Looking for the most affordable way to buy Bitcoin? Generally, the cheapest way to buy Bitcoin is via bank transfer and when you buy Bitcoin through bank wire, you will pay at Simplex up to 27.97%, while Banxa charges around 10.12%. Switchere’s fees stand at 4.75%, and MoonPay offers a lower 1.64% rate and PlasBit charges as low as a 1.10% fee plus a small fixed amount of 1 EUR/USD on bank wire deposits, ensuring you pay the lowest fee and receive the maximum amount of Bitcoin without hidden fees. While many exchanges offer “free deposits through bank wires,” these offers often come with hidden fees embedded in the exchange rates and other unexpected costs so you need to carefully check the entire transaction fees and terms.

This article dives into the most cost-effective way to buy Bitcoin, specifically through PlasBit bank wire transfers. It also explores essential topics, such as comparing fees across different purchase methods, understanding how these fees affect your Bitcoin value, and securing your Bitcoin through cold storage rather than leaving it on an exchange. Additionally, you’ll find valuable strategies like dollar-cost averaging (DCA) to help you make smarter purchases over time. Finally, we’ll cover tips to avoid overpaying and weigh the pros and cons of buying Bitcoin directly versus investing via an exchange-traded fund (ETF).

Send SEPA EUR receive in USDT

| Buying with SEPA transfer in the amount of 2,000 Euros | |||||||

|---|---|---|---|---|---|---|---|

| Provider | Send SEPA EUR | Total Fee in EUR | Total fee in USDT | Fee in % | USDT Worth in USD | Receive in USDT | |

| PlasBit | 2,000 | 22 | 23.57 | 1.10% | 2,140.57 | 2,142.71 | |

| MoonPay | 2,000 | 32.20 | 34.79 | 1.64% | 2,159.85 | 2,125.06 | |

| Switchere | 2,000 | 90.64 | 97.91 | 4.75% | 2,159.85 | 2,061.94 | |

| ramp.network | 2,000 | 125.52 | 135.59 | 6.70% | 2,159.85 | 2,024.26 | |

| Banxa | 2,000 | 183.75 | 198.48 | 10.12% | 2,159.85 | 1,961.37 | |

| Simplex | 2,000 | 437.01 | 472.04 | 27.97% | 2,159.85 | 1,687.81 | |

| Buying with SEPA transfer in the amount of 10,000 Euros | |||||||

|---|---|---|---|---|---|---|---|

| Provider | Send SEPA EUR | Total Fee in EUR | Total fee in USDT | Fee in % | USDT Worth in USD | Receive in USDT | |

| PlasBit | 10,000 | 110 | 117.85 | 1.10% | 10,724.24 | 10,713.53 | |

| MoonPay | 10,000 | 118.05 | 127.52 | 1.20% | 10,788.15 | 10,660.63 | |

| Switchere | 10,000 | 424.76 | 458.81 | 4.44% | 10,788.15 | 10,329.34 | |

| ramp.network | 10,000 | 610.61 | 659.56 | 6.51% | 10,788.15 | 10,128.59 | |

| Banxa | 10,000 | 896.96 | 968.86 | 9.87% | 10,788.15 | 9,819.29 | |

| Simplex | 10,000 | 2,166.64 | 2,340.30 | 27.70% | 10,788.15 | 8,447.85 | |

Step-by-Step Guide to Buying Bitcoin on PlasBit at the Lowest Fees

Please follow the steps below to find the cheapest way to buy Bitcoin using our bank wire option. This guide will walk you through each stage, from logging in and depositing funds to buying Bitcoin, ensuring minimal fee impact on your investment.

