In today's digital age, the world of finance has undergone a profound evolution, driven by the emergence of cryptocurrencies. These decentralized digital assets have captured the imagination of investors, tech enthusiasts, and innovators alike. If you want to Exchange Crypto to Fiat start by navigating to your wallet to deposit your preferred crypto, then go to the wires section, enter your bank account details and the amount you wish to receive and submit a bank wire request and you’ll receive your chosen fiat currency, such as euros, in your bank account on the same day. Just follow the step-by-step guide and we will show you how to sell your cryptocurrencies for fiat currency using the bank wire service. First, we must establish a solid foundation by understanding the fundamental concepts, including 'what is fiat currency?' and 'what is cryptocurrency?' We'll also delve into the distinctions between 'fiat currency vs. cryptocurrency.' In this comprehensive guide on 'how to exchange crypto to fiat,' whether you're a seasoned crypto trader or just beginning your journey into this financial frontier, we'll provide you with the knowledge and practical insights you need to navigate the crypto-to-fiat exchange landscape effectively.

Exchange Crypto to Fiat in PlasBit

One of the easiest and quickest ways to exchange your cryptocurrency into fiat is by using our wire feature to withdraw your cryptocurrency. This guide will explain the steps to get the money transferred to your bank account.

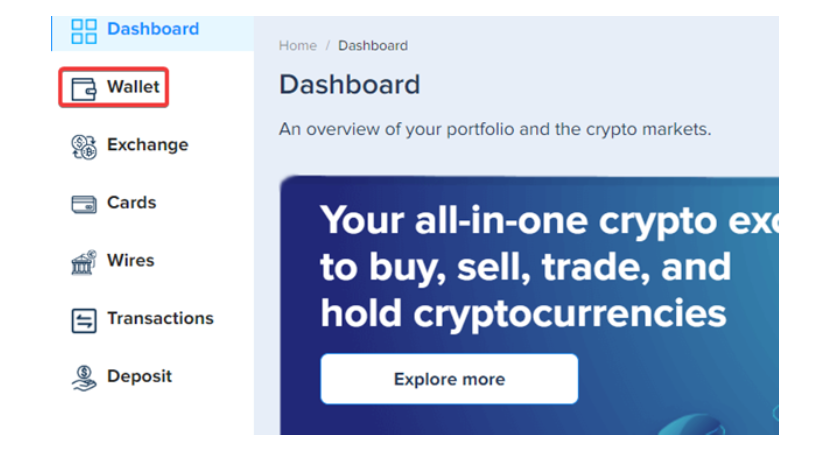

1. Log in to your PlasBit account and click on the [Wallet] tab.

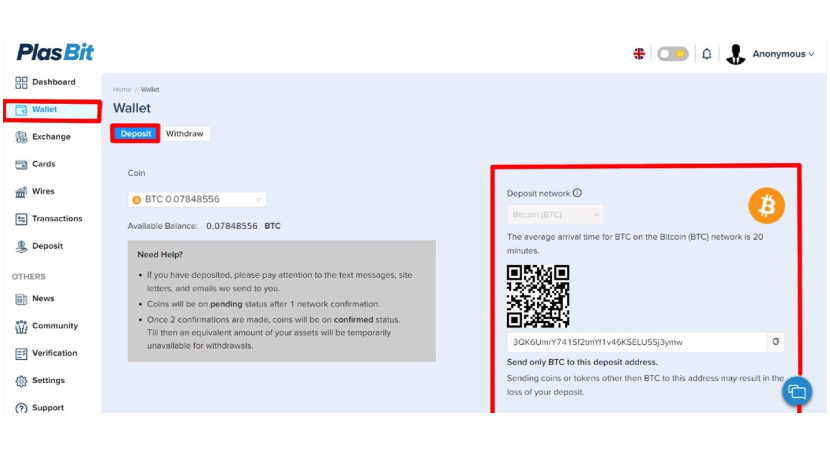

2. Deposit your prefered cryptocurrency into your PlasBit wallet, in this case we'll use Bitcoin.

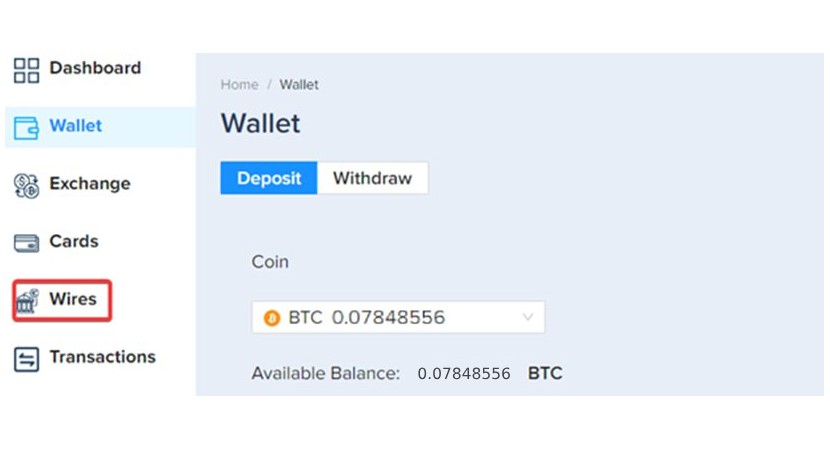

3. Once the Bitcoin has been deposited to your wallet, click on the [Wires] tab.

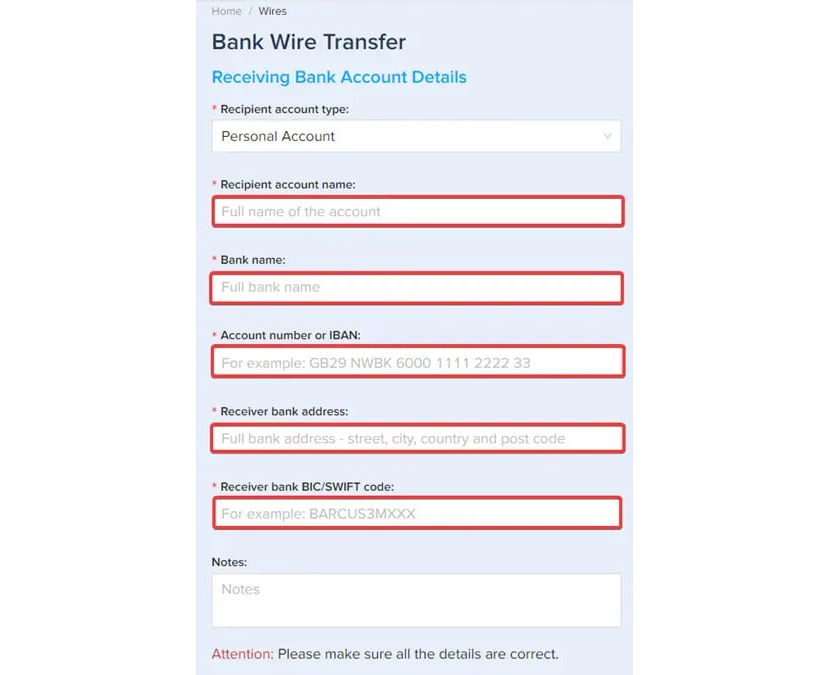

4. Enter your receiving bank account details. Please ensure that the name of the account matches the name of your PlasBit account.

