Peter Todd said that all it would take for him to create Bitcoin before anyone else would be a single tweet sent from the future describing how it works. He is known for outrageous claims, and that is certainly one of them because Bitcoin was created by at least a dozen geniuses, such as Adam Back, who worked on the underlying systems and connected the dots for years before Satoshi wrote his whitepaper. Who is Adam Back? He is a British cryptographer, cypherpunk, and CEO of Blockstream, best known as the inventor of Hashcash back in 1997, a proof-of-work system that influenced Bitcoin mining. He has been speculated to be Bitcoin’s creator because he was one of the first people contacted by Satoshi Nakamoto, and his work on Hashcash was cited in the Bitcoin whitepaper, though he denies being Satoshi. His company, Blockstream, is behind the Liquid Network, a Bitcoin sidechain, and Blockstream Satellite, which lets users download the Bitcoin blockchain without the internet. Among his contributions to the cypherpunk movement are projects like Mixmaster remailers for anonymous email communication and credlib, a cryptographic credential system.

Adam Joins the Cypherpunks and Gets Spammed

Who is Adam Back in the 1990s? He is a university student in computer science at the University of Exeter, studying distributed systems, which sees computer devices as dots that can be connected to create a bigger picture. He joined the original cypherpunks mailing list in 1996, and there he found his life’s purpose. They were digital rebels and visionaries who recognized the power of encryption, computers, the internet, and computers being able to work together over the internet with or without encryption. They realized that this power could be used to give people more freedom than ever before, but they needed an expert to show them how to use it without any intentional or accidental abuse. They didn't know how to play nice, so passions started flaring up, and their discussions soon became childish shouting matches, resulting in huge amounts of spam. When Adam joined the list, he was like a dad coming between squabbling kids that kept getting louder and louder to the point of throwing hands.

Cypherpunks were largely immature and in need of someone like Adam Back

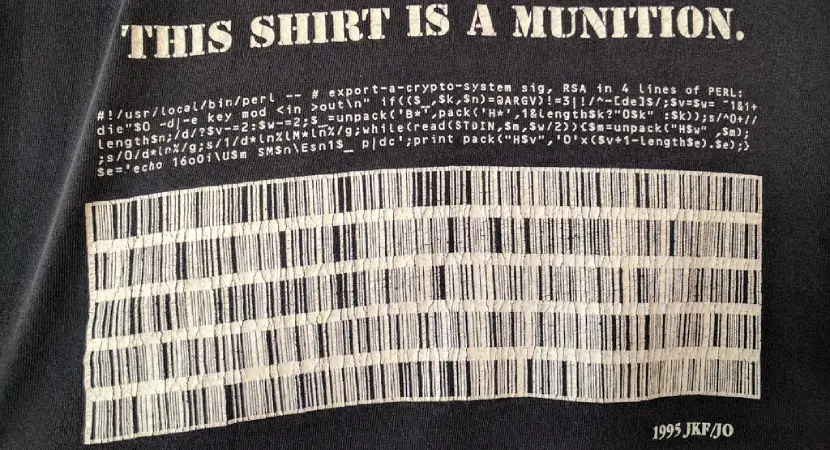

Cypherpunks chatted about their ideas using the anonymous remailer system, which was basically a group chat over email in which a bunch of email servers forwarded their emails to each other to hide the real sender. As I explained in my article on Eric Hughes, the cypherpunk remailing list started in 1992 and exploded in popularity in 1993, counting over 600 participants by then, some of whom were spammers and trolls who impersonated others or sent death threats, leading to endless noise and drama that was driving the smart people crazy. Eric proposed that people pay him $20, and only then he would accept their emails into the system, but Adam came up with a better solution that will eventually become hashcash. He joined the remailing list in August 1995, with one of his notable emails coming from an Exeter University email address on April 1, 1996. It discussed the T-shirt with a printed computer code on it that allowed people to encrypt their messages, which was deemed military technology and declared illegal by the US government at the time.

