Many people who own Bitcoin and other cryptocurrencies want to transfer them to their bank accounts at some point. However, banks do not accept cryptocurrency transactions due to their decentralized and anonymous nature and complex legal regulations. Since banks don’t support direct transfers from crypto-related companies, many ask the question of how to transfer Bitcoin to Bank account? Deposit your bitcoin to the wallet, go to the Wires section and enter your bank account details, submit a transfer request and you will be credited to your bank account on the same day. The only twist with this process is that you’ll have to complete a full KYC process that includes verifying both your identity and your address to be able to use the wire and banking services. This is a way of ensuring that you aren’t involved in illegal activities. This article takes you through the complexities of transferring Bitcoin to your bank account and explores the key aspects of this process you have to keep in mind.

Transferring Money Using PlasBit Explained

PlasBit serves as an intermediary between your crypto wallet and the bank. We allow users to convert Bitcoin, and other cryptocurrencies, into fiat currency, and transfer it into your bank seamlessly. There’s a 1% fee for conducting these transfers, making it an affordable option. The banks won’t flag the transaction, allowing the user to withdraw their crypto whenever, for whatever reason, they have. Another advantage that PlasBit offers is that you can expect same-day bank transfers, depending on your bank's processing time. However, we require a KYC verification, just like all other legitimate crypto exchanges. Besides that, you only need to deposit Bitcoin into your PlasBit account and to have a bank account to conduct a withdrawal successfully.

Why is KYC Essential for Crypto Exchanges

One of the key principles of Blockchain and Bitcoin is the possibility of conducting anonymous transactions without the intrusion of a third party. While this is often a great way to avoid untrustworthy banks, it led to numerous problems, such as online fraud and theft. To show how big of a problem this is, we can refer to the statistic that in 2021 alone, more than 46,000 Americans were victims of crypto fraud. The same problem can be observed in other countries as well. The know-your-customer verification process starts with gathering basic personal information on the customer, including full name, address, and government-issued identification. Once the customer submits their information, the company uses extensive verification procedures such as checking the ID in government institutions, conducting PEP screening, and verifying their address. Once the user is verified, they can proceed with customer onboarding. KYC protects customers and crypto businesses alike. Ensuring KYC compliance is essential for crypto businesses, as it allows them to operate legally in their jurisdiction. Verifying customers ensures that the risk of their platform being exploited for money laundering is minimized. With proper compliance and anti-money laundering practices, crypto businesses are protecting their reputation and building trust among their customers. At the same time, they can report to regulators and stay compliant, as they can confirm that their users aren’t involved in money laundering. When withdrawing money through PlasBit, after you go through the KYC process, you can only send the funds to a bank account with the same account name as the one you used for the KYC process. For example, if your crypto exchange account is in the name of John Doe you can only transfer to a bank account with the beneficiary John Doe.

How to Use the Plasbit Wire Feature

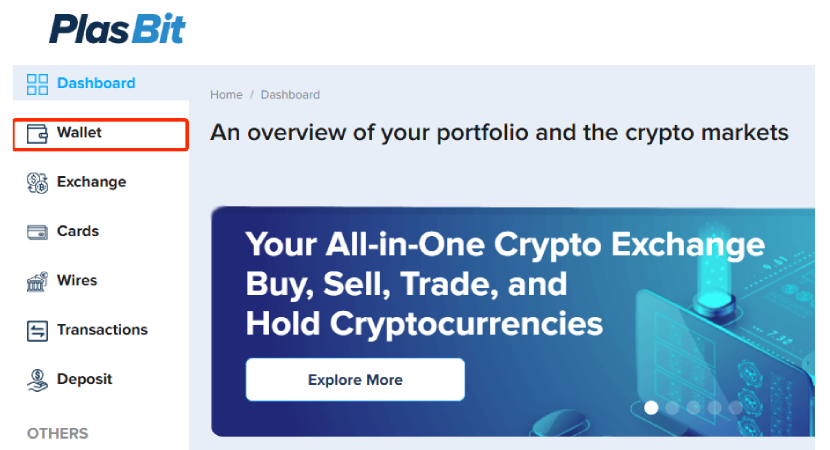

Step 1 – Log in and click on the [Wallet] tab in the upper left corner.

