As you've probably noticed, cryptocurrencies have become a big part of modern finance. For a good reason, we might add, since they offer investors, traders, and everyday users a faster and cheaper way to move money compared to regular banks. However, the biggest challenge crypto users face is trying to use it to directly pay for groceries, order an Uber, or make other everyday payments. That is arguably the primary reason why many who own Bitcoin, Ethereum, or other digital assets look for a way to move their funds back into their “regular” bank account. The problem here is that banks don’t accept direct crypto transfers. What you need to do is convert your crypto to traditional fiat currencies (euros, dollars, and so on) before doing anything else. So, how to transfer crypto to a bank account? Open an account on a centralized exchange, complete the KYC process, deposit crypto to your exchange wallet, fill a transfer request with your bank details and submit a wire, and you will receive the funds to your bank within hours.

Why do banks avoid crypto?

Most banks don’t accept any transactions connected to cryptocurrencies, to the point that they may even cancel transfers, or even block accounts if they suspect the funds being transferred are linked to digital assets. There are a few pretty straightforward reasons for this approach by banks:

- Banks are legally required to verify and document the source of funds, which can be a tricky thing to do when dealing with cryptocurrencies.

- The bank has to make sure those funds are not tied to any money laundering or other criminal activities.

- Finally, banks must confirm that the money was reported to the tax authorities and the taxes were paid in full.

Basically, a lot of work and time go into making sure everything is a-ok, and it's just not worth financially for the banks to do all of these checks. If the proper documentation isn’t provided, they just prefer to cancel the transaction or even block the account. On top of everything, there is the fact that cryptocurrencies grant individuals full control of their own funds. In other words, banks and governments can’t easily exercise their usual control, nor can they make a profit off of it, and they are not interested in giving control over these things.

Nevertheless, you’ve come to the right place if you wish to overcome the issue of converting crypto into fiat in your bank account. At PlasBit, we will show you exactly what documentation is needed and guide you step by step so your bank receives all the required information (more on this a bit later). Most importantly, we know how to transfer crypto to a bank account without hassle and avoid getting your transaction flagged or your account blocked, as is often the case.

A guide on how to transfer crypto to your bank account

To help you with the entire process of how to transfer crypto to a bank account, we made an easy-to-follow guide. Just follow these steps and you will easily be able to convert your crypto into fiat in your bank account.

1. Log in, go to the verification section, and complete the basic and full verification.

Note: You will not be able to request a wire transfer without full verification.

