In cryptocurrencies, where opportunities for substantial gains abound, a darker side has emerged, the phenomenon known as crypto pump and dump. This deceptive practice involves inflating the value of a cryptocurrency through coordinated buying, often fueled by false information, only to be followed by a rapid sell-off, leaving unsuspecting investors with substantial losses. PlasBit research team will shed light on the intricacies of this market manipulation tactic, exploring its origins, mechanics, and the profound impact it has on both individual investors and the broader cryptocurrency market.

Pump and Dump Case Study: The Squid Game Token

In the previous analysis, we focused on the effects and implications of the crypto dust attack, but the pump and dumps are even more dangerous. The Squid Game scam stands as a cautionary tale, and it will be our case study to fully explore the implications and mechanisms of crypto pumps and dumps.

Step 1: Captivating the Crowd with Hype

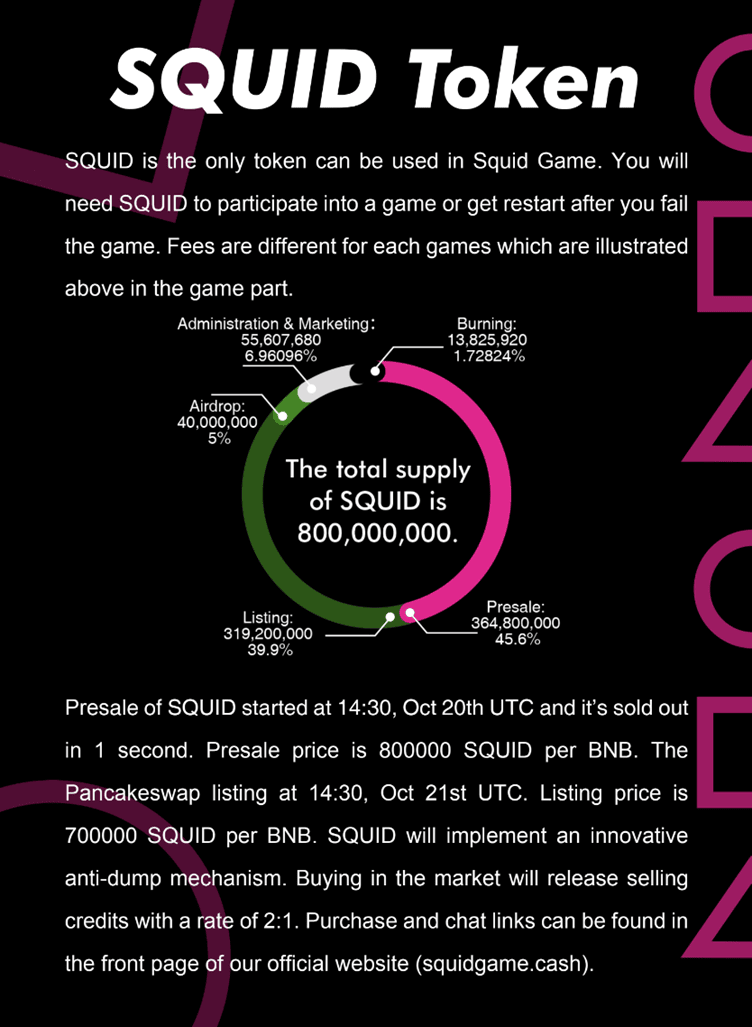

The scammers of this deception masterfully leveraged the immense popularity of the Netflix series "Squid Game" to fuel their scheme. They cleverly built a website and a captivating whitepaper, creating the cryptocurrency with an air of legitimacy and promising growth potential. Simultaneously, they orchestrated a social media marketing campaign, enlisting the support of influencers and celebrities to amplify the hype and attract investors.

Step 2: Setting the Trap with an Appealing Price

Scammers set a low initial price for the Squid Game cryptocurrency, tempting investors with the prospect of quick gains. This promise proved irresistible to many, who tried to capitalize on this opportunity. The initial price was $0.009.

