March 31 2012 | $4.86 | $4.86 | $4.86 | $4.86 |

| March 30 2012 | $4.81 | $4.81 | $4.81 | $4.81 |

| March 29 2012 | $4.79 | $4.79 | $4.79 | $4.79 |

| March 28 2012 | $4.81 | $4.81 | $4.81 | $4.81 |

| March 27 2012 | $4.62 | $4.62 | $4.62 | $4.62 |

| March 26 2012 | $4.55 | $4.55 | $4.55 | $4.55 |

| March 25 2012 | $4.68 | $4.68 | $4.68 | $4.68 |

| March 24 2012 | $4.69 | $4.69 | $4.69 | $4.69 |

| March 23 2012 | $4.70 | $4.70 | $4.70 | $4.70 |

| March 22 2012 | $4.81 | $4.81 | $4.81 | $4.81 |

| March 21 2012 | $4.84 | $4.84 | $4.84 | $4.84 |

| March 20 2012 | $4.69 | $4.69 | $4.69 | $4.69 |

| March 19 2012 | $5.28 | $5.28 | $5.28 | $5.28 |

| March 18 2012 | $5.22 | $5.22 | $5.22 | $5.22 |

| March 17 2012 | $5.34 | $5.34 | $5.34 | $5.34 |

| March 16 2012 | $5.33 | $5.33 | $5.33 | $5.33 |

| March 15 2012 | $5.38 | $5.38 | $5.38 | $5.38 |

| March 14 2012 | $5.27 | $5.27 | $5.27 | $5.27 |

| March 13 2012 | $4.89 | $4.89 | $4.89 | $4.89 |

| March 12 2012 | $4.91 | $4.91 | $4.91 | $4.91 |

| March 11 2012 | $4.83 | $4.83 | $4.83 | $4.83 |

| March 10 2012 | $4.86 | $4.86 | $4.86 | $4.86 |

| March 09 2012 | $4.93 | $4.93 | $4.93 | $4.93 |

| March 08 2012 | $4.94 | $4.94 | $4.94 | $4.94 |

| March 07 2012 | $4.99 | $4.99 | $4.99 | $4.99 |

| March 06 2012 | $4.98 | $4.98 | $4.98 | $4.98 |

| March 05 2012 | $4.82 | $4.82 | $4.82 | $4.82 |

| March 04 2012 | $4.61 | $4.61 | $4.61 | $4.61 |

| March 03 2012 | $4.70 | $4.70 | $4.70 | $4.70 |

| March 02 2012 | $4.92 | $4.92 | $4.92 | $4.92 |

| March 01 2012 | $4.86 | $4.86 | $4.86 | $4.86 |

| February 29 2012 | $4.87 | $4.87 | $4.87 | $4.87 |

| February 28 2012 | $4.96 | $4.96 | $4.96 | $4.96 |

| February 27 2012 | $4.92 | $4.92 | $4.92 | $4.92 |

| February 26 2012 | $4.77 | $4.77 | $4.77 | $4.77 |

| February 25 2012 | $5.03 | $5.03 | $5.03 | $5.03 |

| February 24 2012 | $5.01 | $5.01 | $5.01 | $5.01 |

| February 23 2012 | $4.42 | $4.42 | $4.42 | $4.42 |

