Many crypto enthusiasts think about how Bitcoin has fluctuated since its inaugural launch. Over 15 years since its debut, the constant market shifts are yet to cease. The virtual asset has faced a lot of adversaries over the years. The Bitcoin price in 2022 was around $46k at the beginning of the year, and then it dropped all the way to $16k in December. 2022 was a bearish year after 2021, which was a euphoric year for the cryptocurrency Market. The price drop shattered the confidence of many investors in the future of crypto, with the sharp decline affected by rising inflation and high interest rates by central banks. You can check the price of Bitcoin for each day in 2022 on the table that we have created.

| DATE | OPEN | HIGH | LOW | CLOSE | VOLUME |

|---|---|---|---|---|---|

| December 31 2022 | $16,603.67 | $16,628.99 | $16,517.52 | $16,547.50 | 11,239,186,456 |

| December 30 2022 | $16,641.33 | $16,643.43 | $16,408.47 | $16,602.59 | 15,929,162,910 |

| December 29 2022 | $16,552.32 | $16,651.76 | $16,508.68 | $16,642.34 | 14,472,237,479 |

| December 28 2022 | $16,716.40 | $16,768.17 | $16,497.56 | $16,552.57 | 17,005,713,920 |

| December 27 2022 | $16,919.29 | $16,959.85 | $16,642.07 | $16,717.17 | 15,748,580,239 |

| December 26 2022 | $16,842.25 | $16,920.12 | $16,812.37 | $16,919.80 | 11,886,957,804 |

| December 25 2022 | $16,847.51 | $16,860.55 | $16,755.25 | $16,841.99 | 11,656,379,938 |

| December 24 2022 | $16,796.98 | $16,864.70 | $16,793.53 | $16,847.76 | 9,744,636,213 |

| December 23 2022 | $16,829.64 | $16,905.22 | $16,794.46 | $16,796.95 | 15,329,265,213 |

| December 22 2022 | $16,818.38 | $16,866.67 | $16,592.41 | $16,830.34 | 16,441,573,050 |

| December 21 2022 | $16,904.53 | $16,916.80 | $16,755.91 | $16,817.54 | 14,882,945,045 |

| December 20 2022 | $16,441.79 | $17,012.98 | $16,427.87 | $16,906.30 | 22,722,096,615 |

| December 19 2022 | $16,759.04 | $16,807.53 | $16,398.14 | $16,439.68 | 17,221,074,814 |

| December 18 2022 | $16,795.61 | $16,815.39 | $16,697.82 | $16,757.98 | 10,924,354,698 |

| December 17 2022 | $16,646.98 | $16,800.59 | $16,614.03 | $16,795.09 | 14,463,581,825 |

| December 16 2022 | $17,364.55 | $17,505.53 | $16,584.70 | $16,647.48 | 24,031,608,960 |

| December 15 2022 | $17,813.64 | $17,846.74 | $17,322.59 | $17,364.87 | 20,964,448,341 |

| December 14 2022 | $17,782.07 | $18,318.53 | $17,739.51 | $17,815.65 | 25,534,481,470 |

| December 13 2022 | $17,206.44 | $17,930.09 | $17,111.76 | $17,781.32 | 26,634,741,631 |

| December 12 2022 | $17,102.50 | $17,212.56 | $16,899.39 | $17,206.44 | 19,617,581,341 |

| December 11 2022 | $17,129.71 | $17,245.63 | $17,091.82 | $17,104.19 | 14,122,486,832 |

| December 10 2022 | $17,134.22 | $17,216.83 | $17,120.68 | $17,128.72 | 12,706,781,969 |

| December 09 2022 | $17,232.15 | $17,280.55 | $17,100.84 | $17,133.15 | 20,328,426,366 |

| December 08 2022 | $16,847.35 | $17,267.92 | $16,788.78 | $17,233.47 | 20,496,603,770 |

| December 07 2022 | $17,089.51 | $17,109.38 | $16,750.56 | $16,848.13 | 19,675,404,389 |

| December 06 2022 | $16,975.24 | $17,091.86 | $16,939.92 | $17,089.50 | 19,889,922,369 |

| December 05 2022 | $17,128.89 | $17,378.15 | $16,922.43 | $16,974.83 | 22,209,086,834 |

| December 04 2022 | $16,908.17 | $17,157.77 | $16,903.44 | $17,130.49 | 16,824,520,830 |

| December 03 2022 | $17,090.10 | $17,116.04 | $16,888.14 | $16,908.24 | 16,217,776,704 |

| December 02 2022 | $16,968.68 | $17,088.66 | $16,877.88 | $17,088.66 | 19,539,705,127 |

| December 01 2022 | $17,168.00 | $17,197.50 | $16,888.39 | $16,967.13 | 22,895,392,882 |

| November 30 2022 | $16,445.48 | $17,190.94 | $16,445.48 | $17,168.57 | 29,523,576,583 |

| November 29 2022 | $16,217.64 | $16,522.26 | $16,139.40 | $16,444.98 | 23,581,685,468 |

| November 28 2022 | $16,440.22 | $16,482.93 | $16,054.53 | $16,217.32 | 27,743,025,156 |

| November 27 2022 | $16,463.88 | $16,594.41 | $16,437.03 | $16,444.63 | 20,443,898,509 |

| November 26 2022 | $16,521.58 | $16,666.86 | $16,416.23 | $16,464.28 | 18,000,008,764 |

| November 25 2022 | $16,602.27 | $16,603.32 | $16,388.40 | $16,521.84 | 18,678,255,976 |

| November 24 2022 | $16,611.64 | $16,771.47 | $16,501.77 | $16,604.46 | 26,129,037,414 |

| November 23 2022 | $16,195.59 | $16,638.19 | $16,170.50 | $16,610.71 | 32,958,875,628 |

| November 22 2022 | $15,782.30 | $16,253.05 | $15,656.61 | $16,189.77 | 30,726,828,760 |

| November 21 2022 | $16,291.22 | $16,291.22 | $15,599.05 | $15,787.28 | 37,429,485,518 |

| November 20 2022 | $16,712.92 | $16,746.78 | $16,248.69 | $16,291.83 | 21,313,378,652 |

| November 19 2022 | $16,696.22 | $16,797.88 | $16,570.41 | $16,711.55 | 16,106,223,492 |

| November 18 2022 | $16,687.91 | $16,947.06 | $16,564.61 | $16,697.78 | 26,862,218,609 |

| November 17 2022 | $16,670.43 | $16,726.44 | $16,460.68 | $16,687.52 | 27,868,914,022 |

| November 16 2022 | $16,884.34 | $16,960.29 | $16,430.11 | $16,669.44 | 33,925,512,989 |

| November 15 2022 | $16,617.48 | $17,051.96 | $16,542.55 | $16,884.61 | 36,599,436,183 |

| November 14 2022 | $16,352.03 | $17,109.32 | $15,872.94 | $16,618.20 | 49,630,243,054 |

| November 13 2022 | $16,799.72 | $16,920.77 | $16,320.63 | $16,353.37 | 27,209,183,682 |

| November 12 2022 | $17,036.88 | $17,066.68 | $16,651.78 | $16,799.19 | 29,717,699,419 |

| November 11 2022 | $17,583.25 | $17,650.94 | $16,543.48 | $17,034.29 | 55,871,616,488 |

| November 10 2022 | $15,883.16 | $18,054.31 | $15,834.02 | $17,586.77 | 83,202,283,721 |

| November 09 2022 | $18,543.76 | $18,590.46 | $15,682.69 | $15,880.78 | 102,905,151,606 |

| November 08 2022 | $20,600.67 | $20,664.61 | $17,603.54 | $18,541.27 | 118,992,465,607 |

| November 07 2022 | $20,924.62 | $21,053.25 | $20,489.97 | $20,602.82 | 53,510,852,236 |

| November 06 2022 | $21,285.06 | $21,345.38 | $20,920.19 | $20,926.49 | 35,082,693,210 |

| November 05 2022 | $21,144.83 | $21,446.89 | $21,097.63 | $21,282.69 | 37,846,047,609 |

| November 04 2022 | $20,208.77 | $21,209.56 | $20,188.02 | $21,147.23 | 64,072,727,950 |

| November 03 2022 | $20,162.69 | $20,382.10 | $20,086.24 | $20,209.99 | 43,228,750,179 |

| November 02 2022 | $20,482.96 | $20,742.81 | $20,087.13 | $20,159.50 | 55,552,169,483 |

| November 01 2022 | $20,494.90 | $20,647.29 | $20,359.85 | $20,485.27 | 39,819,303,159 |

