Over the past few years, the cryptocurrency market has grown significantly worldwide, with Austria playing a vital role in this dynamic industry. If you're looking to convert your Bitcoin to Euro, such as the euro, and transfer it to your bank account in Austria, you should be aware of several procedures, laws, and regulations. So, how can I convert my crypto into real cash? For instance, our website offers a "bank wire" feature that enables customers to convert their Bitcoin into cash. PlasBit supports Austria as one of the countries where users can easily convert their digital assets into fiat currency. In this article, we will provide insights on several topics, including how to use the PlasBit wire feature, the laws and regulations on crypto in Austria, the growing community, the history of adoption, and finally, we'll conclude with alternatives to convert your Bitcoin to Euro in Austria.

Is it possible to exchange Bitcoin in Austria?

A common query among cryptocurrency users is how to exchange crypto for fiat. There are many ways to answer the question “how do I sell Bitcoin in Austria,” but using the wire feature of PlasBit is a simple way to answer this question. This part of the article contains a comprehensive guide that will help you to exchange Bitcoin into your bank account utilizing this unique feature. Please confirm that you presently have Bitcoin in your PlasBit wallet to guarantee successful wiring.

Step-by-Step guide for using Plasbit’s Wire

Step 1: Open you PlasBit account

In the first step, head to the official website of PlasBit and open the login page. Enter your valid username and password to exchange your Bitcoin to Euro.

Step 2: Track down the “Wires” section

After logging in to your account, you can see some options on the left side of the page. Click on the wires section to go onto the page that handles the procedure of bank wire transfer.

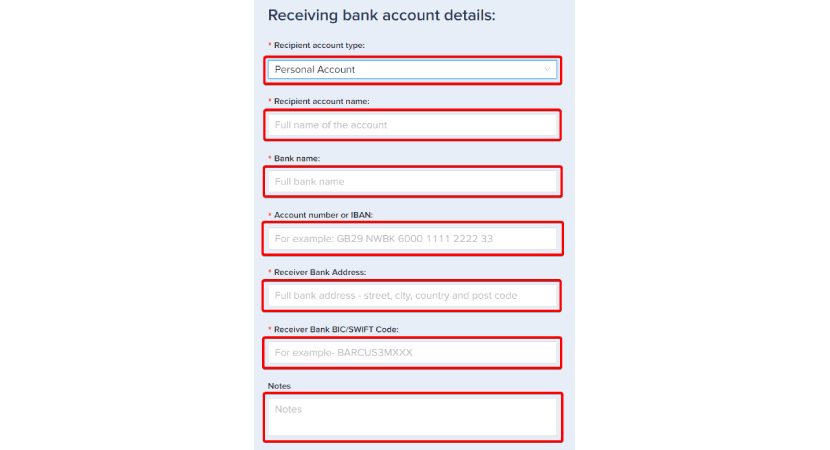

Step 3: Enter the recipient’s bank details

After choosing the Wires section, you have to fill out all the receiving bank account details, including account type, account name, bank name, account number or IBAN, bank address, BIC/Swift code, and any optional notes (if you want to add them) for your reference.

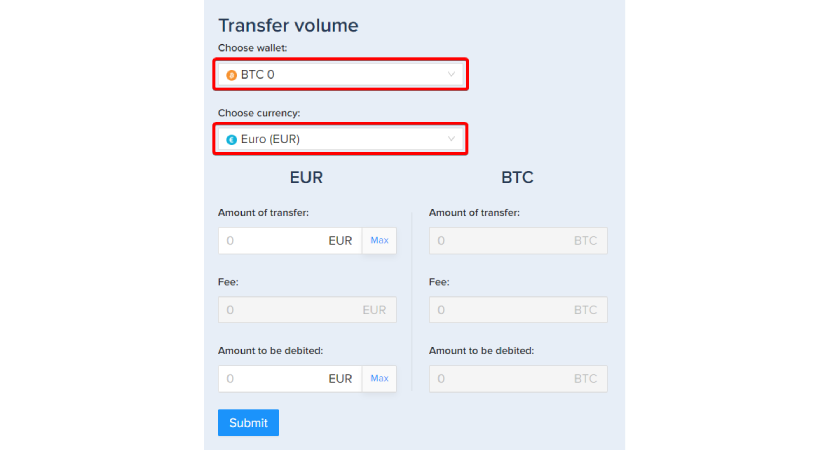

Step 4: Choose the wallet and fiat cash type

After submitting your bank account information, you have to continue by selecting the type of wallet or a token (Bitcoin in this case) and the fiat currency you want it to get converted into (euros). It will allow you to sell Bitcoin for euros, and our system will decide the amount, fees, and the total amount received.

