It's no secret that cryptocurrencies have seen a significant boom in recent years, attracting millions of investors and traders. While the crypto ecosystem is expanding rapidly, Bitcoin is favoured by many as the original and most recognized cryptocurrency on the market. As the popularity of BTC continues to soar, many are looking to maximize their investment by seeking cost-effective ways of purchasing bitcoin. If you want to find out how to buy crypto with a bank account, verify your identity and address, navigate to the deposit section to get the exchange bank account details, and transfer from your own bank account the amount you wish to buy in euro and you will be credited in your euro wallet, then head to the exchange and convert it to whatever crypto you desire and it will only cost you 1% fee from the transfer amount.

Bank transfers have become a favoured method of buying Bitcoin as they are not only more convenient and secure but also boast lower fees compared to other payment types like credit cards. That being said, not all bank transfer options are designed the same way, and there are several things to consider when building a successful portfolio, including fee variations and ownership status.

Step-by-Step Guide to Buying Crypto with a Bank Account

If you are looking for the cheapest way to buy crypto with a bank account, simply follow the steps below to get minimal fees on PlasBit.

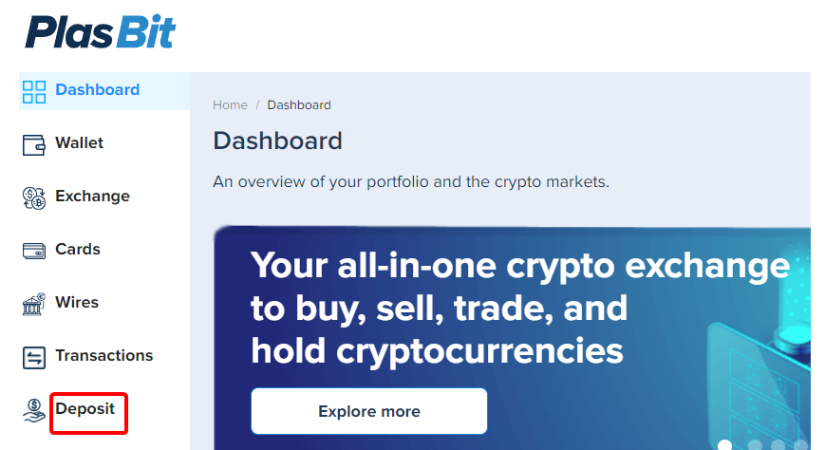

Step 1: Login and head to the Deposit Section

Log in to your PlasBit account and go to the "Transactions" tab. On the right side of the homepage, click on "Deposit." From there, you can start buying Bitcoin at a lower price.

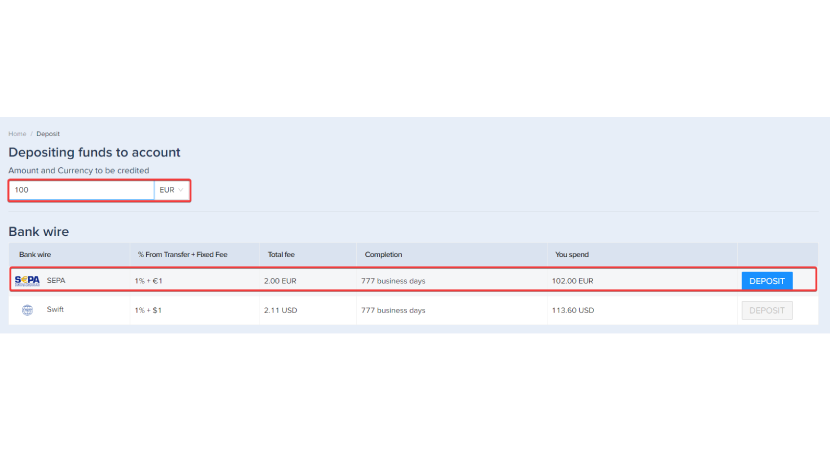

Step 2: Select the Amount and Currency

Enter the amount and currency you want to add, then select the option to deposit fiat via bank wire. Make sure you check the fees for each method before confirming your investment.

