MetaMask is a self-custodial wallet that lets you buy, sell, and trade cryptocurrencies. It can be a helpful way to store your USDT, but if you want to use it as regular money, you will need to go through a few extra steps first. Due to concerns over security, regulatory compliance, and anti-money laundering (AML) requirements, traditional banks do not process direct transfers from crypto-related companies. But PlasBit offers a simple solution to the question how to withdraw USDT from MetaMask to bank account? Transfer the USDT from your MetaMask wallet to your exchange wallet, then head to the "Wires" section, enter your bank account details, and submit a transfer request. After you submit the request, the USDT will be exchanged to your chosen currency and your bank account will be credited within the same day. Keep in mind that you must complete a full KYC (Know Your Customer) process, which includes verifying both your identity and your address before you can access our wire and banking services. Whether you want to use your USDT stored on MetaMask as fiat in your bank account for personal use or for business transactions, knowing the technical and legal details about this conversion is essential. In this article, we’ll guide you on how to make this transfer with ease.

The importance of KYC to crypto exchanges

KYC stands for Know Your Customer and refers to a set of processes that are implemented by financial organizations to identify customers’ identities in the cryptocurrency ecosystem. This is crucial to crypto exchanges as they have to comply with legal requirements and protect users from financial crimes such as money laundering and fraud. In order to avoid these financial crimes, they are required to report to the regulators about each user and its source of funds.

Other benefits for the industry include:

- Prevention of crypto fraud and money laundering: with research showing over 1 billion dollars stolen in scams, KYC helps verify users and keep criminals away

- Stay trusted: It helps the exchange detect and stop illegal activity early, keeping its reputation intact

- Reduction of legal risks: The practice enables the reduction of identity theft or identity fraud, evaluates customer risks, and verifies customer information

- Build user trust: verifying identities helps the exchange protect accounts and build trust with their customers

After completing all the KYC steps, you are only allowed to send funds to a bank account with the same name that was registered in the process. This means that if the account in the exchange is in the name of John Doe, this same account can only send funds to a bank with John Doe’s beneficiary.

How to Withdraw USDT From DeFi Wallet to Bank

With the KYC process completed, it is time to move funds from your non-custodial DeFi wallet to the bank of your choice. This is our simple solution on How to Withdraw USDT from DeFi Wallet to Bank, Transfer the USDT from your external wallet to an exchange wallet, then head to the "Wires" section, enter your bank account details, and submit a transfer request. After you submit the request, the USDT will be exchanged for your chosen currency and your bank account will be credited within the same day. By using our banking services, you can withdraw funds to your bank account without the bank flagging your transfer, as the whole process adheres to financial regulations.

This way, you can use it to transfer any crypto you have and withdraw it for any need you have.

Step-By-Step Guide

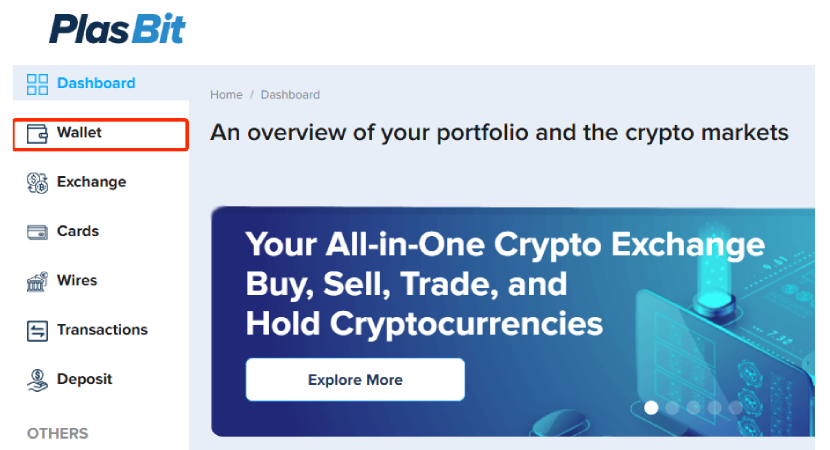

Step 1 — Log in and click on the “Wallet” tab in the upper left corner.