Step 3: Manipulating and Generating False Demand

To further fuel the hype to inflate the token’s value, the scammers engaged in a calculated evil scheme, planning a surge in demand for the Squid Game cryptocurrency. They strategically purchased large quantities of tokens, artificially inflating the price and creating the illusion of huge investor interest.

Step 4: The Culmination of Deception

As the price of the Squid Game cryptocurrency reached its peak, the scammers planned a sudden sell-off of their holdings. This coordinated action triggered a domino effect, as panicked investors rushed to offload their tokens, causing the price to plummet dramatically.

Step 5: The Scammers Vanish into Thin Air

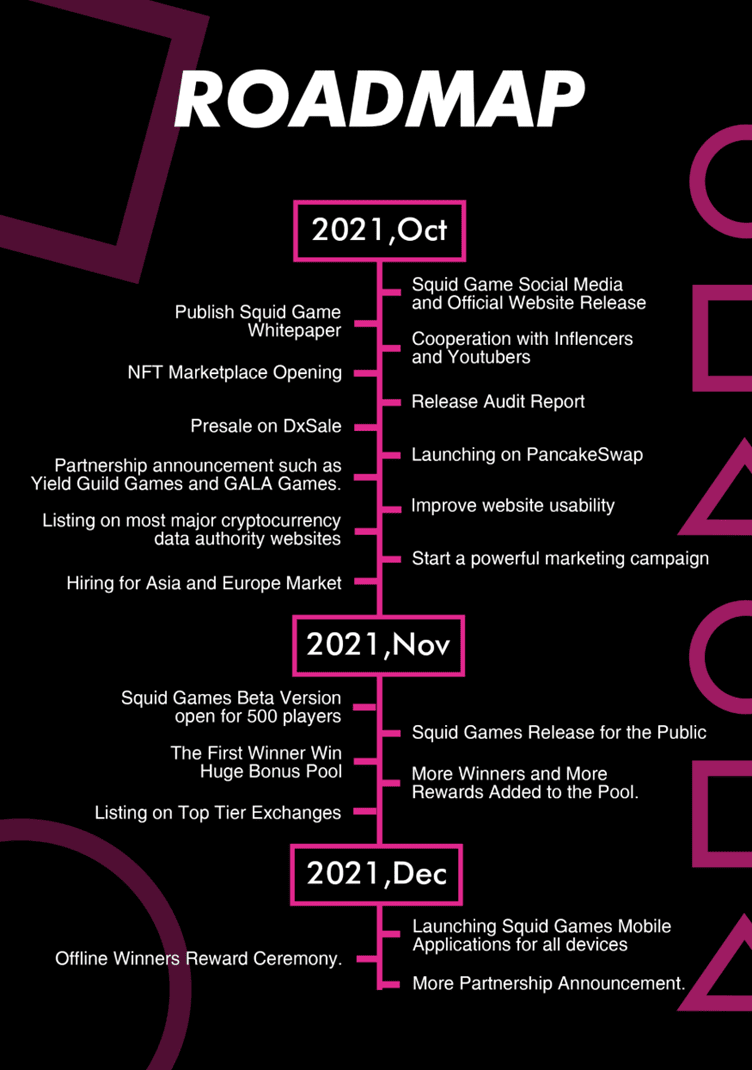

With the price of the Squid Game cryptocurrency plummeting to near zero, the scammers vanished into thin air, leaving behind a trail of devastation and financial ruin. They stole nearly $3.4 million, leaving investors struggling with the sad reality of their losses. The scheduled Roadmap was actually only planned for the first two months of the project. Anonymous founders sell their assets and disappear.

The Aftermath: A Legacy of Mistrust

The Squid Game scam left an indelible mark on the cryptocurrency landscape, tarnishing the reputation of this emerging asset class. It underscored the importance of thorough due diligence and skepticism towards overly enthusiastic promotions, especially those lacking concrete fundamentals.

How to Protect Yourself from Crypto Pump and Dumps

The attraction of significant profits in the cryptocurrency market often blinds investors to the lurking dangers of pump and dump schemes. We'll explore practical steps to shield yourself from falling victim to these manipulative tactics and safeguard your investments.