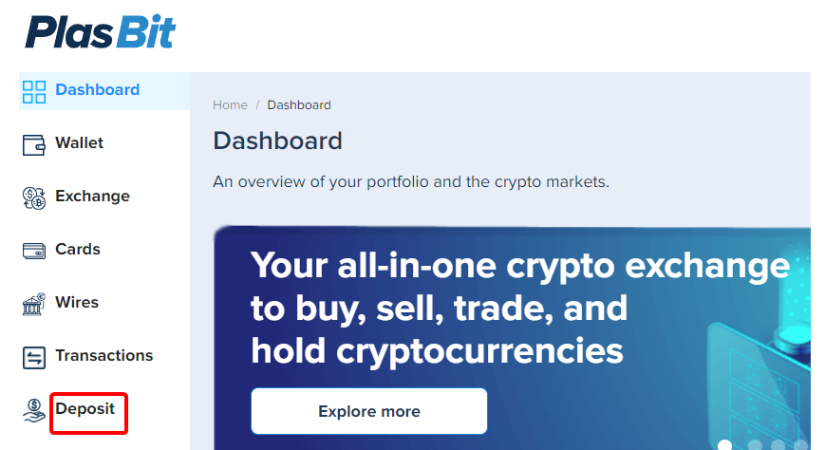

Step 1: Sign in and Go to the Deposit Section

Sign in to your PlasBit account. Under the “Transactions” tab, find the “Deposit” tab on the right side of your homepage. Then, start the process as the first step to buying Bitcoin at a lower cost.

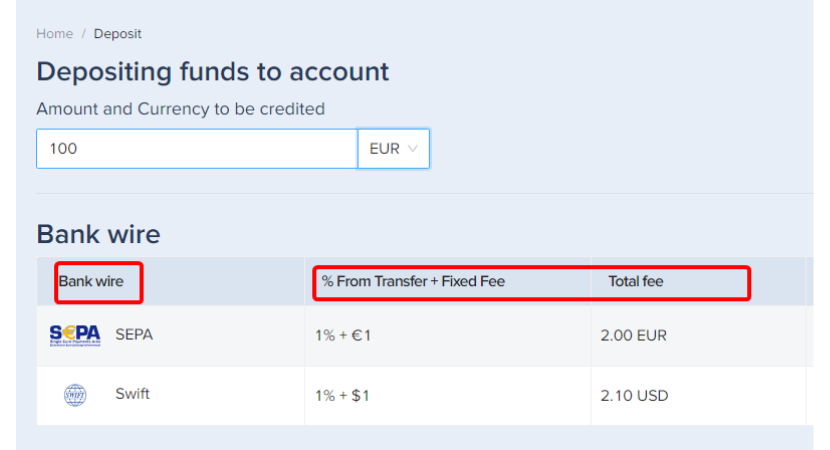

Step 2: Choosing Amount, Currency, and Deposit Method

Enter the amount to deposit and select the currency (e.g., EUR or USD). Choose Bank Wire for fiat deposits, as it's usually the cheapest method with lower fees. Watch out for any extra fees with other deposit methods.

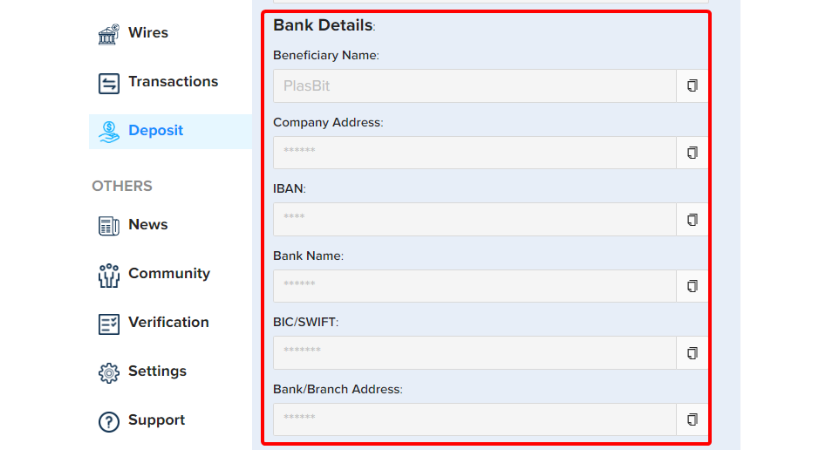

Step 3: Bank Transfer Information

On the deposit page, you'll find PlasBit bank account details. Use this to make a direct bank transfer to PlasBit. This will securely transfer your funds to your account.