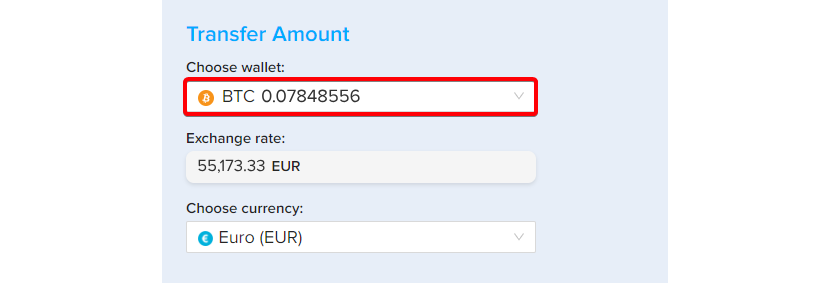

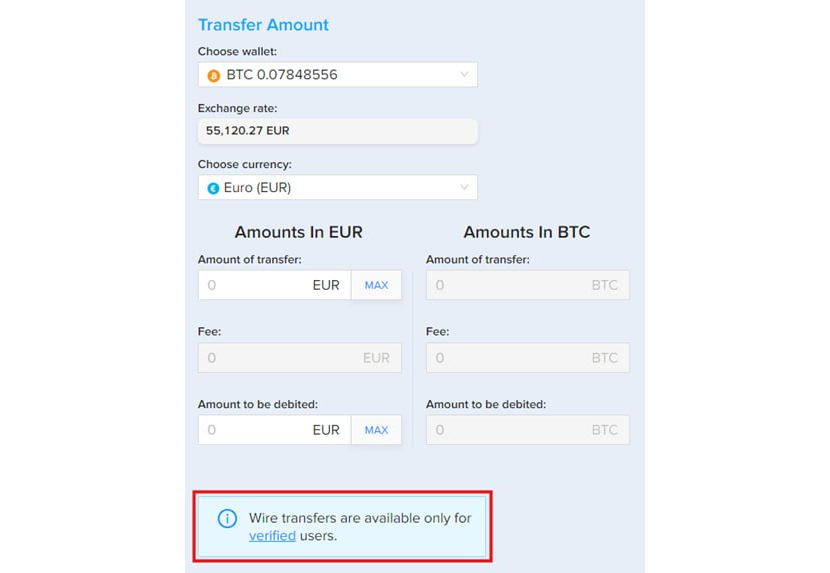

5. Choose the BTC wallet from the list of wallets

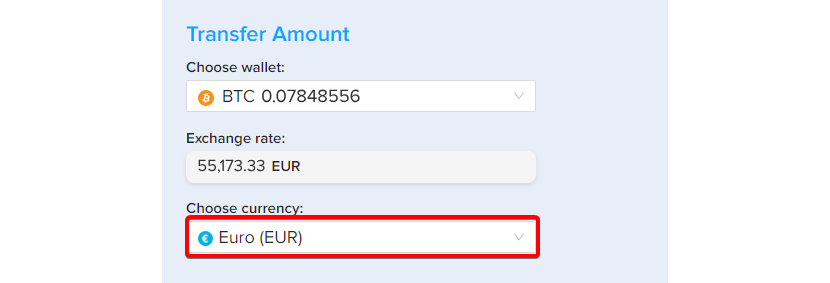

6. Select your prefered currency as the chosen currency, in this case we'll use Euro (EUR).

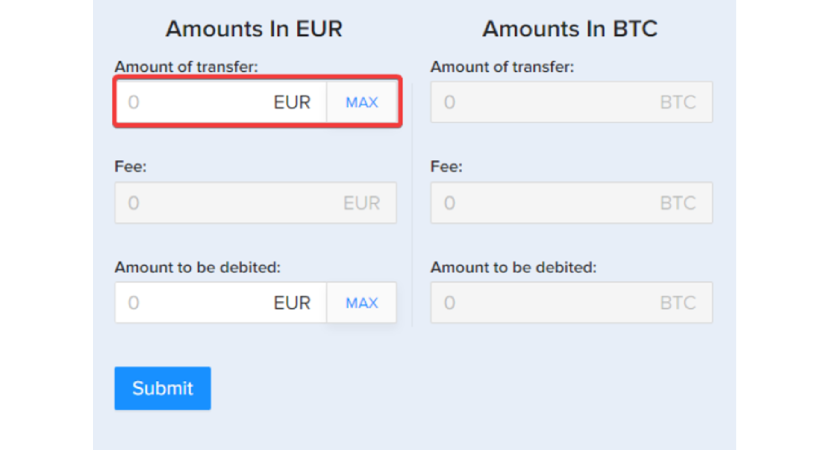

7. Fill in the amount you want to transfer to your account. You can enter the amount you want to transfer, and the fees will be added automatically if you fill the “Amount of transfer” field.