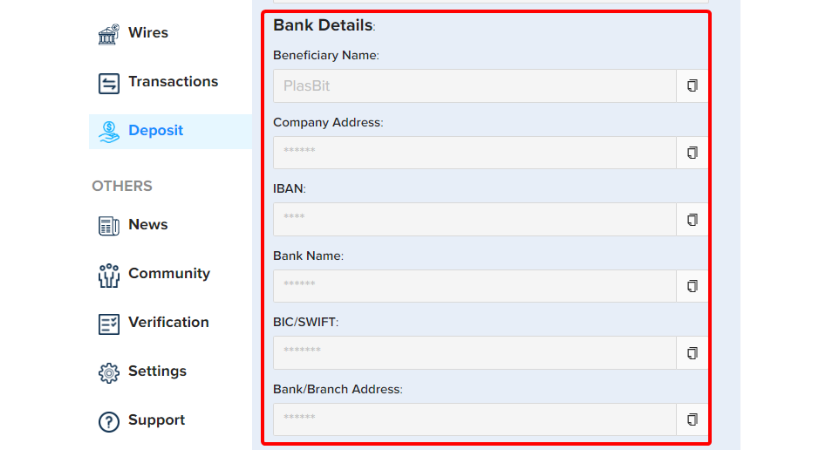

Step 3: Transfer Funds from your Bank

The deposit page contains PlasBit's bank details. Use this information to transfer euros from your bank account to PlasBit’s.

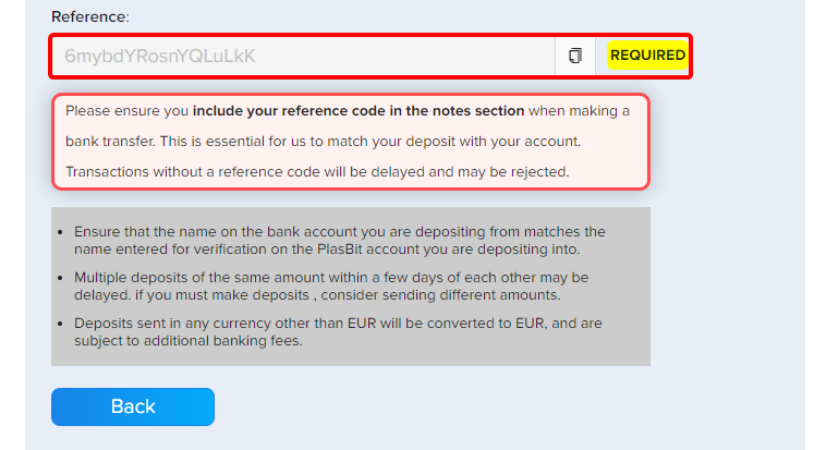

Important Notes:

Please enter the referral code in the "Notes" section so we can match your deposit with your bank account.

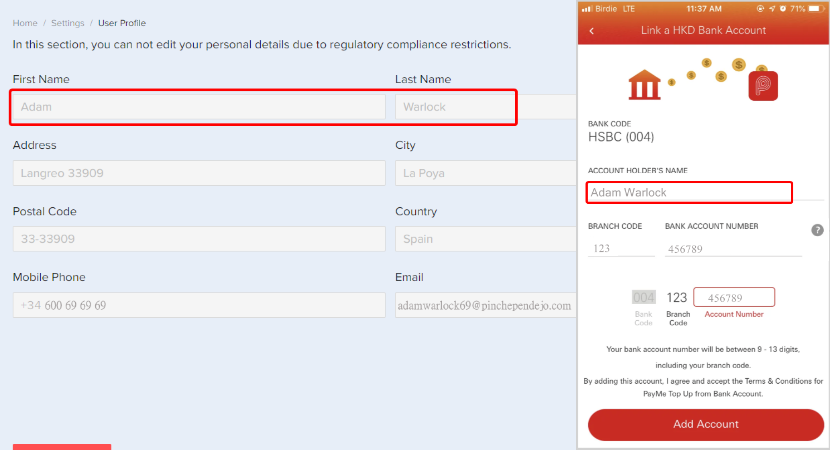

The name on the bank account you transfer from must match your PlasBit account's registered name. Trying to use a joint account will likely be declined.

