Bitcoin has come a long way, starting in July 2010 when the price was only $0.05 to $0.30 in December 2010 and crazy to think that it's broke the $80,000 mark in November 2024. Back then in the early days of Bitcoin, the crypto market had little media attention and liquidity, with cryptocurrencies resembling penny stocks.

The answer to the question of what was the price of Bitcoin in 2010 started as low as $0.01 and reached its yearly High on December 31st when the price hit $0.30.

There was a significant events in 2010, the first cryptocurrency faucet, called "The Bitcoin Faucet," was created by Gavin Andresen, initially giving out five bitcoins per person.

On May 22, 2010, the first major retail transaction with Bitcoin happened when Laszlo Hanyecz from Jacksonville, Florida, traded 10,000 BTC for two pizzas from Papa John’s. Laszlo posted an offer on an online forum, and Jeremy Sturdivant from England accepted, ordering the pizzas for him.

You can track the price of Bitcoin in 2010 with our table that shows the price per day in 2010 -

| DATE | OPEN | HIGH | LOW | CLOSE |

|---|---|---|---|---|

| December 31 2010 | $0.30 | $0.30 | $0.30 | $0.30 |

| December 30 2010 | $0.30 | $0.30 | $0.30 | $0.30 |

| December 29 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| December 28 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| December 27 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| December 26 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 25 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 24 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 23 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 22 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 21 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| December 20 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 19 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 18 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 17 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 16 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 15 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 14 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| December 13 2010 | $0.22 | $0.22 | $0.22 | $0.22 |

| December 12 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| December 11 2010 | $0.20 | $0.20 | $0.20 | $0.20 |

| December 10 2010 | $0.20 | $0.20 | $0.20 | $0.20 |

| December 09 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| December 08 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| December 07 2010 | $0.20 | $0.20 | $0.20 | $0.20 |

| December 06 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| December 05 2010 | $0.21 | $0.21 | $0.21 | $0.21 |

| December 04 2010 | $0.25 | $0.25 | $0.25 | $0.25 |

| December 03 2010 | $0.26 | $0.26 | $0.26 | $0.26 |

| December 02 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| December 01 2010 | $0.21 | $0.21 | $0.21 | $0.21 |

| November 30 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| November 29 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| November 28 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 27 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 26 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 25 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 24 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 23 2010 | $0.29 | $0.29 | $0.29 | $0.29 |

| November 22 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 21 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 20 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 19 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| November 18 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| November 17 2010 | $0.22 | $0.22 | $0.22 | $0.22 |

| November 16 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| November 15 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 14 2010 | $0.28 | $0.28 | $0.28 | $0.28 |

| November 13 2010 | $0.27 | $0.27 | $0.27 | $0.27 |

| November 12 2010 | $0.22 | $0.22 | $0.22 | $0.22 |

| November 11 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| November 10 2010 | $0.21 | $0.21 | $0.21 | $0.21 |

| November 09 2010 | $0.24 | $0.24 | $0.24 | $0.24 |

| November 08 2010 | $0.34 | $0.34 | $0.34 | $0.34 |

| November 07 2010 | $0.39 | $0.39 | $0.39 | $0.39 |

| November 06 2010 | $0.26 | $0.26 | $0.26 | $0.26 |

| November 05 2010 | $0.23 | $0.23 | $0.23 | $0.23 |

| November 04 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| November 03 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| November 02 2010 | $0.20 | $0.20 | $0.20 | $0.20 |

| November 01 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| October 31 2010 | $0.20 | $0.20 | $0.20 | $0.20 |

| October 30 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| October 29 2010 | $0.17 | $0.17 | $0.17 | $0.17 |

| October 28 2010 | $0.19 | $0.19 | $0.19 | $0.19 |

| October 27 2010 | $0.15 | $0.15 | $0.15 | $0.15 |

| October 26 2010 | $0.13 | $0.13 | $0.13 | $0.13 |

| October 25 2010 | $0.12 | $0.12 | $0.12 | $0.12 |

| October 24 2010 | $0.11 | $0.11 | $0.11 | $0.11 |

| October 23 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 22 2010 | $0.11 | $0.11 | $0.11 | $0.11 |

| October 21 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 20 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 19 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 18 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 17 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 16 2010 | $0.11 | $0.11 | $0.11 | $0.11 |

| October 15 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 14 2010 | $0.11 | $0.11 | $0.11 | $0.11 |