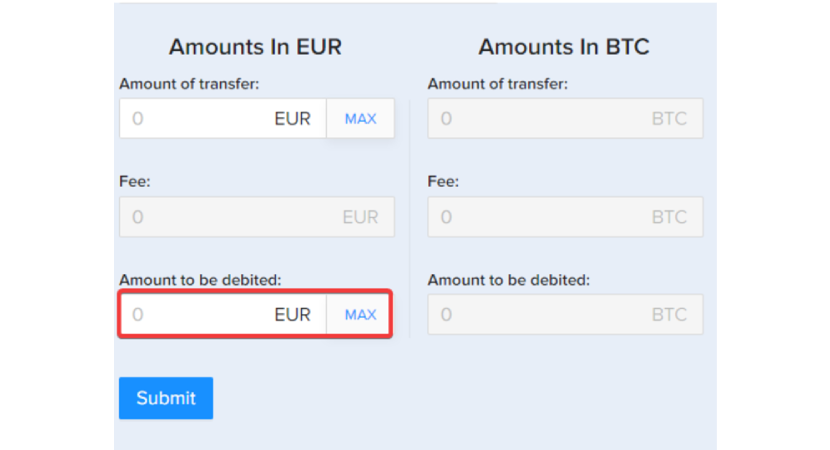

You can also enter the total amount you wish to be debited from your wallet, and we will deduct the fees if you fill in the "Amount to be debited” field.

Then, click the [Submit] button. *Important – Please note that you must complete your identity verification first, Otherwise you will not be able to process the wire request.

