Your transaction cannot be executed when you don't have enough BNB to cover network fees. You can deposit fiat/crypto into your PlasBit wallet, buy BNB, and transfer it to the wallet with the “stuck” BNB to pay the gas/transaction fees. Any transaction on a specific blockchain network, such as BNB, requires a 'gas/transaction' fee, paid in the network's native token. The transaction cannot be executed if you cannot cover the gas fees.

What are gas fees? How does Binance calculate gas fees?

In a blockchain context, the computational effort required to execute a transaction on the network is called 'gas .' Gas prices in the Binance network depend on several factors, e.g., congestion. When there is more demand for transaction processing in the BNB Smart Chain, miners or validators prioritize transactions based on the associated gas fee; higher fees lead to faster processing. Gas fees become a mechanism to discourage network congestion and ensure the blockchain operates smoothly.

Gas fees are used to reward block producers who validate transactions on the network; they could be considered the fuel that allows the transaction to go from point A to point B, hence the name' gas fee'. In the BNB Smart Chain, you need BNB to pay your gas fees.

The transaction sender sets the value of the gas price; it is the price per unit of work done. Realistically, the more complex the transaction, the higher the gas price should be. The gas limit is the maximum amount of work a user estimates a validator will do for a particular transaction. Multiplying the gas limit and gas price gives the total gas fee owed to the network.

Gas fees = Gas Limit X Gas Price

As you can see in the linked chart, gas fees vary widely in the Binance Network. Some of the peaks are way above an average that seldom applies. Therefore, it is entirely possible you will find yourself in a situation where you don't have enough BNB to cover network fees. A PlasBit wallet is your way out.

How to increase your BNB balance using Plasbit wallet.

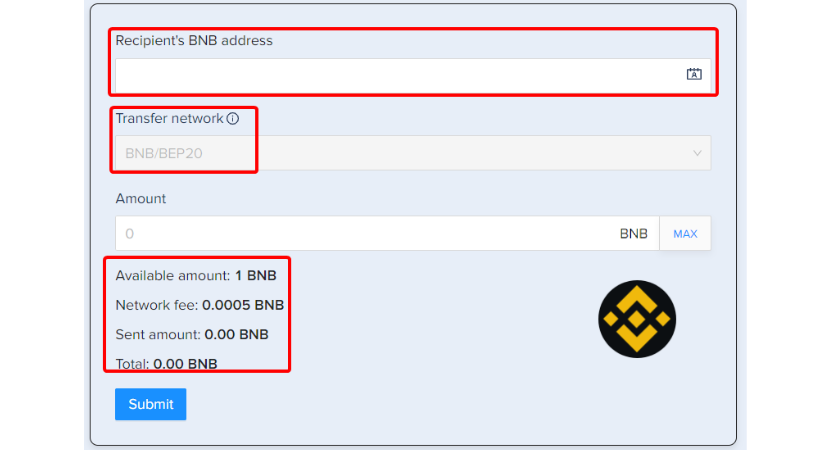

The following steps show you how to use your PlasBit wallet to increase your BNB balance when you don't have enough BNB to cover your network fees. We'll show you how you deposit money through a bank wire to your wallet and use PlasBit exchange services to buy BNB and then transfer it to another wallet:

1. Log in and go into the deposit section

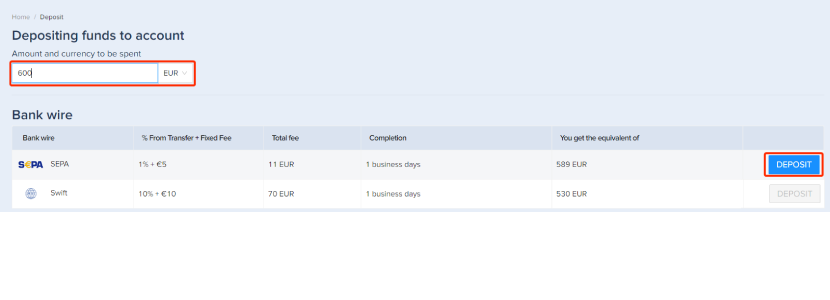

2. enter the Amount and Currency to be credited and choose to deposit fiat through bank wire. Pay attention to the fees for each method

