One of the simplest trading strategy to use while learning how to day trade crypto for beginners is to use two simple moving averages, both set up to on the candles closing price, one set for 13 and the second set for 26, then look for the crossing point to enter the trade and close it when they cross again. When the 13 bar moving average crosses above the 26 bar, it signals an uptrend and a good time to buy, and if the 13 bar moving average crosses below the 26 bar, it shows a downtrend, which is a signal to sell.

To further increase your chance of success, try trading small amounts to make more rational decisions without the pressure of high financial risk. Don’t do high-risk trades so you can test whether day trading suits your mindset and tolerance. Practicing with stop-loss and take-profit orders is also essential, as these tools help you manage trades without constantly watching the screen. Stay informed on market news and refine your strategy as you gain experience that will support your growth as a trader.

In this PlasBit article, we will provide essential steps for beginners in crypto day trading. First, we will start with a simple method to track market trends using moving averages. This is an ideal approach for newcomers to gain an understanding of price movement. We will also introduce different trading strategies like scalping, momentum trading, and range trading, each with unique goals and risk levels. This overview helps beginners choose the method that fits their style best. Moreover, we will cover the importance of managing financial and emotional risks, including setting stop-losses and staying calm to avoid impulsive decisions. These steps together help new traders develop skills, make better decisions, and stay disciplined while trading.

Moving Averages Strategy for Beginner Crypto Traders

The moving averages strategy is a fundamental tool that can show you if the price of a certain cryptocurrency is going up or down. Our research in PlasBit shows that this tool is an excellent starting step for beginners without advanced knowledge.

What Are Moving Averages?

Moving Averages show the average price of a cryptocurrency over different time periods. The moving average line smooths out the small daily fluctuations and helps traders see the broader trend easily. This line will help you to see if the price is, in general trending up or down, and thus aids you to make decisions on when to place trades.

Types of Moving Averages

There are two common types of moving averages used for beginner crypto trading:

• Simple Moving Average (SMA): This is the average price over a certain time, such as the last 10 or 50 days. This method creates a smooth line by giving each day an equal importance in the average.

• Exponential Moving Average (EMA): EMA is a more responsive indicator for short-term considerations as it calculates the average price but assigns greater weight to recent prices. This type might be useful for traders looking to get faster signals.

Choosing the Right Period

You can start using moving averages with the 13 and 26-bar period Simple moving averages. The 13-bar measures the short-term trend, while the 26-bar measure shows the long-term trend. They can give you a clearer picture of where the market is likely headed.

How to Add Moving Averages on a Chart

Most modern trading platforms allow you to place moving averages directly onto your chart. Here is an easy guide for adding and using moving averages on a chart.

Open the Indicators Tab

Start by opening the chart for the cryptocurrency you want to analyze. Look at the top of your screen for the “Indicators” button. This is where you can add different analysis tools.

Add The Simple Moving Average Twice

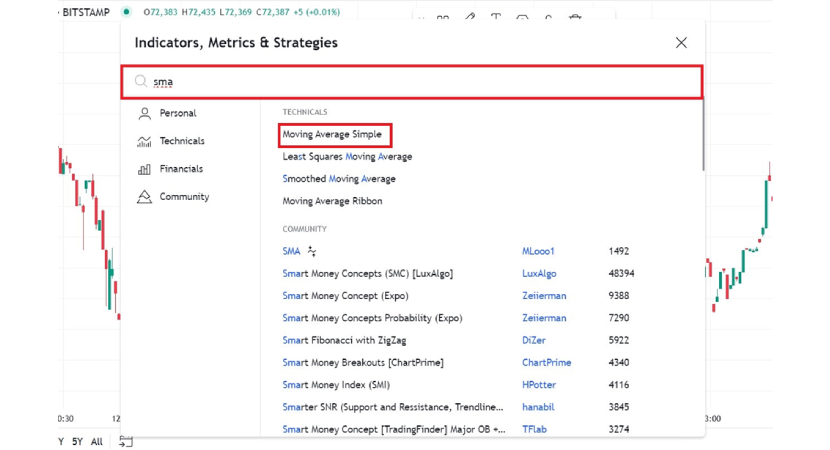

In the Indicators tab, type SMA in the search bar to find the Simple Moving Average. Click on it twice since you’ll need two SMAs.

Find the settings Button

To customize each SMA, find the SMA text on the top left of your chart. Click on it, then select the settings (cog icon).