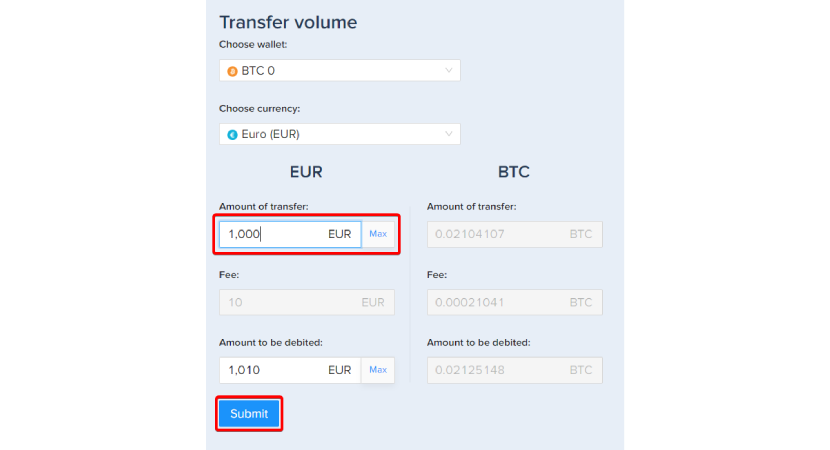

Step 5: Start the Wire Transfer Process

After selecting your preferred token and fiat currency, you can enter the desired amount to transfer to your bank account. Once you have entered the amount, click on the submit button to receive confirmation of the deducted cryptocurrency amount. You can specify the withdrawal amount, inclusive of any applicable fees. If you choose this option, the entered amount will reflect the total amount transferred to your account after the fee deduction. Alternatively, you may input the intended transfer amount, whereby fees will be applied accordingly.

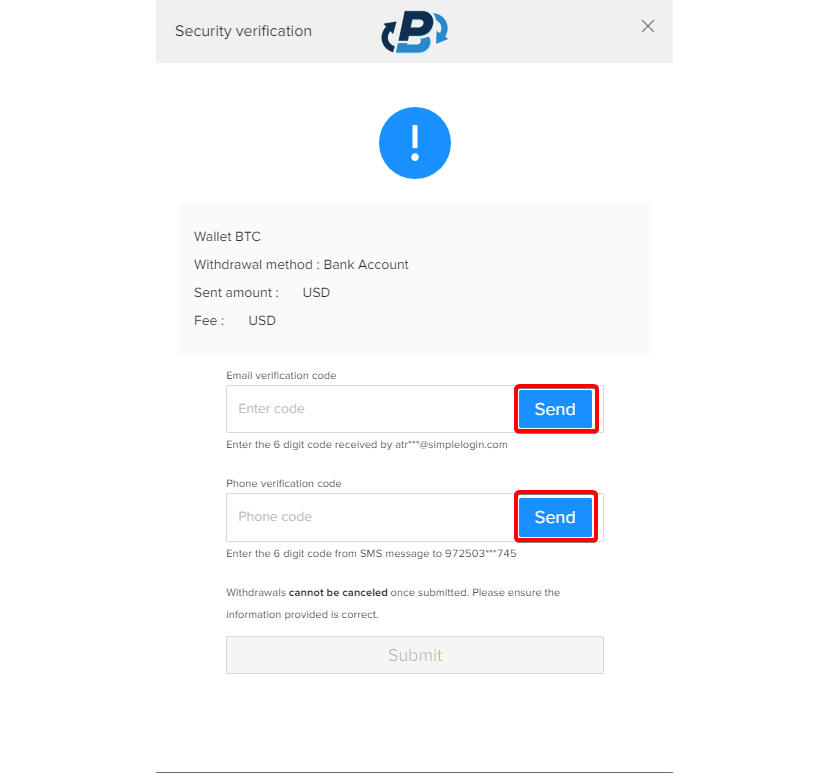

Step 6: Verification for Security

After initiating the wire transfer, you will receive a security verification code. This code will be sent to you based on the verification method you have enabled. You have the option to receive the verification code either via SMS to your registered phone number or through your registered email address. Once you have received the code, enter it accurately into the designated field on the verification page. Then, click on “Submit” to initiate the wire transfer request.