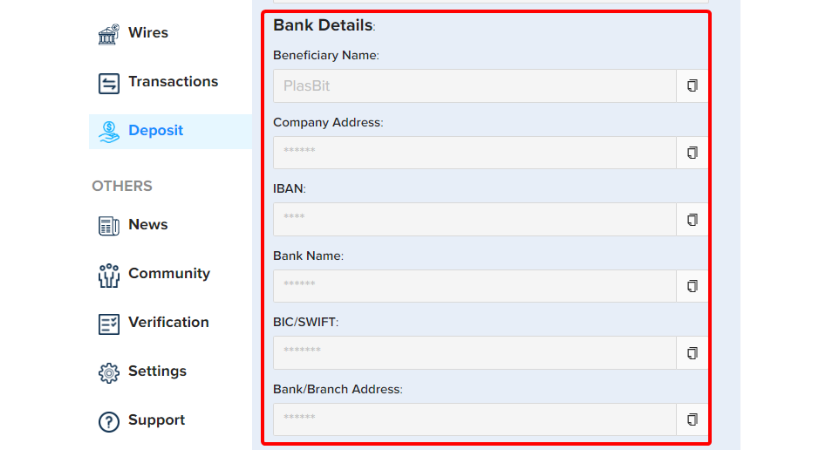

3. PlasBit's bank information is on the deposit details page. Use the given information to make a bank transfer to PlasBit.

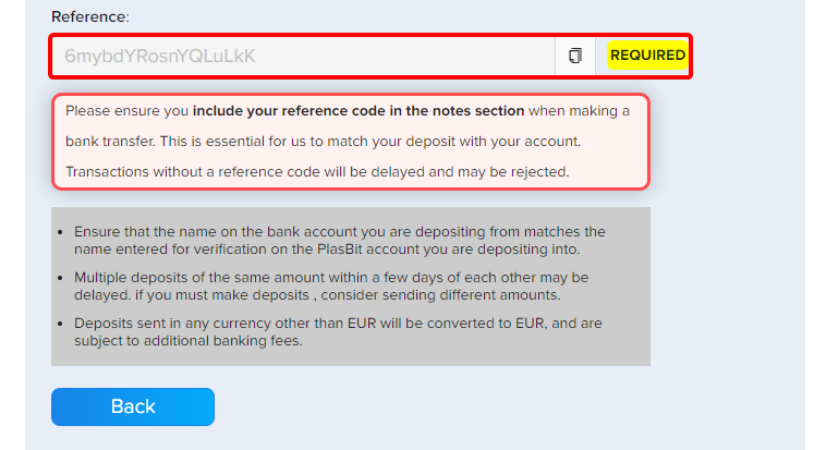

The reference code must be entered under "Notes" to help us identify your deposit with your bank account.

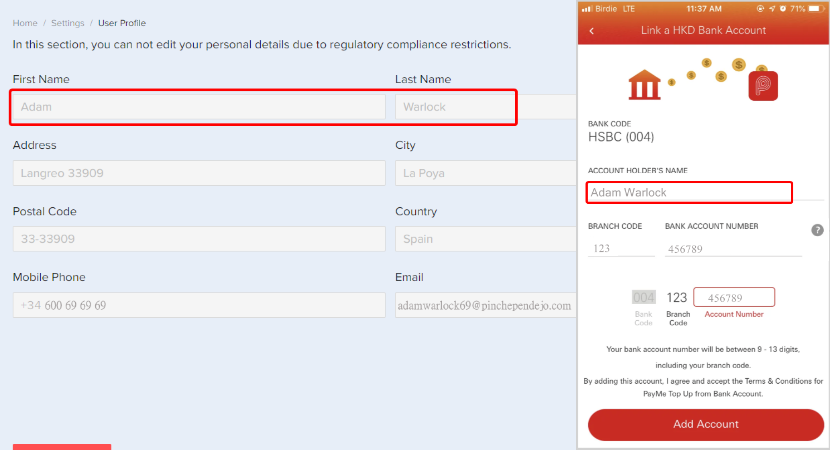

The name on the bank account from which you make the transfer must match the name registered to your PlasBit account. Trying to transfer funds from a joint account will also likely be declined.