Some enthusiasts even tattooed the code on themselves

On December 6, 1998, when the remailing list was bursting at the seams with spam and drama, Adam Back sent an email that discussed Wei Dai’s b-money, a public and distributed protocol for creating and sending money over the internet. Adam found seven flaws in b-money and proposed that his idea, which he called “hashcash,” could be used to solve at least a few of those flaws and create the digital value in b-money. Simply put, hashcash makes computers solve hard mathematical problems in a way that makes the solution easy for others to verify. Those solutions are what is known as “proof of work,” which serves as a shortcut to getting authority in the network. Instead of showing an ID or a license to get access to shared internet resources, a user shows the proof-of-work solution that, once verified as correct by other nodes in the network, lets the user automatically access the amount of resources equal to the amount of work invested in the solution. Since that heavy math is called “hashing” and the proof-of-work system works like paying $20 cash to enter a remailer system, Adam called his idea hashcash.

The Adam Back Hashcash Whitepaper and the Origin of Hashcash

We had to wait until 2002 before we got the Adam Back hashcash whitepaper. It shows that Adam thought of hashcash in 1997 as a proof-of-work system initially intended to limit email spam and DoS attacks, but it later became the foundation of and is mostly known for Bitcoin mining. It requires users to compute a cryptographic hash with a specific number of leading zeros, making automated bulk messaging costly for spammers while remaining efficient for legitimate users. Comparing the whitepaper’s abstract to the cypherpunk email archive reveals the exact thought process Adam Back went through. The first sentence in Adam’s “Hashcash - A Denial of Service Counter-Measure” whitepaper mentions email, anonymous remailers, and the date of hashcash invention. Looking through the remailer archive, I found a May 22, 1997, email from Adam Back on the topic “spam is a good thing,” which was originally called “spam is freedom of speech,” where he said that spam forces cypherpunks to face the flaws of networking and come up with better solutions for them without waiting for big daddy government to create laws that will force everyone to get the equivalent of a driver’s license to use the internet.

In that email, Adam suggested that a long-term solution to spam was proper anonymous ecash, which they still didn’t have at the time, but he also proposed some short-term solutions and linked to an Exeter University webpage, with the now-dead link containing his initials and the word “hashcash.” The whitepaper explained that a user who wants to use a network, for example to send an email to everyone else in the remailer network, would first use hashcash to put his computer’s CPU to work and create a token that is sent to the server that checks its value before allowing the user access to the server. In plain English, hashcash is like a recipe for baking a cookie of the right shape and size that crumbles the right way, which is checked by the main pastry cook before putting the cookie on display. The whitepaper proposed some optional features of hashcash that would allow every server to customize the recipe to its needs, such as dynamically adjusting the difficulty depending on the traffic.

