The cryptocurrency landscape involves understanding the advantages of cashing out Bitcoins, considering such decisions, various methods available, and utilizing specific services on our platform for seamless transactions. How do I cash out Bitcoins? This guide explores the details of cashing out Bitcoins, providing insights, step-by-step instructions, and considerations for users seeking to exchange their digital assets for traditional fiat currency. Whether choosing wire transfers, debit cards, or other methods, this guide aims to empower users with the knowledge needed to make knowledgeable decisions in the dynamic world of cryptocurrency.

List of Ways to Cash out Bitcoins

Cryptocurrency Exchanges:

These platforms facilitate the conversion of Bitcoin into traditional fiat currencies through fiat-to-crypto trading pairs. The process typically involves selling Bitcoins on the exchange and withdrawing the funds in a chosen fiat currency. Cryptocurrency exchanges are pivotal in providing liquidity, price discovery, and a secure environment for trading digital assets. Users can navigate various exchanges, each offering unique features, trading pairs, and user interfaces. Choosing reputable exchanges with robust security measures is important to secure the funds during the cash-out process. As a component of the cryptocurrency ecosystem, exchanges serve as bridges between the digital and traditional financial realms, offering individuals a straightforward means to realize the value of their Bitcoin holdings in fiat currency.

Peer-to-Peer Transactions:

This approach allows individuals to sell their Bitcoins directly to interested buyers seeking to acquire digital assets with fiat currency. Peer-to-peer platforms act as facilitators, connecting sellers and buyers without the need for intermediaries such as traditional exchanges. This method offers a more personalized and direct interaction, allowing for negotiations on pricing and transaction terms between the parties involved. It is crucial, however, to exercise caution and use reputable peer-to-peer platforms that incorporate robust escrow services and security measures to mitigate the risks associated with direct transactions. By participating in peer-to-peer transactions, individuals gain greater autonomy over the sale of their Bitcoins, fostering a more personalized and potentially cost-effective cash-out experience.

Bitcoin ATMs:

These machines offer a user-friendly interface, allowing individuals to sell Bitcoins for cash or initiate direct transfers to a linked bank account. Bitcoin ATMs have increased globally, enhancing accessibility and providing an additional avenue for users to realize the value of their digital assets. The process typically involves locating a nearby Bitcoin ATM, initiating the transaction, and following the on-screen instructions to complete the sale or transfer. While Bitcoin ATMs offer a straightforward cash-out method, users should be mindful of associated fees and adhere to security standard practices to safeguard their transactions. The prevalence of Bitcoin ATMs continues to grow, reflecting the increasing integration of cryptocurrencies into mainstream financial infrastructure and providing individuals with a tangible and accessible means of converting their digital assets into traditional fiat currency.

Over-the-Counter (OTC) Trading:

For individuals dealing with large volumes of Bitcoin, Over-the-Counter (OTC) trading emerges as a tailored solution, offering a discreet and efficient method for cashing out substantial holdings. OTC trading platforms are intermediaries that facilitate direct transactions between buyers and sellers outside the traditional exchange order book. This approach is particularly advantageous for high-net-worth individuals, institutional investors, or entities seeking to execute significant Bitcoin transactions with minimal market impact. OTC trades often involve personalized negotiation on price and terms, allowing for flexibility and customization based on the parties' specific needs. Choosing reputable OTC trading platforms with established track records and robust security measures is essential to ensure a secure and reliable transaction process.

Bitcoin Debit Cards:

By linking Bitcoins to a Bitcoin debit card, users can make purchases or withdraw cash at ATMs in locations that accept traditional debit or credit cards. This innovative financial tool bridges the gap between the cryptocurrency and traditional financial worlds, allowing users to utilize their Bitcoin holdings for day-to-day transactions. Bitcoin debit cards typically come in various forms, such as virtual, plastic, or metal cards, each offering different features and associated fees. Users can select the type of card that aligns with their preferences and usage patterns. While Bitcoin debit cards enhance spending flexibility, users should be mindful of associated fees, transaction limits, and security considerations to make informed decisions.