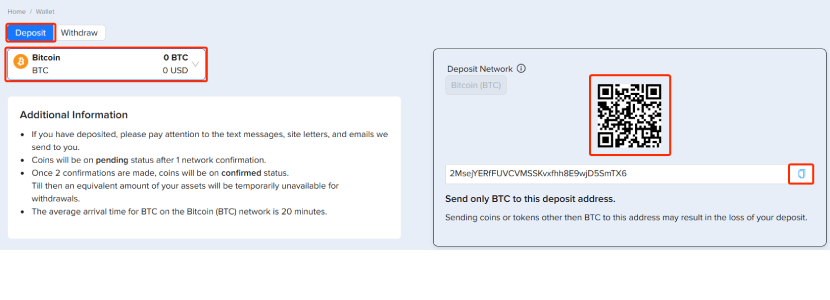

Step 2 – Deposit Bitcoin into your wallet. You can copy the wallet address on the right or use the QR code.

It’s crucial that you select the correct network, as it can otherwise lead to lost funds. The process of depositing Bitcoin can take a couple of minutes.

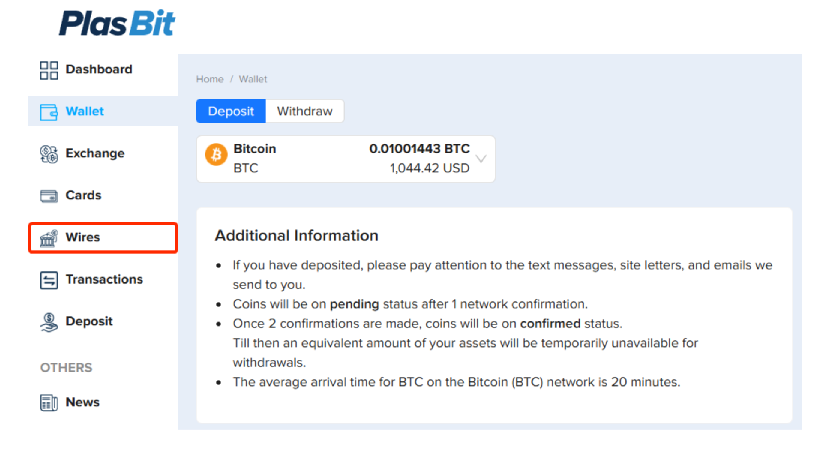

Step 3 – After the Bitcoin has been deposited, navigate to the [Wires] tab.

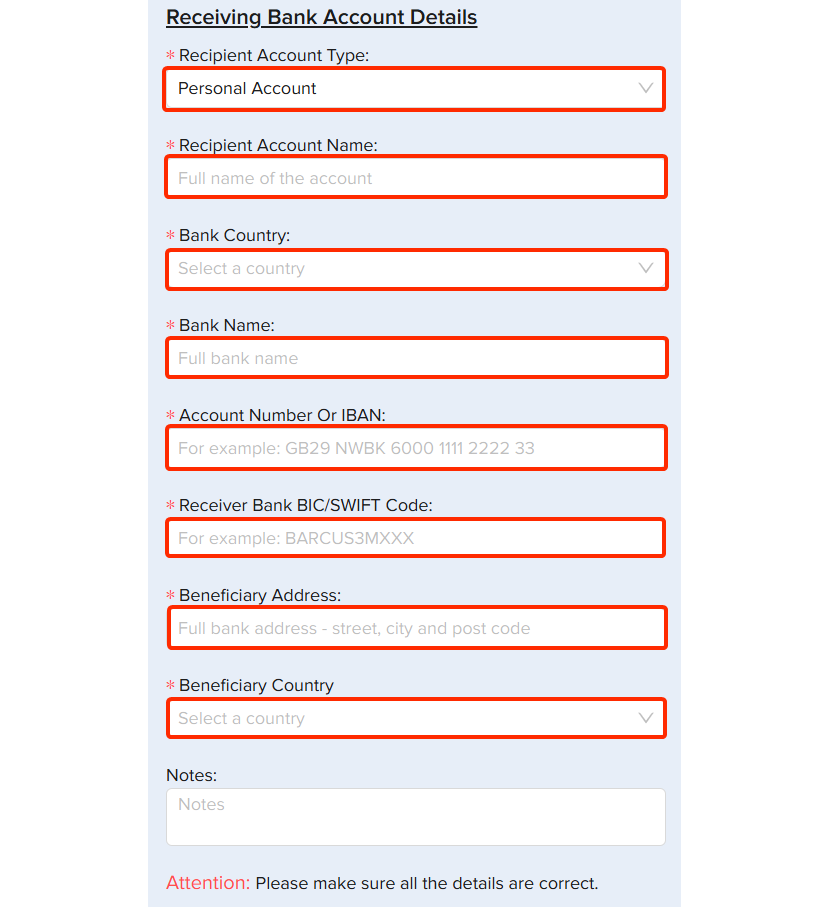

Step 4 – Next, you will need to fill in your bank details.

