“Stuck” tokens in your wallet feel like finding loose change but being unable to reach it. If you get the error you don't have enough XRP to cover network fees, it happens because every transfer on the Ripple network requires a small transaction fee, known as “gas,” that’s paid in the network's native token in this case, XRP and you don’t have enough XRP to complete the transaction. The solution is to use an exchange service to deposit fiat or crypto into your wallet, buy some XRP, and send it to your external wallet that is missing the XRP so you will have enough to pay the gas fee. This way, you’ll get your tokens unstuck and back to where you need them.

10 Steps To Release Your Stuck Tokens On The Ripple Network

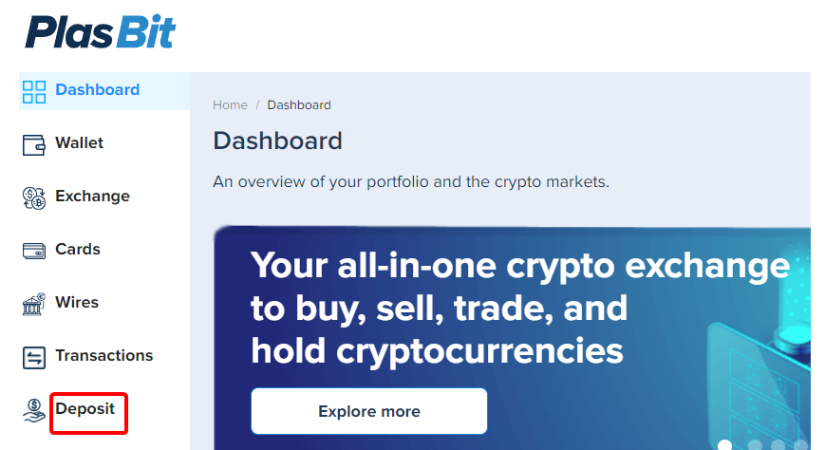

Step 1: Login and head to the deposit section

If you don't have enough XRP to cover network fees, the first step to solve the problem is to log in to your PlasBit account. Once you’re in, head over to the Deposit section. This is where you can deposit either fiat (like dollars or euros) or crypto into your PlasBit wallet. The interface is easy to use and navigate.

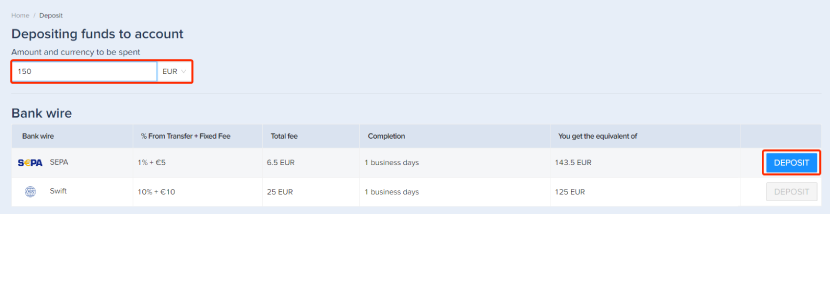

Step 2: Enter the amount and currency to be credited

Once you’re in the Deposit section, next you should enter the amount and currency to deposit, such as $10 or 10 EUR. Once you’ve done that, you’ll see different bank wire methods. Make sure to double-check the fees and speed of transaction for each method and choose the one that suits you best. Once you’ve chosen the method that works best for you, click the Deposit button and you’re good to go.

