This article will explore the most effective approaches for Bitcoin to bank account instant transfer. Our exploration will encompass traditional exchange methods and contemporary solutions such as crypto debit cards. Moreover, we'll tackle frequently asked questions about transferring crypto to a bank account. With the increasing adoption of cryptos like Bitcoin, you might be curious about the seamless conversion of digital assets into fiat funds. Whether you're seeking ways to integrate your crypto holdings into your daily transactions, rest assured that a diverse array of options is available to facilitate this process.

Why Transfer Bitcoin to Bank Account?

Transferring Bitcoin to a bank account is multifaceted and driven by various factors. This analysis aims to shed light on the diverse reasons individuals decide on this conversion, ranging from practical considerations to strategic financial planning.

Digital and Traditional Finance

One primary motivation behind transferring Bitcoin to a bank account is to bridge the gap between the digital and traditional financial worlds. While Bitcoin and other cryptocurrencies offer decentralized and borderless transactions, many individuals still operate within traditional financial systems. Transferring Bitcoin to a bank account allows access to funds in a familiar and widely accepted form.

Everyday Expenses

Cryptocurrencies, including Bitcoin, are gaining acceptance as a venture and asset class. However, for day-to-day expenses, individuals often require fiat currency. Transferring Bitcoin to a bank account allows for the liquidity needed to cover everyday costs, such as bills, groceries, and other expenses.

Volatile Markets

The cryptocurrency market is known for its volatility, with the value of Bitcoin subject to rapid fluctuations. Individuals who want to mitigate their exposure to market volatility may transfer their Bitcoin holdings to a bank account. This strategic move helps safeguard funds against sudden price swings and provides financial stability.

Regulatory Compliance

As the cryptocurrency industry matures, regulatory frameworks are becoming more established. Transferring Bitcoin to a bank account ensures compliance with financial regulations and local laws. Cryptocurrency exchanges often require complete identity verification, adhere to anti-money laundering, and KYC procedures before facilitating fiat withdrawals.

Diversifying Financial Portfolios

Some individuals view Bitcoin as a part of a diversified asset portfolio. Transferring Bitcoin to a bank account allows for the diversification of assets, enabling you to allocate funds across different asset classes. This approach aligns with traditional asset strategies and provides a balanced approach to wealth management.

Market Uncertainties

The unpredictability of global economic conditions and geopolitical events can impact the value of cryptocurrencies. Bitcoin to bank account instant transfer can serve as a hedging strategy, allowing you to secure your gains or limit potential losses in the face of unforeseen market uncertainties.

Transfer Crypto to Bank Account Instantly

Cashing out your crypto instantly through our Transfer Service is straightforward and secure. Follow these steps to seamlessly transfer your crypto to your bank account:

1. Choose the "Get Started" button in the upper right corner to register. Provide your email and create a strong password to complete the registration process.

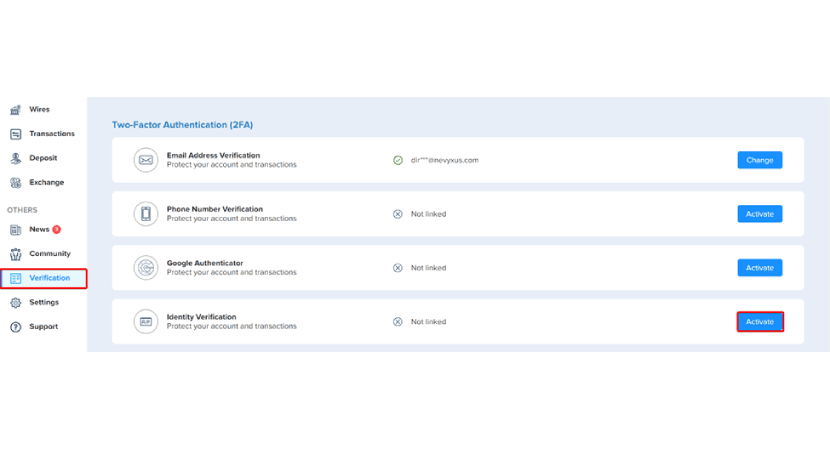

2. After logging in, navigate to the verification section on your account dashboard. Complete the two-factor authentication (2FA) procedures by clicking the "Activate" button to enhance the security of your account.

3. Head to the "Wires" section, where you'll find all the details related to bank wire transfers.

4. Take a moment to review essential details such as transfer completion time, transfer fee, and transfer limits.

5. Ensure your transfer complies with the specified limits for daily and monthly transactions, providing flexibility for your instant crypto-to-bank transfer.

