Many crypto investors and holders are asking themselves if can you cash out crypto for real money? Yes, you can exchange it to fiat like Euro or USD by either loading your crypto into a crypto card and spend it online and in person just like any other debit card or depositing crypto to your wallet and exchanging it to a bank wire. We will provide a detailed overview of the different ways to cash out your crypto and the pros and cons of the different methods, and the important considerations you need to keep in mind.

Different Ways to Convert Crypto to Fiat

This section will explore the different methods available for converting crypto to fiat, providing insights into the intricacies of each approach.

Crypto Debit Cards:

Cryptocurrency debit cards, exemplified by offerings from Plasbit, represent a seamless integration of digital and traditional financial ecosystems. Intricately linked to your crypto wallets, these cards offer a user-friendly and convenient avenue for spending digital assets in everyday transactions. The versatility of cryptocurrency debit cards extends to their acceptance at any merchant that accommodates regular debit or credit cards, facilitating a widespread integration into existing payment systems. While these cards provide an instantaneous gateway to fiat funds, it's essential to consider potential transaction fees associated with their usage and acknowledge that their availability might be comparatively limited when juxtaposed with traditional banking cards. The evolving landscape of cryptocurrency debit cards signifies a transformative step towards enhancing the practicality of digital currencies in day-to-day financial activities while prompting users to weigh the associated considerations for an informed and seamless financial experience.

Cryptocurrency Exchanges:

Cryptocurrency exchanges are the primary gateway for individuals seeking to navigate the intricate landscape of converting their digital assets into fiat currency. Serving as instrumental conduits, these platforms streamline the process by facilitating the seamless sale of crypto holdings. Engaging in this journey often entails users creating an account on the chosen exchange, followed by identity verification procedures and the subsequent execution of a sell order. This method, although straightforward, plays a pivotal role in providing liquidity to crypto holders, allowing you to transform your digital wealth into tangible, real-world funds. The user-friendly interface of these exchanges, coupled with their liquidity-providing function, positions them as foundational pillars in the crypto-to-fiat conversion process, catering to the diverse needs of individuals navigating the dynamic realm of cryptocurrency transactions.

Peer-to-Peer (P2P) Exchanges:

Peer-to-Peer (P2P) exchanges like LocalBitcoins and Paxful present a distinctive alternative for individuals seeking a personalized and direct approach to buying or selling Bitcoin and digital assets. These platforms directly connect buyers and sellers, fostering negotiation and agreement on transaction terms. What distinguishes P2P exchanges is the versatility of payment methods, ranging from traditional bank transfers to cash transactions, providing users with considerable flexibility in executing transactions. While P2P exchanges empower participants with greater control and a tailored trading experience, it's essential to approach this avenue cautiously, given the potential for scams. However, with diligent research, adherence to security best practices, and an astute awareness of the potential risks, individuals can navigate the P2P exchange space securely, facilitating mutually beneficial transactions and harnessing the unique advantages offered by this decentralized approach.

Bitcoin ATMs:

Bitcoin ATMs are tangible manifestations of the crypto revolution, scattered across diverse locations globally. These physical machines serve as direct conduits for converting Bitcoin into real cash, giving you a swift and convenient way to access your digital assets in real-world transactions. Initiating transactions at Bitcoin ATMs involves a seamless process, allowing individuals to exchange their digital holdings for fiat currency effortlessly. However, the inherent convenience of Bitcoin ATMs may come at the cost of higher transaction fees when compared to alternative methods, and their availability is often subject to geographic constraints. Despite these considerations, for those who prioritize immediacy and seek a real connection between their digital wealth and physical currency, these ATMs are a unique and straightforward solution, embodying the evolving landscape of cryptocurrency integration into everyday financial activities.