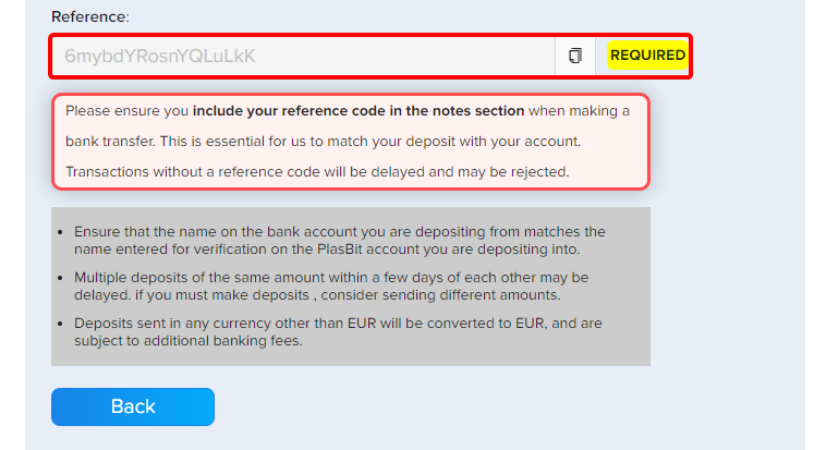

Important Notes:

· Referral Code Usage: Include your referral code in the "Notes" section for credit.

· Account Name Matching: Ensure the "Bank Name" matches your PlasBit account. Transfers from joint accounts may be rejected.

Step 4: Credit to Your Euro Wallet

Once your bank transfer is processed, the funds will be credited to your Euro wallet under the Exchange section of the website.

Step 5: Purchasing Bitcoin

Select 'BTC' from the drop-down menu, and enter the amount of Bitcoin you wish to purchase in the "Amount to Buy" field.

Step 6: Setting the Sale Amount

Choose Euro in the "Amount to Sell" field to decide how much of your Euro balance you want to convert to Bitcoin.

Step 7: Buy BTC with Euro

Click “Buy BTC with Euro” to execute the purchase for a quick and easy transaction at favorable rates.

Step 8: Confirm and Submit Your Order

Review your order details, confirm everything is correct, and click "Submit order" to finalize the purchase.

By following these steps, you can efficiently and affordably buy Bitcoin on our platform with low transaction fees and an easy-to-use process.

Comparing Fees for Different Bitcoin Buying Methods

The payment method you choose also impacts the fees you must pay when buying Bitcoin. Let’s examine different available Bitcoin purchase methods to compare them and answer the question of what is the cheapest way to buy Bitcoin.

Wire Transfer

Due to generally lower fees, wire transfers are widely accepted as an affordable way to purchase large amounts of Bitcoin. This is an excellent method for investors who want to dump large amounts of cash into Bitcoin. The table provides a detailed comparison of fees charged by different cryptocurrency exchange platforms for converting SEPA EUR to Bitcoin.

The chart below clearly shows the fees charged by different cryptocurrency exchanges, making it easy to compare them.

Credit Card

The advantage of using a credit card is that it is the fastest way to buy Bitcoin, but it also comes with the highest fees. These vary but usually fall between 1.5% and 3.5%, based on the platform and particulars of your credit card company. Credit card companies charge processing fees to the platforms, which is worked into higher platform user fees.

PayPal

To buy Bitcoin via PayPal, you must pay different transaction fees corresponding to the money you want to transfer. Transaction Fees for all transactions up to $200 include $0.49 - $2.49. For PayPal deposits over $200, fees are 1.80% for transactions up to $1,000 and 1.50% for those exceeding $1,000. Currency Conversion adds a small spread of around 0.5% under market fluctuations. Because of this, PayPal is still a convenient but not the cheapest way to buy Bitcoin, especially in large amounts.

Crypto to Crypto

You can also buy Bitcoin with other cryptocurrencies at PlasBit, which is also a cost-effective method considering that it charges only a 0.1% fee for converting crypto to crypto. This can be a very cheap way of doing it, especially if you already own crypto and want to diversify or increase your Bitcoin holdings.

Each payment method has pros and cons. We offer solutions for buying Bitcoin cheaply through a big wire transfer or by making crypto-to-crypto transactions. Credit cards and PayPal offer convenience at too high a cost, suitable for people who value their time more than transaction costs.

Finding Low-Cost Bitcoin Purchasing Options

There are ways you can reduce or even completely avoid transaction fees if you're looking for the cheapest way to buy bitcoin:

Promotional Offers

Sometimes, platforms reduce transaction fees for a limited time and call them $0 commission promotions. These can be highly useful, particularly for beginner customers or during some special marketing events.

Zero-Fee Trading Platforms

Some cryptocurrency platforms offer low or no fees to users who meet specific requirements, such as holding a balance of the platform's native cryptocurrency.

