This extensive guide will explore the fascinating domain of stablecoins, primarily focusing on the USD Coin (USDC). USDC is a reliable digital counterpart to the US dollar. Functioning as a "1:1" representation of the fiat currency, USDC ensures stability by being pegged to the value of the US dollar. Cryptocurrency traders seeking valuable insights into what is USDC crypto, its background, benefits, risks, and how it stands out in the market will find this article particularly informative.

What is a Stablecoin?

Stablecoins represent a crucial innovation in the cryptocurrency space, offering a solution to the inherent volatility that characterizes many digital assets. Unlike traditional cryptos such as Bitcoin and Ethereum, stablecoins are created to maintain a stable value by pegging themselves to a reserve asset, often a currency like the USD. This pegging ensures that the value of a stablecoin remains constant, providing a level of predictability and trust often sought after in financial transactions. USD Coin is a prominent example of a stablecoin whose primary goal is to bring stability and reliability to the crypto market. Traders and users often turn to stablecoins like USDC to hedge against the extreme price fluctuations associated with other cryptocurrencies. Stablecoins provide a valuable bridge between cryptocurrency and more risk-averse financial strategies by offering a digital representation of traditional fiat currency with a fixed value.

What is USDC?

USD Coin (USDC) holds a significant position within the cryptocurrency market as a stablecoin, offering a secure peg to the US dollar. This pegging is backed by a reserve of US dollars meticulously held in regulated financial institutions, establishing a safe and transparent foundation for the stablecoin. Traders and users value USDC for its consistent value, which helps mitigate the price volatility associated with other cryptocurrencies like Bitcoin and Ethereum. Behind the creation and management of USDC stands Centre, a joint venture between Circle (a financial technology company) and a cryptocurrency exchange. The Centre's involvement brings credibility to the stablecoin, and its commitment to transparency is evident through regular audits, ensuring that the reserve backing USDC aligns with the circulating supply. Over time, USDC has evolved beyond its initial presence on Ethereum's blockchain. It has expanded to operate on additional networks, such as Algorand and Solana, enhancing its accessibility and utility across diverse blockchain ecosystems. As a pivotal player in the crypto space, USDC facilitates seamless transactions, bridges traditional finance and the digital world, and continues to play a crucial role in developing decentralized finance (DeFi) applications and financial instruments.

Benefits and Risks of USD Coin

While USDC presents a range of benefits that appeal to users and traders, it is essential to acknowledge the associated risks. This comprehensive analysis will explore the advantages and potential drawbacks of USD Coin, providing you with a nuanced understanding of its functionalities and considerations for your engagement with this stablecoin.

Benefits

Low Price Volatility:

One of the primary advantages of the USD Coin is its stability, offering you a reliable digital representation of the US dollar. Unlike many other cryptocurrencies known for their price volatility, USDC maintains a consistent value, making it an attractive option for traders and users. The low price volatility of USDC provides predictability, allowing you to engage in transactions and hold assets without the constant concern of dramatic value fluctuations.

Fully Backed by U.S.-Regulated Reserve Assets:

The stability of USDC is underpinned by its full backing with U.S.-regulated reserve assets. This means that for every USDC token in circulation, regulated financial institutions hold an equivalent amount of US dollars in reserve. This commitment to a robust reserve system enhances the trustworthiness of USDC, assuring you that tangible assets support the stablecoin, and it can be redeemed at any time for its fiat equivalent.

Hedge Against Inflation:

USDC serves as a valuable tool for those seeking a hedge against inflation. As a cryptocurrency pegged to the US dollar, USDC allows you to preserve the value of your assets in times of economic uncertainty. Inflation saturates the purchasing power of traditional currencies. Still, by holding USDC, you can mitigate the impact of inflation on your wealth, safeguarding against the depreciation commonly associated with fiat currencies.

Global Accessibility and Interoperability:

Another notable benefit of USDC is its global accessibility and interoperability. Operating on various blockchain networks, including Ethereum, Algorand, and Solana, USDC can seamlessly facilitate transactions across different platforms and decentralized applications. This versatility makes USDC practical for you engaged in various blockchain activities, from decentralized finance (DeFi) protocols to cross-border transactions.

