Although the initial idea behind the creation of Bitcoin was to act as “digital cash” and make everyday payments without the need for financial institutions as the middleman, we are very far from people being able to conduct their everyday grocery errands while relying solely on Bitcoin, given that supermarkets and grocery stores accept it as a direct payment method. So, if you are asking yourself, can you buy groceries with Bitcoin? Yes, you can deposit Bitcoin to your wallet, order a crypto card and load it with Bitcoin, connect the card to your Apple or Google Pay, and pay with your card in the supermarkets to buy groceries. This article aims to explain how you can use your crypto in real life, turning it from being a digital concept people that’s hard to grasp for most people to something that you can use in ordinary tasks such as grocery shopping.

How Can You Become Your Own Bank?

To give you a full picture of being your bank, I’ve broken this section into multiple parts. In the first one, you’ll get more information about the cons of traditional banks, and the second one talks about the benefits of being your own bank. Then, we’ll compare the two.

State of Banking

Before I explain the concept of being your own bank, it’s important to cover the problems that traditional financial institutions have. It’s considered that as much as 76% of the world's population has a bank account. For some Western countries, this number is close to 100%. However, these statistics don’t show that certain demographics, such as low-income households, minorities, or citizens of undeveloped countries, are facing many problems with opening a bank account. This is mainly because they don’t meet the requirements in terms of their income, limiting their access to loans, mortgages, credit cards, and other services. High-banking fees are also making it difficult for low-income individuals to get their services. On the other hand, there are good reasons to avoid banks, even if you’re a well-off individual. Significant incidents regarding corruption and cyber-attacks have happened in some high-profile international financial institutions in the past years, leading to distrust in the banking system. Furthermore, many individuals want to avoid banks for practical reasons. The working hours of the bank might interfere with their daily schedule, or they simply don’t enjoy waiting in line for hours to make a transaction (Who does?).

Becoming Your Own Bank

Although crypto wallets have numerous differences compared to bank accounts, they can be used in the same manner. You can use a crypto wallet, both hardware and online, to store, send, and receive funds. To make your crypto wallet act like a bank account, you’ll need to obtain a crypto card and then connect it with Google or Apple Pay. This can allow you to complete everyday payments or even withdraw cash from an ATM machine. PlasBit acts as a bridge between crypto and regular payments in currencies like Euro, USD, or other local currencies, and for those wondering can you buy groceries with Bitcoin, while most supermarkets don’t accept it directly, using a crypto card allows Bitcoin holders to shop just like anyone using a traditional payment card. Any merchant that accepts payment cards will also accept crypto-funded cards, making everyday purchases more accessible. You’ll have economic freedom and full control of your funds, and there won’t be third parties to whom you must report. Being your own bank is a great way of taking control of your funds and not being reliant on traditional financial institutions.

Step-by-step Guide on How to Deposit Bitcoin to Your PlasBit Wallet

To actually reap the benefits that we’ve talked about, such as leveraging crypto to purchase groceries, you’ll have to follow this guide.

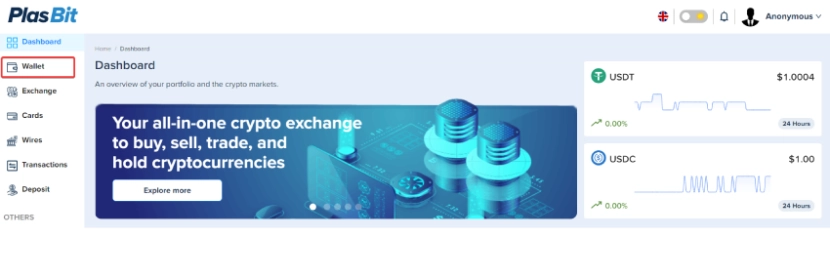

Step 1 – Login To Your PlasBit Account Dashboard

Start with making an account on PlasBit or logging in. Once you’ve logged in, you should head to the dashboard.