Change The Setting for the First Moving Average

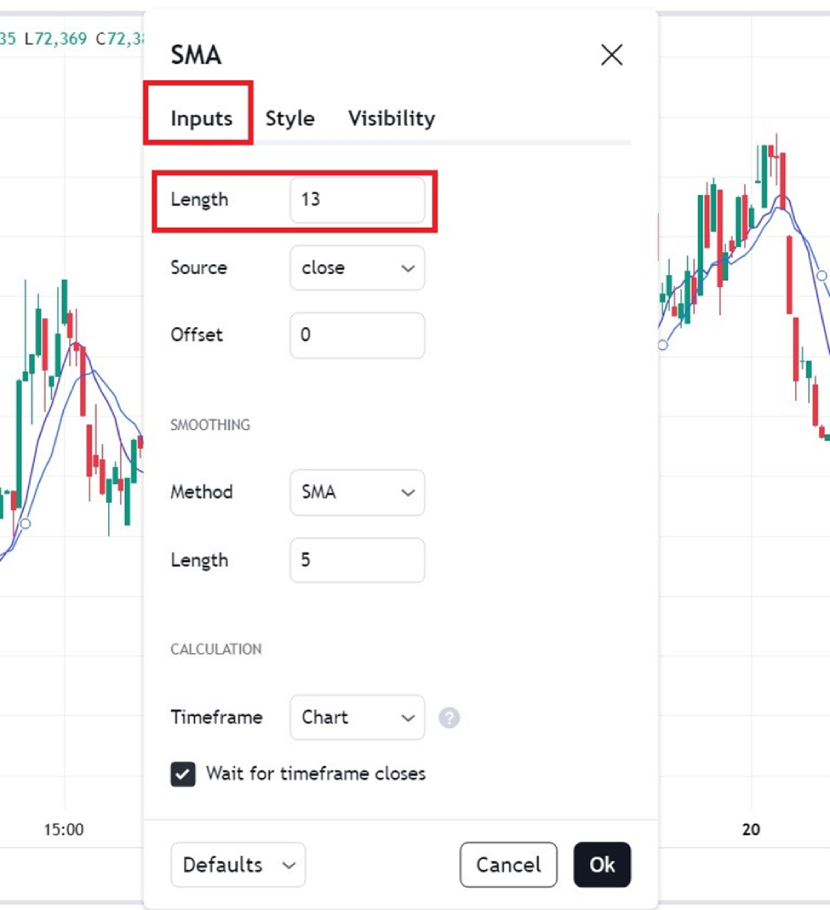

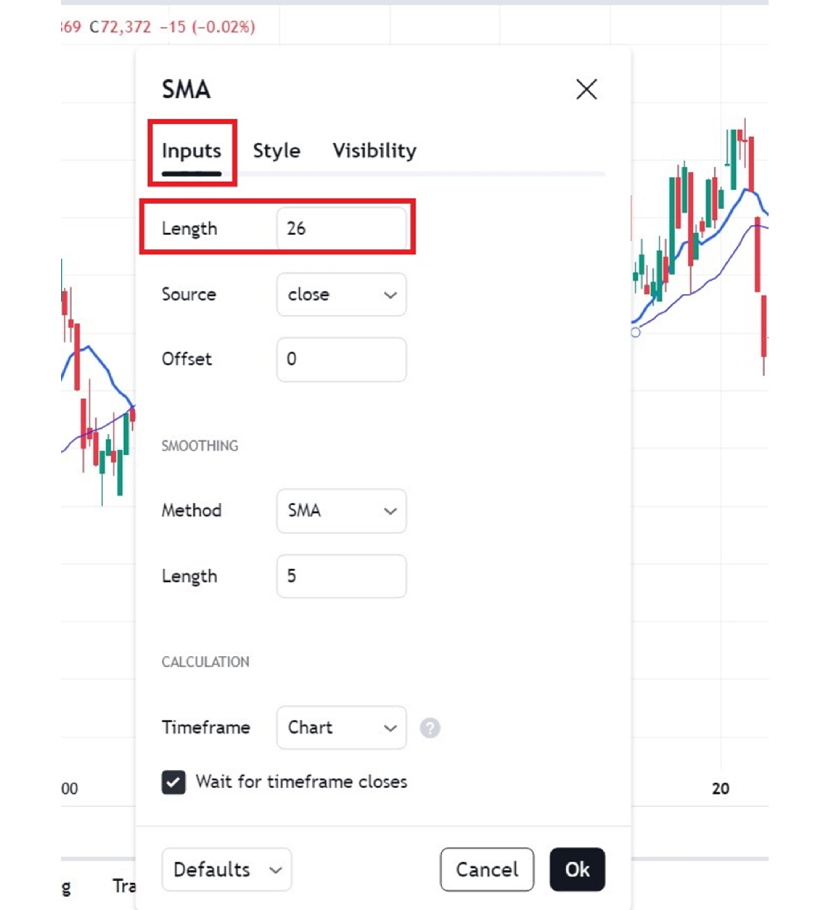