Transparency and Regulatory Compliance:

Regular audits and adherence to regulatory standards ensure that USDC remains accountable and aligned with industry best practices. This commitment to transparency enhances trust among users and regulatory authorities, positioning USDC as a stablecoin that meets the evolving demands of the crypto landscape.

Risks

No Price Appreciation:

One significant risk of holding USD Coin is the need for price appreciation. Unlike other cryptocurrencies with the potential for substantial value increases, USDC maintains a fixed value pegged to the US dollar. While stability is a key feature, users holding USDC may not benefit from potential capital gains experienced by other, more volatile digital assets. Traders seeking significant returns may find this lack of price appreciation a limiting factor.

Mix of Reserve Assets Not Fully Disclosed:

While USDC is generally considered a transparent stablecoin, there have been concerns regarding the complete disclosure of its reserve assets. The breakdown of assets backing USDC, beyond the broad assurance of being U.S.-dollar-backed, may be kept a secret. This lack of granular detail can raise questions about the diversity and quality of assets supporting the stablecoin. You may prefer a comprehensive breakdown to assess the underlying reserve's risk exposure and diversification strategy.

Not Immune to US Dollar Price Inflation:

Despite being a cryptocurrency pegged to the US dollar, USDC is not immune to the effects of US dollar price inflation. Inflation decreases the purchasing power of fiat currencies, including the US dollar. While USDC provides a stable value in the short term, over an extended period, the stablecoin may be impacted by the depreciation of the US dollar due to inflation. You should consider this risk, especially if they hold USDC as a long-term store of value.

How Does USDC Work?

What Is USDC Crypto, and where does it operate? USD Coin (USDC) operates as an ERC-20 token on the Ethereum blockchain, providing a stable and reliable digital representation of the US dollar. Being an ERC-20 token means that all USDCs in circulation adhere to the Ethereum token standard, allowing seamless integration with various Ethereum-based decentralized applications (DApps) and smart contracts. This interoperability extends the utility of USDC, enabling you to engage in a range of activities within the Ethereum ecosystem, from decentralized finance (DeFi) protocols to tokenized asset transfers.

The stability of USDC is maintained through a meticulous process. For every USDC token in circulation, there is a corresponding reserve of US dollars held in custody by regulated financial institutions. This 1:1 pegging mechanism ensures that the value of USDC remains consistently tied to the US dollar. An independent accounting firm regularly verifies the reserve's cash levels to enhance transparency and accountability. This verification process aims to confirm that the US dollars held in reserve match the circulating supply of USDC tokens. Additionally, creating new USDC coins aligns with market demand whenever an individual wishes to acquire USDC with their US dollars, thereby maintaining the stablecoin's equilibrium with the fiat currency it represents.

What Makes USD Coin Unique?

The functional aspects across various offerings may seem similar in stablecoins pegged to the US dollar, where maintaining a consistent value of $1 is the primary objective. They all enable seamless transfers between crypto wallet addresses, giving you a digital representation of fiat currency. However, the emphasis on transparency and trustworthiness sets USD Coin (USDC) apart from many competitors. Managed by the Centre consortium, USDC distinguishes itself by regularly releasing comprehensive monthly reports through Grant Thornton, LLP, a top-tier accounting firm in the United States. These reports offer a detailed account of the number of USDC tokens in circulation and the total value of the reserves backing the stablecoin. This commitment to transparency is crucial in instilling trust among users and market participants, as it provides tangible evidence that actual funds are reserved for every USDC in circulation.

Furthermore, the nature of the funds backing the USD Coin contributes to its uniqueness in the stablecoin landscape. While some stablecoin issuers diversify their reserves with various financial instruments, USD Coin maintains reserves consisting solely of US treasury securities and cash deposits. This focused and transparent approach to backing the stablecoin enhances its credibility, as you can have confidence in the simplicity and stability of the assets supporting USDC. In summary, USD Coin's commitment to transparency, reliance on a reputable accounting firm, and the straightforward composition of its reserves contribute to its uniqueness and make it a standout choice for you seeking a trustworthy stablecoin.

