Due to the nature of cryptocurrencies and their origin, some might (and do) forget that cryptos are just another financial asset. More importantly, they are a taxable asset. Whether people simply mistakenly omit that fact or intentionally ignore it, cryptocurrency taxation is a legal obligation, and quite a serious one at that. The anonymity and the cypherpunk roots, in addition to the decentralized and borderless nature, could make it look like cryptocurrencies are exempt, but in reality, they are not. Governments worldwide have made it clear that realized crypto gains are taxable, and if there’s one thing the government will get you and put you in prison for, it’s tax evasion. After all, money is the name of the game, and in the eyes of the government, you're better off being a drug dealer than a tax cheat. Heck, even the Joker feared the IRS - that’s how serious those folks are.

So, keep in mind that failure to report any of the crypto gains will sooner or later lead to audits, hefty fines, or even jail time. There are no ‘buts’ or ‘ifs’. Even if you are opposed to it ideologically, you have to file taxes for realized crypto gains. Now that we’ve got that out of the way, the reason why the PlasBit team wants you to know about this (apart from us just being good citizens) is because there’s an interesting story about a man named Frank Richard Ahlgren III, also known as Paco Ahlgren, he is a writer, musician, and financial journalist who is known to be the first one to ever be convicted for crypto-related tax fraud in the US and sentenced to two years in prison and ordered to pay $1,095,031 in compensation to the US government. The judge required him to disclose the access codes to his Bitcoin wallets. Frank was involved in Bitcoin since its early days and in 2017, he sold 640 Bitcoins for a total of $3.7 million, used this money to buy a house, and also sold Bitcoins for more than $650,000 in 2018 till 2020 and deliberately didn't report to the tax authorities in order to not pay capital gains tax. We hope you enjoy reading the upcoming tale and come away with a few insights that will prove helpful someday as we dive deeper into Frank’s life and his eventual arrest.

Life before Bitcoin

Frank Richard Ahlgren III led a kind of life that you’d never, ever suspect him of crypto tax evasion. Before we get to the crux of the story, our protagonist was born in 1968 in El Paso, Texas, and is better known as Paco Ahlgren. He’s a rather versatile person, considering he’s a writer, musician, and financial journalist. During his teenage years back in 1987, Frank’s musical career started while playing with his band called Bentley Tock (that’s the 80s - everybody had a band at some point). Interestingly enough, a year later, the band’s first single, titled ‘She’ was the most requested song on WVUA-FM, which is the student-run college radio station at the University of Alabama. The song was written by Ahlgren, who also did the vocals, guitar, and banjo (again, these were the 80s). His musical pursuits continued in 1989 when Bentley Tock played a show at the University of Alabama's Riverside Amphitheater. The band recorded a self-titled 6-song EP that same year, and then in 1992, a full-length album titled ‘Able’.

Cover image of the band’s first and only full-length album (Image credit: Discogs.com)

Ahlgren’s musical career didn’t take off, but he did hit the charts while being a journalist. He worked for various platforms and blogs, mostly dabbling in financial content. This could very well be where his love for finance, and later on Bitcoin, originated. His most notable journalistic achievement was the writing of a novel entitled ‘Discipline’ - a science-fiction and financial thriller that follows the story of Douglas Cole, a brilliant but disillusioned hedge fund manager. Things get hectic quickly when he begins to experience bizarre and fragmented visions that suggest a deeper, hidden structure to reality. The novel was published by Greenleaf Book Group in July 2007, and became quite a hit, earning three rewards for commercial fiction. It got a slew of positive reviews, the most prominent one from Jeffrey Satinover, a psychiatrist, psychoanalyst, physicist, and a distinguished visiting professor of Math and Science at King's College, New York City.