| October 31 2022 | $20,633.70 | $20,795.32 | $20,287.46 | $20,495.77 | 45,668,466,815 |

| October 30 2022 | $20,817.98 | $20,917.01 | $20,547.46 | $20,635.60 | 31,486,345,556 |

| October 29 2022 | $20,595.10 | $20,988.39 | $20,566.48 | $20,818.48 | 40,369,840,645 |

| October 28 2022 | $20,287.96 | $20,724.98 | $20,086.07 | $20,595.35 | 43,994,715,910 |

| October 27 2022 | $20,772.80 | $20,854.04 | $20,255.37 | $20,285.84 | 49,625,110,402 |

| October 26 2022 | $20,092.24 | $20,938.13 | $20,076.12 | $20,770.44 | 58,895,950,537 |

| October 25 2022 | $19,344.96 | $20,348.41 | $19,261.45 | $20,095.86 | 47,761,524,910 |

| October 24 2022 | $19,567.77 | $19,589.13 | $19,206.32 | $19,345.57 | 30,202,235,805 |

| October 23 2022 | $19,207.73 | $19,646.65 | $19,124.20 | $19,567.01 | 22,128,794,335 |

| October 22 2022 | $19,172.38 | $19,248.07 | $19,132.24 | $19,208.19 | 16,104,440,957 |

| October 21 2022 | $19,053.20 | $19,237.38 | $18,770.97 | $19,172.47 | 32,459,287,866 |

| October 20 2022 | $19,138.09 | $19,315.20 | $18,971.46 | $19,053.74 | 24,493,974,420 |

| October 19 2022 | $19,335.03 | $19,348.42 | $19,127.69 | $19,139.54 | 22,425,387,184 |

| October 18 2022 | $19,550.47 | $19,666.99 | $19,144.77 | $19,334.42 | 30,580,012,344 |

| October 17 2022 | $19,268.56 | $19,635.80 | $19,173.33 | $19,550.76 | 27,472,552,998 |

| October 16 2022 | $19,068.91 | $19,389.60 | $19,068.91 | $19,268.09 | 17,988,916,650 |

| October 15 2022 | $19,185.44 | $19,212.54 | $19,019.25 | $19,067.63 | 16,192,235,532 |

| October 14 2022 | $19,382.53 | $19,889.15 | $19,115.41 | $19,185.66 | 38,452,356,727 |

| October 13 2022 | $19,156.97 | $19,453.33 | $18,319.82 | $19,382.90 | 44,219,840,004 |

| October 12 2022 | $19,052.65 | $19,203.20 | $19,029.76 | $19,157.45 | 24,950,173,846 |

| October 11 2022 | $19,139.00 | $19,241.96 | $18,925.60 | $19,051.42 | 28,711,532,910 |

| October 10 2022 | $19,446.42 | $19,515.47 | $19,102.98 | $19,141.48 | 27,425,022,774 |

| October 09 2022 | $19,417.48 | $19,542.54 | $19,349.26 | $19,446.43 | 16,837,262,532 |

| October 08 2022 | $19,546.33 | $19,601.70 | $19,299.41 | $19,416.57 | 16,437,423,167 |

| October 07 2022 | $19,957.56 | $20,041.09 | $19,395.79 | $19,546.85 | 29,227,315,390 |

| October 06 2022 | $20,161.04 | $20,408.39 | $19,900.09 | $19,955.44 | 34,711,412,966 |

| October 05 2022 | $20,335.90 | $20,343.75 | $19,801.80 | $20,160.72 | 33,223,790,572 |

| October 04 2022 | $19,623.58 | $20,380.34 | $19,523.84 | $20,336.84 | 35,887,278,685 |

| October 03 2022 | $19,044.07 | $19,653.54 | $19,025.23 | $19,623.58 | 30,484,729,489 |

| October 02 2022 | $19,311.85 | $19,370.31 | $18,970.62 | $19,044.11 | 20,765,955,327 |

| October 01 2022 | $19,431.11 | $19,471.15 | $19,231.08 | $19,312.10 | 18,719,537,670 |

| September 30 2022 | $19,573.43 | $20,109.85 | $19,265.66 | $19,431.79 | 43,975,248,085 |

| September 29 2022 | $19,427.78 | $19,589.27 | $18,924.35 | $19,573.05 | 41,037,843,771 |

| September 28 2022 | $19,104.62 | $19,688.34 | $18,553.30 | $19,426.72 | 53,071,298,734 |

| September 27 2022 | $19,221.84 | $20,338.46 | $18,915.67 | $19,110.55 | 58,571,439,619 |

| September 26 2022 | $18,803.90 | $19,274.87 | $18,721.29 | $19,222.67 | 44,148,798,321 |

| September 25 2022 | $18,936.31 | $19,134.73 | $18,696.47 | $18,802.10 | 23,359,966,112 |

| September 24 2022 | $19,296.99 | $19,310.20 | $18,861.97 | $18,937.01 | 26,149,643,168 |

| September 23 2022 | $19,412.40 | $19,464.67 | $18,617.55 | $19,297.64 | 38,896,078,052 |

| September 22 2022 | $18,534.65 | $19,456.91 | $18,415.59 | $19,413.55 | 41,135,767,926 |

| September 21 2022 | $18,891.28 | $19,674.63 | $18,290.31 | $18,547.40 | 46,363,793,975 |

| September 20 2022 | $19,545.59 | $19,602.46 | $18,813.46 | $18,890.79 | 36,791,346,508 |

| September 19 2022 | $19,418.57 | $19,639.48 | $18,390.32 | $19,544.13 | 40,177,002,624 |

| September 18 2022 | $20,127.23 | $20,127.23 | $19,387.49 | $19,419.51 | 31,254,779,144 |

| September 17 2022 | $19,777.03 | $20,162.53 | $19,777.03 | $20,127.58 | 24,957,448,100 |

| September 16 2022 | $19,704.01 | $19,870.63 | $19,400.08 | $19,772.58 | 30,123,362,273 |

| September 15 2022 | $20,242.29 | $20,318.17 | $19,636.73 | $19,701.21 | 36,389,011,503 |

| September 14 2022 | $20,184.55 | $20,467.20 | $19,793.40 | $20,241.09 | 37,872,380,889 |

| September 13 2022 | $22,371.48 | $22,673.82 | $20,062.67 | $20,296.71 | 51,091,116,622 |

| September 12 2022 | $21,770.15 | $22,439.18 | $21,603.90 | $22,370.45 | 50,212,088,965 |

| September 11 2022 | $21,678.54 | $21,770.55 | $21,406.95 | $21,769.26 | 34,493,951,963 |

| September 10 2022 | $21,376.91 | $21,760.28 | $21,168.72 | $21,680.54 | 36,913,738,894 |

| September 09 2022 | $19,328.14 | $21,439.41 | $19,310.96 | $21,381.15 | 48,469,528,171 |

| September 08 2022 | $19,289.94 | $19,417.35 | $19,076.71 | $19,329.83 | 32,194,477,850 |

| September 07 2022 | $18,837.68 | $19,427.17 | $18,644.47 | $19,290.32 | 35,239,757,134 |

| September 06 2022 | $19,817.72 | $20,155.27 | $18,800.17 | $18,837.67 | 43,403,978,910 |

| September 05 2022 | $19,988.79 | $20,031.16 | $19,673.05 | $19,812.37 | 28,813,460,025 |

| September 04 2022 | $19,832.47 | $19,999.69 | $19,636.82 | $19,986.71 | 25,245,861,652 |

| September 03 2022 | $19,969.72 | $20,037.01 | $19,698.36 | $19,832.09 | 23,613,051,457 |

| September 02 2022 | $20,126.07 | $20,401.57 | $19,814.77 | $19,969.77 | 29,123,998,928 |

| September 01 2022 | $20,050.50 | $20,198.39 | $19,653.97 | $20,127.14 | 30,182,031,010 |

| August 31 2022 | $19,799.58 | $20,420.99 | $19,799.58 | $20,049.76 | 33,225,232,872 |

| August 30 2022 | $20,298.61 | $20,542.64 | $19,617.64 | $19,796.81 | 34,483,360,283 |

| August 29 2022 | $19,615.15 | $20,357.46 | $19,600.79 | $20,297.99 | 32,637,854,078 |

| August 28 2022 | $20,041.04 | $20,139.05 | $19,616.81 | $19,616.81 | 24,366,810,591 |

| August 27 2022 | $20,262.48 | $20,340.78 | $19,890.52 | $20,041.74 | 30,116,729,776 |

| August 26 2022 | $21,596.09 | $21,804.91 | $20,199.48 | $20,260.02 | 42,326,789,564 |