Use Cases for USD Coin

As exemplified by USD Coin (USDC), stablecoins have emerged as versatile instruments within the cryptocurrency space, offering a range of use cases that extend beyond the conventional scope of digital assets.

Trading:

USDC plays a pivotal role as a trading pair on cryptocurrency exchanges. Traders leverage its stable value to swiftly navigate in and out of positions, capitalizing on its consistency amid the market's inherent volatility. During heightened market uncertainty, traders frequently opt to park their funds in USDC, aiming to shield their capital from abrupt fluctuations in the crypto market.

Stable Value Transfers:

One of the fundamental use cases of USDC is its role as a stable medium for transferring value. The stability it offers makes USDC an attractive option for remittances and cross-border transactions, as recipients can receive a predictable value without the risk of rapid price swings, contributing to the efficiency and reliability of international financial transactions.

Decentralized Finance (DeFi) Activities:

USDC is integral to the decentralized finance landscape, where it finds extensive application in lending, borrowing, earning interest, and providing liquidity. Its stability is particularly advantageous in DeFi protocols like yield farming and lending, where maintaining a stable value is essential for the effective functioning of financial instruments.

E-Commerce and Online Payments:

The acceptance of USDC as a form of payment on online platforms and businesses is steadily increasing. You can utilize your USDC holdings to make purchases without converting to fiat currencies, streamlining international transactions and reducing transaction fees.

Smart Contract Operations:

USDC's integration into smart contracts on various blockchain platforms enables developers to create programmable financial applications. This includes subscription models, automated payments, and conditional transfers, showcasing the adaptability of USDC in facilitating sophisticated financial operations.

US Dollar Exposure:

Non-U.S. traders seeking exposure to the US dollar can incorporate USDC into their cryptocurrency asset portfolios. This allows you to benefit from the stability of the US dollar without the need for direct fiat currency holdings.

Hedge Against Inflation:

For non-U.S. traders concerned about inflation in their local currencies, holding a stablecoin like USDC can serve as a hedge to protect the value of their money. This strategy helps mitigate the erosion of purchasing power associated with inflation, providing a reliable store of value.

Global Crowdfunding:

Startups and nonprofit organizations can harness the global nature of stablecoins like USDC for fundraising. By soliciting digital currencies, particularly stablecoins, these entities ensure that the funds' value remains stable, offering a more predictable financial foundation for their initiatives.

Difference Between USDC and Other Stablecoins

What Is USDC Crypto? USD Coin (USDC) distinguishes itself from other stablecoins primarily through its specific reserve backing and commitment to transparency.

Asset Backing:

One key distinction lies in the assets that back stablecoins. USDC, in particular, is backed by a reserve of US fiat currency. This means that for every USDC token in circulation, an equivalent amount of US dollars is held in reserve. This direct pegging to the US dollar aims to provide users with a high confidence level in the stability and value of USDC. In contrast, other stablecoins may be backed by various assets, including other fiat currencies, commodities, or a combination of assets. Tether (USDT), for instance, is a popular stablecoin known for being backed by a mix of fiat currencies, making its asset composition somewhat different from the singular focus on US dollars seen with USDC.

Transparency and Audits:

USDC stands out for its transparency. The Centre consortium, which manages USDC, releases monthly reports from reputable auditing firms such as Grant Thornton, LLP. These reports provide detailed information on the number of USDC tokens in circulation and the total value of the reserves backing the stablecoin. This regular auditing and disclosure of reserve levels enhance the transparency of USDC, offering you a clear view of the stablecoin's financial health. In comparison, not all stablecoins adhere to such rigorous reporting standards. Some stablecoins may need more transparency or external auditing, raising questions about the verifiability of their reserve backing.

Reserve Composition:

Another point of differentiation is the composition of the reserves backing stablecoins. USDC reserves consist exclusively of US treasury securities and cash deposits. This focused approach aims to maintain simplicity and stability. In contrast, other stablecoins may have a more diversified reserve composition, including a mix of bonds, fiat currencies, and even cryptocurrencies. The diversity of reserve assets can impact a stablecoin's risk profile and stability, making the composition of reserves a critical factor for users and traders to consider.