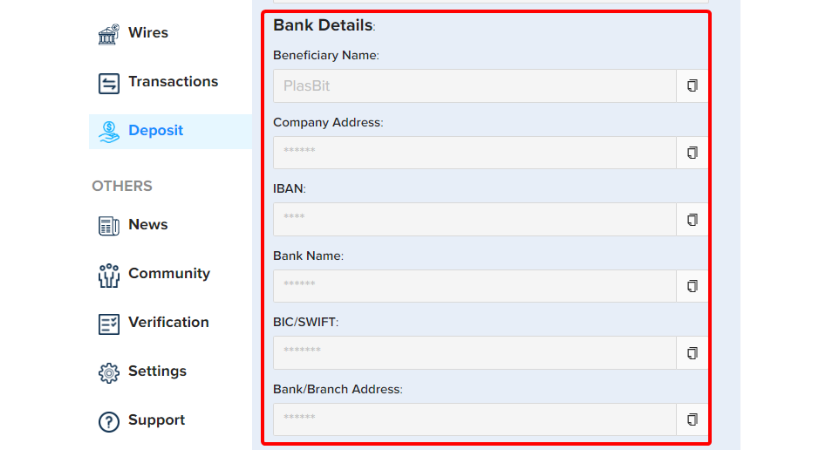

Step 3: Transfer funds from your bank

After clicking “Deposit” you’ll see all of PlasBit’s bank information, like the IBAN, Bank Name, and SWIFT/BIC code. These details are necessary for making the transfer from your bank to PlasBit. You’ll need to make sure you enter everything exactly as shown, so copy each section to the clipboard using the buttons provided and paste it into your banking app.

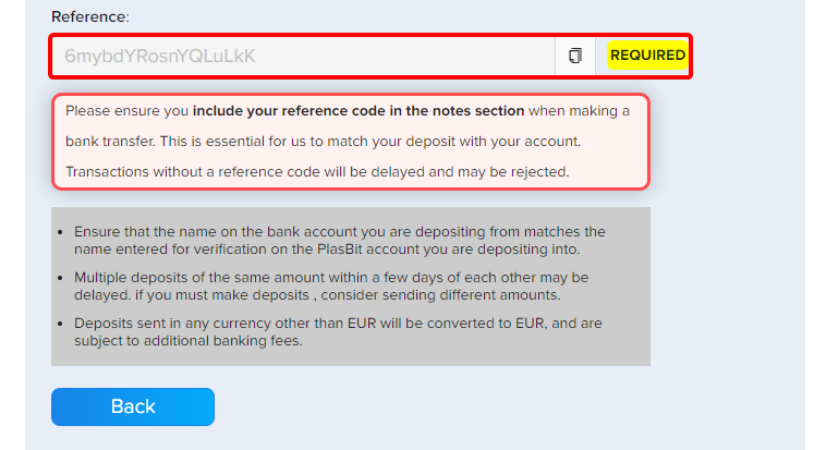

Important Notes

Don’t forget to add your referral code in the "Notes" section so PlasBit can link your transfer to your account.

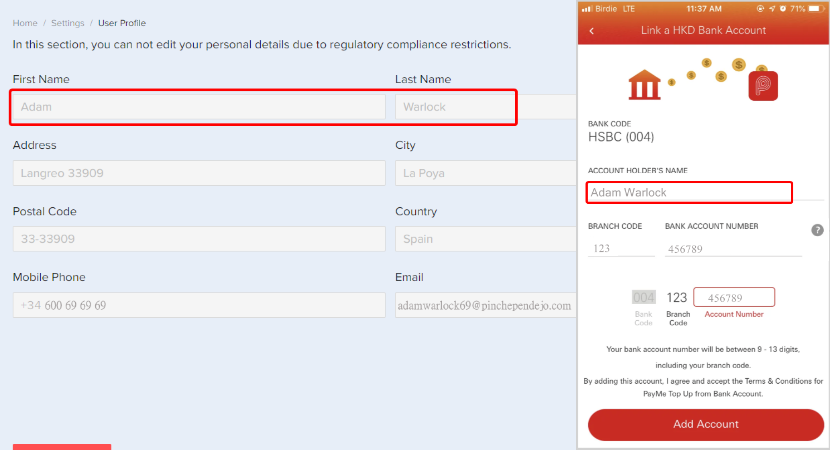

When making a bank transfer, it’s important that the name on the bank account you’re using matches the name registered to your PlasBit account. As shown in the example, the full name should appear exactly the same in both places. If you’re using a joint account or if the names don’t match, the transfer could get declined, so double-check this before making the transaction to avoid any hiccups.

