Crypto is slowly becoming a more common way to pay for goods and services, both online and in physical stores. While not fully mainstream yet, it’s more used than ever before, especially if we compare it to several years ago. The crypto cards are likely the main reason for broader adoption, as they instantly convert crypto to regular money when you make a purchase. These cards connect your crypto to your everyday spending, and you can even get cash from an ATM, just like a normal debit card. This begs the question, can I withdraw from an ATM with a crypto card? Yes, you can withdraw up to €5000 per day and up to €1000 per single withdrawal, using PlasBit plastic and metal cards. Just order a crypto card, load it with your crypto, and when it arrives by mail, you can use the PIN code to withdraw cash at any ATM worldwide.

What is a crypto card?

A crypto card works almost exactly as a normal debit card, with the main difference being that it uses your crypto for payment, not the funds in your bank account. When you make a purchase or withdraw cash, the card provider automatically converts the required amount of crypto into fiat and then completes the transaction. The conversion is usually done at the current exchange rate, allowing you to use your crypto like any other payment method, whether you're paying in a shop, buying something online, or withdrawing cash from an ATM. Do note that if you want to get cash from an ATM with a crypto card, you need a physical card. Virtual cards that only exist in an app rarely work at cash machines, so you have to use the plastic ones to get your money out. The good news is that most crypto cards are backed by Visa or Mastercard, so you can use them with any ATMs that support those two payment networks.

Crypto cards versus Bitcoin ATMs

When people think about turning crypto into cash, Bitcoin ATMs often come to mind as an alternative to crypto cards. While these machines do let you swap crypto for cash, they have several downsides that make crypto cards the easier and more practical choice. One of the biggest differences is the cost, as Bitcoin ATMs are known for high fees. They often take 5% to 15% per transaction, and these costs are somewhat hidden in the exchange rate. On the other hand, crypto cards have a much lower fee for cash withdrawals, it costs 1.5% to load funds onto the card, making them a cheaper option if you withdraw cash frequently. Finding a Bitcoin ATM can also be an issue, since they’re still not very widespread and are mostly found only in big cities. Even then, the ATM might be out of service or not accept the crypto you have. In contrast, crypto cards work at almost any ATM in the world that takes Visa or Mastercard, giving you many more options.

Another important difference is that Bitcoin ATMs involve multiple steps, such as scanning a code, checking an address, and waiting for the transaction to process on the blockchain. This can be confusing and time-consuming for first-timers. With a crypto card, you simply put it in, type your PIN, and get your cash right away as you normally would with a bank card. Lastly, while Bitcoin ATMs can seem more private, most now require ID checks and a phone number, or have withdrawal limits due to government rules. Crypto cards work under similar rules but offer a much smoother and more reliable process.

A Bitcoin ATM that lets you either buy Bitcoin with cash or sell your Bitcoin for cash (Image credit: bitcoinwiki.org)

How Crypto Debit Cards Work in Real Life

With a traditional bank card, withdrawing cash from an ATM is simple once everything is set up. If you have never done it before, you usually start by opening a bank account. That means visiting the bank in person, filling out forms, verifying your identity, and signing paperwork. When the account is open, you need to wire money so you will have a balance. In many cases, the bank may review your credit score and financial history before approving you for a card. Once approved, you order the card and wait for it to arrive via mail in a few days. After that, you can use it at an ATM to withdraw cash.

With crypto cards, the setup is typically done online and can take just a few minutes. You sign up with your email, then verify your identity and address by uploading documents. There is no credit score or financial history check and you can fund your account by sending crypto. After that, you can order a physical card, which will be delivered in a few days. Once you receive the card, you can use it to withdraw cash from an ATM.

Your crypto is converted to fiat when you load or spend from the card. The conversion happens automatically, so you can access your funds right away. You can load and a minute later withdraw it in cash. This is why crypto cards are so convenient to people who want a a fast and direct way to spend or withdraw their crypto.

Crypto card is a safe way to get cash

Before crypto cards became widely available, selling crypto for cash was often risky and inconvenient. If you wanted real money, you generally had to find someone to meet you in person and pay you in cash. These meetings typically took place in public locations, but even then, they carried serious risks. People exposed themselves to the possibility of being robbed, scammed, threatened, or physically harmed, particularly when large amounts of cash were involved.