Step 4: Head to the Exchange Section

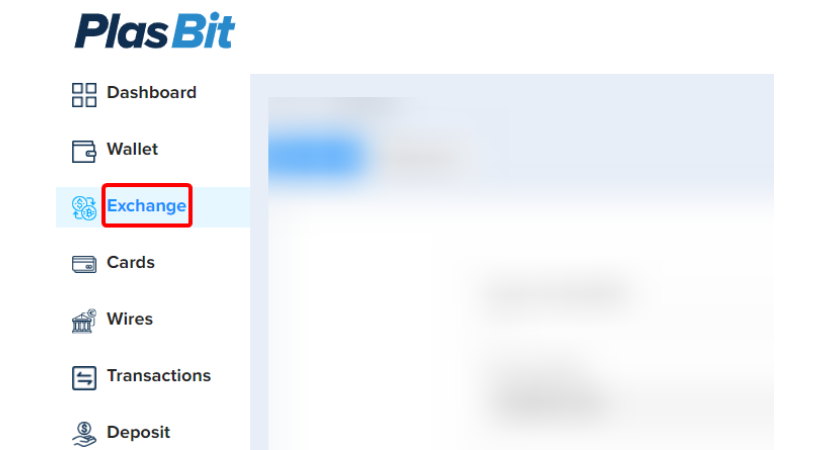

After the bank transfer arrives and appears in your wallet, go to the "Exchange" section.

Step 5: Start Buying Bitcoin

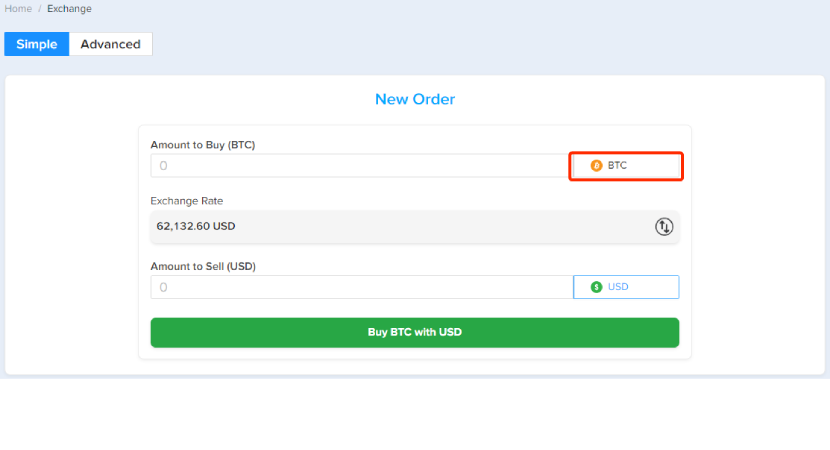

Select BTC from the drop-down menu.