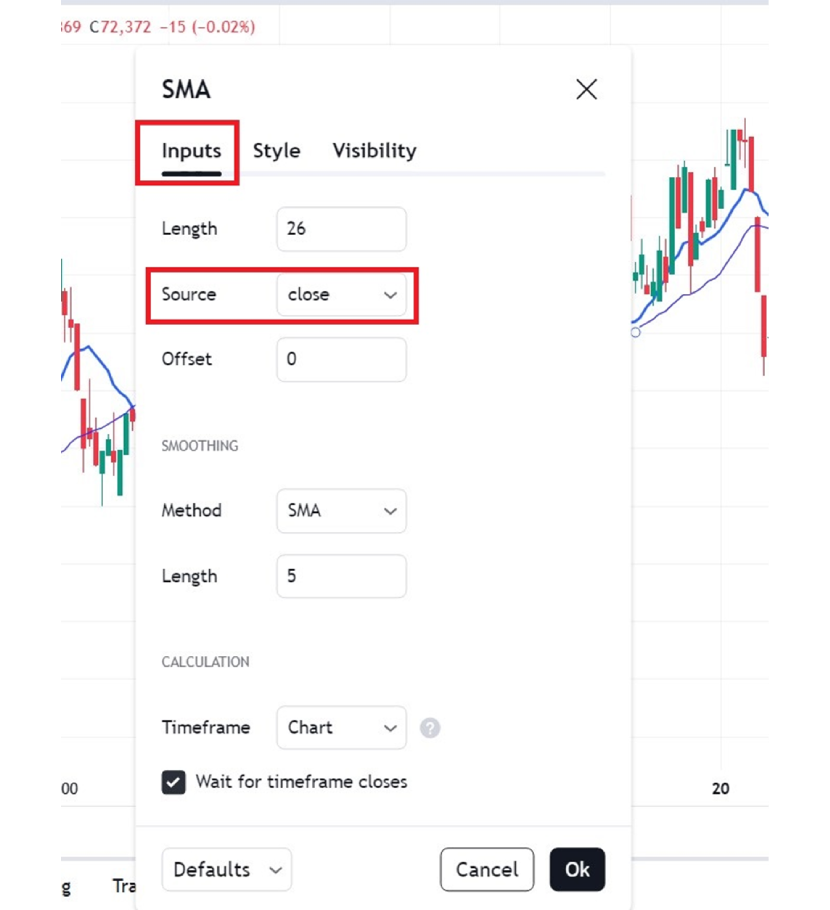

Go to the Inputs section and change the Length to 13.

Set the source to the closing price.