Using Specific Trading Options

You can get discounts on fees by using certain features on exchanges. For instance, if you provide liquidity with limit orders set at your desired price in some platforms, you can trade without fees. Avoiding fees can be challenging, so you need to know the trading interface and cryptocurrency market to cut the trading fees.

Through these strategies, you can cut the costs of buying Bitcoin to a fraction, making your investments much more effective. Remember to familiarize yourself with the fees of any platform you use, so you do not experience unexpected charges.

Impact of Trading Fees on Bitcoin Earnings

Transaction fees are significant in the profit you earn when trading Bitcoin, especially if you trade daily! When looking for the cheapest way to trade bitcoin, knowing how these fees work and using tips to reduce them can either make or break your daily trading returns.

Understanding Transaction Fees

Bitcoin transaction fees are essentially expenses for processing exchanges on the Bitcoin network. Fees can fluctuate greatly depending on your transaction's data volume and network congestion. These fees ensure that your transaction is processed by the network miners. Actually, because of the greater incentives, Miners typically prioritize transactions that include higher fees.

How Fees Affect Earnings

For those trading Bitcoin, particularly for methods like day trading, which targets small profit margins, you may find high transaction fees rapidly eating away at potential gains. When the network is busy, this becomes especially relevant as fees may increase dramatically. Fees can rise significantly during high-volume periods, affecting traders executing fast transactions.

Strategies to Minimize Fees

Choosing the Right Time to Make a Trade

The price of fees will depend on the time of day and the day of the week (peak times usually have higher fees than off-peak hours). Planning your transactions around this can help you save on costs.

Using Efficient Transaction Methods

Using efficient transaction services like SegWit (Segregated Witness) may reduce the size of transactions, which can, in turn, decrease high fees. Also, choosing less urgent transactions can allow you to pay a lower cost.

Exchange and Wallet Choices

The fee structure varies across different platforms. Using our platform, which offers low transaction fees or better management tools for handling fees, can significantly cut costs. By strategically managing these fees, you can protect your Bitcoin from unnecessary losses and increase trading efficiency. Implementing these strategies is crucial, especially for frequent Bitcoin traders or those handling large volumes.

Finding the Best Time to Buy Bitcoin

How you time the market is obviously significant when considering the cheapest way to buy Bitcoin. Because Bitcoin's prices fluctuate constantly, it's actually possible to buy them on certain days of the week and times of the month for a lower price. This means you can even get more value out of your Bitcoin purchases and simply maximize your investment.

Weekly Timing for Lower Prices

BTC prices are often lower on the weekend, and in particular, on Sunday. There are different factors involved, but decreased trading volumes and reduced activity on major exchanges are the main reasons for this price fall. It is also a typical trend in other financial activities over weekends, resulting in fewer transactions and lower prices. Some investors take this opportunity to purchase Bitcoin at a cheaper price before the market picks up again at the beginning of the week.

Monthly Trends

Though not as widely reported on a month-by-month basis, some investors analyze bigger market trends or macroeconomic happenings that can impact cryptocurrency prices, like new regulations or large economic announcements. But given bitcoin's volatility, historical data may not be an infallible trajectory forecaster.

Strategic Buying

One may incorporate risk mitigation strategies such as Dollar-cost Averaging (DCA) for a more optimal purchasing strategy. DCA, which means buying Bitcoin with a fixed dollar amount according to a regular plan regardless of the price, would mitigate the volatility effect on the final purchase over time.

At the end of the day, however, using price behavior to drive your decisions is a losing game in a highly volatile asset such as Bitcoin. Understanding and being able to adapt ideas quickly are important in learning how to navigate the cryptocurrency markets effectively. But whether it is on Sunday or using DCA, you should understand market moves and educate yourself for wise financial investments in this market.

By considering these timing strategies during your search for the cheapest way to buy Bitcoin, you can increase the possibility of seeing better financial outcomes and leveraging opportunities that crop up due to trading movements.

Factors Influencing Bitcoin Exchanges

When it comes to the factors that determine the price of Bitcoin when trading on the exchanges, different factors would come to light including the demand for Bitcoins, the readily available supply, the general emotions of the investors and FOMO, regulations, inflation rates, and other macro-economic fundamental type factors.

Market Demand and Supply

Two major factors that have shaped Bitcoin’s prices include market demand and the buyer and seller market equilibrium. Bitcoin has a fixed supply, which is limited to 21 million units in circulation, in addition to the halving cycle, which determines the futuristic price changes of Bitcoin[NK2] . Consequently, when the supply is limited, the price of Bitcoin rises.

