This guide will explore crypto to crypto exchange, providing you with the knowledge and tools to navigate this dynamic market. Crypto-to-crypto swapping involves exchanging one cryptocurrency for another without the need for intermediaries like traditional fiat currencies such as the US Dollar or Euro. This method allows traders to capitalize on the market's volatility and diverse range of cryptocurrencies.

What is Crypto to Crypto Exchange?

A crypto-to-crypto exchange is a platform that facilitates the direct swapping of one cryptocurrency for another without the involvement of traditional fiat currencies. Unlike conventional exchanges that bridge the gap between cryptocurrencies and fiat money, these platforms enable users to trade between digital assets seamlessly. The primary objective of crypto-to-crypto trading is to capitalize on the inherent volatility of the cryptocurrency market and leverage the diverse range of available digital assets. Users typically begin by selecting a cryptocurrency exchange platform to initiate a crypto-to-crypto exchange. Security, trading fees, liquidity, and the availability of diverse trading pairs are critical considerations in this selection process. Once a suitable platform is chosen, traders can delve into the intricate world of trading pairs, which represent the combinations of two cryptocurrencies that can be exchanged against each other. This dynamic form of trading opens avenues for strategic decision-making, where factors like market trends, news, and the overall blockchain landscape play a crucial role in shaping trading strategies. The flexibility and accessibility inherent in crypto-to-crypto exchanges provide a gateway for enthusiasts and investors to navigate the digital asset market, fostering an environment of innovation and continual evolution.

Commitment to Regulatory Standards

At PlasBit Sp z.o.o, we emphasize strict adherence to regulatory standards, ensuring a secure and compliant environment for cryptocurrency transactions. Our commitment to transparency and robust security measures is integral to building and maintaining user trust. As a cryptocurrency platform licensed by the Polish government, regulated by the Ministry of Finance (REFERENCE NO. RDWW-533), and under NIP 5214002884, we operate within established legal norms, prioritizing user safety and regulatory compliance. User confidence and trust are pivotal in cryptocurrency, and adhering to regulatory standards is the foundation for cultivating trust. Operating within legal frameworks assures users of the platform's reliability and legitimacy, meets compliance requirements, and demonstrates a commitment to transparency and accountability. Legal compliance protects users and strategically shields the platform, contributing to its long-term sustainability and stability in the ever-evolving crypto ecosystem. Our security measures go beyond mere compliance, constituting a proactive approach to safeguarding users and their sensitive information.

By implementing stringent identity verification processes and continuous transaction monitoring, we aim to reduce the risk of fraudulent activities within our exchange. This commitment enhances the overall security infrastructure, allowing users to engage in transactions confidently in a secure and trustworthy environment. Market credibility is essential for the success of any crypto exchange, and our adherence to regulatory standards plays a crucial role in achieving and sustaining this credibility. Operating within established legal boundaries fosters trust among existing users and attracts new ones. This commitment positions us as a reliable and credible player in the competitive cryptocurrency landscape, potentially drawing a broader user base and facilitating meaningful integration with traditional financial institutions. Beyond compliance, our commitment to regulatory standards opens pathways for meaningful integration with traditional financial institutions, broadening the spectrum of services for our users. This collaboration enhances the exchange's reputation and stability, strengthening its endurance in the dynamic crypto market. Regulatory compliance assurance provides a solid foundation for sustained growth, user retention, and longevity in the cryptocurrency space.

How to Exchange Crypto to Another Crypto?

