In a world that is increasingly driven by digital innovation, cryptocurrency has emerged as a transformative force, reshaping how we think about finance. While many have embraced cryptocurrencies for their potential to decentralize and democratize financial systems, the need for a bridge between crypto and traditional banking remains evident. This is where crypto wallets that allow transfer to bank account come in, allowing you to deposit crypto into your wallet, then navigate to the 'Wires' section, Select 'Euro' as the transfer currency, fill in your personal bank details, and submit a bank transfer request. You will receive the amount in Euros in your bank account on the same day. There are a few Important things to know before submitting your request, first you need to ensure you have completed the identity and address verification process before transferring funds into your Bank account. Second, you need to fill in a bank account with a beneficiary name that matches your PlasBit account name. Due to regulatory restrictions, you will not be able to complete a wire to bank accounts that do not bear the exact name of your PlasBit account, and you will be refunded to the wallet. Under no circumstances are wires to a third-party bank account allowed.

How to Withdraw Crypto to Your Bank Account using SEPA

Here's a basic overview of the steps involved in executing a SEPA bank transfer using PlasBit, our all-in-one cryptocurrency platform:

- Login in your wallet: Access to the dashboard to start the process.

- Open the Wires section: To start the transfer, go to the Wires section on the platform.

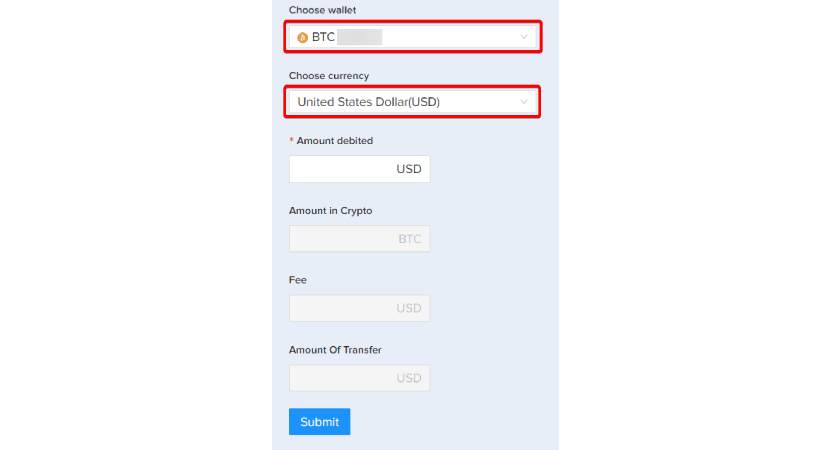

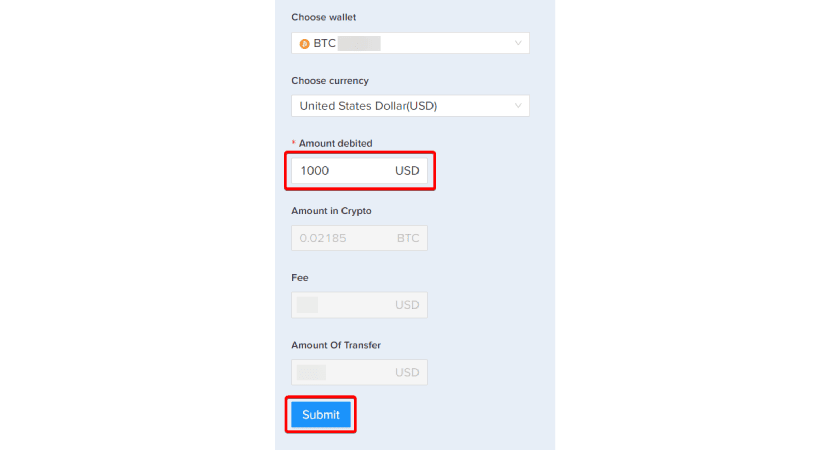

3. Choose the Amount to Transfer: Decide how much cryptocurrency you want to convert to euros and transfer to your bank account.