Gift Cards and Vouchers:

This approach allows individuals to convert their digital assets into a form that can be utilized at various retailers, offering diverse spending options. The process involves exchanging Bitcoins for gift cards or vouchers through platforms facilitating such transactions. While this method may introduce a level of intermediacy, it allows individuals to explore a broad spectrum of spending possibilities, from online retailers to brick-and-mortar stores. Choosing reputable platforms that offer various gift card options and ensure secure transactions is important.

Crypto Payment Platforms:

These platforms enable users to seamlessly transition their digital assets into fiat, with the added convenience of transferring the funds directly to their bank accounts. By leveraging crypto payment platforms, individuals gain a versatile and efficient means of realizing the value of their Bitcoins while navigating the cryptocurrency ecosystem. The process typically involves initiating a conversion on the platform, with the resulting fiat funds becoming accessible for withdrawal or further use. Users should prioritize platforms with robust security measures and transparent fee structures to ensure a secure and cost-effective cash-out experience. Incorporating crypto payment platforms into one's financial strategy reflects a forward-thinking approach to integrating digital assets, fostering accessibility and usability.

Cryptocurrency Loans:

How do I cash out Bitcoins? Cryptocurrency lending platforms provide a strategic avenue for individuals seeking to maintain exposure to their Bitcoin holdings while unlocking liquidity. These platforms offer the option to borrow fiat currency against existing Bitcoin holdings, allowing users to access funds without selling their digital assets. This approach is particularly beneficial for those who anticipate future appreciation in the value of Bitcoin or wish to retain ownership while meeting immediate financial needs. Users can collateralize their Bitcoin holdings and, in return, receive a loan denominated in fiat currency. Choosing reputable lending platforms that offer competitive terms, transparent conditions, and robust security measures is crucial. Cryptocurrency loans offer a dynamic and innovative solution, allowing individuals to leverage their Bitcoin as collateral for obtaining fiat liquidity, aligning with diverse financial objectives and market expectations.

Cash Out Bitcoins with a PlasBit Debit Card

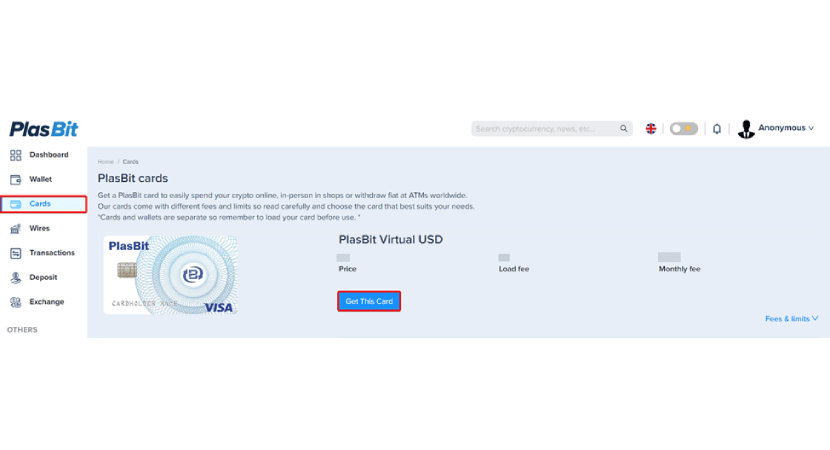

How do I cash out Bitcoins? One way is through our debit card. Here's a step-by-step guide on how to cash out Bitcoin with our debit card:

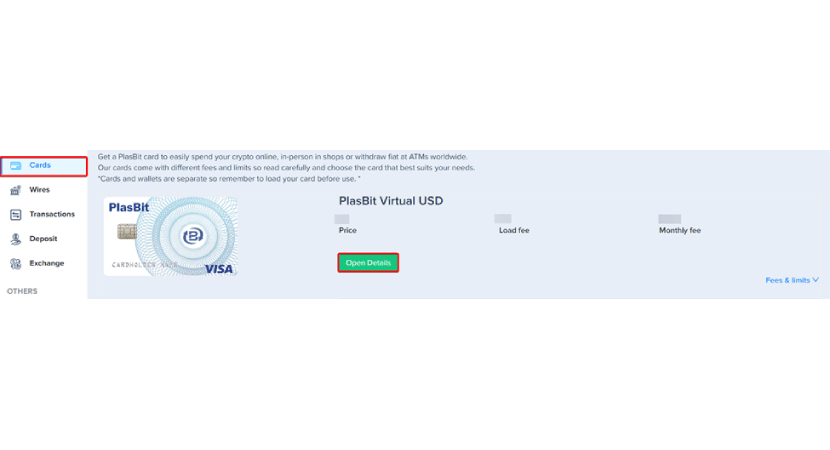

1. Log in to your account and navigate to the 'Cards' section on the platform.

2. Select the type of debit card you prefer from options like Virtual USD, Plastic USD, or Metal USD. Each card comes with its associated price and fees.