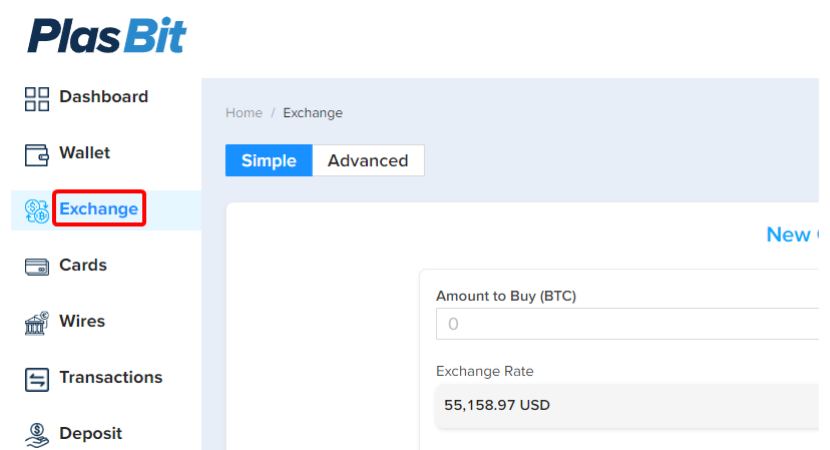

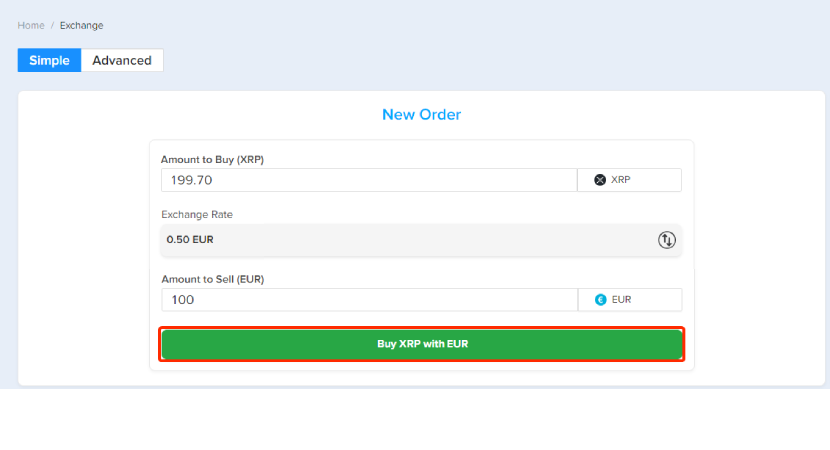

Step 4: Head to the Exchange

Once you’ve completed your deposit, head to the Exchange section on the left-hand menu. This is where you can buy XRP using the funds you’ve deposited. The interface will show you a simple option to select the currency you want to exchange and how much XRP you want to buy. It’s really straightforward, just follow the steps, and soon you'll have the XRP you need to cover the network fees.