Note: The name of the bank account holder and the PlasBit account must be the same.

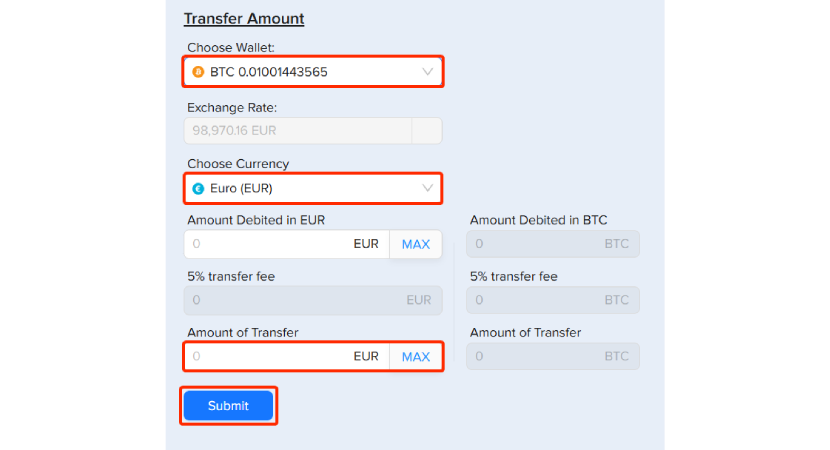

Step 5 – Fill in the transfer details.

Choose the wallet where you have just deposited your Bitcoin. Then, you can choose the currency and fill in the amount you want to receive in your bank account.

Now, just press [Submit].

Note: To be able to do the wire transfer, you will have to complete the identity verification. If you haven’t done so, you won’t have the option to press submit.

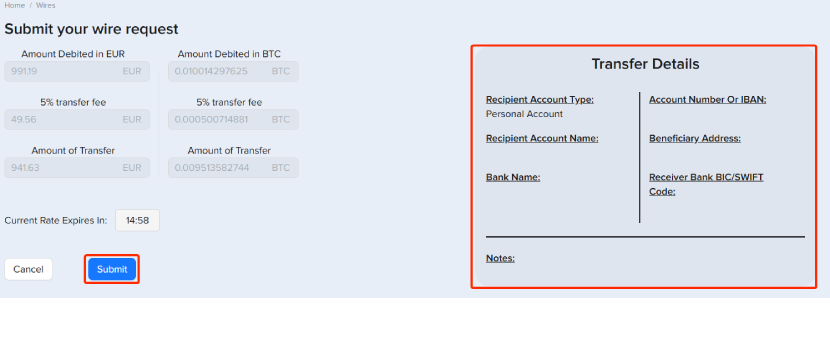

Step 6 – Carefully check all the details of the Bank Transfer and press [Submit] again.

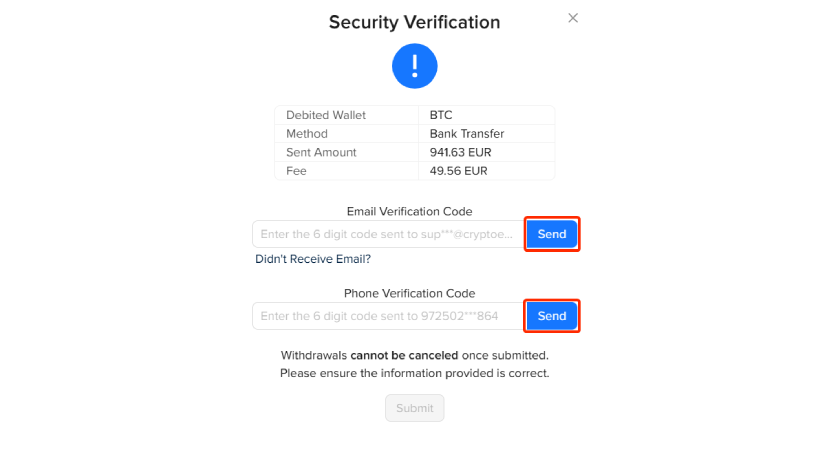

Step 7 – Now, you must go through the security verification. Press [Send] to receive verification codes on your email and phone.