3. Click the 'Get This Card' button to proceed with the purchase of your chosen debit card.

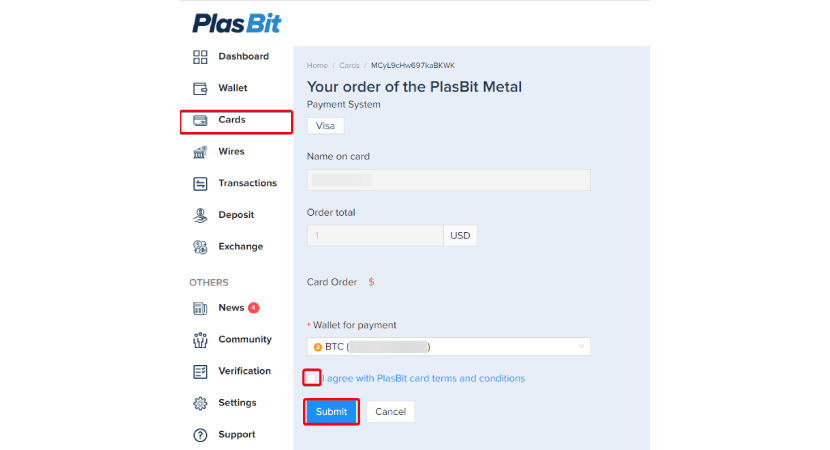

4. Verify and provide necessary payment information, including your card name. Agree to the terms and conditions by checking the box and clicking 'Submit.'

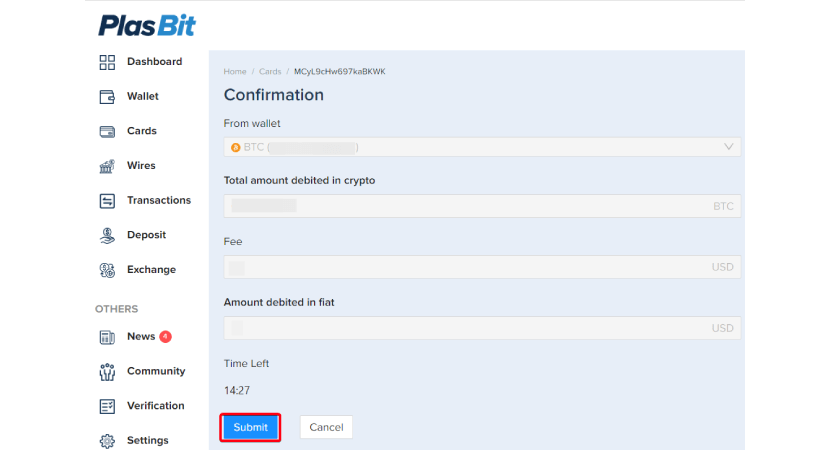

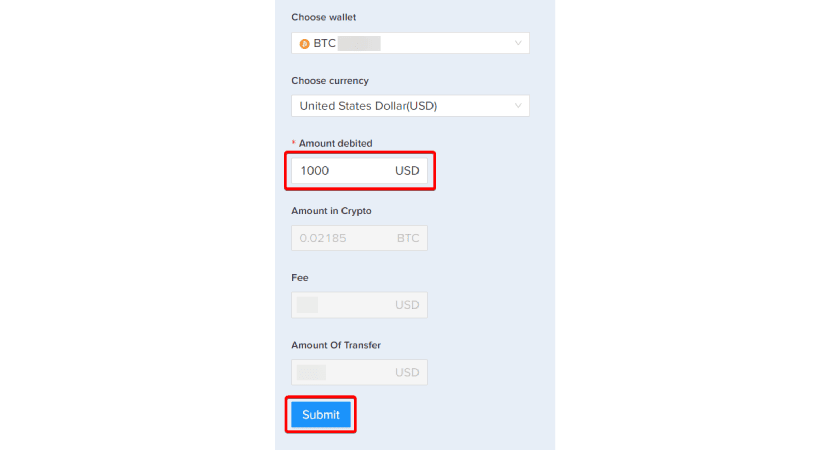

5. You will be diverted to a verification page displaying your wallet balance, the total amount debited in Bitcoin, associated fees, and the amount debited in fiat. Review the details and click 'Submit' to proceed.