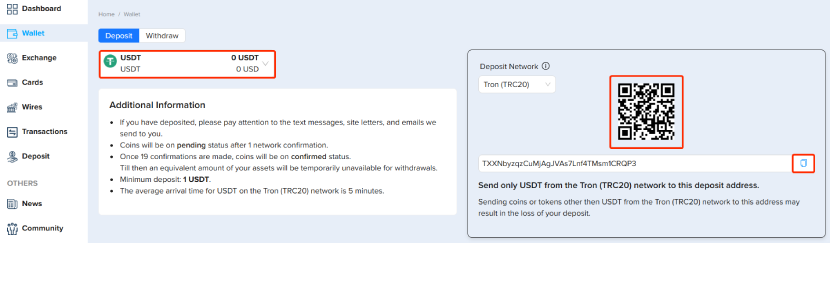

Step 2 — Deposit USDT into your wallet. You can copy the wallet address on the right or use the QR code.

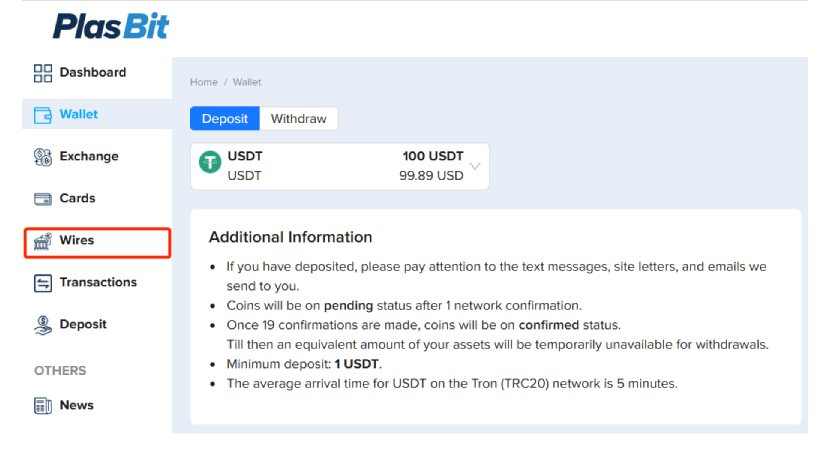

Step 3 — After the USDT has been deposited, navigate to the “Wires” tab.