Step-by-Step Guide to Convert Crypto to Fiat

Crypto to Fiat Exchange with PlasBit Debit Card

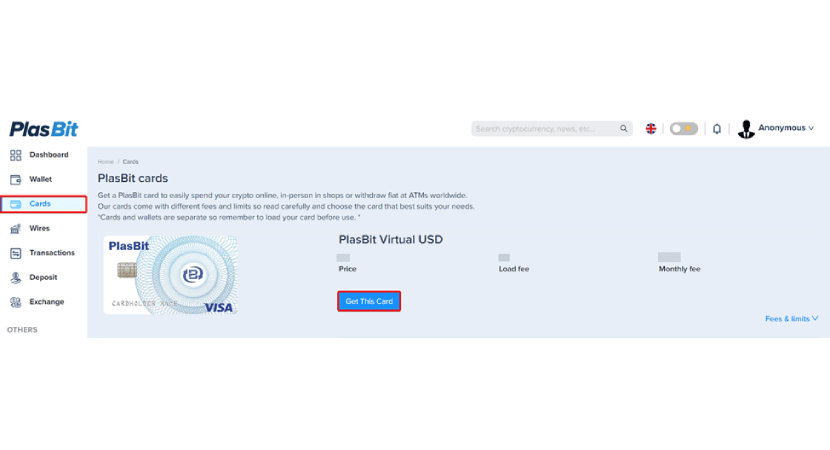

1. Navigate to the 'Cards' section, where you can select your card type (Virtual USD, Plastic USD, or Metal USD), then proceed by clicking 'Get This Card.'

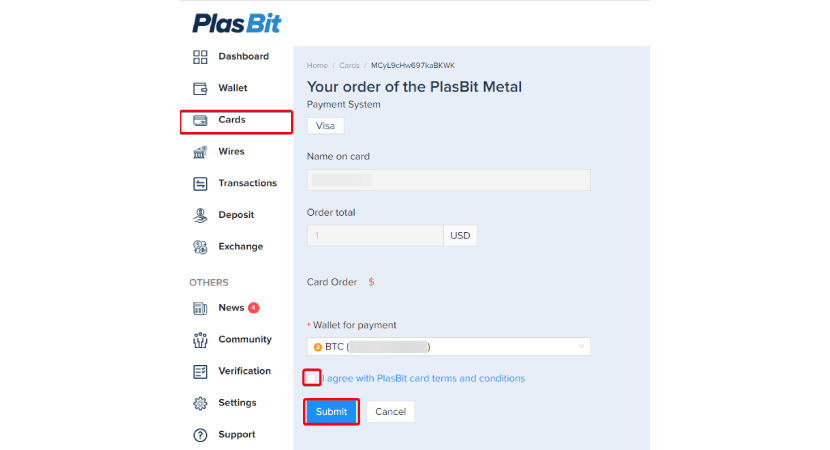

2. Validate payment details by entering your card name, agreeing to the terms, and submitting the necessary information for verification.