Step 7: Verify the wire transfer confirmation

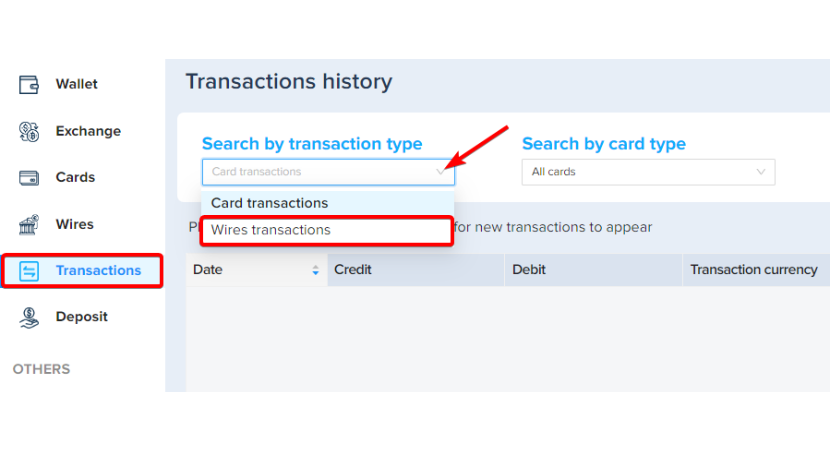

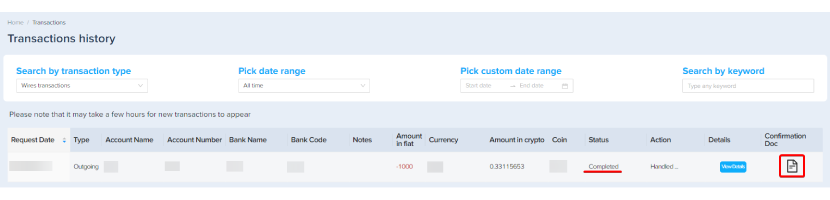

Once your wire transfer is successfully validated, you will receive an email with instructions to submit a bank wire request through our website. Once we approve the wire transfer, you will receive an email confirming the completion of the transaction. You can also check the status of your wire transfer by logging into your PlasBit account. Go to our website, click “Transactions” on the left side of your screen, and select “Wires transaction” to view all the relevant details.

You can see all the details of the initiated wire, like transaction status, bank details, confirmation doc from the bank, etc., in this section.

Is crypto regulated in Austria?

Now, as we have discussed “how do I sell Bitcoin in Austria”, let's take a closer look at the laws and regulations on crypto in this nation. Over time, the Laws of Austria on cryptocurrencies have changed as the government has tried to address the benefits and challenges of digital assets. Cryptocurrencies are not considered legal tender in Austria. Instead, they are digital commodities or assets subject to the laws and regulations on crypto that apply to investments and financial transactions.

Regulatory Bodies

The primary regulatory authority overseeing cryptocurrency-related activities in Austria is the Financial Market Authority (FMA). All facets of the financial markets, including securities, banking, insurance, and cryptocurrencies, are governed by the FMA. The FMA is

crucial in determining how to shape regulations about cryptocurrencies. It works with international organizations, industry players, and other governmental bodies to create frameworks that support financial stability, investor protection, and market integrity. If entities fail to comply with regulations or breach regulatory requirements, the FMA can enforce measures against them. These actions may encompass issuing warnings, levying fines, or even revoking licenses as deemed necessary to maintain regulatory integrity.

Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

Exchanges and wallet providers are examples of businesses involved in cryptocurrency-related operations that might need to register or obtain a license from the FMA. Applying for the permit will reduce the risks of financial crime and fraud by ensuring compliance with know-your-customer (KYC) and anti-money laundering (AML) rules. Strict AML regulations have been put in place in Austria to stop illegal activities possible by cryptocurrency. Exchanges and other cryptocurrency service providers must put strong AML policies in place. These policies must include transaction monitoring, client due diligence, and reporting of questionable activities.

European Union Regulation

Apart from the domestic regulatory framework, Austria is also bound by the legislation of the European Union (EU) concerning financial services and cryptocurrencies. Austria complies with EU directives and rules as a member state to promote uniform standards within the European Economic Area (EEA). With initiatives like the Fifth Anti-Money Laundering Directive (5AMLD), which includes provisions specifically targeting virtual asset service providers (VASPs), which include cryptocurrency exchanges and wallet providers, the EU has been proactive in addressing the opportunities and challenges posed by cryptocurrencies. Moreover, the Markets in Crypto-Assets Regulation (MiCAR) of the European Union seeks to create a thorough legal framework for digital assets throughout the EU by regulating the issuance and trading of crypto-assets.

In conclusion, Austria has created a thorough regulatory framework for cryptocurrencies with an emphasis on taxation, investor protection, and AML compliance. Austria endeavors to cultivate a favorable atmosphere for conscientious innovation and enduring expansion in the cryptocurrency sector through partnerships with regulatory bodies and industry participants.

The History of Bitcoin Adoption in Austria

The history of Bitcoin adoption in Austria shows a gradual but consistent increase in the nation's interest in and usage of the cryptocurrency. When Bitcoin came onto the scene in 2009, it mainly attracted the attention of tech-savvy individuals and cryptocurrency enthusiasts. Although it had limited appeal, early adopters and enthusiasts in Austria were drawn to Bitcoin because of its disruptive potential. People with technical backgrounds and a strong interest in alternative finance began experimenting with software development, mining, and Bitcoin trading.

In 2013, online forums and groups dedicated to Bitcoin and other cryptocurrencies emerged in Austria. These forums and groups served as a platform for Austrian Bitcoin supporters to network, discuss, and share their expertise on sites like Reddit, Bitcointalk, and other local forums. At this time, the earliest Bitcoin companies and start-ups began to appear in Austria. Cryptocurrency exchanges, wallet providers, and payment processors started to offer services tailored especially for Austrian customers, facilitating the buying, selling, and storing of Bitcoin.

In late 2017, Bitcoin's value increased sharply, which grabbed the attention of mainstream media worldwide, and Austria was no exception. This upsurge sparked a wave of new users and investors who became interested in Bitcoin and wanted to learn more about it. Many Austrian companies started accepting Bitcoin payments for their goods and services, especially in tech-forward cities like Vienna and Graz. While it is still on a small scale, cafes, restaurants, and even some conventional businesses have started accepting Bitcoin payments.

The Financial Market Authority (FMA) and other regulatory bodies in Austria have clarified the legal standing of Bitcoin and other cryptocurrencies. Despite the risks associated with digital assets, Austrian regulators acknowledged the potential advantages of blockchain technology and innovation and took an open-minded approach toward them.

The Bitcoin ecosystem in Austria has grown significantly in recent years, with a stable infrastructure comprising wallets, exchanges, and regulatory bodies in place. Traditional financial services in Austria are increasingly integrating with Bitcoin and other cryptocurrencies. To meet the changing demands of clients looking for exposure to digital assets, several banks offer services associated with cryptocurrencies, such as custody options or joint ventures with cryptocurrency exchanges. Institutional investors, including asset management companies and corporate treasuries, are interested in Bitcoin as a hedge against inflation and macroeconomic volatility. This institutional influx helps legitimize Bitcoin as an investment asset class and store of value.

In conclusion, the trajectory of Bitcoin adoption in Austria may be summarized as one of early experimentation, gradual mainstream acceptance, and continuous integration into a range of societal and economic domains. Although there are still obstacles to overcome, such as regulatory complexity and volatility concerns, the general trend points to an increasing acceptance and use of Bitcoin inside Austria's financial system.