| August 25 2022 | $21,395.46 | $21,789.64 | $21,362.44 | $21,600.90 | 31,028,679,593 |

| August 24 2022 | $21,526.46 | $21,783.08 | $21,195.01 | $21,395.02 | 31,962,253,368 |

| August 23 2022 | $21,401.04 | $21,646.20 | $20,955.14 | $21,528.09 | 31,878,280,659 |

| August 22 2022 | $21,531.46 | $21,531.46 | $20,939.18 | $21,398.91 | 31,666,498,758 |

| August 21 2022 | $21,160.39 | $21,668.85 | $21,103.20 | $21,534.12 | 23,102,307,723 |

| August 20 2022 | $20,872.84 | $21,350.81 | $20,856.73 | $21,166.06 | 27,595,671,000 |

| August 19 2022 | $23,213.31 | $23,213.31 | $20,868.85 | $20,877.55 | 40,509,610,260 |

| August 18 2022 | $23,341.04 | $23,563.83 | $23,177.60 | $23,212.74 | 23,747,613,147 |

| August 17 2022 | $23,881.32 | $24,407.06 | $23,243.35 | $23,336.00 | 30,931,623,076 |

| August 16 2022 | $24,126.14 | $24,228.42 | $23,733.50 | $23,883.29 | 27,753,685,646 |

| August 15 2022 | $24,318.32 | $25,135.59 | $23,839.78 | $24,136.97 | 35,123,501,685 |

| August 14 2022 | $24,429.06 | $24,974.91 | $24,206.26 | $24,319.33 | 22,994,133,555 |

| August 13 2022 | $24,402.19 | $24,860.05 | $24,346.12 | $24,424.07 | 22,987,346,289 |

| August 12 2022 | $23,957.20 | $24,412.57 | $23,657.27 | $24,402.82 | 27,265,804,688 |

| August 11 2022 | $23,948.35 | $24,822.63 | $23,901.00 | $23,957.53 | 37,127,036,580 |

| August 10 2022 | $23,162.90 | $24,127.41 | $22,771.52 | $23,947.64 | 32,837,431,722 |

| August 09 2022 | $23,811.48 | $23,898.62 | $22,982.00 | $23,164.32 | 23,555,719,219 |

| August 08 2022 | $23,179.53 | $24,203.69 | $23,176.55 | $23,809.49 | 28,575,544,847 |

| August 07 2022 | $22,963.51 | $23,359.01 | $22,894.56 | $23,175.89 | 15,886,817,043 |

| August 06 2022 | $23,291.42 | $23,326.56 | $22,961.28 | $22,961.28 | 15,978,259,885 |

| August 05 2022 | $22,626.83 | $23,422.83 | $22,612.18 | $23,289.31 | 28,881,249,043 |

| August 04 2022 | $22,848.21 | $23,198.01 | $22,485.70 | $22,630.96 | 25,120,229,769 |

| August 03 2022 | $22,981.30 | $23,578.65 | $22,747.84 | $22,846.51 | 26,288,169,966 |

| August 02 2022 | $23,308.43 | $23,415.04 | $22,710.08 | $22,978.12 | 28,389,250,717 |

| August 01 2022 | $23,336.72 | $23,464.79 | $22,890.80 | $23,314.20 | 25,849,159,141 |

| July 31 2022 | $23,652.07 | $24,121.64 | $23,275.70 | $23,336.90 | 23,553,591,896 |

| July 30 2022 | $23,796.82 | $24,572.58 | $23,580.51 | $23,656.21 | 28,148,218,301 |

| July 29 2022 | $23,845.21 | $24,294.79 | $23,481.17 | $23,804.63 | 35,887,249,746 |

| July 28 2022 | $22,933.64 | $24,110.47 | $22,722.27 | $23,843.89 | 40,212,386,158 |

| July 27 2022 | $21,244.17 | $22,986.53 | $21,070.81 | $22,930.55 | 31,758,955,233 |

| July 26 2022 | $21,361.12 | $21,361.12 | $20,776.82 | $21,239.75 | 28,624,673,855 |

| July 25 2022 | $22,607.16 | $22,649.12 | $21,361.64 | $21,361.70 | 35,574,561,406 |

| July 24 2022 | $22,465.51 | $22,974.00 | $22,306.84 | $22,609.16 | 23,565,495,303 |

| July 23 2022 | $22,706.98 | $22,977.21 | $22,002.91 | $22,465.48 | 24,021,799,169 |

| July 22 2022 | $23,163.75 | $23,671.93 | $22,603.42 | $22,714.98 | 31,421,555,646 |

| July 21 2022 | $23,233.20 | $23,388.32 | $22,431.15 | $23,164.63 | 33,631,012,204 |

| July 20 2022 | $23,393.19 | $24,196.82 | $23,009.95 | $23,231.73 | 42,932,549,127 |

| July 19 2022 | $22,467.85 | $23,666.96 | $21,683.41 | $23,389.43 | 48,765,202,697 |

| July 18 2022 | $20,781.91 | $22,633.03 | $20,781.91 | $22,485.69 | 39,974,475,562 |

| July 17 2022 | $21,195.04 | $21,600.64 | $20,778.18 | $20,779.34 | 22,927,802,083 |

| July 16 2022 | $20,834.10 | $21,514.40 | $20,518.90 | $21,190.32 | 24,302,954,056 |

| July 15 2022 | $20,573.16 | $21,138.24 | $20,397.00 | $20,836.33 | 25,905,575,359 |

| July 14 2022 | $20,211.47 | $20,789.89 | $19,689.26 | $20,569.92 | 31,158,743,333 |

| July 13 2022 | $19,325.97 | $20,223.05 | $18,999.95 | $20,212.07 | 33,042,430,345 |

| July 12 2022 | $19,970.47 | $20,043.45 | $19,308.53 | $19,323.91 | 25,810,220,018 |

| July 11 2022 | $20,856.35 | $20,856.35 | $19,924.54 | $19,970.56 | 24,150,249,025 |

| July 10 2022 | $21,591.08 | $21,591.08 | $20,727.12 | $20,860.45 | 28,688,807,249 |

| July 09 2022 | $21,716.83 | $21,877.14 | $21,445.96 | $21,592.21 | 29,641,127,858 |

| July 08 2022 | $21,637.15 | $22,314.94 | $21,257.45 | $21,731.12 | 49,899,834,488 |

| July 07 2022 | $20,547.81 | $21,771.82 | $20,296.10 | $21,637.59 | 25,814,972,520 |

| July 06 2022 | $20,194.62 | $20,595.53 | $19,823.51 | $20,548.25 | 24,598,943,708 |

| July 05 2022 | $20,225.35 | $20,635.47 | $19,341.23 | $20,190.12 | 26,715,546,990 |

| July 04 2022 | $19,297.31 | $20,258.75 | $19,063.07 | $20,231.26 | 21,594,638,208 |

| July 03 2022 | $19,242.10 | $19,558.27 | $18,966.95 | $19,297.08 | 16,390,821,947 |

| July 02 2022 | $19,274.84 | $19,371.75 | $19,027.08 | $19,242.26 | 18,100,418,740 |

| July 01 2022 | $19,820.47 | $20,632.67 | $19,073.71 | $19,269.37 | 30,767,551,159 |

| June 30 2022 | $20,108.31 | $20,141.16 | $18,729.66 | $19,784.73 | 26,267,239,923 |

| June 29 2022 | $20,281.17 | $20,364.16 | $19,937.79 | $20,104.02 | 23,552,740,328 |

| June 28 2022 | $20,731.54 | $21,164.42 | $20,228.81 | $20,280.63 | 21,381,535,161 |

| June 27 2022 | $21,028.24 | $21,478.09 | $20,620.20 | $20,735.48 | 20,965,695,707 |

| June 26 2022 | $21,496.49 | $21,783.72 | $21,016.27 | $21,027.29 | 18,027,170,497 |

| June 25 2022 | $21,233.61 | $21,520.91 | $20,964.59 | $21,502.34 | 18,372,538,715 |

| June 24 2022 | $21,084.65 | $21,472.92 | $20,777.51 | $21,231.66 | 24,957,784,918 |

| June 23 2022 | $19,986.61 | $21,135.76 | $19,950.12 | $21,085.88 | 26,188,097,173 |

| June 22 2022 | $20,719.41 | $20,835.75 | $19,848.08 | $19,987.03 | 28,574,793,478 |

| June 21 2022 | $20,594.29 | $21,620.63 | $20,415.06 | $20,710.60 | 28,970,212,744 |

| June 20 2022 | $20,553.37 | $20,913.32 | $19,689.17 | $20,599.54 | 30,818,458,597 |