| February 22 2012 | $4.27 | $4.27 | $4.27 | $4.27 |

| February 21 2012 | $4.36 | $4.36 | $4.36 | $4.36 |

| February 20 2012 | $4.39 | $4.39 | $4.39 | $4.39 |

| February 19 2012 | $4.22 | $4.22 | $4.22 | $4.22 |

| February 18 2012 | $4.41 | $4.41 | $4.41 | $4.41 |

| February 17 2012 | $4.27 | $4.27 | $4.27 | $4.27 |

| February 16 2012 | $4.33 | $4.33 | $4.33 | $4.33 |

| February 15 2012 | $4.46 | $4.46 | $4.46 | $4.46 |

| February 14 2012 | $5.26 | $5.26 | $5.26 | $5.26 |

| February 13 2012 | $5.51 | $5.51 | $5.51 | $5.51 |

| February 12 2012 | $5.60 | $5.60 | $5.60 | $5.60 |

| February 11 2012 | $5.91 | $5.91 | $5.91 | $5.91 |

| February 10 2012 | $5.83 | $5.83 | $5.83 | $5.83 |

| February 09 2012 | $5.60 | $5.60 | $5.60 | $5.60 |

| February 08 2012 | $5.69 | $5.69 | $5.69 | $5.69 |

| February 07 2012 | $5.45 | $5.45 | $5.45 | $5.45 |

| February 06 2012 | $5.69 | $5.69 | $5.69 | $5.69 |

| February 05 2012 | $5.87 | $5.87 | $5.87 | $5.87 |

| February 04 2012 | $5.96 | $5.96 | $5.96 | $5.96 |

| February 03 2012 | $6.10 | $6.10 | $6.10 | $6.10 |

| February 02 2012 | $6.08 | $6.08 | $6.08 | $6.08 |

| February 01 2012 | $5.48 | $5.48 | $5.48 | $5.48 |

| January 31 2012 | $5.49 | $5.49 | $5.49 | $5.49 |

| January 30 2012 | $5.38 | $5.38 | $5.38 | $5.38 |

| January 29 2012 | $5.63 | $5.63 | $5.63 | $5.63 |

| January 28 2012 | $5.29 | $5.29 | $5.29 | $5.29 |

| January 27 2012 | $5.34 | $5.34 | $5.34 | $5.34 |

| January 26 2012 | $5.75 | $5.75 | $5.75 | $5.75 |

| January 25 2012 | $6.29 | $6.29 | $6.29 | $6.29 |

| January 24 2012 | $6.36 | $6.36 | $6.36 | $6.36 |

| January 23 2012 | $6.31 | $6.31 | $6.31 | $6.31 |

| January 22 2012 | $6.18 | $6.18 | $6.18 | $6.18 |

| January 21 2012 | $6.49 | $6.49 | $6.49 | $6.49 |

| January 20 2012 | $6.36 | $6.36 | $6.36 | $6.36 |

| January 19 2012 | $5.92 | $5.92 | $5.92 | $5.92 |

| January 18 2012 | $5.60 | $5.60 | $5.60 | $5.60 |

