Tether, the crypto company behind the largest stablecoin, USDT (which stands for USD Tether) develops and operates the TRON blockchain, enabling USDT transfers while maintaining a 1:1 peg to the US dollar. As of 2025, Tether has reported $13 billion in profit for 2024 and although USDT has been delisted from major European exchanges due to its lack of MiCA regulatory approval, USDC has emerged as the preferred stablecoin in the region, holding the necessary regulatory approvals and licenses. Despite this, USDT remains the third largest cryptocurrency by market cap at $142 billion, while USDC holds a $57 billion market cap.

While TRX serves as TRON’s network native token, USDT is a multi-network token that can be transferred across different blockchains, including Tron (TRC20), Ethereum (ERC20), and Solana. It’s important to consider that each network has different transaction confirmation times and varying fees, affecting the speed and cost of transfers. If you want to know how to send USDT from wallet? navigate to the wallet section, select the withdrawal option, enter the recipient's address and the amount, choose the desired network, and submit and approve the withdrawal request.

What is a wallet address?

A wallet address is a unique string of letters and numbers representing a destination for crypto transactions on a particular crypto network (or blockchain). It does a similar job as a traditional bank account number – it identifies your account where you can deposit or send funds. Each network or blockchain uses a specific format for its wallet addresses – note all the examples following are randomly-generated simulated addresses that are not linked to any actual wallet:

· Bitcoin – uses multiple address formats:

o Legacy (P2PKH) – 26-34 characters, beginning with 1, using Base58 encoding e.g. 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa

o Script (P2SH) – 26-34 characters, beginning with 3, using Base58 encoding e.g. 3J98t1WpEZ73CNmQviecrnyiWrnqRhWNLy

o SegWit (Bech32) – 42-62 characters, beginning with bc1, and use lower case letters only e.g. bc1qw508d6qejxtdg4y5r3zarvary0c5xw7kv8hxzq

o Taproot (Bech32m) – 42-62 characters, beginning with bc1p e.g. bc1p5cyxnuxmeuwuvkwfem96l5tn6x92rzs6p33p7y

· Ethereum – using ERC-20 technical standard – is always a hexadecimal string (consisting of digits 0-9 and letters A-F with a prefix of 0x) and is always 42 characters long (including the 0x prefix) – e.g. 0x8507eb81f9de95230b8430bb5f8b8958ba9b2839

· TRON – using TRC-20 standard – is a 34-character string, beginning with T, using a Base58 encoding – e.g. TNd4gJ5xUwFV2E4hP4a8d1yPtZ6a9H9cQn

· Binance Smart Chain – using BEP-20 standard – is exactly the same format as Ethereum – 42-character hexadecimal number (including the leading 0x). e.g. 0x742d35Cc6634C0532925a3b844Bc454e4438f44e. Because the address format is the same, you must ensure that you choose the correct network for your transaction – being the same format, it won’t fail the initial validation checks.

· Solana – using SPL standard – fixed length of 44 characters, using Base58 encoding, resulting in a mix of upper and lower case letters and numbers e.g. 3nP8F5HfWxt1Bk6xzPU1s1KKdPLB1tsBX5x7HJ2mKnHT

What makes crypto trading secure?

The basis of security in crypto is Public Key Cryptography (PKC) – the same stuff used in encrypting emails, for instance. Although we may not understand the algorithms behind it, we are all exposed to this when we use the internet. It all depends on the use of a pair of ‘keys’ – the Public and Private keys – which are created using complex mathematical functions which easily generate the keys but are effectively impossible to reverse. If I want to send you an encrypted email that only you can decrypt, I use your Public key to encrypt it, and you use your Private key to decrypt it. Without knowing your private key, it would take potentially thousands of years, using the fastest computers available, to break the encryption – that’s why the private key must be kept private – once it is acquired, it can be used to decrypt anything that was encrypted with the corresponding public key. Yet I want to publish my Public key so that you can use it to encrypt something you want to send to me.

In cryptocurrencies, the Public key is related to a wallet address, which enables someone to send funds to your account, whereas the Private key is like the password to your wallet, enabling you to access the funds in your wallet. If you were to lose your private key, you would lose access to the funds in your wallet. To get round this, another algorithm has been created which generates a ‘seed phrase’ consisting of a series of words, typically 12 or 24, chosen from a set list of words by manipulating data generated from the wallet itself. The seed phrase can later be used to regenerate your private key, so it’s very important that you protect the seed phrase. Obviously, don’t share your seed phrase, you would be giving access to your wallet and your funds. Write it down on paper, don’t store it electronically since devices can be hacked. Consider using a hardware wallet, which can generate and store the seed phrase securely.