| June 19 2022 | $19,010.90 | $20,683.82 | $18,067.15 | $20,553.27 | 35,329,942,625 |

| June 18 2022 | $20,473.43 | $20,736.04 | $17,708.62 | $19,017.64 | 42,009,436,760 |

| June 17 2022 | $20,385.72 | $21,243.31 | $20,326.52 | $20,471.48 | 27,132,421,514 |

| June 16 2022 | $22,576.30 | $22,868.92 | $20,265.23 | $20,381.65 | 31,183,975,654 |

| June 15 2022 | $22,196.73 | $22,642.67 | $20,178.38 | $22,572.84 | 54,912,007,015 |

| June 14 2022 | $22,487.99 | $23,018.95 | $20,950.82 | $22,206.79 | 50,913,575,242 |

| June 13 2022 | $26,737.58 | $26,795.59 | $22,141.26 | $22,487.39 | 68,204,556,440 |

| June 12 2022 | $28,373.51 | $28,502.69 | $26,762.65 | $26,762.65 | 34,163,220,274 |

| June 11 2022 | $29,084.67 | $29,401.92 | $28,236.21 | $28,360.81 | 27,246,574,439 |

| June 10 2022 | $30,110.33 | $30,245.81 | $28,978.15 | $29,083.80 | 29,867,476,527 |

| June 09 2022 | $30,215.28 | $30,609.31 | $30,020.27 | $30,112.00 | 21,692,004,719 |

| June 08 2022 | $31,151.48 | $31,253.69 | $29,944.40 | $30,214.36 | 30,242,059,107 |

| June 07 2022 | $31,371.74 | $31,489.68 | $29,311.68 | $31,155.48 | 40,770,974,039 |

| June 06 2022 | $29,910.28 | $31,693.29 | $29,894.19 | $31,370.67 | 31,947,336,829 |

| June 05 2022 | $29,835.12 | $30,117.74 | $29,574.45 | $29,906.66 | 17,264,085,441 |

| June 04 2022 | $29,706.14 | $29,930.56 | $29,500.01 | $29,832.91 | 16,588,370,958 |

| June 03 2022 | $30,467.81 | $30,633.04 | $29,375.69 | $29,704.39 | 26,175,547,452 |

| June 02 2022 | $29,794.89 | $30,604.73 | $29,652.71 | $30,467.49 | 29,083,562,061 |

| June 01 2022 | $31,792.55 | $31,957.29 | $29,501.59 | $29,799.08 | 41,135,817,341 |

| May 31 2022 | $31,723.87 | $32,249.86 | $31,286.15 | $31,792.31 | 33,538,210,634 |

| May 30 2022 | $29,443.37 | $31,949.63 | $29,303.57 | $31,726.39 | 39,277,993,274 |

| May 29 2022 | $29,019.87 | $29,498.01 | $28,841.11 | $29,445.96 | 18,093,886,409 |

| May 28 2022 | $28,622.63 | $28,814.90 | $28,554.57 | $28,814.90 | 35,519,577,634 |

| May 27 2022 | $29,251.14 | $29,346.94 | $28,326.61 | $28,627.57 | 36,582,005,748 |

| May 26 2022 | $29,564.78 | $29,834.16 | $28,261.91 | $29,267.22 | 36,774,325,352 |

| May 25 2022 | $29,653.13 | $30,157.79 | $29,384.95 | $29,562.36 | 27,525,063,551 |

| May 24 2022 | $29,101.13 | $29,774.36 | $28,786.59 | $29,655.59 | 26,616,506,245 |

| May 23 2022 | $30,309.40 | $30,590.59 | $28,975.56 | $29,098.91 | 31,483,454,557 |

| May 22 2022 | $29,432.47 | $30,425.86 | $29,275.18 | $30,323.72 | 21,631,532,270 |

| May 21 2022 | $29,199.86 | $29,588.87 | $29,027.39 | $29,432.23 | 17,274,840,442 |

| May 20 2022 | $30,311.12 | $30,664.98 | $28,793.61 | $29,200.74 | 30,749,382,605 |

| May 19 2022 | $28,720.36 | $30,430.75 | $28,708.96 | $30,314.33 | 33,773,447,707 |

| May 18 2022 | $30,424.48 | $30,618.72 | $28,720.27 | $28,720.27 | 31,285,268,319 |

| May 17 2022 | $29,862.41 | $30,694.49 | $29,570.30 | $30,425.86 | 29,101,473,475 |

| May 16 2022 | $31,304.38 | $31,305.34 | $29,251.88 | $29,862.92 | 32,613,897,286 |

| May 15 2022 | $30,098.59 | $31,308.19 | $29,527.74 | $31,305.11 | 25,835,372,065 |

| May 14 2022 | $29,285.64 | $30,192.80 | $28,702.91 | $30,101.27 | 28,579,868,620 |

| May 13 2022 | $29,030.91 | $30,924.80 | $28,782.33 | $29,283.10 | 42,841,124,537 |

| May 12 2022 | $28,936.73 | $30,032.44 | $26,350.49 | $29,047.75 | 66,989,173,272 |

| May 11 2022 | $31,016.18 | $32,013.40 | $28,170.41 | $28,936.36 | 70,388,855,818 |

| May 10 2022 | $30,273.65 | $32,596.31 | $29,944.80 | $31,022.91 | 59,811,038,817 |

| May 09 2022 | $34,060.02 | $34,222.07 | $30,296.95 | $30,296.95 | 63,355,494,961 |

| May 08 2022 | $35,502.94 | $35,502.94 | $33,878.96 | $34,059.27 | 36,763,041,910 |

| May 07 2022 | $36,042.50 | $36,129.93 | $34,940.82 | $35,501.95 | 24,375,896,406 |

| May 06 2022 | $36,573.18 | $36,624.36 | $35,482.13 | $36,040.92 | 37,795,577,489 |

| May 05 2022 | $39,695.75 | $39,789.28 | $35,856.52 | $36,575.14 | 43,106,256,317 |

| May 04 2022 | $37,748.01 | $39,902.95 | $37,732.06 | $39,698.37 | 36,754,404,490 |

| May 03 2022 | $38,528.11 | $38,630.00 | $37,585.62 | $37,750.45 | 27,326,943,244 |

| May 02 2022 | $38,472.19 | $39,074.97 | $38,156.56 | $38,529.33 | 32,922,642,426 |

| May 01 2022 | $37,713.27 | $38,627.86 | $37,585.79 | $38,469.09 | 27,002,760,110 |

| April 30 2022 | $38,605.86 | $38,771.21 | $37,697.94 | $37,714.88 | 23,895,713,731 |

| April 29 2022 | $39,768.62 | $39,887.27 | $38,235.54 | $38,609.82 | 30,882,994,649 |

| April 28 2022 | $39,241.43 | $40,269.46 | $38,941.42 | $39,773.83 | 33,903,704,907 |

| April 27 2022 | $38,120.30 | $39,397.92 | $37,997.31 | $39,241.12 | 30,981,015,184 |

| April 26 2022 | $40,448.42 | $40,713.89 | $37,884.98 | $38,117.46 | 34,569,088,416 |

| April 25 2022 | $39,472.61 | $40,491.75 | $38,338.38 | $40,458.31 | 35,445,730,570 |

| April 24 2022 | $39,478.38 | $39,845.93 | $39,233.54 | $39,469.29 | 17,964,398,167 |

| April 23 2022 | $39,738.72 | $39,935.86 | $39,352.20 | $39,486.73 | 16,138,021,249 |

| April 22 2022 | $40,525.86 | $40,777.76 | $39,315.42 | $39,740.32 | 28,011,716,745 |

| April 21 2022 | $41,371.52 | $42,893.58 | $40,063.83 | $40,527.36 | 35,372,786,395 |

| April 20 2022 | $41,501.75 | $42,126.30 | $40,961.10 | $41,374.38 | 27,819,532,341 |

| April 19 2022 | $40,828.18 | $41,672.96 | $40,618.63 | $41,502.75 | 25,303,206,547 |

| April 18 2022 | $39,721.20 | $40,986.32 | $38,696.19 | $40,826.21 | 33,705,182,072 |

| April 17 2022 | $40,417.78 | $40,570.73 | $39,620.89 | $39,716.95 | 19,087,633,042 |

| April 16 2022 | $40,552.32 | $40,633.68 | $40,078.43 | $40,424.48 | 16,833,150,693 |

| April 15 2022 | $39,939.40 | $40,617.72 | $39,866.83 | $40,553.46 | 21,756,855,753 |