The novel also received recommendations from The Midwest Book Review, The Houston Press, and the Durango Herald. The accolades kept coming as ‘Discipline’ was recognized as a 2007 Booksense Notable by the American Booksellers Association. What’s more, it was even opted for the big screen in 2009 by David Permut and Steve Jones, but seeing Nicholas Cage (our pick for the role) as a disillusioned and hallucinatory hedge fund manager never came to fruition. Ahlgren was also a frequent contributor to Seeking Alpha, which is a community-driven content service focusing on financial markets. Then Bitcoin came. Ahlgren quickly became a fan of it, being an early investor since at least 2011. It’s possible he put money into Bitcoin even earlier, but that’s the year Frank was first mentioned as being interested as an investor in cryptocurrency. Apart from investing, he was an avid advocate for Bitcoin and its widespread use (probably a bit too much when we take into account what eventually happened to him). As the years went by, Ahlgren became more and more involved in the world of cryptocurrency. As you’re about to see, too much Bitcoin can be bad for you, or more precisely, too much of not informing the government about it.

Paco the Bitcoin trader

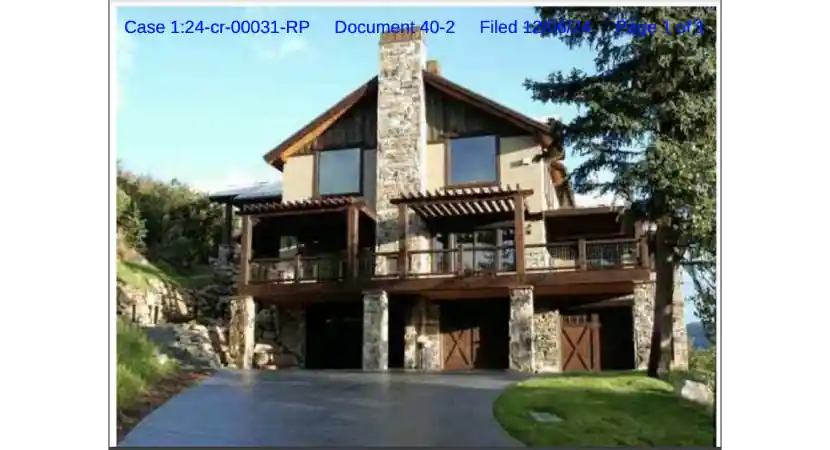

Frank Richard Ahlgren III was extensively trading Bitcoin during the last decade. The first notable transaction happened in 2015, when he bought around 1,366 Bitcoins using his accounts with Coinbase. At that time, Bitcoin’s price was going from approximately $250 to a little bit below $500. That was just a start for Ahlgren, though, as two years later, he sold roughly 640 Bitcoins at a price of about $5,800, which netted him $3.7 million. Stating the obvious - that’s a lot of money, and he used those earnings to buy a house in Park City, Utah. It was smart of him to buy a bunch of Bitcoins two years earlier, but what he did in the following months was quite the opposite (putting it mildly). As he was preparing his 2017 federal income tax return, he did a really dumb thing - he lied. Ahlgren gave a false summary to his accountant of his transactions regarding Bitcoins. To hide his actual gain, he stated that he bought the Bitcoins at a much higher price than he actually did. Maybe his math wasn’t the best, but Ahlgren claimed to have paid prices that were actually higher than the maximum market price before he bought his house in Utah. In other words, he stretched the truth and underreported his true capital gain.

The Park City house Ahlgren purchased with his Bitcoin sales (Image credit: Chainalysis.com)

Perhaps Ahlgren thought he got away with it, considering he continued to stash his earnings in the following years. In both 2018 and 2019, he went a step further and didn’t report any sales at all. It must have slipped his mind, since he earned more than $650,000 selling Bitcoins during that time frame. Our sarky tone aside, Ahlgren knew he was committing a felony, and started to employ all kinds of intricate ways to camouflage his actual acquisition. To put his Bitcoin transactions out of sight, he moved funds through numerous wallets, used mixers to conceal the origins of transactions, and simply put, did what he could to hide his identity. He even met with people face to face for cash exchange. To cover up his doings even more, he also made a lot of cash deposits in amounts under a certain limit to avoid having to report his gains. Ahlgren was very prominent in doing this in 2019 since there are at least dozens of cases of him doing this. The numerous cash deposits consisted of $10,000 or less to circumvent the filing of a CTR (company tax return). Ahlgren used several financial institutions to pull off the move, such as JPMorgan Chase Bank, Texas Health Credit Union, and University Federal CU.