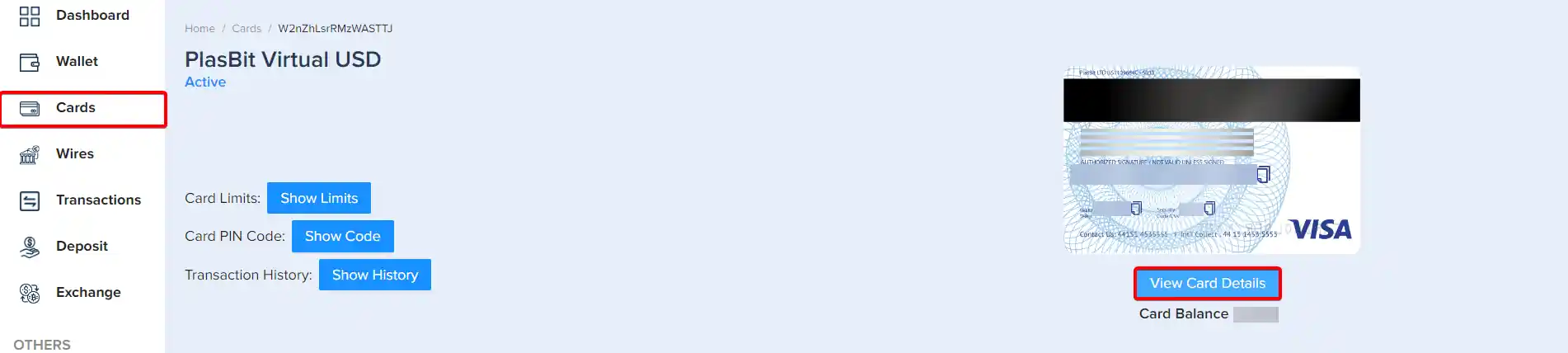

Deposit fiat and exchange cryptocurrencies on our PlasBit with these straightforward steps.