| October 13 2010 | $0.09 | $0.09 | $0.09 | $0.09 |

| October 12 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 11 2010 | $0.10 | $0.10 | $0.10 | $0.10 |

| October 10 2010 | $0.09 | $0.09 | $0.09 | $0.09 |

| October 09 2010 | $0.09 | $0.09 | $0.09 | $0.09 |

| October 08 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| October 07 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 06 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 05 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 04 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 03 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 02 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| October 01 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 30 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 29 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 28 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 27 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 26 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 25 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 24 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 23 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 22 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 21 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 20 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 19 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 18 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 17 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 16 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 15 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 14 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 13 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 12 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 11 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 10 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 09 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 08 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 07 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 06 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 05 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 04 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 03 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 02 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| September 01 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 31 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 30 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 29 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 28 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 27 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 26 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 25 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 24 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 23 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 22 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 21 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 20 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 19 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 18 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 17 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 16 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 15 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 14 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 13 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 12 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 11 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 10 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| August 09 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 08 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 07 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 06 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 05 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 04 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 03 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 02 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| August 01 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| July 31 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| July 30 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| July 29 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| July 28 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| July 27 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| July 26 2010 | $0.05 | $0.05 | $0.05 | $0.05 |

| July 25 2010 | $0.05 | $0.05 | $0.05 | $0.05 |

| July 24 2010 | $0.06 | $0.06 | $0.06 | $0.06 |

| July 23 2010 | $0.05 | $0.05 | $0.05 | $0.05 |

| July 22 2010 | $0.08 | $0.08 | $0.08 | $0.08 |

| July 21 2010 | $0.07 | $0.07 | $0.07 | $0.07 |

| July 20 2010 | $0.08 | $0.08 | $0.08 | $0.08 |

| July 19 2010 | $0.09 | $0.09 | $0.09 | $0.09 |

| July 18 2010 | $0.05 | $0.05 | $0.05 | $0.05 |

| July 17 2010 | $0.05 | $0.05 | $0.05 | $0.05 |

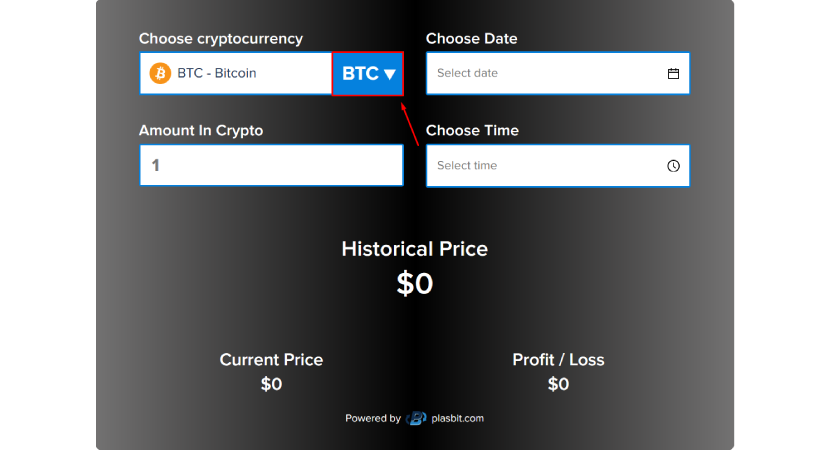

To check the historical price of Bitcoin for specific dates, we’ll use the Plasbit crypto-to-USD historical price calculator.

Step-by-step guide on finding the historical price of Bitcoin

1. Visit the Plasbit Crypto History Calculator and scroll down. Click the blue dropdown button and pick the currency (you may need to switch to another currency first).

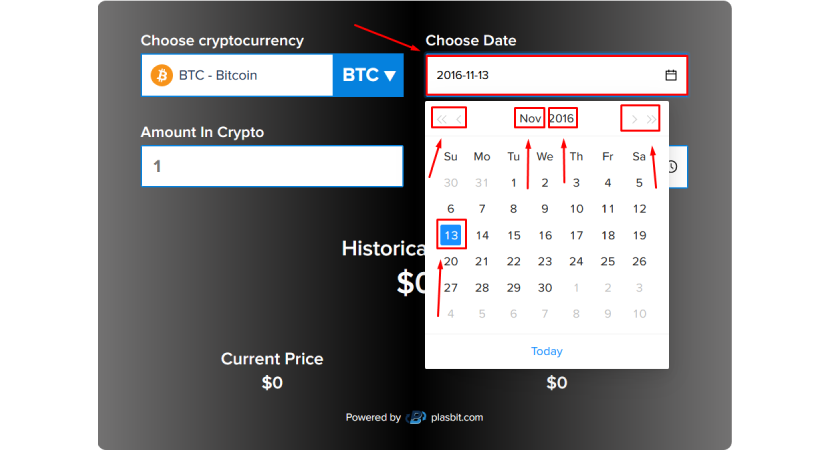

2. Choose the target date by clicking the input field to the right. Click the month, the year, and the day to choose them. You can also type the date in the YYYY-MM-DD format and press Enter or click the less/greater than symbols to quickly skip around months and years.