- Thorough Due Diligence:

Before investing in any cryptocurrency, conduct a comprehensive research. Scrutinize the project's whitepaper, team members, and development roadmap. Look for red flags like anonymous teams, vague project goals, or unrealistic promises. If the information seems too good to be true, it probably is.

- Skepticism towards Hype:

Be cautious of investments driven solely by hype, especially those linked to pop culture or celebrity endorsements. Pump and dump organizers often capitalize on the FOMO (Fear of Missing Out) phenomenon, creating a false sense of urgency. Evaluate investments based on their fundamentals rather than momentary excitement.

- Verification of Information:

Cross-verify information from multiple sources before making investment decisions. False narratives and misleading news can artificially inflate the value of a cryptocurrency. Reliable news outlets, official project channels, and reputable cryptocurrency analysts can be trustworthy sources.

- Understanding Tokenomics:

Familiarize yourself with the tokenomics of the cryptocurrency you're considering. Know the total supply, distribution plan, and mechanisms affecting the token's value. Projects with transparent and well-defined tokenomics are less likely to be involved in pump and dump schemes.

- Avoiding Penny Stocks Mentality:

Just as in traditional stock markets, the attraction of low-priced tokens can be deceptive. Scammers often set an initial low price to attract investors looking for quick gains. Focus on the project's potential and the underlying technology rather than being focused on the token's nominal value.

- Monitoring Trading Patterns:

Stay vigilant and monitor trading patterns on cryptocurrency exchanges. Sudden and unnatural trading volume spikes, especially with a rapid price increase, may signal a pump and dump in progress. Exchanges with advanced trading tools and alert systems can aid in detecting unusual market behavior.

- Participating in Reputable Exchanges:

Choose well-established and reputable cryptocurrency exchanges for your transactions. These platforms often have stringent listing criteria, reducing the likelihood of pump and dump schemes. Additionally, reputable exchanges implement security measures that protect users from fraud.

- Educating Yourself Continuously:

The cryptocurrency landscape is dynamic and ever-evolving. Stay informed about market trends, regulatory developments, and emerging scams. Engage with the community, participate in forums, and attend educational events to enhance your understanding of the crypto space.

- Utilizing Stop-Loss Orders:

Implement stop-loss orders when trading cryptocurrencies. Setting predefined exit points helps mitigate potential losses in case of sudden market downturns. This risk management strategy is crucial for protecting investments in a volatile market.

- Reporting Suspicious Activities:

Actively participate in reporting suspicious activities to both exchanges and regulatory bodies. Collaboration within the cryptocurrency community is essential to create a safer environment. Timely reporting can aid in swiftly identifying and mitigating pump and dump schemes.

By combining these measures, investors can navigate the cryptocurrency market more safely and minimize the risk of falling victim to pump and dump scams. Remember, vigilance and continuous education are your best defenses in this rapidly evolving financial frontier.

Causes Behind Crypto Pumps and Dump

The reason for Crypto Pump and Dump schemes can be attributed to a combination of factors exploiting cryptocurrency markets' decentralized and relatively unregulated nature. We will explore the underlying causes that contribute to the emergence of these manipulative practices.

Lack of Regulation and Oversight

One of the primary reasons for pump and dump schemes in the cryptocurrency space is the limited regulatory framework and oversight compared to traditional financial markets. The decentralized nature of many cryptocurrencies and the absence of a centralized authority create an environment where manipulative activities can occur with greater ease. Regulatory bodies, while increasingly vigilant, often struggle to keep pace with the rapidly evolving cryptocurrency landscape. The absence of standardized regulatory measures allows opportunistic individuals and groups to exploit regulatory gaps for personal gain.

Anonymity and Pseudonymity

Using pseudonyms and anonymous accounts on online platforms further complicates efforts to trace and hold accountable those behind pump and dump schemes. Cryptocurrency transactions, inherently designed to prioritize user privacy, provide a cloak for orchestrators to execute their plans discreetly. In the absence of clear identification protocols, bad actors can operate with a level of anonymity that shields them from immediate consequences, fostering an environment conducive to market manipulation.