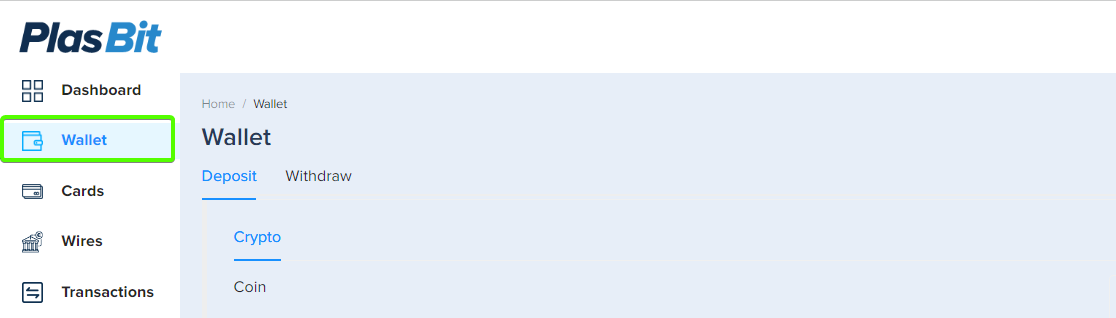

1. Go to the "Wallet" section on our dashboard.

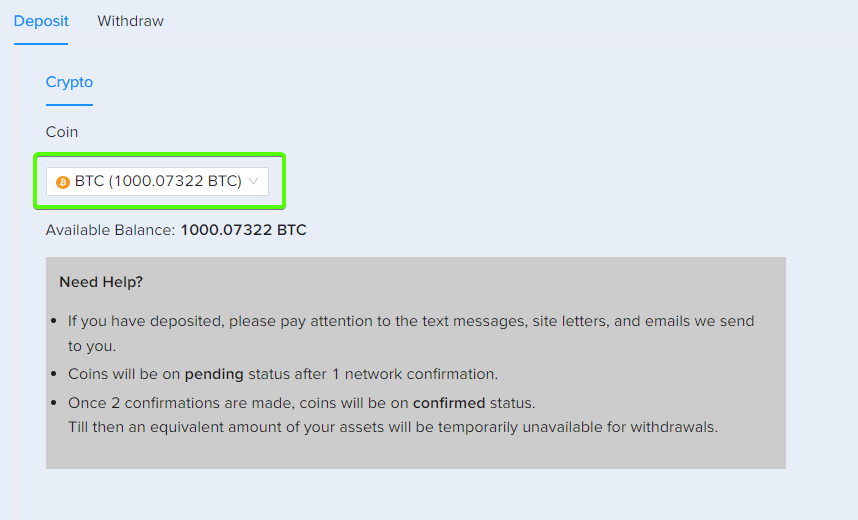

2. Choose the cryptocurrency for the deposit.

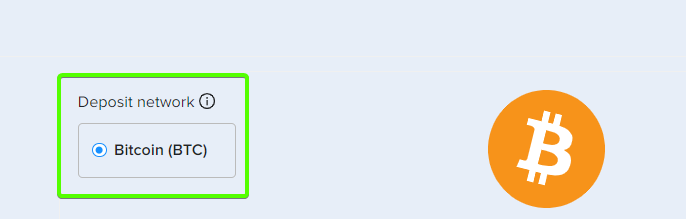

3. Select your preferred deposit network.

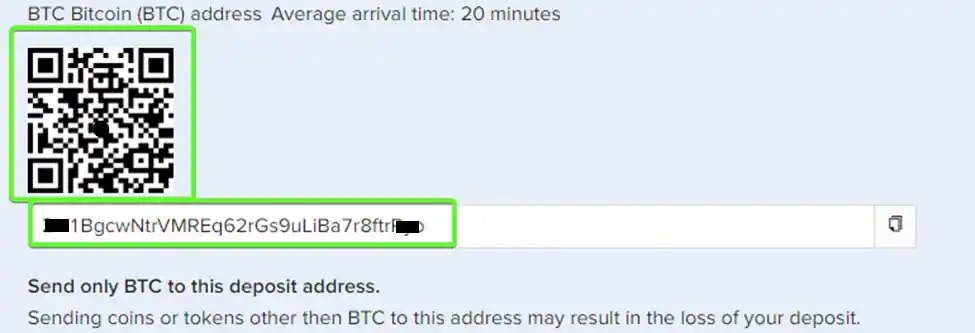

4. Copy the provided deposit address.

5. Be mindful of required network confirmations and double-check details for safety.

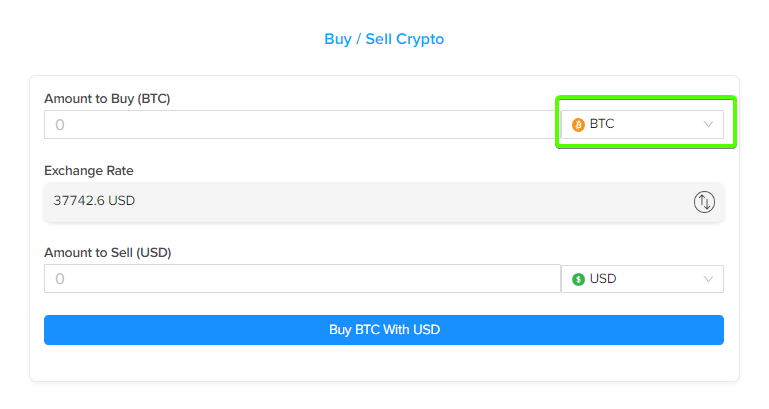

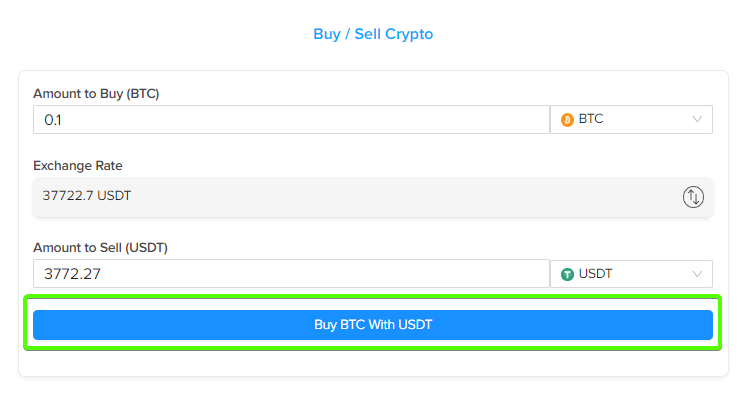

6. Navigate to the "Exchange" section.

7. Choose the cryptocurrency to acquire.

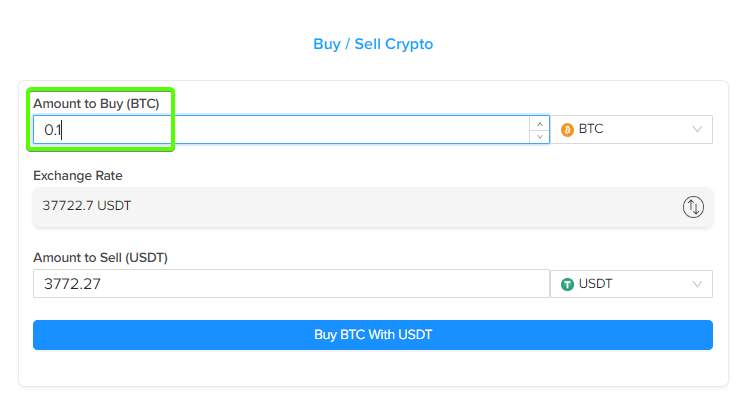

8. Enter the amount to exchange.

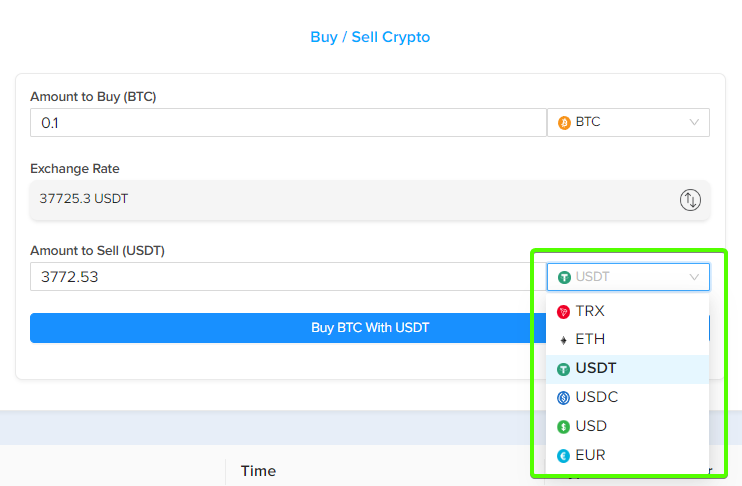

9. Select the cryptocurrency to sell

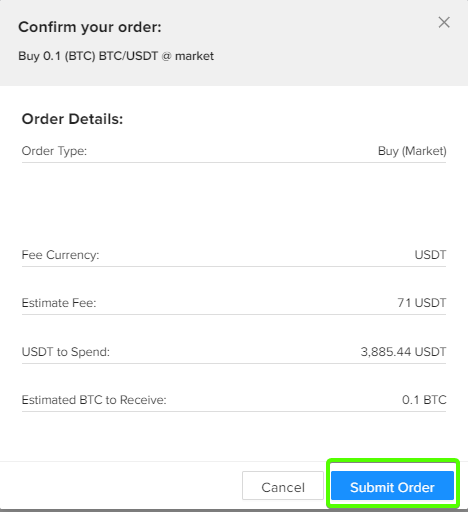

10. Confirm the total transaction amount.