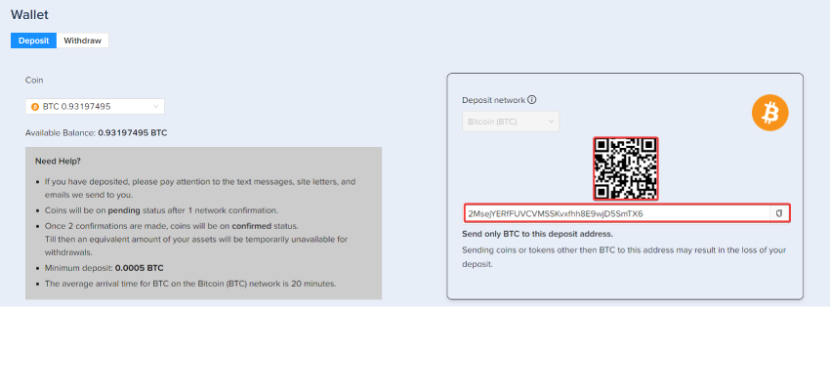

Step 2 – Go to the Wallet section and Deposit Bitcoin.

Here, you’ll be able to deposit any amount of Bitcoin (As long as it’s above the minimum deposit).

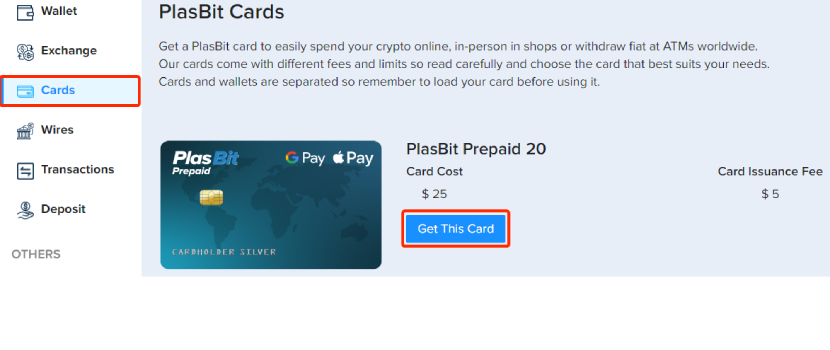

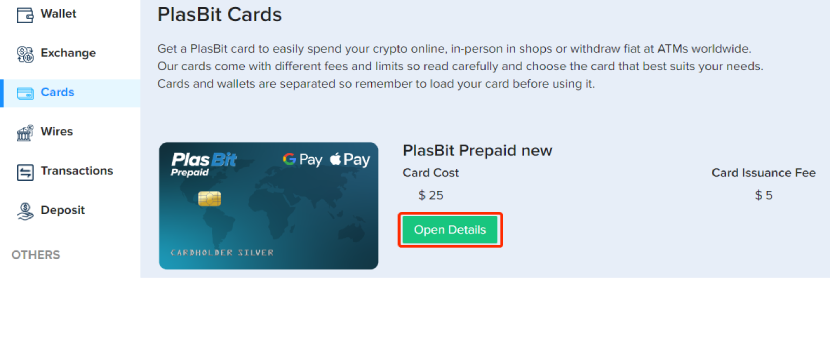

Step 3 – Head Over To The Card Section

Select the crypto card of your choice and click "Get This Card". Explore the details for each and understand which of them suits your requirements.