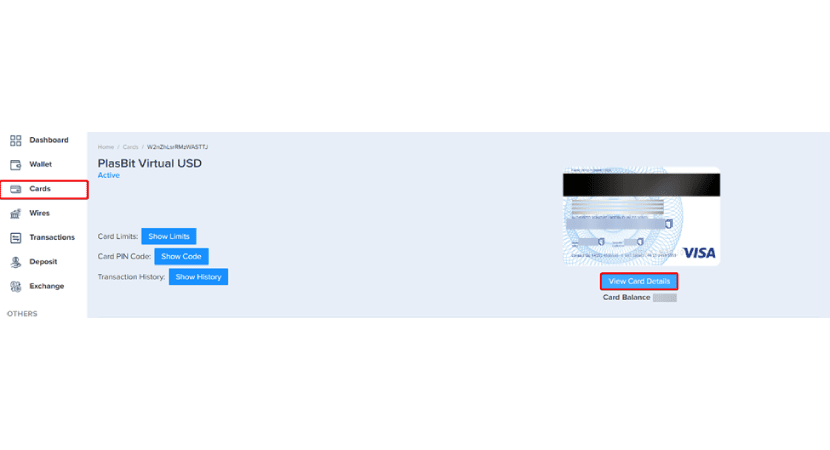

6. If you wish to check the details of your selected card, click the 'Open Details' button in the "Debit Card" section.

7. In the "Debit Card" section, explore your card limits (daily, monthly, and yearly), PIN code (if applicable), transaction history, and essential details like card validity, CVV, and signature.

8. Choose to fund your debit card with Bitcoin. Select the Bitcoin wallet as the source to load the debit card.

9. Choose the debit card you want to load, indicate the amount you wish to load onto the card, and review the associated fees and the final amount to be received.

10. The specified amount in Bitcoin will be deducted from your wallet, and fees will automatically be subtracted. Review the total amount your debit card will receive.

11. After reviewing all details, click 'Submit' to complete the transaction. The funds will be loaded onto your debit card.

Following these steps, you can efficiently cash out your Bitcoin using our debit card.

How to Cash Out Bitcoins with PlasBit Wire Transfers

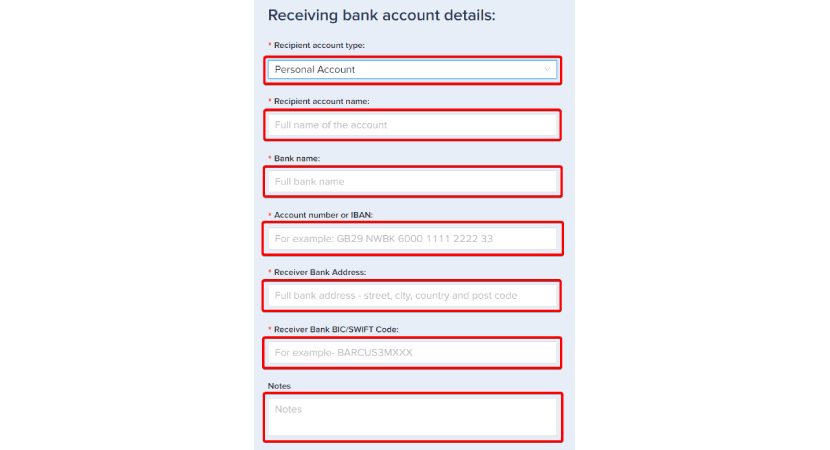

1. Log in to your account and navigate to the "Wires" section for comprehensive details on BTC to USD bank wire transfers.