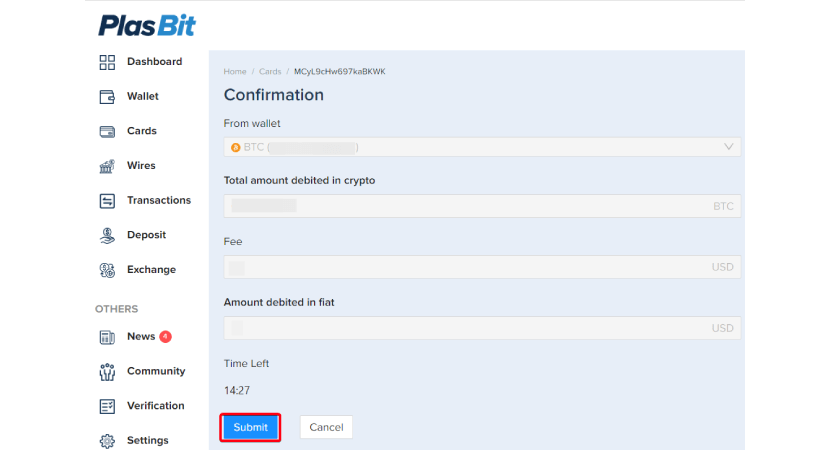

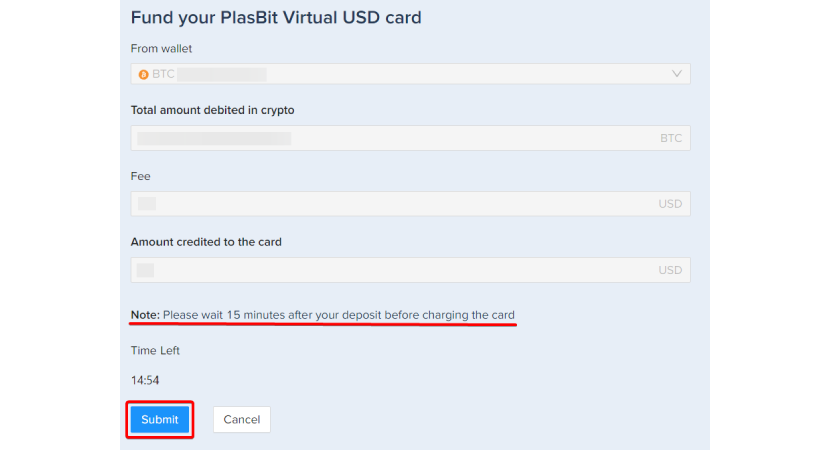

3. Confirm essential information such as wallet balance, debited crypto amount, associated fees, and fiat amount on the verification page. Complete the process by clicking 'Submit.'

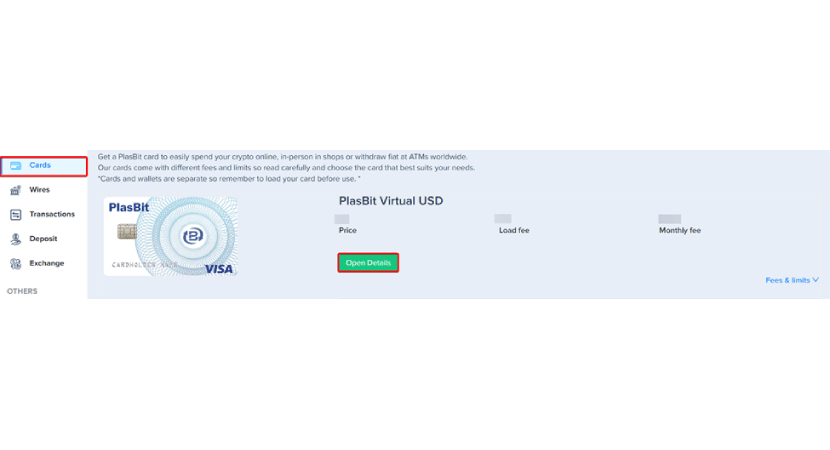

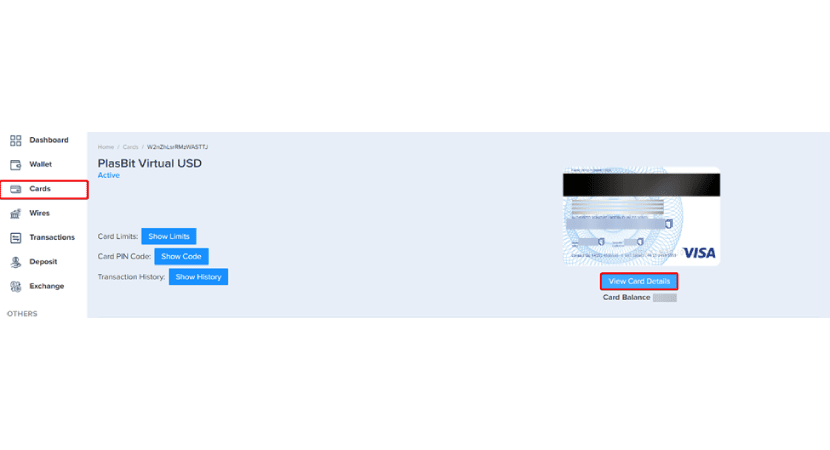

4. For more in-depth insights, examine your card details by selecting 'Open Details.'

5. Explore the "Debit Card" section to scrutinize card limits, PIN code, transaction history, validity, CVV, and signature. Please note that virtual cards do not have a PIN for ATM use.