| January 17 2012 | $6.68 | $6.68 | $6.68 | $6.68 |

| January 16 2012 | $7.00 | $7.00 | $7.00 | $7.00 |

| January 15 2012 | $6.75 | $6.75 | $6.75 | $6.75 |

| January 14 2012 | $6.41 | $6.41 | $6.41 | $6.41 |

| January 13 2012 | $6.80 | $6.80 | $6.80 | $6.80 |

| January 12 2012 | $6.90 | $6.90 | $6.90 | $6.90 |

| January 11 2012 | $6.36 | $6.36 | $6.36 | $6.36 |

| January 10 2012 | $6.33 | $6.33 | $6.33 | $6.33 |

| January 09 2012 | $7.11 | $7.11 | $7.11 | $7.11 |

| January 08 2012 | $6.81 | $6.81 | $6.81 | $6.81 |

| January 07 2012 | $6.70 | $6.70 | $6.70 | $6.70 |

| January 06 2012 | $6.95 | $6.95 | $6.95 | $6.95 |

| January 05 2012 | $5.57 | $5.57 | $5.57 | $5.57 |

| January 04 2012 | $4.88 | $4.88 | $4.88 | $4.88 |

| January 03 2012 | $5.22 | $5.22 | $5.22 | $5.22 |

| January 02 2012 | $5.27 | $5.27 | $5.27 | $5.27 |

| January 01 2012 | $4.72 | $4.72 | $4.72 | $4.72 |

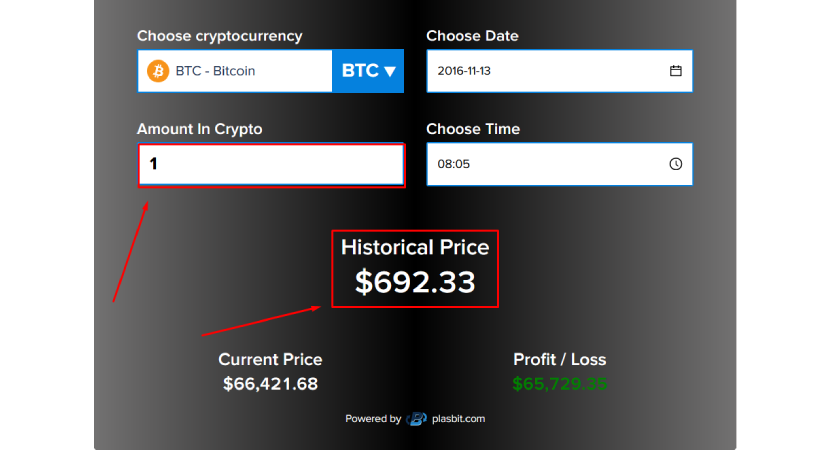

Plasbit historical calculator

The Plasbit historical calculator is one of several widgets available as a resource on the main home page (before you log in). It can give you an instant assessment of the value of Bitcoins through time and the outcome of your investment if you have Bitcoins in your portfolio.

Step 1 – Go to the Plasbit Crypto History Calculator page.

To access Plasbit Crypto History Calculator access the home page, scroll down to the footer, look to the ‘Resources’ heading on the right end of the screen and select “Site Widgets”.

You will access the Widget page, select History Calculator

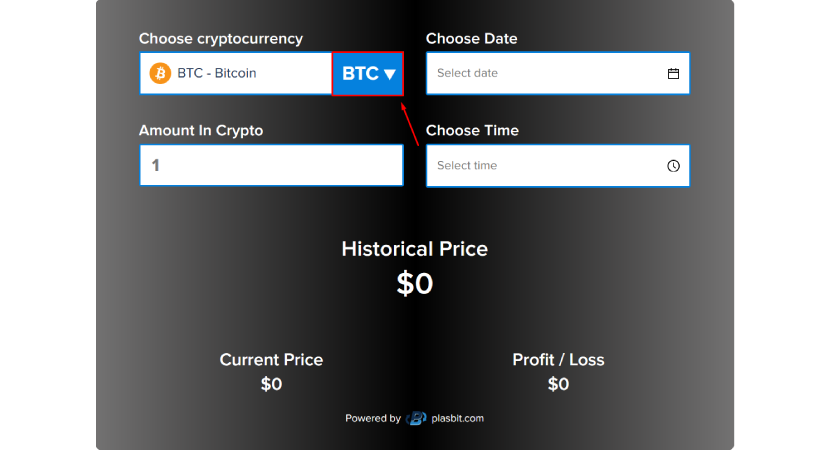

Step 2 – Select the cryptocurrency you want to check.

Once you have accessed the calculator, select the cryptocurrency you want to check; in this example, BTC (Bitcoin)

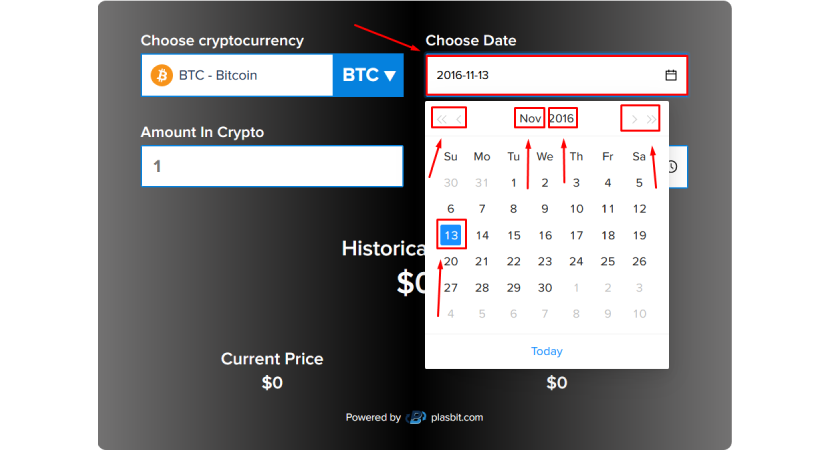

Step 3 - Choose the date

Click the month, the year, and the day in the input field to the right.