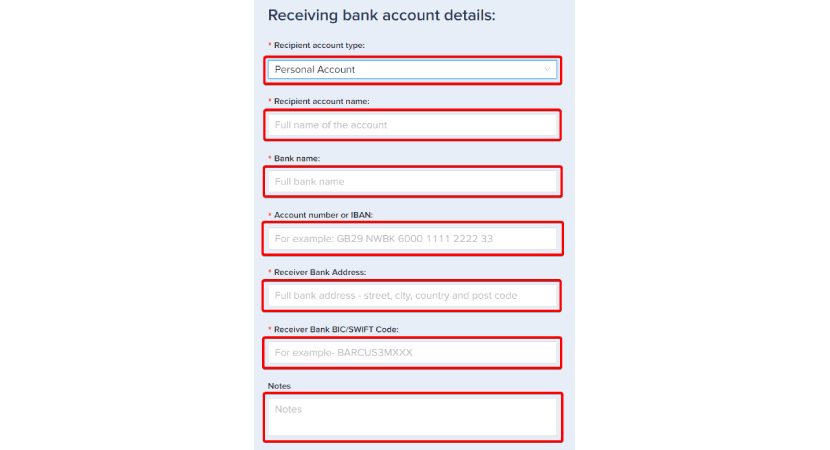

6. Enter the receiving bank account elements, including account name, type, bank details, and any additional notes.

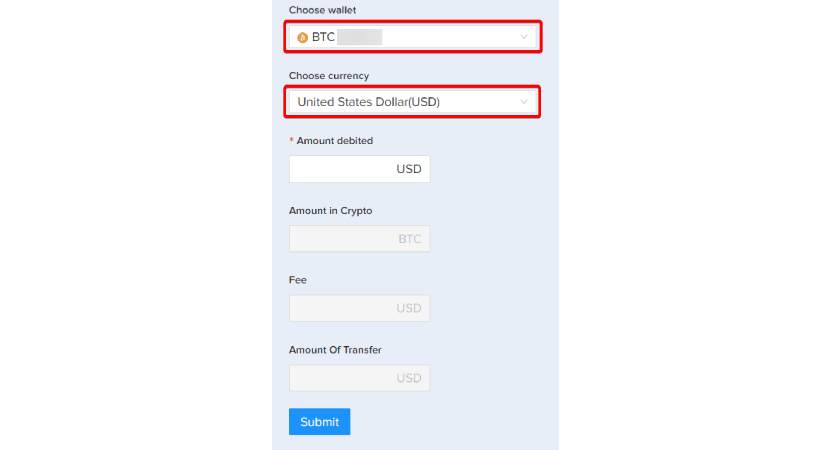

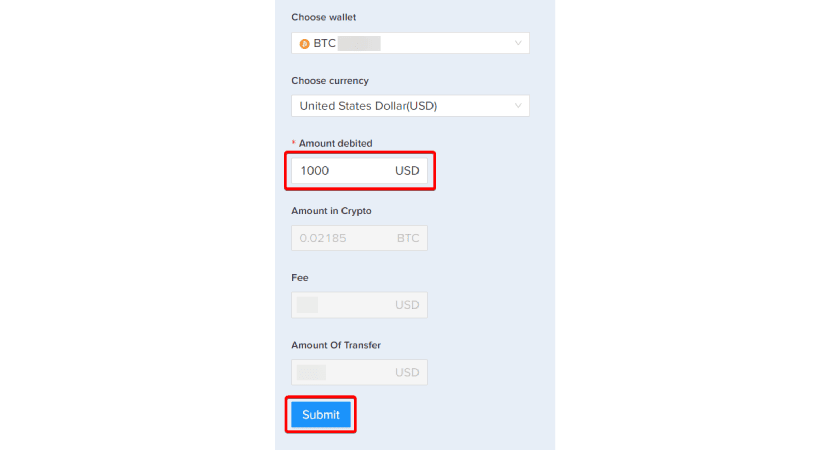

7. Choose the cryptocurrency you want to convert into fiat currency. Our system will calculate amounts and fees automatically.

8. Carefully review the summary of your transfer, including the debited crypto amount, fees, and total transferred in fiat currency.

9. Click "Submit" to initiate the transfer. Complete any necessary security verification steps, including entering the verification code sent to your chosen method.

10. Upon successful submission, receive a confirmation prompt. The deducted crypto amount will be reflected in your wallet as a pending wire request.

Who Transfers Bitcoin to Bank Account?

In cryptocurrency, transferring Bitcoin to a bank account involves various participants, each driven by distinctive motives. This diverse engagement underscores the evolving interplay between cryptocurrency and traditional financial systems. Let's explore the different types of people transferring Bitcoin and other cryptos to a bank account.

