This comprehensive guide will explore the question: What Is CEX? Explore the distinctions between centralized and decentralized exchanges, evaluate the reliability of CEX, and explore its definition, functions, advantages, disadvantages, and role in the broader crypto landscape. One fundamental term that frequently surfaces in discussions about crypto trading is CEX.

What Does CEX Stand For?

The acronym CEX reveals its identity as a "Centralized Exchange".These exchanges, denoted by CEX, serve as vital hubs where users engage in the dynamic activities of buying, selling, and trading digital assets. What distinguishes Centralized Exchanges is their operational framework, orchestrated by centralized entities, often corporate entities or companies. The defining characteristic of CEX lies in its departure from the decentralized model, with transactions occurring under the watchful eye of a central authority, introducing a layer of oversight that can facilitate smoother trading processes. Unlike their decentralized counterparts, CEX platforms offer users a user-friendly interface and a structured environment that often includes fiat integration, bridging the gap between traditional and digital finance within the evolving tapestry of the cryptocurrency ecosystem.

What Is a Centralized Exchange?

A Centralized Exchange, often referred to as a CEX, stands as a linchpin in the world of cryptocurrency, offering a structured platform for the buying, selling, and trading digital assets. What is CEX? A CEX operates with a centralized authority, facilitating transactions and providing a user-friendly interface for individuals to engage in the dynamic realm of digital currencies. CEX's centralized nature sets it apart, operating under the governance and control of a central entity, often a company or organization. In contrast to decentralized exchanges, where users interact directly with smart contracts and retain control over their private keys, CEX introduces an intermediary that oversees and facilitates trading activities. The fundamental mechanism of a centralized exchange involves users creating accounts on the platform, depositing their cryptocurrencies into exchange-controlled wallets, and executing trades within the platform's ecosystem. This centralization fosters an environment of order and oversight, streamlining trading processes and providing a familiar interface for users. The platform manages order books, matches buy and sell orders, and ensures liquidity, creating a seamless trading experience. The advantages of Centralized Exchanges are evident in their user-friendly interfaces and accessibility. These platforms cater to users of varying levels of expertise, from beginners to seasoned traders, offering tools and features that simplify the trading journey. Furthermore, the centralized nature of these exchanges often allows for direct fiat integration, enabling users to trade cryptocurrencies with traditional currencies. This feature facilitates a more straightforward onboarding process for newcomers and expands the market accessibility for users worldwide. However, the centralized model of exchanges comes with its share of drawbacks. Security concerns are a prominent consideration, as the concentration of user funds and sensitive information becomes an attractive target for malicious actors. High-profile hacking incidents have underscored the importance of robust security measures on CEX platforms. Additionally, the need for users to undergo KYC (Know Your Customer) verification processes on centralized exchanges compromises the anonymity intrinsic to some decentralized alternatives. PlasBit Exchange distinguishes itself as a centralized crypto exchange (CEX) by implementing stringent procedures to ensure security and regulatory adherence. With a commitment to asset security, 100% of customer funds are stored in cold storage, adhering to a 1:1 backing ratio for accessibility and reliability. The emphasis on data protection through encryption technology aligns with CEX standards, safeguarding user confidentiality. Our platform's user-friendly interface, coupled with 24/7 customer support accessible through various channels, reflects the centralized approach, providing users with a convenient and centralized support system. The encouragement of identity verification further solidifies the platform's CEX status, enhancing account security and compliance with regulatory requirements. A Centralized Exchange embodies a trade-off between convenience and potential vulnerabilities in the cryptocurrency ecosystem. As the landscape continues to evolve, understanding the dynamics of CEX becomes essential for users navigating the multifaceted terrain of digital asset trading.

Key Features of Centralized Exchange

Centralized exchanges serve as the backbone of cryptocurrency trading, offering a myriad of features that shape the user experience and the overall functionality of these platforms. From the custody of private keys to sophisticated order book matching technology, each element plays a crucial role in defining the landscape of centralized exchanges. This overview delves into the key features, including user-friendly interfaces, regulatory compliance, and security measures, highlighting how these aspects collectively contribute to the seamless and secure trading environment that centralized exchanges strive to provide. Understanding these features is essential for novice and experienced traders navigating the dynamic world of digital assets.