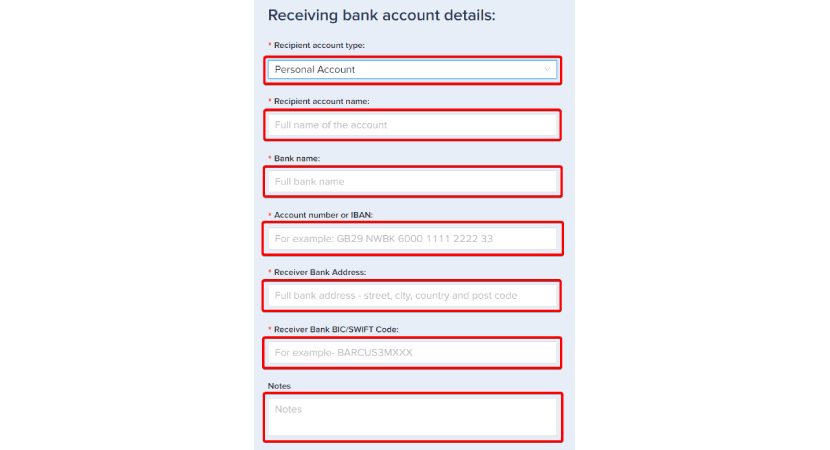

4. Enter Bank Account Details: Input your bank details, including your IBAN (International Bank Account Number) and BIC (Bank Identifier Code).

5. Confirm Transaction: Review the transaction details and confirm the SEPA transfer.

6. Wait for Confirmation: Single Euro Payments Area transfers typically process within two business days. You'll receive confirmation when the funds are deposited into your bank account.

The Power of Crypto Wallets and Financial Freedom

Crypto wallets are the cornerstone of cryptocurrency management, providing secure storage for your digital assets. Yet, their capabilities extend beyond mere storage. This comprehensive guide will explore the world of crypto wallets that enable transfers to your bank account. This financial bridge can allow you to convert, spend, and manage your cryptocurrency holdings in real-world scenarios. We'll delve into various crypto wallets, discuss the importance of connecting them to your bank accounts, review popular wallet options with banking features, examine security and privacy concerns, and explore practical use cases. By the end of this journey, you will be equipped with the knowledge needed to make informed decisions about integrating crypto wallets into your financial world, ultimately empowering you to take full advantage of the cryptocurrency revolution.

Types of Crypto Wallets

Crypto wallets are the digital safes where you store your cryptocurrencies. They come in various forms, each with its own set of advantages and use cases. Understanding the different types of crypto wallets is crucial for making an informed decision, especially when considering their compatibility with bank transfers. We'll explore the three primary categories of crypto wallets: software wallets, hardware wallets, and mobile wallets.

Software Wallets: Advantages and Choices

Software wallets, or digital wallets, are one of the most common and accessible types of crypto wallets. They are typically applications or software programs you can download and install on your computer or mobile device. They are user-friendly and suitable for beginners, making them a popular choice for those new to cryptocurrency. They are often free to use and provide a convenient way to manage digital assets. However, they are also susceptible to cybersecurity risks, so understanding security measures and best practices is essential when using software wallets like Metamask. This kind of wallet doesn't provide integration with banking systems.

Hardware Wallets: Security and Usability

On the other hand, hardware wallets are physical devices designed explicitly for storing cryptocurrencies. These wallets offer an extra layer of security, as they are not connected to the internet, reducing the risk of online hacking. We'll delve into the advantages and discuss the usability of hardware wallets. The primary benefit of hardware wallets is their security. These devices store your private keys offline, making them highly resistant to online threats. They are ideal for long-term holders of cryptocurrency who prioritize safeguarding their investments. However, software wallets may be less user-friendly than hardware wallets, and they come with a cost. They haven't the functions to send crypto to a bank account.

Why Transfer to a Bank Account Is Important

While crypto wallets are essential for managing your digital assets, there comes a time when you may need to convert your cryptocurrencies into traditional fiat currency, such as dollars, euros, or any other national currency. This is where transferring your crypto holdings to a bank account becomes significant. There are several reasons why you might want to transfer crypto to a bank account:

- Access to Traditional Financial Services: By converting your crypto assets into fiat currency, you can access traditional financial services like ATM withdrawals, bill payments, and everyday purchases with ease.