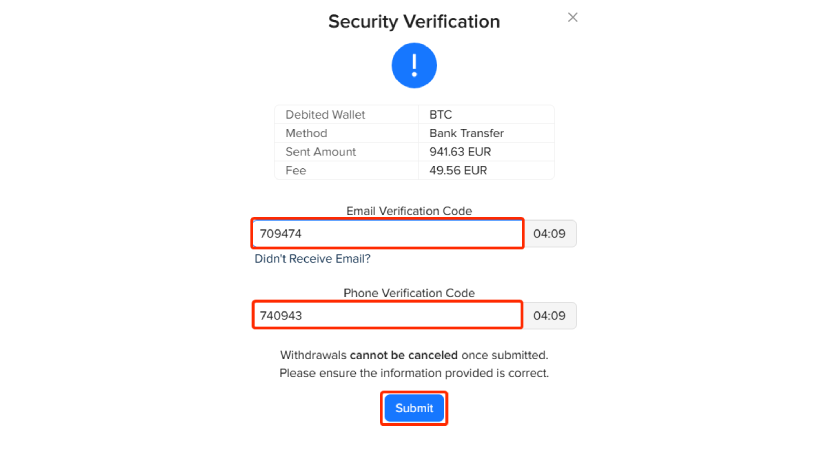

Step 8 – Copy and paste both verification codes after receiving them and click [Submit] to finish.

Note: You have 5 minutes before the codes expire.

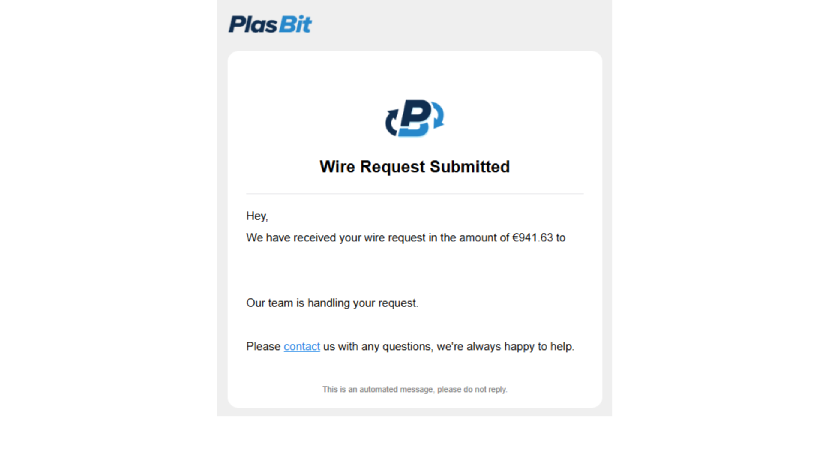

Step 9 – After this, you will be automatically redirected to the dashboard and receive an email verifying “Wire Request Submitted.”

After we approve the request, you will receive another email, “Wire Request Approved.”

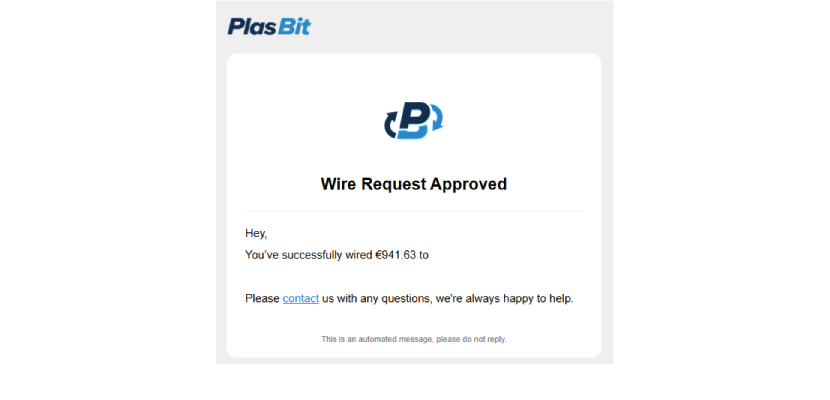

Step 10 – Follow the transactions status

In the [Transactions] section, if you select [Wires transaction] from the drop-down menu, you will be able to see the status of your transfer, and after the transaction is approved, you can download the transaction details in PDF.

