As a crypto enthusiast, have you thought about the growth of Bitcoin prices over the years? It has been almost 15 years since its existence. Despite this range, the price of Bitcoin is still constantly fluctuating. In fact, many have even forgotten that the coin was launched in 2009. Simply put, Bitcoin is now in its teens. Has the question ever crossed your mind: what was the price of Bitcoin in 2009? At a rate of $0.00099 per bitcoin, the first Bitcoin-to-dollar trade took place in 2009 on the New Liberty Standard Exchange, where 5,050 bitcoins were exchanged for $5.02 through PayPal on the BitcoinTalk forum. The price of Bitcoin lingered around $0 throughout the year. In 2009, during Bitcoin’s early "block 0" phase, this faucet was created to help distribute the coin.

How can you find out prices in the past? By using a historical calculator, you may conduct thorough research and find out how much prices have changed in prior years. Numerous occurrences have impacted the Bitcoin pricing structure. We will discuss how they impacted the coin. Also, we will highlight the steps taken to keep things under control. Let's start by discussing the price of Bitcoin in 2009.

A Closer Look At How Bitcoin Was Traded In 2009

For Cryptocurrencies, 2009 was a new beginning. The year birthed the rise of Bitcoin, which is a groundbreaking digital currency. This one-of-a-kind currency used blockchain technology to upend established financial institutions through decentralization. Its key objective was to offer a peer-to-peer electronic cash system that functioned independently as opposed to banks.

On January 3, an unknown entity codenamed Satoshi Nakamoto mined the genesis block, which is known as block 0. This move marked the beginning of Bitcoin's history. However, there was no official price for Bitcoin at the time. This was because there was neither a market nor a recognized value for it. Initially, early Bitcoin users basically mined the cryptocurrency on computers. What was the price of Bitcoin in 2009 has been a common question to many, so you should know there weren't many transactions then to determine the price.

The first site to permit trading of Bitcoin was BitcoinMarket.com. It was launched in March 2010. This month opened a pathway to exchanges on several other platforms. Later, the first transaction on record was made. This occurred when Laszlo Hanyecz paid 10,000 BTC for two pizzas. It amounted to millions of cash as of that time. Due to the groundbreaking transaction, 22nd May is referred to as Bitcoin Pizza Day.

Between 2010 and 2011, the price of Bitcoin fluctuated a lot, although it remained quite low. It wasn’t until 2012 before the price started rising. There was a brief surge above $31 in June 2011, but it fell to single digits rapidly. The volatile nature of Bitcoin was a concern in the early days and this was due to its unproven stability and low public acceptance. Also, many people doubted the potentials of a currency that sprouted out of nowhere.

The price of Bitcoin climbed significantly toward the end of 2012. It reached about $13. What led to it was the growing public interest and technology. Because Bitcoin had no market value when it was first created, its 2009 price was not formally determined. The whole economic downturn opened the path for Bitcoin's eventual ascent to prominence. This made it formidable in the financial industry and provided the groundwork for its future expansion.