Speculative Nature of Cryptocurrency Markets

Cryptocurrency markets, characterized by high volatility and speculative trading, create fertile ground for pump and dump schemes. The allure of significant, quick profits entices experienced and novice investors to participate in market movements driven by hype rather than fundamental value. The absence of stringent valuation metrics and the susceptibility of certain cryptocurrencies to price manipulation make them attractive targets for those seeking to exploit market sentiment for short-term gains.

Influence of Social Media and Online Communities

The interconnected nature of cryptocurrency communities on social media and online forums plays a pivotal role in the propagation of pump and dump schemes. Coordinated efforts to disseminate misleading information, endorsements, and speculative news contribute to the rapid spread of FOMO (Fear of Missing Out) among investors. Organizers exploit these platforms to create a sense of urgency and excitement, amplifying the impact of their manipulative actions. We will delve into pump and dump schemes' legal and ethical implications, exploring how the cryptocurrency community, developers, and regulatory bodies can work collaboratively to address these challenges. Understanding the root causes is paramount in developing effective countermeasures that protect the integrity of the cryptocurrency market.

Legal and Ethical Implications

The rise of Crypto Pump and Dump schemes has raised concerns within the cryptocurrency community and prompted regulatory bodies to examine the legal and ethical ramifications of market manipulation. This chapter will explore the complex landscape of laws, regulations, and ethical considerations surrounding pump and dump activities in the cryptocurrency market.

Legal Frameworks and Challenges

The decentralized nature of cryptocurrencies poses challenges for legal authorities aiming to ban pump and dump schemes. While some jurisdictions have implemented regulations to address market manipulation, cryptocurrency markets' global and borderless nature often complicates enforcement efforts. Regulatory bodies face the challenge of adapting existing frameworks or developing new ones to keep pace with the rapidly evolving cryptocurrency ecosystem. The lack of standardized international regulations further restricts global efforts to effectively combat pump and dump activities. Global collaboration among regulatory bodies and law enforcement agencies is crucial to creating a unified front against market manipulation, but achieving this unity remains an ongoing challenge.

Ethical Considerations

Beyond legal implications, the ethical dimensions of participating in or facilitating pump and dump schemes cannot be overlooked. Individuals involved in such activities knowingly exploit the vulnerabilities of fellow investors, often causing substantial financial harm.

As the cryptocurrency community matures, an emphasis on ethical behavior becomes paramount. Developers, influencers, and community leaders play a crucial role in fostering a culture of transparency and responsibility. Ethical guidelines and codes of conduct within cryptocurrency communities can serve as a collective effort to deter and condemn market manipulation.

Investor Protection

Protecting investors from the adverse effects of pump and dump schemes is a shared responsibility among regulatory bodies, cryptocurrency exchanges, and the broader community. Implementing measures such as increased transparency, educational initiatives, and stricter due diligence processes can contribute to creating a safer investment environment. In the next chapter, we will explore the consequences of pump and dump schemes for investors and discuss potential countermeasures to mitigate these risks. Addressing both legal and ethical aspects is essential to fostering a trustworthy and resilient cryptocurrency ecosystem that safeguards the interests of all participants.

How to Protect Investors from Web3 Scams

A proactive and collaborative approach is essential in response to the escalating threat of Crypto Pump and Dump schemes. We will explore a range of countermeasures and preventive strategies to mitigate the risks posed by market manipulation.

Increased Regulatory Oversight

One of the fundamental countermeasures involves enhancing regulatory oversight of cryptocurrency markets. Regulatory bodies must adapt swiftly to the evolving ecosystem, implementing measures that deter and penalize orchestrators of pump and dump schemes. Collaborative efforts on an international scale are crucial to address jurisdictional challenges and create a unified front against market manipulation.

Transparency and Reporting Mechanisms

Cryptocurrency exchanges can play a pivotal role in preventing pump and dump schemes by promoting transparency and implementing robust reporting mechanisms. Enhanced disclosure requirements, real-time monitoring of trading activities, and the ability to report suspicious behavior can act as deterrents and facilitate quicker responses to potential manipulative activities.