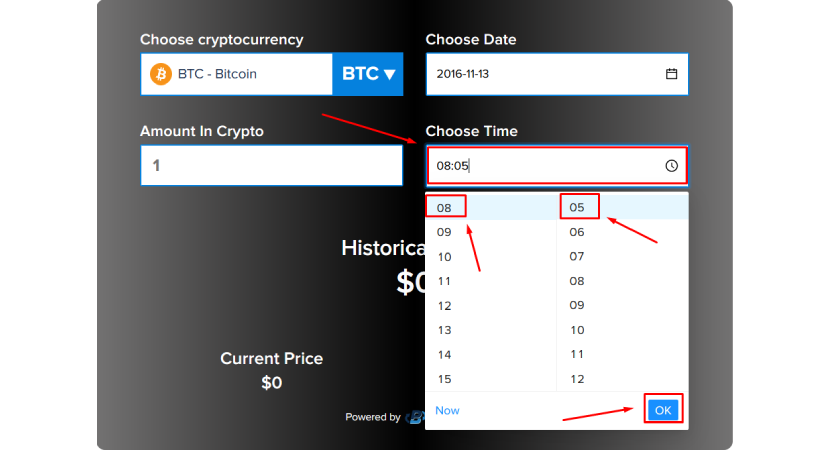

Step. 4 Choose the time of the day.

Click "OK" to confirm your choice

Step 5 – Type the amount

Type the amount of Bitcoin you want to check in the input box on the left

In the image above, the example shows that the value of 1 Bitcoin on 13 November 2016 was $692.23; if you had bought one BTC on that day, the value of your investment today would be $66,421.68; if you had not sold it, the profit from your investment would be $65,729.35.

So, if you want to find out what was the price of bitcoin in 2012, for instance, on 02 January 2012 you would select BTC as cryptocurrency, 2012-01-02 as the date, time 9:00, and amount 1. The result would be $4.72. If you had bought one Bitcoin on that day and still had it on the day the screenshot above was taken, you would have made a profit of $66,416.96.

However, some of the historical Bitcoin price data is missing. The crypto market was spotty and unregulated in the early days, and most transactions would occur in forums. The lack of historical data is not a flaw; Bitcoin was designed to provide anonymity to its owners.

The early history of Bitcoin

In 2024, Bitcoins and other cryptocurrencies are consolidated investment instruments. They are traded in exchanges; investors use them to store value and hedge against inflation, market uncertainty, and the potential consequences of global or local crises. Bitcoin's creators thought they were designing a digital currency to be used for daily transactions.

Bitcoin prehistory

The concept of Bitcoin was born during a period of financial crisis. In 2007, many subprime lenders went bankrupt; in 2008, the crisis spread beyond subprime lenders and reached the banking world. When Lehman Brothers collapsed in September 2008, the global financial system was in a deep crisis, and many governments feared a systemic collapse. Many think Bitcoin was conceived in this environment, although no evidence supports or disproves this theory.

The domain name bitcoin.org was registered on 18 August 2008. On 31 October 2008, a link to a paper by Satoshi Nakamoto titled Bitcoin: A Peer-to-Peer Electronic Cash System was posted on a cryptography mailing list.

On 09 November, the Bitcoin project was registered at the open-source-projects community resource, SourceForge.net.

Satoshi Nakamoto: a pseudonym or a real person?

Satoshi Nakamoto gave birth to Bitcoin, the first decentralized cryptocurrency; he has been a very elusive individual if he is a person. He communicated with the Bitcoin community using forums and email exchanges, but nobody has laid eyes on him. The most widely accepted theory is that it is a pseudonym. Theories about his identities range from a group of financial software developers in the city of London to entrepreneurs to computer scientists, but the exact identity is still a mystery.