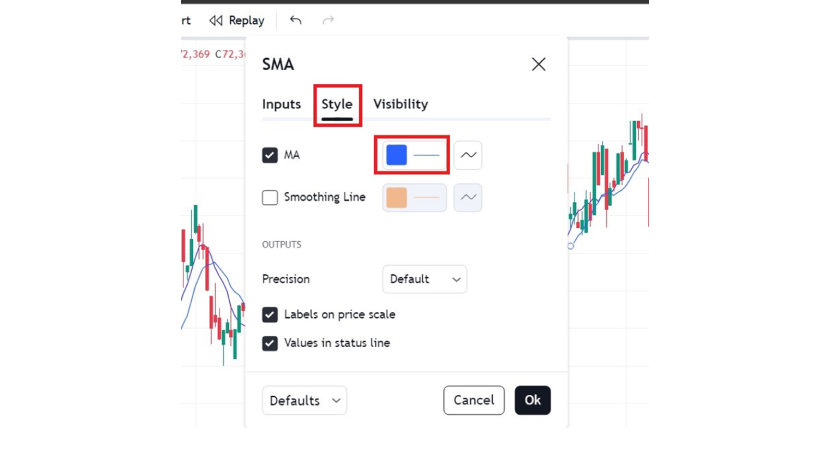

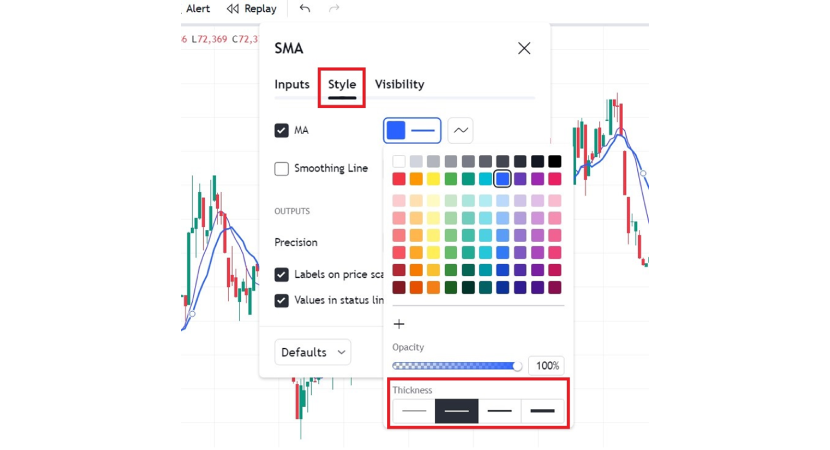

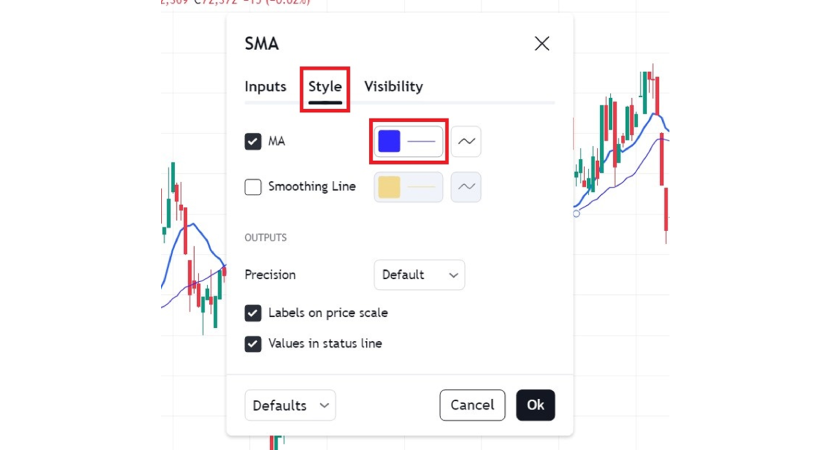

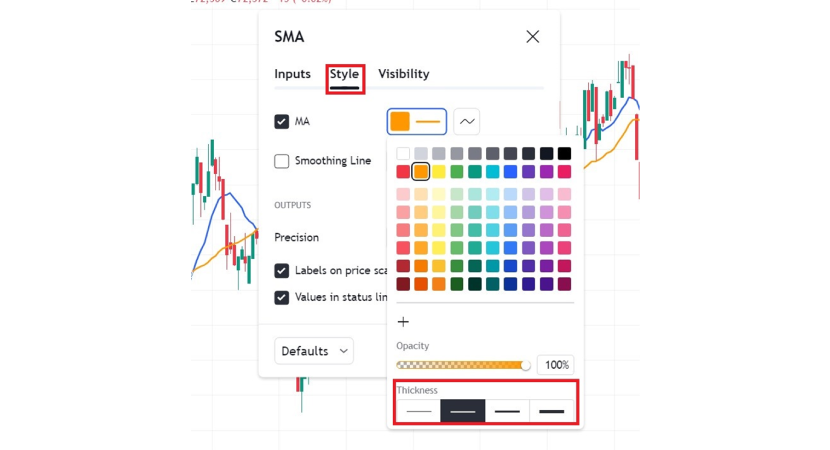

Under Style, you can adjust the SMA line’s color. In our guide, the 13 period SMA appears as a blue line.

Also, change the thickness for better visibility

Change The Setting for the Second Moving Average

For the second SMA, go back and click on the second SMA text on the top left. Click on the cog icon.