| April 14 2022 | $41,160.22 | $41,451.48 | $39,695.75 | $39,935.52 | 24,342,001,973 |

| April 13 2022 | $40,123.57 | $41,430.05 | $39,712.75 | $41,166.73 | 27,691,105,228 |

| April 12 2022 | $39,533.71 | $40,617.59 | $39,388.33 | $40,127.18 | 30,991,500,854 |

| April 11 2022 | $42,201.04 | $42,424.59 | $39,373.06 | $39,521.90 | 33,949,912,166 |

| April 10 2022 | $42,781.09 | $43,376.38 | $42,021.21 | $42,207.67 | 17,654,475,582 |

| April 09 2022 | $42,282.08 | $42,786.82 | $42,183.25 | $42,782.14 | 16,050,772,496 |

| April 08 2022 | $43,505.14 | $43,903.02 | $42,183.29 | $42,287.66 | 27,215,995,394 |

| April 07 2022 | $43,207.50 | $43,860.70 | $42,899.91 | $43,503.85 | 26,101,973,106 |

| April 06 2022 | $45,544.36 | $45,544.36 | $43,193.95 | $43,206.74 | 39,393,395,788 |

| April 05 2022 | $46,624.51 | $47,106.14 | $45,544.81 | $45,555.99 | 29,640,604,055 |

| April 04 2022 | $46,445.27 | $46,791.09 | $45,235.82 | $46,622.68 | 32,499,785,455 |

| April 03 2022 | $45,859.13 | $47,313.48 | $45,634.11 | $46,453.57 | 25,414,397,610 |

| April 02 2022 | $46,285.50 | $47,028.28 | $45,782.51 | $45,868.95 | 29,336,594,194 |

| April 01 2022 | $45,554.16 | $46,616.24 | $44,403.14 | $46,281.64 | 38,162,644,287 |

| March 31 2022 | $47,062.15 | $47,512.03 | $45,390.54 | $45,538.68 | 33,327,427,106 |

| March 30 2022 | $47,456.90 | $47,655.15 | $46,746.21 | $47,062.66 | 29,333,883,962 |

| March 29 2022 | $47,100.44 | $48,022.29 | $47,100.44 | $47,465.73 | 31,397,059,069 |

| March 28 2022 | $46,821.85 | $48,086.84 | $46,690.20 | $47,128.00 | 36,362,175,703 |

| March 27 2022 | $44,505.36 | $46,827.55 | $44,437.29 | $46,820.49 | 28,160,889,722 |

| March 26 2022 | $44,349.86 | $44,736.00 | $44,166.27 | $44,500.83 | 16,950,455,995 |

| March 25 2022 | $43,964.55 | $44,999.49 | $43,706.29 | $44,348.73 | 30,574,413,034 |

| March 24 2022 | $42,886.65 | $44,131.86 | $42,726.16 | $43,960.93 | 31,042,992,291 |

| March 23 2022 | $42,364.38 | $42,893.51 | $41,877.51 | $42,892.96 | 25,242,943,069 |

| March 22 2022 | $41,074.11 | $43,124.71 | $40,948.28 | $42,358.81 | 32,004,652,376 |

| March 21 2022 | $41,246.13 | $41,454.41 | $40,668.04 | $41,078.00 | 24,615,543,271 |

| March 20 2022 | $42,191.41 | $42,241.16 | $41,004.76 | $41,247.82 | 20,127,946,682 |

| March 19 2022 | $41,794.65 | $42,316.55 | $41,602.67 | $42,190.65 | 19,664,853,187 |

| March 18 2022 | $40,944.84 | $42,195.75 | $40,302.40 | $41,801.16 | 34,421,564,942 |

| March 17 2022 | $41,140.84 | $41,287.54 | $40,662.87 | $40,951.38 | 22,009,601,093 |

| March 16 2022 | $39,335.57 | $41,465.45 | $39,022.35 | $41,143.93 | 39,616,916,192 |

| March 15 2022 | $39,664.25 | $39,794.63 | $38,310.21 | $39,338.79 | 23,934,000,868 |

| March 14 2022 | $37,846.32 | $39,742.50 | $37,680.73 | $39,666.75 | 24,322,159,070 |

| March 13 2022 | $38,884.73 | $39,209.35 | $37,728.14 | $37,849.66 | 17,300,745,310 |

| March 12 2022 | $38,794.46 | $39,308.60 | $38,772.54 | $38,904.01 | 14,616,450,657 |

| March 11 2022 | $39,439.97 | $40,081.68 | $38,347.43 | $38,794.97 | 26,364,890,465 |

| March 10 2022 | $41,974.07 | $42,004.73 | $38,832.94 | $39,437.46 | 31,078,064,711 |

| March 09 2022 | $38,742.82 | $42,465.67 | $38,706.09 | $41,982.93 | 32,284,121,034 |

| March 08 2022 | $38,059.90 | $39,304.44 | $37,957.39 | $38,737.27 | 25,776,583,476 |

| March 07 2022 | $38,429.30 | $39,430.23 | $37,260.20 | $38,062.04 | 28,546,143,503 |

| March 06 2022 | $39,404.20 | $39,640.18 | $38,211.65 | $38,419.98 | 19,745,229,902 |

| March 05 2022 | $39,148.45 | $39,566.34 | $38,777.04 | $39,400.59 | 16,975,917,450 |

| March 04 2022 | $42,458.14 | $42,479.61 | $38,805.85 | $39,137.61 | 28,516,271,427 |

| March 03 2022 | $43,925.20 | $44,021.58 | $41,914.75 | $42,451.79 | 24,967,782,593 |

| March 02 2022 | $44,357.62 | $45,077.58 | $43,432.85 | $43,924.12 | 29,183,112,630 |

| March 01 2022 | $43,194.50 | $44,793.60 | $42,952.59 | $44,354.64 | 32,479,047,645 |

| February 28 2022 | $37,706.00 | $43,760.46 | $37,518.21 | $43,193.23 | 35,690,014,104 |

| February 27 2022 | $39,098.70 | $39,778.94 | $37,268.98 | $37,709.79 | 23,450,127,612 |

| February 26 2022 | $39,213.08 | $40,005.35 | $38,702.54 | $39,105.15 | 17,467,554,129 |

| February 25 2022 | $38,333.75 | $39,630.32 | $38,111.34 | $39,214.22 | 26,545,599,159 |

| February 24 2022 | $37,278.57 | $38,968.84 | $34,459.22 | $38,332.61 | 46,383,802,093 |

| February 23 2022 | $38,285.28 | $39,122.39 | $37,201.82 | $37,296.57 | 21,849,073,843 |

| February 22 2022 | $37,068.77 | $38,359.86 | $36,488.93 | $38,286.03 | 25,493,150,450 |

| February 21 2022 | $38,423.21 | $39,394.44 | $36,950.48 | $37,075.28 | 29,280,402,798 |

| February 20 2022 | $40,118.10 | $40,119.89 | $38,112.81 | $38,431.38 | 18,340,576,452 |

| February 19 2022 | $40,026.02 | $40,418.88 | $39,713.06 | $40,122.16 | 13,736,557,863 |

| February 18 2022 | $40,552.13 | $40,929.15 | $39,637.62 | $40,030.98 | 23,310,007,704 |

| February 17 2022 | $43,937.07 | $44,132.97 | $40,249.37 | $40,538.01 | 26,246,662,813 |

| February 16 2022 | $44,578.28 | $44,578.28 | $43,456.69 | $43,961.86 | 19,792,547,657 |

| February 15 2022 | $42,586.46 | $44,667.22 | $42,491.04 | $44,575.20 | 22,721,659,051 |

| February 14 2022 | $42,157.40 | $42,775.78 | $41,681.96 | $42,586.92 | 20,827,783,012 |

| February 13 2022 | $42,236.57 | $42,693.05 | $41,950.94 | $42,197.52 | 14,741,589,015 |

| February 12 2022 | $42,412.30 | $42,992.55 | $41,852.57 | $42,244.47 | 18,152,390,304 |

| February 11 2022 | $43,571.13 | $43,810.83 | $42,114.54 | $42,407.94 | 26,954,925,781 |

| February 10 2022 | $44,347.80 | $45,661.17 | $43,402.81 | $43,565.11 | 32,142,048,537 |

| February 09 2022 | $44,096.70 | $44,727.80 | $43,232.97 | $44,338.80 | 23,245,887,300 |

| February 08 2022 | $43,854.65 | $45,293.87 | $42,807.84 | $44,118.45 | 33,079,398,868 |

| February 07 2022 | $42,406.78 | $44,401.86 | $41,748.16 | $43,840.29 | 28,641,855,926 |