Regulatory Compliance:

USDC distinguishes itself by its adherence to regulatory standards. Issued by financial institutions and backed by US dollars, USDC aligns with regulatory requirements, contributing to its trustworthiness within the financial ecosystem. While some other stablecoins may also strive for regulatory compliance, the degree of adherence can vary, and some stablecoins may operate more decentralized, potentially introducing additional regulatory considerations.

How to Buy USDC?

There are different ways to acquire USDC through our platform. Follow the guides to obtain your USDC on our platform successfully.

Depositing USDC on PlasBit Wallet

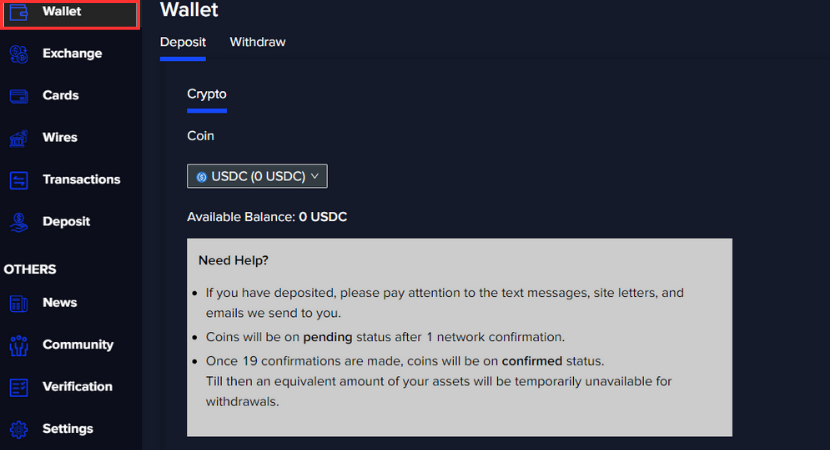

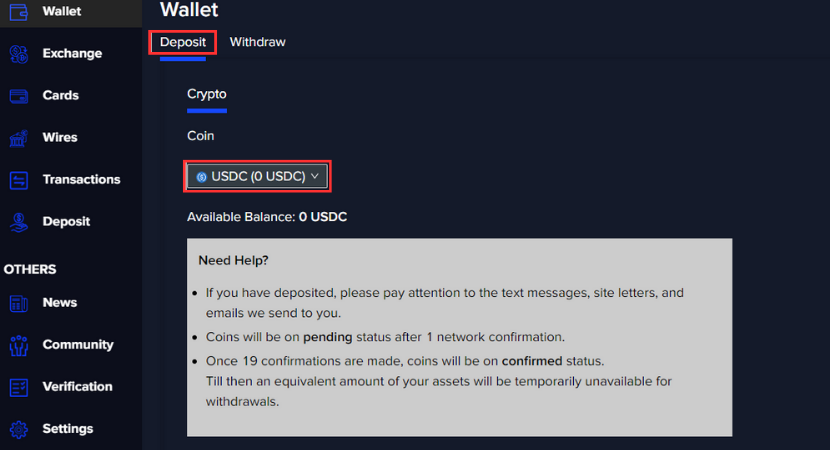

1. Go to the “Wallet” section in your account.

2. Click on “Deposit” and choose USDC as the coin.

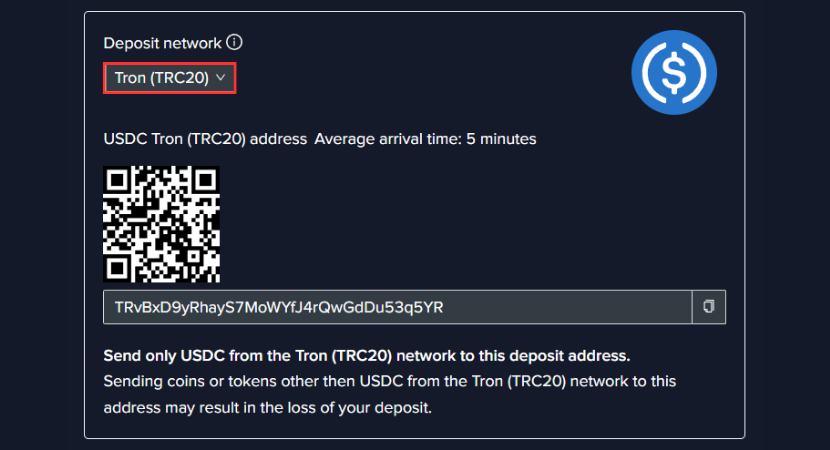

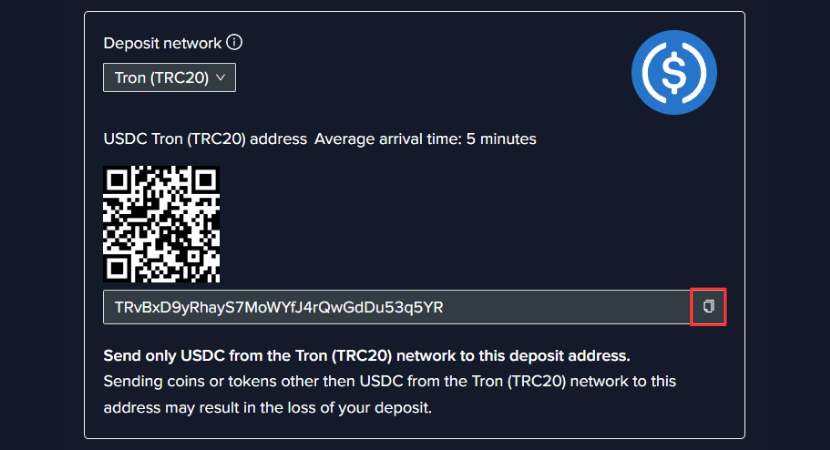

3. Select either the TRC20 or ERC20 network for your deposit.

4. Copy the wallet address based on your chosen network.

Keep in mind that only deposit USDC from your designated network.

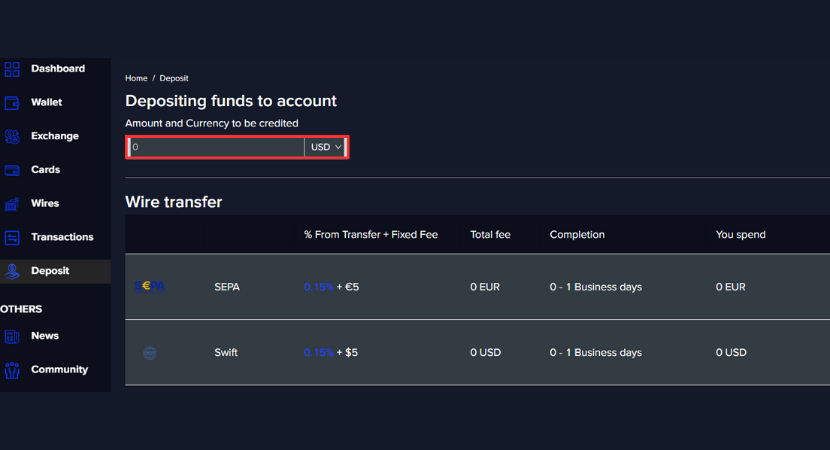

Acquiring USDC Through Wire Transfer

To acquire USDC through wire transfer, follow these secure steps for a successful transaction:

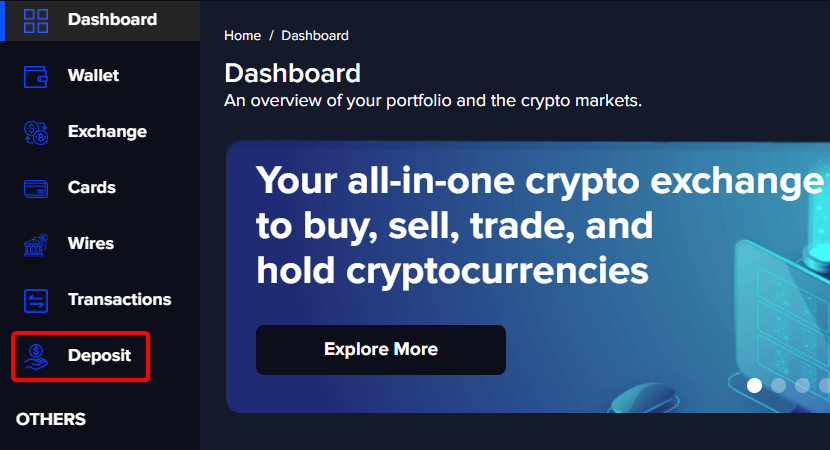

1. Head to the deposit section in your dashboard.

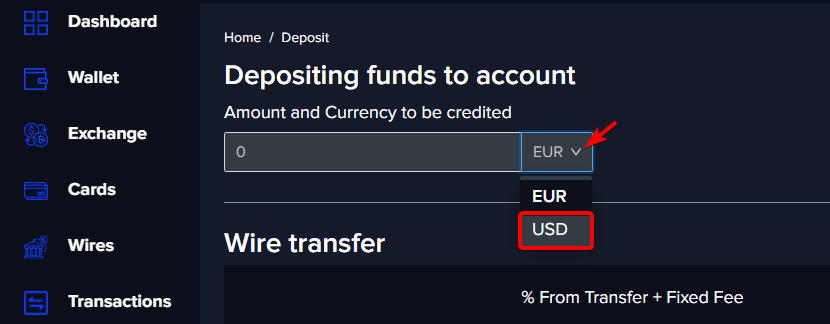

2. Select USD as your deposit currency.

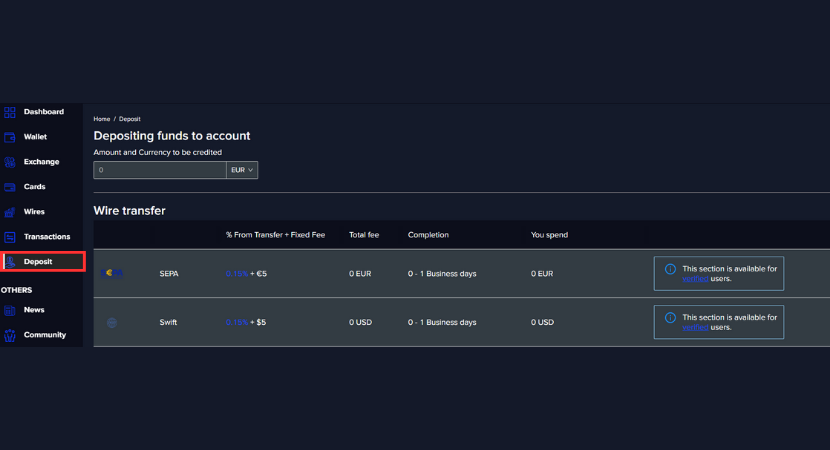

3. Enter the desired amount and opt for the 'Swift' wire transfer option. Click 'Deposit' to proceed.

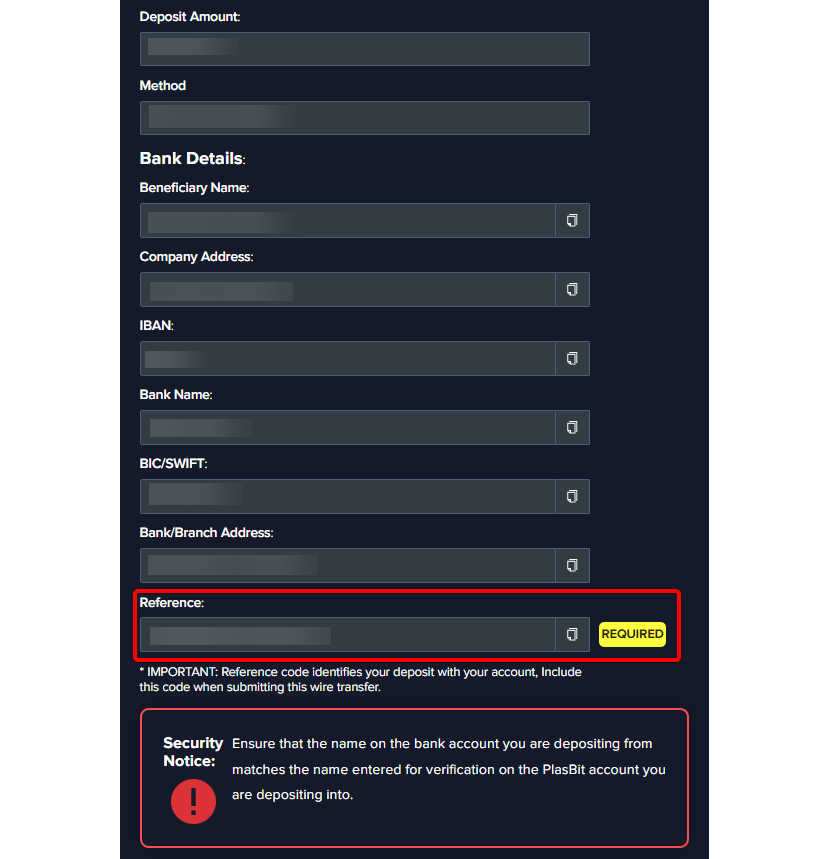

4. In the deposit details section, provide the banking information for the bank initiating the transfer. Include beneficiary name, company address, IBAN, bank name, BIC/SWIFT, bank/branch address, and a reference code.

Now that your account is funded with USD, you can proceed to exchange your USD for USDC through our platform.

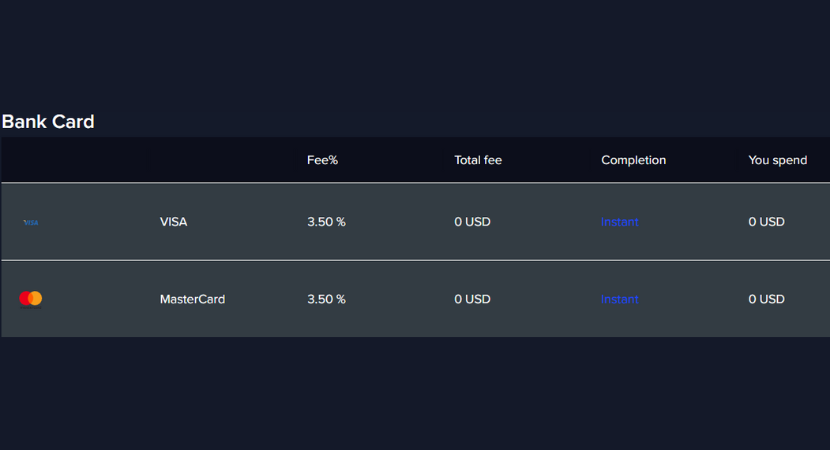

Converting USD to USDC via Bank Card

1. Proceed to the deposit section in your account.

2. Enter the USD amount you plan to use for acquiring USDC. Make sure your daily funding stays within the set limit.

3. Choose the bank card option in the deposit section and specify whether you have a Visa or Mastercard. Find details on transaction fees and the expected completion time.

4. Upon confirming the deposit amount and card selection, click the "Deposit" button.

5. You will be directed to a verification section containing essential deposit guidelines. Review and agree to these terms before advancing.

To ensure a smooth deposit process, keeping your daily funding within the specified USD limit is important. We exclusively accept plastic cards; virtual cards are not permissible. Verify that your card is registered in your name, as anonymous cards are prohibited. Corporate or business cards are not accepted, and the card used for the deposit must be issued in the same country as your profile address. While you can utilize different cards, please note that you can use up to two cards every 60 days. Lastly, physically damaged cards cannot be accepted for the deposit process. Following these guidelines ensures a hassle-free experience when utilizing your card for deposits.