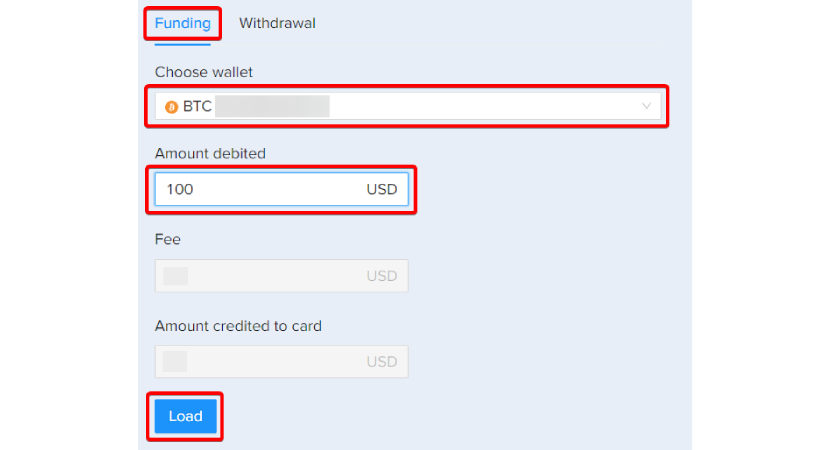

6. Opt to fund your debit card with USD and choose the crypto wallet as the source.

7. Select the debit card, specify the load amount, review associated fees, and confirm the final USD amount.

8. Verify and submit. Your debited cryptocurrencies, minus fees, are now successfully loaded onto your debit card.

.webp)