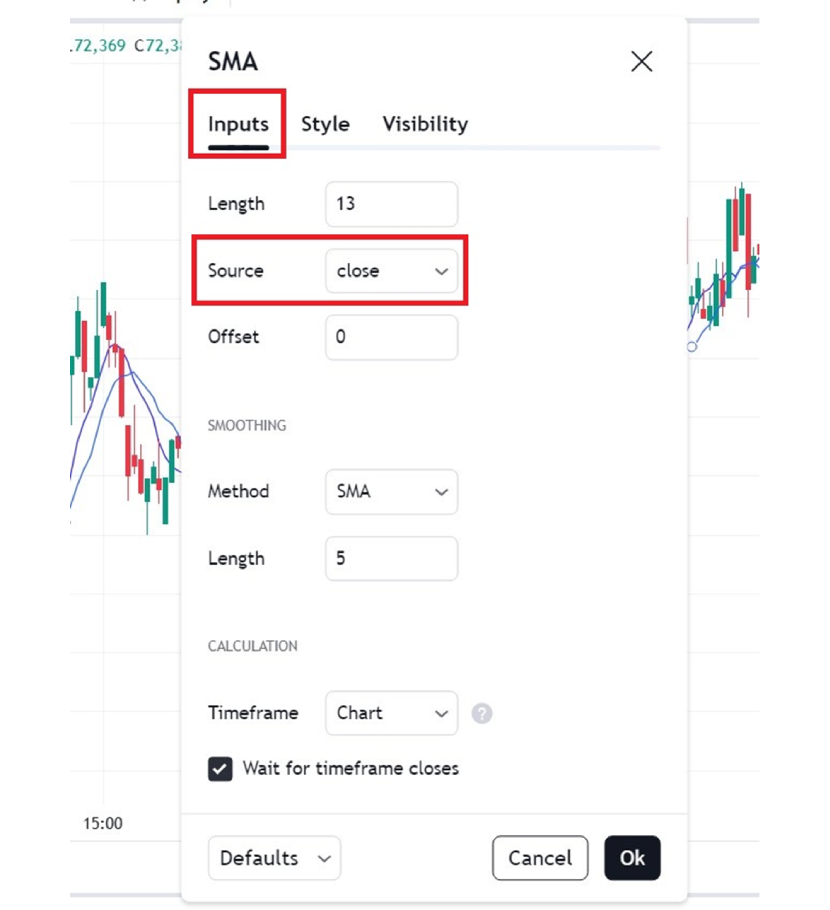

In the Inputs section, set the Length to 26.

Set the closing price as the source.

In the Style section, you can change the color of the line to something you like. We have used orange for the 26-period SMA.

You can also adjust the thickness for clarity.

Look for Crossovers

A crossover between two moving averages can be interpreted as a bullish or bearish signal. Such crossovers can be referred to as the Golden Cross and Death Cross.

Golden Cross (Buy Signal)

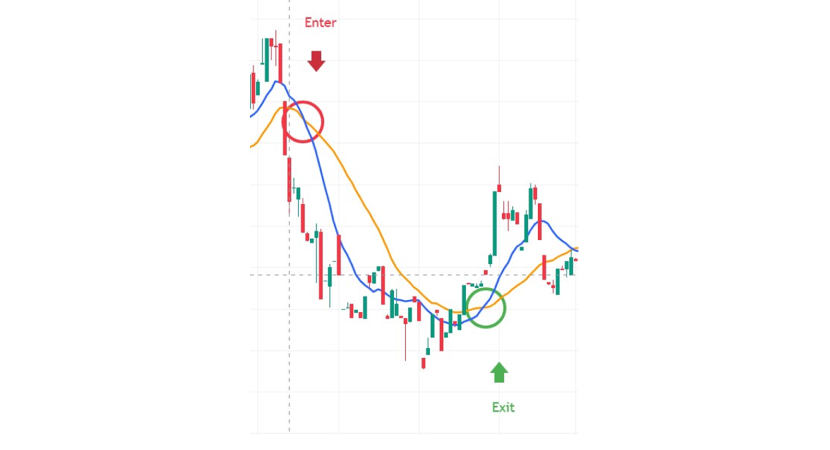

When the 13-bar moving average (a faster-moving average) goes above the 26-bar moving average (a slower one), this signals an increased chance for a bullish trend to begin. This is usually a good time to consider buying. You can also use the next Death or downward crossover as your exit point, as it might indicate a trend reversal.

In the picture below, you can see an example of this happening, and the blue line representing the 13-bar SMA goes above the 26 SMA represented by the orange line.

Death Cross (Sell Signal)

When the 13-bar moving average drops below the 26-bar moving average, this can be considered a death cross. This suggests a downturn and can be a good time to consider selling or opening a sell trade. You need to watch for the next Golden crossover, which signals a possible reversal and the best time to exit your sell trade.

You can see the example of the Death Cross happening in the chart below. The blue line is the 13-bar SMA, and the orange line is the 26-bar SMA.