11. Review transaction details for accuracy.

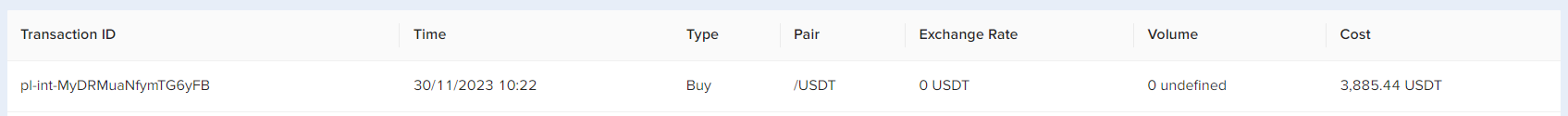

12. Execute the exchange and monitor transaction status.

Follow these steps for depositing and crypto-to-crypto transactions. Contact us for assistance with any questions or concerns. Presently, our cryptocurrency platformsupports BTC, TRX, USDT, USDC, and ETH on TRC20 (Tron) and ERC20 (Ethereum) networks. Future additions include WETH, DOGE, SHIBA INU, LINK, DAI, BLUR, MATIC, and other ERC20 tokens.

Why Exchange Crypto to Another Crypto?

Cryptocurrency enthusiasts often find themselves in the dynamic realm of crypto-to-crypto trading, which involves exchanging one digital asset for another. In this exploration, we delve into the motivations and benefits that drive individuals and traders to engage in this fascinating aspect of the cryptocurrency market.