Investor Sentiment

This comes from public news, the media, or market sentiment. On the positive side, news of technological advancement or institutional adoption can drive prices up, whereas negative news will inevitably lead to price falls. Market sentiment is frequently analyzed using tools such as the Fear and Greed Index taking into account whether market changes are being driven by too much fear or greed.

Regulatory Developments

The prices of Bitcoin are prone to changes in regulations. For example, proper regulation may make more investors invest in the market, enhancing the demand and price of property. On the other hand, pressure or outright bans certainly lead to a decrease in demand and, hence, a reduced price. Regulatory actions, decisions and policies either strengthen or erode the confidence of the market.

Technological Advancements

Advancements within the Bitcoin network, as well as innovations and improvements concerning blockchain technology, also affect its functionalities as a safer investment. For instance, Bitcoin's utility and adoption would be enhanced through scalability solutions, making Bitcoin transactions faster and cheaper.

Global Economic Conditions

Bitcoin tends to respond well to macroeconomic events like inflation, economic uncertainty, or even a currency collapse. When traditional financial markets are threatened, Bitcoin can be a viable option against conventional financial platforms and consequently, its price is likely to rise.

Liquidity on Exchanges

The fact that Bitcoin can be easily traded in various exchanges influences its price. This orientation indicates that large amounts of stock can be sold without pressure on the market share price. Even within these exchanges you may see different prices depending on the liquidity available in that exchange and the flow of orders being executed.

Arbitrage Opportunities

Slight price differences between different exchanges can cause traders to buy on one exchange and then sell for a higher price elsewhere, this is called arbitrage. Arbitrage opportunities are almost always quickly filled, but this can exacerbate short-term price differences between platforms in prices of Bitcoin.

By understanding these factors, traders and investors can make better-informed choices when it comes to trading Bitcoin, such as choosing the cheapest exchanges in terms of fees but costs a little more depending on individual preferences for trade fee or degree of liquidity enforced by regulations.

Selecting the Most Cost-Effective Cryptocurrency Exchange

Before signing up to a new cryptocurrency exchange you need to look beyond the surface. There are several factors that should be taken into consideration if you want what is best for not only your wallet but also your experience in the market as well. Let's take a further look at the essential aspects to consider:

Trading Fees

The first and the main cost of using an exchange is trading fees. Transaction costs, including the deposit and withdrawal fees, are crucial, especially for active traders. In some platforms, transaction costs are very low for users making a high volume of transactions, and even there are some free transactions for some in different exchanges.

Security

Security should always be a huge factor when selecting any particular cryptocurrency exchange. It is also important to consider that the best exchanges are those that hold most of the money in cold storage and have security measures such as two-factor authentication. Likewise, before making an investing, it is wise to find out if the exchange has ever been attacked by hackers in the past.

Liquidity and Volume

High liquidity and volume in an exchange mean that trades can be executed at stable prices, reducing the risk of price slippage. When trading volume increases, it leads to more active participants and consequently improves the bid-ask spread and price convergence. This is important, in particular, for traders interested in conducting large-scale investments with cryptocurrencies. That is why an exchange with a higher trading volume is more reliable in providing smoother transactions and minimizing market impact.

User Experience

Trading efficiency is greatly intensified by a user-friendly UI. Find an exchange that provides a neatly packed, smooth, and responsive design in both the original desktop version as well as different mobile versions. It could simplify the trading process and help prevent errors, especially for those new to cryptocurrency trading.

Customer Support

Good customer support is essential, especially when handling financial transactions. Look for exchanges that offer fast and responsive support on multiple channels such as live chat, email, and phone. Quality customer support can be extremely helpful when you urgently need assistance with a problem or query.

Range of Offerings

Your trading strategies may vary depending on the range of cryptocurrencies and also how well-known some of them are. If you want to delve into the world of lesser-used cryptocurrencies or simply check out a more expansive selection, then an exchange that offers dozens if not hundreds of possibilities is where you need to go. This will let you start investing aside from your savings and take more investments as they come.

Additional Features

It is important to note that different exchanges come with extra features that help you take on other roles when trading or investing. These might include choices of getting interest on their holding, being part of staking pools, and other features such as futures and options markets. Learn what additional tools an exchange provides and how they may help you in achieving your trading objectives.