Verifying Signals with Other Indicators

Combining moving averages with indicators like the Relative Strength Index (RSI) or volume indicators can strengthen signals and reduce errors. If a Golden Cross happens alongside a high volume, this can show a strong buy signal.

The moving averages strategy is straightforward to understand and apply. By starting with moving averages and adding a few basic indicators, beginners can build confidence in their trading approach without needing extensive knowledge of the crypto market.

Key Day Trading Strategies in Cryptocurrency

Crypto traders have various trading strategies to consider and choose from. So, to understand how to day trade crypto for beginners, you must first learn about different day trading strategies. Each one of these methods has different goals and risk levels, making them fit various types of traders. Here’s a look at popular day trading strategies and how they compare.

Scalping

Scalping involves making many small profits by opening and closing trades within seconds or minutes. These traders focus on minor price shifts and try to yield substantial gains over the day. This method is suitable for traders who closely monitor the market. Scalping needs rapid decision-making and incurs higher fees due to many transactions. It targets liquidity and short-term fluctuations rather than long-term trends, making it time-consuming.

Momentum Trading

This strategy relies on strong price trends, with traders riding the wave until the trend fades. Indicators like RSI and MACD measure trend strength and help such traders avoid false signals.

Momentum trading is slower than scalping and has fewer transaction fees. This is because it aims for larger moves with fewer trades. Also, it’s more easier than scalping but requires monitoring to make prompt reactions to shifting trends.

Range Trading

Range traders use support and resistance levels in a market and buy at support and sell at resistance. This method is popular in low-volatility markets. Range trading differs from momentum and breakout trading. Because it focuses on a defined price range rather than strong trends. It is also more appealing to traders seeking steady returns rather than quick profits because it involves lower risk.

Reversal Trading

Reversal traders spot likely trend reversals. Using indicators like the RSI, reversal traders try to find overbought or oversold assets. Doing so they find the opportunities to enter trades when a trend is about to shift. In comparison to trend-following momentum strategies, reversal trading predicts trend changes, making it riskier due to timing challenges.

Arbitrage Trading

Arbitrage traders exploit price differences across exchanges. They buy at a lower price on one exchange and sell at a higher price on another. This method requires fast action and decision-making.

This method is different in the sense that it doesn’t depend on trend analysis or human judgment. Instead, it focuses on price differences across platforms. It has low-risk but needs fast execution and multiple exchange accounts.

Breakout Trading

Breakout traders enter trades as soon as a price “breaks out” from a stable range. These traders enter open high-volume trades either above resistance or below support. Like momentum trading, breakout trading relies on strong trends but focuses on the initial breakout. It’s distinct from range trading because it does not expect prices to stay within bounds and is different from scalping because it needs strong trends to reach profit.

High-Frequency Trading (HFT)

HFT traders profit from small price differences. To reach these profits, they use algorithms to execute trades in milliseconds. This strategy requires technology and is usually used by large institutions.

HFT differs from other strategies as it relies solely on speed and volume. It does not rely on human analysis or market trends. It is also complex and typically inaccessible to individual traders.

Each strategy has unique benefits depending on the trader’s experience and risk tolerance. Scalping and HFT suit high-speed traders, while range and momentum trading offer steady returns and longer trends. Beginners usually start with simpler strategies like range or momentum trading, while advanced traders may prefer HFT or arbitrage.

Risk Management for New Traders

It is essential to manage financial risks and psychological risks if you want to learn how to day trade crypto for beginners. Increase your chance of trading success and go over some tips for managing the risks involved in day trading.

Set Stop-Loss and Take-Profit Orders

Stop-loss orders limit potential losses by automatically closing a trade if it hits a set price level. Take-profit orders secure gains by closing trades when a target price is reached. Using such measures reduces stress from constant monitoring and protects against unexpected market swings.

Follow the 1% Rule

The 1% rule suggests not risking more than 1% of trading capital on a single trade. For example, a $10,000 account should limit losses to $100 per trade. This approach preserves capital through a losing streak and encourages daily discipline.

Risk-Reward Ratio

Aim for a 1:2 risk-reward ratio to target double the potential profit over the amount at risk. This approach ensures profits typically outweigh losses leading to long-term gains.

Start Small and Scale Up

Begin with small trades while learning, then gradually increase trade sizes with experience. This minimizes large early losses and allows for growth without risking significant financial setbacks.

Keep a Trading Journal

Documenting trades, outcomes, and emotions in a journal helps evaluate what works. This highlights patterns where emotions influenced poor choices. Use such records and make adjustments to better your strategy.