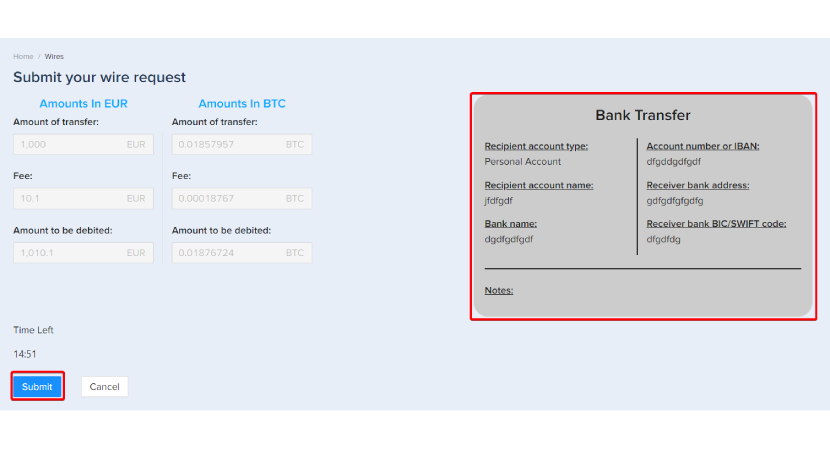

8. Go over the wire request details and make sure everything is correct, then click [Submit]

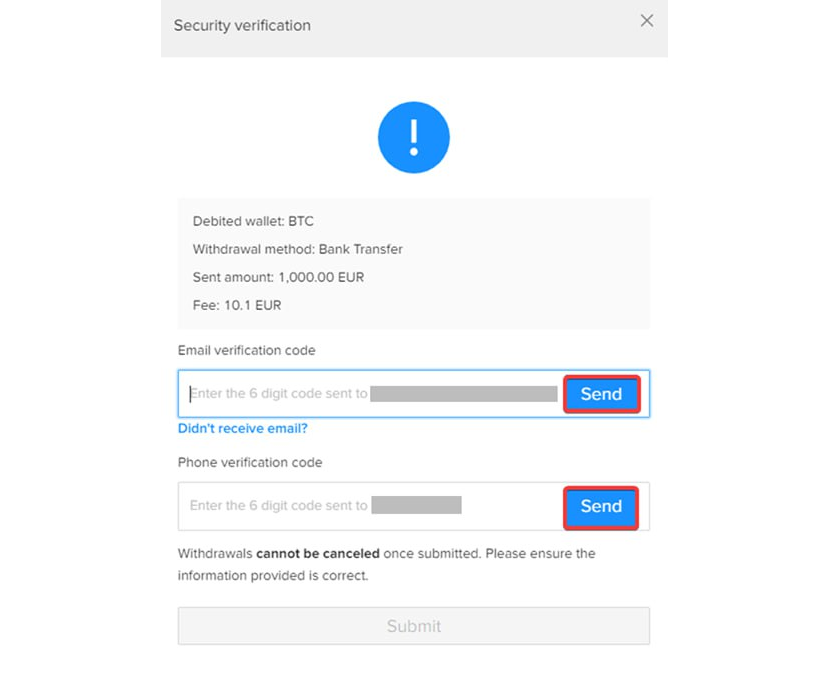

9. In the security verification section, click the [Send] button to receive verification codes to your phone and email.

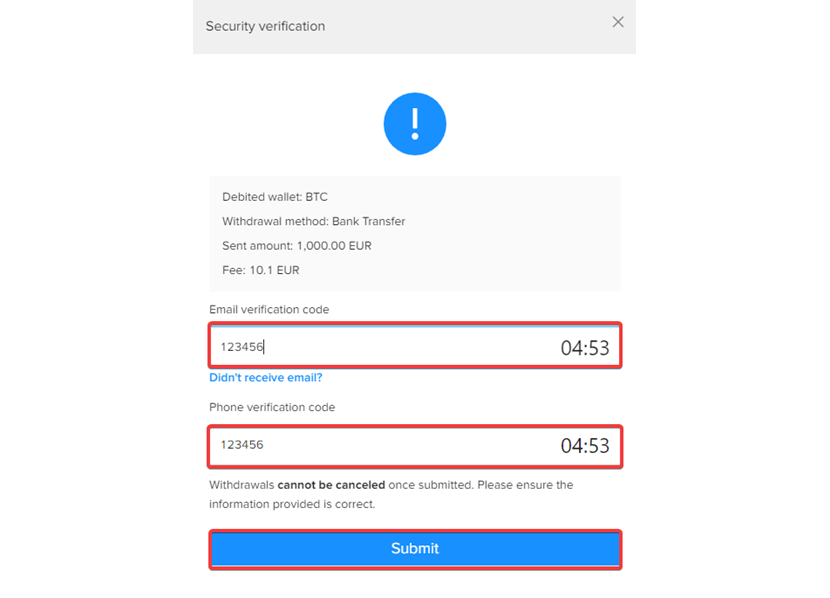

10. Input both verification codes, then click [Submit] to complete the wire transfer request.