One example of a scam that is becoming more common is the “wrench attack”, which involves physically hitting someone to steal their crypto. Just two weeks ago, Miami police arrested a man believed to be connected to a million dollar crypto and property robbery. Police say the victim first met the suspect, 28 year old Dontae Lamar Johnson, at a Miami nightclub in October. They stayed in touch and met up again on December 8th. On the day of the robbery, the victim got into the suspect's car, and Johnson forced them at gunpoint to give up all valuables. He then ordered the victim to open their crypto wallet and send him the crypto, threatening to kill the victim if he didn’t do as Johnson demanded.

Considering the story above, this is one more benefit of the crypto cards, because rather than having to meet strangers face to face, users can safely and instantly get cash from an ATM. There's no need to meet anyone, haggle over price, or trust a stranger. When asking can I withdraw from an ATM with a crypto card, remember that by using a crypto card, you can access cash in a controlled and secure environment, just like with a traditional bank card. Doing so makes it one of the safest options to turn your crypto into cash.

Buying a crypto card on PlasBit’s site

In the next couple of minutes, we’ll show you a step-by-step guide on how to purchase a crypto card on PlasBit’s site and load it with crypto.

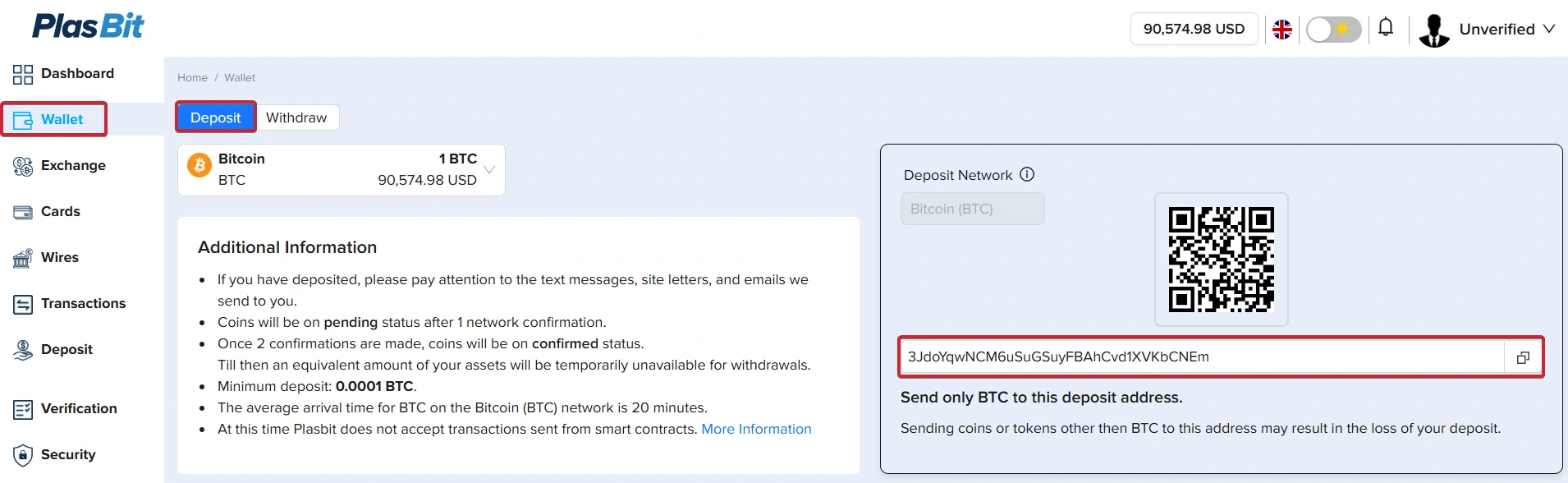

Step 1 -

Go to the 'Wallet' section and deposit your preferred crypto.