2. Within the "Wires" section, thoroughly review transfer details such as completion time, fees, and minimum/maximum amounts per transaction.

3. Begin the process by inputting the recipient account information. Include details such as account name, type, number/IBAN, bank name, BIC/SWIFT code, bank address, and any additional necessary notes.

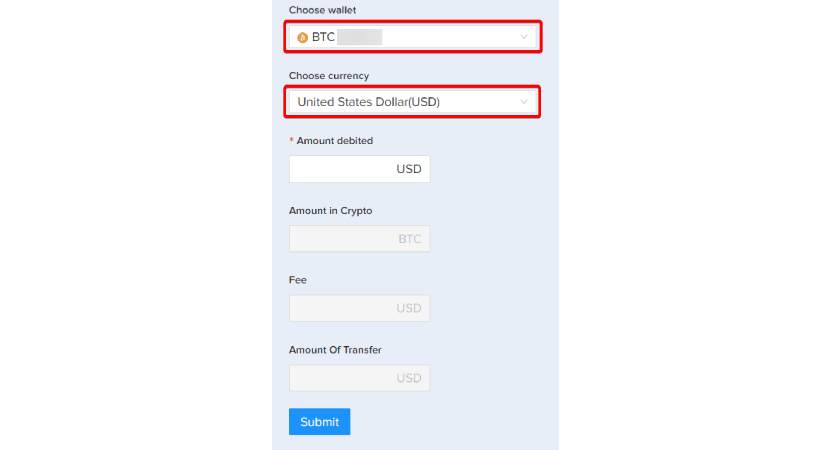

4. Specify BTC as the cryptocurrency for conversion to USD. After deducting fees, our system will automatically calculate amounts, fees, and the total transfer. Ensure your wallet has sufficient BTC for the transaction.

5. After inputting all necessary details, submit the wire transfer request. You will receive a confirmation prompt indicating the deducted crypto amount, which is reflected in your account and listed as a pending request.

You have successfully cashed out your Bitcoin using our wire transfer. Track the progress of your transfer within your account. The transfer will be processed within the allotted timeframe. Following these steps, you can efficiently cash out your Bitcoins through our wire transfer service, ensuring a seamless and transparent process from cryptocurrency to traditional fiat currency.

Advantages of Cashing out Bitcoins

Cashing out Bitcoins into traditional fiat currency offers stability, predictability, and ease of use for everyday transactions, reducing exposure to volatile cryptocurrency markets. It enables meeting financial obligations, provides potential tax advantages, and allows portfolio diversification. Access to traditional financial services and addressing security concerns are additional benefits. However, individual financial goals and market conditions should be examined before making such decisions. Are you wondering how do I cash out Bitcoins? Explore the various methods and factors to make informed choices aligned with your unique financial objectives.

Stability and Predictability:

Cashing out Bitcoins into traditional fiat currency provides a shield against the inherent volatility of cryptocurrencies. Fiat currencies, backed by established monetary systems, generally exhibit more stable values compared to the unpredictable price fluctuations of cryptocurrencies like Bitcoin. This stability and predictability instill confidence in financial transactions and serve as a foundation for strategic financial planning. It allows individuals to traverse the financial landscape with greater assurance, especially during market turbulence when cryptocurrency values can experience rapid and unpredictable changes. The ability to convert Bitcoins into fiat currency gives users a store of value, enhancing their financial stability in an otherwise dynamic and fluctuating market.

Ease of Use:

With their wide acceptance for everyday transactions, Fiat currencies significantly enhance the practicality of managing daily expenses. Cashing out Bitcoins into traditional fiat currency aligns with the universal acceptance of fiat and streamlines the ease of conducting various financial activities. The seamless integration of fiat into the existing financial infrastructure means that individuals can effortlessly use their funds from routine purchases to more complex financial transactions. This ease of use extends beyond online transactions to in-person interactions, as fiat currency is universally recognized and accepted across a diverse range of merchants and service providers. The ability to cash out Bitcoins and leverage fiat for daily transactions reflects a user-friendly approach, simplifying the financial landscape for individuals and promoting a more accessible and versatile use of their cryptocurrency assets.

