A tax calculator for cryptocurrencies is a powerful tool designed to help you and businesses accurately calculate tax liabilities related to crypto transactions. Whether buying, selling, trading, or earning cryptocurrencies through various activities such as mining or staking, every transaction potentially has tax implications. This tool simplifies the process by automating the calculations based on the relevant tax laws and regulations. This guide will discuss this tool widget, how to use it, the benefits you can gain, the tax obligations, how crypto taxes work, and how you should report your taxes.

How to Use PlasBit’s Tax Calculator?

Using tax calculator is easy and simple. It allows you to estimate your capital gains or losses, calculate taxes and compare short-term and long-term capital gains. Whether you're planning to sell cryptocurrency or have already done so, this tool provides insights into your crypto tax obligations helping you make informed decisions about your crypto transactions. Here's a guide on using this crypto tool;

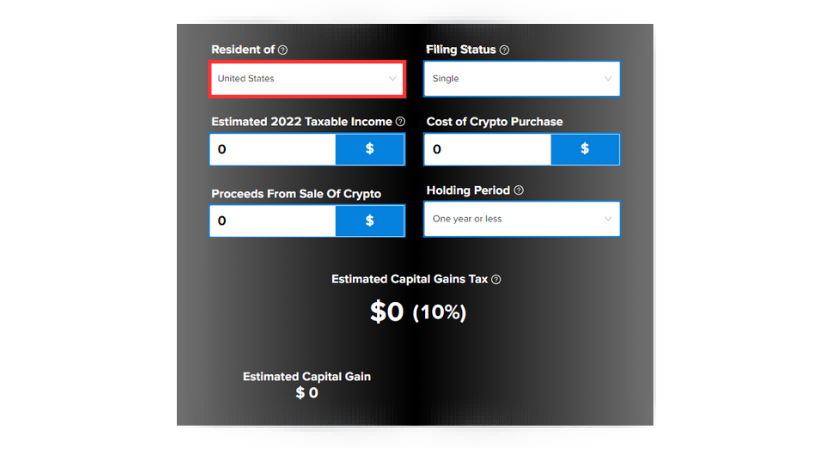

1. Start by selecting your residency location.

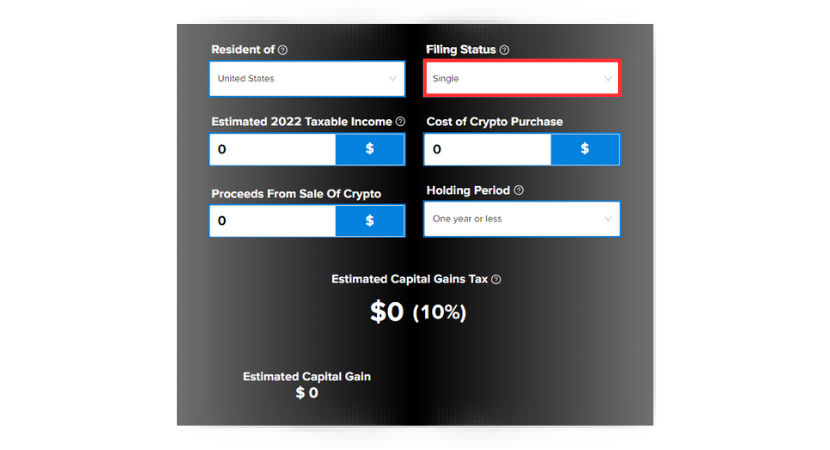

2. Choose your residency status from the available options like "Single", "Married, Filing Jointly", "Married, Filing Separately" or "Head of Household." This ensures tax calculations based on your filing status.