| February 06 2022 | $41,441.12 | $42,500.79 | $41,244.91 | $42,412.43 | 16,142,097,334 |

| February 05 2022 | $41,501.48 | $41,847.16 | $41,038.10 | $41,441.16 | 19,652,846,215 |

| February 04 2022 | $37,149.27 | $41,527.79 | $37,093.63 | $41,500.88 | 29,412,210,792 |

| February 03 2022 | $36,944.80 | $37,154.60 | $36,375.54 | $37,154.60 | 18,591,534,769 |

| February 02 2022 | $38,743.71 | $38,834.62 | $36,832.73 | $36,952.98 | 19,155,189,416 |

| February 01 2022 | $38,481.77 | $39,115.13 | $38,113.66 | $38,743.27 | 20,288,500,328 |

| January 31 2022 | $37,920.28 | $38,647.26 | $36,733.57 | $38,483.13 | 20,734,730,465 |

| January 30 2022 | $38,151.92 | $38,266.34 | $37,437.71 | $37,917.60 | 14,643,548,444 |

| January 29 2022 | $37,780.71 | $38,576.26 | $37,406.47 | $38,138.18 | 17,194,183,075 |

| January 28 2022 | $37,128.45 | $37,952.88 | $36,211.11 | $37,784.33 | 22,238,830,523 |

| January 27 2022 | $36,841.88 | $37,148.32 | $35,629.28 | $37,138.23 | 25,041,426,629 |

| January 26 2022 | $36,950.52 | $38,825.41 | $36,374.91 | $36,852.12 | 31,324,598,034 |

| January 25 2022 | $36,654.80 | $37,444.57 | $35,779.43 | $36,954.00 | 26,428,189,594 |

| January 24 2022 | $36,275.73 | $37,247.52 | $33,184.06 | $36,654.33 | 41,856,658,597 |

| January 23 2022 | $35,047.36 | $36,433.31 | $34,784.97 | $36,276.80 | 26,017,975,951 |

| January 22 2022 | $36,471.59 | $36,688.81 | $34,349.25 | $35,030.25 | 39,714,385,405 |

| January 21 2022 | $40,699.61 | $41,060.53 | $35,791.43 | $36,457.32 | 43,011,992,031 |

| January 20 2022 | $41,744.03 | $43,413.02 | $40,672.82 | $40,680.42 | 20,382,033,940 |

| January 19 2022 | $42,374.04 | $42,478.30 | $41,242.91 | $41,744.33 | 23,091,543,258 |

| January 18 2022 | $42,250.07 | $42,534.40 | $41,392.21 | $42,375.63 | 22,417,209,227 |

| January 17 2022 | $43,118.12 | $43,179.39 | $41,680.32 | $42,250.55 | 21,690,904,261 |

| January 16 2022 | $43,172.04 | $43,436.81 | $42,691.02 | $43,113.88 | 17,902,097,845 |

| January 15 2022 | $43,101.90 | $43,724.67 | $42,669.04 | $43,177.40 | 18,371,348,298 |

| January 14 2022 | $42,598.87 | $43,346.69 | $41,982.62 | $43,099.70 | 23,577,403,399 |

| January 13 2022 | $43,946.74 | $44,278.42 | $42,447.04 | $42,591.57 | 47,691,135,082 |

| January 12 2022 | $42,742.18 | $44,135.37 | $42,528.99 | $43,949.10 | 33,499,938,689 |

| January 11 2022 | $41,819.51 | $43,001.16 | $41,407.75 | $42,735.86 | 26,327,648,900 |

| January 10 2022 | $41,910.23 | $42,199.48 | $39,796.57 | $41,821.26 | 32,104,232,331 |

| January 09 2022 | $41,734.73 | $42,663.95 | $41,338.16 | $41,911.60 | 21,294,384,372 |

| January 08 2022 | $41,561.46 | $42,228.94 | $40,672.28 | $41,733.94 | 28,066,355,845 |

| January 07 2022 | $43,153.57 | $43,153.57 | $41,077.45 | $41,557.90 | 84,196,607,520 |

| January 06 2022 | $43,565.51 | $43,748.72 | $42,645.54 | $43,160.93 | 30,208,048,289 |

| January 05 2022 | $45,899.36 | $46,929.05 | $42,798.22 | $43,569.00 | 36,851,084,859 |

| January 04 2022 | $46,458.85 | $47,406.55 | $45,752.46 | $45,897.57 | 42,494,677,905 |

| January 03 2022 | $47,343.54 | $47,510.73 | $45,835.96 | $46,458.12 | 33,071,628,362 |

| January 02 2022 | $47,680.93 | $47,881.41 | $46,856.94 | $47,345.22 | 27,951,569,547 |

| January 01 2022 | $46,311.75 | $47,827.31 | $46,288.48 | $47,686.81 | 24,582,667,004 |

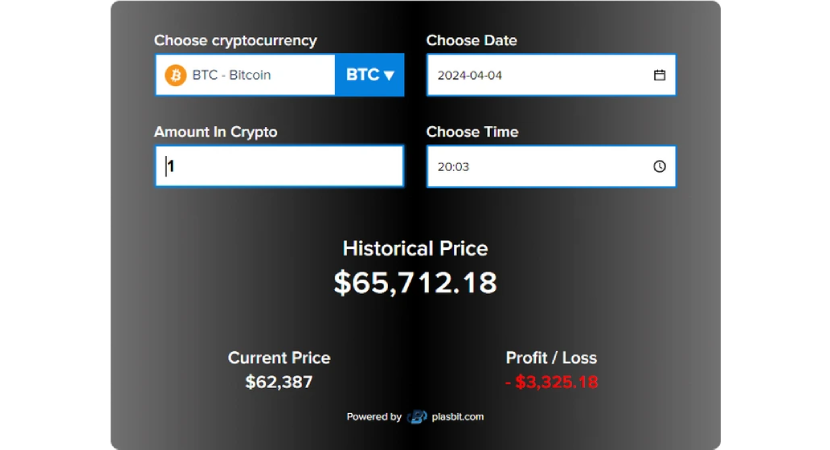

How can you discover prices in the past? Using the PlasBit historical calculator, you can conduct thorough research and determine how much prices have changed in previous years. Many things have influenced the Bitcoin pricing system. We will discuss how they impacted the coin. Also, we will highlight the steps taken to keep things under control. Let's start by discussing the price of Bitcoin in 2022.

A Timeline of Events That Affected Bitcoin Price in 2022

In this section, we will discuss the events that impacted the price of Bitcoin over 2022.

February to May

The cryptocurrency industry, which was riding high in 2021, had great hopes for 2022. Numerous large corporations invested millions of dollars in promotional activities. The U.S. Super Bowl, with an estimated 200 million viewers, featured advertisements from cryptocurrency giants like FTX and Coinbase. Notably, the FTX ad encouraged viewers to explore the world of crypto, which was touted as the next big thing. Adding to the mix, the U.S. Federal Reserve made a significant move by raising the benchmark federal funds rate from 0.25% to 0.50%, marking the first increase since 2018.

In March, the Ronin network was the victim of one of the largest cryptocurrency thefts in history. After breaking into the network, hackers made off with $625 million in Ethereum and USDC stablecoin. However, over $30 million in funds was recovered with the help of US authorities. Terra-LUNA collapsed in May. 2018 was a great start for the Terra network. In April, the market capitalization of TerraUSD (UST) reached about US$18.7 billion. However, in May, it all shattered into pieces. From May 9 to May 11, UST's U.S. dollar peg started to falter. It first fell to US$0.479. The price rose again a day later, but on May 19th, it fell below US$0.10. Within this period, the price of Bitcoin started at $37k and closed around $31k. This led to a loss of about $6k.

June to September

In June, a series of bankruptcies occurred. Due to extreme market conditions, bitcoin lenders such as Celsius and Voyager suspended withdrawals and transfers. Several other companies, such as 3AC, filed for bankruptcy and laid off numerous staff members. A decline in non-fungible tokens (NFT) occurred alongside a decrease in the bitcoin market. Monthly NFT trading volumes decreased from over US$4.9 billion in January to less than US$1 billion. It further fell to less than half a million in October as falls in the pricing of cryptocurrency assets continued. By July, Bitcoin had fallen almost 70% from its peak in November 2021. A lot of supposedly alt-coins had a steeper decrease than Bitcoin. During the cryptocurrency winter, cryptocurrency companies started to hibernate and lay off employees. Within this period, the price of Bitcoin started at $29k and closed at $19k. This was a further reduction, and a loss of about $10k was recorded.