A Step-By-Step Guide To Finding the Historical Price of Bitcoin

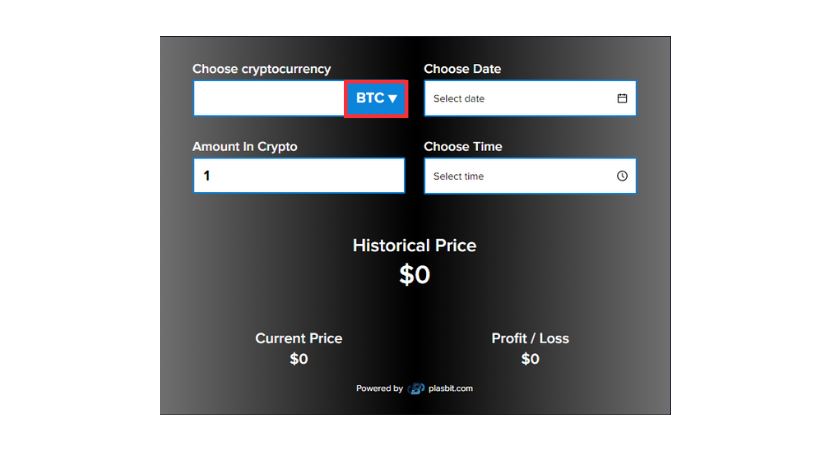

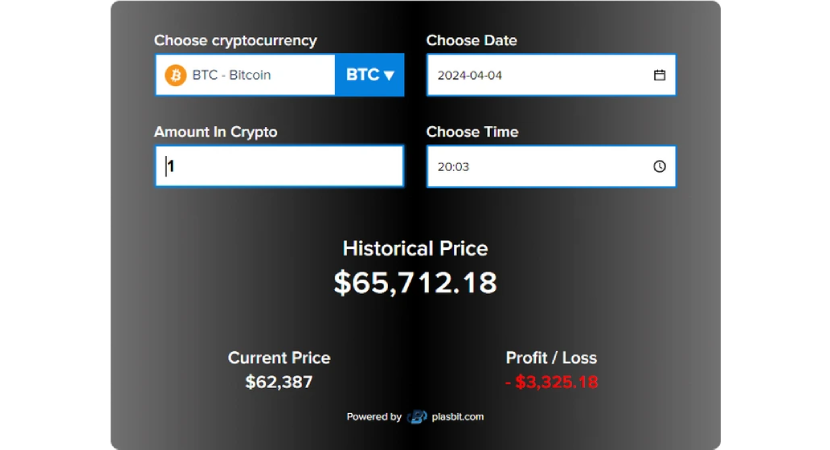

To identify trends or make informed decisions, you have to know a lot about the price history of Bitcoin. How can you seamlessly do this? Our PlasBit historical calculator is ideal. It is a feature-rich, user-friendly widget you can use to track the price of Bitcoin over time. Here's a step-by-step guide for you to successfully use it.

Step 1- Select Your Preferred Currency

Go to the historical price calculator, which we embedded at the top of this page, and choose Bitcoin as the cryptocurrency of your choice. Doing this establishes Bitcoin's value conversion, delivering precise results catered to your preference. A user-friendly interface that facilitates currency selection enhances the whole experience and is accessible to both novice and expert users. At PlasBit, we support major fiat currencies, such as USD and EUR.

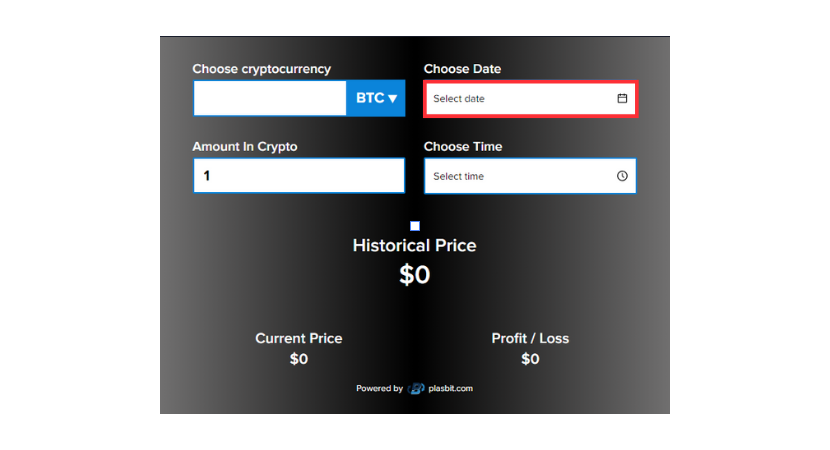

Step 2- Input the Date

Insert the date for the period for which you need results. By selecting specific dates, you can figure out how the coin grew within a period. The dates in the price history of Bitcoin must be synchronized. Generally speaking, this dates back to 2010. Curiosity may get a part of you. It could lead to you asking yourself, what was the price of Bitcoin in 2009, and after 5, 10 years? You can use this calculator to determine the fluctuations.