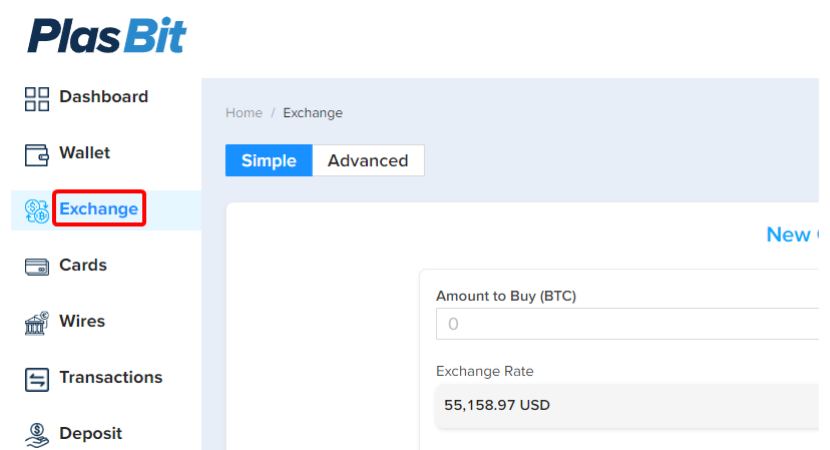

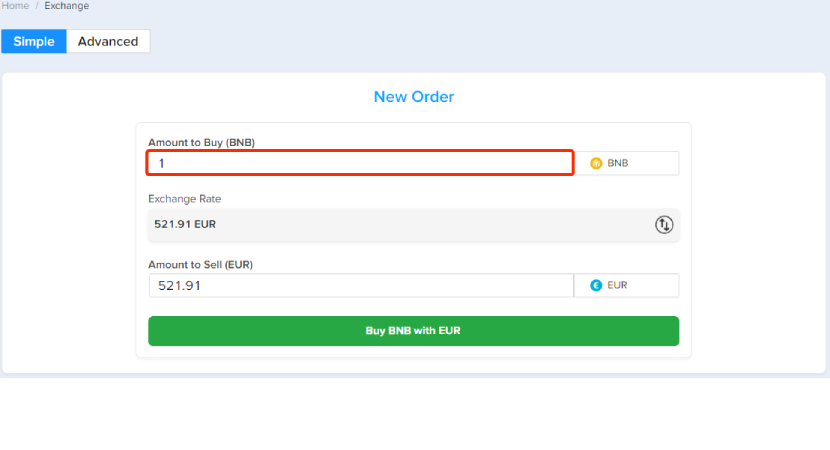

4. go to the "Exchange" section.