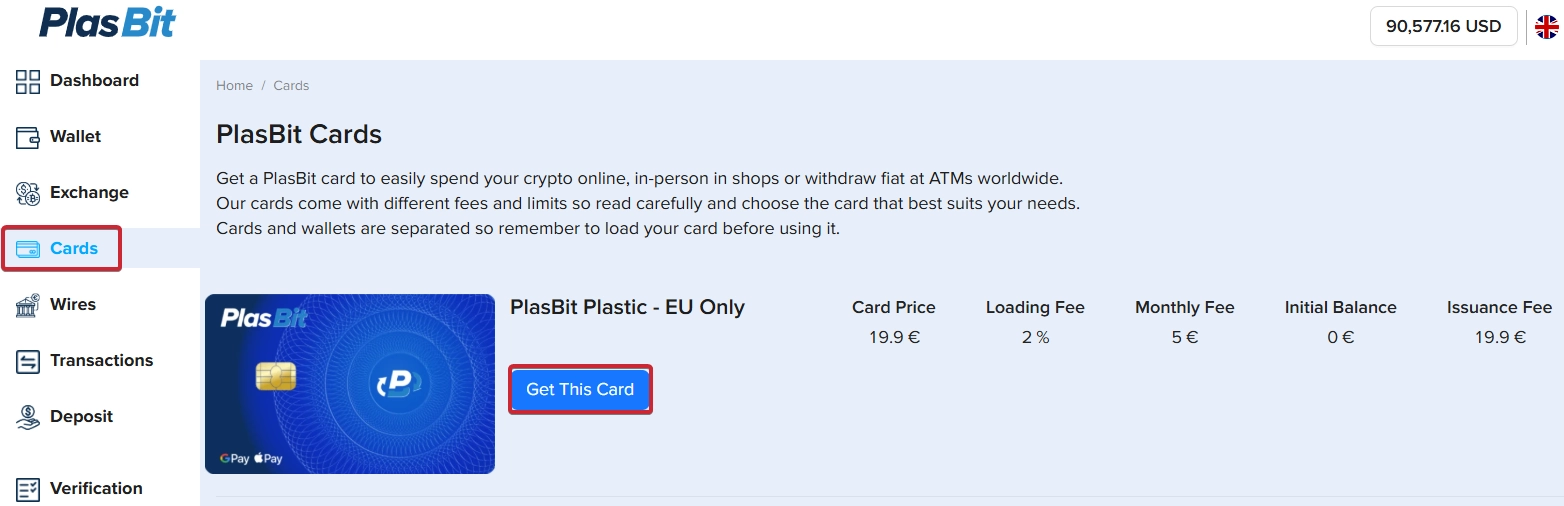

Step 2 -

Head over to the Cards section, order your preferred card, and click “Get This Card”.

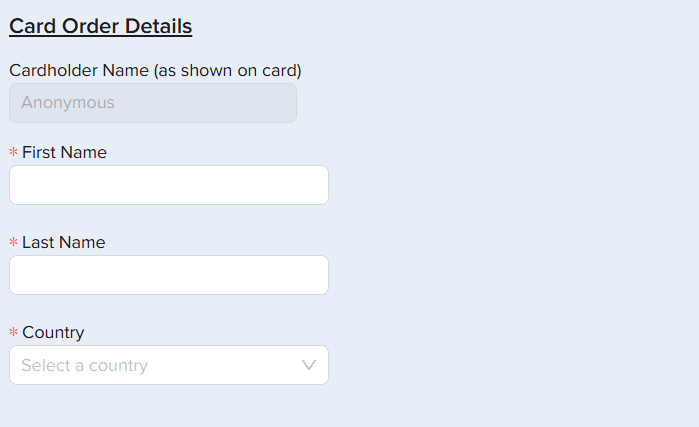

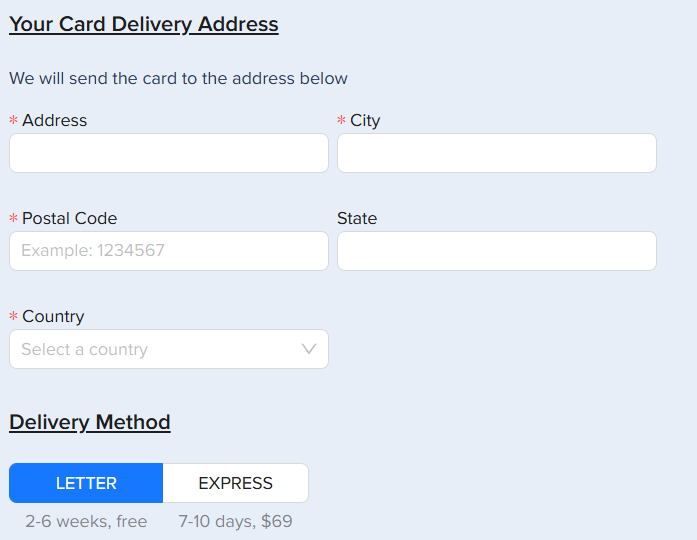

Step 3 -

Fill out your personal information and choose the delivery method of your card:

Step 4 -

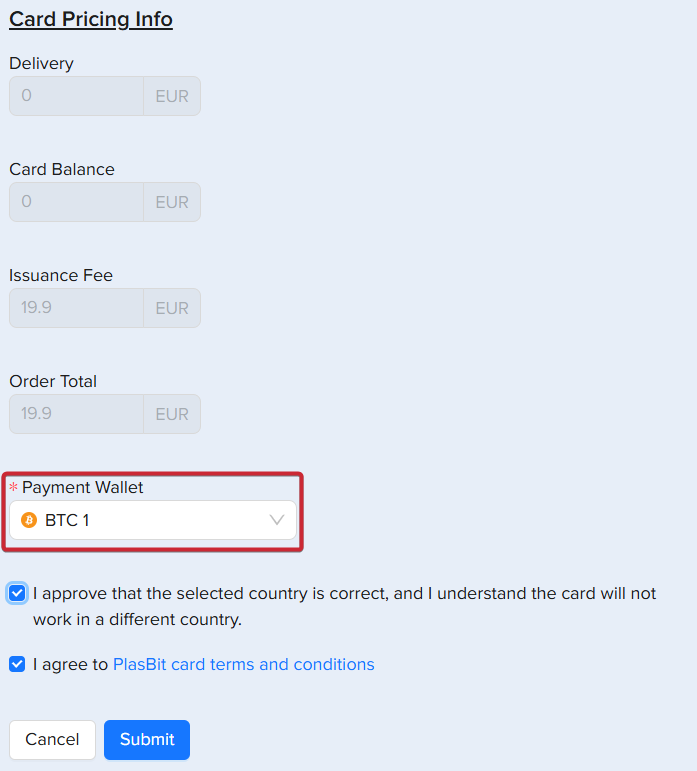

Select the wallet you want to pay for the card with:

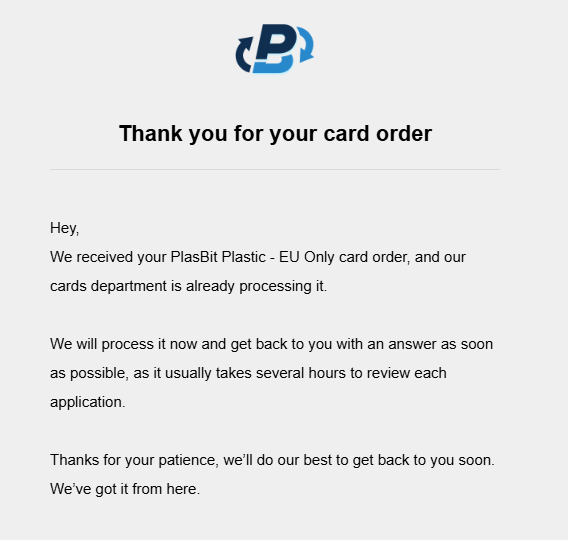

After you click submit, you will get an email confirmation once your physical card has been successfully issued:

Step 5 -

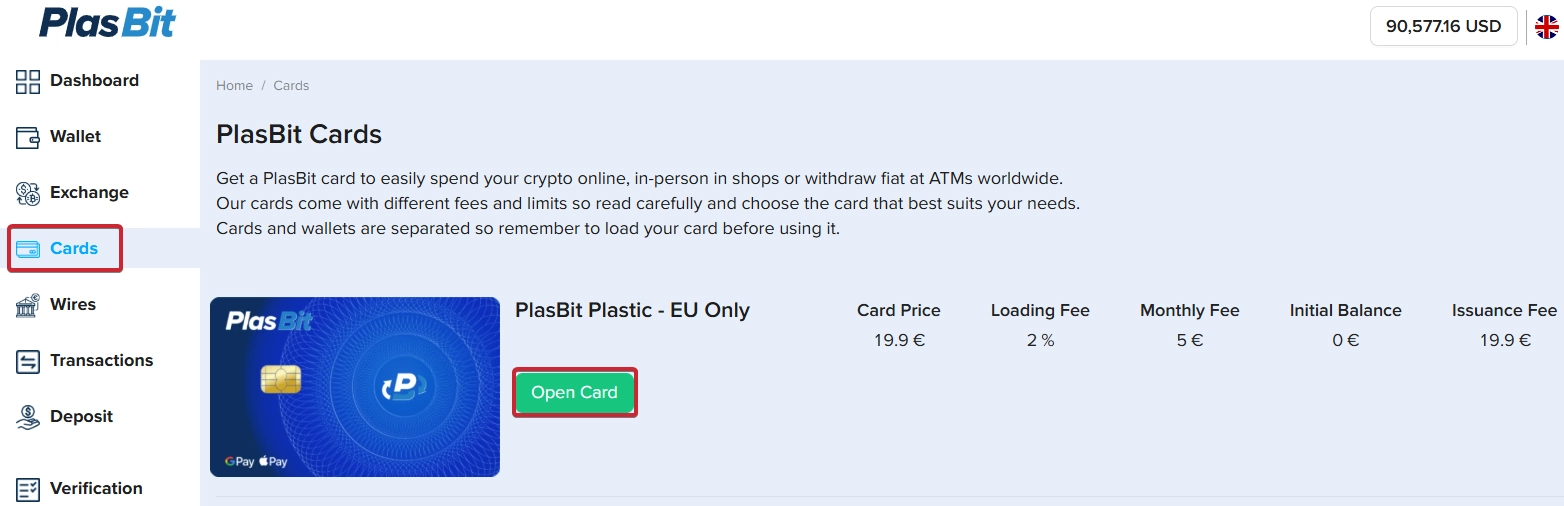

Return to the Cards section and click the “Open Card” button for the card you bought.