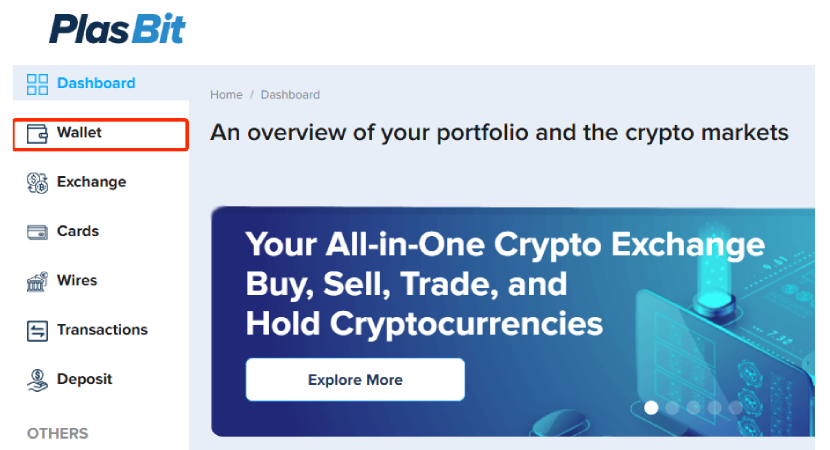

2. Go to the Wallet section.

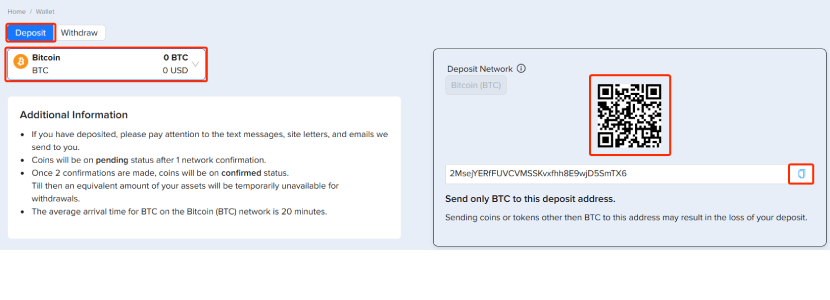

3. Deposit crypto into your wallet. You can copy the wallet address on the right or use the QR code.

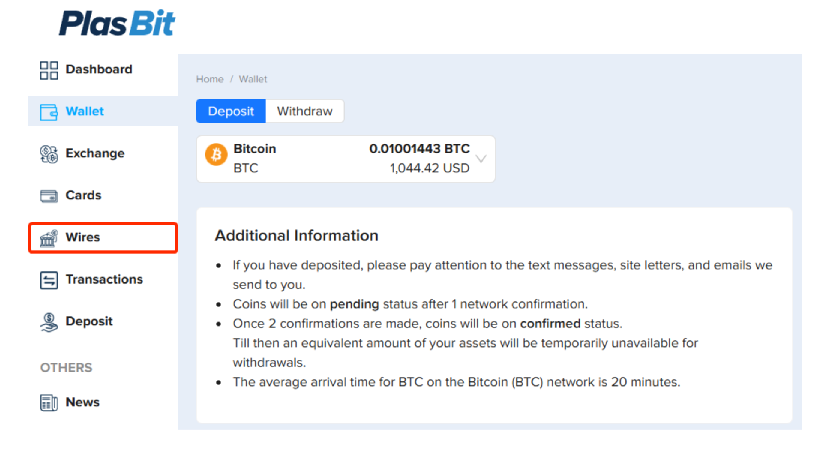

4. After the crypto has been deposited, navigate to the Wires section.

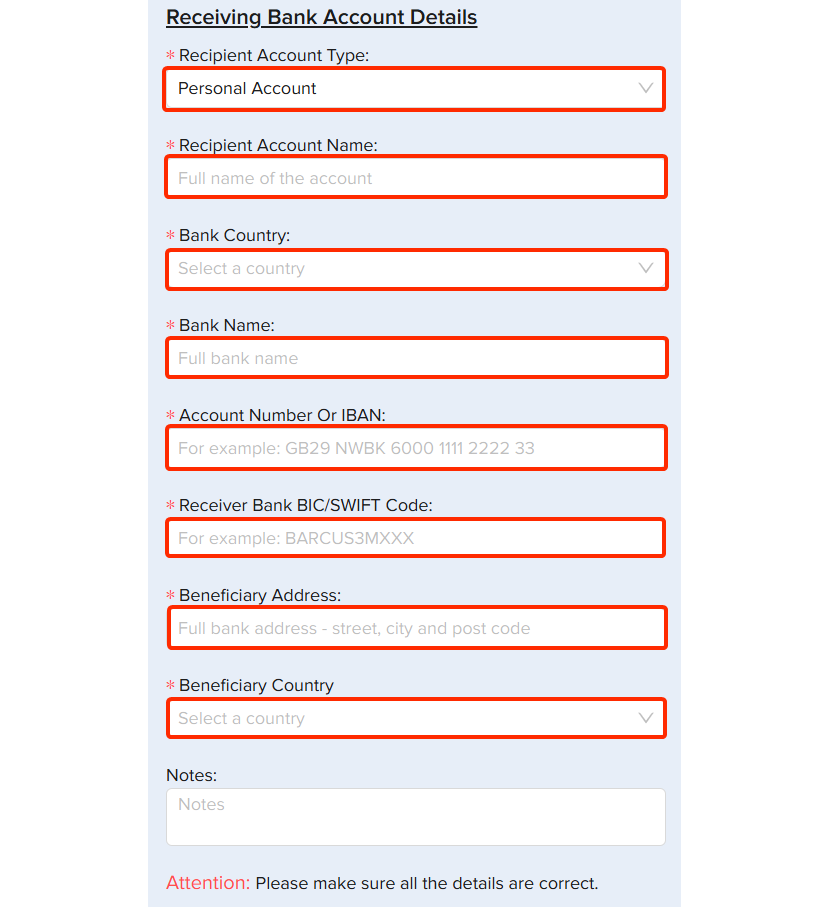

5. Next, you will need to fill in your bank details.

Note: The name of the bank account holder and the PlasBit account must be the same.