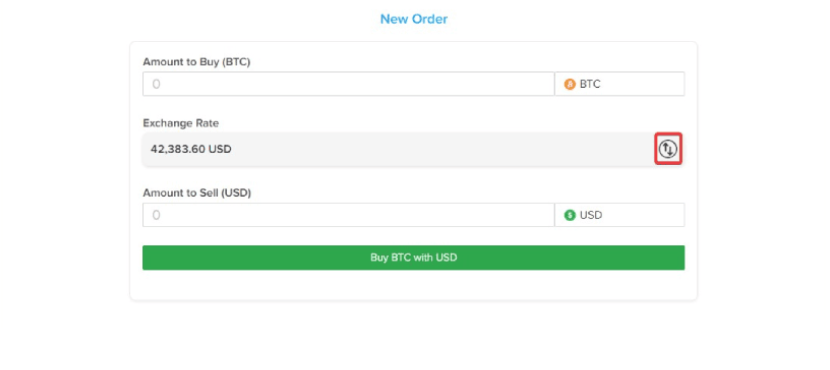

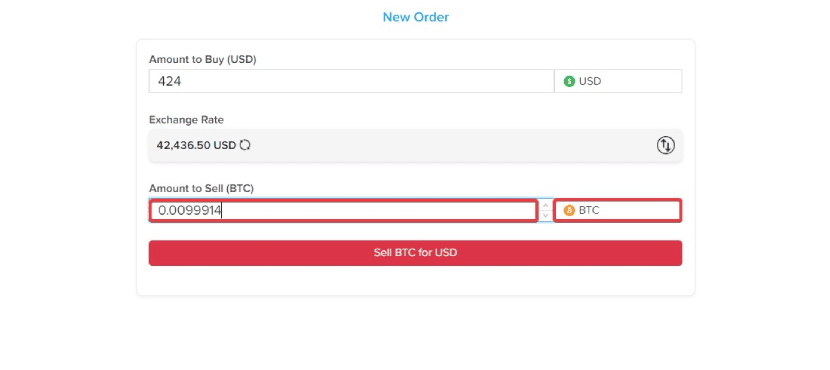

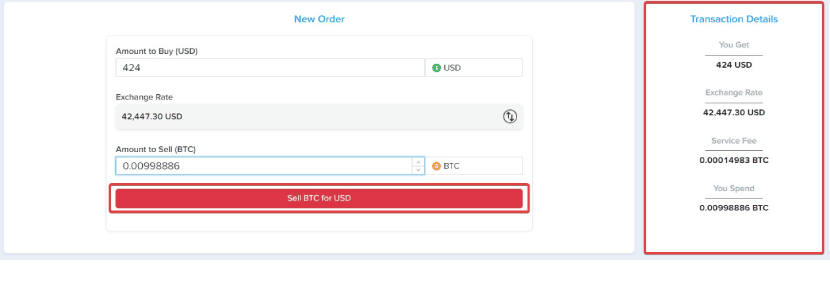

Convert Crypto to Fiat With Our Exchange

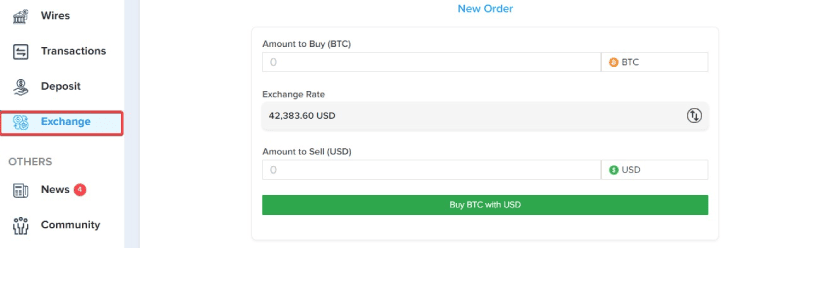

1. Head to the "Exchange" section on our platform.

2. Indicate USD as your preferred currency for the transaction.

3. Input the quantity of cryptocurrency you plan to sell.

4. Confirm the transaction amount and proceed by clicking "Sell for USD."

5. Once confirmed, the corresponding USD will be credited to your wallet.

Execute these instructions for a seamless cryptocurrency-to-fiat conversion using our exchange.

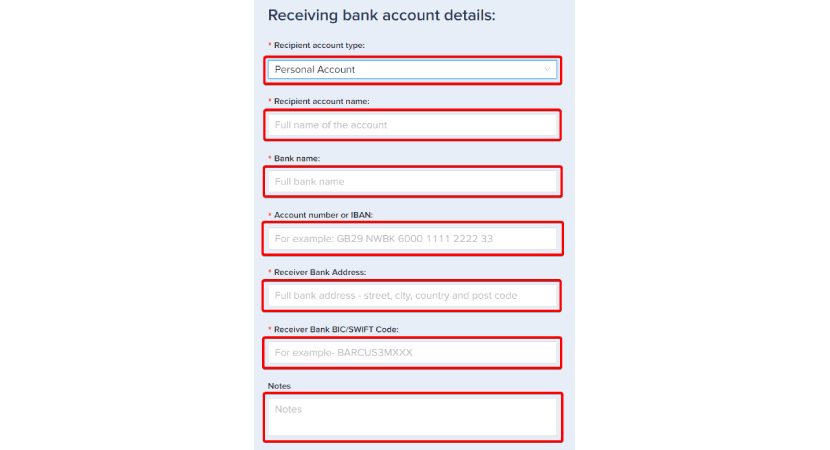

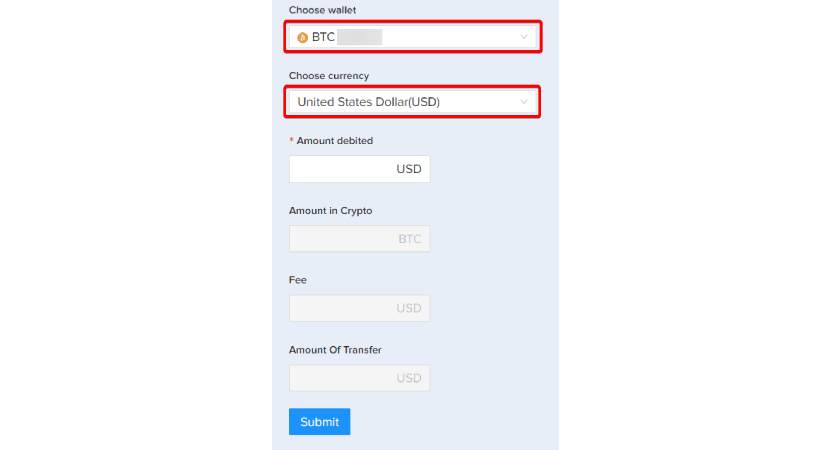

Crypto to Fiat Conversions via PlasBit Wire Transfers

1. Explore the "Wire Transfers" section for information regarding crypto to USD bank transactions, including details on transfer time, fees, and limits.