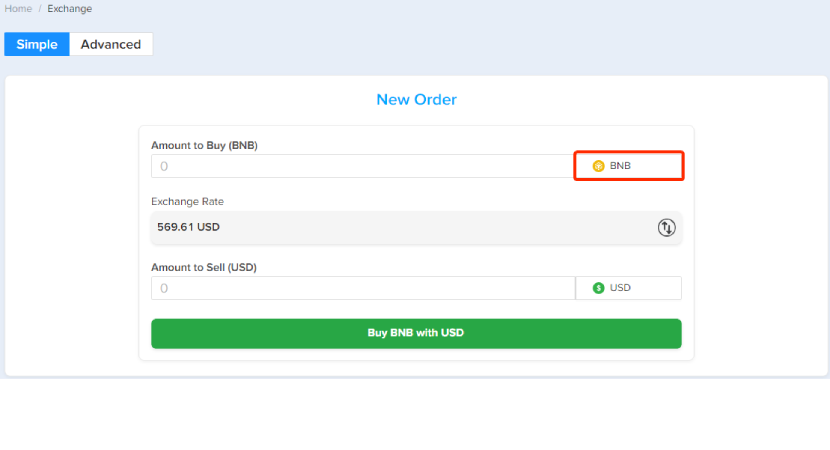

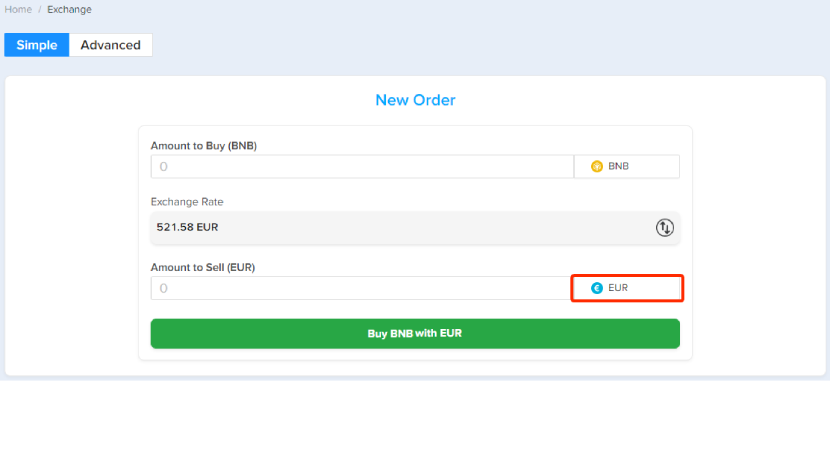

5. in the "Amount to Buy" field, Select BNB from the drop-down

6. In the "Amount to Sell" field, select the fiat currency you have chosen to deposit

7. Enter the amount you want to buy in the BNB textbox field

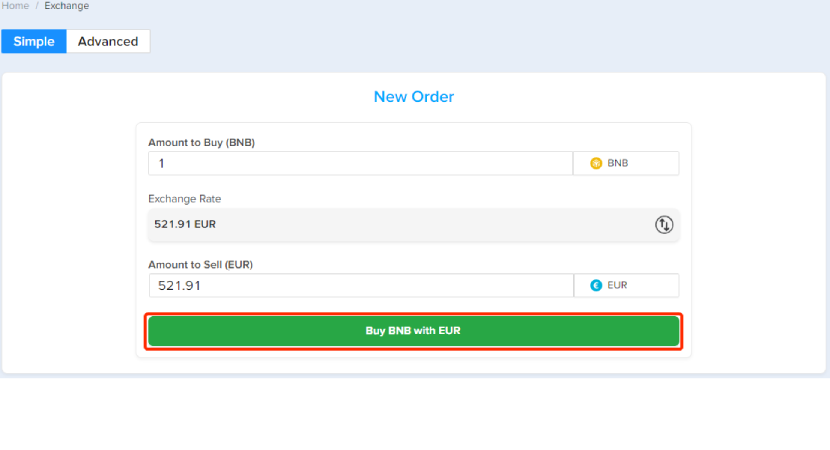

8. Click "Buy BNB with EUR"

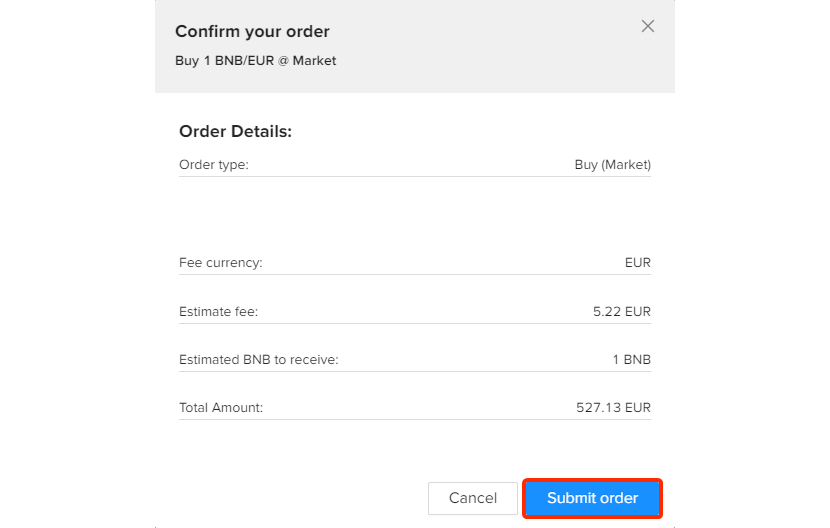

9. Confirm your order details and click "Submit order."

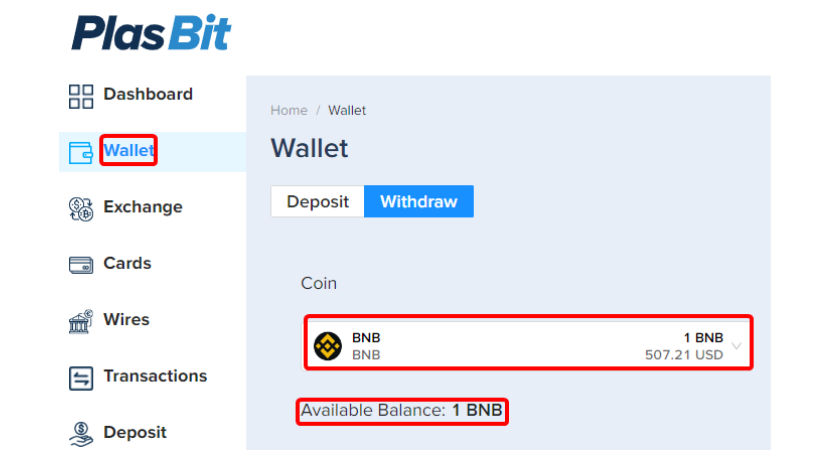

10. Once the BNB is in your wallet

11. you can transfer it to the other wallet that has the stuck coins

Layer 1 and Layer 2 Blockchains

What is a Layer 1 blockchain?

A Layer 1 (L1) blockchain is the foundational level of blockchain architecture; it is the primary and autonomous chain where transactions are directly executed and confirmed. It provides essential infrastructure for decentralized applications and smart contracts. A Layer 1 blockchain operates independently and does not rely on another blockchain for its functionality. It has it own network of nodes to validate transactions and add new blocks to the chain. Transactions are validated using consensus algorithms. A L1 blockchain remains secure, transparent, and unchangeable.

L1 Blockchains can execute smart contracts, self-executing contracts with the terms of the agreement written in the code, making a blockchain a versatile platform that can be used for applications of any type, not just simple financial transactions. L1 blockchain have a role in the broader blockchain ecosystem, because they are the underlying base to many Layer 2 solution.