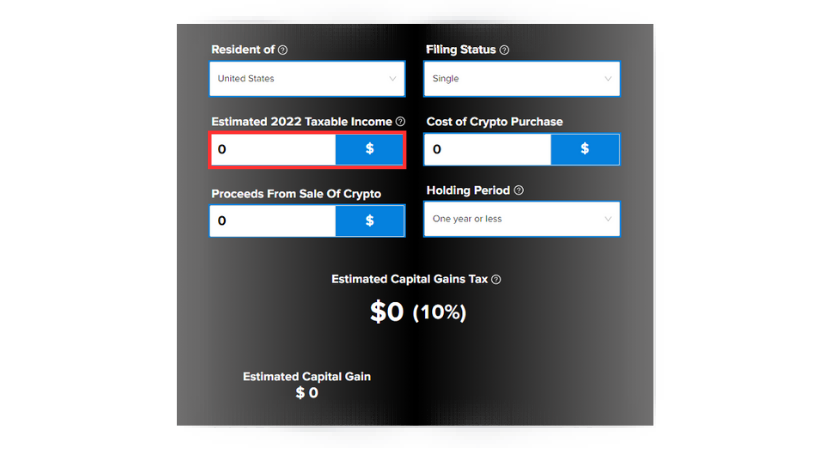

3. Next, enter your estimated income in the designated field. This is crucial for determining your tax liability accurately.