October to December

October was the biggest month in the biggest year ever for cryptocurrency hackers. Over US$718 million was taken from decentralized financial platforms. FTX moved from being an industry leader to declaring bankruptcy in a matter of days. The crisis began when Binance CEO Changpeng Zhao announced that his platform would liquidate FTX's native coin, the FTT token.

Zhao's remarks followed the disclosure on November 2nd that an excessive quantity of FTT was recorded on the balance sheet of Bankman-Fried's cryptocurrency trading company, Alameda Research. The industry was unsettled, and the token's value was damaged when Binance's FTT sell-off was made public. A liquidity crisis emerged as soon as FTX users began taking money out of the exchange.

On November 8, FTX announced the end of withdrawals. After Binance’s acquisition proposal failed, the CEO stepped down. On November 11, affiliates under FTX filed for bankruptcy. This further worsened the situation. Due to its impact, the price of Bitcoin dropped. It declined to US$16,000 for the first time since 2020. The whole FTX collapse led to about US$9 billion in losses in the crypto industry. Within this period, the price of Bitcoin still lingered around $19k and closed at $16k. This recorded a reduced loss of $3k.

A Step-By-Step Guide To Finding the Historical Price of Bitcoin

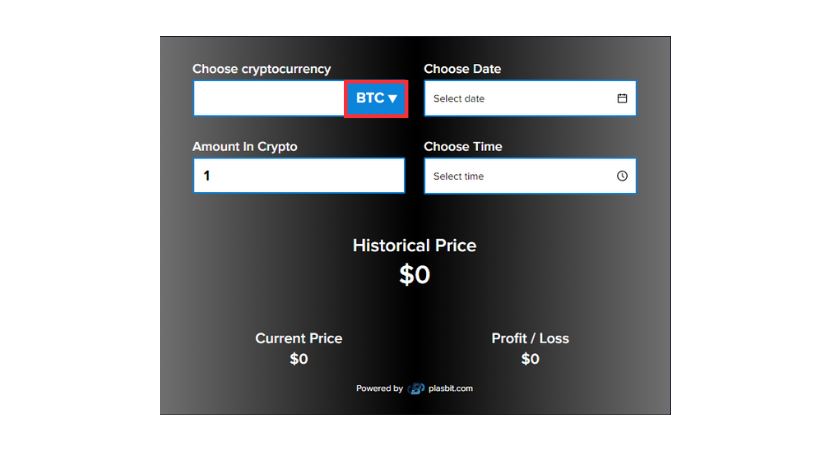

You need to have a thorough understanding of Bitcoin's price history in order to spot trends and make wise judgments. How do you do this with such ease? The historical price calculator by PlasBit is perfect for it. You can use this feature-rich, intuitive widget to monitor the evolution of the price of Bitcoin. Here's how to utilize it successfully, step by step.

Step 1 - Choose Your Preferred Currency

The historical pricing calculator is located at the top of this page; just scroll to use it. Select Bitcoin as your preferred cryptocurrency.

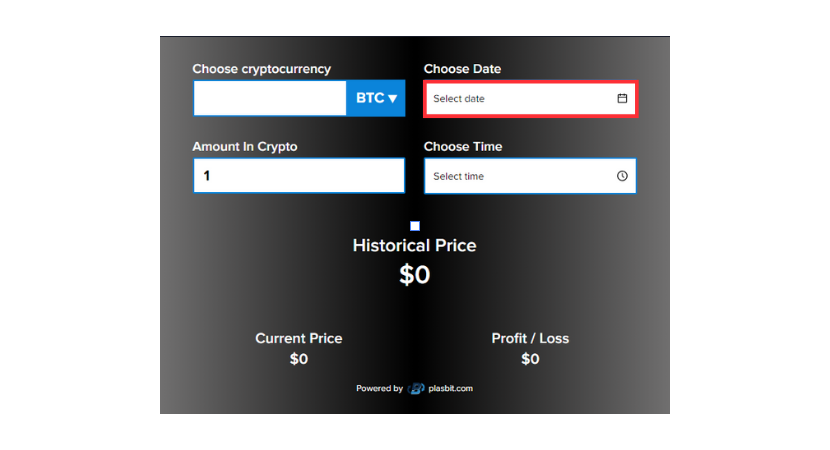

Step 2 - Insert the Preferred Date

Add the date that corresponds to the time frame you require results.

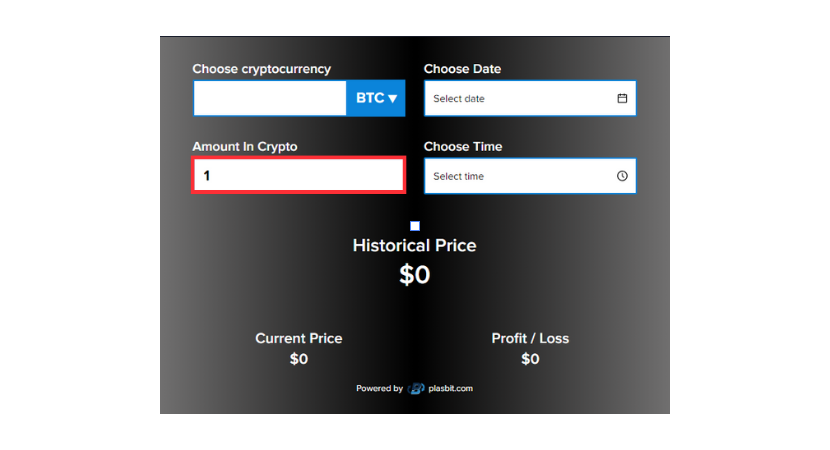

Step 3 - Type in the Amount

When running an analysis, you have to specify how much you want to evaluate. You are free to enter any figure.

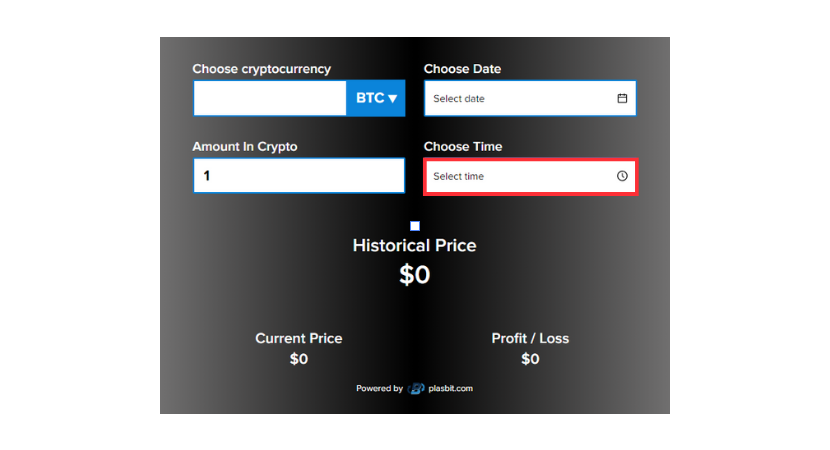

Step 4 - Choose the Time

Once you've entered the required amount, you can choose the precise time. The time stamp aids in determining the historical hourly price fluctuations.

Step 5 - View the Results

When all the required information has been entered, the calculator will show the results. The price of Bitcoin for the chosen period, as well as the current period, will be represented in the illustration. To find patterns, trends, and previous price levels, you can examine the data. Additionally, a Profit/Loss indicator is used to indicate the variations between the two results. This will enable you to assess how much has changed by comparing the current price to earlier figures.

In addition, if you are the owner of a website, this widget could be a very helpful addition. You may also change the visual components of the widget, such as the chosen language, background color, and text color, to make it exactly what you want for your website.

Why was Bitcoin Created

After the 2008 global financial crisis, a whitepaper was published. It was titled "Bitcoin: A Peer-to-Peer Electronic Cash System." This paper was released by an unidentified person codenamed Satoshi Nakamoto. The action led to the release of Bitcoin into the world. As of then, it was the only cryptocurrency with no other in view. The coin had a very important goal: to offer an alternative to conventional fiat currencies. It was also designed to override the centralized banking system. How did it work out? What was the adoption process like? We will discuss the key details below.

1. The Birth of Bitcoin

Analyzing the era's financial circumstances is necessary to comprehend why Bitcoin was founded. The 2008 global financial crisis highlighted the dangers of centralization and the flaws in the current banking structure. The public's finances could not be stabilized by governments, banks, or other financial organizations.

The banks' incorrect decision to lend more money on the erroneous assumption that home values will keep rising is what caused the economic crisis. To buy and build more homes, real estate developers resorted to irresponsible borrowing. A large number of the mortgage loans were for sums that were comparable to the cost of buying a home. A significant portion of these hazardous loans were obtained by investors hoping to turn a profit quickly.