Which network is USDT on?

The answer to this question is not quite as simple as you might expect, because one of the important features of USDT (Tether) is the wide range of networks (blockchains) that it can be traded on. You can check out Tether’s own site for the full detail on which network is USDT on. Among the most popular networks are TRON, Ethereum, Ton, Binance Smart Chain, Solana, Avalanche, Polygon, Arbitrum.

How to send USDT from your PlasBit wallet – a step-by-step guide

Here are the full details on how to send USDT from wallet, showing actual screenshots for each step:

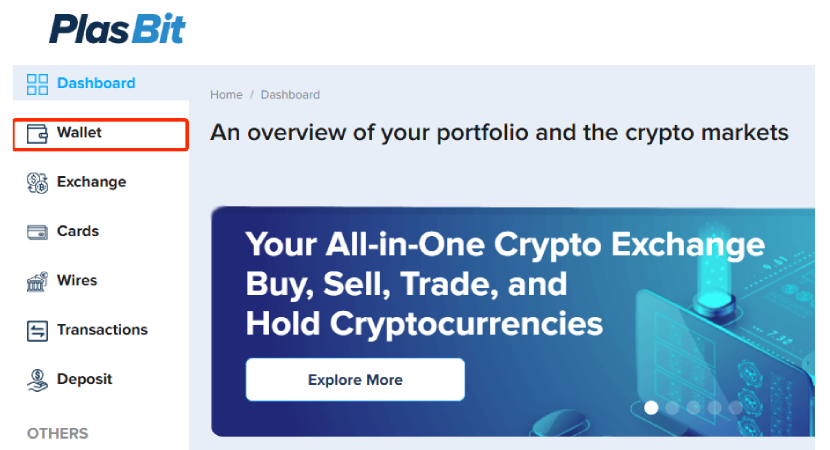

1. Login and go to the [Wallet] section.

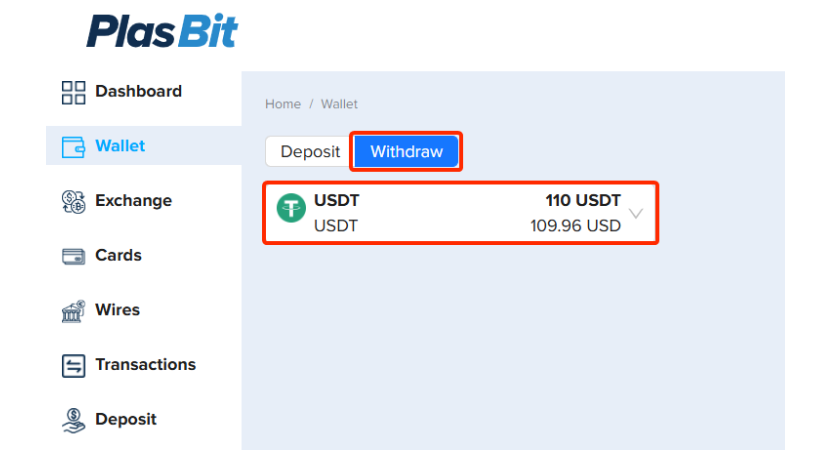