Whether there is a natural person or a team behind the pseudonym, Nakamoto introduced the idea of the decentralization, a concept that led to the introduction of new financial assets and a new way to invest.

Nakamoto was involved in the project till April 2011 before he passed over management to a well-known software programmer named Gavin Andresen. Even after he transferred the management, no one still decoded his identity. On 23 April 2011, Nakamoto sent the last email ever received under his name, saying, "I've moved on to other things."

The early years – 2009 to 2011.

The Bitcoin network came into existence in January 2009 with the release of the first open-source Bitcoin client and Satoshi Nakamoto mining the first block of Bitcoin ever, known as the genesis block; the genesis block produced a reward of 50 bitcoins. Embedded in the coinbase of this block was the text: The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.

"[In 2009]There was no action to speak of and no news cycle," says Alex Preda, a professor of professions, markets, and technology at King's Business School in London. "Bitcoin was a fringe phenomenon confined to a subculture of software engineering and not a financial phenomenon."

The first Bitcoin transaction took place on 12 January 2009; the sender was Satoshi Nakamoto, and the receiver was a programmer called Hal Finney. The first Bitcoin transactions were negotiated between two individuals on the Bitcoin forum.

Bitcoin had a price of zero when it was introduced in 2009. It was only on 05 October that the first exchange rate USD/BTC was published, 1 USD=1,309.03 BTC, giving 100 Bitcoins a value of slightly less than $0.08. A public sale was launched on the New Liberty Standard stock exchange on the same day.

On 09 October, the channel #bitcoin-de is registered on IRC. Bitcoin 2.0 was launched on 16 December

The growth in BTC adoption in the early years started slow.

Bitcoinmarket, the first official cryptocurrency stock exchange, was launched In early February 2010. Gavin Andresen (who took over the management of Bitcoin from Satoshi Nakamoto in April 2011) discovered Bitcoin later the same year and created the first Bitcoin faucet in April 2010; before the end of the year, he gave away 19,700 BTC. In May, Laszlo Hanyecz offered 10,000 BTC for two pizzas delivered by Papa John's, the first indirect purchase using Bitcoin. Given the value of bitcoins at the time ($ 0.0025), those two pizzas cost $25. At the time of writing this article, those 10,000 BTC would be worth $876,142,500 (and maybe more by the time this article is published)!

In July, the news website Slashdot.org mentioned Bitcoin v0.3, and the number of Bitcoin users increased significantly, to the extent that the value increased 10 times in 10 days, from $0.008 to $0.08 per BTC. The bitcoin exchange rate began to rise and reached $0.06 at the beginning of October. A month later, the exchange rate reached $0.50 per BTC on MtGox.

In December, a user created a Bitcoin app for the Nokia N900, and the first-ever P2P transaction with the help of mobile devices took place.

In 2011, other cryptocurrencies started to emerge based on the open-source code of Bitcoin. The Electronic Frontier Foundation, a non-profit group, started accepting bitcoins in January 2011, then stopped accepting them in June 2011, citing concerns about a lack of legal precedent about new currency systems. Later, on 03 January, accounts in Zimbabwe made the largest monetary transaction in bitcoin history on the #bitcoin-otc channel in ITC. 4 BTC had a corresponding value of 100 trillion Zimbabwean dollars (a big number, but relatively small value).

In early February, Bitcoin reaches parity with the US dollar. In the same month, an Austrian user puts an old Porsche on sale on a bitcoin exchange for 3000 BTC.

In April, Gavin Andresen took over Bitcoin from Satoshi Nakamoto. The general capitalization of BTC reaches 10 million US Dollars. In June, BTC reached $10; in the same month, there was the first reported theft of Bitcoins, and MtGox's database suffered a security breach; a hacker stole names, passwords, hashes, and emails of sixty thousand users. A second hack accesses an administration account and sends hundreds of fake bitcoins, decreasing the value of BTC to $0.01. The value of BTC kept rising for the remainder of 2011, closing at $4.72 on 31 December 2011.