2. Input recipient bank details, including account name, type, number or IBAN, bank name, BIC/SWIFT code, and address.

3. Select the preferred cryptocurrency for conversion into USD, and our system will automatically calculate fees and the total transfer amount. Ensure that your account holds sufficient cryptocurrency for the transaction.

4. Click the "Submit" button, receive a prompt confirming the deducted crypto, and track the progress of the wire transfer in your account.

5. You will proceed to the security verification page. Select 'Send' to receive the code on your email and phone.

6. Enter the corresponding verification code from your email and phone and press the "Submit" button to complete the process.

Pros and Cons of Cashing Out Crypto

Can you cash out crypto for real money? Yes, and there are various ways; this comprehensive overview will explore the pros and cons of cashing out crypto in three popular methods: Crypto debit cards, Peer-to-Peer (P2P) exchanges, and Bitcoin ATMs. Each method presents unique advantages and considerations, providing a spectrum of choices based on your preferences and geographic considerations. Let's explore the intricacies of these cash-out options to empower individuals with informed decision-making in cryptocurrency transactions.

Crypto Debit Cards

Cryptocurrency debit cards have emerged as a versatile and convenient tool for seamlessly integrating your digital assets into everyday transactions. While they offer a straightforward solution for accessing real-world money, it's essential to explore the advantages and drawbacks of these cards.

Pros:

Swift and Straightforward:

One of the primary advantages of crypto debit cards is their speed and simplicity. You can quickly convert crypto into fiat currency, enabling instant access to funds for various purposes.

Versatility in Usage:

Crypto debit cards function much like traditional debit cards, allowing you to purchase online or in-store and even withdraw cash from ATMs. This versatility makes them a practical choice for those seeking a seamless transition between their crypto holdings and everyday spending.

No Need for a Bank Account:

Unlike traditional banking systems, crypto debit cards eliminate the requirement for a linked bank account. This feature particularly benefits individuals who prefer managing their finances without relying on conventional banking services.

Cons:

Limited Availability, Mostly for U.S. Residents:

Despite their growing popularity, crypto debit cards are not universally accessible. Many cards are primarily designed for U.S. residents, limiting their availability to a global audience. Users outside the U.S. may have fewer options or face additional hurdles in obtaining these cards.

Usual ATM Fees Applicable:

While crypto debit cards provide the convenience of accessing cash through ATMs, you should be mindful of the associated fees. Traditional ATM fees may apply, impacting the card's overall cost for cash withdrawals.

Peer-to-Peer (P2P) Exchanges:

Can you cash out crypto for real money? One option is through peer-to-peer (P2P) exchanges, which have emerged as an alternative to centralized platforms. These decentralized marketplaces connect buyers and sellers directly, offering advantages and disadvantages that you should consider carefully.

Pros:

Lower Fees Than Centralized Exchanges:

One of the primary attractions of P2P exchanges is the potential for reduced transaction fees over their centralized counterparts. By cutting out the intermediaries, P2P platforms often incur fewer operational costs, translating to reduced fees for users buying or selling Bitcoin and crypto assets.

Ability to Negotiate Rates:

Unlike traditional exchanges with fixed rates, P2P platforms empower you with the ability to negotiate transaction rates. This flexibility allows buyers and sellers to find mutually agreeable terms, creating a more personalized and adaptable trading experience.

Enhanced Privacy:

P2P transactions often provide a higher degree of privacy compared to centralized exchanges. You can directly interact with each other without the need for extensive identity verification processes, offering a level of anonymity that aligns with the ethos of decentralized finance.

Global Accessibility:

P2P exchanges operate globally, providing users with broader access to a diverse pool of buyers and sellers. This global accessibility enhances liquidity and allows for a more extensive range of trading pairs and options.

Cons:

Potential for Slower Transactions:

While P2P exchanges offer advantages in terms of fees and privacy, the nature of direct transactions between users can sometimes result in slower transaction times. The negotiation process, confirmation of payments, and other manual elements can contribute to delays compared to the swift execution of centralized exchanges.