Set Realistic Expectations

Unrealistic goals lead to frustration and impulsive actions. Set achievable targets to reduce stress from losses. Recognize losses as a part of the process while focusing on steady progress rather than chasing big gains.

Take Breaks and Stay Mindful

Regular breaks prevent impulsive decisions. Techniques like mindfulness or simply stepping away during stressful moments help reset and approach trading with a clear mindset.

Control FOMO (Fear of Missing Out)

FOMO often drives poorly timed trades. Stick to a trading plan and wait for new opportunities to come. Improving your Discipline also helps avoid trades that don’t fit your strategy.

Update and Evaluate Performance Regularly

After major market changes, review trading results and risk management techniques to keep strategies effective and aligned with current goals.

Traders can use these financial and emotional risk management techniques together to approach trading in a balanced way. Practicing such techniques Protects capital, reduces stress, and forms a strong foundation for informed decisions. Use these strategies to build good habits and achieve long-term success.

Day Trading Crypto Risks and Challenges

Day trading cryptocurrency comes with risks that traders should be aware of. Here are the key challenges this high-risk business can include.

High Volatility and Price Fluctuations

Cryptocurrencies are usually volatile as prices often change rapidly and unpredictably. Unexpected events or new regulations may cause shocks in the market and can lead to sudden profits or losses. Such volatility demands quick decision-making and can result in significant losses if mishandled.

Leverage and Amplified Risks

Many traders use leverage to increase potential profits by borrowing funds. This method also increases losses. Even small price moves can result in large losses or even liquidation. Over-leveraging is especially dangerous for beginners, as it often leads to faster and more significant capital loss than expectations.

Emotional and Psychological Stress

The cryptocurrency market is open 24/7, and constant activity can lead to emotional fatigue. As traders reach mental exhaustion, they often fall victim to loss aversion and impulsive trades. Experienced traders recommend relying on a disciplined trading plan to avoid emotional decisions that can derail strategies.

Market Manipulation and Security Risks

The cryptocurrency market is known for anonymity and lower regulations. This is why it is prone to manipulation by large players and scams. One example of such scams is “pump-and-dump” schemes. Where groups artificially inflate an asset’s price only to sell off at the top and leave others with losses. Security issues like hacked online wallets are also prevalent.

Regulation and Uncertainty

Cryptocurrency regulations are still developing, and new regulations can cause sudden shifts and impact the market. This causes uncertainty as governments around the world implement a range of new policies and regulations.

Tax Implications and Record-Keeping

Crypto trading generates taxable gains and losses for each transaction. Tracking these gains and losses for tax reporting is essential but challenging. It is vital for traders to be familiar with tax laws and maintain detailed records, as misreporting can lead to penalties.

Human Errors and Technical Issues

Mistakes like sending funds to the wrong address or trading the wrong asset are common. Platform outages and other technical issues can also prevent order execution, leading to missed opportunities or unintended losses.

These challenges highlight the need for a solid risk management plan. Beginners are encouraged to start small, use stop-loss orders, and avoid high leverage. Staying updated on market news and regulations further helps in managing these risks. With caution and informed strategies, traders can take advantage of market peaks while minimizing losses.

When to Exit a Trade

Knowing when to close a trade is crucial for realizing gains and managing losses. For those learning how to day trade crypto for beginners, timing exits effectively can be one of the most challenging aspects. Here are several strategies to help make these decisions easier.

Trailing Stops to Lock in Gains

Trailing stops follow the price upward, locking in gains as the market moves in your favor. If the price reverses, the trailing stop activates, securing profits without manual adjustment. This strategy is ideal for trending markets, where it is necessary to capture gains without exiting too early.

Exit at Support and Resistance Levels

Support and resistance levels often see price pauses or reversals. Traders exit around these levels, selling near resistance or buying near support, to capture profits before a reversal. These levels offer realistic price boundaries, avoiding unexpected reversals.

Time-Based Exits

Setting time limits based on trading style, hours for day traders, and days for swing traders, can reduce prolonged exposure. Exiting on time helps release capital from stagnant trades, encouraging disciplined decision-making.

Track Market News and Sentiment

News events and market sentiment significantly impact prices. When unexpected news or sentiment shifts arise, closing trades can secure profits or limit losses. Staying informed helps adjust exit strategies as needed in response to major announcements or economic changes.

Avoiding Emotional Exits

A structured exit plan prevents emotional decisions. Avoid hasty exits driven by fear or excitement. Using a trading journal to track exit patterns helps refine decisions, promoting consistency for better long-term results.