Custody of Private Keys:

Centralized exchanges' custody of private keys is a double-edged sword in cryptocurrency trading. On the one hand, it offers users a streamlined and convenient transaction process, eliminating individuals needing to manage their cryptographic keys personally. This convenience is particularly appealing to novice users who may need help with the complexities of private key management. However, relying on exchanges to safeguard these keys introduces a crucial trust factor. Users entrust the security of their digital assets to the exchange's infrastructure, emphasizing the paramount importance of robust security measures and practices. The challenge for centralized exchanges lies in striking a delicate balance between providing user-friendly services and maintaining high security and trust within the cryptocurrency ecosystem.

Know Your Customer (KYC) Procedures:

The Know Your Customer (KYC) procedures implemented by centralized exchanges serve as a cornerstone of regulatory compliance within the cryptocurrency space. Beyond submitting identity information and verification documents, the KYC process is a meticulous and critical step for users and exchanges. Users gain the authorization to fund their accounts and engage in trading activities upon completing these procedures. The verification of KYC documents not only establishes the legitimacy of users and plays a pivotal role in preventing illegal activities such as money laundering and terrorist financing. By adhering to KYC regulations, centralized exchanges contribute to the broader effort of creating a secure and transparent financial ecosystem, aligning with regulatory standards, and fostering a sense of trust and accountability among users and regulatory bodies alike.

Order Book Matching Technology:

At the heart of centralized exchanges, the intricate order book matching technology is the linchpin of operational efficiency. This sophisticated system meticulously scans and identifies matches between buy and sell orders submitted by users. Doing so enables the swift and seamless execution of cryptocurrency trades, contributing to the dynamic nature of the market. Order books, a real-time ledger of trading activity, enhance liquidity and play a vital role in establishing fair market prices. The continuous updating and matching of orders ensure that buyers and sellers transact at prices that reflect current market conditions. This real-time transparency fosters a competitive and equitable trading environment, thereby underlining the pivotal role order book matching technology plays in maintaining the integrity and efficiency of centralized exchanges.

Liquidity Enhancement through Market Makers:

The symbiotic relationship between centralized exchanges and market makers is integral to the fluidity and vibrancy of cryptocurrency markets. Market makers, often entities or individuals with expertise in trading, assume a crucial role in enhancing liquidity on these platforms. By providing competitive spreads for the listed cryptocurrencies, market makers contribute to narrowing bid-ask spreads, a key factor in creating a more liquid market. This collaboration fosters a dynamic and competitive trading environment and attracts a diverse range of traders, from institutional investors to individual retail participants. Market makers' continuous presence ensures a ready market for buying and selling, mitigating the risk of slippage and promoting price efficiency. The partnership between centralized exchanges and market makers is instrumental in maintaining a robust and accessible marketplace for participants of varying sizes and trading strategies.

User-Friendly Interface:

The emphasis on a user-friendly interface within centralized exchanges extends beyond mere aesthetics, forming a cornerstone of the user experience. These platforms prioritize accessibility by designing interfaces catering to a diverse user base, accommodating beginners and seasoned traders. Including intuitive tools and charts for technical analysis further enhances the overall usability, empowering users to make informed decisions. The positive user experience is not only about visual appeal but also revolves around streamlined functionality, ensuring users can navigate the platform seamlessly. From straightforward account management to executing trades, the user-friendly interface is engineered to reduce complexities associated with cryptocurrency trading, fostering a more inclusive space where individuals with varying levels of expertise can confidently engage in the market. This commitment to user-centric design positions centralized exchanges as approachable and accommodating hubs in the broader landscape of digital asset trading.

Compliance with Regulatory Standards:

Centralized exchanges' commitment to regulatory compliance extends beyond Know Your Customer (KYC) procedures, encompassing a comprehensive adherence to broader regulatory requirements. In navigating the evolving legal landscapes of the cryptocurrency industry, exchanges recognize the importance of aligning with established standards to foster a secure and trustworthy trading environment. This dedication involves staying abreast of regulatory developments, implementing robust anti-money laundering (AML) protocols, and engaging in transparent reporting practices. By proactively meeting and often exceeding regulatory expectations, centralized exchanges demonstrate their commitment to legal integrity and contribute to the broader acceptance of cryptocurrencies in the financial mainstream. Such compliance instills confidence among users and positions these platforms as responsible and accountable players in the ever-evolving regulatory landscape of the digital asset ecosystem.