Bitcoin, Ethereum, Avalanche, and Cardano are examples of Layer 1 chains. Cryptocurrencies used to pay gas fees and reward miners/validators on L1 blockchains are called coins, like BTC, ETH, ADA, and DOGE

What is a Layer 2 blockchain?

Layer 2 blockchains are 'layered' on top of a Layer 1 solution; they use the underlying layer for network and security infrastructure but have a higher level of flexibility in scaling transaction processing and network throughput, such as Polygon network layers on top of Ethereum and Lightning network layers on top of Bitcoin.

Cryptocurrencies in Layer 2 networks are called tokens, like IMX, ARB, MNT, and OP.

Layer 1 and Layer 2 scaling solutions compared

The ability to scale a blockchain network impacts the network’s ability to increase capacity and is important to the overall adoption of a cryptocurrency. Layer 1 and Layer 2 scaling solutions improve the ability to handle more transactions and help preserve the integrity of the underlying blockchain, but they do it in a different way

Layer 1 scaling solutions

There are several ways to scale a Layer 1 blockchain; the most common are:

· Increased block size – An increased block size allows more transactions to be verified and expands the overall capacity of a network. For instance, Bitcoin Cash (BCH) upgraded its block size from 1MB to 8MB, then to 32MB; the network can process more than 100 transactions per second compared to Bitcoin’s seven transactions per second.