Step 6: Specify the Currency You Wish to Exchange

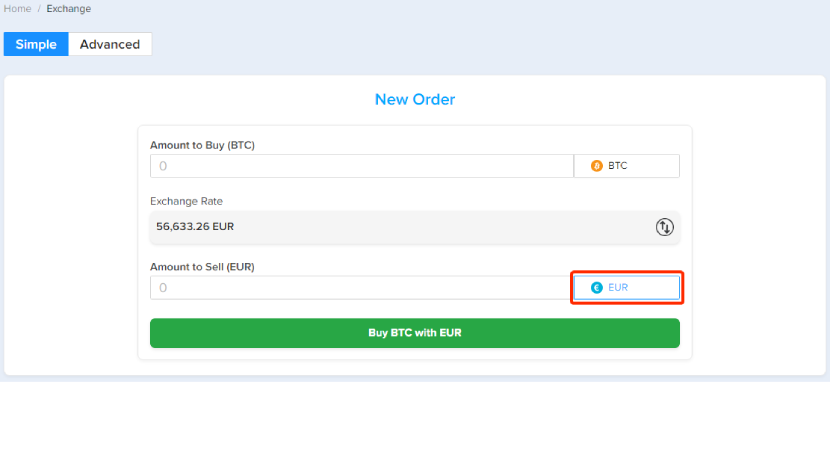

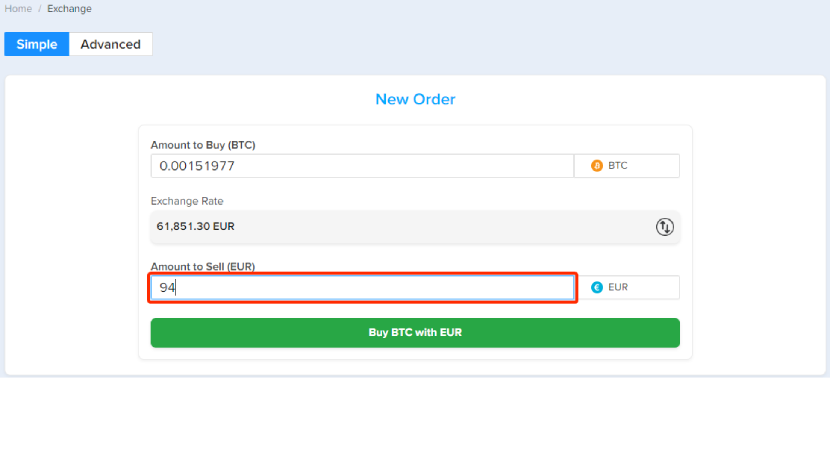

Select Euro (EUR) from the drop-down menu.

Step 7: Set How Much Euro You Want to Sell

Input how much Euro you wish to exchange into Bitcoin. Pay attention to the current exchange rate.

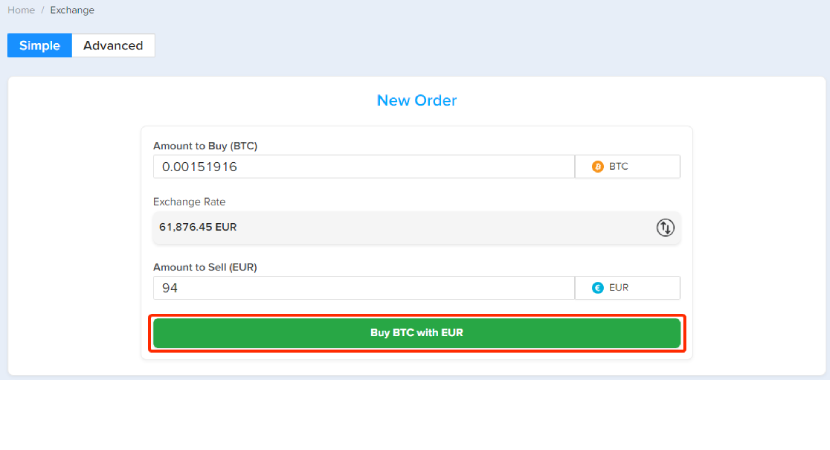

Step 8: Submit the Purchase of BTC

Click "Buy BTC with Euro".