He wasn’t quite done yet though, as in 2020, when everybody was socially distancing themselves, he added $44,000 to his account by socially distancing himself from 5 more Bitcoins. Unfortunately for Ahlgren, back in 2014, he blogged about the use of mixers and his knowledge about the way they operate. In particular, he shared how they can be used to keep one's identity secret and stay anonymous when it comes to Bitcoin transactions. He used CoinJoin and Wasabi Wallet mixers, noting in his blog how crypto miners can employ them to conceal transactions. We’re no betting people, but we’d put good money that this part didn’t help him when it came to his defense of tax evasion, as according to the court documents, Ahlgren stored away at least 1,287 Bitcoins using a mixer service. He made them go ‘poof’ like a true magician. Alas, his magic skills failed when it came to hiding the actual traces of his doings. The government and the IRS got him in their sight and his days were numbered.

The arrest

Despite his many ways of trying to steer clear of the authorities, IRS investigators ultimately traced his doings and connected the dots. It didn’t do Ahlgren any favors that since 2023, crypto exchanges in the US had to send out forms detailing all the activity on their sites. As such, the IRS managed to track all his transactions from start to finish, carefully noting the dates, values, and any involved parties. The government agency got a hold of the records from several exchanges, including blockchain data. Then, the agents cross-referenced everything they’d gathered with the records provided by Ahlgren, and they figured out that something fishy was going on there. In the end, the taxman knocked on Ahlgren’s doors, and he was sentenced in December 2024 for tax fraud. More specifically, he was convicted for an abundance of tax crimes, including false reports of tax returns regarding over $4 million he earned by selling Bitcoin and using that capital gain to purchase a house.

That’s not all, as his crimes also included lying to his accountant and filing false reports in 2017 by inflating the actual price he paid for his Bitcoins, and completely ignoring to report his earnings in 2018 and 2019, where he earned over $650,000. Considering it’s all crypto-based, this arrest and case is the first of its kind, so at least Paco has that historical aspect going for him. It was concluded that through his actions, the tax loss exceeded $1 million, and he was sentenced by US District Court Judge Robert Pitman to two years of jail time, followed by one year of supervised release. Also, he must give the authorities his crypto wallet keys and disclose all cryptocurrency accounts, and he must pay almost a $1.1 million fine in restitution to the US government. Perhaps he has some Bitcoin tucked away to pay for this fine? In any case, Ahlgren is barred from using any of his assets without the court’s permission, besides being banned from transferring or selling them. The exception is only for his regular living expenses. Ahlgren’s lawyer, Dennis Kainen, said that his client will follow the court’s directives.

Since there is no publicly available mugshot, here’s a picture of Ahlgren - he’s the one on the right.

Due to its nature, this case generated a lot of buzz in the US government agencies. Acting Deputy Assistant Attorney General Stuart M. Goldberg of the Justice Department’s Tax Division said, and we quote: “Frank Richard Ahlgren III earned millions buying and selling Bitcoins, but instead of paying the taxes he knew were due, he lied to his accountant about the extent of a large portion of his gains, and sought to conceal another chunk of his profits through sophisticated techniques designed to obscure his transactions on the Bitcoin blockchain. That conduct today earned him a two-year sentence.” Then, another authority figure shared their thoughts. This time it was Lucy Tan, who is the Special Agent in Charge of IRS-CI’s (Internal Revenue Service-Criminal Investigation) in Houston, saying: “Ahlgren will serve time because he believed his cryptocurrency transactions were untraceable. This case demonstrates that no one is above the law. My team at IRS Criminal Investigation has the expertise and tools to track financial activity, whether it involves dollars, pesos, or cryptocurrency”. Furthermore, she called this case the first criminal tax evasion prosecution centered solely on cryptocurrency and also used the label as a warning for any other individuals who might think to do the same, mentioning that people should avoid the temptation of not paying taxes with crypto as they will inevitably end up in a federal prison. Sounds like a no-brainer, but we’re rather positive that someone, somewhere, at one point in time will try a similar action. For us at PlasBit, this doesn’t necessarily have to be a bad thing, because when they’re arrested, we’ll have even more crypto topics to write about.