Ways to Exchange Bitcoin to Euro

Since the early peer-to-peer days of Bitcoin exchange, numerous ways of converting BTC to Fiat have emerged. One of the most popular and convenient ways of doing this is through crypto exchanges. While our guide helps you understand how to transfer Bitcoin to bank account using PlasBit, there are more ways to do that. Large crypto exchanges allow you to exchange your Bitcoin for Euro and then withdraw it using SEPA transfers. This type of transfer is convenient and effective for users located in the European union. However, keeping your crypto on exchanges means you don’t have full control over your money, so if the company runs into financial trouble or goes bankrupt, your funds could be locked. A good example of this was the FTX bankruptcy, since user withdrawals weren’t processed at one point. Crypto debit cards are a reliable way of exchanging your cryptocurrencies for fiat. They are directly connected to your exchange account and allow you to make instantaneous purchases with crypto by converting them into Fiat at the moment of purchase. In the end, we have crypto ATMs. At their core, they are used as regular ATMs, but they often have high fees. Furthermore, some crypto ATMs don’t allow the withdrawal of fiat; they only allow the purchase of crypto. They are also location-dependent, and you should opt for them only if you know that there’s a reliable crypto ATM near you.

You can find a side-by-side comparison of the methods below:

| Method of Transfer | Fees | Convenience | Time | Security | Best for |

|---|---|---|---|---|---|

| Bank | 1-3% | Moderate | 1-3 business days | High | Large transfers |

| Transfer via Exchange | (exchange & withdrawal fees) | (requires KYC) | Days | (regulated exchanges) | Withdrawals to bank accounts |

| Crypto Debit Cards | 2-5% (conversion & transaction fees) | Initially moderate as it requires KYC. Then you can use it like a regular card | Instant for purchases, ATM withdrawals take minutes | High | Everyday purchases & ATM cash withdrawals |

| Bitcoin ATMs | 5-10% (high fees) | Small (Rare and location dependent) | Instant (cash in hand) | Moderate (risks of scams or low liquidity) | Quick access to cash in urban areas |

How Can I Sell My BTC to My Bank Account?

One of the most important questions that crypto enthusiasts have is how can I sell my BTC to my bank account? Transfer the Bitcoin you want to sell into your exchange wallet, go to the Wires section in your dashboard, enter your bank account details, submit a transfer request and the funds will be credited to your bank account on the same day. Besides bank transfers, Plasbit also offers the possibility of owning a Bitcoin card. These cards allow you to act like your own bank by keeping your finances in one place and allowing you to make daily purchases with ease.

History of Bitcoin Exchange

The majority of early adopters of Bitcoin were individuals in tech, economics, and cryptography. Exchanging Bitcoin for money was hard, as there weren’t many individuals who were a part of the community, and platforms for such actions were rare. There also weren’t ways how to transfer Bitcoin to bank account without a direct agreement with the other party. The early days of Bitcoin, from 2009 to 2011, can be called a “Peer-to-Peer” era, as users relied on direct trades arranged through forums and chat groups. Transactions were often manual and trust-based, requiring users to send Bitcoin to another person in exchange for fiat via bank transfers, PayPal, or even cash in person. The first Bitcoin to Fiat exchanges happened in 2008 when Martti Malmi, a Finnish computer scientist who contributed to Bitcoin’s source code in the early days, exchanged 5000 Bitcoins for 5$. During the P2P period, the notorious Bitcoin Pizza Day happened when Laszlo Hanyecz paid 10,000 BTC for pizza. This was among the first notable Bitcoin purchases. During that time, the number of daily transactions was calculated in hundreds , compared to hundreds of thousands today.