Bitcoin in 2012

Before we discuss what was the price of bitcoin in 2012, we need to consider the importance of 2012 in bitcoin's history. It is described as a non-descript year, when value steadily increased from $4.72 per 1 Bitcoin to $13.45, reaching a peak of $13.70 during the year, a growth of 185%. This period of relative stability and gradual growth was crucial for Bitcoin's development, as it helped establish credibility and attract more investors, setting the stage for the cryptocurrency's future expansion and adoption.

It is also described as the time when 'the early years' of Bitcoin history ended, and Bitcoin history started; analysts consider 2012 a pivotal year because the basic structure of the framework currently in place for Bitcoin took shape. It was not considered a currency for day-to-day payments; its early adopters already considered it an investment asset, a vehicle to store value to hedge against inflation and market and global uncertainties.

Factors affecting market trend and prices in 2012

Its steady growth in 2012 was the forerunner of the overall trend from that year to the present; if we consider a chart of Bitcoin value from creation to the present, the growth in value was impressive despite three slumps. The steady price increase and increased mainstream attention helped set the foundation for the dramatic surge that would follow in 2013

The following events are considered the key factors that influenced the 2012 market:

- Gradual Market Consolidation - Bitcoin spent much of 2012 in a consolidation phase, slowly strengthening throughout the year; this period of stability helped build a foundation for future growth and increased adoption.

- First Halving – In November 2012, Bitcoin experienced its first halving event, the reward structure for miners, where the number of new bitcoins generated per block is cut in half from 50 BTC to 25 BTC. This pre-programmed event contributed to the price stability and gradual increase throughout the rest of the year.

- Mainstream Media Exposure - Bitcoin began gaining widespread attention in 2012, appearing in mainstream media outlets. It was featured as a significant plot element in an episode of CBS's drama "The Good Wife," which was watched by 9.45 million viewers.

- Launch of Bitcoin Foundation - The Bitcoin Foundation was established in September 2012 to accelerate Bitcoin's global growth through standardization, protection, and promotion of the open-source protocol.

- Bitcoin Magazine – Mihai Alisie and Vitalik Buterin founded the magazine and published the first issue in May.

- Market Performance - The price of Bitcoin reached a high point of $13.70 in mid-August and again in mid-December. Throughout December, the price ranged from about $13.30 to $13.70.

- Market Capitalization - On 31 December 2012, Bitcoin's market cap reached $142,758,972.50, based on a total of 10,614,050 BTC in circulation.

- Increasing Merchant Adoption - Over 1,000 merchants accepted Bitcoin through the payment processing service they used.

- Regulatory Development – 2012 saw discussions and concerns about the regulatory status of Bitcoin influencing market sentiment and investment decisions.

Destabilizing events that may have had an impact on the Bitcoin market in 2012

Gold has been the major investment in hedging against global (or local) instability for centuries. In 2012, Bitcoin exchanges were already a reality, and their anonymous nature and ease of transport turned them into another investment to hedge against the risks introduced by major global destabilizing events. In 2012, any of the following events might have had an impact on the Bitcoin market:

- European Debt Crisis - The Eurozone debt crisis remained a significant source of global economic uncertainty; several European countries faced severe financial difficulties, with Greece, Spain, and Italy particularly affected. There were concerns about the potential breakup of the Eurozone if the crisis worsened.

- Arab Spring Aftermath - The aftermath of the Arab Spring continued to unfold, with ongoing instability in several countries. In Egypt, protests and unrest continued as the Muslim Brotherhood and Mohammed Morsi consolidated power, leading to concerns about the country's democratic transition. Syria's civil war intensified, with increased violence and casualties. By the end of 2012, the conflict had become a major humanitarian crisis.

- Iran's nuclear program – The program remained a flashpoint, with increased sanctions and concerns about potential military action.

- North Korea's missiles and nuclear tests - escalated tensions in East Asia.