2. Choose your USDT Wallet and navigate to the Withdraw tab.

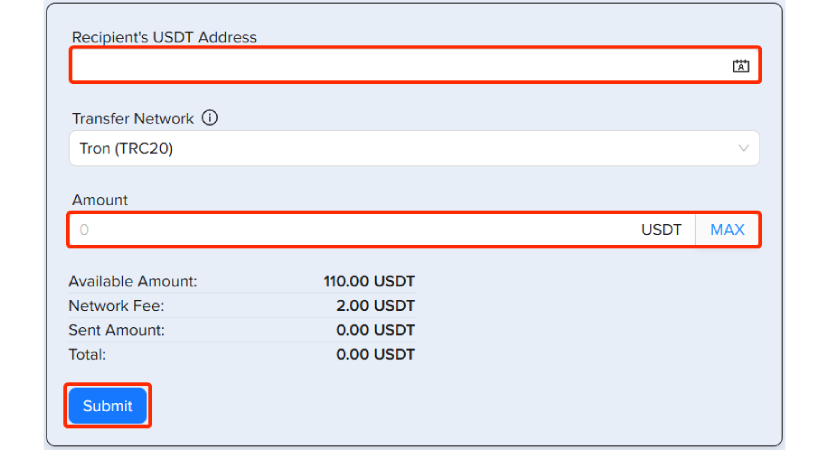

3. Fill in the recipient's address and the amount of USDT you wish to send and press [Submit].

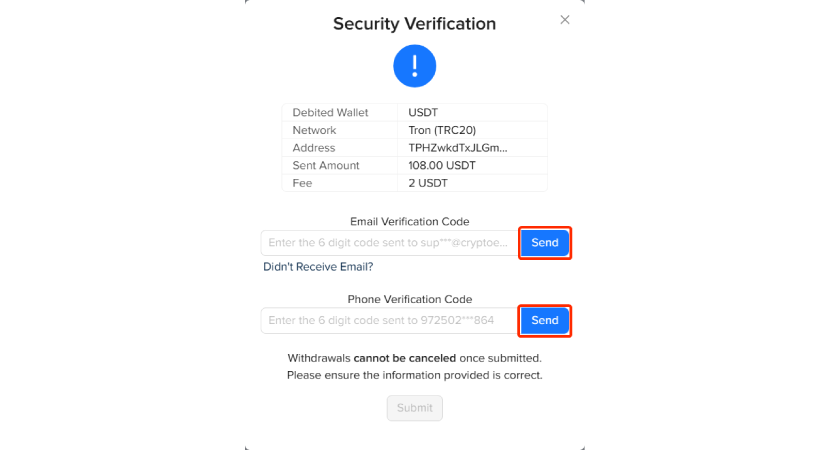

4. Now, you must go through the security verification. Press [Send] to receive verification codes on your email and phone.

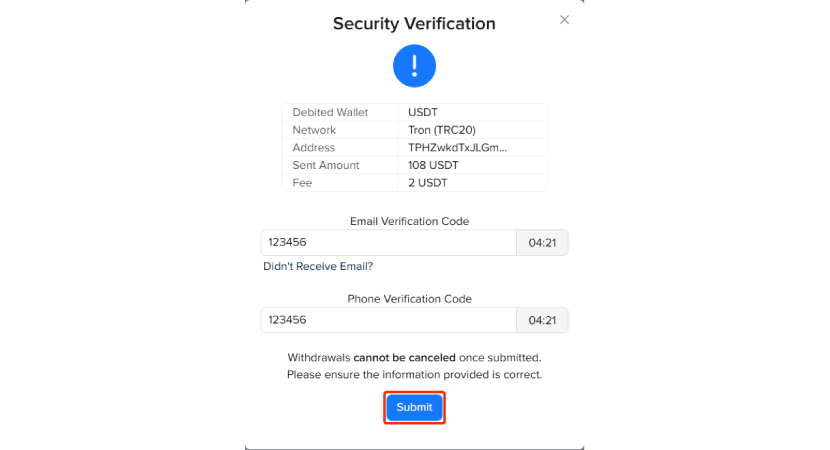

5. Copy and paste both verification codes after receiving them and click [Submit] to finish.

Note: You have 5 minutes before the codes expire.

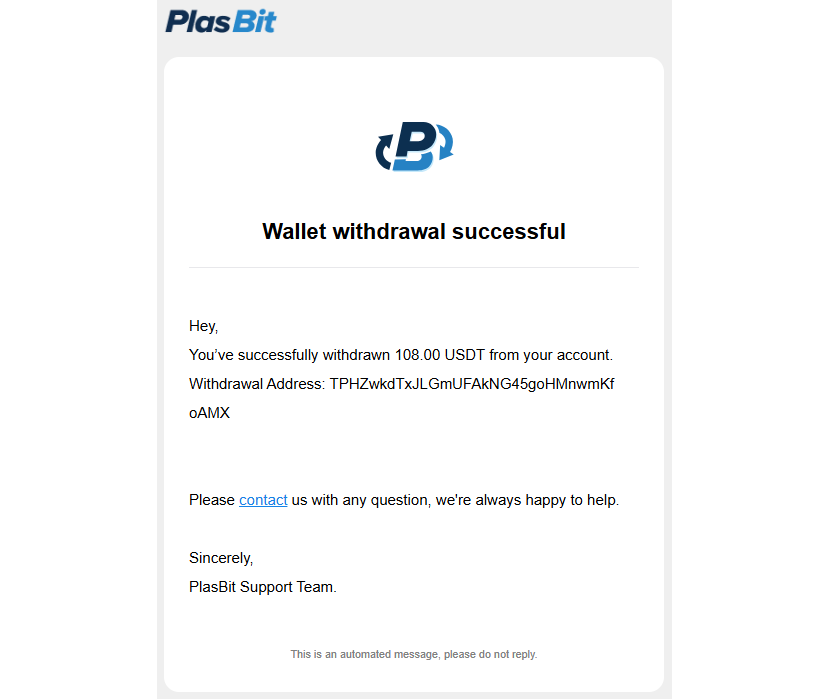

6. After this, you will be automatically redirected to the dashboard and receive an email verifying.

How long do USDT transfers take?