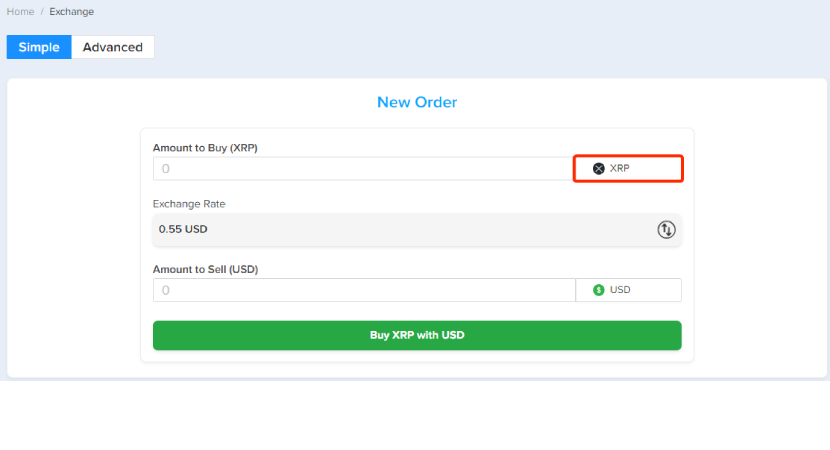

Step 5: Select XRP from the Pop-up Menu

Select XRP from the pop-up menu next to the "Amount to Buy" text box. Once you’ve done that, you’ll also see the exchange rate displayed for transparency.

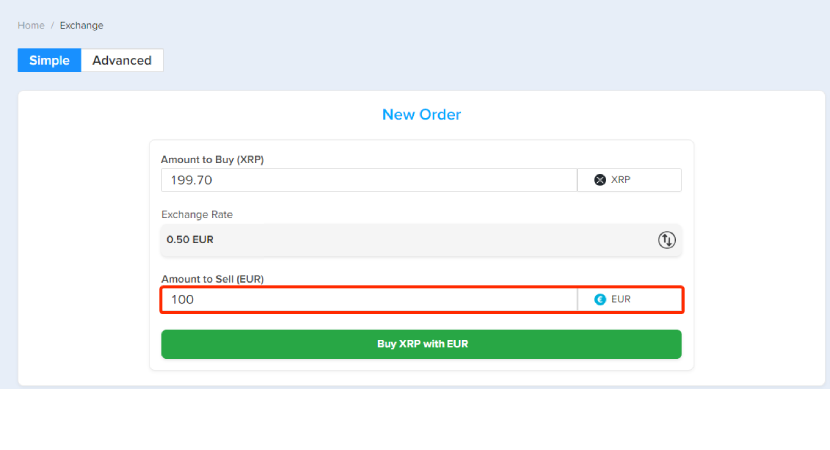

Step 6: Enter the amount of fiat currency to sell

In the “Amount to Sell” section, you’ll need to select the currency you’ve deposited, like EUR, as in the example. Enter the amount you want to exchange for XRP. The system will show you how much XRP you’ll receive based on the current exchange rate. Once everything looks good, you’re ready to hit the Buy XRP with EUR button.

Step 7: Buy XRP with EUR

Once you’ve reviewed the amounts, click the green button that says "Buy XRP with EUR". Clicking that will confirm your purchase, and you’ll soon have the XRP in your wallet, ready to cover those transaction fees.

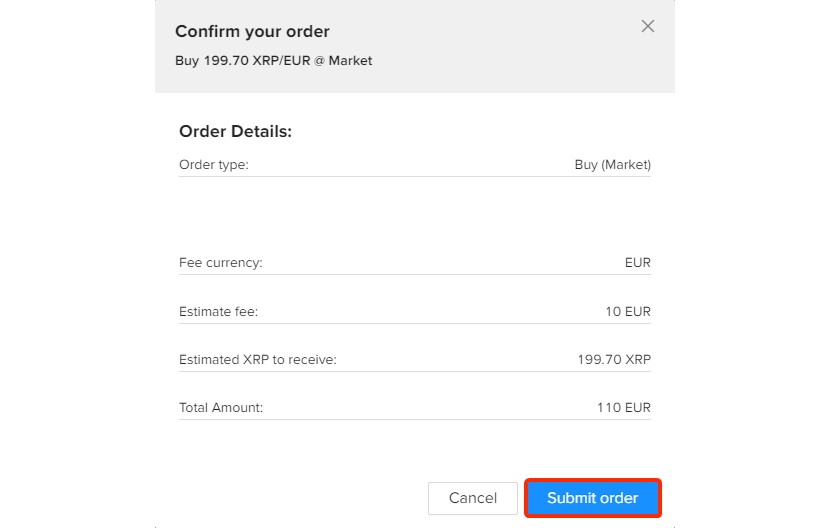

Step 8: Submit your order

After reviewing all your order details, click the “Submit order” button. The next screen shows you the amount of XRP you’ll receive, any fees involved, and the total amount of your transaction. Double-check everything to make sure it looks good, then hit Submit. Once done, your XRP will be on its way to your wallet, ready to help you cover those network fees.