Frank Richard Ahlgren III Bitcoin

During his life, Ahlgren developed various skills, from singing in a rock/folk/country band to covering finance as a journalist. His tale should serve as a caution to anyone who may give thought to doing something along the lines of tax fraud. As such, here’s the most important part of what you should remember in regard to Frank Richard Ahlgren III Bitcoin, as he has been involved with Bitcoin since 2010 and has been buying since 2011. In 2015, he purchased 1,366 Bitcoins through his Coinbase account. His failure to report Bitcoin profits ultimately led to his arrest and trial. He tried to hide his profits and failed, making it worse for himself in the long run.

Frank Richard Ahlgren III net worth

Early Bitcoin trading was very profitable, which means those who managed to get their hands on the cryptocurrency early on struck digital gold. Ahlgren was one of those shrewd few, as he amassed substantial wealth despite his arrest. So, how much is Frank Richard Ahlgren III net worth? It’s estimated at $125 million, factoring in his 1,287 Bitcoins as mentioned in the indictment, along with profits from previous sales. He has been consistently selling his Bitcoins over the years. Court documents showed him parting ways with roughly 13 Bitcoin in April 2018, netting him $125,000. Then in the same year, he said goodbye to around 38 Bitcoins and earned $398,000. Interestingly, he used this money to buy gold, and with all the relatively accumulated smaller transactions, his wealth grew to seven digits.

Frank Richard Ahlgren III sentence

Once the dutiful agent at the IRS got a hold of what Ahlgren had been doing, his tax-evading days were all over for him. It was just a matter of time until the authorities arrested him. Near the end of 2024, that day happened and Ahlgren was taken to court. So, what was Frank Richard Ahlgren III sentence? Two years in prison for tax evasion and structuring financial transactions to avoid reporting requirements. What’s interesting about this is the fact that this is the first crypto-related tax fraud sentence in US history. We dare say it’s a case that will likely be told over and over again, used as an example and a warning for anyone who tries or even thinks to do the same.

Be smart, pay your taxes, and stay out of jail

When all is said and done, jail time and a hefty fine is not something Ahlgren was looking forward to, nor would anyone in his shoes. It’s vital to remember that despite their shifting nature and fairly novel status, cryptocurrencies are taxable, and you can bet that the government will get you (sooner or later) if you try to navigate around your duty. At best, perhaps you’ll get away with it for a few years, but in due course, you’ll end up behind bars, shacking up with some of the rougher members of the community. IRS-CI and IRS are more than capable of pursuing complex crypto cases like these, even after a few years have passed. Plus, new laws are getting changed and updated almost constantly with the cryptocurrencies practically going mainstream. Case in point: the fact that as of two years ago, all crypto exchanges in the United States have to gather tax information from users by sending both them and the IRS the 1099-MISC forms. These so-called crypto forms report income from sources other than employers. To be precise, if you earned more than $600 in crypto, the exchanges must report that transaction to the IRS as miscellaneous income. Moreover, regardless if your staking or rewards income was below $600, you’re still under obligation to report the full amount on your tax return. You can bet that in the future, there will be more similar laws so you’ll have a minimal chance of evading taxes when it comes to crypto. The bottom line is, don’t be like Frank Richard Ahlgren III. All crypto holders should file their taxes, regardless of their ideology or way of thinking. We guess you could, theoretically speaking, try to hide your profits better by doing things differently, but there is nevertheless a high chance doing so may not work well in your favor, and we at PlasBit certainly advise against that. Bear in mind that while Ahlgren’s demise is primarily the US government’s doing, it’s pretty much the same all around the world. Hey, if they can get Al Capone, then they most definitely can get to you, so pay your taxes, crypto or otherwise!