Overall, selecting the best crypto exchange involves an understanding of the factors outlined above and an analysis that determines that one has found the most favorable and – most of all – secure and potentially profitable investment.

Comparing Bitcoin ETFs and Direct Bitcoin Purchases

If you are looking for the cheapest way to buy Bitcoin, it is important to compare the cost differences and perceived benefits of purchasing Bitcoin through an Exchange-Traded Fund (ETF) versus buying Bitcoin directly. The two choices attract different types of investors who prioritize their needs for security, simplicity of management, and investment purposes.

Purchasing Bitcoin Directly

Buying Bitcoin directly allows you to have complete control of your digital currency. This way, trading or using Bitcoin at any time and place is possible since cryptocurrency markets are 24/7. Buying Bitcoin directly often incurs lower trading fees than ETFs, especially if you use cost-effective cryptocurrency exchanges. But you are on your own to maintain your Bitcoins safe. Technical abilities are needed to work with digital wallets and find ways to secure them from cyber risks.

Investment in Bitcoin through ETFs

Some Bitcoin ETFs (exchange-traded funds) allow you to purchase a share of this cryptocurrency without handling the digital coins. It means you do not have to take care of a digital wallet or remember your private keys. ETFs can be traded in a regular brokerage account and are also regulated, giving investors an additional layer of safety and ease. Nonetheless, ETFs tend to have higher operating fees, and you may also be subject to other transaction costs. Additionally, since ETFs are traded like stocks, you can only trade them during market hours, so you cannot get at your investment whenever it's off-market.

Fee Comparison

Direct purchases costs have trading fees, which vary from 0.1% to 1.5% while Bitcoin ETF costs an annual expense ratio that depends on the range between 0.20% to 1.5%. The expense ratio concerns management, custody, and security fees. For instance, the Bitwise Bitcoin ETF (BITB) has management fee of 0.20%, while the Grayscale Bitcoin Trust (GBTC) has charges of up to 1.5%. However, it is important to note that when you purchase BTC directly, you typically pay a one-time trading fee. On the other hand, there are ongoing annual fees tied to owning Bitcoin ETFs. This difference implies that over the long-term, holding Bitcoin ETFs can become expensive due to their recurrent.

Which one is Better?

Whether you plan to invest in Bitcoin through ETF or buy it directly depends on your circumstances. But if you want an investment that fits into traditional portfolios, has a hands-off approach, and is willing to pay a little more for convenience and security, a Bitcoin ETF might be the better option. On the other hand, It is cheaper and more convenient to simply buy Bitcoin directly, provided that you are fine with managing the security of your investments, which many newcomers would not want to deal with.

To conclude, the easier and more practical method in the old world of finance is through ETFs but at an elevated cost compared to direct purchases, which offer more control and low fees but require a better understanding of Crypto storage and security. Either approach you take, do so based on your investment style and desire for hands-on digital asset management.

Conclusion

We've explored a range of strategies in this article to help you determine the cheapest way to buy Bitcoin, focusing on cost-effective payment methods, optimal timing for purchases, and securing your investment. Among the options, bank wire transfers generally offer the lowest fees compared to alternatives like credit cards or PayPal, even though many services advertise “free deposits” through bank transfers that can still carry hidden fees within exchange rates and other less obvious costs. So we've laid out how to use wire transfer in PlasBit as it offers minimal fees—charging just 1% plus a small fixed amount, which contrasts sharply with higher fees from platforms like Simplex (up to 27.97%) or Banxa (around 10.12%).

In addition, this article highlighted not only the advantages of cost-effective transfers but also explored key strategies to optimize your Bitcoin purchases. From employing dollar-cost averaging (DCA) to timing purchases for better rates and comparing purchase methods. Our research showed that weekends often see price dips, with Sundays typically offering the best rates due to reduced trading volumes. Understanding these patterns can help you choose a more cost-effective moment to purchase.

Finally, we highlighted the importance of securing your Bitcoin investment regardless of its amount. Using secure methods like cold storage can safeguard your investment from digital threats. Storing Bitcoin offline would keep your assets away from potential online vulnerabilities, ensuring a secure investment over the long term.

Prioritizing these aspects of buying Bitcoin, choosing cost-effective payment methods, purchasing strategically advantageous times, and providing strong security practices enables you to structure your Bitcoin buying strategy financially savvy and secure.