Taxation on Bitcoin in Austria

Numerous countries are friendly to crypto tax, but unfortunately, Austria is not one of them. Cryptocurrencies are assets subject to capital gains tax under Austria's tax regulations, which govern the taxation of cryptocurrencies, including Bitcoin. The exchange or sale of cryptocurrencies, whether they result in gains or losses, is treated the same way as the sale of real estate or stocks. The Austrian tax authorities have intensified their enforcement of cryptocurrency tax compliance. They employ various techniques, including data analysis and audits, to ensure that individuals and businesses accurately report their cryptocurrency-related income and capital gains.

Capital Gains Tax

The profits from the sale or exchange of cryptocurrencies are subject to capital gains tax. The tax is calculated based on the difference between the buying and selling prices of the cryptocurrency. The tax rate applied varies on the duration of owning the asset. Profits from its sale or exchange are subject to short-term capital gains tax if a cryptocurrency is held for less than a year. This tax rate depends on the individual's income level and can be as high as 55%. Similarly, if a cryptocurrency is held for more than a year before being sold or exchanged, the gains are categorized as long-term capital gains and are liable to a flat tax rate of 27.5% in Austria.

VAT Treatment

Cryptocurrencies are free from value-added tax (VAT) in Austria, implying that the transactions involving the purchase, sale, or exchange of cryptocurrencies are exempt from VAT. The exception covers cryptocurrency-related transactions involving both individuals and businesses. No VAT is charged for transactions involving the purchase of goods or services in Austria by individuals or businesses using cryptocurrency. This exception makes it easier for cryptocurrencies to be accepted in business transactions and promotes their usage as a medium of exchange. The VAT regulation of the European Union, which exempts transactions involving legal tender currencies and specific financial services from VAT, is in line with Austria's exemption from VAT on cryptocurrencies.

Taxation on Mining Income

In Austria, money earned through cryptocurrency mining is liable to taxes. Profits from mining cryptocurrencies are classified as business income instead of capital gains, implying that the revenues from mining operations are taxable to both persons and companies that engage in mining activities. The individual's income tax rate, which fluctuates based on the total taxable income received during the tax year, applies to revenue from mining cryptocurrencies. In Austria, income tax rates vary from 0% to 55%, with higher rates for higher income brackets.

In conclusion, capital gains tax is levied in Austria on earnings from the exchange or sale of cryptocurrencies, with tax rates changing according to how long the asset is held. To avoid fines or legal repercussions, people who transact with cryptocurrencies must comply with reporting regulations and pay their taxes. Austria's tax system will probably change as the bitcoin market develops to take into account new regulations and shifting consumer preferences.

Attractive crypto community of Austria

Austria boasts a flourishing and extensive cryptocurrency ecosystem involving investors, developers, enthusiasts, and business owners. Through different types of initiatives, several established crypto groups actively support the expansion of this ecosystem. Austria has several internet communities on Facebook and Telegram that host physical meetups and gatherings for crypto enthusiasts. These events offer opportunities to share knowledge, network with experts in the field, and engage in discussions with like-minded individuals. In this article, we will explore some of the top crypto communities in Austria.

CryptoAustria

Crypto Austria is a popular online forum for Austrian cryptocurrency enthusiasts. It provides a platform for its members to engage in conversations, share knowledge, and stay updated with the latest news related to cryptocurrency. The community is active on Facebook and regularly holds get-togethers, workshops, and online chats to create a welcoming environment for people interested in learning about and using Bitcoin.

Lion CALLS AT Austria

An active cryptocurrency community on telegram called "Lion CALLS AT Austria" serves as a guide for beginners in Austria interested in cryptocurrency and provides a platform to share insights, market trends, updates, and statistics related to the topic. Enthusiasts and experts engage in discussions of blockchain, Bitcoin, and other relevant fields in the group.

University research programs

Universities in Austria, such as the Vienna University of Economics and Business (WU Wien), offer research programs and academic courses focusing on blockchain and digital currencies. These programs allow students to explore blockchain technology through research projects and interdisciplinary collaborations. There are also several courses and workshops held by the university that cover several topics, including blockchain fundamentals, smart contracts, decentralized finance (DeFi), and cryptocurrency trading.