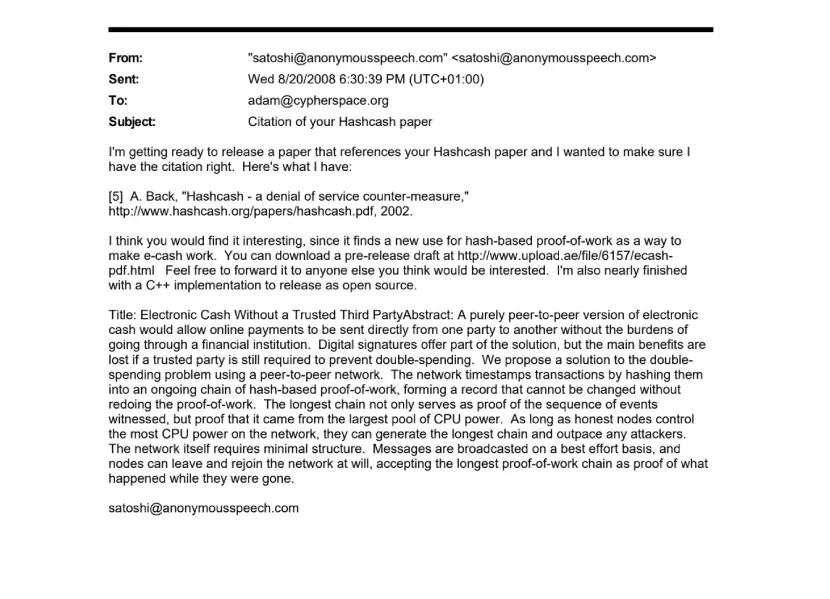

The Big Picture in the Adam Back Satoshi Nakamoto Emails

Adam started connecting the dots by participating in the remailing list, which led him to propose a solution to stop spam in a distributed system, but it took Satoshi Nakamoto to see the big picture and think of actually using hashcash in Bitcoin, which we can see from the Adam Back Satoshi Nakamoto emails. In their email correspondence from 2008 and 2009 that went public after being entered into the official court records in the UK in February 2024, Satoshi Nakamoto and Adam Back discussed the citation of Back’s hashcash whitepaper in Satoshi’s upcoming Bitcoin whitepaper. Adam confirmed the citation was correct and mentioned Wei Dai’s b-money proposal as a related concept. Satoshi acknowledged this and planned to credit Dai. They also discussed using proof-of-work not just for minting coins but also for network timestamping, replacing Usenet, which was the most popular messaging platform at the time. The final email was sent from Satoshi to thank Adam and notify him of the release of the 0.1 version of the Bitcoin whitepaper.

The court case involved the Crypto Open Patent Alliance (COPA) on one side and the Australian crypto influencer Craig Wright on the other, with Adam called as a witness for COPA. Craig claimed that he is Satoshi, that he invented Bitcoin, and that he holds intellectual property rights on the Bitcoin whitepaper, even going so far as to make a hard fork, a separate version of the blockchain, of Bitcoin as an altcoin called “Bitcoin Satoshi’s Vision” (BSV). He made some blunders in his court filings, stating that he based Bitcoin on b-money, which Adam’s previously unreleased emails contradicted. The court ruled in March 2024 in favor of COPA, stating that Craig is not Satoshi, that he must stop suing or threatening to sue people for using the Bitcoin whitepaper, and that he should be prosecuted for lying and presenting fake documents in court.

Is Adam Back Satoshi? There Is Little Evidence for It

Bitcoin is so important for the crypto community that, had Craig succeeded, he could have pressured pretty much anyone who ever cited the Bitcoin whitepaper into paying him money or giving him ownership of their product. Luckily, he failed, but many others foolishly claim to be Satoshi just to get some authority in the crypto community and promote their ideas. Is Adam Back Satoshi? No, he's not, and he has never claimed it and has actually denied it. The reasons people suspect him are: his deep cryptographic expertise, cypherpunk values, the invention of hashcash, a key component of Bitcoin’s proof-of-work system, Satoshi citing his work in the Bitcoin whitepaper, being one of the first people Satoshi emailed while drafting the whitepaper, and him claiming to have deleted any emails from Satoshi. One big reason against him being Satoshi is his support of institutional adoption and trading that contradicts Satoshi’s original vision of decentralized, peer-to-peer electronic cash.

Additionally, Adam tweeted that he joined the bitcoin-wizards IRC channel in 2013 to ask numerous technical questions about Bitcoin, and he even provided channel logs from that time to prove that he only proposed concepts to improve Bitcoin in the latter half of 2013, further indicating that he is not Satoshi. The public first heard about who is Adam Back in Section 4 of the Bitcoin whitepaper, where Satoshi said hashcash is useful for distributed timestamping. That was probably where Peter Todd got his idea to start OpenTimestamps, a service that allows decentralized timestamping based on the Bitcoin blockchain that avoids any calendar maintained by a government or a religious institution. Can you guess who is Adam Back going to hire at Blockstream? He got the cream of the crop of Bitcoin engineers and programmers, with one notable hire being none other than Peter Todd, with the Money Electric HBO documentary hinting that there is a dad-son relationship between them.

The Misleading HBO Documentary on Adam Back as Satoshi

Money Electric: The Bitcoin Mystery is a 2024 HBO documentary that tried to appear objective, but it ended up floating some outrageous claims regarding the identity of Satoshi Nakamoto, including Peter Todd, who had to vehemently deny he’s Satoshi after he realized that the documentary took his words out of context and that there are many crazies out there who want to kidnap Satoshi. The central person interviewed in the documentary was Adam Back, who factually described his interaction with Satoshi and calmly stated that he is not Satoshi. Still, the documentary put a lot of effort into piecing together circumstantial evidence to show that he is, such as the fact that in 2015 Satoshi sent out an email that criticized Bitcoin’s development and was in line with Blockstream’s agenda. In addition, Peter Todd, a famous troll, provoked Adam Back to admit that he’s Satoshi on camera, which was another way to mislead the viewer of the documentary into hinting that Adam Back is the real Satoshi. In October 2024, Adam did an interview for Cointelegraph titled “The Truth About Satoshi Nakamoto: Adam Back Explains,” where he tried to set the record straight.