Diversification Opportunities:

One of the primary reasons for exchanging crypto for another crypto is the pursuit of diversification. Cryptocurrency markets are vast and diverse, with thousands of digital assets available. Traders may spread their assets across cryptocurrencies to mitigate risk and enhance returns. By diversifying their portfolio, traders can reduce their exposure to the volatility of any single cryptocurrency.

Capitalizing on Market Volatility:

Crypto markets are known for their volatility, presenting opportunities and risks. Traders engaging in crypto-to-crypto exchanges often capitalize on these price fluctuations. Individuals aim to take advantage of short-term market movements by strategically trading between cryptocurrencies and profiting from the inherent volatility.

Access to New and Emerging Projects:◙

The crypto space continuously evolves, with new projects and tokens regularly entering the market. Exchanging one cryptocurrency for another allows traders to access and participate in the growth of new and emerging projects. This proactive approach enables individuals to stay ahead of market trends and explore opportunities in the ever-expanding world of blockchain technology.

Optimizing Investment Strategies:

Crypto to crypto trading provides a platform for optimizing investment strategies. Traders may adjust their portfolios based on market trends, news, or developments in specific blockchain projects. This flexibility allows for the reallocation of assets to align with evolving market conditions, enabling a more dynamic and responsive approach.

Arbitrage Opportunities:

Crypto-to-crypto trading also opens doors to arbitrage opportunities. Arbitrage involves exploiting price discrepancies of the same cryptocurrency across different exchanges. Traders can buy the crypto at a lower value on one exchange and sell it at a higher value on another, profiting from market inefficiencies.

Privacy and Anonymity:

Some individuals engage in crypto to crypto exchanges for privacy and anonymity reasons. Certain cryptocurrencies offer enhanced privacy features, and by exchanging one for another, users can maintain confidentiality in their transactions. This aspect appeals to those who prioritize privacy in their financial dealings.

Strategic Tax Planning:

In some jurisdictions, the tax treatment of cryptocurrency transactions varies depending on whether the exchange involves fiat currencies or only cryptocurrencies. Traders may strategically exchange one crypto for another to manage their tax liabilities more efficiently. However, consulting with tax professionals is crucial to ensure compliance with local regulations.

Are Crypto to Crypto Trades Taxable?

The intersection of cryptocurrency and taxation is a complex landscape that requires careful consideration. As digital assets gain prominence, questions surrounding the taxability of crypto-to-crypto trades have become increasingly relevant. In this exploration, we delve into crypto taxation to understand the implications of trading one cryptocurrency for another.

Taxable Events in Cryptocurrency:

To comprehend the tax implications of crypto-to-crypto trades, it's essential to understand what constitutes a taxable event. In many jurisdictions, cryptocurrency exchange is taxable, triggering a calculation of capital gains or losses. This includes converting crypto to fiat and swapping one cryptocurrency for another.

Capital Gains and Losses:

Crypto-to-crypto trades are subject to capital gains or losses tax treatment. When you exchange one cryptocurrency for another and experience a change in value, it prompts a taxable event. The capital gain or loss is calculated depending on the difference in value between the two assets at the time of the trade.

Short-Term vs. Long-Term Capital Gains:

The duration for which you hold a cryptocurrency before trading it can impact the tax rate. In many jurisdictions, gains from cryptocurrencies held for less than a year are considered short-term and taxed at a higher rate than long-term gains. Understanding the holding period is crucial for accurate tax reporting.

Tax Reporting and Record-Keeping:

Proper record-keeping is essential for fulfilling tax obligations related to crypto-to-crypto trades. Detailed records should include information about the date of the trade, the value of the cryptocurrencies at the time of the transaction, and any associated fees. This documentation is crucial for accurate tax reporting and may be requested by tax authorities during audits.

Like-Kind Exchanges and Changes in Tax Law:

Some traders may be familiar with the concept of like-kind exchanges, where certain property types can be exchanged without triggering an immediate tax liability. However, tax laws related to like-kind exchanges of cryptocurrencies have changed in many jurisdictions. It's crucial to stay informed about evolving tax regulations to ensure compliance.

Specific Regulations in Different Jurisdictions:

Crypto taxation varies significantly from one jurisdiction to another. Some countries have clear guidelines on how to tax crypto-to-crypto trades, while others are still developing their regulatory frameworks. Traders must be aware of the specific regulations in their jurisdiction and pursue professional advice if needed.