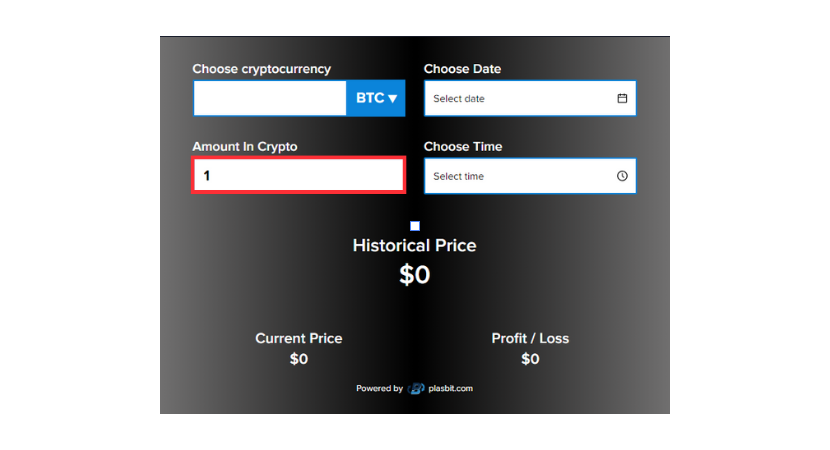

Step 3- Enter the Amount

When conducting a Bitcoin analysis, it is imperative to indicate the amount you wish to assess. You can choose any value for this quantity, ranging from 1 to 10 Bitcoins, based on your needs and the extent of your research. For instance, you may decide to examine a larger quantity if you're trying to comprehend the long-term market trends of a particular cryptocurrency.

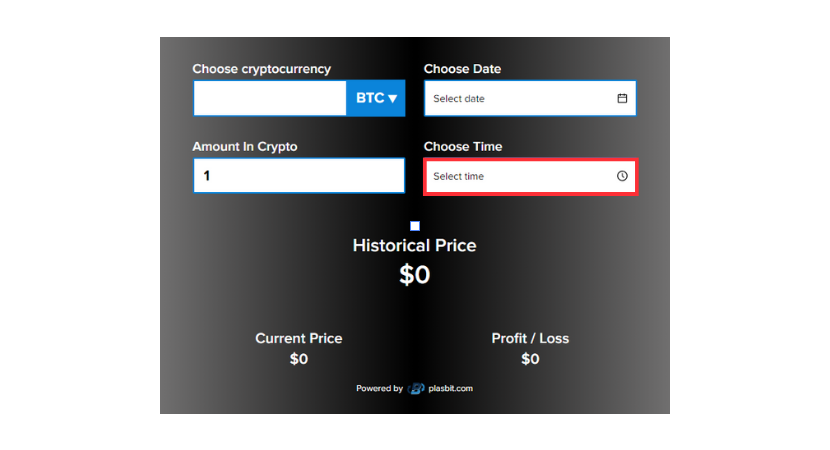

Step 4- Choose the Time

After inserting the amount you need, you have an option of specifically selecting the time. The exact time helps figure out the price variations hour by hour in the past.

Step 5- View the Results

Once you've inputted all the necessary details, the calculator will display the results. A figure showing Bitcoin's price details over the selected period and in the current period will be displayed. You can analyze the results to identify trends, patterns, and historical price levels. There is also a Profit/Loss icon which shows the differences between the two outcomes. This will allow you to compare the current price to previous values and determine how much has changed.

Additionally, this widget might be a really useful addition to your website if you are the owner of one. To create the widget precisely what you want for your website, you can even alter the visual elements, such as the background color, text color, and language that is selected.

How Bitcoin Emerged and Why It Was Created

After the 2008 global financial crisis, a whitepaper was published. It was titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This paper was released by an unidentified person. With this, Bitcoin was introduced to the world. It was a cryptocurrency unmatched by any other. The goal of this coin was to offer an alternative to conventional fiat currencies. It was also designed to override the centralized banking system. How did it come into existence? Follow us as we proceed.

How Bitcoin came to Exist

Analyzing the era's financial circumstances is necessary to comprehend why Bitcoin was founded. The 2008 global financial crisis highlighted the dangers of centralization and the flaws in the current banking structure. The public's finances could not be stabilized by governments, banks, or other financial organizations. What led to the economic crisis was the miscalculation made by banks to lend more money with the expectation that house prices would continue to rise.

Households and property developers borrowed imprudently to purchase and build houses. Many of the mortgage loans were for amounts close to the purchase price of a house. A large share of such risky borrowing was done by investors seeking to make short-term profits. Unexpectedly, when house prices began to fall, banks and investors incurred large losses because they had borrowed so much. Developers increasingly borrowed money for very short periods, to purchase assets that could not be sold quickly.