- Risk Mitigation: Cryptocurrencies can be highly volatile, and moving your funds to a bank account can help you mitigate the risks associated with price fluctuations.

- Legal and Tax Compliance: In many jurisdictions, you are required to report and pay taxes on your crypto gains. Transferring crypto to a bank account can simplify the tax reporting process.

- Financial Planning: For those who prefer to manage their finances with a traditional banking structure, the ability to transfer crypto to a bank account is an important part of their financial planning.

Overview of Crypto Bank Transfer Methods

Various methods are available for transferring your cryptocurrencies to a bank account, each with advantages and limitations. We will delve into the specifics of these transfer methods, including:

- SEPA Bank Transfer: Ideal for European users, the Single Euro Payments Area (SEPA) system allows for euro-denominated transfers within the Eurozone.

- Swift Bank Transfer: Swift is a global financial network that enables secure cross-border transfers in multiple currencies.

- Converting Crypto to Fiat: This involves using cryptocurrency exchanges to convert your digital assets into fiat currency and then transferring the funds to your bank account.

SEPA Bank Transfer: Europe's Choice

For cryptocurrency holders in Europe, the Single Euro Payments Area bank transfer is a widely used to convert their digital assets into euros and transfer them to a European bank account.

What Is a SEPA Bank Transfer?

SEPA is an initiative of the European Union aimed at creating a single, integrated market for electronic payments in euros. These transfers enable quick and cost-effective euro-denominated transactions between bank accounts in the Single Euro Payments Area zone, which includes 36 European countries.

Advantages and Limitations of SEPA Transfers

- Speed: SEPA transfers are typically faster than traditional international bank transfers. Euro transactions within the zone usually clear within one business day.

- Lower Costs: Single Euro Payments Area transfers are cost-efficient, often with low or no fees for sending and receiving funds.

- Widespread Acceptance: This kind of payment is widely accepted by European banks and financial institutions, making it a convenient option for local users.

- Currency Conversion: If your cryptocurrency isn't in euros, Single Euro Payments Area transfers often handle currency conversion during the transfer process.

Limitations:

- Euro Transactions: SEPA transfers are limited to transactions in euros. Transaction fees may apply if your bank account is in a different currency.

- Regional Coverage: While Single Euro Payments Area covers many European countries, it may not be suitable for those dealing with non-EU countries.

- Bank Account Requirements: You need a bank account in a country participating in the SEPA scheme to utilize this method fully.

Crypto Wallets and SWIFT Bank Transfers

The intersection with the traditional financial system, especially SWIFT (Society for Worldwide Interbank Financial Telecommunication) transfers, is crucial. We will provide in-depth insights into how crypto wallets can seamlessly connect with SWIFT transfers, enabling a world of financial opportunities.

Understanding SWIFT Transfers

SWIFT is a global standard for interbank financial communication used by financial institutions worldwide to facilitate international transactions. It's essential to grasp how SWIFT transfers work, including the messaging system and bank network. Crypto wallets can bridge the digital world of cryptocurrencies and the traditional financial realm of SWIFT transfers. Here's a detailed look at how crypto wallets can facilitate SWIFT transactions:

- Conversion of Cryptocurrencies: Crypto wallet owners can convert their digital assets into traditional fiat currencies, making them suitable for SWIFT transfers.

- Initiating SWIFT Transfers: Starting SWIFT transfers through crypto wallets involves sending the converted funds to a recipient's bank account.

Benefits and Considerations

The integration of crypto wallets in SWIFT transfers comes with a set of advantages and considerations:

- Speed: Crypto wallets can expedite the process, potentially reducing the time it takes for transactions to be completed, especially for international transfers.

- Cost Efficiency: Potential cost savings are associated with using crypto wallets, such as reduced exchange rate fees.

- Global Reach: Crypto wallets operate worldwide, simplifying cross-border transactions and offering enhanced accessibility to a broader range of financial institutions.

Challenges and Concerns

It's essential to be aware of the challenges and concerns:

- Security: The security of the crypto wallet and the SWIFT transfer must be addressed, as these transactions involve a blend of digital and traditional financial systems.

- Cryptocurrency Volatility: The inherent volatility of cryptocurrencies can affect the value of the funds being transferred during the conversion process.