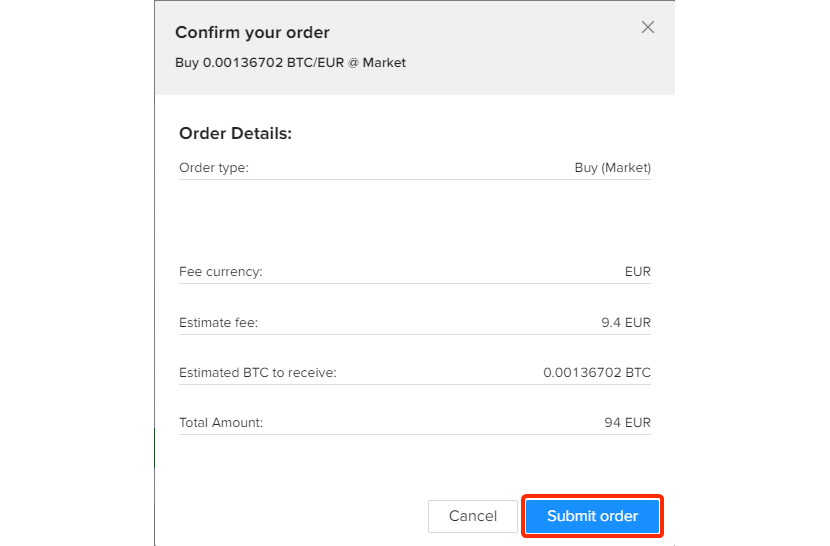

Step 9: Confirm and Submit Your Order

Check that everything inputted is correct. Once you are happy, click "Submit Order".

Comparing Bitcoin Purchase Fees

Avoiding trading fees and spreads is incredibly difficult, but that doesn't mean there aren't more cost-effective ways to purchase cryptocurrency. Depending on the exchange you use, wire transfers using SEPA EUR to Bitcoin can impose fees as low as 1%, as offered by Plasbit, and up to 27%, as seen with Simplex. The bank, whether the transfer is domestic or international, can also affect the fee percentage. This is why considering all potential fees before committing to an exchange is vital to maximizing profit.

Buying Bitcoin with a credit card can be convenient for those who don’t have much disposable income, but it comes with a much higher fee, ranging between 1.5% and 3.5%, in addition to a flat fee. This is due to processing fees and network charges from the provider, which will cut into your potential profits, especially when factoring in the credit interest accumulated through the transaction. Overall, wire transfers are the most preferable way to buy Bitcoin, as well as the most secure.

Buying Bitcoin using PayPal is also very convenient, but fees can vary. On average, fees are around 40% to 50% for transactions, and you can only find it in P2P marketplaces. While this option does offer convenience, like using a credit card, it will result in higher costs overall compared to buying crypto with a bank account.

Buy Bitcoin Without Fees with Promotions and Reduced Rates

Why do fees exist when buying Bitcoin? Miners receive transaction fees to verify and bundle transactions into blocks before they become a part of the blockchain. This is an important part of the crypto ecosystem, as it encourages miners to build and maintain the blockchain.

Promotional Offers

Platforms sometimes reduce transaction fees for a limited time, often during onboarding, and these are frequently marketed as $0 commission promotions. These can be convenient for those starting out in crypto, but they often come with the risk of a larger spread, which could end up being more expensive than a trading platform with a standard transaction fee.

Zero-Fee Trading Platforms

Some cryptocurrency platforms offer fee waivers or reduced fees to users who hold a certain balance of the platform’s native crypto. For example, Binance gives fee discounts to those using their coin (BNB) to pay for trading fees. Robinhood also offers fee-free Bitcoin purchases, but again, it’s crucial to understand the spread costs before committing.

Crypto Reward Schemes

Crypto reward schemes are designed to give incentives to users by rewarding them with free cryptocurrency or reducing fees. This encourages both veteran and new traders to get involved, which increases activity on the platform, builds loyalty, and strengthens the ecosystem.

Some ways to take advantage of reward schemes include staking their crypto, which supports the network and provides stakers with rewards, which are often in the form of tokens paid annually. Some platforms, like Crypto.com, offer cashback on debit and credit cards in the form of CRO tokens.

Exchanging Crypto for Crypto

Other fees should also be considered, including conversion fees. These are the rates charged for exchanging one type of cryptocurrency for another, such as BTC to ETH. These fees are standard across most exchanges and depend on the platform and transaction amount. While some platforms offer low or even waived conversion fees, their conversion rates can be higher. When searching for exchanges or trading platforms, look for low transaction charges and a 0% Bitcoin conversion fee, like what PlasBit offers.

How Fees Impact Your Earnings from Bitcoin Trading

While crucial to the blockchain, fees can seriously impact your overall profitability when trading BTC, especially when trading in smaller volumes. Factoring in all the other types of fees you'll encounter will allow you to optimize your trading strategy and encourage a positive return on your investment.