After the P2P era, the first Bitcoin exchanges were launched to enable trading and provide liquidity. Some of the notable exchanges included Mt. Gox, Bitstamp, Coinbase, and Kraken. Kraken and Bitstamp were founded in 2011, while Mt. Gox and Coinbase were founded in 2010 and 2012, respectively. While Bitstamp, Coinbase, and Kraken are still operating, Mt. Gox suffered a massive hack that led to the loss of 850,000 BTC, leading to its termination. Since 2017 major exchanges such as Binance also joined the market, expanding the possibilities for crypto adopters. They’ve implemented futures and derivatives training, and institutional investments. Because of these possibilities, we can treat Bitcoin similarly to Fiat currencies but also as a long-term investment asset. Online crypto exchanges significantly contributed to a wider adoption of cryptocurrencies, and they’ve also provided a safer way of exchanging Bitcoin to Fiat. As Bitcoin gained more recognition, governments started to pay more attention to it, leading to the introduction of regulatory frameworks. By adhering to laws and regulations, crypto exchanges can ensure that they’ll provide users with what they promise. This applies to both transactions between individuals and conversions to Fiat currencies.

How Do I Cash Out My Bitcoin?

Whether that’s because a Bitcoin reached a high point and you can make some profits, or if you need money for personal reasons, it’s good to ask the question, how do I cash out my Bitcoin? Your best option is to cash out via back transfer: just transfer the Bitcoin you want to sell into your exchange wallet, go to the Wires section in your dashboard, enter your bank account details, submit a transfer request and the funds will be credited to your bank account on the same day. Without platforms, cashing out Bitcoin would require you to make a trust-based peer-to-peer exchange, just like in the early days. Not only does this expose you to the risk of scams, but it can also be illegal, depending on your local laws and regulations.

Most Common Scams Targeting Bitcoin Wallets

Cryptocurrencies offer some great advantages in terms of security compared to traditional finance. All transactions can be transparently observed on the blockchain, and they’re also immutable, meaning that no one can reverse them. However, there are also scams that are specific to cryptocurrencies. Knowing how to transfer Bitcoin to bank account also includes understanding how to recognize and protect against common scams like the ones below:

Phishing scams

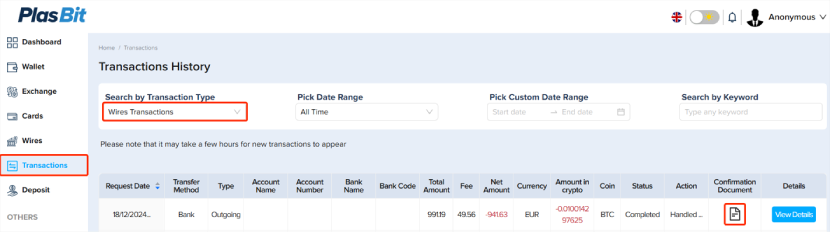

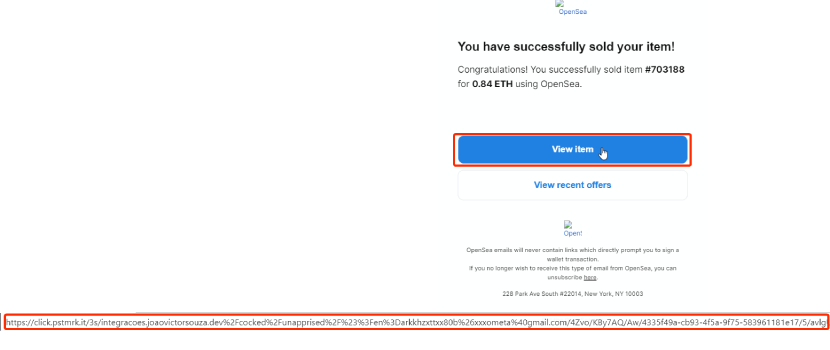

In short, phishing involves using fake websites to obtain one’s credentials. When it comes to cryptocurrencies, hackers create fake websites that resemble legitimate platforms. Then, they send victims links to these platforms via emails or social media. Once a victim opens the website, they try to log-in, allowing hackers to grab their credentials or wallet phrase. Then, the hackers can use these credentials to steal their cryptocurrencies, or misuse their account on the real platform. To spot phishing attempts, one must verify the source of an email and the URL of the website in the message. Phishing emails and websites usually have minor differences in the URL, for example: Instead of “opensea.io” the phishing website would look like this “opensee.io.” Phishing websites also don’t have an SSL certificate activated, meaning that your data isn’t encrypted when sent to this website. One can check this by looking to the left of the URL bar and seeing whether there’s a padlock icon. Here’s an example of a phishing email that I’ve received. As you can see, the content of the email is poorly created, the sender’s email is not related to opensea, not even carrying the same domain, and the mail was sent to multiple addresses.