Tax Planning Strategies:

Traders may explore tax planning strategies to optimize their tax liabilities. These strategies include managing the timing of trades to minimize short-term capital gains, offsetting gains with losses, and considering tax-efficient structures. Consulting with tax professionals can help tailor strategies to individual circumstances.

Educational Resources and Guidance:

Given the complexities of crypto taxation, various educational resources and guidance are available. Tax professionals, online platforms, and government agencies often provide information to help individuals navigate the intricacies of reporting crypto transactions.

What Influences Crypto Prices?

Understanding the myriad factors influencing cryptocurrency prices is essential for anyone navigating digital assets' volatile and dynamic world. The crypto market is subject to diverse influences, from market structure to regulatory developments that can shape price movements. Let's explore the key factors that play a pivotal role in determining the prices of cryptocurrencies.

Market Structure and Cycles:

The cryptocurrency market exhibits cyclical patterns characterized by periods of bullish growth and subsequent corrections. Several factors can influence these cycles:

Technological Advancements:

Innovations and advancements in blockchain technology can trigger market cycles. Introducing new consensus mechanisms, scalability solutions, or security enhancements may impact trader sentiment.

Market Sentiment:

Trader sentiment, often influenced by news, social media, and macroeconomic trends, contributes to market cycles. Positive sentiment can drive prices upward, while negative sentiment may lead to corrections.

Macroeconomic Trends:

Economic indicators, geopolitical events, and global economic trends can impact cryptocurrency prices. For instance, economic uncertainty may drive traders toward cryptocurrencies as a perceived haven.

Supply and Demand Dynamics:

The fundamental supply and demand economic principle is a cornerstone of cryptocurrency pricing. If the supply of a cryptocurrency exceeds demand, its price may decline. Conversely, limited supply and increased demand can drive prices higher.

Availability on Exchanges:

The accessibility of a cryptocurrency on various exchanges can significantly influence its price. Cryptocurrencies listed on multiple exchanges tend to have higher liquidity, making it easier for traders to buy and sell. Delisting from major exchanges can reduce accessibility and impact prices negatively.

Inflation of Fiat Currency:

Cryptocurrencies, particularly Bitcoin, are often viewed as a hedge against inflation. High inflation rates in traditional fiat currencies can drive individuals to seek alternative stores of value, such as cryptocurrencies, potentially leading to price increases.

Competition in the Market:

The competitive nature of the cryptocurrency market can affect prices. New cryptocurrencies with superior technology or innovative features may compete for market share, influencing the prices of existing cryptocurrencies.

Governance Models:

The governance structure of a cryptocurrency project can impact trader confidence. Cryptocurrencies with transparent and stable governance models are often more attractive to traders, providing a sense of predictability.

Regulatory Landscape:

Regulatory developments and news play a crucial role in shaping cryptocurrency prices. Positive regulatory developments like favorable legal frameworks can boost trader confidence and drive prices upward. Conversely, negative regulatory news may lead to price declines.

Cryptocurrency Whales:

Large holders, known as "whales," wield significant influence over prices. Whales can impact prices by executing large trades. Their buying or selling activities may trigger market movements, leading to fluctuations in cryptocurrency prices.

Fundamentals of Crypto to Crypto Exchange

Crypto-to-crypto trading represents a dynamic facet of the cryptocurrency market, allowing traders to navigate the digital landscape without relying on traditional fiat currencies like the US Dollar or Euro. A thorough understanding of the fundamentals is paramount to embark on this journey successfully.

Cryptocurrency Exchange:

The foundation of crypto-to-crypto trading rests on choosing the cryptocurrency exchange. This decision can significantly impact your trading experience and success. Consider the factors when selecting an exchange:

Security Measures:

Prioritize exchanges with robust security features, including encryption, two-factor authentication (2FA), and cold storage for digital assets. PlasBit has robust security measures to safeguard user data and ensure complete privacy. Utilizing advanced encryption, two-factor authentication, and 24/7 support, we protect server and client-side surfaces, with 100% of user cryptocurrencies stored offline in cold storage. Our commitment extends to regular automated penetration tests, stringent internal controls, and compliance with the Cryptocurrency Security Standard Level 3, reinforcing our dedication to providing a secure and enduring crypto platform.