6. Fill in the transfer details.

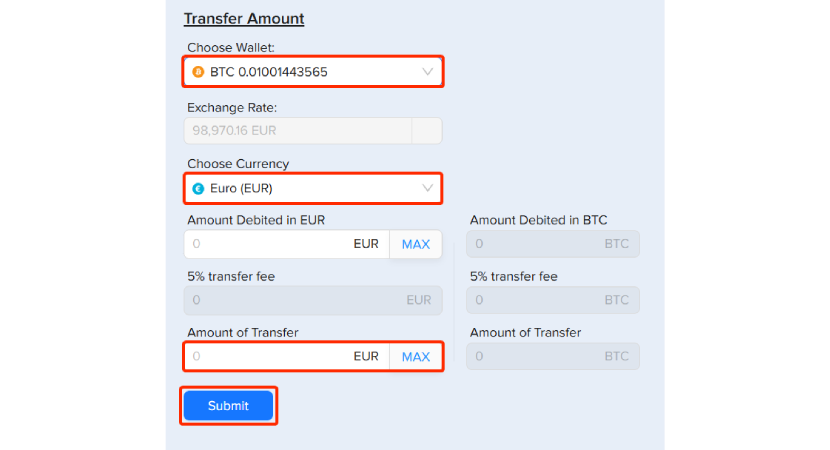

Pick the wallet where you have just deposited your crypto. Then, choose the currency, in this case, EUR, and see the exchange rate. Once that is done, fill in the amount you want to receive in your bank account.

Now, just press the [Submit] button.

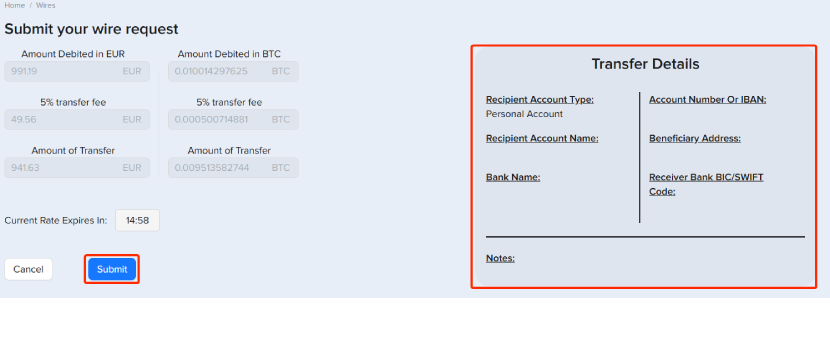

7. Check all the details of the Bank Transfer and press [Submit] again.

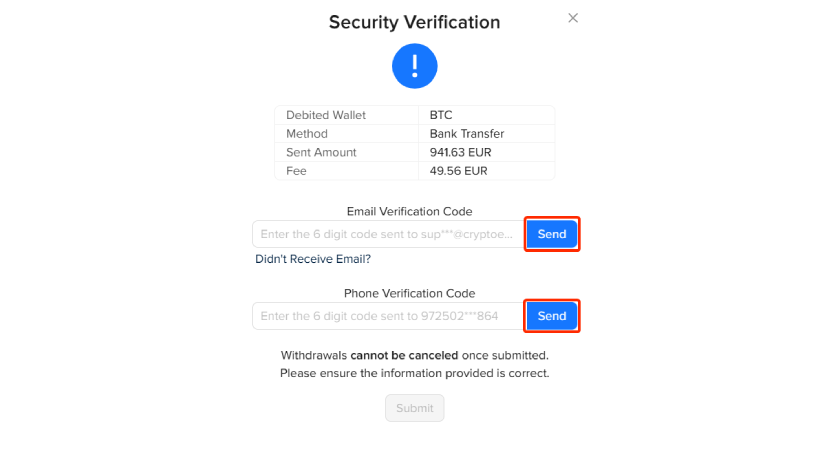

8. Here, you must go through the security verification. Press [Send] to receive verification codes on your email and phone.