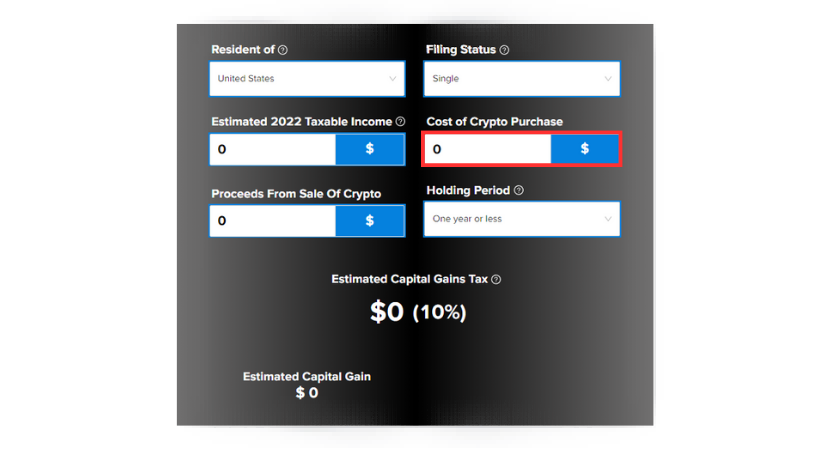

4. Enter the amount you spent acquiring the cryptocurrency in the "Cost of Crypto Purchase" field.

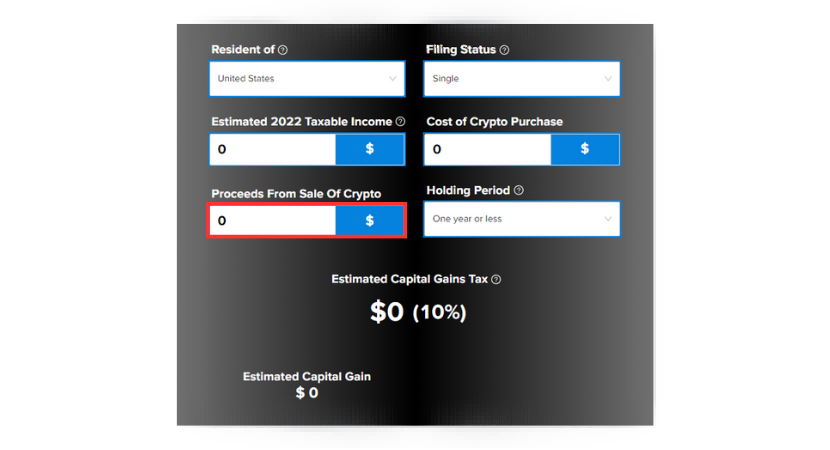

5. Input the amount received from selling your cryptocurrency in the "Proceeds From Sale Of Crypto" field.

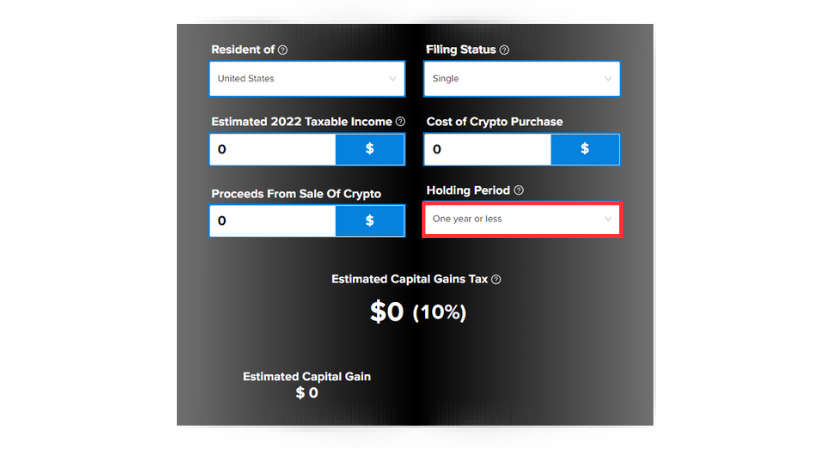

6. Select the holding period that corresponds to your cryptocurrency asset. Please choose "One year or less" if you held the cryptocurrency for a period or select "More than one year" if your ownership lasted longer.

7. To see an estimate of your crypto capital gains tax based on the information provided, access the Estimated Tax Details. Take a look at the "Estimated Capital Gains Tax" to get an idea of the projected tax amount. Additionally you can find the "Estimated Capital Gain," which gives you insight into the profits from your cryptocurrency investment. For an understanding of how different tax rates may impact your crypto gains, this calculator provides a breakdown of estimated crypto capital gains taxes at specified rates (e.g., 10%). This breakdown will help you plan effectively and optimize your tax strategy.

Benefits of Using a Tax Calculator

There are advantages to utilizing this tool for cryptocurrency transactions;

Accuracy:

One of the benefits of using this tool for cryptocurrency transactions is its ability to automate complex calculations with precision. By determining your tax liabilities the calculator reduces the errors that could lead to penalties or audits providing a sense of security and peace of mind.

Time Savings:

Calculating taxes manually for crypto transactions can be a time-consuming task. This calculator simplifies this process saving you time that can be allocated to other important aspects of financial planning or business operations. This time saved allows individuals and businesses to focus on decision-making instead of being overwhelmed by administrative tasks.

Compliance:

Maintaining compliance with changing tax laws and regulations is crucial in the cryptocurrency industry. This calculator serves as a tool to ensure compliance by providing accurate calculations and assisting you in meeting your crypto tax obligations. Choose platform that operates under the government rules and regulations. PlasBit is fully compliant with Polish regulations, as we are a registered company in Poland and hold a crypto exchange license issued by the Polish government's Ministry of Finance, allowing us to conduct activities in the field of virtual currencies. By adhering to the law, individuals and businesses can avoid legal issues and uphold a positive reputation within the industry.

Transparency:

Transparency plays a role in financial matters especially when it comes to cryptocurrency , which is often seen as complex and shrouded in mystery. This calculator brings transparency by outlining the factors that contribute to crypto tax obligations, such as transaction details, applicable tax rates and deductions. This transparency not only helps you gain a better understanding of your tax responsibilities but also builds trust and confidence in the taxation process.

Planning and Optimization:

With the insights provided by this crypto calculator you can make decisions to optimize your tax strategy. Whether its timing your transactions to minimize taxes or strategically claiming deductions this calculator empowers you to plan effectively.

Risk Mitigation:

Cryptocurrency markets are known for their volatility, which introduces risks for investors and traders. By providing insights into tax liabilities associated with different investment strategies this calculator helps mitigate these risks. You can make decisions about managing risk effectively and safeguarding their financial interests by understanding the tax implications of various transactions.

Record Keeping:

Maintaining records is essential for both tax compliance and financial planning purposes. This calculator can keep records of your cryptocurrency transactions making it easier when filing taxes or going through auditing processes. By having access to all transaction data and accurate calculations, you are able to efficiently address any inquiries from tax authorities and maintain comprehensive financial records for future reference.

Education:

Utilizing this tool offers individuals and businesses a chance to further their knowledge of cryptocurrency taxation. Through using the calculator and exploring various scenarios you can acquire valuable insights into tax laws, regulations and best practices. This educational experience empowers you to make decisions about their tax strategy while enhancing their overall financial literacy, within the cryptocurrency industry.

Tax Obligations for Crypto Holders

Tax responsibilities can feel overwhelming for individuals holding cryptocurrency. However it's crucial to grasp the concepts of Income Tax and Capital Gains Tax (CGT) to ensure compliance and effective financial planning.