He said that there needs to be a discussion about Satoshi because an influencer might want to claim he’s Satoshi before releasing his altcoin, obviously referring to Craig Wright and BSV. But, Adam said that we’ll never have digital proof of who Satoshi is and that anyone can speculate on who that might be. Who is Adam Back considering the most likely candidate for Satoshi? He answered that there are dozens of candidates, that it’s possible to make an equally strong case for any of them, and that it’s good that Bitcoin doesn’t have a loud, vocal, or obnoxious character as the leader, someone like Elon Musk. He said that the faceless nature of Bitcoin makes it feel more like a discovery rather than a startup, which helped Bitcoin become a commodity. That interview gave me the impression that Adam is what is known as a “BTC maxi,” meaning he wants Bitcoin to be the dominant currency in the world, so his goal is to maximize BTC adoption through services and products that help people use it safely and anonymously. But, that goes against the agenda of many people who want to muddy the waters and make a quick buck off of Bitcoin. Adam also said in the interview that now there is an incentive for people to make startups that try to mimic the creation of Bitcoin, but they are essentially pyramid schemes. We can recognize them because they work just like regular companies with CEOs, marketing departments, and so on, which led to the creation of nearly 3 million cryptocurrencies. In Adam’s opinion, only Bitcoin is worth the investors’ time and money because it is the only cryptocurrency that can achieve price parity with gold. The more that happens, the more likely it is that there is a flow of funds from gold into Bitcoin, which should increase Bitcoin’s price even more.

The Block Size Debate Flares Up

It makes sense to abandon gold and move to Bitcoin because it only requires an internet connection to transact, keep, and hide, but in 2015 it met a problem that was threatening to undo all those advantages. Bitcoin developers realized to their dismay that Bitcoin was having too many transactions that clogged up the Bitcoin network, which couldn’t scale to meet the demand because of hardcoded limitations set by Satoshi. There was a heated debate, with some participants acting like squabbling kids, with two solutions emerging:

- Keep the block size as is, advocated by engineers

- Increase the Bitcoin block size, advocated by influencers

The former side was called “Small Blockers,” and their idea was to create layers called “sidechains” or “Layer-2" or "L-2" on top of Bitcoin’s network and use them for fast daily transactions. One Small Blocker sidechain is the Lightning Network, which is still not working as promised due to liquidity and routing problems that are unsolvable because they go against the core features of the Bitcoin network, such as anonymity and trustless decentralization. Meanwhile, big corporations were behind Big Blockers, who clamored for changing the Bitcoin source code to pump those numbers up and increase the block size, which would give more power to big miners and erode trust in Bitcoin. If only daddy Satoshi were there to end the argument.