Security Measures:

In recognizing the critical importance of safeguarding user assets and sensitive data, centralized exchanges deploy a multifaceted security approach beyond holding private keys. Two-factor authentication (2FA) stands as a frontline defense, adding a layer of identity verification to user accounts. Encryption techniques are employed to secure communication channels, protecting against potential eavesdropping and data breaches. To bolster these measures, many exchanges subject their security systems to rigorous scrutiny through periodic audits conducted by reputable third-party firms. These audits serve as a proactive evaluation of the exchange's security infrastructure, identifying vulnerabilities and ensuring that best practices are consistently upheld. By implementing these comprehensive security measures, centralized exchanges mitigate the risks related to cyber threats and reinforce user trust, making the platform a robust and secure environment for storing and trading digital assets.

Custodial Wallet Services:

Custodial wallet services by centralized exchanges represent a significant convenience for users seeking a streamlined and hands-off approach to managing their digital assets. A custodial wallet, managed by the exchange, alleviates users from the responsibility of independently handling private keys. This service is particularly appealing to those who may find the intricacies of private key management daunting or wish to delegate this task for the sake of simplicity. While offering an additional layer of ease and accessibility, the reliance on custodial services underscores the importance of trusting the exchange's security protocols. Users must be confident in the robustness of the exchange's infrastructure, as the custodial relationship implies a degree of dependence on the exchange for the security and integrity of their crypto holdings. Striking a balance between user convenience and ensuring a secure custodial environment is key for centralized exchanges providing services to meet their user base's varied preferences and needs.

Insurance Coverage for User Assets:

Including insurance coverage for user assets is a strategic move by centralized exchanges to foster a heightened sense of security and confidence among their user base. The potential for unforeseen events, such as hacks or system failures, is a constant concern in the cryptocurrency market's dynamic and often unpredictable landscape. By offering insurance coverage, exchanges provide users with a crucial safety net, reassuring them that their financial losses will be mitigated in case of a security breach or technical failure. This feature provides a layer of protection and demonstrates the exchange's commitment to the financial well-being of its users. The varying nature of insurance policies across exchanges reflects a nuanced approach to risk management, and the transparency surrounding these policies strengthens the overall trust and reliability users place in the centralized exchange, ultimately contributing to the platform's credibility in the eyes of the broader cryptocurrency community.

Centralized vs. Decentralized Exchange

Cryptocurrency trading is marked by the ongoing debate between centralized exchanges (CEX) and decentralized exchange s (DEX). Each model has advantages and drawbacks, shaping the user experience and security protocols in distinct ways.

Centralized Exchanges (CEX)

User-Friendly Interface:

One of the primary advantages of CEX platforms is their user-friendly interface. Designed to cater to users of varying levels of expertise, these platforms often provide intuitive dashboards, trading charts, and tools, making them accessible to beginners and experienced traders.

Liquidity:

CEX platforms are known for their higher liquidity compared to DEX. Liquidity is vital for efficient trading, ensuring users can buy or sell assets without significant price slippage. The centralized structure facilitates liquidity pooling from various sources, enhancing the overall trading experience.

Advanced Trading Features:

Centralized exchanges often offer advanced trading features such as margin trading, futures contracts, and stop-loss orders. These features cater to experienced traders looking for diverse investment opportunities and strategies.

Fiat Integration:

Answering the question what is CEX? commonly supports direct trading with fiat currencies, simplifying the onboarding process for crypto users. This integration with traditional currencies provides a familiar bridge for individuals transitioning from conventional financial systems.

Decentralized Exchanges (DEX)

Complex User Experience:

DEX platforms are often criticized for having a steeper learning curve. The decentralized nature requires users to interact directly with smart contracts and manage their private keys, which can be daunting for those new to crypto.

Lower Liquidity:

By their decentralized design, DEX platforms may need higher liquidity than their centralized counterparts. This can lead to challenges such as higher price slippage, especially when trading larger volumes.

Limited Trading Pairs:

While the number of trading pairs on decentralized exchanges has increased, they may offer a different variety than centralized exchanges. This limitation can restrict users looking for specific cryptocurrencies or trading pairs.

Security Concerns:

While decentralized exchanges aim to provide enhanced security by eliminating the need for a central authority, they are not immune to vulnerabilities. Smart contract exploits and hacking incidents have been reported, highlighting the need for consideration of security measures.

How To Buy Crypto on a CEX?