Each network has its own processing time but you need to consider there are different fees for each Network. If you’re sending USDT on the TRON network, you'll need to pay between $2 and $5 in TRX. On the Ethereum network, the fee is much lower, ranging from $0.10 to $1. Meanwhile, the Solana network has the cheapest fees, costing just a few cents. So how long do USDT transfers take? Transferring USDT on the Sola na network takes between 2-3 minutes, on the Tron network, it usually takes 5 minutes, and on the Ethereum network, it takes 10 minutes which is the longest. The transfer time can be affected by network congestion, the amount of gas fees paid by the sender, or, as stated before, which network you have chosen to transfer the USDT on.

How do I pay someone in USDT?

If you want to live your life on crypto, using it to purchase goods and services, you need to know how do I pay someone in USDT? Ask for the recipient's wallet address and what network he wants to receive the USDT on. Navigate to the withdraw option in your wallet, fill in the recipient's address and the amount of USDT you want to send, (make sure you select the correct network!) Review the transaction details and the network fee, and submit the request.

Don’t forget if you get the address or network wrong, you will be sending your tokens into the ether with no chance of getting them back, so double check you’ve got the details correct. Note the network fee and ensure you have enough available in the wallet to cover the fee as well as the amount you want to send.

Trading safely with USDT

As we’ve said, giving the wrong wallet address or choosing the wrong network can be as simple as making a typing error. Once you commit the transfer, the tokens are gone from your wallet, and there’s no sure way to get them back. If you can identify the actual recipient, you would need their cooperation to recover your funds, but you have no leverage if they choose to decline your request. One way to avoid this easy mistake is to do a test transfer of a small amount first, to make sure the intended recipient does receive what you sent. Only after you have done this successfully, then send the bulk of what you need to transfer.

The risk of human error

But it’s not just human error you have to be careful of – there are plenty bad guys out there who will do their best to get their hands on your crypto. So you need to consider the security of your crypto wallet.

Bear in mind that, in finance terms, crypto is like the wild west – if something goes wrong, you are probably on your own. This makes it a target for criminals who will use all kind of scams to separate you from your hard-earned funds. They will use all the same techniques that we’ve heard of in other finance scams – you’ve probably received dozens of scam emails saying someone has been spying on your online activities and they will release videos of you watching dubious online movies unless you send them some bitcoin – even if you have ever done that, they almost certainly are just telling a story and don’t really have any access to your computer to monitor your activities; nevertheless, people have been known to fall for this scam and paid over crypto to avoid the blackmail attempt.

Phishing scams in crypto

In fact, all the types of phishing you’ve ever heard of can be used against you and your crypto funds – romance scams, charity scams, blackmail, begging; not many businesses yet raise or pay invoices in crypto, but when that does become common then we can expect the same kind of fake invoices scams that we see currently with regular currency. Any time you have to think how to send USDT from wallet to someone new that you don’t really know, step back and review whether this is a genuine transaction. This is the same warning that banks tend to issue when you set up a new payee in your bank account, and the dangers are the same.

Fake trading websites and fraudulent exchanges

When you use a trading website, make sure it’s the real thing – scammers can make duplicates of sites that are almost indistinguishable from the real ones – watch for subtle differences in the website address, be careful if you notice spelling or grammatical errors, when you hover over links on the page check that the displayed address matches something you’d expect.

Scammers will go further – they make real trading sites that allow you to make small trades successfully, but simply steal your funds when you want to extract your money from larger trades.

Connecting your wallet to apps

It's quite common to connect your wallet to a crypto trading app, but you need to be sure you are connecting to a trustworthy app that has good reputation and history. If you connect to an app that’s actually run by the bad guys, they’re going to drain your funds in the blink of an eye, so check out a new app very carefully before you give it access to your wallet. Always protect your passwords, private keys and seed phrase.