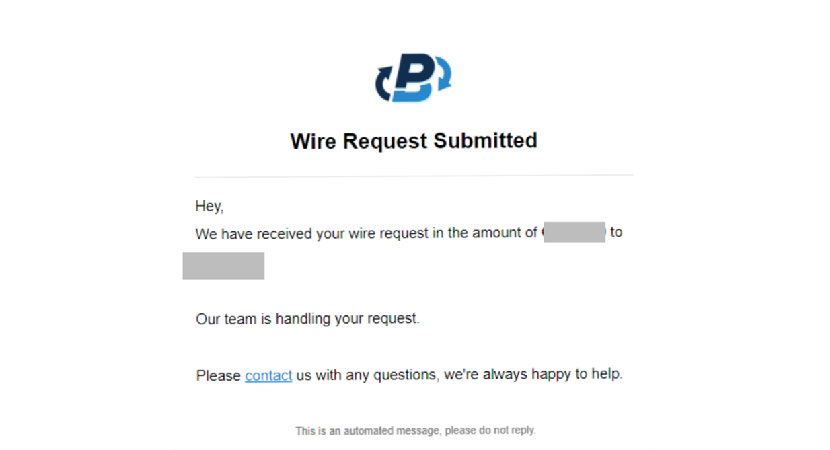

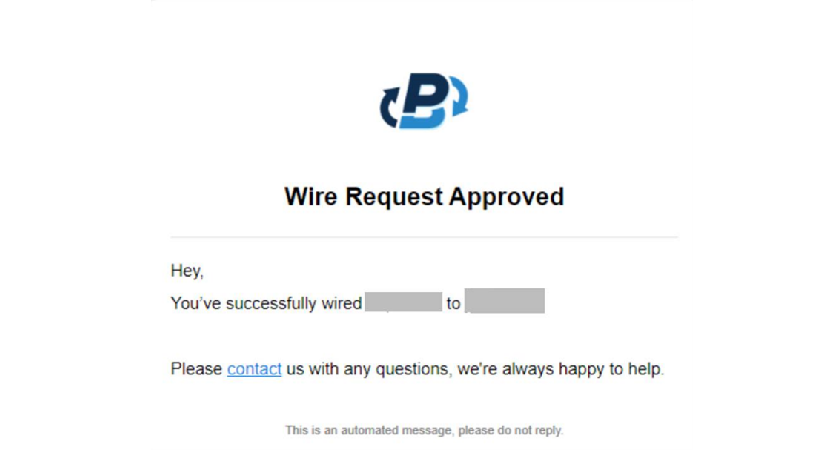

11. You will be automatically redirected to your dashboard, and receive an email verifying “Wire Request Submitted."

After we approve the request on our side, you will get another email that says “Wire Request Approved”

Usually, the transfer completion time is 0-5 business days.