Traders and Speculators:

Active traders and speculators frequently engage in short-term moves in the cryptocurrency market. Transferring Bitcoin to a bank account allows them to swiftly capitalize on market opportunities or secure gains, bridging the gap between the dynamic digital asset space and traditional financial systems.

Shareholders:

Seasoned shareholders often transfer Bitcoin to a bank account for their strategic portfolio management. This process provides them with liquidity, enabling the conversion of digital assets into fiat currency for immediate use or to navigate market fluctuations with a more stable financial instrument.

Freelancers:

For freelancers receiving payments in Bitcoin for their services, the need to convert to a bank account is practical. This allows them to cover everyday expenses in traditional fiat currency, streamlining their financial activities and ensuring seamless integration with the broader economy.

International Transactions:

Individuals engaged in international transactions leverage Bitcoin's borderless nature to facilitate cross-border financial activities. Transferring Bitcoin to a bank account becomes a crucial step in the process, offering a swift and efficient means of converting digital assets into a universally recognized form of currency.

Cheapest Way to Send Bitcoin to Bank Account

The most economical method for sending Bitcoin to a bank account hinges on multiple factors, each playing a role in determining the overall cost-effectiveness of the transaction. To navigate this financial landscape with optimal savings, consider the following tips:

Select an Exchange with Low Fees:

Choosing a centralized exchange with low fees is a strategic move for those prioritizing ease of use and various features. Platforms with slightly higher fees than P2P exchanges provide a user-friendly experience and additional functionalities. It's important to compare the fee structures of different centralized exchanges to choose the one that aligns with your preferences and cost-saving goals.

Utilize a Crypto Debit Card:

Leveraging a crypto debit card can be a convenient and direct method to spend your crypto assets at merchants without needing a prior conversion. These cards are linked to your cryptocurrency holdings, allowing you to purchase seamlessly. However, it's important to note that fees are usually associated with using debit cards. PlasBit's crypto debit card ensures seamless global payments in local currency, featuring low fees and the flexibility to lock or unlock instantly. With enhanced security through an EMV chip and dedicated PIN, our card simplifies transactions worldwide, letting you manage crypto and fiat currencies effortlessly. While the convenience is undeniable, you should consider the associated costs carefully to ensure they align with your financial goals. Comparing fees and features of different crypto debit cards can help you choose the most cost-effective option for your spending needs.

Consider the Type of Cryptocurrency:

The type of cryptocurrency you possess can influence the cost of transferring it to a bank account. Different cryptocurrencies may have varying transaction fees and associated costs. Researching the fees associated with the specific cryptocurrency you hold can aid in selecting the most cost-effective method for your situation.

Evaluate the Amount Being Converted:

The amount of Bitcoin being converted is a pivotal factor in determining the cost-effectiveness of the transfer. Some platforms may offer tiered fee structures, where larger transactions incur lower percentage-based fees. Considering the scale of your conversion can optimize cost savings and maximize the value of your Bitcoin when transferring it to a bank account.

Timing the Market:

Selling your crypto during market hours can significantly impact the overall cost. Active market hours often result in higher liquidity and tighter spreads, translating to better prices for your crypto assets. Timing your transaction strategically during periods of market activity can contribute to cost optimization, ensuring you get the most value when converting Bitcoin to fiat currency.

Explore Peer-to-Peer (P2P) Exchanges:

Utilizing P2P exchanges can often be a cost-effective alternative. In these platforms, buyers and sellers directly engage in transactions, eliminating the need for intermediaries and their associated fees. While this method can potentially result in lower fees, caution is advised to avoid scams, and you should thoroughly research and understand the P2P process.

Ways to Transfer Bitcoin to Bank Account

When transferring Bitcoin and other cryptocurrencies to your bank account, the myriad options available can be bewildering. If you're pondering the intricacies of transferring crypto to a bank account, this guide illuminates the process. Let's explore two popular methods: SWIFT/SEPA transfer and the Peer-to-Peer (P2P) marketplace.

Crypto Exchange via SEPA/SWIFT:

The prevailing method crypto holders favor involves utilizing a cryptocurrency exchange that supports SEPA or SWIFT transfers. These exchanges serve as online platforms where you can engage in the trading of cryptocurrencies. While some platforms exclusively deal in cryptocurrencies, others offer crypto on-ramps and off-ramps, allowing you to trade crypto with fiat money. On these versatile exchanges, you can seamlessly convert your Bitcoin and other cryptocurrencies into any supported fiat currency, whether Euros or Dollars. For instance, at PlasBit, we go beyond mere crypto transactions. We provide a comprehensive platform where you can manage your crypto assets with the same ease as traditional fiat holdings. This includes the secure sale of your crypto assets and the swift transfer of funds to your bank account, streamlining the entire process for our users.