Spreads

The spread is the difference between the price you pay for an asset and the selling price, which is the value you can sell it for. This is the profit margin that exchanges and trading platforms make from each transaction. Wider spreads tend to occur on platforms with lower liquidity, which means the price of your Bitcoin will have to increase to make up the difference in the spread to break even, even if you are saving on fees by buying Bitcoin with a bank transfer.

Flat Fees

Some trading platforms offer a flat fee for a transaction opposed to a percentage. This can get expensive for those trading in a smaller amounts. For example, a fixed fee of $10 for transactions under $200 will severely eat into your profits.

Withdrawal Fees

You might also come across withdrawal fees when exchanging cryptocurrency for fiat. On some platforms, these fees can vary based on how busy the network is; when activity spikes, fees tend to go up. For smaller withdrawals, this fee can increase, which will cut into your potential gains. You can reduce how much you pay out on fees by consolidating your withdrawals where possible instead of making frequent smaller withdrawals and paying individual charges.

Margin Trading

Margin trading allows traders to lend currency and increase the size of their trades. The problem is that margin trading comes with overnight financing fees, which build up over time. The longer you hold onto this leveraged position, the more some exchanges will charge interest on the funds borrowed, which is risky and could take a chunk from your profits if the market doesn't behave as you wanted it to. While the daily fees can be small, it all adds up.

Why It's Important to Keep Your Bitcoin in Cold Storage

Hot wallets are digital wallets that stay connected to the internet, making them perfect for quick and easy transactions. Cold wallets, on the other hand, stay offline and are known for their next-level security. While many exchanges use a combination of both types, keeping the bulk of your Bitcoin in cold storage is crucial because it makes them impenetrable against hackers. When looking for a platform to help you manage your portfolio, prioritize security and ensure that it has the capabilities to keep your funds offline until you need to access them.

When exchanges keep your wallets online, they are more prone to the three words that make any investor shiver—fraud, phishing, and hacking. In the early days of Bitcoin, there were many instances of hacks, including one of the worst crypto hacks that happened to Mt. Gox between 2011 and 2014. This hack resulted in the theft of 850,000 bitcoins, which were valued at $470 million at the time and are now worth over $50 billion!

Some exchange platforms holding hot wallets have access to the private keys. This means that you are not in control of the Bitcoin, and if they were to run into trouble, such as going insolvent, you could risk losing access to your wallet. Also, there is always the chance that an employee with the private keys could accidentally (or purposely) affect your wallet in a negative way.

While some exchanges offer insurance, depending on the volume, they may not fully cover your losses. By taking advantage of services that only keep funds in cold storage, such as PlasBit, you get total control over the private keys, keeping your funds completely secure. Cold storage for long-term investments is perfect because it gives investors peace of mind that their funds are safe.

Many new crypto investors and traders make the mistake of prioritizing lower fees over security, which can end poorly. PlasBit not only keeps every asset in cold storage but also provides two-factor authentication, end-to-end encryption, and SSL.

Comparing Bitcoin Purchases vs Investing Through an ETF

There are several differences between buying Bitcoin and using an ETF to invest. The fees and ownership status can vary, and trading hours can be affected. Buying Bitcoin offers far more control over the asset, preventing potential losses.

Fee Differences

When buying Bitcoin directly, the fees incurred depend on the exchange platform's rates and the transaction size. When it comes to ETFs, however, they often charge annual management fees, which are the percentage of your total investment, which could be as much as 1.5%. Over time, this can really add up, especially for long-term investors. That's without any additional deposit or withdrawal fees when using credit cards or bank transfers. Last year, some ETF providers offered a 0% fee waiver but later increased it. For example, Fidelity completely dropped its fees in the hopes of getting new investors onboard, but after July 31st, the rate went up to 0.25%.

Bitcoin Ownership

A huge difference between investing in Bitcoin with an ETF and buying it directly is the ownership of the assets. Buying Bitcoin and managing it through a trading platform means you own the actual BTC, allowing you to transfer it to a private wallet if that's what you want to do. ETFs, on the other hand, only give you a share of the ETF and not the actual Bitcoin. The fund manager will keep custody, which does take away the burden of managing the asset but also affects the freedom of the investment.