Income Tax:

Income tax is an aspect of financial obligations that encompass various income sources, such as wages, dividends, interest and royalties. When it comes to assets like cryptocurrencies income tax implications can arise from activities like mining staking, receiving crypto-based salaries, lending assets or participating in airdrops. The taxation associated with these activities usually depends on the market value of the received assets at the time of acquisition. Many jurisdictions allow for deductions related to expenses incurred during these activities (like electricity costs for mining). It's crucial for cryptocurrency holders to understand the rules and regulations governing income tax in their jurisdiction in order to meet compliance requirements and optimize their tax positions. This knowledge allows you to manage your crypto tax obligations while maximizing your outcomes within the crypto realm.

Capital Gains Tax (CGT):

Capital gains tax applies to your profits from selling assets including assets like Bitcoinand Non-Fungible Tokens (NFTs). To calculate capital gains accurately, one must determine the differences between the selling and purchase price of the asset. In general, when it comes to cryptocurrency transactions like selling NFTs they are usually subject to crypto capital gains tax. It's crucial for individuals who hold cryptocurrencies to have an understanding of the specific tax consequences associated with these transactions. This knowledge helps in devising plans that can minimize crypto tax obligations and maximize financial benefits. PlasBit profit calculator can assist you in computing your crypto profits before calculating your crypto capital gains tax. Simply input your investment details, including the investment amount in USD, the cryptocurrency purchased, initial and final prices, and associated fees. This will provide you with a clear overview of your investment's profit or loss, total investment amount, and total exit amount. Moreover capital gains often enjoy favorable tax rates compared to regular income underscoring the significance of comprehending and effectively managing this aspect of taxation.

How Does the Taxation of Crypto Work?

When it comes to taxing cryptocurrency, the IRS generally considers assets as property or investments rather than traditional currency. This means that any transactions involving crypto whether it's selling coins or using them for purchases are subject to the tax treatment as other capital gains and losses. For individuals who hold onto their investments for a year or longer there can be significant advantages. They may qualify for lower long-term crypto capital gains taxes, which can range from 0% to 20% depending on their income level. On the other hand, if someone sells their crypto within a year of acquiring it, they may qualify for short-term crypto capital gains taxes at rates similar to regular income tax brackets. For the tax filing season, these rates range between 10% and 37% based on federal income tax bracket.

Moreover individuals who earn crypto through mining activities or collect it in exchange for goods and services may also have crypto tax obligations. In cases, the value of the received crypto is taxed at ordinary income tax rates based on its value on the day it was received. It's important to keep in mind that taxes may also apply when selling mined or received crypto at a profit in the future. Please note that this information is not intended as tax advice; consulting with a qualified accountant or tax advisor is recommended for personalized guidance regarding cryptocurrency taxation. This thorough strategy for taxing cryptocurrency guarantees that individuals and businesses are held responsible for their income and transactions related to crypto in accordance with the regulations set by the IRS.

How to Report Your Crypto Taxes?

Well, when it comes to documenting your gains or losses from buying and selling assets for the IRS there are a few steps you can take. Luckily many crypto exchanges provide transaction reports that outline all your buy, sell and exchange activities within your account. This makes the reporting process a lot easier. However, if your crypto transactions involve crypto exchanges, wallets or crypto credit cards things might get a bit more complicated. In cases you'll have to gather transaction reports from each platform or manually keep track of the transactions yourself to ensure accurate reporting.

To simplify this process using specialized tax software like CoinTracker or TokenTax can be incredibly helpful. These programs allow you to input all your transactions from different exchanges and generate comprehensive cost-basis reports that will assist you in tax reporting. While some of these services may come with a fee they offer a solution, for organizing and reporting cryptocurrency transactions. Once you've compiled all your transactions neatly and organized them properly the next step is to report them on IRS Form 8949 under "Sales and Other Dispositions of Capital Assets."This classification categorizes transactions as either term (for assets held for one year or less) or long-term (for assets held for more than one year). The resulting gains or losses are then recorded on Schedule D (Form 1040): Capital Gains and Losses as a component of your tax return.

Conclusion

This crypto calculator is valuable for financial management purposes. It functions as a tool for individuals and businesses offering calculations and streamlined processes to ensure compliance with crypto taxation regulations. By utilizing the power of this tool you can take charge of your destiny and thrive in the cryptocurrency industry.