Reduced Exposure to Market Volatility:

The inherent volatility of cryptocurrency markets is a well-known characteristic that can challenge investors. Cashing out Bitcoins strategically is a risk mitigation strategy, offering a shield against potential losses from sudden and unpredictable price fluctuations. This becomes particularly crucial during periods of market uncertainty when cryptocurrency values can experience rapid and substantial changes. By converting Bitcoins into traditional fiat currency, individuals reduce their exposure to the unpredictable nature of the cryptocurrency market. This risk reduction strategy ensures that the value of their assets is more resilient to cryptocurrency's often turbulent and dynamic shifts. Cashing out Bitcoins provides a practical way for individuals to secure their gains, protecting their wealth from extreme volatility.

Meeting Financial Obligations:

It bridges digital assets and traditional finance, enabling individuals to fulfill financial commitments that may not yet embrace cryptocurrencies. While the adoption of digital currencies is progressing, numerous facets of everyday life, such as utility bills, mortgages, and other conventional financial obligations, predominantly operate in traditional fiat. Converting Bitcoins into fiat currency allows individuals to seamlessly meet these financial obligations, ensuring a smooth integration of their wealth into established financial systems. This strategic move reflects practicality in navigating the current financial infrastructure and facilitates a more comprehensive and hassle-free approach to managing diverse financial responsibilities.

Diversification:

While cryptocurrencies offer unique investment opportunities, their inherent volatility can introduce risk. Individuals can diversify their holdings by converting a portion of digital assets into traditional fiat currency. Holding a mix of assets, including fiat currencies, contributes to a more resilient and stable portfolio. This diversification strategy is rooted in spreading risk across different asset classes, reducing volatility's impact on any single investment type. Cashing out Bitcoins becomes a deliberate step towards achieving a holistic investment approach, combining the potential growth of cryptocurrencies with the stability of fiat currencies. Diversifying holdings in this manner provides individuals with a nuanced financial strategy that aims to optimize returns while effectively managing and mitigating risk.

Access to Traditional Financial Services:

Fiat currency facilitates access to a wide range of services, including conventional loans, interest-bearing accounts, and diverse investment options that may not be readily available for cryptocurrencies. Many financial institutions operate within the framework of traditional fiat, offering products and services that cater to the needs of individuals navigating the conventional financial landscape. It strategically positions individuals to leverage these services, providing opportunities for securing loans, earning interest on deposits, and exploring a variety of investment vehicles. This access to traditional financial services enhances financial flexibility and aligns with the established frameworks that govern mainstream financial transactions. It reflects a practical approach for individuals seeking a seamless integration of their cryptocurrency wealth into the broader financial ecosystem, combining digital assets' advantages with traditional financial institutions' well-established offerings.

Security Concerns:

The inherent security challenges associated with holding large amounts of cryptocurrency underscore the importance of a strategic approach to financial management. Cashing out Bitcoins is a proactive measure to mitigate potential security risks, safeguarding against hacking and other threats linked to digital wallets. Holding substantial cryptocurrency assets exposes individuals to the ever-evolving landscape of cyber threats, where malicious actors actively target digital wealth stored in decentralized formats. By converting Bitcoins into traditional fiat currency and transferring funds to secure bank accounts, individuals reduce their vulnerability to such security risks. Traditional banking infrastructure often comes fortified with robust security measures, including encryption protocols and fraud detection systems, providing additional protection. This strategic move safeguards against potential financial losses due to security breaches and instills confidence in the broader financial system's ability to protect and preserve wealth. In doing so, only choose a platform with robust security measures. PlasBit prioritizes customer security with stringent measures such as storing all user cryptocurrencies offline, strong encryption, and two-factor authentication. Our commitment includes regular penetration tests, secure platform servers, and internal controls like not holding passwords, ensuring a trustworthy and safe environment for cryptocurrency transactions.

Considerations Before Cashing Out Bitcoin

Market Conditions:

Cryptocurrency is characterized by fluctuations influenced by various factors such as demand, regulatory developments, and macroeconomic trends. Before initiating the conversion of Bitcoin into traditional fiat currencies, individuals must consider factors like current market prices, liquidity, and overall market sentiment. A thoughtful analysis of these conditions empowers individuals to make decisions that align with their economic goals. This strategic approach ensures that the timing of the cash-out process maximizes potential returns and minimizes exposure to market volatility.