- Tax Implications: Depending on your jurisdiction, there may be tax implications when converting cryptocurrencies to fiat and conducting SWIFT transfers.

Real-World Use Cases

To provide a practical perspective, we'll examine real-world use cases where integrating crypto wallets with SWIFT transfers can be highly advantageous:

- International Business Transactions: Crypto wallets can simplify cross-border payments and facilitate international business transactions.

- E-commerce: Online retailers can benefit from the efficiency of crypto wallet-enabled SWIFT transfers, allowing for smoother international sales.

- Personal Finance Management: Individuals can manage their international investments, savings, or family support more efficiently using this combination.

Crypto Wallets That Allow Transfer to Bank Account

Some wallets are designed for use on platforms and exchanges. They are user-friendly, readily available, and can be used to make purchases or payments in physical stores that accept cryptocurrency. Using crypto wallets from platforms such as PlasBit, you can easily integrate cryptocurrencies for spending in everyday life. In fact, our platform offers a secure wallet that allows international transfers to current accounts. Furthermore, with our debit cards, you can only use our platform for crypto and banking transactions. You can use debit cards to make online and offline payments and withdraw cash at any ATM, bridging the relationship between cryptocurrencies and fiat currencies.

Utilizing Debit Cards for Cash Out Without Bank Transfers

In this chapter, we'll explore an alternative method for accessing your cryptocurrency funds and converting them into traditional currency without needing a direct bank transfer. Debit cards offer a practical solution for those who seek a more direct and convenient way to cash out their crypto assets.

Debit Cards and Crypto Wallets: A Synergistic Approach

Cryptocurrency debit cards, also known as crypto debit cards, have emerged as a bridge between the crypto and traditional financial worlds. These cards can be linked to your crypto wallet, enabling you to use your cryptocurrency holdings for everyday expenses. This section delves into the benefits and considerations of using cryptocurrency debit cards as a cash-out method.

Advantages of Crypto Debit Cards

- Immediate Access: One of the primary advantages is instant access to your crypto holdings in the form of traditional currency. You can use the debit card for transaction at point-of-sale (POS) terminals, online purchases, or ATM withdrawals.

- Global Usability: Many cryptocurrency debit cards are accepted worldwide, allowing you to use them for transactions in multiple countries and currencies.

- Reduced Banking Dependency: Using crypto debit cards, you can bypass the need for direct bank transfers and enjoy a more direct connection between your crypto wallet and real-world spending.

Considerations and Limitations

While crypto debit cards offer numerous advantages, there are also certain considerations and limitations to be aware of:

- Fees: Crypto debit cards may come with various fees, including issuance fees, transaction fees, and foreign exchange fees. Understanding these costs is crucial.

- Security Measures: It's essential to ensure the security of your crypto debit card to protect your funds. This includes setting up secure PINs and enabling additional security features the card issuer provides.

- Limited Cryptocurrency Support: Not all cryptocurrencies may be supported by crypto debit cards, so it's important to verify which assets can be used with your specific card.

Convert Crypto to Fiat: Use a Crypto Debit Card for Cash Out

We'll outline the typical steps to use a debit card for cashing out your cryptocurrency holdings:

- Acquire a Crypto Debit Card: Choose the best cryptocurrency debit card and sign up for PlasBit services. You can choose the most suitable card for your needs, with different spending, withdrawal, and deposit limits.

- Link Your Crypto Wallet: Connect your crypto wallet to your debit card account, allowing you to load funds onto the card.

- Load the Card: Deposit a certain amount of funds onto the card, converting it into a fiat balance that can be used for spending.

- Use the Card: Your crypto debit card can be used for everyday transactions like a traditional debit card. Use it for purchases or withdraw cash from ATMs, as you would with a regular bank card.

- Monitor and Manage: Monitor your card's balance and transaction history through the card provider's app or platform. This will help you manage your crypto funds effectively.

By adopting this approach, you can effectively cash out your cryptocurrencies and utilize them for various financial activities while maintaining a certain degree of independence from traditional bank transfers. Cryptocurrency debit cards bridge the crypto and fiat worlds, offering a streamlined and user-friendly solution for accessing your digital assets.