When you take a look at the URL, it’s a gibberish link, not even under the OpenSea domain.

One way to protect against phishing scams, beyond recognizing such attempts, is through the use of two-factor authentication (2FA). So even if your credentials are stolen, the hackers won’t be able to log in without a biometric authentication or a one-time token.

Pump and dump schemes

Some projects and tokens seem completely reliable at the surface. For example, they might have a whitepaper and a team behind it. However, there are other aspects of crypto projects that need to be observed closely to understand whether you’re looking at a pump-and-dump scheme. This type of project is usually hyped by influencers and social media accounts. But, if the project doesn’t offer a lot of value and utility besides being marketed as the “next big thing” or a “get rich” strategy, it’s likely a scam. Pump-and-dump tokens are artificially hyped, driving up the price at one point, allowing the individuals who prepared in advance and purchased tokens to cash out at that moment. That being said, sudden unexplained price spikes are a good indicator of a scheme. For investors and crypto enthusiasts, it’s important to check whether a coin is listed on legitimate platforms or only on obscure exchanges with bad reputations.

Airdrop scams

Airdrop scams trick users into revealing private information or transferring funds by promising free cryptocurrencies. They are similar to the phishing scam, as they resemble real airdrops, but they have mechanisms to steal one’s information. Scam airdrops can be distinguished from real airdrops, as they ask you for your private keys or seed phrases. Furthermore, they sometimes ask you to connect to suspicious websites or require an upfront payment from the participants. Legitimate airdrops are promoted by reputable projects, often requiring simple tasks like following social media or signing up. The awards are then received directly in one’s wallet or claimed on reputable websites.

Giveaway scams

It’s pretty obvious if you get contacted by Vitalik or Elon Musk and they ask you to send them your Bitcoin, you’re being contacted by a scammer. However, some giveaway scams are more complex and detailed then that. Impersonators of celebrities, influencers, or companies that promise to double your crypto or provide you with free Bitcoin need to be reported and blocked as soon as they contact you. If the offer of free crypto isn’t suspicious enough, make sure that you check whether they’re verified and real.

Malware and clipboard hijacking

Some malware can steal your cryptocurrencies without you even realizing it. When sending cryptocurrencies to a platform or an individual, malware can replace your copied address with the address of the scammer. Then, without batting an eye, you’ll send your precious cryptocurrencies to someone else. The best way to protect against this is to have real-time protection in the form of an anti-virus, but you should also always double-check the recipient’s wallet address before hitting "send." A good practice would also be keeping the cryptocurrencies you don’t want to trade or exchange soon in hardware wallets, as they offer additional protection against multiple types of fraud, including this one.

Can You Deposit Bitcoin Into Your Bank Account?

People who don’t want to hold cryptocurrencies as assets and want to use them for daily purchases ask the question, Can you deposit Bitcoin into your bank account? No, you can't deposit Bitcoin directly to your bank, you must sell it to cash first: transfer the Bitcoin into your exchange wallet, go to the Wires section in your dashboard, enter your bank account details, submit a transfer request and the funds will be credited to your bank account on the same day. There’s also an alternative that includes creating your crypto debit card through a platform like PlasBit to make purchases. This revolves around the principle of being your own bank. You can connect your crypto wallet with your crypto card, connect it to Google or Apple Pay, and buy groceries with it. When you convert crypto and transfer Fiat funds to your bank account, you’re protected against the volatility of cryptocurrencies. However, with crypto debit cards, you’ll actually have Bitcoin, or other cryptocurrency, that’s converted to Fiat at the moment of the purchase. This way, you can spend more or less money than planned depending on the price of Bitcoin. Whether this is an upside or a downside depends on your outlook on Bitcoin’s volatility.

Conclusion

Bitcoin has come a long way since 2009, and it’s incredible what possibilities we nowadays have. Learning how to transfer Bitcoin to bank account has never been easier with platforms like PlasBit. We allow you a streamlined and easy way to exchange your Bitcoin for Fiat and receive it in your bank account within hours.