Tax Implications:

Converting Bitcoin into traditional fiat currency may trigger taxable events, and the nature of these events can vary based on jurisdiction and circumstances. As tax laws related to cryptocurrencies evolve, seeking professional advice becomes advisable to navigate the intricacies of tax reporting accurately. Professional guidance not only aids in ensuring compliance but also assists individuals in optimizing their tax position within the legal framework. By proactively addressing tax implications, individuals can make well-informed decisions, aligning their financial strategy with regulatory requirements and personal financial goals.

Individual Financial Goals:

For those with immediate financial requirements, such as covering living expenses or fulfilling short-term obligations, a well-timed cash-out may provide the necessary liquidity. On the flip side, individuals with a long-term investment horizon may strategically choose to retain Bitcoin exposure, aligning with their broader wealth accumulation objectives. This tailored approach ensures that the decision to cash out is not a standalone event but a deliberate step in pursuing individual financial aspirations. By harmonizing the cash-out decision with personal financial goals, individuals can craft a financial strategy that is not only pragmatic but also attuned to their unique visions for financial success.

Market Volatility:

During heightened uncertainty and increased market volatility, the decision to cash out can emerge as a strategic move to mitigate potential losses. Individuals can shield their wealth from sudden and adverse price fluctuations by converting Bitcoin into traditional fiat currency during turbulent market conditions. This risk mitigation strategy becomes particularly pertinent for those who prioritize preserving the value of their assets and seek to navigate the unpredictable nature of cryptocurrency markets. A nuanced understanding of market volatility empowers individuals to time their cash-out decisions effectively, ensuring that the conversion process aligns with broader risk management objectives.

Alternative Investment Opportunities:

Considering traditional markets opens avenues for diversification, with options like stocks, bonds, or real estate offering stable and established investment vehicles. By thoroughly investigating these alternative opportunities, individuals can make knowledgeable choices that align with their risk tolerance, financial goals, and broader investment strategies. This comprehensive approach ensures that the decision to cash out Bitcoin is not made in isolation but within the context of a well-rounded exploration of the myriad investment possibilities available in global finance.

Transaction Costs:

Individuals must navigate fees charged by exchanges or other intermediaries, as these costs can significantly influence the overall returns from the transaction. Transaction costs may encompass various elements, including exchange fees, withdrawal fees, and conversion fees, among others. Awareness of these costs ensures a transparent understanding of the financial implications of the cash-out decision. Prudent financial planning involves evaluating the impact of transaction costs on the net proceeds received, allowing individuals to make decisions that optimize their returns. This diligent consideration of transaction costs becomes a cornerstone in the overall strategy, ensuring that the cash-out process is executed with a clear understanding of the associated financial implications.

Regulatory Environment:

The regulatory landscape governing digital assets varies globally, with each jurisdiction imposing unique rules and compliance requirements. Staying well-informed about these regulations ensures a smooth and legally compliant cash-out process. This diligence involves knowing the regulations governing the conversion of Bitcoin into traditional fiat currencies and staying abreast of any recent developments or changes in the regulatory framework. Compliance with legal requirements becomes a cornerstone of responsible financial conduct, mitigating potential risks associated with regulatory non-compliance. If needed, individuals are advised to seek legal counsel or consult regulatory authorities to navigate the intricate web of cryptocurrency regulations effectively. By proactively engaging with the regulatory environment, individuals can confidently conduct their cash-out activities, knowing they adhere to the established legal frameworks that govern digital assets.

Conclusion

How do I cash out Bitcoins? Cashing out Bitcoins into traditional fiat currency offers stability, predictability, and ease for everyday transactions, reducing exposure to volatile cryptocurrency markets. This allows individuals to meet financial obligations, potential tax advantages, and portfolio diversification. Access to traditional financial services and addressing security concerns are additional benefits. However, carefully considering individual financial goals, market conditions, and potential future developments in cryptocurrency is crucial before making such decisions. Various methods, including cryptocurrency exchanges, peer-to-peer transactions, Bitcoin ATMs, Over-the-Counter (OTC) trading, Bitcoin debit cards, gift cards, crypto payment platforms, and cryptocurrency loans, provide users with diverse options for cashing out based on their preferences and requirements.