· Updated Consensus Mechanism - The consensus mechanism of a blockchain validates transactions to ensure the accuracy and security of the network. Bitcoin uses Proof of Work (PoW) consensus. PoW requires very high processing power to record the next block in the blockchain and confirms the transactions by verifying block hashes. Ethereum started using PoW and then upgraded to Proof of State (PoS), which requires nod operators to lock up a large Ether (ETH) deposit to process transactions. It uses a sort of lottery system to award block recording to stakers, allowing the blockchain to be faster without requiring computing power to mine the next block in the chain.

· Sharding – Sharding allows a blockchain database to be broken into smaller parts to process transactions simultaneously.

Level 2 scaling solutions

There are also several types of Layer 2 scaling solutions, including:

· Rollups – Bundles of transactions can be ‘rolled up’ into a single transaction instead of being processed individually, increasing the number of transactions that can be processed. Transactions are recorded off-chain, bundled, and brought back into the main chain to process the bundle as a single entity.

· Side Chains – Independent blockchain networks with their own set of validators can process transactions in parallel. Slide chains increase the transaction-processing power of a blockchain, but you must trust the integrity of the side chain network and the integrity of the bridge network that connects it to the main blockchain.

· State Channels – Transactions are recorded in bulk off-chain. Once the state of the channel is set at ‘complete,’ the complete state is broadcasted to the main network, and the transactions are recorded in bulk on the main chain.

Risks of Layer 1 and Layer 2 scaling solutions

Some scaling solutions move transactions to an off-chain network. There is a lack of transparency, which introduces an exposure to the risk of manipulating transaction data. Also, updating the blockchain to scale may require a fork of that blockchain. Forking the code allows the scaling update to take place. However, it results in two networks running at the same time, which can confuse users and cause division among the blockchain supporters.

Last, but not least, scaling solutions are more cost-effective and very efficient, but their level of security varies. One could compare L1 chains to people trying to get into a venue; their value could be compared to the desirability of that venue. The higher the demand for entry, the higher the price of entry. Using the same metaphor, L2 currencies open new entry points to that venue; their value reflects the desirability of the venue and the desirability of their alternative point of entry.

If we continue with the same metaphor, we could say that L1 coins combine the security of the venue and the security of the entry point. L2 tokens only have the security of the alternative entry point. Layer 1 coins are more secure.

Blockchain Layers

Blockchain architecture is designed with a layered structure, layers that work together to enable the functioning of a blockchain network. They are:

· Hardware Layer – The physical infrastructure: servers, computers, storage devices, and other hardware components that are used to run nodes in the blockchain network. It is a decentralized network of nodes; different entities may operate each node.

· Data Layer – Blockchain uses a distributed ledger to record transactions. The data layer ensures that the information is tamper-proof and all the participants in the network can verify it.

· Network Layer – Nodes communicate with each other to process transactions, validate them, and share information about the state of the network. The network layer facilitates communication and connectivity between nodes in the network. Peer-to-peer (P2P) networking protocols ensure efficient and secure communication between nodes.

· Consensus Layer – Its algorithms enable nodes to agree on the state of the blockchain and validate transactions. Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), Delegated Proof of Stake (DPoS), and Practical Byzantine Fault Tolerance (PBFT).

· Application Layer – This is where decentralized applications (DApps) and smart contracts are built and executed.

The BNB project

The BNB network started as a utility token on the Binance exchange and developed into a comprehensive blockchain ecosystem.

Timeline

2017-2019

BNB was launched in 2017 as an ERC-20 token in the Ethereum blockchain to facilitate trading fee discounts on the Binance exchange. The ICO raised about $15 million with a unit price of about $0.11. In April 2019. Binance launched Binance Chain, its blockchain, migrated BNB from Ethereum to the Binance Chain, and created a decentralized exchange (Binance DEX).

2020

In September 2020, Binance Smart Chain (BSC) was introduced alongside Binance Chain. BSC is compatible with Ethereum Virtual Machine (EVM), and therefore, it facilitates the development of decentralized applications (DApps). The network uses a hybrid consensus mechanism (Proof of Staked Authority, PoSA), combining aspects of Proof of Stake (PoS) and Proof of Authority.

