Cryptocurrency adoption grows every day, to the point it’s getting closer to becoming mainstream. Due to this, many enthusiasts and casual users are looking for an easy way to bridge the gap between digital assets and traditional banking. Regardless of how you came into owning the crypto, be it through trading, payments, or long-term investments, there will be a point in time when you’ll want to cash out and deposit your earnings into your bank account. This is where crypto wallets come in handy, but before we dive into what they do, it’s important to understand the basic process of converting crypto to fiat currency. In simplest terms, it pretty much means exchanging digital assets such as Bitcoin, Ethereum, and the rest for a government-issued currency like US dollars, euros, and so on.

The most common way to do this is through a centralized crypto exchange. It’s a relatively simple process where you deposit your crypto into your wallet on the exchange and then convert it to traditional money like dollars or euros. Then, the exchange performs a bank transfer to your bank because centralized crypto exchanges are regulated and have access to banking services (do note that there will be a transfer fee). With that out of the way, it’s time to discuss what crypto wallets allow transfer to bank account? You can use PlasBit, Kraken, or Coinbase. They let you exchange crypto into your preferred local currency, such as euros, and transfer the funds directly to your bank account via bank wire. Deposit crypto to your wallet, go to the wires section, fill in your bank details, enter the amount you wish to withdraw and submit the wire request, and you will receive it to your bank account within hours.

Sadly, crypto won’t pay your rent (yet)

Even though cryptocurrencies offer decentralized freedom (something that isn’t possible with traditional currencies because governments are controlling their own currencies), many still choose to convert a portion or even all of their digital assets into fiat currencies. However, as much as crypto is gaining influence in today’s world, there are good reasons to convert, transfer, and deposit your crypto earnings into a traditional bank account. As we discuss what crypto wallets allow transfer to bank account, we have to name some reasons to convert in the first place:

- Cryptocurrencies still haven’t reached total mainstream adoption, and buying everyday things with crypto isn’t fully supported. Most daily transactions, from rent to groceries, are paid in fiat currency, which is likely the prime reason to convert.

- Volatility is the name of the game in the crypto industry, and fiat currencies such as the US dollar or euro are generally less volatile. As such, transferring your crypto into a fiat currency can help keep your money safe if the crypto market suddenly drops sharply due to unexpected global events, like a war in the Middle East or a major political shift.

- Getting insurance, mortgages, credit, or even tax reporting is often done via fiat currency simply because crypto isn’t accepted directly, so you have to convert it in order to pay for all those things.

- If you hold crypto without converting, it’s going to be tough to get a good credit score (important when asking for a loan or taking a mortgage). To be more precise, you need to show the Source of Funds (SOF) documents to the bank. Without them, you won’t have a proper trail of funds and you won’t be able to receive a bank transfer, which means you’ll end up stuck with crypto you can’t move.

- Creating a clean paper trail is another key reason and using regulated centralized exchanges ensures your transactions are properly documented, which can be useful for paying capital gains taxes, passing KYC (Know Your Customer) or AML (Anti-money laundering) checks if your bank questions you, or verifying your income, especially as regulators continue pushing for tighter oversight in the crypto space..

While we’re on the subject of law, since the start of this year, the EU has adopted MiCA (Markets in Crypto-Assets) regulation, which is one of the biggest pieces of crypto legislation in the world. It’s designed to regulate crypto assets across EU member states, and its main goal is to create a consistent legal framework that promotes innovation while protecting consumers and financial stability. That would be an official definition at least (we won’t go too much into it), but taking into account that MiCA has been in effect for more than half a year, it has impacted the crypto industry in the European Union. For instance, all wallet providers and exchanges operating in the EU must be licensed, apply strict AML standards, and be very transparent about possible risks. Also, if you’re in the EU, you can only use MiCA-compliant platforms and services for transferring crypto to bank accounts. Overall, one of the main points of this regulation is to bring higher consumer protection and to reduce the risk of scams (we love writing about those) or frozen funds during withdrawal.