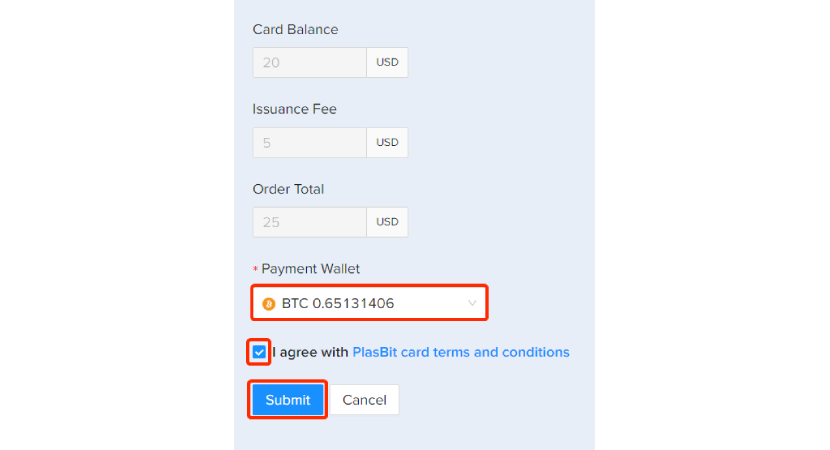

Step 4 - Fill in your Personal Details. Select Bitcoin as the payment wallet and click "Submit"

Choose the payment wallet that will be used to deposit funds.

Step 5 – Once your card has been issued, you will receive an email notifying you that it is ready for use.

If you’ve done everything correctly so far, you’ll be notified by your email.

Step 6 - Navigate to the Cards section and select 'Open Details' for your specific card.

Once everything is approved, you can check the details of your card.

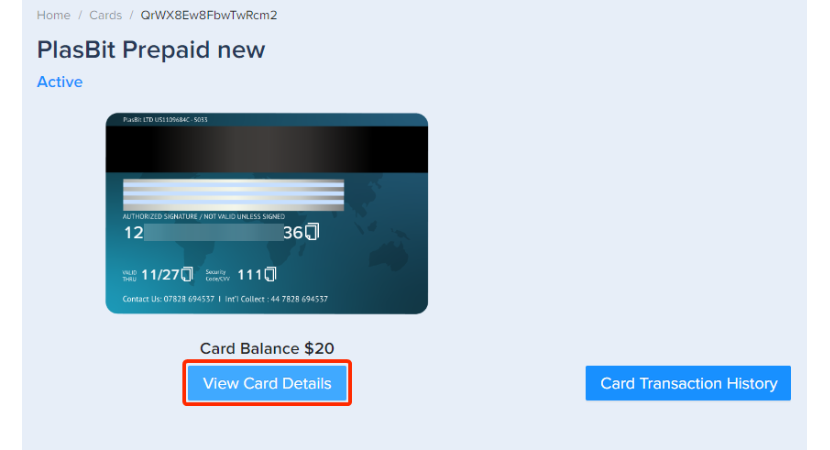

Step 7 – Get Your Crypto Card Details

You can access your card details and retrieve your card number, expiry date, and CVV by pressing the View Card Details button. Basically, everything that a credit card from the bank has, this card has as well.

Step 8 - Use your new card by adding it to Apple Pay or Google Pay.

In order for you to be able to pay with this digital card in a physical grocery store, you need to first add it to Apple Pay or Google Pay using the guides we have made.

Step 9—You're all set.

You can now use the card at any grocery store that accepts crypto cards.

What Supermarkets Accept Bitcoin

More and more businesses are experimenting with crypto payments. You can find hotels, online stores, and a number of other businesses that support crypto payments. If you’re wondering what supermarkets accept Bitcoin, Whole Foods is the only supermarket that accepts Bitcoin at checkout via a partnership with the Spedn app, answering the question of whether can you buy groceries with Bitcoin but every supermarket in the world will accept a crypto card. Just deposit Bitcoin in your wallet, order a crypto card and load it with Bitcoin, connect the card to your Apple or Google Pay, and pay with your card in any supermarket. You can explore these supermarkets in more detail below:

Menufy

Menufy is an online food ordering platform that accepts Bitcoin and a few other supported cryptocurrencies. It also allows customers to order from grocery and convenience stores. The payments are made possible through Menufy’s partnership with Bitpay. What’s important to mention is that Menufy operates in over 3,000 cities across the U.S., partnering with thousands of local restaurants. This shows that services that embrace crypto can have a significant presence.