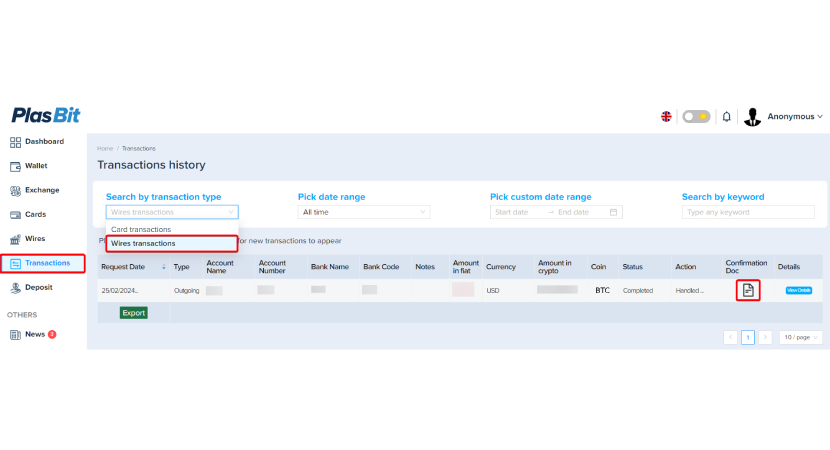

12. In order to monitor your transfer process, enter the [Transactions] section, and select [Wires transaction] from the drop-down menu. Once the transaction has been approved, you can also download the Bank wire PDF.

What is Fiat Currency?

Fiat currency is traditional, government-issued currency with no intrinsic value, deriving its worth from the trust of users and its status as legal tender. Governments and central authorities, like central banks, control the issuance and supply of fiat currency, allowing them to implement monetary policies and manage economic conditions. It exists in physical forms, such as banknotes and coins, and digital representations within the modern financial system, serving as the primary medium of exchange for everyday transactions worldwide. Exchange rates fluctuate when converting one fiat currency to another, and factors like inflation and government policies can influence its value. At the same time, cryptocurrencies have prompted discussions about the future of fiat currencies in a digitally evolving financial landscape.

What is Cryptocurrency?

Cryptocurrency is a digital or virtual currency characterized by a decentralized nature, relying on cryptography for security and operating on blockchain technology. Unlike traditional fiat currencies, cryptocurrencies exist exclusively in digital form and are not controlled by any central authority but maintained by a computer network. Transactions are recorded transparently on a public ledger, offering pseudonymity to users. Cryptocurrencies often have limited supplies and can be used globally, facilitating borderless transactions and delivering innovative solutions beyond just serving as a medium of exchange, such as supporting smart contracts and decentralized applications. However, the cryptocurrency market is known for its price volatility, and regulatory environments vary widely, making thorough research and caution essential for participants in this evolving financial ecosystem.

Fiat Currency vs. Cryptocurrency

Fiat Currency and Cryptocurrency are two fundamentally different forms of currency, each with its own set of characteristics and advantages:

Centralization vs. Decentralization

Centralization involves concentrating control and decision-making authority at a central entity, promoting efficiency and accountability but potentially reducing flexibility and innovation. In contrast, decentralization distributes sources across various levels or entities, allowing for flexibility, local responsiveness, and innovation, but it may need to be revised regarding consistency and accountability. The choice between centralization and decentralizationdepends on specific organizational goals, structures, and the context in which they operate, with many organizations finding a balance between the two approaches.

Trust and Authority

Trust is the belief in someone's reliability and integrity, earned over time through consistent behaviour, honesty, and authenticity. It's like the trust we place in traditional financial institutions when we use fiat currency. On the other hand, authority, much like PlasBit's role in the crypto world, is the legitimate power to make decisions and give orders, often associated with formal functions or expertise. Trust can enhance the effectiveness of authority, and authority can influence trust, but they are distinct yet crucial concepts in interpersonal, organizational, and societal dynamics. Trust is essential for healthy relationships and cooperation, while authority involves the right to make decisions and enforce obedience, often associated with formal roles or positions.