Not all crypto wallets are made equal

We can’t talk about what crypto wallets allow transfer to bank account and not mention PlasBit, as well as a few others, such as Kraken and Coinbase. The principle is the same, though some have specific features that others don’t, so we’ll try our best to do a comparison of sorts.

- Plasbit was built from the ground up with privacy and security in mind. We believe privacy is a right, not a privilege, which is why we collect only the bare minimum needed to provide our users with access to the traditional banking system. We work with regulators to ensure compliance without extra tracking or unnecessary data collection, gathering just what’s needed to keep things running and your information and funds secure.

- Kraken’s wallet will likely entice professional traders and institutions that need large fiat transfers. This is due to the fact that, depending on the verification level (basically an account type), you can withdraw millions in a single transaction to linked bank accounts. Most other wallets have a cap at around $100,000 per transaction.

- Lastly, Coinbase has an interesting feature called FDIC (Federal Deposit Insurance Corporation) insurance. The wallet itself isn’t insured, but the platform does offer FDIC pass-through coverage for US dollar balances held in its custodial accounts at an FDIC-insured bank. This means that if Coinbase holds customer funds at a bank that fails, those funds may be protected up to $250,000 per depositor.

Of course, there are other wallets that allow transfers to bank accounts, such as the Binance wallet. However, as popular as Binance is, over time, it has faced increasing regulatory crackdowns in the US, EU, UK, Australia, and a whole lot of places across the globe. In other words, this potentially limits fiat access in many regions and makes cash-outs harder for the users. Another popular wallet is MetaMask, but it has one rather big flaw that might deter users, depending on their needs. The thing is, MetaMask doesn’t support Bitcoin, and you can't send Bitcoin directly to your MetaMask wallet. It’s a popular choice for Ethereum users, but anyone who wants to use Bitcoin should stay away from it. The truth is, there are a lot of wallets available in the market at the moment, and listing them all would take a better part of our week. So, to make the most out of this article, from here on, we’ll focus on the different types of wallets and bank transfers.

Using PlasBit wallet to transfer your crypto to a bank account

First things first, you need to know how to actually transfer your crypto to a bank account with PlasBit.

- Step 1 - Log in and click on the [Wallet] tab in the upper left corner.

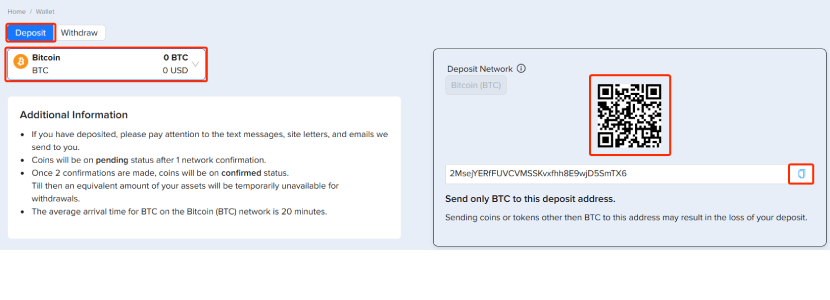

- Step 2 - Deposit Bitcoin into your wallet. You can copy the wallet address on the right or use the QR code.

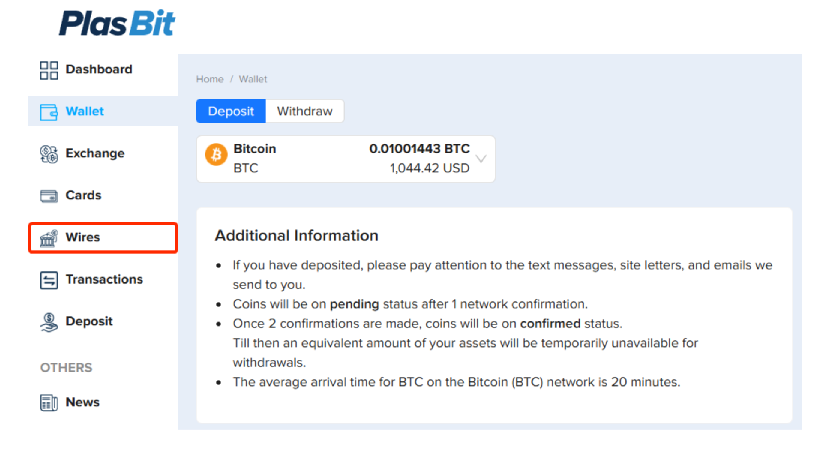

- Step 3 - After the Bitcoin has been deposited, navigate to the [Wires] tab.