Events and Meetups

The Vienna Blockchain Meetup is a regular event held in the Austrian capital. It is an excellent opportunity for blockchain developers, enthusiasts, and entrepreneurs to come together and exchange ideas. The meetup covers various topics related to blockchain technology and cryptocurrencies and includes presentations, panel discussions, and networking opportunities. Crypto Cafe Vienna is a popular gathering place for Viennese residents interested in cryptocurrencies. The cafe hosts unofficial get-togethers and conversations where patrons can converse freely, share stories, and gain knowledge from one another in a laid-back environment.

In conclusion, the cryptocurrency community in Austria is known for its robust online communities, educational programs, entrepreneurial initiatives, and social events. Over time, these activities are helping to foster growth and development in the Austrian crypto ecosystem by promoting innovation, cooperation, and the exchange of information.

Alternative ways for selling Bitcoin in Austria

Plasbit’s wire feature is just one of the many alternatives and answers to the question, “How do I sell Bitcoin in Austria.” There are a few other ways you can always use for selling your Bitcoin or withdrawing Bitcoin to Euro. Some examples of these alternative approaches are Crypto ATMs, OTC trading services, and Direct trades.

Crypto ATMs

Bitcoin ATMs are becoming more common in Austria's major cities, such as Salzburg, Graz, Linz, and Vienna. These cities have a larger population and a greater demand for Bitcoin services, resulting in a greater concentration of Crypto ATMs. These machines allow customers to quickly and easily sell Bitcoin for cash and also let them take out euros right from the machine. Crypto ATMs give consumers convenient access to Bitcoin transactions during their daily routines and are frequently seen in prominent places like cafes, retail centers, transit hubs, and convenience stores.

OTC trading services

An OTC cryptocurrency trading service is available for individuals and institutions who want to trade large amounts of Bitcoin. These platforms offer secure transactions and reasonable prices to Austrian vendors. A few financial service providers and local cryptocurrency brokerages offer OTC Bitcoin trading services in Austria. Sellers can interact with these brokerages to sell their Bitcoin at market rates or to create custom agreements that meet their specific requirements.

Direct trades

Direct trading opportunities can occasionally arise from participating in local cryptocurrency communities and networking with other enthusiasts of Bitcoin. Social media groups, forums, and meetups are examples of platforms that could help link users with others interested in purchasing Bitcoin directly from Austrian merchants.

In conclusion, in addition to using PlasBit's wire feature to exchange or sell your Bitcoin, you can also consider the alternatives mentioned above based on your needs and requirements. However, it is vital to consider factors such as transaction costs, security, liquidity, and the desired level of privacy before deciding how to sell Bitcoin in Austria. Sellers should also ensure that they comply with all local laws and tax obligations related to Bitcoin transactions.

Factors to consider when choosing a method

Before choosing a method to sell Bitcoin, it's essential to consider several factors to ensure a smooth and secure transaction. You can find some basic factors to always look for before making any type of decision:

Transaction Fees

A range of fees, such as trading, withdrawal, and network fees, may be associated with different selling strategies. To find the most economical choice, compare the fees related to each technique.

Security

Prioritizing security above everything else is crucial when selecting a sales strategy. Verify the platform's or service provider's robust security procedures to guard against fraud or unauthorized access to your financial information and data.

Liquidity

If you plan to sell a significant amount of Bitcoin, you should consider the liquidity of the selling method. Select a way that will accommodate the amount of your transaction with sufficient liquidity to avoid delays or price slippage.

In conclusion, you should select a selling method that best suits your needs for affordability, security, dependability, and convenience, which will ensure a smooth and stress-free Bitcoin sale process.

Conclusion

One of the easiest and most effective solutions to the main question, "How do I sell Bitcoin in Austria?" may be found in PlasBit's "Wire" feature. Austria has a friendly atmosphere, a legal framework, a booming cryptocurrency business, and several selling options for those looking to sell their Bitcoin holdings for euros or USD. By following the practical advice given above and keeping up with the latest developments in legislation and tax strategies, individuals can successfully and swiftly navigate the Bitcoin world.