Community Vigilance and Education

Empowering the cryptocurrency community with knowledge and vigilance is a key element in the fight against pump and dump schemes. Educational initiatives within online communities and through broader awareness campaigns can raise awareness about the signs of market manipulation. Encouraging responsible behavior and due diligence among investors contributes to a more resilient and informed community.

Algorithmic Monitoring and Surveillance

Cryptocurrency exchanges and trading platforms can deploy advanced algorithmic monitoring and surveillance systems to detect unusual trading patterns indicative of pump and dump schemes. Real-time analysis of trading activities, coupled with machine learning algorithms, can help identify and halt suspicious transactions before they escalate.

Collaborative Efforts with Social Media Platforms

Given the significant role of social media in the propagation of pump and dump schemes, collaboration between cryptocurrency platforms and social media networks is essential. Implementing measures to identify and address misleading information, false endorsements, and coordinated efforts to manipulate market sentiment can disrupt the effectiveness of these schemes.

Developer and Community Involvement

Cryptocurrency developers and community leaders can contribute to the prevention of pump and dump schemes by fostering a culture of responsibility and ethical behavior. Clear codes of conduct, ethical guidelines, and mechanisms for reporting suspicious activities within development communities can serve as additional layers of defense.

Improved Due Diligence for Investors

Investors themselves play a crucial role in preventing pump and dump losses. Conducting thorough due diligence before making investment decisions, verifying information from multiple sources, and remaining skeptical of unrealistic promises can help individuals avoid falling prey to manipulative schemes.

Other Commons Crypto Scams

The Squid Game scam, with its calculated steps and devastating consequences, serves as a poignant example of the risks embedded within the cryptocurrency ecosystem. However, this is not an isolated incident. The ever-evolving world of digital assets is rife with a variety of scams, such as Ponzi schemes, zero transfer scams, and more, each posing unique threats to investors. As we conclude our exploration of the Squid Game deception, it's crucial to broaden our understanding by briefly acknowledging other prevalent types of crypto scams.

Ponzi Schemes and Pyramid Schemes

These age-old fraudulent models have found a new haven in the cryptocurrency realm. Ponzi schemes promise consistent returns to early investors using funds from new participants, while pyramid schemes rely on recruitment to generate profits. Both prey on the allure of quick riches and unsustainable growth.

Fake ICOs (Initial Coin Offerings)

Scammers often masquerade as legitimate projects, conducting fake ICOs to solicit funds from unsuspecting investors. These projects promise groundbreaking innovations, only to vanish once the fundraising is complete, leaving investors with worthless tokens.

Phishing and Social Engineering Attacks

Cryptocurrency holders are frequent targets of phishing attacks, where malicious actors use deceptive tactics to acquire sensitive information, such as private keys or login credentials. Social engineering exploits human psychology to manipulate individuals into divulging confidential details.

Exit Scams

Similar to the Squid Game scam, exit scams involve cryptocurrency projects abruptly shutting down or disappearing after amassing significant funds from investors. These schemes often involve promises of revolutionary technology or high returns, only to vanish when it's time to deliver.

Address Poisoning Attacks

In address poisoning scams, the scammers identify wallets that periodically receive large amounts of cryptocurrencies, create a wallet with very similar alphanumeric characters, send a small amount of cryptocurrencies to the wallet that routinely sends the funds, and hopes that by sending the money, the sender copies and pastes the scammer's address in its transaction history.

Navigating the Ocean of Crypto Scams with Wisdom

In conclusion, the journey through the cryptocurrency ecosystem is captivating but requires savvy and awareness. The Squid Game and the other scams described in our journey should not be viewed as insurmountable obstacles but as learning opportunities. PlasBit believes that continued education, adherence to best security practices, and a community-driven commitment to transparency and ethical conduct are pivotal in fortifying the cryptocurrency ecosystem against the tide of fraudulent activities. As blockchain technology revolutionizes how we manage value, we are responsible for shielding this new financial frontier from those seeking to exploit its vulnerabilities. While challenges persist, regulators', industry participants, and informed investors' collective efforts contribute to the evolution of a more secure and resilient digital financial frontier. Through sharing knowledge and collective commitment, we can contribute to shaping a safer and more prosperous future for the world of cryptocurrencies.