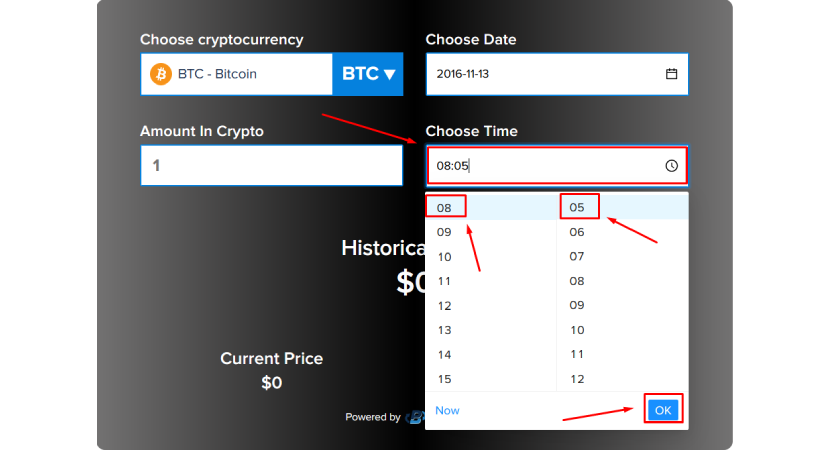

3. Click the input box below and choose the time of the day. Click “OK” to confirm your choice. You can also type in the time in the 24-hour HH:MM format and it will be selected. Press Enter to confirm your choice.

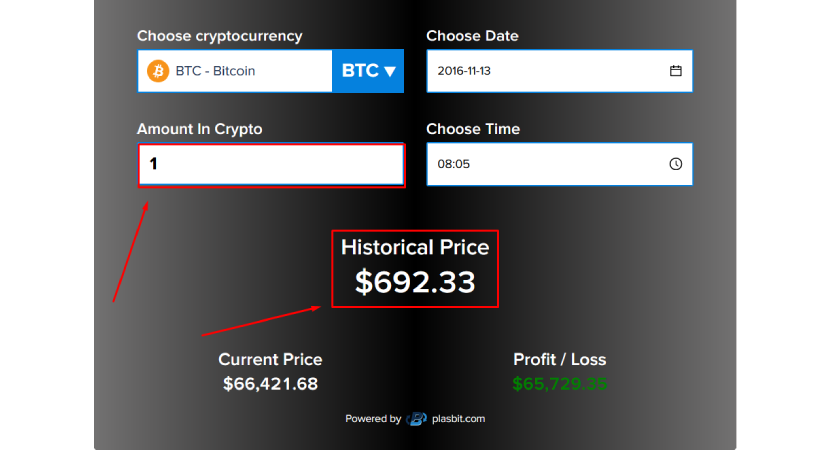

4. Click the input box to the left and type in the crypto amount. If there is historical data for the chosen time and date, it will be displayed under “Historical Price.”

Why is there no historical data for older dates?

If you’ve fiddled with the Plasbit Crypto History Calculator a bit, you noticed some of the historical Bitcoin price data is missing. In fact, the month we’ve chosen in the above screenshots (August 2013) shows no historical Bitcoin price data. As you move forward in time, such as to 2016, the price data becomes spotty until eventually becoming granular.

No, the Calculator is not broken; it’s all because of the state of the crypto market in those early days since Bitcoin’s inception in 2008–9. Back then, crypto markets were unregulated, and crypto was traded regularly only on illegal exchanges such as Mt. Gox.

Bitcoin was designed to work in that environment and provide its owners anonymity; the lack of historical Bitcoin price data is a feature, not a flaw.

What was the price of Bitcoin in 2010 — the creation of Bitcoin

Bitcoin started its existence in 2008–9 as a virtual, experimental currency that could be sent to recipients the same way we send each other text messages or letters. The motive for creating it was to make a trustless, decentralized, anonymous payment method that works without involving banks, the value of which cannot be reduced through reckless printing of currencies that causes inflation, which is what was happening at the time.