P2P Marketplace:

Another viable option for transferring crypto to a bank account is through a Peer-to-Peer (P2P) Marketplace. These platforms facilitate direct transactions between crypto buyers and sellers. Sellers list their cryptocurrencies for sale, and interested buyers initiate contact. Once an agreement is reached, the buyer transfers the agreed-upon fiat currency directly to the seller's bank account. Subsequently, the seller releases the corresponding amount of cryptocurrency to the buyer. While P2P transactions offer efficiency, it's crucial to acknowledge the associated risks, such as the potential for fraud and payment delays. Engaging in thorough research is imperative when using P2P platforms. It's paramount to release your crypto assets when the fiat money is securely deposited in your bank account, ensuring a safe and trustworthy exchange process.

Security Measures for Bitcoin to Bank Account Transfers

As you transfer Bitcoin to a bank account, implementing robust security measures becomes paramount in safeguarding digital assets and ensuring a seamless transaction experience. The following considerations contribute to a secure and resilient transfer process:

Two-Factor Authentication (2FA):

Implementing Two-Factor Authentication (2FA) is a paramount security measure when using Bitcoin to bank account transfers. 2FA acts as a robust defense mechanism by introducing an additional layer of verification to access cryptocurrency exchange accounts. This supplementary step, often involving a unique code from a mobile app, acts as a formidable barrier against unauthorized access and security breaches. By requiring this second form of verification, you take a proactive stance in fortifying your accounts, thereby significantly enhancing the overall security posture while transferring Bitcoin to a bank account. This additional layer of security safeguards users' digital assets and contributes to a more resilient and protected financial ecosystem within cryptocurrencies.

Secure Wallet Usage:

It would help if you employed reputable and secure cryptocurrency wallets to hold Bitcoin and facilitate transfers. Hardware wallets, known for their enhanced security features, offer an offline storage solution, protecting digital assets from online vulnerabilities. PlasBit focuses on user security by safeguarding personal data for complete privcay. We provide a secure environment for managing crypto assets with features like offline cold storage, encryption, and two-factor authentication. Regular penetration tests ensure ongoing protection against potential threats. Selecting a wallet with a strong reputation and prioritizing security features aligns with best practices for a secure transfer process.

Regular Security Audits:

Regular security audits constitute a fundamental practice in the continuous risk mitigation strategy for individuals involved in Bitcoin to bank account transfers. By conducting periodic assessments of account security and thoroughly reviewing exchange practices, you reinforce the resilience of your financial ecosystem. These audits involve a comprehensive examination of account settings, access logs, and recent activities, empowering you to detect and address potential vulnerabilities promptly. Staying vigilant ensures a proactive approach to security, fostering a heightened awareness of any irregularities that may compromise the integrity of cryptocurrency transactions. Emphasizing the importance of regular security audits underscores the commitment to maintaining a secure digital environment, ultimately enhancing users' safety and confidence in navigating the complexities of transferring Bitcoin to a bank account.

Education and Awareness:

Prioritizing education and awareness is pivotal in fostering a secure environment for individuals engaged in Bitcoin to bank account instant transfers. Empowering you with comprehensive knowledge about potential security threats establishes a culture of heightened awareness. Leveraging educational resources offered by exchanges and industry experts equips you with insights into common phishing attempts, social engineering tactics, and various security risks prevalent in the cryptocurrency landscape. A well-informed user can discern and effectively mitigate potential threats from Bitcoin to a bank account during the instant transfer process. Individuals create a vigilant user community by emphasizing education and awareness, promoting a safer and more resilient ecosystem for digital asset transactions.

Address Whitelisting:

The implementation of address whitelisting emerges as a strategic security measure, particularly for individuals navigating the intricacies of Bitcoin to bank account transfers. Certain exchanges provide the option to enable withdrawal addresses, introducing an additional layer of protection against unauthorized fund transfers. By opting for address whitelisting, you can proactively mitigate the risk of malicious actors attempting to redirect funds to unauthorized destinations. This security feature lets you specify and pre-approve withdrawal destinations, ensuring that only predetermined addresses are eligible for fund transfers. Address whitelisting thus serves as a robust defense mechanism, enhancing the overall security posture and offering you a proactive means of safeguarding your assets while transferring Bitcoin to a bank account.