2022

In 2022, Binance rebranded BSC to BNB Chain, unifying the BNB chains: BNB Beacon Chain for governance and BNB Smart Chain for smart contracts. The rebranding underlined community governance thanks to BNB ownership; users were allowed to participate in the decision-making process to implement network upgrades and changes.

Future Directions

BNB Chain supports several DApps and DeFi projects. It aims to enhance interoperability with other blockchains and become even more scalable. Upgrades aim to improve speed, reduce fees, and expand developer capabilities within the BNB environment thanks to initiatives centered on user engagements and decentralization. BNB seeks to promote the broader adoption of decentralized technologies and solidify its competitive advantage in the crypto ecosystem.

Top 20 cryptocurrencies on the BNB Chain

The list below shows the diversity of the BNB blockchain applications, an ecosystem driven by low fees and fast transactions. It includes stablecoins, decentralized finance (DeFi) projects, gaming platforms, and more.

| Token Name | Ticker | Description |

|---|---|---|

| Tether | USDT | A widely used stablecoin pegged to the US dollar. |

| Binance USD | BUSD | A stablecoin backed 1:1 by the US dollar, used for trading on Binance. |

| PancakeSwap | CAKE | The leading decentralized exchange (DEX) on BSC allows users to swap tokens. |

| SafePal | SFP | A cryptocurrency wallet project providing secure asset management. |

| Venus | XVS | A money market protocol for borrowing and lending cryptocurrencies. |

| Baby DogeCoin | BabyDoge | A meme coin that has gained popularity through community engagement. |

| Swipe | SXP | A platform that enhances the usability of cryptocurrencies through debit cards. |

| CryptoBlades | KBLADE | A play-to-earn game that incorporates DeFi elements. |

| Mobox | MBOX | Combines DeFi and gaming in its ecosystem, featuring various play-to-earn games. |

| Tranchess | CHESS | A yield farming protocol that allows users to manage their investments effectively. |

Comparing BNB and Ethereum

Scalability, cost-efficiency, and user management are very important in the blockchain space. As both BNB and Ethereum continue to evolve, their relative position in the world of decentralized applications will change. The DApps world is very competitive, and any improvement in any of the three features mentioned in the paragraph will change their competitive position.

BNB Chain has more DApps than Ethereum; in early February 2024, BNB had 5,215 DApps, and Ethereum 4,497. BNB Chain had a broader user base, 5.3 Million unique active wallets (UAW) against 1.36 Million UAW.

BNB Chain has a higher scalability than Ethereum and lower transaction fees. Ethereum has a larger ecosystem of tools and libraries than BNB Chain.

The BNB Community

The BNB chain is a community-driven, open-sourced, and decentralized ecosystem; Binance CEO Changpeng Zhao likes to say BNB stands for 'Build the community, and let the community build.' Binance has allocated funds to incentivize developers of projects within the BNB ecosystem; they also support various applications (e.g., GameFi, SocialFi, and NFTs). Moreover, ownership of BNB tokens allows users to participate in governance decisions on the BNB chain.

There is also an official BNB community forum; the topics discussed at the time of writing this article were:

- BSC (BNB Smart Chain)

- OpBNB 41 (BSC Rollup layer)

- Greenfield 12 (BNB Storage Chain)

- BEP

- Security

- Operators

- MEV

- Rollups

- Bridges

- Oracles

- BC Fusion

- AA solution

- Other solutions

The official BNB community site also has several other links, such as:

- Website: https://www.bnbchain.org/en 23

- Blog: https://www.bnbchain.org/en/blog/tag/all 8

- Twitter: https://twitter.com/BNBCHAIN 3

- Discord: https://discord.gg/bnbchain 6

- Documentation: https://docs.bnbchain.org/bnb-smart-chain/overview/

- GitHub: https://github.com/bnb-chain 3

- DappBay: https://dappbay.bnbchain.org/

They are not the only sites open to discussion about the BNB chain. The community is also active on other platforms like:

· Reddit – subreddits like r/binance and r/BNB Chain.

· Several Telegram Groups facilitate real-time discussions about trading strategies, community events, and project updates.