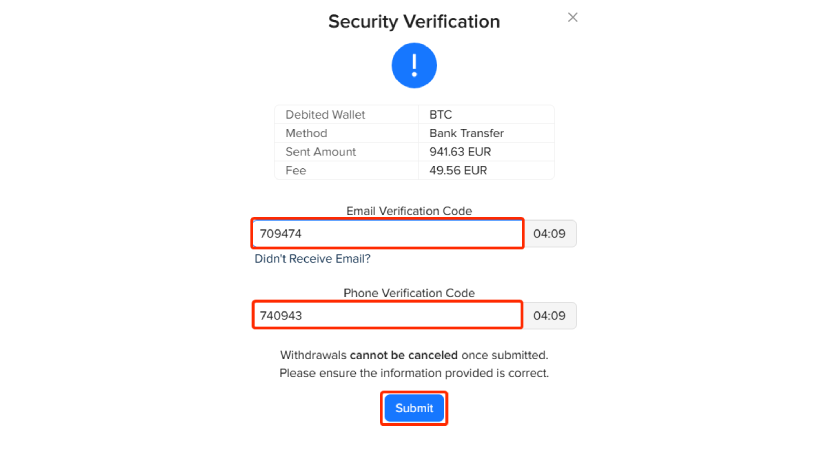

9. Copy and paste both verification codes after receiving them and click [Submit] to finish.

Note: You have 5 minutes before the codes expire.

10. Congratulations, the wire request has been submitted.

You should receive a confirmation via email, and the funds should be transferred within a few hours.

In the next section, we'll focus on how things actually work in Europe for crypto users.

Centralized exchanges play a key part in transferring crypto

If you’ve been paying attention, you’ve noticed we mentioned a centralized exchange (or CEX for short) a few times in this article. There’s a good reason for that because without one, transferring crypto to your bank wouldn’t be possible. You see, centralized exchanges were originally created to act as a bridge between crypto and the good ole banking system.

While they do have certain downsides, such as cyber attack risks and sometimes unclear rules specific to that exchange, they are the fastest and safest way to convert your crypto to fiat, acting as the trusted middleman between the crypto and the fiat money systems. This is all possible due to CEXs handling all the annoying parts regarding KYC (Know Your Customer), AML (Anti-money laundering), and other necessary details, like providing source of funds documents, so the banks can receive properly verified transfers. There are several specifics when it comes to centralized exchanges:

- CEXs hold your cryptocurrency for you and manage your private keys. This is very convenient but also requires you to trust in their security measures.

- Since they handle KYC and AML, you will need to provide documents to prove your identity. Confirming your identity and the origin of your funds makes it possible for the banks to safely accept the wire transfer from the CEX to your bank account.

- CEXs have high liquidity pools, lots of active users, and large-volume trades. This is important for traders, as it is easier to sell and buy tokens without big spikes in prices or high trading fees. This means that there are naturally a lot of buyers and sellers, making it easier to buy and sell tokens, even those that are not very popular. Also, high liquidity in the exchange helps "cushion" big price spikes, and traders prefer to trade in less volatile environments.

- If a CEX gets hacked or goes bankrupt, you can rest easy knowing that your money will be safe because the regulation requires the exchange to set aside enough funds in a wallet that cannot be used for anything other than to cover claims by the users who have their assets on the exchange.

That being said, crypto holders are still skeptical when it comes to CEXs, because hacks are somewhat common. When the hackers manage to breach an exchange, more often than not, the damage is devastating, with millions lost in crypto, and no guarantee the exchange will be able to recover from the loss. For example, the biggest hack in crypto history happened in February this year, when Bybit suffered a loss of 400,000 Ethereum, valued at approximately $1.4 billion. The entire attack happened in minutes, as cybercriminals exploited a private key leak in Bybit’s hot wallet system.

Before this, Coincheck had $534 million stolen, FTX lost $477 million (although FTX collapsed and was involved in a major scam, people did get their money back, which is a positive point for the exchanges), and so on - unfortunately, the list goes on quite a bit. Since CEXs are regulated, they are required to insure user funds, but despite the fact that you will get your money back, it is still a good idea to spread your assets to cold wallets, since they are usually a safer option for long-term custody of your funds.