Whole Foods

Amazon’s Whole Foods is one of the few major grocery chains that allows crypto payments. They are conducted through the Spedn app, which is powered by Flexa’s crypto payment network. To purchase at Whole Foods using crypto, you’ll have to download the Spedn app and fund it with Bitcoin or other supported cryptocurrencies. Then, you’ll be able to generate a QR code that you’ll have to scan at the checkout. Since Whole Foods is owned by Amazon, we can expect more Amazon businesses and projects to embrace cryptocurrencies.

Instacart

Unfortunately, Instacart doesn’t support direct Bitcoin payments, but you’ll be able to use crypto-funded debit cards. Of course, you can also buy Gift cards with Bitcoin from third-party vendors, which you’ll be able to use on Instacart later.

Other Food Businesses that Implemented Crypto

Besides supermarkets, some businesses in the food industry allow crypto payments as well. Not all of these implementations lasted for longer durations of time, but it’s certain that they impacted the popularity and adoption rate of cryptocurrencies in retail.

Subway

One of the first examples of crypto purchases happened in a Subway Restaurant in Moscow in 2013. To streamline purchases, the branch used Mycelium, a mobile payment system. There were multiple cases of people recording and making their purchases using Bitcoin at the time. One of them paid 0.018 BTC, which was then worth around $6. The Moscow-based Subway also offered a 10% discount on purchases made by digital currencies. Another case happened In 2013. in the US, аn entrepreneur and founder of Kuhcoon named Andrew Torba visited Allentown, PA, in order to purchase a Subway sandwich with Bitcoin. The transaction was made using Coinbase’s app. Andrew documented his experiences on Coindesks’s blog, and he also mentioned that over a hundred crypto enthusiasts made purchases at Subway during that period. While the decision to use cryptocurrencies wasn’t company-wide, local franchises were free to use crypto payments. These cases make Subway one of the first major food chains to accept payment using Bitcoin.

Burger King

Another notable brand, Burger King, which has some notable connections with cryptocurrencies. Burger King released WhopperCoin in 2017, which is considered the first issuance of a branded cryptocurrency by a large company in the food industry. This project was released by the Russian branch of Burger King, and it served as a loyalty program. While WhopperCoin is now defunct, Burger King also collaborated with a brokerage platform called RobinHood to give rewards in the form of cryptocurrencies to individuals who spent money at their restaurants. BurgerKing has also installed crypto payments in their restaurants in Paris. Since Paris is one of the most visited cities in the world, this implementation is very important for the popularity of cryptocurrencies.

Chipotle

Chipotle, the recognizable Mexican food chain, has embraced crypto in many ways. They’ve partnered with Flexa, which is a software that streamlines digital payments, to make crypto payments at Chipotle possible. However, to use Flexa, customers also need to install Gemini or the SPEDN app to store digital assets. At their US locations, Chipotle allows payments in 98 different cryptocurrencies using Flexa. Furthermore, anyone who makes a purchase using digital currencies has a 10% discount. Chipotle has also shown its positive outlook on crypto by celebrating National Burrito Day with a burrito and Bitcoin giveaway.

Problems Associated With Underbanked Regions

In many developing countries, opening a bank account requires proof of income, identification documents, and an established credit history. The problem with underbanked countries is that their citizens often work in informal economies, lack official documentation, or simply live too far from banking facilities. This makes it hard for them to save money, obtain credit, or work towards investing. Because of the lack of institutions, many individuals rely on cash, which is vulnerable to theft and loss due to circumstances such as natural disasters. Besides relying on cash, citizens of underbanked countries can opt for alternative financial systems, such as money lenders, remittance services, or mobile money platforms. This exposes them to a number of other risks. Most importantly, these systems can charge high fees and have unfavorable exchange rates or interest rates. Additionally, fraudulent schemes and scams prey on those who lack access to reliable financial education.