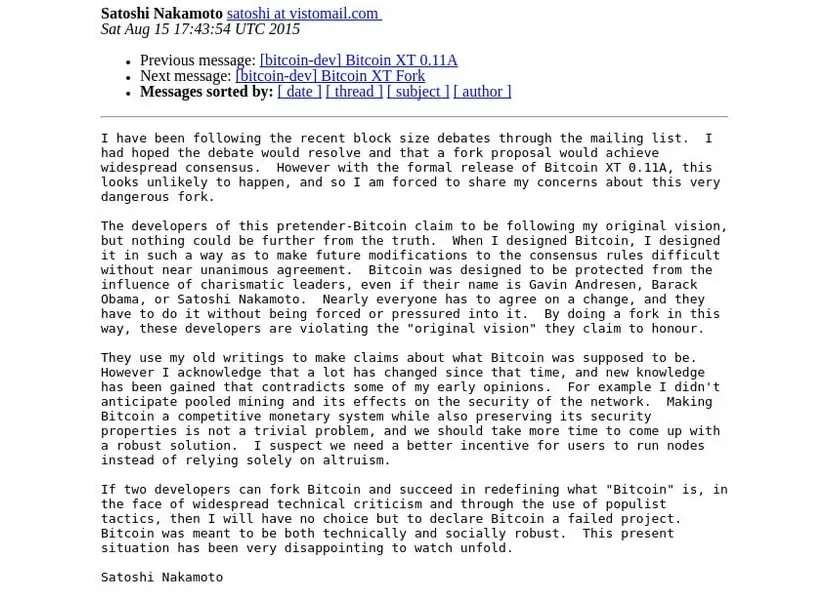

On August 15, 2015, the Bitcoin developer mailing list got an email sent from the same address used by Satoshi to announce Bitcoin. The email was critical of the block size debate and the idea of changing the Bitcoin source code to increase the block size, calling the situation “very disappointing.” The cryptocurrency community roundly rejected the email with the explanation that it was probably someone who got into Satoshi’s account, mostly because the choice of words did not match Satoshi’s writing style. One phrase in particular, “populist tactics,” was also used by some employees from Blockstream to defend against Big Blocker accusations that they are stifling Bitcoin’s growth, giving rise to the notion that someone from Blockstream sent the email (my money is on Peter Todd). To give you an idea of how heated the arguments were at times, check out this video of Rick Falkvinge, the founder of the Swedish Pirate Party, mercilessly poking holes in the Lightning Network.

Writing patterns are not reliable proof of identity, but in this case the differences are jarring

The arguments against Small Blockers were piling up, and they were pretty compelling. While the HBO documentary tried to make Small Blockers seem more influential than they were, even going so far as to place Adam on the Small Blocker side, my research revealed that they had no ground for their stubborn refusal to grow Bitcoin and that Adam was stealthily a Big Blocker because he advocated for growth with caution and careful timing to avoid breaking Bitcoin or the crypto community. Adam was not against Big Blockers, but he was against their reckless experiments made on behalf of governments, rogue agents, or big businesses, and he has openly called out some of the Big Blockers for avoiding a debate with him and using, as it were, populist tactics. It's only when Blockstream got investor funding that he started openly promoting Big Blocker ideas and came dangerously close to taking on the role of a fake Satoshi, which is the favorite tactic of Big Blockers to generate hype and promote themselves and their self-serving agendas.

The more finance bros enter a field, the more vain and self-serving it becomes

Adam Starts Blockstream To Test His Bitcoin Improvements

The block size debate was at its core a discussion on whether Bitcoin should serve the rich or the poor. Increasing the block size would increase Bitcoin’s transactions per second to come closer to that of VISA, but Bitcoin would then become reliant on big miners and broadband internet connections. Small Blockers wanted to make Bitcoin the money for the people who cannot get access to traditional banking, which meant keeping the blocks small so that people with bad internet connections could run a full Bitcoin node. The problem is that people who can’t access a bank often can’t access the internet, electricity, or the road either, which is especially the case in Africa. For example, there was only one full Bitcoin node in the entire Nigeria, which was reported by Motherboard in 2017 (the article was later deleted for unknown reasons but is available through archival websites). The rest of Africa isn't faring any better.