Trading Fees:

Evaluate the fee structure of the exchange, including transaction fees, withdrawal fees, and any other associated costs. Some exchanges offer competitive fee structures that align with your trading strategy.

Liquidity:

Liquidity is crucial for efficient trading. Opt for exchanges with high liquidity to ensure that your orders can be executed without significant price slippage.

Available Trading Pairs:

Look for exchanges that offer a diverse range of trading pairs. Exchanges provide access to various cryptocurrencies, enabling you to explore various opportunities.

Understanding Trading Pairs:

Trading pairs are the cornerstone of crypto-to-crypto trading. These pairs represent the combinations of two cryptocurrencies that can be traded against each other. Key considerations include:

Base and Quote Currencies:

In a trading pair like BTC/ETH, BTC is the base currency, and ETH is the quote currency. Understanding these roles is essential for executing trades and assessing the relative value of each cryptocurrency.

Market Orders vs. Limit Orders:

Familiarize yourself with different order types. Market orders are performed at the market price, while limit orders allow you to authorize you to set a specific price you want to trade. Each order type has advantages, depending on market conditions and your trading strategy.

Technical Analysis:

Given the inherent volatility of crypto markets, technical analysis becomes a powerful tool for traders. Delve into the basics of technical analysis to make informed decisions:

Candlestick Charts:

Learn to interpret candlestick charts, providing valuable insights into price movements. Understanding patterns, such as doji, hammer, and engulfing patterns, can aid in predicting market trends.

Indicators and Oscillators:

Familiarize yourself with technical indicators like Moving Averages, Relative Strength Index (RSI), and MACD (Moving Average Convergence Divergence). These tools can assist in identifying trends, momentum, and potential reversal points.

Support and Resistance Levels:

Recognize key support and resistance levels on charts. These levels indicate where the price has struggled to move above (resistance) or below (support), offering insights into potential entry and exit points.

Risk Management:

Mitigating risks is integral to successful crypto-to-crypto trading. Implement the following risk management strategies:

Setting Stop-Loss and Take-Profit Orders:

Define clear risk-reward ratios by setting stop-loss orders to limit possible losses and take-profit orders to secure profits at predefined levels.

Diversification:

Spread your assets across different cryptocurrencies to decrease the impact of poor performance in a single asset. Diversification is a fundamental principle in risk management.

Cryptocurrency Trading Strategies

In cryptocurrency trading, a well-defined strategy is the compass that guides traders through the complexities of the market. These strategies provide systematic approaches to buying and selling, empowering traders to manage risk and make informed decisions. PlasBit price charts offer comprehensive data on cryptocurrency performance, presenting users with essential information such as price changes over 24 hours, weekly, monthly, and yearly intervals. The platform also includes crucial metrics like 24-hour trading volume, market capitalization, and circulating supply, facilitating thorough market analysis. In addition to its detailed crypto price charts, our charts feature a convenient price calculator alongside the graphical representation of the selected crypto token, enhancing usability for investors and traders. Let's explore some of the most commonly employed strategies in cryptocurrency trading.

Arbitrage Trading Strategy:

Arbitrage trading is a sophisticated approach where traders exploit price differences in the same cryptocurrency across various exchanges. Rooted in the efficient market hypothesis, arbitrage capitalizes on deviations from the ideal scenario where identical assets should have identical prices. Traders swiftly buy at a lower price range on one exchange and trade at a higher price range on another, with spatial arbitrage focusing on simultaneous transactions and temporal arbitrage capitalizing on variations over time. Successful execution demands consideration of transaction costs, market liquidity, and the accessibility of cryptocurrencies on different exchanges. However, challenges such as execution risk and regulatory changes underscore the need for precision and adaptability in this dynamic strategy.

Swing Trading Strategy:

Swing trading is a strategic approach designed to capitalize on short to medium-term price movements within the overarching trend of the market. In contrast to the rapid pace of day trading, swing traders strategically position themselves to exploit the oscillations or 'swings' in the market, holding positions for a few days to weeks. Key components of swing trading include trend analysis, where technical tools like moving averages and trendlines inform trading decisions. Setting clear entry and exit points and diligent risk management through stop-loss orders distinguishes successful swing traders. Understanding market sentiment, influenced by external factors like news and social media, further refines the strategy.