Buying cryptocurrency on a centralized exchange involves a series of straightforward steps, with the deposit process being a crucial starting point. PlasBit offers users a variety of deposit options to fund their accounts, providing flexibility and convenience. Acquiring USDC through various deposit options on our cryptocurrency exchange provides flexibility. Follow these steps from account registration to exploring deposit options:

Register Your Account:

- Click "Get Started" to begin the registration process.

- Provide your email address and produce a secure password.

- Agree to the "Terms of Use" and complete the captcha.

- Verify your email and access your "Dashboard."

Depositing Fiat Currency:

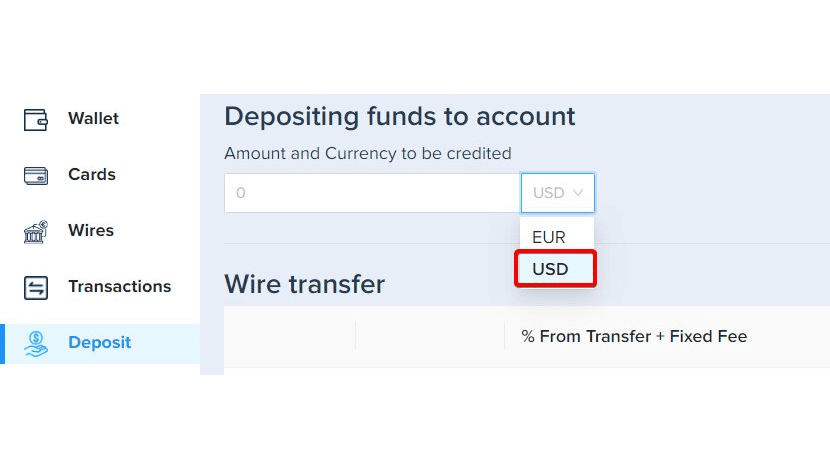

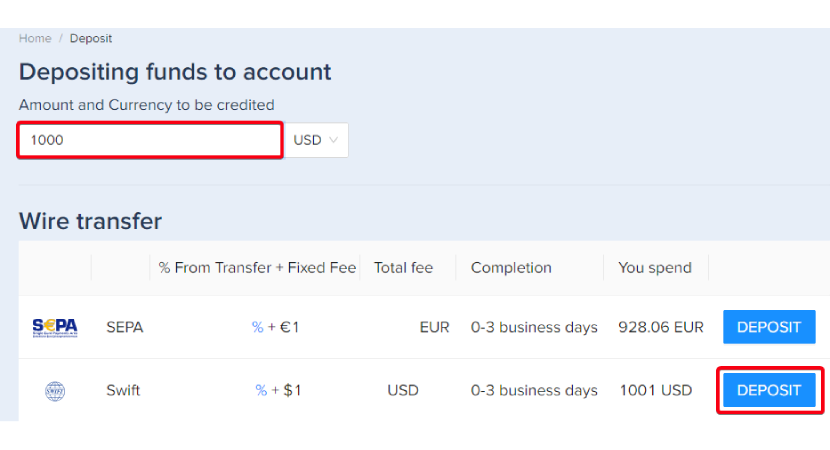

1. Navigate to the "Deposit" section on your dashboard.

2. Specify the fiat amount (USD) you want to deposit.

3. Choose your preferred payment method:

SEPA Bank Transfer:

Opt for this method for Euro deposits within the SEPA zone, ensuring cost-effective and efficient transactions.

Swift Bank Transfer:

Choose Swift for international deposits, offering a global solution with associated fees and varying completion times.

Credit Card:

Select the credit card option (Visa or Mastercard) for a swift deposit process with associated fees.

How to Buy USDC with Bank Transfer:

- After depositing fiat, click "Wire Transfer" and choose SEPA or Local Bank.

- Take note of associated fees and the completion time.

- Initiate the deposit process.

How to Buy USDC with a Credit Card:

- Click "Deposit" and choose the "bank card" option (Visa or Mastercard).

- Note the fees and completion time for credit card deposits.

- Initiate the deposit process.

How to Buy USDC with Other Cryptocurrencies:

- Log in and access your dashboard.

- Navigate to the "Exchange" section.

- Choose USDC as the target currency.

- Specify the cryptocurrency amount to exchange.

- Select the crypto to sell and confirm the total amount.

- Review and confirm transaction details.

- Execute the exchange and monitor the transaction status.

By understanding these deposit options, users can leverage the method that aligns with their preferences and needs for acquiring USDC on our platform.