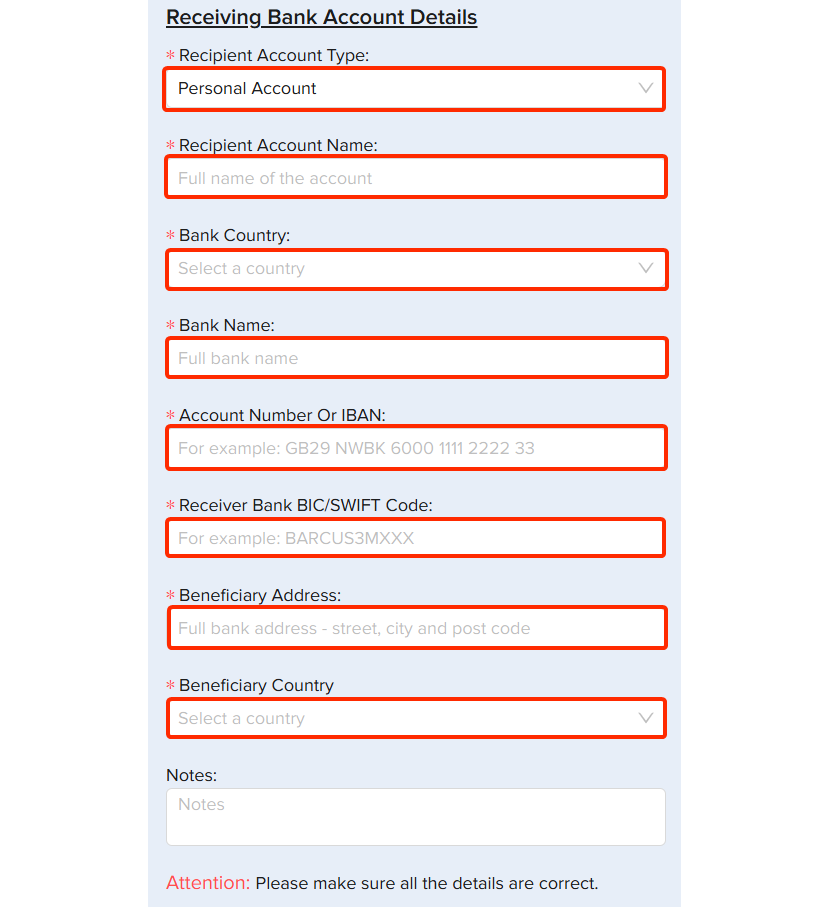

- Step 4 - Next, you will need to fill in your bank details.

Note: The name of the bank account holder and the PlasBit account must be the same.

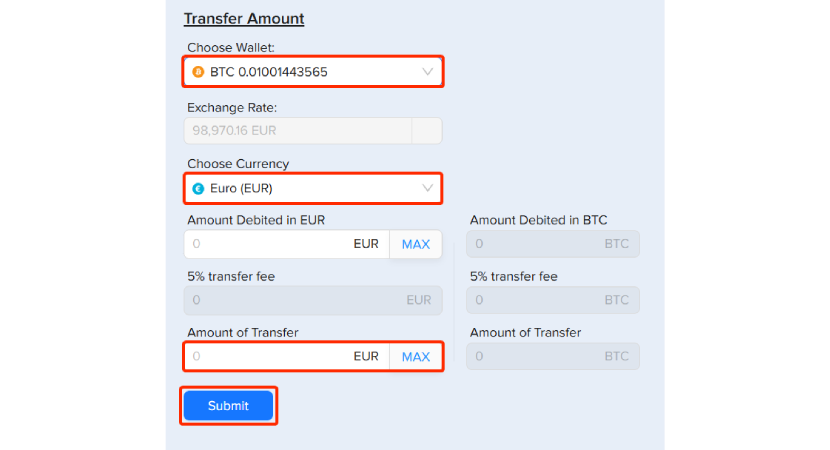

- Step 5 - Fill in the transfer details.