Another common objection crypto holders have toward using CEXs is the loss of privacy. Users who want to keep their identity private likely won’t be thrilled to reveal their personal information to the exchange. Finally, depending on where the CEX is located, there may be some user restrictions, different countries have different laws and regulations, and many still haven’t fully regulated crypto-related matters. So, use CEXs that are open about their compliance and have a good history of being trustworthy and secure.

In the end, the reason CEXs exist in the first place is because banks generally view cryptocurrencies as too risky and avoid them, but people still need a way to exchange crypto for fiat currencies. Granted, it probably also has something to do with banks perceiving the crypto industry as a threat to their business. In general, cryptocurrencies run on sets of rules written in code without needing any intermediaries (one of the core functions of banks), and if crypto became widely used, it would reduce the role that the banks play in today’s society, and make a dent in their profits.

How to transfer Bitcoin to your bank account?

As you may have figured out by now, transferring crypto to your bank account securely requires using a licensed and regulated exchange. We already talked about it, and now it’s time to discuss how to transfer Bitcoin to your bank account. Just open an account on a centralized exchange, verify your address and identity, deposit Bitcoin to your wallet on the exchange, fill in your bank details, and withdraw your Bitcoin to the bank via a wire transfer. Usually, you should receive the funds within a few hours.

Europe’s MiCA regulation and how it changes the game

To show you how banks used to deal with crypto transfers, let's take a look at European banks before MiCA (Markets in Crypto-Assets Regulation) was introduced. If you were trying to receive a bank transfer from a crypto exchange before the regulation kicked in, you likely faced serious challenges since banks blocked such transfers immediately and asked for a huge amount of records regarding the origin of your crypto. In the most severe cases, some accounts got frozen simply for receiving money tied to crypto, even if a transfer was small and everything was by the book. Luckily, the situation started to change at the very end of last year, when MiCA officially went into full effect.

If you’re not familiar with it (perfectly understandable), MiCA is an EU regulation that establishes legal certainty for various crypto assets, like cryptocurrencies, security tokens, and stablecoins. It is very similar to the EU's Markets in Financial Instruments Directive (MiFID), which is all about governing securities markets, investment firms, and trading venues. MiCA rules apply to many different players in the crypto world, such as:

- Crypto-asset issuers (like Stablecoin companies)

- Trading platforms

- Exchanges

- Custodian wallet providers

One of the major characteristics of the regulation is that it allows banks and investment companies to have clear guidelines when dealing with crypto, basically with MiCA, it is now much easier for the banks to cooperate with centralized crypto exchanges, since the exchanges now perform all the checks the banks were refusing to do. This reduces the likelihood of being endlessly questioned about your crypto earnings and lowers the risk of having your account flagged or blocked for trying to make a wire transfer from a crypto exchange to your bank account.

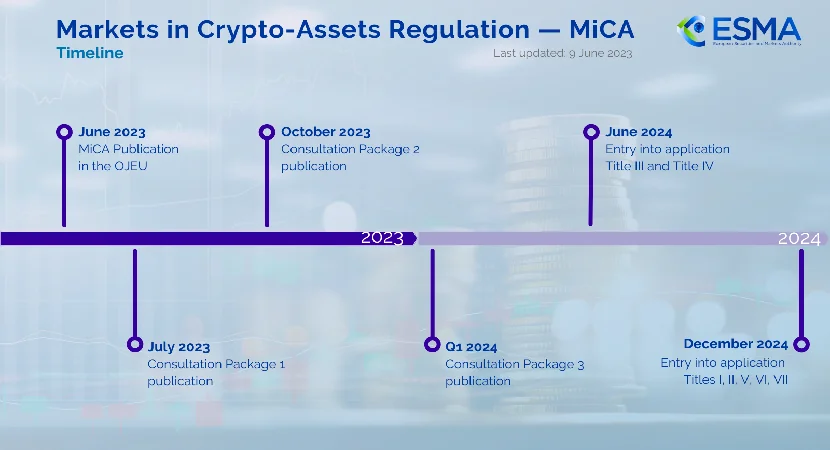

Timeline of MiCA implementation (Image credit: www.esma.europa.eu)

All you need to know about KYC and why it is super important

We briefly mentioned KYC (Know Your Customer) as something you absolutely must be aware of when registering on a CEX, but chances are, you never really got into the details or why it is needed. For starters, KYC is a process that verifies your identity by asking you to provide documents confirming it. It’s a part of a large set of rules that has to do with anti-money laundering (AML) and counter-terrorism financing (CTF).