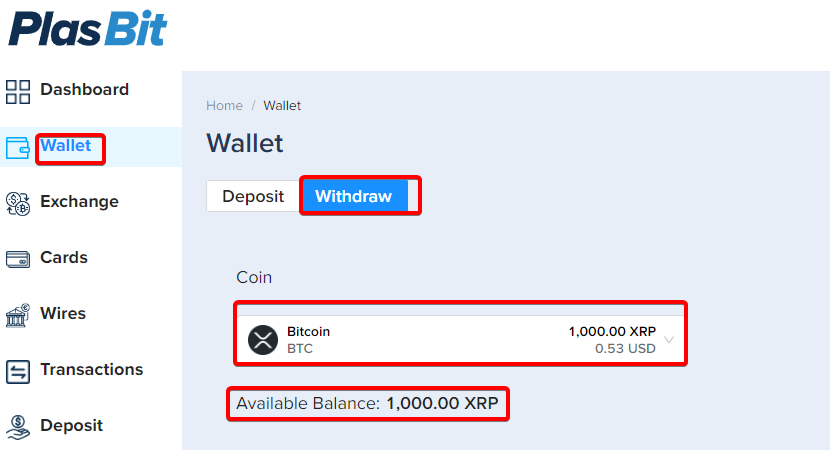

Step 9: Start your withdrawal

Once the XRP shows up in your wallet, head back to the Wallet section. Here, you’ll see your updated balance. Click on the Withdraw tab to move your XRP to another wallet, i.e., the one where your tokens are stuck.

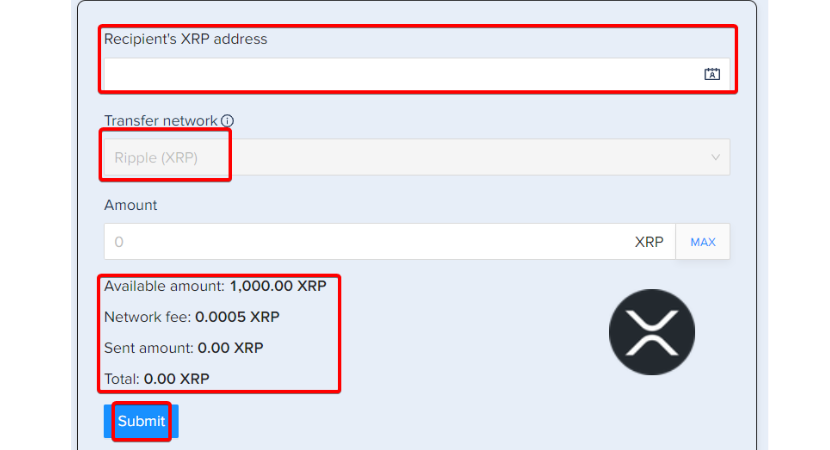

Step 10: Transfer your crypto

You don't have enough XRP to cover network fees? Not anymore! Now you have the XRP in your PlasBit wallet. You can transfer it to the wallet that has the stuck coins.

Enter the recipient's XRP address in the designated field, select the Ripple (XRP) network, and input the amount of XRP you want to send. You’ll see the available amount, the network fee, and the total to be sent. Once everything looks right, click Submit to complete the transfer.

Alternative Method: Borrowing or Swapping Crypto for XRP

If you don’t want to deposit fiat currency to buy XRP, another way to get it is to borrow via DeFi platforms or swap existing crypto tokens.