Observe Changes in Market Volume or Liquidity

A sharp fall in trading volume indicates a loss of interest or liquidity in that asset. Lower volume and liquidity make it more difficult to sell at your preferred price due to fewer participants in the market. Prices also become more susceptible to volatile changes and can be influenced when a small number of people make large trades. This is known as price manipulation and slippage. This is why you should consider exiting your trade if liquidity starts to reduce because it helps to mitigate downside risks.

Check for Divergence in Fundamental and Technical Data

Sometimes, an asset's technical indicators and fundamentals may start to diverge, such as network performance in crypto. A cryptocurrency might show bullish technical signals with stable indicators yet weak fundamentals. This could hint at upcoming issues. Monitoring how these metrics shift over time helps in identifying when a price trend moves from being fundamentally supported to relying mainly on sentiment, signaling the potential for a downturn.

One of the best results is accomplished by trading using all approaches in their rightful place. Every strategy is fit for a different trading style, which is why it’s important to understand what type of trader you are and how experienced you are with the market.

Bitcoin vs Altcoins: Key Differences for Day Traders

Choosing between day trading Bitcoin or altcoins depends on factors like volatility, liquidity, market sentiment, and risk tolerance. Each choice has unique risks and rewards.

Volatility and Price Movement

Bitcoin

With its larger market cap and broader adoption, Bitcoin tends to be more stable than many altcoins. This can create a steadier trading experience. Bitcoin still experiences fluctuations just less extreme than smaller altcoins.

Altcoins

Smaller altcoins are very volatile and offer the chance for high gains within short timeframes but also carry higher risks due to quick price drops. Traders often seek altcoins for potential explosive gains, but they must be prepared for sudden reversals.

Liquidity and Trading Volume

Bitcoin

Bitcoin’s liquidity is the highest among cryptocurrencies, allowing easier entries and exits at consistent prices without significant slippage. This makes it ideal for large trades and offers reliability in volatile markets.

Altcoins

big altcoins have good liquidity. However, smaller altcoins often have low trading volumes and liquidity. Lower liquidity can lead to slippage, where trades execute at less favorable prices, impacting potential profits.

Market Sentiment and News Impact

Bitcoin

Bitcoin often reflects the sentiment of the entire crypto market and is sensitive to macroeconomic news, regulatory updates, and other major announcements. Its price movements often set market trends, which can affect altcoin prices.

Altcoins

Altcoin prices are more affected by project-specific news, such as partnerships, upgrades, or regulatory changes. These factors often create sharp price movements, presenting opportunities but also risks for traders.

Reliability of Technical Analysis

Bitcoin

High liquidity and a larger market presence make Bitcoin’s technical indicators more reliable. Tools like moving averages and support/resistance levels tend to be more reliable.

Altcoins

many altcoins have high volatility and lower liquidity. So, the results of predictions using technical indicators can be less reliable. This makes day trading altcoins riskier without close monitoring.

Potential for Returns

Bitcoin

Bitcoin’s steadier price movements may yield moderate but consistent returns. It’s less likely to see the rapid, short-term gains of altcoins but offers a more stable trading environment.

Altcoins

Smaller altcoins are known for high short-term profit potential due to their volatility. Traders can capitalize on price spikes. But they must also manage increased risk.

Day trading Bitcoin offers predictability and liquidity, making it suitable for traders who prefer lower risk and consistency. Day trading altcoins presents high-risk, high-reward scenarios, attracting traders comfortable with market unpredictability. Altcoin traders need to stay informed on project-specific news, while Bitcoin traders often focus more on general market trends. Knowing these differences helps traders align their approach with their risk tolerance and trading style.

Conclusion

In this PlasBit article we tried to give new traders the necessary tools they need to begin crypto day trading confidently. For those looking into how to day trade crypto for beginners, the Moving Averages Strategy offers an easy way to follow trends and make more informed trading choices. Learning about additional strategies like scalping, momentum, and range trading allows readers to explore different ways to profit based on their comfort level and risk tolerance. The tips on managing financial and emotional risks are essential, especially for keeping calm and focused under market pressures.

Understanding when to close a trade helps traders hold onto gains and avoid unnecessary losses, which is also a big part of trading success. The comparison between Bitcoin and altcoin day trading provides insight into the unique challenges and rewards of each market. We also learned that day trading comes with its share of challenges like price swings and emotional stress, and this article’s advice helps readers prepare for these issues with practical solutions. These strategies build a foundation that makes it easier for beginners to start strong and handle the ups and downs of the crypto market skillfully.