Trend Trading Strategy:

Trend trading is a strategy centered around the directional momentum of market prices. Traders leveraging this strategy aim to capitalize on cryptocurrencies experiencing either a positive or negative upward trend. Traders use technical analysis tools to recognize trends, such as moving averages or trendlines. They enter the market in the direction of the trend, buying during upward trends and selling during downward trends. Successful trend trading involves disciplined risk management. Traders may use stop-loss orders to limit possible losses and let profits run during favorable trends.

Range Trading Strategy:

Range trading is employed when a cryptocurrency's price moves within a specific range, oscillating between defined support and resistance levels. Traders execute buy orders at or near the support level (the price at which it tends not to fall below) and sell orders at or near the resistance level (the price at which it tends not to rise above). Range trading requires patience as traders wait for the price to recover between support and resistance levels. It's crucial to avoid making impulsive decisions during periods of sideways movement.

Breakout Trading Strategy:

Breakout trading involves capitalizing on price movements after they break through a previously defined support or resistance level. Traders monitor key support and resistance levels. When the price breaks through a significant level, they enter trades in the direction of the breakout. Breakout trading demands prompt responses. Traders need to act swiftly when a breakout occurs to maximize potential profits.

Scalping Strategy:

Scalping is a high-frequency trading strategy aimed at exploiting small price fluctuations. Scalpers make numerous trades within a day, accumulating small profits. Scalpers enter and exit trades rapidly, taking advantage of small price movements. The goal is to accumulate profits through multiple trades. Scalpers rely on advanced trading technology and precise timing. Low-latency trading platforms and real-time market data are crucial for successful scalping.

How to Store Cryptocurrency?

The security of your cryptocurrency holdings is paramount in the digital finance landscape. Knowing how to store your digital assets securely ensures protection against threats like hacking and fraud. Here's a detailed guide covering various storage options and best practices for safeguarding your cryptocurrency.

Wallet Types:

Hot Wallets:

Hot wallets are connected to the internet, considering them convenient for daily transactions but potentially vulnerable to online threats. They come in software wallets (desktop, mobile, or online) and are suitable for small amounts of cryptocurrency you intend to use regularly.

Cold Wallets:

Cold wallets are offline storage solutions, making them more secure against online attacks. Hardware wallets (physical devices) and paper wallets (physical documents with private keys) fall into this category. Cold wallets are perfect for long-term storage and large amounts of cryptocurrency.

Software Wallets:

Online Wallets:

Online wallets, accessible through web browsers, are convenient but susceptible to hacking. Choosing reputable platforms with robust security features and enabling two-factor authentication is crucial.

Desktop Wallets:

Desktop wallets are applications installed on your computer. They offer control over your private keys but require diligent security measures, such as regular updates and antivirus protection.

Mobile Wallets:

Mobile wallets, designed for smartphones, provide convenience for on-the-go transactions. Security measures include PIN codes and biometric authentication, but users must safeguard their devices against loss or theft.

Hardware Wallets:

Hardware wallets keep your private keys offline, offering enhanced security. These wallets are immune to online hacking attempts but should be purchased from trusted sources to avoid tampering.

Paper Wallets:

A paper wallet involves printing your public and private keys on paper. While offline and secure from online threats, precautions must be taken to protect the physical document from damage, loss, or unauthorized access.

Conclusion

Navigating the intricate landscape of crypto-to-crypto exchange, understanding the tax implications, and employing effective storage strategies are crucial aspects for any cryptocurrency enthusiast. Diversification, capitalizing on market volatility, accessing new projects, and optimizing investment strategies are key motivations for engaging in crypto-to-crypto exchanges. As the crypto market evolves, so do the complexities of taxation, requiring careful consideration of taxable events, capital gains, and jurisdiction-specific regulations. Successful trading strategies, including arbitrage, swing, and trend trading, empower individuals to navigate the dynamic market effectively. Finally, securing your digital assets through crypto wallet methods, whether using software wallets, hardware wallets, or paper wallets, is fundamental to protecting your assets in the ever-evolving world of cryptocurrencies.