Choose the wallet where you have just deposited your Bitcoin. Then, you can choose the currency (in this case, EUR) and see the exchange rate. Once that is done, fill in the amount you want to receive in your bank account.

Now, just press [Submit].

Note: To be able to perform the wire transfer, you will have to complete identity verification. If you haven’t done so, you won’t have the option to press Submit.

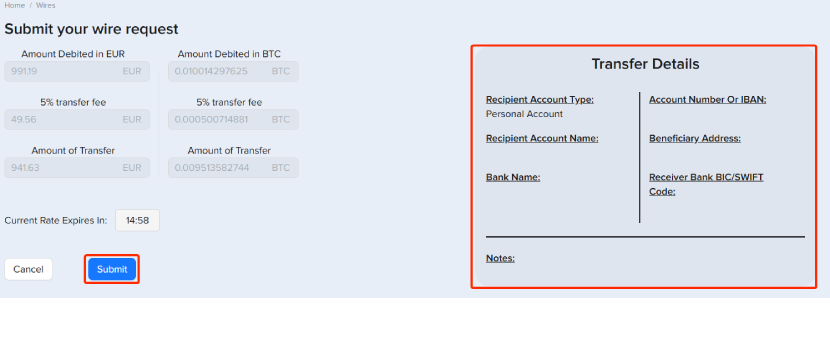

- Step 6 - Carefully check all the details of the bank transfer and press [Submit] again.

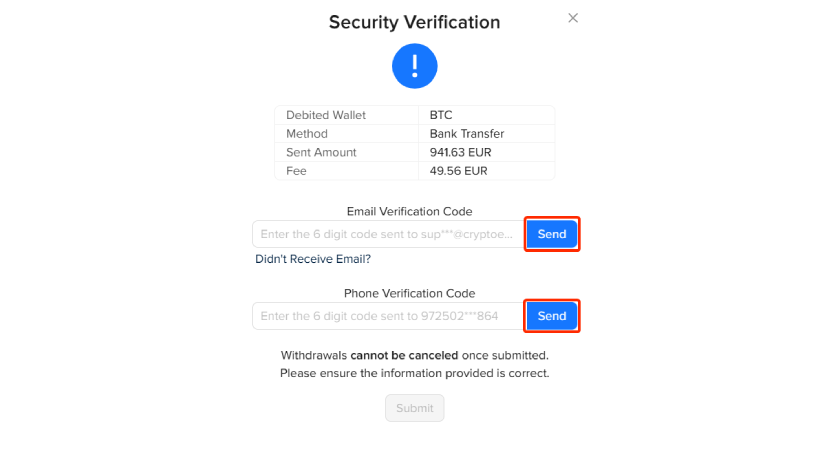

- Step 7 - From here, you must go through the security verification. Press [Send] to receive verification codes on your email and phone.

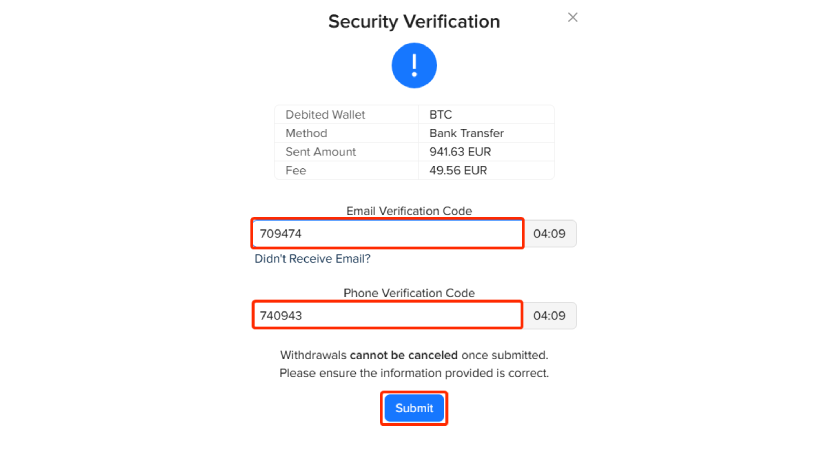

- Step 8 - Copy and paste both verification codes after receiving them and click [Submit] to finish.