Step 6 -

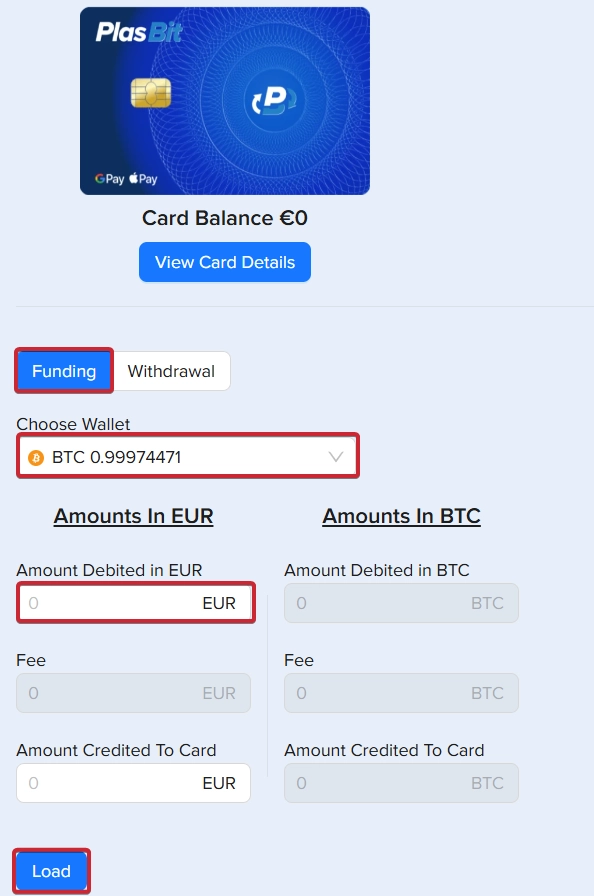

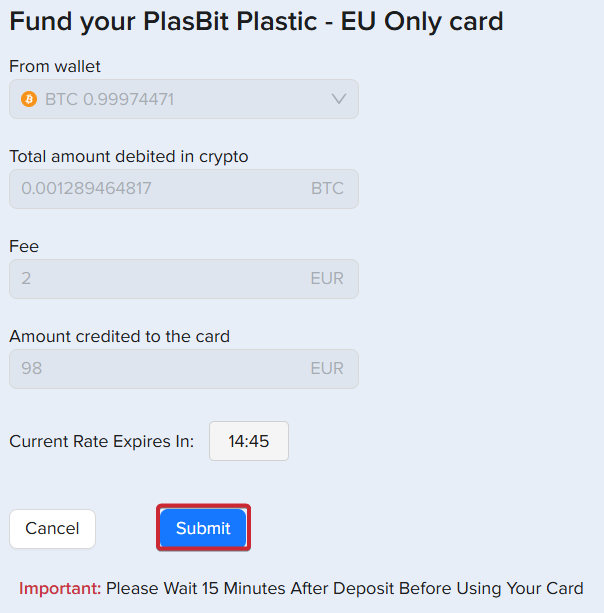

Click on the “Funding” tab and choose the wallet you wish to deposit funds from, then fill in the amount you wish to fund the card with. Then, press the “Load” button.

Step 7 -

Press “Submit” once you verify that the amount is correct.

Step 8 -

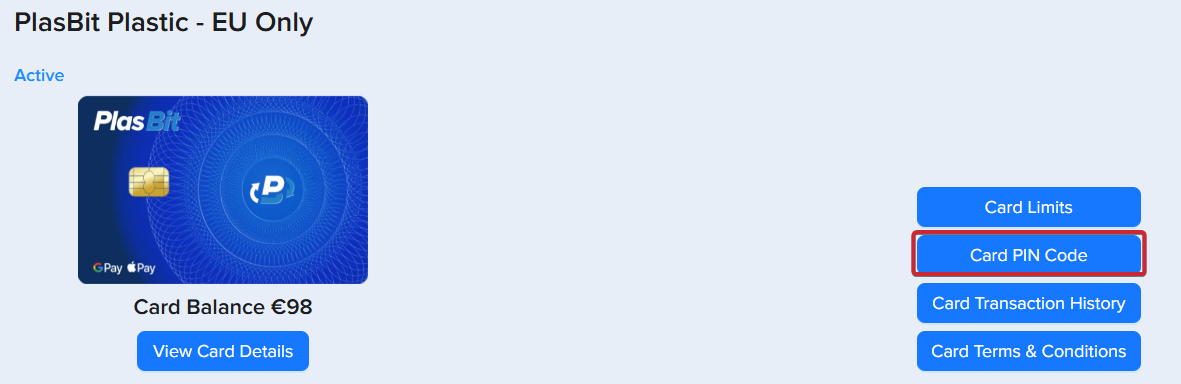

If you want to withdraw from an ATM, you will need to get your card's PIN code by pressing the “Card PIN Code” button.

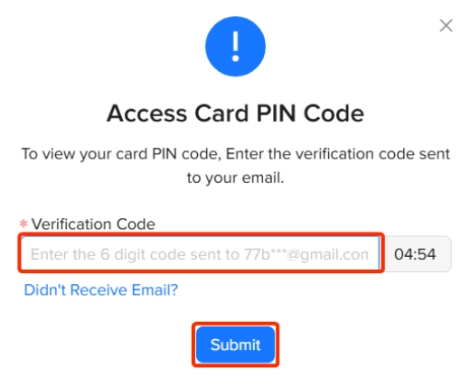

Step 9 -

You will receive a confirmation code in your email. To see your PIN code, paste the code and click submit.

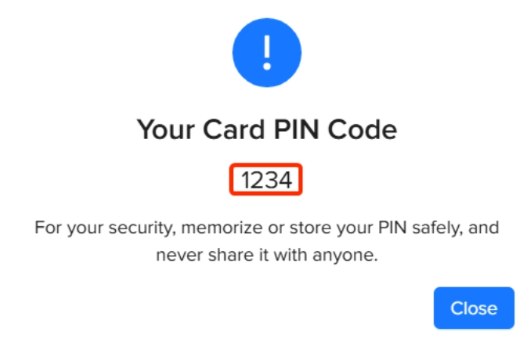

Step 10 -

Write down your PIN code and memorize it.

Step 11 -

Use the PIN code when you are withdrawing cash from an ATM.