Quite the opposite, even though Bitcoins can be created by operators of the Bitcoin transaction network, there is a limited supply of them baked into the system (21 million), which means Bitcoin’s worth would deflate and its purchasing power would only rise, rewarding early adopters. Even though early Bitcoin transactions involved tens or hundreds of Bitcoins, each Bitcoin was designed by Satoshi Nakamoto to be divisible into 100 million smaller units called “satoshi” or “sat”.

Value of Bitcoin

There is nothing backing the value of Bitcoin like there is with traditional currencies. There are no armed enforcers upholding arbitrary laws or governments issuing decrees; Bitcoin is secured by cryptography designed by its maker to make fraud and inflation impossible.

There is some super complex math behind Bitcoin’s security, with the gist of it being that Bitcoin is powered by strings of letters and numbers that can be entered into a math equation to produce the expected answer, which means the owner of the string is the owner of that many Bitcoins. The strings are put into blocks and chained one after another. Hence, the name for the Bitcoin transaction history is “blockchain”. Whichever blockchain is the longest is considered valid by miners.

How is Bitcoin produced?

Bitcoin network operators, known as “miners,” handle transaction processing and also create new Bitcoins by “mining” them. The mining process is more akin to solving Sudoku puzzles than actual hard labor — strong computers solve math equations to find a solution, for which the miners are rewarded with new Bitcoins. All solutions and all Bitcoin transactions are recorded in the blockchain, which is designed to be unfalsifiable and public, and of which every miner in the Bitcoin network has a copy.

The last Bitcoin should be mined in 2140, with miners paying for their operating costs after that with transaction fees they get for running the transaction network and updating the blockchain. Bitcoin processing fees are customizable, with miners deciding whether they are willing to process the transaction and collect the fee. In general, a 0.001 BTC fee (around $65 in April 2024) is enough to get a quick confirmation of a transaction.

The amount of work that miners need to put into processing various coin combinations favors large Bitcoin holders and large payments — a payment of 1+1 Bitcoin takes more effort to process than one with a single 2-Bitcoin amount. All of the above combined makes Bitcoin holders with small funds, small transactions, and small fees unfavored in the network; they might have to wait days for their transactions to be processed.

How do miners work?

Miners used to be private individuals, but with Bitcoin becoming harder and harder to mine, they have fallen out of favor due to unforeseen problems caused by Bitcoin mining. Miners are now organized in mining pools that allow them to mine without drawing excessive attention to themselves.

Mining pools distribute work among pool participants and issue their share of the reward proportional to their work done when the next block is mined. The largest mining pools were in China until 2021, when the CCP banned Bitcoin, at which point it slipped to second place behind the USA. As of 2024, 66% of Bitcoin’s computing power is in three mining pools:

● Foundry USA (30%)

● AntPool (22%)

● F2Pool (14%)

Miners and mining pools are not obliged to process a Bitcoin transaction and may issue requests, such as a demand for identification, before processing it. Large mining pools may also be regulated by a government, which can regulate them with rules and procedures similar to those put on banks, particularly identity verification (KYC) and anti-money laundering (AML).

Bitcoin blockchain size 2009–2024

If blocks are appended and only the longest blockchain is valid, the Bitcoin blockchain must be enormous, right? As of April 2024, the Bitcoin blockchain sits at 550 gigabytes, with the tendency to increase by 100 GB a year. At that pace, it will increase by 1 TB (terabyte) every ten years, resulting in an 11.6 TB or 11,600,550 GB blockchain by 2140.

Any Bitcoin transaction, no matter how small, requires hardware that goes through the entire blockchain to verify every transaction and signature up to the very first block. The power required to verify the blockchain does not diminish with transaction size.

At least in that aspect, Bitcoin has failed Satoshi’s original design goal — instead of being decentralized, two Bitcoin users who want to send a couple of sats among themselves both need substantial hardware that can verify the Bitcoin blockchain unless they want to trust one another, which defeats another design goal of Bitcoin.

Alternatively, they can trust dedicated network operators, who are the only ones with the hardware and capacity to run transactions. In effect, the network activity is centralized in miners and mining pools, which have become banks, and users trust them because it is convenient to do so.