Security and Privacy in Crypto Wallets

In cryptocurrencies, security and privacy are paramount when dealing with transactions, especially those involving the connection between crypto wallets and bank accounts. We will explore the crucial elements of securing your assets and maintaining financial privacy during these transactions.

Security in Bank Transfers Using Crypto Wallets

Security is paramount when managing digital assets and traditional bank transactions. Here's what you need to know:

- Password and 2FA Authentication: The password is your digital assets' keys to the kingdom. Safeguarding it is essential. Always store your password securely, as it grants access to your digital assets. In addition, implement two-factor authentication (2FA) to add an extra layer of security to your wallet.

- Secure Wallet Platforms: Some wallet platforms offer different levels of security. Choosing a reputable wallet is crucial. Ensure you keep your wallet software or hardware firmware up to date to protect against vulnerabilities and exploits. Our platform uses all the best precautions to avoid hacks, including multi-factor authentication, and users' funds are protected in cold wallets with multi-signature features.

- Encryption and Data Protection: Robust encryption is vital to secure transactions and personal information. Understanding the principles and practices of encryption can help you protect your data.

Recommended Security Measures

Here are some practical security measures you should consider when using crypto wallets that support bank transfers:

- Cold Storage: Cold storage involves keeping your cryptocurrencies offline, away from potential online threats. It's an effective way to secure your assets for the long term.

- Backup and Recovery: Creating regular backups of your wallet and understanding the recovery process is essential. In the event of wallet loss or theft, you should be able to restore your wallet securely and swiftly.

- Regular Auditing: Regularly monitoring your wallet and transaction history is a proactive approach to identify and address any unauthorized activity early, helping protect your assets.

Conclusion: The Future of Crypto Wallets in Banking

We'll synthesize the key takeaways from our exploration of crypto wallets that enable transfers to bank accounts and their implications for the future of finance.

Summary of Available Options

To start, let's recap the various aspects we've covered:

- Types of crypto wallets include software, hardware, and platform wallets.

- The significance of linking your wallet to a bank account for seamless financial interaction.

- In-depth reviews of crypto wallets with banking features and their pros and cons.

- Best practices for enhancing security and preserving privacy during transactions.

- A thorough examination of the fees and costs of using crypto wallets for bank transfers.

- Real-world use cases where this financial bridge between cryptocurrencies and traditional banking can shine.

- The role of crypto wallets in SWIFT transfers and their advantages and challenges.

Tips for Choosing the Right Wallet for Your Needs

Now, let's delve into practical guidance for selecting the ideal wallet to suit your unique requirements:

- Assess your security needs and choose a wallet that aligns with your risk tolerance and asset value.

- Consider the convenience and accessibility of the wallet, especially if you plan to use it for daily transactions.

- Examine the wallet's compatibility with your bank and the availability of features for your specific financial needs.

Future Outlook for Crypto Wallets

As the financial ecosystem continues to evolve, it's essential to consider the future of crypto wallets that allow transfer to bank account:

- Cryptocurrencies are becoming increasingly integrated into the mainstream financial system. This trend will likely continue, bringing even more options for seamless transfers between cryptocurrencies and traditional bank accounts.

- Innovations in blockchain technology and user interfaces are expected to make crypto wallets more user-friendly and secure.

- As governments and financial institutions respond to the rise of cryptocurrencies, regulations, and tax considerations may evolve, influencing the use of crypto wallets for financial transactions.

- The demand for more significant financial inclusivity, especially in regions with limited access to traditional banking, could drive the adoption of crypto wallets with banking features.

- Advancements in the use of cryptocurrencies for international trade, investment, and cross-border transactions may further establish the role of crypto wallets in global finance.

In conclusion, the world of crypto wallets that allow transfer to bank accounts is dynamic, offering versatility and accessibility in an ever-evolving financial system. The combination of security, convenience, and the potential for cost savings make this an attractive option for those seeking to navigate the interface between traditional and digital finance. As the financial world adapts to the rise of cryptocurrencies, crypto wallets will likely play a pivotal role in shaping the future of banking and financial transactions. By staying informed and making well-informed choices, individuals and businesses can harness the power of this technology for their economic benefit.