Withdrawing cash without a crypto card

In case you don’t want to use a crypto card, there’s still a straightforward way to turn your crypto into cash. Instead of withdrawing from an ATM directly, you can deposit your crypto into your PlasBit wallet and then request a bank wire transfer to your personal bank account. After the funds reach your bank account, you can get cash from an ATM using your bank debit or credit card. This method doesn’t require a physical crypto card and works well for users who prefer sticking with traditional banking tools. The main difference is that the crypto to fiat conversion happens inside the exchange first, and only then does the money enter your bank account. While this takes an extra step compared to a crypto card, it's still a great way to get cash if you don't want to get or carry a card.

Using a crypto card for everyday payments

A crypto card isn’t just useful for withdrawing cash from an ATM, since it can be used for everyday spending the same way as a regular bank debit card. Once your card is loaded with crypto, you can pay online, shop in physical stores, and cover daily expenses. For example, you can use your card to pay for services like Netflix. From the merchants’ point of view, they receive payment in regular money, but your crypto balance is reduced to cover it. This makes crypto cards an easy way to spend your crypto, since you can use them just like cash without converting it.

When asking can I withdraw from an ATM with a crypto card, do note that you can monitor your spending through crypto cards without much trouble. For instance, on our dashboard, you can easily download all your spending to an Excel spreadsheet, see your spendings just like in your regular bank account, check which store or service each purchase was for, and get the latest details on your card's available balance. The bottom line is, with crypto cards, you can see where your money is going as it happens, making it easy to manage your budget.

Can you use a crypto card at ATM?

As crypto becomes more integrated with traditional finance systems, more people are looking for easy ways to actually use their digital money in the real world. So, one question that naturally comes up is, can you use a crypto card at ATM? Yes, you can use it to withdraw up to €5,000 per day and up to €1000 in a single withdrawal with the plastic or metal card. Just order your crypto card, and once it arrives, load it with crypto, and use your PIN code to cash out at any ATM worldwide. Do note that card provider limits define how much you can withdraw to help prevent fraud and follow card company rules. In some cases, even if the card lets you take out more money per day, you might have to visit the ATM more than once to get the full amount. Also, keep in mind that ATMs themselves ordinarily have their own limits that are separate from what your card allows. Many machines in Europe only permit you to take out €200 to €500 at a time. So, even if your crypto card allows you to withdraw more per day, you might need to go to different ATMs or make several transactions to get a large sum. This is completely normal and happens with regular bank cards, too.

How much crypto can you load on a crypto card?

To manage your crypto well, you need to know exactly how you can spend it and where you can keep it securely. As such, if you are planning your financial strategy, you might wonder, how much crypto can you load on a crypto card? You can load crypto up to €10,000 per day, €30,000 per month, and €360,000 per year onto Plasbit plastic or metal cards.

What is the fee for using a crypto card at an ATM?

To avoid any surprises while managing your crypto finances, you should know the costs of turning it into cash. So, what is the fee for using a crypto card at an ATM? Flat 1% fee applies to all Plasbit crypto card ATM withdrawals, plastic or metal. However, loading the card comes with an additional fee depending on the card type. Most platforms charge 2-4% just for ATM withdrawals, plus another 2-8% for loading the card. It’s worth mentioning that some ATMs may temporarily decline withdrawals due to network issues, insufficient cash, or local banking restrictions. If that happens, trying another nearby ATM usually solves the problem. Just to be on the safe side, it’s a good idea to also check your remaining daily withdrawal limit before visiting an ATM.

Crypto cards are easy to use

In the end, the question can I withdraw from an ATM with a crypto card has a fairly simple answer: it works just as easily as it does with a regular bank card. Once you have a physical crypto card, you simply insert it into an ATM, enter your PIN, and withdraw cash in local currency, while the crypto is converted automatically in the background. From the user’s perspective, it's no different than what they are already well used to. Just make sure your crypto card will work with the ATM (look for the Visa or Mastercard logo) and be informed about what fees you'll be charged before you use it. Moreover, remember that the rate you get when your crypto is turned into cash can change. Check what exact rate you're being offered and how it's set before you take money out, so that if you don't like it, you can simply cancel and not complete the withdrawal. Finally, just like with a regular bank card, only use ATMs in safe, public places and always keep your PIN and card details to yourself.