Lightning Network

There was an attempt to tack another layer for quick payments on top of the blockchain, but this “Lightning Network” has seen minimal improvements since its launch in 2019. As of April 2024, it carries only 764 Bitcoins, which represents 0.0036% of the total Bitcoin scheduled to be in circulation. Even with enough liquidity, users may struggle to use Lightning Network for payments due to its inherent flaws that discourage peers from joining the network in numbers that can guarantee peer-to-peer connectivity.

In short, Lightning Network promises to be “the internet of money” but disregards the fact that internet infrastructure is based on trust. Network packets on the internet coming from users are shuffled into a huge bucket or trough from which national ISPs draw and absorb those that match their destination IP addresses.

There is nothing stopping an ISP from drawing wrong packets and disrupting internet package communication, but in that case, other ISPs may decide not to send any packets meant for it to the trough, effectively killing it. There is no such protection mechanism on the Lightning Network and adversaries have a far greater (monetary) incentive to act maliciously to other nodes in the network.

Can Bitcoin transactions be faked?

Fraud is still theoretically possible by a group of determined attackers, but faking a transaction that occurred in a Bitcoin block that was mined in the past would require computing power to redo all the subsequent blocks and keep that fake blockchain going. Satoshi dubbed this security protocol “proof-of-work.” It relies on enough people getting behind the idea of Bitcoin and using their computing power to keep the blockchain going.

In theory, quantum computers could outstrip conventional computing hardware by a huge margin, allowing them to fake Bitcoin transactions and the entire blockchain with little advance warning. Quantum computers would have to achieve at least a 15-fold increase in power to do that, making Bitcoin quantum-proof for at least the next 15–30 years.

Nation states or entities with a grudge or interest in destroying Bitcoin and with enough manufacturing capacity could create dedicated chips and graphics cards to overpower miners and take over the network. Andreas Antonopoulos, one of the Bitcoin enthusiasts, claims that it would be prohibitively expensive and states it would take 10 minutes before the miners restore their control over the Bitcoin network.

What was the price of Bitcoin in 2010 — why was Bitcoin created?

Satoshi Nakamoto published the Bitcoin whitepaper in October 2008, dubbing it “Bitcoin: A Peer-to-Peer Electronic Cash System.” The reasons for its creation are given in the whitepaper as follows:

● the desire to create a currency with irreversible transactions

● the need to promote casual, small transactions that can be done without mediation

● to minimize fraud and double-spending

Another motive for creating Bitcoin can be found in its first block, mined by Satoshi on January 3, 2009, and containing an embedded encrypted message. This is now called “Bitcoin genesis block,” and the embedded message is:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

The message refers to The Times front page headline published on that date discussing recovery measures for the banking system post the 2007–2008 financial crisis. In short, that crisis revealed toxic lending and investment habits prevalent in the global financial system that caused the collapse of major banks and widespread financial instability. Instead of letting banks fail so that the markets could recover naturally, governments worldwide intervened by printing money and giving it to the banks, causing inflation.

That headline is telling because it reveals that:

● banks may engage in toxic behavior and won’t get punished for it

● governments will support banks at all times

● the ordinary people will be the ones harmed by inflation

● there was the first bailout, meaning one was not enough, and as many will be done as necessary

Satoshi’s forum posts

In a series of forum posts starting on February 11, 2009, on P2PFoundation.org’s forum, Satoshi described the root problem with conventional currencies — excessive trust. Users of a classic currency need to trust the bank not to overproduce the currency and debase its value, but users of Bitcoin can rely on a system based on math and information. In theory, that would make Bitcoin the only currency without a single point of failure.

Satoshi made 542 posts, all dealing with technical details of Bitcoin, until December 12, 2010, when his posting activity abruptly stopped. It was only on March 7, 2014, that the same account posted again with a cryptic:

“I am not Dorian Nakamoto.”

That post was in reply to media investigations surrounding Satoshi Nakamoto’s true identity, which to this day remains a mystery. That forum account has not posted since.

What was the price of Bitcoin in 2010 — who was Satoshi Nakamoto?

Satoshi Nakamoto is an enigmatic figure who, judging by the name, was natively Japanese, but his flawless English use does not match that persona. His use of British expressions and the reference to The Times indicate he is or was a citizen of The Commonwealth or was deeply interested in English-speaking government affairs. However, those clues could have been planted on purpose as red herrings.

Numerous candidates, including Elon Musk, were considered for the real identity of Satoshi Nakamoto, but there is no definite confirmation. That makes sense because Satoshi’s vast Bitcoin wealth and prominence would make him a target for government and anarchist action alike. The wildest identity theory is that there is no single person behind the name “Satoshi Nakamoto,” which is a front for an intelligence agency operation, which would explain the genius design of Bitcoin.