· Medium Articles posted by community members and developers share project developments, insights, and tutorials.

· Many projects built on the BNB Chain have their own Discord servers, where developers and users can interact directly and collaborate.

· The BNB community is also active on X (formerly known as Twitter); you may have to follow relevant hashtags to stay connected with community discussion.

Investment success story

Early investors had an astronomical return on their investment. During the ICO in July 2017, BNB was sold at $0.15. When it started trading on Binance, the price was around $1.50. Four years later, in 2021, it peaked at $639. An investor who bought during the ICO and held until the peak would have had a 42,500% return. One who bought it when it started trading on Binance would have seen gains of over 42,000%.

BNB started as a utility token for discounted trading fees on Binance, but it became an integral part of the Binance ecosystem reasonably quickly, growing with Binance. Now, it is used for DeFi projects, NFT marketplaces, staking, lending, and real-world applications like travel bookings and shopping. The BNB chain has many L2 coins and tokens built on it. Some have seen impressive growth; at the time of writing this article, the Coingecko web page for the Top BNB ecosystem coin and NFTs by market cap showed the following three ‘largest gainer’ coins: WeSendit (146.4%), Oddz (56%), and Gold Fever Native Gold (31%). The two ‘largest gainer’ NFTs were Playbux Early Bird Quest (8233.3%) and Gaixe Oat (BNB) (4900%).

These are examples. As any investment prospectus has to say, investments can go up as well as down. However, the BNB ecosystem is an investment success story mainly because of its liquidity. Liquidity is the basis of a good investment; you need to be able to cash your investment when you need it. Even if you had a better return than BNB early investors, your gains are meaningless if it is complicated to cash them. The BNB ecosystem boasts coins and NFTs with high levels of liquidity

Looking at the Coingecko web page, you can see that the top four coins in their list had quite an impressive volume of trading compared to their market capitalization, as shown in the table below:

| Coin Name | Symbol | 24h Volume | Market Cap | Volume as % of Market Cap |

|---|---|---|---|---|

| BNB | BNB | $781,816,375 | $84,191,048,725 | 0.93% |

| USDC | USDC | $758,935,551 | $35,338,800,319 | 21.46% |

| Dogecoin | DOGE | $976,768,211 | $17,178,220,136 | 5.69% |

| Toncoin | TON | $302,924,775 | $14,638,679,691 | 2.07% |

In the same page, the top four NFTs by number of transactions also show a very active exchange

| NFT Name | Number of transaction in 24h |

|---|---|

| Meta Merge Pet | 133 |

| Synclub’s SNBNB Early Adopters | 38 |

| Nooties | 35 |

| Thetan Hero | 22 |

Looking at the monthly visits to the top 4 Decentralized Exchanges (DEX) in the BNB Chain, there is also a consistent perception of a highly liquid ecosystem.

| Dex Name | Monthly visit |

|---|---|

| Uniswap v3(BSC) | 7,558,445 |

| PancakeSwap v3(BSC) | 1,387,030 |

| PancakeSwap v2 | 1,387,030 |

| PancakeSwap (Stableswap) | 1,387,030 |

Challenges

BNB is a success story, but regulatory scrutiny of Binance in various countries has impacted BNB’s price and outlook. Like all other cryptocurrencies, BNB has also gone through periods of high volatility. However, BNB has kept its position as one of the top cryptocurrencies by market capitalization thanks to its resilience, and it continues to play a crucial role in the Binance ecosystem.

Trading in a highly liquid exchange

The cryptocurrency world has experienced high volatility. Trading in a highly liquid exchange has many strong points, but your transaction may be stuck because you don't have enough BNB to cover network fees. Investors can manage their BNB balances very well, but it is difficult to estimate gas fees; therefore, a transaction may not be executed. It is particularly frustrating in a highly liquid exchange in a volatile environment. Plasbit exchange services allow you to make a bank transfer to your PlasBit wallet, and convert it into BNB. You can transfer those BNBs to your Binance wallet and have enough to pay gas fees. It is a straightforward solution to unblock the transaction that was stuck because you didn’t have enough BNB to pay your gas fees.