The Future of Crypto Exchanges

The future trajectory of cryptocurrency exchanges is poised for remarkable growth, driven by the escalating mainstream acceptance of digital currencies and the dynamic evolution of the crypto landscape. As governments and regulatory bodies worldwide respond to the expanding influence of cryptocurrencies, implementing structured regulations will be a factor in shaping the operations of crypto exchanges. Establishing regulatory frameworks is expected to foster increased investor confidence, opening avenues for integration with traditional financial institutions and creating a market environment that prioritizes security and transparency. This regulatory clarity will not only enhance the legitimacy of crypto exchanges but also pave the way for broader adoption by institutional investors, potentially catalyzing a new era of maturity for the crypto market. In tandem with regulatory developments, technological advancements are poised to revolutionize the functionality of crypto exchanges. Innovations such as decentralized finance (DeFi) protocols, blockchain interoperability, and improved consensus mechanisms promise to enhance the usability and efficiency of crypto exchanges. These technological strides will refine the overall user experience, streamline transaction processes, and fortify the operational infrastructure of exchanges, contributing to a more seamless and accessible crypto trading ecosystem. Despite the optimistic outlook, crypto exchanges will grapple with persistent challenges that have plagued the industry. Adverse regulatory developments, potential market manipulation, and ongoing security concerns remain significant hurdles. Mitigating these challenges will be paramount for sustainable growth and enduring success for crypto exchanges. The industry's ability to navigate and address these issues, coupled with continued innovation and adaptation, will play an important role in shaping the future landscape of cryptocurrency exchanges as they continue to play a central role in the global financial landscape.

Is CEX Reliable?

In cryptocurrency trading, the reliability of centralized exchanges (CEX) is a paramount concern for users navigating the dynamic landscape of digital assets. Several factors contribute to assessing the reliability of CEX platforms, ranging from security measures and operational transparency to regulatory compliance. First and foremost, many established centralized exchanges implement rigorous security protocols to safeguard user funds and sensitive information. Measures such as 2FA, cold storage for most user funds, and encryption techniques help fortify the platforms against potential cyber threats. Notable exchanges often undergo regular security audits conducted by third-party firms to validate the effectiveness of their security measures, providing an additional layer of assurance to users concerned about the safety of their assets. Transparency is another key aspect that influences the reliability of CEX. Reputable platforms are increasingly adopting mechanisms like Proof of Reserves, which allows users to independently verify that the exchange holds the amount of cryptocurrency it claims to have. This transparency initiative builds trust among users and demonstrates a commitment to responsible business practices. Furthermore, communication practices, including regular updates on system status, ongoing developments, and security enhancements, contribute to the overall transparency of a CEX, further solidifying its reliability in the eyes of the user base. PlasBit prioritizes the security and accessibility of our users' crypto assets by maintaining a 1:1 reserve on our platform. Our proof of reserves for Bitcoin demonstrates a verified 103% coverage, ensuring that we have accounted for and secured 103% in the exchange and third-party custody for every Bitcoin held by users. Similarly, our proof of reserves for Ethereum reflects a strong 103% coverage, reinforcing transparency and trust by backing users' 966,527 ETH holdings with 978,378 ETH in the exchange and an additional 10,253 ETH in third-party custody. Additionally, we offer a KYC verification service, where users can provide their ID for verification, further enhancing the security and integrity of our platform. Regulatory compliance is a crucial factor that must be considered when evaluating the reliability of a CEX. Exchanges that adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations demonstrate a commitment to legal and regulatory standards. User verification processes mandated by KYC not only enhance the security of user accounts but also ensure that the exchange operates within the bounds of applicable laws. This alignment with regulatory frameworks adds an extra layer of legitimacy, positioning compliant CEX platforms as reliable entities in the cryptocurrency ecosystem.

Conclusion

The landscape of centralized exchanges (CEX) is multifaceted, encompassing key features, operational dynamics, and the ongoing debate surrounding centralized versus decentralized models. From the custody of private keys to advanced trading features and regulatory compliance, CEX platforms play a pivotal role in molding the user experience within the cryptocurrency ecosystem. The future trajectory of crypto exchanges holds promise, driven by regulatory developments and technological innovations that enhance security, transparency, and overall usability. As exemplified by platforms, Assessing CEX platforms' reliability involves a comprehensive consideration of security measures, transparency initiatives, and regulatory compliance. As the industry evolves, navigating challenges and embracing advancements will be crucial for cryptocurrency exchanges' enduring success and maturation on the global financial stage.