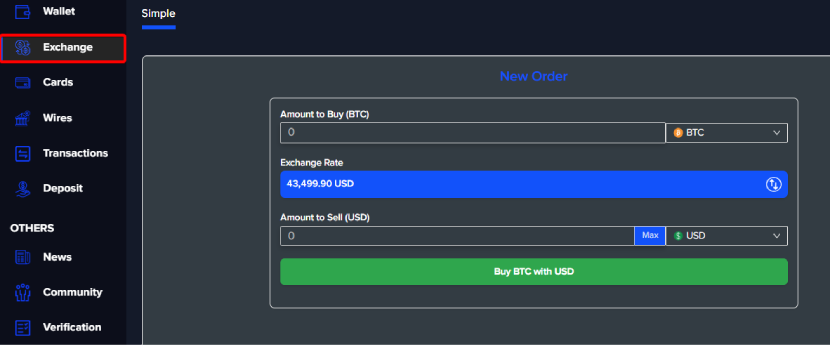

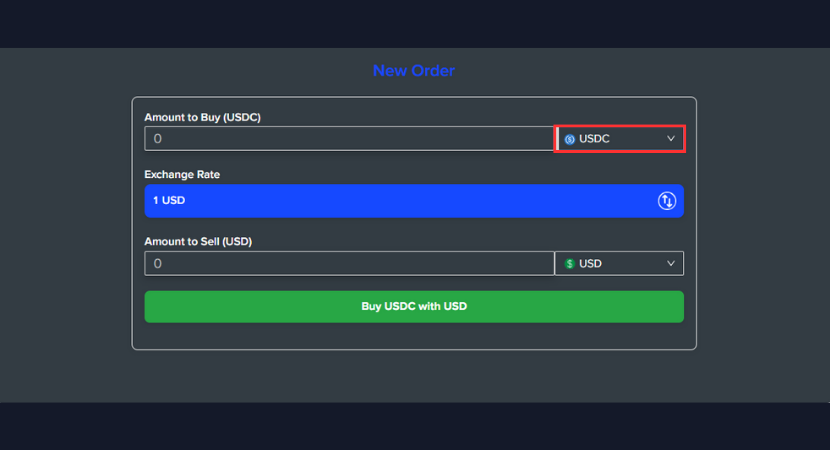

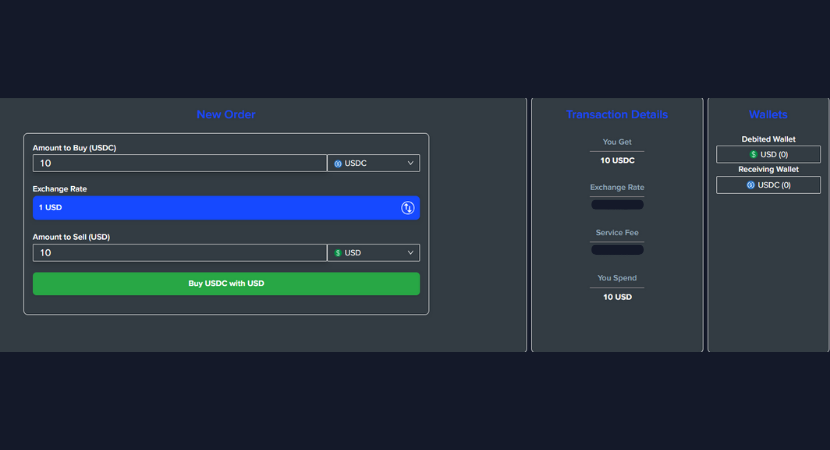

Converting USD to USDC via PlasBit Exchange

1. Navigate to the "Exchange" tab on your dashboard.

2. Select USDC as the cryptocurrency you want to buy.

3. Enter the amount of USD you intend to exchange for USDC.

4. Review the total transaction amount details for validation and click "Buy USDC with USD."

5. Once confirmed, your wallet will be updated to reflect the amount of USDC you have acquired.

Conclusion

This guide provides an overview of what is USDC crypto, a stable and reliable cryptocurrency pegged to the US dollar. Highlighting its benefits, such as low price volatility, full backing by U.S.-regulated reserves, and its role as a hedge against inflation, we also addressed potential risks and operational aspects. We explored its distinction from other stablecoins by emphasizing USDC's unique features, including transparency, simplicity in reserve composition, and regulatory compliance. Additionally, the guide touched on diverse use cases, from trading to global crowdfunding. This article concludes by offering insights into the practical aspects of purchasing USDC, providing a holistic understanding of this stablecoin and its significance in digital finance.