Bitcoin requires a stable power grid, which Africa largely lacks

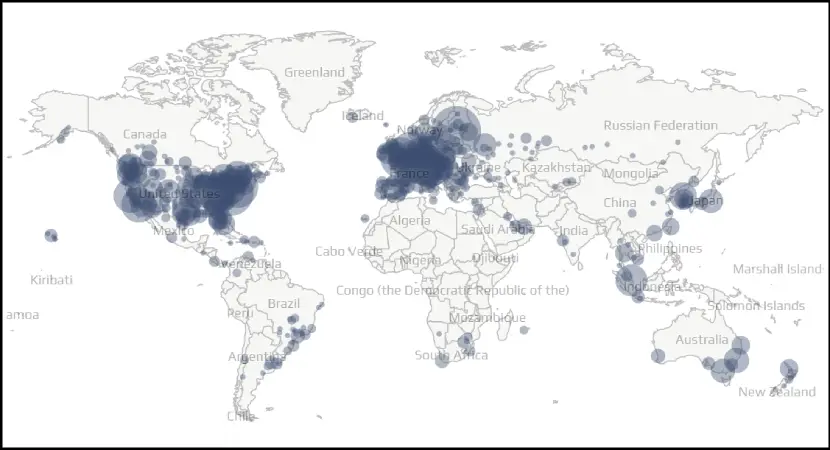

As seen from the map, the majority of Africa doesn’t have a full Bitcoin node, and there is little anyone can do to get them to run one because running it costs a lot. When Adam founded Blockstream in 2014, he made Bitcoin products and services that help people in those poor areas use Bitcoin without reckless experimentation. To me, it seems like that was the original Blockstream philosophy, but the company has slowly changed course and become just another outlet for Big Blockers. For example, the Blockstream blog articles regularly post about Bitcoin being the best digital asset in the world, with updates for other Blockstream products and services being few and far between. In May–June 2025, Blockstream did a promotional tour in the USA that started with donating 1,000 Blockstream Jade Classic hardware wallets to a non-profit Bitcoin organization and continued with Adam’s address in Las Vegas at the Bitcoin 2025 conference, where he said that he hopes Bitcoin will have a billion users and become the future of finance. The shift in Adam’s attitude from cautious to adventurous Big Blockism is unsurprising, seeing how Blockstream received funding from major financial players, such as AXA Strategic Ventures, getting $55 million in 2016 alone. Those players are only interested in hyping Bitcoin up and riding the hype wave for their own profit. They will do whatever it takes to increase short-term profits, no matter if it harms Bitcoin in the long run, and that includes telling Adam what to say in his public appearances, which is apparent from the finance bro jargon he used in his address. Since he didn’t say a single word about Blockstream products, I will.

Blockstream Satellite

Launched in August 2017, Blockstream Satellite is a service in which Blockstream’s satellite antennas broadcast the Bitcoin blockchain to five satellites in orbit, from which the data goes to receiver antennas almost anywhere in the world. To receive the signal, users need to have either the Blockstream Satellite Pro Kit, priced at around $1,000, or the Base Station, priced at around $500 (sold out as of June 2025). The satellite dish is not included with the Pro kit, but any dish antenna with a minimum diameter of 60cm will do. The inspiration for the idea probably came from one Bitcoin enthusiast who ran an experiment showing that it’s possible to transmit Bitcoin data over radio waves, which isn’t practical but makes it possible to continue updating the BTC blockchain in cases of internet collapse or global censorship. The goal of Blockstream Satellite is to reduce the reliance on regional and national Internet providers, who can introduce new censorship rules that will affect Bitcoin and effectively cut off a region or a country from the Bitcoin network. The Blockstream Satellite means the user can receive the entire Bitcoin blockchain over the satellite connection, but he still needs to have a separate internet connection to actually become a participating Bitcoin node. The press release quoted Tim Akinbo from Nigeria, who is the same person featured in the now-deleted Motherboard article, which I found interesting.

Liquid Network

Liquid Network is a Bitcoin sidechain announced on October 12, 2015, and launched on September 27, 2018. As seen in the press release, the Liquid Network at launch connected 23 big financial players, such as crypto exchanges and banks, into a network that handles user assets by using L-BTC, a token that can be used to settle Bitcoin transactions between users on the sidechain without using the Bitcoin blockchain. The main feature of Liquid Network is speed, which is achieved by allowing partially signed Bitcoin transactions that would not be accepted on the actual Bitcoin blockchain. An interesting upside of that feature is that no Bitcoins are held in custodial wallets, so any exchange or bank using Liquid Network doesn’t lose funds by being hacked. Some announced features for Liquid Network are bonds and security tokens that allow the issuance of debt.

Elements

Launched in 2015, Elements is an open source development platform that helps cryptocurrency enthusiasts create and deploy their own blockchain or sidechain. The platform was created using Bitcoin’s code, with certain added features, such as asset issuance, confidential transactions, and multi-party block signatures. Liquid Network was made using Elements.

PlasBit’s Dedication to the Crypto Community Is Priceless

A network becomes exponentially stronger with each node that joins it, which holds true for people and computer devices. But, all it takes is one rogue node to disrupt the entire network, and if there are several rogue nodes or they organize an attack on the network, it can become almost unusable. Cypherpunks experienced that firsthand when they made a computer network that gave users maximum freedom of speech while preserving their anonymity, but they couldn’t figure out a solution to rogue nodes and spam until Adam Back proposed hashcash. Adam Back was the first to figure out how to connect the dots without giving any of them too much power, although we had to wait for Satoshi to see the big picture and propose Bitcoin. That set the foundation for the entire cryptocurrency ecosystem, of which PlasBit is a part. I found it deeply saddening that Adam Back betrayed his principles and became a shill for Big Blockers, slowly becoming the kind of fake Satoshi e-daddy figure that he so earnestly fought against for years. I guess he has a price too, and it goes as low as a couple dozen million dollars. I know that PlasBit isn’t motivated by money but by a desire to build something strong and leave it to the next generation. I’m not in it for the money either, which is why I know that PlasBit is the perfect partner for me and why I expect that we’ll create something amazing and lasting in the years to come.