For businesses, access to credit is an important factor in business decisions. In these regions, small business owners and entrepreneurs struggle to secure loans, whether that’s because of the lack of banks or because the requirements for credit are hard to achieve. Another demographic of people who struggle in underbanked regions are digital nomads and tourists. This is why many of them for crypto. For example, a traveler can use a crypto debit card in Sudan without worrying about finding a bank to exchange money or receiving an emergency transaction from another country. For practical reasons, cryptocurrencies are helpful in some countries because there aren’t many banks and ATMs where you can withdraw money.

Does McDonald's Accept Bitcoin?

One of the most recognizable fast food chains in the world is McDonalds. They’re innovative, and they’re among the first businesses to experiment with drive-throughs and other orders. Since they’re innovative, one might ask the question: Does McDonald’s accept Bitcoin? No, most McDonald's branches do not accept Bitcoin as a direct payment, but you can pay at any McDonald's branch in the world using a crypto card. Just deposit Bitcoin to your wallet, buy a card, load it with Bitcoin, and connect it to your apple/google pay, and use it to pay for your meal. Whether Bitcoin can be used in McDonald’s or basically any other restaurant also depends on the country’s policies on currencies. One of the best examples of this is El Salvador. This country has accepted Bitcoin as a legal tender in 2021, allowing customers to use it at McDonalds and grocery stores. Similarly, McDonald's in Lugano, Switzerland, started accepting Bitcoin and Tether in 2022. This was a part of the city’s initiative to promote crypto adoption. However, regardless of the McDonald’s location, you’ll always be able to use crypto-funded debit cards.

How Crypto Payments Help in Hyperinflationary Economies

While cryptocurrencies may seem volatile, some currencies are more unstable. Countries like Venezuela, Argentina, and Zimbabwe have experienced extreme inflation rates, where the value of fiat money plummets in a matter of days. Bitcoin, on the other hand, is a deflationary asset, as there’s only a limited amount of it. If you decide to use a crypto debit card in Venezuela, for example, you’ll have a greater chance of protecting your wealth and keeping your purchasing power. During periods of hyperinflation, there is often a shortage of foreign currencies, preventing citizens from saving money. If Bitcoin is considered too volatile by someone, they can still use stablecoins, such as Tether (USDT), in other to keep their purchasing power. Stablecoins are pegged to traditional fiat currencies like the U.S. dollar or euro. There are multiple factors behind hyperinflation in these countries. Some struggle with poor management of government finances, while others face political crises that further destabilize their economies.

This leads many to explore alternatives, often asking, can you buy groceries with Bitcoin? Bitcoin and stablecoins offer a solution, as they are decentralized and resistant to government monetary policies, making them a viable option for preserving purchasing power. Some people in countries with hyperinflation rely on their families abroad for money. Many of them use traditional banking services, which impose high fees and delays. Cryptocurrencies can help significantly with cross-border transfers of funds, providing families that rely on their relatives' remittances with a faster, cheaper, and more reliable way to receive money. Banks in these countries also make it harder for individuals to earn interest on their holdings or access loans. Many decentralized finance platforms allow them to make investments and expand their capabilities just like they would through banks. Only the users, in this case, bypass the corrupt and insecure financial systems. Loans and credits are also important for small businesses and entrepreneurs. Thus, DeFi platforms allow entrepreneurs to position themselves better in these countries, as they can get funding through cryptocurrencies. There are also crypto payment processors that allow businesses to receive payments in Bitcoin, and other cryptocurrencies.

The Self-reliance That Crypto Offers is the Future of Finance

Cryptocurrencies, and more precisely, Bitcoin, have significantly changed the way we see money and finance in the past decade. While we’re far from the widespread adoption of Bitcoin, more and more countries and corporations are considering ways to implement it. The concept of being your own bank can alleviate a lot of stress tied to traditional finance, and it could help many towards financial independence. Of course, cryptocurrencies aren’t without challenges and downsides, but they are a better alternative in many cases.