Due to their excessive borrowing, banks and investors unexpectedly suffered significant losses as home prices started to decline. More and more developers were taking short-term loans to buy assets that would take time to sell.

Additionally, their dependence on lenders increased. As a result, many borrowers were unable to pay back their loans. Because they had no idea who would be the next to fall, investors started withdrawing their money from banks across the world.

As a result of everyone trying to sell at the same time and many institutions being unable to secure new financing, the financial markets went into chaos. As confidence declined, businesses likewise became considerably less inclined to invest, and households grew less willing to spend. Many global economies experienced their worst recessions because of this. The safety of funds was at stake, so people could no longer trust the banks.

This tragedy led to a greater desire for a more decentralized, transparent, and safe solution amidst a growing distrust for centralized institutions. In response to these difficulties, Bitcoin was created. It was designed to operate independently of any entity, including the government or a financial institution. It allowed peer-to-peer (P2P) transactions to take place, eliminating the need for intermediary financial authorities.

The currency was successful because of blockchain, which is a cryptographically secured distributed database containing blocks of transactions. What made the Bitcoin platform more decentralized was its high-end security and global consensus. Collectively, network users were continuously updating and validating the system's current state.

Every user has the ability to confirm whether the contents have not been altered, as every block in the chain is connected to its predecessor. Users provide a distributed computing effort and are compensated for it. Despite being targeted at a huge number of users, the platform's decentralized structure protected it against numerous hacks.

2. What Did Satoshi Nakamoto, The Founder, Consider Prior to the Creation

The whitepaper outlined several key concepts and elaborated the founder’s vision for Bitcoin. The primary objective was to enable peer-to-peer transactions. This should be operated without the involvement of intermediaries such as payment processors.

Due to this, people could have dealings that don’t involve extra fees. At the same time, speed and increased productivity will be guaranteed. Moreover, there was a fixed 21-million-coin supply to create a deflationary currency. This scarcity was enabled to halt inflation and preserve its value throughout its existence.

Because of its restricted supply, Bitcoin functions as a valuable currency, just like gold. It is independent, in contrast to fiat currencies. It was created to be resistant to censorship. This would restrict entities from controlling transactions on the network. The initiative was extremely appealing to people who lived in countries with strict financial restrictions. It triggered the acceptance so as to battle banking institutions that could be used to quell opposition.

3. How Bitcoin Has Impacted the Economy

Bitcoin has significantly impacted the financial and technology sectors since its debut. It has led to the creation of thousands of new cryptocurrencies. These coins have their own unique features and uses.

Bitcoin has also sparked a global conversation about the nature of money in the future. It has also modified the role of centralization in our financial systems. Some see it as a revolutionary force for good that promotes financial independence.

Others see it as a medium that gives individuals more power. However, some lingering concerns are still in existence. These are mainly the volatility and security threats that could cause doubts.

4. Future Expectations from Bitcoin

Given how quickly it is evolving, the future of Bitcoin is yet uncertain. It has to contend with administrations who want to put more stringent laws on cryptocurrencies. However, many people feel that in the end, the decentralization feature will prevail.

Furthermore, it has turned into a widely accepted payment system. The currency was developed in reaction to the need for a more decentralized system. Since it has received wide acceptance from users, nothing could stop it from growing. An added advantage is its transparency and safe financial system to curb the flaws of traditional ones.

Its influence has been immense, igniting a global dialogue about the future of money and propelling the development of a new digital economy. There's no doubting Bitcoin's impact on the financial and technology industries, even though it's unclear whether it will reach its full potential.

Satoshi Nakamoto: Who is He?

Satoshi Nakamoto is an anonymous character responsible for the birth of Bitcoin. It is often accepted that the name is a pseudonym. The primary means of contact between Satoshi Nakamoto and the Bitcoin community were forums and email exchanges. Early in Bitcoin's development, the founder took part in discussions with other users and developers. During these talks, he shared his technical knowledge and thoughts on the creation and application of virtual currency.

Yet, as Bitcoin gained popularity and notoriety, Nakamoto gradually vanished from view. When Nakamoto last spoke in late 2010, they indicated they had gone on to other endeavors and had entrusted a dependable group of collaborators with the development of Bitcoin. Since then, Nakamoto has not been seen or mentioned in the media regarding their involvement with Bitcoin.

Since their sudden disappearance, the mystery surrounding Nakamoto's identity and objectives has only gotten stronger. To date, there have been multiple attempts to determine Nakamoto’s genuine identity, all of which have ended in failure. Researchers and admirers have conducted extensive studies to identify the person or group that goes by the pseudonym.

The real identity of Satoshi Nakamoto remains a mystery to this day, and many unsolved questions remain. Due to their technical know-how, proximity to the cryptocurrency's birth, or early-stage involvement, many have been proposed as potential Nakamoto candidates. Nonetheless, these candidates have not yet been proven to be Nakamoto beyond a reasonable doubt, and the greater public has regarded them with skepticism.

State of the Crypto Market in 2022 and How the Economy Influenced It

In 2022, the crypto market witnessed interplays between economic forces and valuations. The year suffered from enormous volatility and updated regulations. Bitcoin first experienced a continuation of the bull-run coming from 2021. But as time moved, economic issues posed a threat to the industry. The industry became more volatile due to rising prices and stringent regulations.

Also, interest rate hikes caused investors to convert their holdings. Many of them converted from crypto to more conventional assets. This was the first move that affected the Bitcoin price history in 2022. Afterward, governments across the world stepped up investigations into the cryptocurrency industry. They did this to reduce the frequent rates of fraud and money laundering.

What Led to the Rise of Bitcoin Price Over the Years?

One of the reasons Bitcoin rose over the years is because it makes use of blockchain technology. Due to its transparent nature and ability to record every transaction via a network of computers, this distributed ledger is safe. Another factor that drove up Bitcoin's value was its scarcity. In contrast to conventional currencies, which central banks can generate indefinitely, the total number of Bitcoin coins is 21 million. Its value has significantly increased over time due to a combination of growing demand and scarcity.

Furthermore, consumers wanting privacy for their financial transactions were drawn to Bitcoin due to its pseudonymous character. This feature further hastened its growth. The privacy and decentralization of Bitcoin provided solace to a growing number of individuals who had lost faith in established banking institutions.

Despite its potential, the adoption of Bitcoin could have happened sooner. One of the primary issues was regulatory complexity. Because Bitcoin may be used for illicit activities like tax evasion and money laundering, governments were initially hesitant to embrace it. This regulatory uncertainty caused periods of volatility and hindered mainstream adoption as changes began to take shape. Another problem was that people considered Bitcoin more of a speculative asset than a reliable store of value or medium of exchange. Its price swings were so extreme within short durations that many did not find it trustworthy for investment or transactions. The difficulties associated with purchasing and storing Bitcoin also prevented many prospective users from using it.

Over time, this cryptocurrency has managed to overcome these challenges. So what led to the rise of Bitcoin over the years? Technological innovation, economic factors, and societal changes all contributed to the rise of Bitcoin. It started off almost worthless but has now grown to be a significant asset. Currently, it has a market valuation of hundreds of billions of dollars. There are now more favorable regulations in certain jurisdictions. This has led to improvement in usage and acceptance. People can buy, sell, or keep their Bitcoins with ease thanks to the user-friendly exchanges. Institutional acceptance of Bitcoin has also increased. This is due to its recognition as a legitimate asset by many financial institutions and organizations.

Just like the previous years, Bitcoin experienced increased price fluctuations in 2022. Throughout the first half, the price gradually decreased after hitting new highs the previous year. The decrease was caused by factors including unstable investor confidence and growing interest rates. For the first time since late 2020, the price of Bitcoin dropped below $23k.

This disappointing occurrence was recorded in June 2022. By the end of the year, the coin had dropped further below $20k. This indicated that the second half had not been much better. The consistent drop from the peak was noticeable to all and sundry. Regardless of these issues, 2022 had some positive aspects as well. What do we mean by this? The foundation for a successful resurgence in 2023 was established. When 2023 arrived, things started to settle down. Bitcoin recovered and eventually surpassed its peak in 2022.

Conclusion

Bitcoin has come a long way to get to this point. You may have been wondering what the Bitcoin Price History in 2022 was before reading this piece. In order to help you, we have included a variety of relevant information. A historical calculator has also been embedded to assist you in navigating the price structure over time. You may study trends and learn what to expect by using the PlasBit historical calculator. Dealing with cryptocurrencies is risky, but using the right tools will help you navigate through the industry.