Regular Software Updates:

Prioritizing regular software updates is fundamental in bolstering the security framework for individuals engaged in Bitcoin to bank account transfers. It is imperative to ensure that the operating system and any associated software, including wallets and exchange platforms, are consistently updated. This proactive approach is vital for maintaining the resilience of the user's digital infrastructure. Software updates typically encompass essential patches to address vulnerabilities, fortifying the overall security posture. By adhering to regular updates, you continuously enhance your digital security, mitigate potential risks, and ensure a more robust environment while transferring Bitcoin to a bank account.

Use of Secure Networks:

Using secure and trusted networks is essential for individuals engaged in Bitcoin to bank account instant transfers, ensuring an added layer of protection throughout the transaction journey. Performing transfers over secure networks involves avoiding public Wi-Fi and prioritizing encrypted connections. This proactive approach significantly contributes to establishing a secure transaction environment, mitigating the potential risks associated with unauthorized access during the transfer process. By steering clear of public Wi-Fi, you reduce the vulnerability to potential cyber threats and unauthorized interceptions, fostering a safer and more controlled setting for executing Bitcoin to bank account transfers. Emphasizing encrypted connections further fortifies the overall security posture, underscoring the importance of a cautious and vigilant approach in cryptocurrency transactions.

How Long Does it Take to Transfer Bitcoin to Bank Account?

The duration for Bitcoin transfers to reflect in your bank account is subject to many variables, contributing to a varied timeframe you should consider. One influential factor is network congestion on the Bitcoin blockchain. In periods of high demand, the network can experience congestion, leading to longer confirmation times for transactions. Additionally, the exchange or service processing time through which the Bitcoin is being transferred plays a crucial role. Different platforms have varying processing times, influenced by factors such as their internal procedures and verification protocols.

On average, the time it takes for Bitcoin to reflect in your account can differ from a few moments to several days. The transaction speed often depends on the efficiency and policies of your exchange or service. Moreover, when utilizing the Peer-to-Peer (P2P) method, the timeline is further influenced by the responsiveness of the buyer in transferring funds and the processing time of your bank to reflect the money in your account. Navigating these factors with a comprehensive understanding enables you to set realistic expectations for the duration of Bitcoin transfers, ensuring a smoother and more informed process.

What are the Fees to Get Crypto Into Bank Account?

The fees incurred when transferring crypto to a bank account are contingent upon the specific platform or service utilized, constituting a spectrum you should carefully navigate. One common component of these fees is the network fee, a charge associated with the blockchain network facilitating the transfer. This fee is influenced by network congestion and the type of cryptocurrency being transferred. Additionally, exchanges may impose fees for facilitating crypto to fiat currency conversion, known as exchange fees. These fees can vary widely among different platforms, and you should scrutinize the fee structures of various exchanges to identify the most economical option.

Moreover, withdrawal fees may apply, depending on the policies of the exchange or service handling the transaction. These fees are levied for transferring funds from the exchange to your bank account. It's crucial to note that fees associated with transferring crypto to a bank account can significantly impact the overall cost-effectiveness of the process. Therefore, conducting thorough research and comparing the fee structures of different platforms empowers you to make informed decisions and select options that align with your financial goals and priorities.

How to Transfer Crypto to Bank Account Instantly?

The desire for instant transfers from crypto to a bank account is a common query among traders seeking swift access to fiat currency. It's essential to acknowledge that instantaneous transfers may encounter limitations due to factors beyond one's control, such as processing times and network confirmations inherent in blockchain transactions. These considerations are inherent in cryptocurrencies, where the confirmation of transactions relies on the consensus mechanisms of the blockchain network. While blockchain technology's decentralized and transparent nature provides security, it also introduces a variable confirmation timeline.

However, opting for a reliable platform can be a strategic move to enhance the likelihood of a faster transfer. Certain platforms leverage advanced technologies and streamlined processes to expedite transactions. Our platform may employ efficient internal procedures and responsive services, reducing the time it takes for the crypto to be converted and reflected in your bank account. Users looking for expedited transfers should explore such platforms, keeping in mind that while instant transfers may not always be guaranteed, selecting a reputable and efficient service can significantly contribute to a swifter crypto-to-bank transaction experience.

Conclusion

Transferring Bitcoin to a bank account involves navigating various methods and considerations. From traditional exchanges to innovative solutions like crypto debit cards, you have diverse options to cater to your financial needs. The motivations behind such transfers, including bridging digital and traditional finance, managing everyday expenses, and mitigating market uncertainties, add depth to the decision-making process. To optimize cost-effectiveness, you must consider fees associated with different platforms, cryptocurrency types, transaction amounts, and market timing. While instant transfers are a common preference, the inherent limitations of blockchain technology should be acknowledged. Some crypto exchanges can enhance transaction speed, contributing to a swifter crypto-to-bank transition.