Note: You have 5 minutes before the codes expire.

Once your wire is approved, you will receive an email confirmation. The transfer of funds usually happens on the same day or up to 5 days.

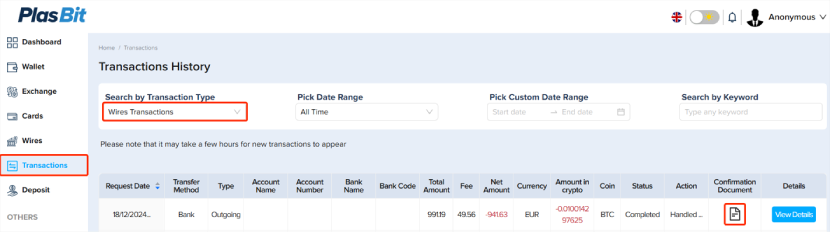

- Step 9 - In the [Transactions] section, if you select [Wires Transactions] from the drop-down menu, you will be able to see the status of your transfer. After the transaction is approved, you can download the transaction details in PDF.

The battle between hot and cold (wallets)

When it comes to what crypto wallets allow transfer to bank account, there are two categories available: cold wallets (offline) and hot wallets (online). Since there is a huge number of wallets available, we'll only mention some of the more well-known ones that allows you to convert your crypto to a bank transfer -

- Ledger is one of the most popular cold wallets on the market. Users can convert crypto to fiat and transfer it to their bank account through Ledger integrated partners such as Coinify. This means that when you sell your crypto on Ledger, Coinify will send that money to your bank and help you off-ramp, which is the process of converting crypto to traditional currencies. There are several fees present for this, such as 1% fee for Coinify, a 0.5% foreign transaction fee, and a network fee. Interestingly, the entire process is embedded in Ledger Live (the official app for Ledger users).

- Trezor is another well-liked cold wallet that does things a little bit differently compared to Ledger. For instance, there isn’t an off-ramping feature by itself, but there is an integration with several providers that can offer users the ability to do that, such as Invity. The process of selling your crypto and receiving that money in your bank account is largely the same as with Ledger. You’ll sell the crypto to Trezor, and then Invity will send a bank transfer to your bank account. What is different are the fees, which are 1.5% for the bank transfers without including the exchange fee.

- Metamask is a hot wallet, unlike the two above. There is an option of a cash out via bank transfers, although this can be very expensive due to a combination of exchange fees and transfer fees, sometimes reaching 8% or 9%. Like many wallets, Metamask also uses third-party providers as partners to help their users with the off-ramping, with companies such as MoonPay and Banxa facilitating the transactions. In an effort to reduce the fees, Metamask collaborated and integrated with Ramp Network to provide faster cashouts with lower fees.

Bank transfer showdown

Similarly to the wallets, there are a few types of bank transfers as well, and we’ll list the most common ones.

- SEPA (Single Euro Payments Area) is a region-specific transfer method available only in the EU. This type of transaction has very low fees and is generally fast, since in most instances, the transaction will be completed within 24 hours. As the name suggests, the main limitation is that it’s only available for euro transactions.

- Wire transfers are the most well-known and are ideal for transferring large amounts. They have a wide reach and are available for sending pretty much anywhere worldwide. The bad part is that they can have expensive fees (up to $50 and more) and take at least several days to finish the transactions. Furthermore, in some instances, wire transfers may even trigger a compliance review (a check-up that banks do to make sure that money transfers, both local and international, follow all the rules and their own guidelines). Technically, this isn't bad per se, but it does mean extra waiting time.

- ACH (Automated Clearing House) is the US’ counterpart to SEPA. The best thing about it is the very low fees, costing a few dollars at best. Sometimes, that drops to less than $1 per transaction, while in some cases, there are no fees at all. However, ACH is rather slow, and you’ll need to wait at least a few days for it to complete.