Storing crypto safely

In any case, keep most of your crypto in an offline hardware wallet so it can’t be accessed by anyone else – but keep that under the tightest security you have available, and as your portfolio grows, increase the strength of your security accordingly – your device is actually recording your private keys, not storing any coins as such - so you could effectively have hundreds of millions of dollars worth of crypto on the same size device as a newbie with a few hundreds, but it would warrant a different level of care!

The dangers of public WiFi

Another thing to be careful of, whether you are trading in the coffee shop or you are living the digital nomad lifestyle, is the use of public wifi. Very often a public wifi access point will have no security – the giveaway is whether you get access without a unique account or security access code. If you just get direct access, then your device is visible on the local network to anyone else on the same network, which gives them the chance to spy on your device and your activities – so they might be able to capture your access codes for your wallet, for instance.

If you have to use a public wifi, consider using a VPN (Virtual Private Network) which means all your internet interactions go over an encrypted logical connection riding on the untrusted public network. If you are using a mobile device, consider using the internet over your phone’s data connection, since this will always be more secure than the coffee shop free wifi.

Pump and dump scams

Pump and dump is another fraudulent scheme, where fraudsters will hype up some new token, maybe getting influencers to join in the promotion to boost the price, then quickly sell all their stock of tokens at the peak, causing the value of the remaining tokens to crash, to the detriment of the ordinary punters who bought in on the way up.

The risks of airdrops

If someone in the street stopped you and offered you bank notes just to look at a video or website, you would likely be suspicious. But essentially the same thing happens with crypto all the time and yet we tend to just assume it’s a genuine offer. These are called airdrops, and many of them are indeed genuine – your trading platform may offer small amounts of new coins to raise awareness and spread the news about the new coin; scammers will use any kind of contact they can to entice you into doing something to get free crypto, and then stealing your credentials or emptying your wallet. Be very careful about airdrop offers from unsolicited contacts, check that the apparently familiar site making an offer is the real thing (check the address carefully, hover over links – take all the usual precautions).

Different kinds of crypto wallets

Probably the first kind of wallet you will come across when you start with crypto currencies is provided by your trading platform. This wallet is intrinsically connected to the internet – this is known as a ‘hot wallet’ because it’s always ready for trading. That introduces the first level of risk – being connected to the internet means you are susceptible to being hacked, though a good trading platform will take great care to minimise this risk by using multiple layers of security to keep out the bad guys. But there’s the second level of risk - in order to facilitate trading, the platform will need access to your private keys– you have to trust your trading platform and the people who operate it, so you’ll need to apply due diligence, see what other traders say about the platform security, and check out their history. This aspect of the wallet – the fact that the platform needs access to your keys – leads to the term ‘custodial wallet’ since they have custody of the keys.

As you build your crypto funds, a good plan is to move a portion of the funds away from the custodial hot wallet, to a non-custodial cold wallet. This is a wallet, separate from the one on your trading platform, in which you retain control of the keys (so ‘non-custodial’), and normally disconnected from the internet (so ‘cold’). Typically you might use an electronic device similar to a USB thumb drive to store your keys (remember - the keys give you access to your crypto funds, there are no actual coins involved). This is an instance where you need to understand how to send USDT from wallet, in this case both the sending and receiving wallets are your own. But electronic devices can fail, and you can lose a USB stick, so ideally you need yet another level of security as backup.

It's the keys that are the fundamental access mechanism for your funds. There’s nothing to stop you keeping your keys in a readable form even down to writing them on a piece of paper or other legible medium; in practice it’s more likely you will record the seed phrase comprising 12 or 24 words, from which the keys can be reconstructed, but, if you are that way inclined, you could record the long sequence of characters representing your keys directly. Let’s say you want to store the seed phrase in a permanent way – there’s a class of ‘devices’ to do this, typically consisting of a metal sheet on which you can record the details of the seed phrase, leading to the term ‘steel wallet’ since they are generally made of sheets of steel on which the seed phrase can be encoded. If you have built up significant funds, you will probably want to keep multiple copies, maybe hidden in your home, lodged with your bank, solicitor, accountant or other trustworthy party, maybe family members. Don’t be like the guy in UK who has been searching a rubbish tip for months trying to locate his lost USB wallet with $600M in crypto at stake!

Learn more about USDT / Tether

In this article we’ve looked at USDT from the point of view of the crypto trader, with guidance on its use and benefits, and specifically how to send USDT from wallet. If you’d like to learn more about the background of the currency, its history and the organisation that manages it, take a look at the Wikipedia entry on Tether.