Bank Account Requirement:

Unlike other methods, P2P exchanges typically require you to have a bank account. This requirement can hinder users who prefer to avoid involving traditional banking systems in their crypto transactions. However, it's worth noting that the necessity of a bank account contributes to the security and legitimacy of transactions.

Bitcoin ATMs:

Can you cash out crypto for real money? Bitcoin ATMs, or BTMs, have become an increasingly popular avenue for individuals seeking to convert their cryptocurrencies into cash or acquire digital assets conveniently. These physical machines, scattered worldwide, offer unique advantages and disadvantages that you should carefully evaluate before engaging in transactions.

Pros:

Global Accessibility:

Bitcoin ATMs are strategically positioned worldwide, providing convenient access to cryptocurrencies. This global accessibility contributes to the widespread adoption of digital assets, allowing you to buy or sell Bitcoin in various locations.

No Bank Account Required:

Unlike many traditional methods, Bitcoin ATMs do not necessitate a linked bank account for transactions. This feature appeals to individuals who prefer managing their cryptocurrency holdings without the involvement of traditional banking systems.

Ease of Use:

Bitcoin ATMs are built to be user-friendly, with interfaces that guide you through the transaction process. These machines typically support buying and selling Bitcoin, providing a straightforward experience for individuals with varying cryptocurrency expertise levels.

Enhanced Privacy:

Bitcoin ATMs offer a level of privacy to users, as transactions can be conducted without extensive identity verification. While some ATMs may require minimal verification, the overall process is less intrusive than centralized exchanges.

Cons:

High Fees:

A notable drawback of Bitcoin ATMs is the potential for high transaction fees. These fees can vary significantly between machines and operators, impacting the overall cost of buying or selling Bitcoin. You should carefully review fee structures to make informed decisions based on your financial preferences.

Sparse Availability in Rural Areas:

While Bitcoin ATMs are prevalent in urban and metropolitan areas, their availability can be sparse in rural locations. This limitation may pose challenges for individuals in less densely populated areas seeking convenient access to cryptocurrency services.

Cash Limits Based on ATM Reserves:

Bitcoin ATMs often have cash limits for transactions, which are determined by the machine's reserve of physical currency. Users looking to conduct larger transactions may face limitations, and this factor should be considered when choosing the appropriate method for buying or selling Bitcoin.

Considerations Before Cashing Out Crypto

Cashing out crypto for fiat currency can be a strategic move, but carefully considering various pitfalls that could impact your financial outcomes is crucial before making this decision. Here are key considerations to keep in mind before converting all your crypto to cash:

Taxes:

When contemplating cashing out cryptocurrency, an integral consideration that takes precedence is the intricate web of tax implications associated with such transactions. Profits derived from the sale of cryptocurrencies are subject to taxation, necessitating a comprehensive understanding and adherence to tax regulations prevalent in the respective jurisdiction. To embark on a secure and compliant cash-out journey, it becomes imperative for you to meticulously plan your strategy while maintaining a keen awareness of potential tax liabilities. Seeking the guidance of a tax professional is a prudent step, ensuring accurate reporting and adherence to the nuances of tax laws. Notably, reputable third-party broker exchanges are pivotal in facilitating this process by furnishing transaction reports explicitly designed for tax purposes. This transparency not only empowers you with an accurate record of your crypto transactions but also aids in fulfilling tax obligations with precision, exemplifying the critical intersection between cryptocurrency transactions and the intricate landscape of taxation.

Transaction Fees:

Delving into converting cryptocurrency to cash unveils the critical consideration of transaction fees, a facet that significantly impacts the overall cost and efficiency of the cash-out process. Particularly evident in Bitcoin-to-bank-account transactions, exchange fees are unavoidable and require careful scrutiny. It's imperative for individuals embarking on this financial maneuver to recognize that these fees can exhibit considerable variations among different platforms, necessitating a comprehensive understanding of the cost implications. With this awareness, you can make informed decisions regarding the preferred conversion method and the suitable timing for your cash-out endeavors. The fee structure of exchanges plays a pivotal role in optimizing the value of crypto assets during the conversion process, rendering a transparent understanding of these charges essential. Given the diversity in fee policies across platforms, conducting thorough research becomes a linchpin in decision-making, allowing individuals to discern between transparent fee structures and potential hidden charges, ensuring a financially prudent and well-informed approach to cryptocurrency cash-out.