Consequently, they became increasingly reliant on lenders. As a result, a rising number of borrowers were unable to repay their loans. Investors began pulling their money out of banks and investment funds around the world as they did not know who might be next to fail. Consequently, financial markets became dysfunctional as everyone tried to sell at the same time and many institutions wanting new financing could not obtain it. Businesses also became much less willing to invest and households less willing to spend as confidence collapsed. As a result, many world economies fell into their deepest recessions. The safety of funds was at stake so people could no longer trust the banks.

This tragedy led to a greater desire for a more decentralized, transparent, and safe solution amidst a growing distrust for centralized institutions. In response to these difficulties, Bitcoin was created. It was designed to operate independently of any entity, including the government or a financial institution. It allowed peer-to-peer (P2P) transactions to take place, eliminating the need for intermediary financial authorities.

The currency was successful because of blockchain, which is a cryptographically secured distributed database containing blocks of transactions. What made the Bitcoin platform more decentralized was its high-end security and global consensus. Collectively, network users were continuously updating and validating the system's current state. Every user has the ability to confirm whether the contents have not been altered, as every block in the chain is connected to its predecessor. Users provide a distributed computing effort and are compensated for it. Despite being targeted for a huge number of users, the platform's decentralized structure protected it against numerous hacks.

The Vision Behind this Currency

The whitepaper outlined several key concepts and elaborated the founder’s vision for Bitcoin. The primary objective was to enable peer-to-peer transactions. This should be operated without the involvement of intermediaries such as payment processors.

Due to this, people could have dealings that don’t involve extra fees. At the same time, speed and increased productivity will be guaranteed. Moreover, there was a fixed 21-million-coin supply to create a deflationary currency. This scarcity was enabled to halt inflation and preserve its value throughout its existence.

Because of its restricted supply, Bitcoin functions as a valuable currency, just like gold. It is independent, in contrast to fiat currencies. It was created to be resistant to censorship. This would restrict entities from controlling transactions on the network. The initiative was extremely appealing to people who lived in countries with strict financial restrictions. It triggered the acceptance so as to battle banking institutions that could be used to quell opposition.

Its Impact on the Economy

Bitcoin has significantly impacted the financial and technology sectors since its debut. It has led to the creation of thousands of new cryptocurrencies. These coins have their own unique features and uses.

Bitcoin has also sparked a global conversation about the nature of money in the future. It has also modified the role of centralization in our financial systems. Some see it as a revolutionary force for good that promotes financial independence. Others see it as a medium that gives individuals more power. However, some lingering concerns are still in existence. These are mainly the volatility and security threats that could cause doubts.

What to Expect From Bitcoin

Given how quickly it is evolving, the future of Bitcoin is yet uncertain. It has to contend with administrations who want to put more stringent laws on cryptocurrencies. However, many people feel that in the end, the decentralization feature will prevail.

Furthermore, it would turn it into a widely accepted payment system. The currency was developed in reaction to the need for a more decentralized system. Since it has received wide acceptance from users, nothing could stop it from growing. An added advantage is its transparency and safe financial system to curb the flaws of traditional ones.

Its influence has been immense, igniting a global dialogue about the future of money and propelling the development of a new digital economy. There's no doubting Bitcoin's impact on the financial and technology industries, even though it's unclear whether it will reach its full potential.

The Identity of Satoshi Nakamoto

He is the unidentified figure who gave birth to Bitcoin. The mystery surrounding his identity is one of Bitcoin's most intriguing qualities. His name is commonly understood to be a pseudonym. Forums and email exchanges served as the main channels of communication between Nakamoto and the Bitcoin community. Bitcoin is the first decentralized cryptocurrency and is credited to him. This unidentified person wrote the whitepaper "Bitcoin: A Peer-to-Peer Electronic Cash System." It was published in 2008, before the coin's debut.

In January 2009, the Bitcoin blockchain's genesis block was mined. Nakamoto was involved in the project till 2010 before he passed over management to a well-known software programmer named Gavin Andresen. Even when he transferred the management, no one still decoded his identity. After taking this action, people began to know more about Bitcoin. As Bitcoin gained popularity, he gradually vanished from view. Since then, Nakamoto has not been mentioned in the media regarding his involvement with Bitcoin.