Platforms like Aave allow you to deposit assets like Ethereum as collateral, borrow stablecoins, and then swap them for XRP. By borrowing on DeFi platforms, you avoid selling your existing holdings while still gaining access to the needed XRP. Another option is using decentralized exchanges (DEXs) like Uniswap, where you can directly swap other crypto tokens for XRP.

Managing Transaction Fees (Gas Fees)

How to Avoid Running Out of XRP for Network Fees

To avoid running out of XRP for network fees in the future, you’ll find some useful tips and best practices below.

- Keep a Reserve: A little bit of extra XRP in your wallet is useful, especially during periods of high network traffic when transaction fees might spike without warning. Maintain a small buffer of around 5 to 10 XRP. That way, you’ll always be able to cover fees without having to rush to buy more in the middle of a transaction. For example, imagine you’re trying to transfer a token on the Ripple network and only have 1 XRP left. If fees rise unexpectedly, your transaction could get stuck.

- Set Balance Notifications: If your wallet or exchange allows it, setting balance notifications is a great way to stay ahead and prevent your XRP balance from dropping too low. For example, you can set a notification to trigger when your XRP balance dips below 5 or 10 XRP, which gives you enough time to proactively top up before you run into any transaction issues.

- Track Network Fees: Track fees carefully, especially during high transaction volume periods. Network fees on the Ripple blockchain, though typically low, fluctuate based on demand. To stay on top of it, check fee rates through your wallet or use online fee-tracking tools.

- Batch Transactions: If you're sending payments to multiple wallets, try to consolidate them down to one if you can. It’s a smart way to cut down on fees, especially when you’ve got multiple transfers to make. Instead of sending each transaction individually, group them together and process them all at once. This reduces network fees, as each transaction typically incurs a separate fee.

- Wallets with Auto-Replenishment Features: Although it isn’t possible yet, in the future there may be wallets that offer auto-replenishment features. In this case, the exchange automatically tops up your balance by converting other cryptocurrencies when your XRP balance falls below a set threshold, saving you the hassle of constantly checking your balance.

- Use Trusted Platforms: Using trusted platforms like PlasBit ensures secure and reliable transactions. You’ll avoid unnecessary fees and errors that could lead to stuck tokens. PlasBit prioritizes transparency, telling you all the fee details upfront and providing a secure environment to exchange your crypto.

How Are Gas Fees Calculated On The Ripple Blockchain?

On the Ripple blockchain, every transaction requires a small fee (commonly called gas fees) to prevent spam and overloading the network. These fees are paid in XRP and are destroyed, meaning no one profits from them.

The cost depends on network load. When traffic is high, the fees go up to discourage overloading. The base fee is incredibly low, around 0.00001 XRP, but can rise if the network gets busy. It’s all about maintaining efficiency and security on the network.

Gas fees apply to all blockchain networks, not just Ripple. For instance, if you want to move crypto on the Tron network, you’ll have to pay the gas fees using TRX.

Before making a transaction on the XRP network, predicting network fees can free you from any surprises. There are several tools and resources you can use to track and estimate fees in real-time.

- XRP Scan: This ledger explorer is a useful resource that provides current transaction fees and network performance data.

- Wallet Alerts: Some wallets allow you to check real-time fees and set notifications for fee changes.

- Crypto News Platforms: Crypto news sites like CoinGecko and CoinMarketCap sometimes track fee fluctuations for multiple networks.

- Social Media Networks: Platforms like Discord and Telegram often host dedicated crypto communities where users discuss the latest fee trends and share real-time updates on fees. Twitter and Reddit also have communities that provide insights on transaction timing and the best ways to optimize fees.

- Use PlasBit: If you send a coin on the Ripple network using our exchange, the fee will be paid in the same coin. As a centralized exchange, we handle the whole transaction for you.

How Do XRP Fees Compare To Other Networks?

The Ripple network, using XRP, consistently stands out as cheaper than other popular cryptocurrency networks. The low gas fee of $0.0002 per transaction, on average, means it’s cheaper than many of the bigger networks, such as Ethereum.