No bank, no problem - alternative ways to convert crypto to cash

It’s worth noting that besides what crypto wallets allow transfer to bank account, there are also some alternative ways of converting crypto to cash, and we’ll be listing some of the more usual ones.

A cryptocurrency ATM (Image credit: generalbytes.com)

- Bitcoin ATMs offer a different way of converting crypto into cash, especially if Bitcoin is the only crypto you have. All you need to do is find a Bitcoin ATM, send your Bitcoin to the ATM's wallet, and you’ll get your funds instantly. Due to the rising crypto popularity, some of these ATMs also support cryptocurrencies such as Ethereum or various stablecoins, despite the Bitcoin-first sentiment. They aren’t that widespread yet, so you won’t find them everywhere, and do note that there’s a rather high fee involved, sometimes even over 10%.

- Peer-to-peer is another alternative method that is quite flexible but also requires trust above all else. You can sell various cryptocurrencies on peer-to-peer platforms, where you’re directly interacting with the buyer. They transfer the money to your bank account, and you transfer the crypto to them. As you can see, while private, it’s also risky and requires caution and trust, because there is a chance the other side won’t stay true to the agreement.

- Crypto cards offer a convenient way of transferring your digital assets to traditional currency. These cards work pretty much the same way as the traditional ones we all use and love, as you simply need to find a regular ATM and withdraw the amount you wish.

- Instant card payout is one of the fastest ways to convert crypto to fiat. With some exchanges, you have the option to withdraw funds directly to your card, often instantly, or at the very least, within the same day, making it ideal for smaller amounts. The main drawback is the fee, which typically comes as a percentage of the amount, usually around 3%.

You can also consider converting crypto to PayPal (or similar platforms) or prepaid card balances because a lot of exchanges do allow this type of withdrawal without requiring direct access to the bank.

What crypto wallets let you withdraw to a bank account?

As you may have figured out by now, some allow you to cash out directly. So, what crypto wallets let you withdraw to a bank account? PlasBit, Kucoin, Crypto.com allow you to convert crypto to fiat and withdraw it via bank transfer. You can deposit crypto into your wallet, convert it to fiat, and then submit a bank transfer request to your personal bank account, either via SEPA for European banks or SWIFT worldwide. Log in to your Plasbit wallet, deposit crypto, navigate to the wires section, provide your bank account info, specify the withdrawal amount, and submit your request. The funds will be transferred to your bank account within a few hours.

Can you transfer money from a crypto wallet to a bank account?

Here is a quick recap on how things work with transferring and what to do. So, can you transfer money from a crypto wallet to a bank account? Yes, you can, by depositing to your wallet, either in Plasbit, Binance, or Gemini, which allow you to exchange your crypto into your local currency, like euros, and send a wire to your bank account. Log in to your wallet, deposit crypto, navigate to the wires section, fill in your bank details, choose the amount to transfer, and confirm the transaction.

How to make a crypto withdrawal to bank account?

With cryptocurrencies rising in popularity, a lot of people have questions regarding transferring, withdrawals, and similar stuff. One of the common questions users often ask is how to make a crypto withdrawal to bank account? Platforms like Plasbit, Binance, and Kraken allow you to do so by exchanging crypto to a bank transfer, and sending the money to your bank account. Sign in to your wallet, deposit crypto, head to the wires section, enter your bank account information, fill in your desired transfer amount, and submit the transaction. The money should reach your bank account on the same day.

Pick a wallet that does it all

In the end, there is no shortage of crypto wallets available on the market, some good, some bad, but also some limited in their functionality. With most of them, you get to store crypto, but some go the extra mile and do even more. Case in point is the PlasBit wallet, which not only stores and keeps your crypto safe, but it also allows you to directly transfer your crypto into a bank account. On top of that, it’s very convenient and easy to use, so you’ll have your fiat currency ready in no time. It just goes to show that, whether for trading, spending, or cashing out, the right crypto wallet can make all the difference in closing the gap between digital and traditional finance.