Speed:

The speed of the cash-out process is a practical consideration, particularly for those who require quick access to funds. Notably, while providing a reliable avenue for converting crypto to cash, third-party broker exchanges may require several days to effectuate the transfer into your bank account. This temporal delay introduces a pertinent factor influencing the immediacy with which the funds can be utilized for other financial purposes. To navigate this aspect judiciously, you are advised to factor in the processing time inherent to your chosen cash-out method and align it meticulously with your distinct financial needs. When practicality is paramount, exploring alternative options, such as leveraging crypto debit cards or engaging in peer-to-peer transactions, becomes a strategic avenue. These alternatives offer swifter access to cash, providing a more accelerated solution for individuals navigating time-sensitive financial scenarios, thereby adding a layer of flexibility to the broader landscape of cryptocurrency cash-out strategies.

Market Conditions:

Before cashing out, assess the current market conditions. The highly dynamic nature of cryptocurrency prices introduces a layer of complexity, where the art of meticulous timing assumes paramount significance in determining the ultimate fiat currency returns. The inherent volatility of the crypto market accentuates the need for a nuanced understanding of market trends, necessitating a continuous and vigilant monitoring process. A keen eye on price movements becomes imperative in deciphering the intricate dance of digital assets. This astute market awareness empowers you to make informed decisions, strategically navigating the opportune moments to convert your digital holdings into tangible fiat currency. Such a proactive approach protects against potential losses and positions individuals to capitalize on favorable market conditions, optimizing the returns derived from your cryptocurrency holdings. The symbiotic interplay between market dynamics and strategic decision-making underscores the importance of a meticulous and well-informed approach when converting digital assets into real-world funds.

Security Measures:

The paramount consideration in any cryptocurrency cash-out strategy is the assurance of robust security measures within the platform or exchange. The pervasive threat of security breaches in the digital realm accentuates the indispensable need for airtight protective protocols. Entrusting one's financial assets to a platform fortified with comprehensive security measures becomes a choice and a requisite in safeguarding against potential risks. A reputable and secure platform forms a bulwark, ensuring the unwavering integrity of the cash-out process and fortifying users against the perils of unauthorized access and malicious activities. Navigating the cash-out landscape assumes a confident stride when prioritizing security, deriving assurance from knowing your funds are shielded from potential threats. Therefore, the meticulous and deliberate selection of a secure platform emerges as a foundational pillar, reinforcing the integrity of the cash-out process and preserving the safety and sanctity of one's cryptocurrency assets in an ever-evolving and dynamic digital environment.

Diversification Strategies:

Consider your overall asset strategy. A wholesale cash-out, while offering immediate liquidity, may need to align harmoniously with long-term financial goals, potentially overlooking the inherent benefits of diversification. Instead, a more nuanced and strategic approach involves exploring diversification strategies where maintaining a balanced portfolio takes precedence. By strategically allocating funds across a spectrum of assets, traders can effectively mitigate the risks associated with market volatility, unforeseen economic shifts, or fluctuations in cryptocurrency values. This deliberate diversification not only acts as a hedge against potential downturns but also optimizes the overall outcome of one's asset portfolio. Thoughtful integration of diversified assets, encompassing traditional and alternative investments, aligns seamlessly with the principles of prudent financial planning. This approach fosters resilience and imbues adaptability within the broader context of an individual's trading journey, providing a robust foundation for navigating the ever-evolving landscape of financial markets.

Conclusion

Can you cash out crypto for real money? Yes, converting cryptocurrency to fiat is possible and increasingly accessible through various methods. You should carefully evaluate your needs, preferences, and the associated considerations before selecting the most suitable method. Whether through a crypto debit card, P2P exchange, or Bitcoin ATM, the ability to cash out crypto for real money provides flexibility. It opens up new avenues for utilizing digital assets in the real world.

.webp)