Trading Hours

Trading hours for Bitcoin ETFs work more like those of a traditional stock exchange, which means you can only access your investment from Monday to Friday between 9.30 a.m. and 4.00 p.m. With how volatile crypto values can be, not having access to your assets for 17 and a half hours most days and 48 hours over the weekend could damage your profits if you can't act fast enough. Buying BTC provides you with complete control and 24/7 access to it.

While ETFs may seem appealing to those starting out in crypto, as you won't have to manage your wallets, you should be wary that ETF and Bitcoin values may differ, as ETF premiums and discounts can impact the price. What you gain in convenience, you could lose in overall gains.

The Best Day and Time to Optimize Bitcoin Profit

The cheapest way to buy crypto with a bank account can depend on the day the purchase is made and, more importantly, knowing which days to avoid. Many traders make the mistake of waiting until the end of the week to start buying, as it's outside of regular job hours or when people get paid. This means you will want to avoid Friday and Saturday and wait until activity tapers off on Sunday and hits its lowest price on Monday.

Another reason prices seem to drop on Sundays is that larger exchanges, such as the New York Stock Exchange, are closed on the weekend. Many institutional investors also take a break during the weekend, as do US derivatives like the CME Group, which deals with over $500 million of bitcoin every weekday, ultimately lowering liquidity.

But what time of day is best to buy crypto? Well, there is no magic formula when it comes to a specific time, although the trading volume has been known to drop during late night and early morning hours when the US markets are closed and many traders are not active. With that being said, Europe and Asian countries, such as Tokyo, are active during this time, which can make the market incredibly volatile between 1 a.m. and 5 a.m. UTC.

Of course, this isn't always the rule, and those trading and investing will want to keep a keen eye on the uptrends of any given day. As prices soar, it can result in short-term gains followed by losses. Only invest when you are feeling confident, have a solid trading strategy, and have a good understanding of the current market trends.

The Best Month for Buying Cheap Bitcoin

It's not just the day of the week you should focus on but the month itself. In general, the end of the month is regarded as the best time to buy crypto, with overall prices rising in the first few weeks but dropping after they peak. With that being said, certain seasons can also affect the buying price of Bitcoin based on previous market behaviour, with the Summer months being more volatile on average and winter months offering one of the best times to start buying.

Early Year

January is often considered the rebound period when the market sees a dip. This is usually accredited to end-of-year activities, such as tax-loss harvesting, where investors sell poorer-performing assets for less than they are worth in December to take advantage of the tax reduction. This often provides a short-term price recovery as people continue buying, as seen in the average monthly returns data for Bitcoin. January typically has a -1% return, while February shows a healthy 8% increase. This generally is a prime time to buy crypto, especially when reducing fees by using a bank account. March appears to steady out with a further increase of 3%, with April typically having the highest growth at 29%.

Summer Months

The Summer months tend to be more volatile, and those looking for ways to buy the cheapest Bitcoin will have to be incredibly cautious. While July still sees an average 7% increase based on previous behaviour, August can drop by -2%, with September having the most significant plunge of the year, with an average of -10%. This is typically attributed to market corrections following the rapid price increase during April and June.

Winter Months

October can often see a spike in profit, with a historical average increase of 13%, with November and December seeing 13% and 21% rises. Following the festive season, however, many people look for entry opportunities as prices dip when investors begin to offload, hoping for a healthy increase in profit around February.

The best month to buy Bitcoin

Going off past market patterns, early January seems to offer the best entry point, although October, November, and late December also offer good opportunities. Always remember that the Bitcoin market can be unpredictable at times and anomalies can spring up at any time and for any number of reasons, including economic changes like inflation and interest rates.

Conclusion

Whether you are a crypto veteran or looking to dip your toe, it's important to consider all the aspects covered in this article. Ensure you buy crypto with a bank account to lower fees and maximize profit, avoid any hidden or fluctuating fees, and keep your assets secure by keeping them in cold storage. Once you know your assets are in the safe hands of a trading platform like PlasBit, you can focus on your trading strategy, monitor market activity, and succeed with your investments.