Transaction Speed and Cost

Transaction speed and cost are pivotal factors that significantly influence financial transactions, whether they involve traditional economic systems or digital currencies. Transaction speed pertains to the duration required for a financial transaction to be initiated, processed, verified, and ultimately settled. The swiftness of a transaction can vary widely depending on the payment method, economic infrastructure, and the specific currency or system in use. Traditional financial systems, like bank or wire transfers, may take hours or even days to complete, particularly for cross-border transactions. In contrast, some cryptocurrencies, such as Ripple's XRP or Stellar (XLM), are engineered for rapid transactions, often concluding in seconds. Transaction cost, or fees, encompasses the expenses of initiating and executing a financial transaction.

These costs can include processing fees, exchange fees, and network fees. The factors affecting transaction costs are multifaceted and depend on the chosen payment method, the financial institution involved, and the complexity of the transaction. Traditional economic systems often incur various fees, such as wire transfer and currency conversion fees, which can add up, especially for international transactions. In the realm of cryptocurrencies, transaction costs can differ significantly. Some digital currencies feature low prices, making them economical for small transactions. However, the costs can rise during network congestion, especially for cryptocurrencies like Bitcoin. Ultimately, transaction speed and cost considerations play a crucial role in selecting the most appropriate payment method or currency for a particular financial transaction. They are vital factors for individuals and businesses seeking efficient, cost-effective, and timely financial solutions, whether operating within traditional economic systems or exploring the realm of digital currencies.

How to Exchange Crypto to Fiat?

Indeed, before delving into how to exchange crypto to fiat currency, it's crucial to understand the methods and factors involved in these transactions. Once the foundation is set, we can explore the various ways to exchange cryptocurrency for fiat. Here's the continuation:

Understanding how it works:

Exchanging cryptocurrency for fiat currency is a process that allows individuals and businesses to convert their digital assets into traditional government-issued money like US Dollars, Euros, or any other fiat currency. This exchange can be vital for various purposes, including cashing out profits, paying bills, or making everyday purchases. The method you choose for this exchange can significantly impact speed, cost, and ease of use.

The way to do it:

Cryptocurrency Exchanges:

Most cryptocurrency exchanges offer a direct way to exchange cryptocurrencies for fiat. This typically involves selling crypto assets on the exchange platform and withdrawing the fiat currency to your linked bank account. Popular exchanges like Coinbase, Kraken, Binance and PlasBit.

Peer-to-Peer (P2P) Platforms:

P2P platforms like LocalBitcoins and LocalCryptos facilitate direct transactions between buyers and sellers. Users can list their cryptocurrency for sale and negotiate prices and payment methods with potential buyers, including cash payments or bank transfers.

Bitcoin ATMs:

Bitcoin ATMs (BTMs) are physical machines that allow users to exchange Bitcoin for cash or fiat deposits. These machines are located in various cities worldwide and provide a straightforward way to convert your Bitcoin holdings.

Over-the-Counter (OTC) Desks:

OTC desks are services offered by cryptocurrency brokers or platforms that cater to large-volume traders. They facilitate large crypto-to-fiat trades with personalized service and pricing.

Payment Services and Wallets:

Some cryptocurrency wallets and payment services, like PayPal and Square's Cash App, allow users to buy, sell, and hold cryptocurrencies. You can sell crypto within the wallet or app and withdraw the funds to your linked bank account.

Cryptocurrency Debit Cards:

Crypto debit cards, such as those offered by Coinbase or BitPay, allow you to spend your cryptocurrency holdings as if they were fiat. When you purchase, the card provider automatically converts the crypto to fiat at the current exchange rate.

Crypto-to-Gift Cards:

Various platforms and websites enable users to exchange their cryptocurrencies for gift cards from popular retailers. These gift cards can be used to make purchases in stores or online.

Cryptocurrency Loans:

Some platforms offer cryptocurrency-backed loans, allowing you to borrow fiat currency while using your cryptocurrency holdings as collateral. This provides a way to access fiat without selling your crypto.

Crypto Payment Processors:

Some businesses and merchants accept cryptocurrency payments and may offer discounts or incentives for paying with digital assets. This can indirectly allow you to use crypto for everyday expenses.