Entrepreneurs and computer scientists are among the popular professions that have been linked to Nakamoto. Despite their efforts, his exact identity is still a mystery. This is because none of these allegations have been definitively confirmed. Despite being anonymous, Nakamoto's idea had a significant influence on the society. Through the introduction of the decentralization idea, Bitcoin has completely changed the way that people view financial assets.

In addition, many other cryptocurrencies have been developed due to Bitcoin’s existence. This also established the framework for the larger blockchain and decentralized finance ecosystem. Even if Satoshi Nakamoto's identity may never be known, there is no denying his impact on finance. This is even unlimited to the technology world. The way future generations will view financial assets has been shaped by Nakamoto’s innovation. Decentralization, financial inclusivity, and digital sovereignty have sparked a new dispensation.

Impacts of the Economy on the Crypto Market in 2009

In 2009, the cryptocurrency market was in its early stages. Bitcoin was the only player as of then. It was when Satoshi Nakamoto released the first version of Bitcoin. Also, he mined the first block of the Bitcoin blockchain. At this time, Bitcoin had little to no monetary value. Even its potential as a digital currency was doubted and largely unknown. What led to its spark all of a sudden? The global economy in 2009.

The economy was recovering from the 2008 financial crisis. The crisis has had a significant impact on traditional financial markets. Many people were losing faith in traditional banking systems. This propelled them to look elsewhere for a sustainable alternative form of money. What came to the rescue of many? Bitcoin. With its decentralized nature, it captured the hearts of interested individuals.

Further, with the promise of financial freedom, it appealed to many more in search of an alternative to the traditional banking system. Nevertheless, in 2009, the cryptocurrency market was still comparatively small. It was undeveloped despite the economic unrest. Early adopters and computer enthusiasts were the major users of Bitcoin. As of then, its worth was mostly speculative. It was later on that more people realized how valuable Bitcoin was.

How Did Bitcoin Rise and What Was the Price of Bitcoin in 2009 and 10 Years After?

Innovations and economics majorly contributed to the rise of Bitcoin. The once-worthless coin has now grown to be a significant asset. Currently, it is valued at hundreds of billions of dollars. One key reason Bitcoin became popular is the use of blockchain technology. Due to its transparent nature, it is extremely safe to use. Moreover, its ability to record every transaction via a network makes it attractive to users.

There are many factors that drove Bitcoin's value up. One of them is the scarce nature. Unlike conventional currencies, the total number of Bitcoins is 21 million. This limit supersedes the financial security that is offered by central banks that generate money indefinitely. The value of Bitcoin has also significantly increased over time due to growing demand caused by scarcity.

Furthermore, people who value privacy in their financial records were easily attracted to Bitcoin. Just like its founder, the currency has a pseudonymous structure which hastened its growth. The privacy function provided much-needed solace to many individuals who had lost faith in established banking institutions.

The market value of Bitcoin was unknown upon its introduction in 2009. As of then, early miners mainly traded it for pleasure. Some did it just for experimentation. However, it was still worthless at the moment. In 2010, the first recorded price of Bitcoin came into reality. It was less than $0.01. The value gradually increased on the low scale till 2011. This was when it started to garner more interest. 10 years later, the public was already drawn to the coin.

Even mainstream investors were not left behind. The currency had grown to become a global sensation. 2019 was the year considerable swings occurred in the price of Bitcoin. It was around $3,500 when the year started. By the time 2019 ended, it had increased to almost $7,000.

For Bitcoin, the decade between 2009 and 2019 was a crucial one to its development. Its price changed to reflect its increasing acceptance and appeal as it went from being a specialized digital currency to a well-known asset class. During that period, the price of Bitcoin displayed how unstable it could be.

Many sharp price swings may occur as a result of macroeconomic trends and regulatory changes. In general, the 2009 price of Bitcoin was extremely low. The price at the end of 2019 was a growth phenomenon. This change was indicative of its infancy, lack of public awareness, and potential that paid in the long run. Bitcoin has emerged as a major force in the financial markets. Its rising popularity and impact have also been reflected in its growing price.

Conclusion

It took quite a journey for Bitcoin to reach this stage. What was the price of Bitcoin in 2009 must have been lingering on your mind before this article. However, we have provided the necessary details to guide you. The historical calculator has also been included to help you navigate the price structure over the years. Dealing with cryptocurrency holds many risks but making use of the calculator will enlighten you more.