Basically, the purpose of KYC is to create a risk profile for each user so the exchange can avoid cases of identity theft, account takeovers, or credit card frauds, and also to prevent known criminals from using the exchange to launder their crypto or evade taxes. Due to this, KYC is mandatory, and without completing it, you can't even request a transfer. Originally, only financial institutions were required to do KYC, but now it applies to non-financial industries such as fintech firms, virtual asset dealers, and even non-profit organizations in many countries.

To successfully pass the KYC, you’ll have to present several documents depending on the risk level, or rather, how you are perceived. There are three levels, and the higher the level, the more documents you need.

- Basic KYC is the first in line and the most common one, usually the one required to make a deposit into the exchange. For it, you will need:

- Name

- Date of birth

- ID (could be a passport, national ID card, or driver’s license

- Liveness check (a video that confirms you are the person on the ID)

- Full KYC if you want to be able to request wire transfers to your bank, you will need the following as well:

- Proof of address (you can do it via a recent utility bill, bank statement, or an official government document that shows your residential address)

- Short questionnaire about your occupation, income, and other information

- Enhanced KYC is the third level and is used when you require large transfers ($10,000 or above), or for those users who are deemed a higher risk, for example, if the system detected a pattern of suspicious behavior in their deposits and withdrawals. For this verification you are required to show:

- Source of funds or wealth documentation, which can be a recent bank statement covering several months, a tax return, a payslip, or even an accountant's letters.

- Proof of occupation that includes “papers” like invoices, business registration, employment contracts, and so on.

- Stronger ID verification, which may include certified or notarised copies of ID, in-person interviews, and similar.

Either way, know that when dealing with how to transfer crypto to a bank account, KYC is something you can’t do without.

Can you transfer crypto to your bank account?

Now that we’ve gotten the technicalities out of the way and you know which documents are necessary for smooth sailing, it’s time to tackle the question can you transfer crypto to your bank account? Yes, but not directly, choose a centralized exchange and open an account, complete a KYC, deposit your crypto to your exchange wallet, fill in your bank details and submit a wire transfer request. The transfer should be processed within a few hours.

That being said, there is a simpler option if you don’t plan to transfer a large amount of money but still want to use your crypto for everyday purchases. We’re talking about a crypto debit card, since with it, you don’t need to go through the banking system at all. Instead of converting your crypto into traditional currencies and then wiring that to your bank account, you’ll be adding crypto directly to your crypto card. Essentially, you give crypto to the exchange, and in return, the exchange loads the card with fiat. For you as the user, it may just seem as if you load that crypto directly into the card. This basically allows you to use that card as you would any other regular one (your Visa, Mastercard, and similar). You’ll have a much more convenient way of spending your crypto, and best of all, won’t have to deal with wire transfers, paperwork, and other things.

Can you transfer Bitcoin to bank account?

Up to this point, we’ve covered everything related to crypto bank transfers, but now we’ll focus on a specific cryptocurrency, namely Bitcoin. Being the most popular and widespread cryptocurrency, it’s natural to wonder can you transfer Bitcoin to bank account? Yes, you can, open an account on a CEX, go through the verification process, deposit Bitcoin to your exchange wallet, add your bank account details and request a wire transfer. The transfer will arrive to your bank account usually on the same day.

The process is pretty much the same for any other tokens you may have, just make sure you check that the exchange supports these tokens before registering.

Crypto is growing, but you still can't do without traditional currencies

Cryptocurrencies and their practical uses are constantly expanding, especially if we compare the situation to several years ago. Not only that, but an increasing number of people are getting familiar with the world of crypto, which will likely prompt even more use in the future. However, traditional fiat currencies dominate and will continue to do so in the foreseeable future, at the very least. After all, we’ve been using them for centuries, and massive changes like these don’t happen fast, if they ever do. So, for the time being, we will have to rely on the traditional banking system to get us by. This also means that we need centralized exchanges or crypto debit cards as a way of converting crypto to fiat. We showed you several ways and how to do just that, accompanied by all the necessary paperwork you’ll have to supply. That is how it works right now, until cryptocurrencies become mainstream and replace the traditional banking system, and that is a future the PlasBit team would like to see one day.