Whoever Satoshi is, he/she/they are rumored to have hundreds or thousands of Bitcoin wallets, most holding 50 BTC, which was the default reward for mining a block at the time. Satoshi may have anywhere between half a million and a million Bitcoins in his wallets that have remained dormant since his withdrawal to total anonymity, that is, until 2024.

Satoshi’s recent activity

In 2024, one of Satoshi’s original wallets received nearly a million dollars in Bitcoin, sparking media attention. That is not necessarily a sign of Satoshi being alive, though. Anyone can send toa Bitcoin wallet, but only the one with access can send from it. Even if there is Bitcoin sent from one of his alleged wallet addresses, that need not mean he is alive and active.

Craig Steven Wright is the most prominent pretender to the name of Satoshi Nakamoto. A crypto enthusiast and investor, Craig Wright has made repeated attempts to have courts declare him Satoshi Nakamoto, which would give him exclusive rights to Bitcoin and Bitcoin-related merchandise. The Bitcoin brand alone would allow Craig Wright to start a multibillion-dollar business empire and control who can use Bitcoin.

What was the price of Bitcoin in 2010 — state of the crypto market in 2010

Back in 2010, Bitcoin was a novelty, a quirky gift that was given as a joke; you’d be lucky to be able to buy anything with Bitcoin. There was no idea what the logo should be like either. The general consensus landed on something resembling the Thai baht (฿).

Users could still mine Bitcoin at home using standard computers with little risk to themselves and others. Early adopters could buy Bitcoin for as little as $0.3 per Bitcoin but had to send money in advance through Western Union or PayPal and hope it all goes well.

In May 2010, a Florida resident Laszlo Hanyecz sold 10,000 Bitcoins to get two large pizzas, valued at $41, from Florida’s Papa John’s. Today, that 10,000 Bitcoin would be worth $670,700,000. The buyer of those Bitcoins, Jeremy Sturdivant, spent them all on travel. Neither regrets spending Bitcoin. The pizzas were cheese and “supreme”.

In remembrance of that event, May 22 is celebrated as Bitcoin Pizza Day.

Mt. Gox

In 2010, the now-defunct Bitcoin exchange was launched in Tokyo. Originally slated for trading Magic: The Gathering Online cards (hence the name), Mt. Gox allowed users to trade Bitcoin on July 18, 2010. It would soon gain enormous notoriety for being vulnerable to hacks, exploits, and government seizure of funds. In one notable instance in 2011, hackers used Mt. Gox to send 2,609 Bitcoin to faulty wallet addresses, causing that Bitcoin to be permanently locked and lost.

In 2013, the US government got involved and seized some of Mt. Gox’s funds from its payment processor, Dwolla. On February 7, 2014, Mt. Gox went insolvent and stopped all withdrawals after discovering year-long theft due to an alleged exploit in the Bitcoin software. Leaked documents revealed the company had lost 744,408 Bitcoins belonging to customers and 100,000 of its Bitcoins.

On February 23–24, 2014, the Mt. Gox Twitter account was scrubbed and the official website was shut down. On February 28, Mt. Gox filed for bankruptcy. As of September 2023, the bankruptcy proceedings are ongoing, and the 142,000 Bitcoins remaining in Mt. Gox’s possession should be distributed to creditors.

The reasons behind the rise of Bitcoin

Bitcoin caught the attention of investors as a brand-new vehicle for investment with solid technical fundamentals. The current price of Bitcoin is due to an array of factors that boil down to anticipated supply and demand. Another important reason was the freedom of government seizure, at least in theory. In practice, courts in the US can keep you locked up until you hand over any Bitcoin they believe you have.

Media attention also factored heavily into the steady rise of Bitcoin, which some media personalities can exploit for financial gain. In February 2021, Elon Musk publicly announced that Tesla bought $1.5bn of Bitcoin and that the company would start accepting Bitcoin for purchases. He said that:

“I do at this point think Bitcoin is a good thing and I am a supporter of Bitcoin.”

By July 2022, Elon Musk revealed that Tesla had sold off 75% of its Bitcoin holdings and would no longer accept it for payment, citing environmental concerns.

Conclusion

Bitcoin took 15 years to get where it is now, from a humble cryptocurrency akin to a penny stock to a crypto behemoth that features in breaking news and inspires the crypto industry to innovate. Predicting Bitcoin’s future is difficult, but based on what we have seen so far, it will be a wild ride.