Major investors in Bitcoin in 2012

In 2012, Bitcoin was still in its early stages and had not yet gained widespread attention from institutional or private investors. The Bitcoin ecosystem in 2012 was primarily composed of early adopters, tech enthusiasts, and developers who saw potential in the cryptocurrency. Some key figures included:

- Gavin Andresen - One of the earliest Bitcoin developers who took over as lead developer after Satoshi Nakamoto stepped back. In 2012, Andresen became the lead developer at the Bitcoin Foundation.

- Charlie Shrem - Another founder of the Bitcoin Foundation, Shrem was an early Bitcoin entrepreneur and advocate.

- Mark Karpelès - The CEO of Mt. Gox, which was the largest Bitcoin exchange in 2012.

It's worth noting that black markets like Silk Road were significant users of Bitcoin in its early days. The dark web marketplace Silk Road, which operated from February 2011 to October 2013, exclusively accepted Bitcoin as payment, transacting approximately 9.9 million bitcoins worth about $214 million during its existence.

Numerous individual investors likely bought Bitcoin in 2012, though most remained anonymous. For instance, an anonymous software engineer known as "Mr Smith" claimed to have invested $3,000 in Bitcoin in 2010 when the price was just $0.15, holding nearly 20,000 Bitcoins by 2012.

What influences the price of Bitcoin?

In 2012, Bitcoin became an investment asset. Its price was affected by several factors that are still valid today.

Supply and Demand

Like other currencies, products, or services within a country or economy, Bitcoin and other cryptocurrency prices depend on perceived value, supply, and demand. If people believe that Bitcoin is worth a specific amount, they will buy it, especially if they think its value will increase.

There is a specific limit to the number of Bitcoins that will ever be created. The closer Bitcoin gets to its limit, the higher its price should be, assuming all other factors remain the same. This limit is intended to keep increasing the value of Bitcoin over time as new coins become more and more scarce, putting upward pressure on demand.

Bitcoins are created by mining software and hardware at a specified rate. This rate splits in half every four years, slowing down the number of coins made. The first halving was in 2012; the last occurred on 19 April 2024.

Bitcoin's price should continue to rise as long as it continues to grow in popularity and its supply cannot meet demand. However, if popularity wanes and demand falls, there will be more supply than demand. Then, Bitcoin's price should drop unless it maintains its value for other reasons.

New Bitcoin Securities

Another factor that affects Bitcoin's price also relates to the supply and demand of related securities. Bitcoin became a financial instrument that investors and financial institutions use to store value and generate returns. As a result, derivatives have been developed to broaden access to BTC for a broader range of investors. Derivatives and new securities also influence the demand for Bitcoins. As new Bitcoin securities hit the market, Bitcoin's price will adjust due to the changes in supply and demand.

Investors' behavior

Speculation, investment product hype, irrational exuberance, investor panic, and fear can also affect Bitcoin's price because demand will rise and fall with investor sentiment.

Competing Cryptocurrencies

Other cryptocurrencies may also affect Bitcoin's price. The utility of cryptocurrencies continues to grow as regulators, institutions, and merchants address concerns and adopt them as acceptable forms of payment and currency. If consumers and investors believe other coins will be more valuable than Bitcoin, demand will fall, taking prices with it. Or, demand will rise along with prices if sentiment and trading move in the bullish direction.

Bottom Line

Since its launch in 2009, Bitcoin has remained a popular and closely followed asset and continues to demonstrate highly volatile price action. 2012 was an important year in its development, setting the scene for the extraordinary growth the cryptocurrency has had so far. Determining what was the price of Bitcoin in 2012 could be problematic because daily prices may not necessarily be available. However, the importance of 2012 in the history of Bitcoin should not be underestimated. Using the metaphor of the stages in a child's life, Bitcoin was an infant in 2008, a toddler from 2009 to 2011, and in 2012, it became steady on its feet and started growing. If past and recent events and prices are any indication, we can expect the volatility to continue as long as there is demand for it as an investment asset.