Cryptocurrency to Prepaid Cards:

Certain services allow you to load cryptocurrencies onto prepaid debit cards, which can be used for everyday transactions, including cash withdrawals from ATMs. Before using any of these methods, it's crucial to consider factors like fees, security, regulatory compliance, and the specific cryptocurrencies and fiat currencies supported by the platform or service. Additionally, be aware of tax implications in your jurisdiction, as crypto-to-fiat transactions may have tax consequences.

How to Open an Account in PlasBit? Your Step-by-Step Guide

Are you ready to dive into the world of cryptocurrency? Opening an account is your gateway to a variety of cryptocurrency services and financial possibilities. Here's a straightforward guide on how to get started:

Access Website: Begin by visiting website. On the front page, you'll find a menu with categories identified as "Products," "Company," "Blog," "Login," and "Get started.

Click on "Get Started": To initiate the process of creating a new account, simply click on the "Get Started" option. This action will guide you to the registration process.

Register in Page: You will be redirected to the Register page, where you'll be prompted to provide essential details to set up your account.

Enter Your Email: In the designated field, enter your email address. Ensure the accuracy of the email you provide, as it will be your primary contact for communication and verification purposes.

Create a Secure Password: Security is a top priority at our Platform. Your password must meet specific criteria to ensure its strength. It should consist of at least 8 characters, including at least one uppercase letter, one lowercase letter, one number, and one special character. Take your time to create a strong and memorable password.

Click "Continue": After entering your email and password, click the "Continue" button to proceed to the next step.

Verify Your Email: To ensure the security of your account and verify your identity, Platform will send a verification link to the email address you provided during registration.

Check Your Inbox: Open your email inbox (the one you used for registration) and look for an email from the Platform. This email will contain a verification link. Click on the link to verify your email address.

Dashboard: Once you have successfully verified your email, you will gain access to your dashboard. On the left side of the dashboard, you will find various options, including "Wallet," "Cards," "Wires," "Transactions," and "Deposit."

Wallet: This section allows you to manage your cryptocurrency holdings.

Cards: Explore options related to cards, which may include debit cards or other financial services.

Wires: Access wire transfers and related banking services.

Transactions: Keep track of your transaction history.

Deposit: Find options for depositing funds into your account.

Activation of 2FA and KYC: A Secure Guide

Securing your account is a top priority; you can activate Two-Factor Authentication (2FA) and undergo Know Your Customer (KYC) verification. Here's a step-by-step guide to completing these essential security measures:

Activating Two-Factor Authentication (2FA):

Navigate to Verification: After logging into your account, head to the "Verification" section. You'll find this in your account settings.

Choose 2FA Method: In the Verification section, you'll encounter four verification options.

Email Address Verification: You've verified your email during registration, so proceed to the next steps.

Phone Number Verification: Follow the instructions to verify your phone number securely.

Google Authenticator: If you haven't already, download the Google Authenticator app. Scan the QR code provided by PlasBit within the app. Enable Microsoft/Google Authenticator and complete the setup process.

Identifier (KYC)

To activate the "Identifier" option, you must confirm your identity accurately, including your full name and place of residence. Next, choose the document type you wish to use for verification: a passport, driver's license, or residence permit.

Upload Document: In the subsequent step, upload explicit images of your chosen document's front and back parts.

Continue on Your Phone: This step involves three sub-steps:

Send a Secure Link to Your Phone: The Platform will send a secure link for further verification.

Open the Link and Complete Tasks: Follow the link to complete additional verification tasks, which may include document verification and video confirmation.

Check Back Here to Finish Submission: Return to the Verification section to finalize the submission process. By following these steps, you'll activate Two-Factor Authentication (2FA) and KYC verification, significantly bolstering your account's security.

Conclusion

Exchanging cryptocurrencies for fiat currency has become increasingly accessible and secure, thanks to reliable platforms like PlasBit. Following the steps outlined above, you can easily navigate the process while adhering to 2FA, KYC and security measures. As a writer of this Platform, I'm proud to share this information with you, emphasizing this Platform's commitment to transparency, security, and user-friendliness in the crypto-to-fiat exchange process. For more news and updates, check out the PlasBit blog. This platform is a trustworthy partner for crypto enthusiasts looking to exchange digital assets for fiat currency in a rapidly evolving financial landscape. So, whether you're a seasoned crypto investor or just getting started, Our Platform is here to make your crypto-to-fiat exchanges seamless and secure. Start your journey with us today!