XRP's ability to process transactions quickly (typically within four seconds) is another big advantage, especially if you do a lot of frequent transfers or cross-border payments.

Using platforms like PlasBit, which prioritize transparency and security, users can easily manage and monitor their XRP without worrying about unexpected or high fees. This gives XRP a leading edge when compared to other coins with fluctuating costs, such as Bitcoin or Ethereum, during times of high network congestion.

What’s The Difference Between Layer One and Layer Two Crypto?

Layer 1 is the main blockchain, like Bitcoin or Ethereum, where all transactions are processed. It handles the core work, but as demand grows, it can slow down. Layer 1 tends to be safer than Layer 2, but slower in growth.

Layer 2 sits on top of Layer 1, helping scale the network by processing transactions off-chain or bundling them before sending them back to Layer 1. Examples are Bitcoin's Lightning Network or Ethereum's Polygon. Layer 2 is generally faster, but security is often stronger with Layer 1. Investment-wise.

Best Practices for Large Transactions

For high-value transactions, the stakes are higher, so you need to be more strategic. If you're not in a rush, waiting for lower network fees during off-peak times can save you quite a lot of money. However, if time is of the essence, paying a higher fee to prioritize the transaction might be worth it, for instance if it’s for an important business deal or investment.

Additionally, always monitor the network status using real-time fee trackers. This way, you stay informed about when it's the right moment to make your move. Being well-prepared can make a huge difference when you're handling large sums on the blockchain.

Information About The Ripple Network

What Is Ripple Labs, Inc?

Ripple Labs, Inc. is a tech company based in San Francisco that develops blockchain-based payment protocols, especially for cross-border transactions.

Ripple Labs was founded in 2012 by Chris Larsen and Jed McCaleb. It aims to make transferring money faster and more efficient, using less energy than traditional crypto systems like Bitcoin.

The founders created the XRP Ledger and the XRP cryptocurrency to facilitate these payments. Ripple has grown in credibility in recent years, partnering with banks and financial institutions worldwide. The company is now led by CEO Brad Garlinghouse and CTO David Schwartz.

How Does The XRP Ledger Work?

The XRP Ledger (XRPL) is a decentralized blockchain designed for fast, low-cost transfers of XRP and other assets. It was created by Ripple’s founders to solve issues in cross-border payments, offering real-time settlement and scalability.

The XRP ledger uses a unique consensus mechanism, known as the Ripple Protocol Consensus Algorithm (RPCA), instead of energy-intensive mining, such as that used by Bitcoin. Instead, a network of validators ensure transaction security and decentralization.

XRPL is used not just for payments but also for issuing tokens, decentralized finance (DeFi), and more, making it highly versatile. As well as making payments, many people use crypto networks for trading. If you take the time to develop a good strategy, you can make 1% by trading crypto.

Who is the XRP Community?

The XRP community is highly active and engaged, consisting of developers, investors, and enthusiasts who discuss a wide range of topics. Forums like Twitter, Reddit, XRP Chat, and Discord host conversations on Ripple developments, XRP price predictions, legal battles (like the SEC lawsuit), and use cases for XRP and the Ripple network.

Community members often engage in technical discussions, sharing news about partnerships, and speculating on future developments. You’ll also find insider knowledge on the latest crypto developments, such as which new crypto coins are showing the most potential for success.

The Ripple management team, including CEO Brad Garlinghouse and CTO David Schwartz, also actively participates in these discussions, keeping the community fully informed.

Potential Future Developments in Ripple Fee Structures

One promising avenue is the potential for Layer 2 solutions, which are designed to process transactions off-chain before settling on the main XRP Ledger, allowing for faster and cheaper transactions.

Ripple might also partner with financial institutions to improve scalability and reduce congestion on the network. Protocol upgrades, such as adjusting the consensus mechanism, might also help maintain low fees while boosting security and transaction speed.