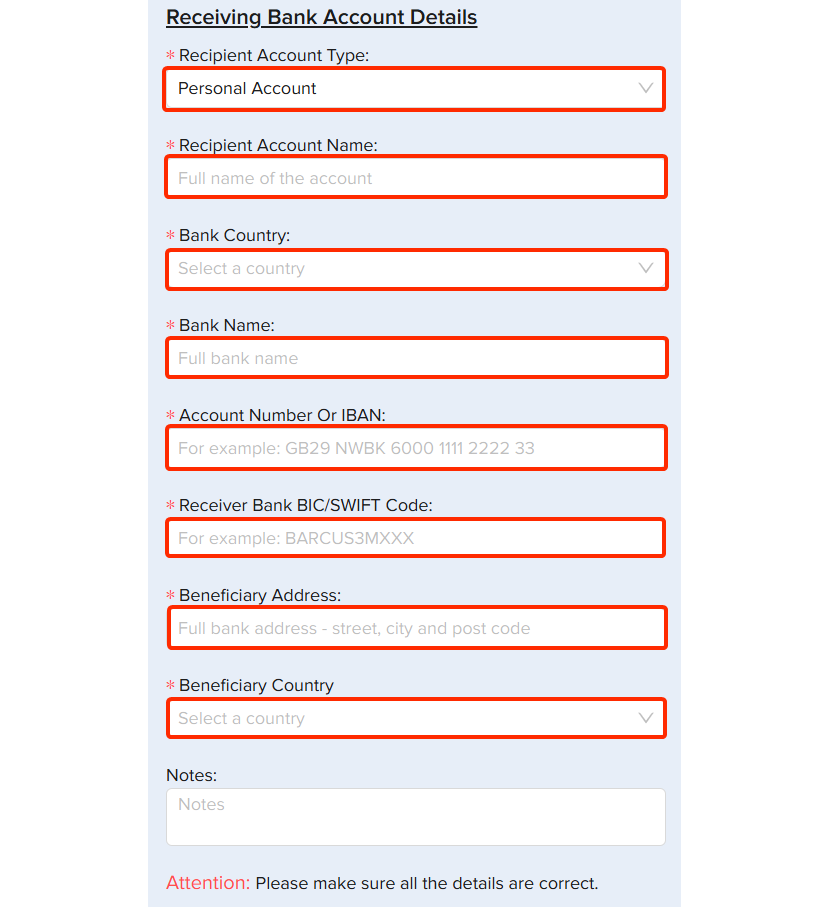

Step 4 — Next, you will need to fill in your bank details.

Note: The name of the bank account holder and the PlasBit account must be the same.

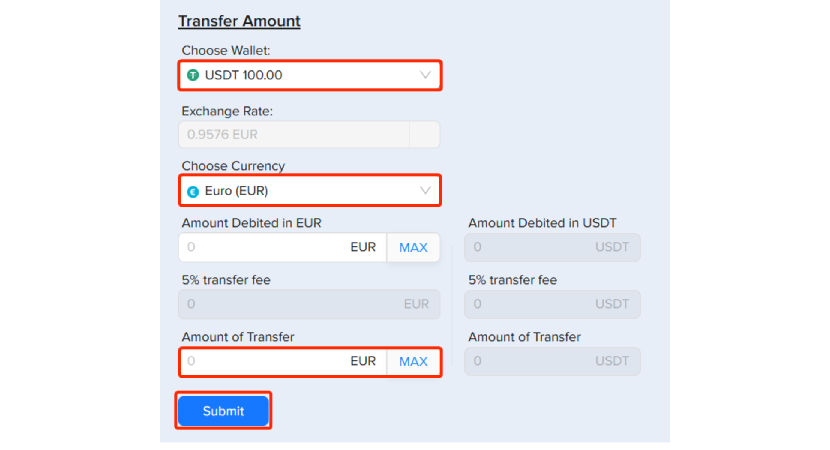

Step 5 — Fill in the transfer details. Choose the wallet where you have just deposited your USDT. Then, you can choose the currency and fill in the amount you want to receive in your bank account. Finally, just press “Submit”.

Note: To be able to do the wire transfer, you will have to complete the identity verification. If you haven’t done so, you won’t have the option to press submit.

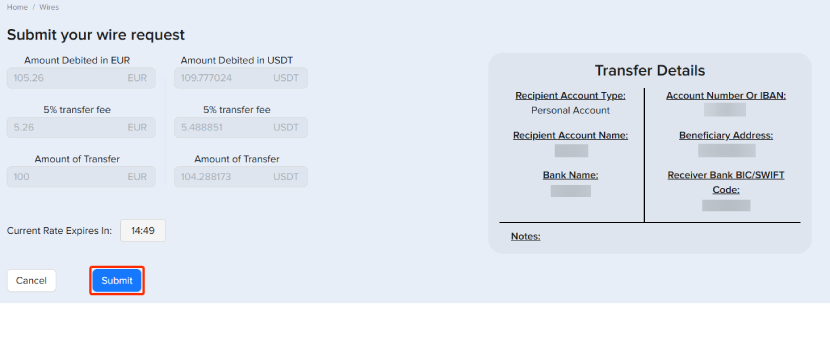

Step 6 — Carefully check all the details of the Bank Transfer and press “Submit” again.

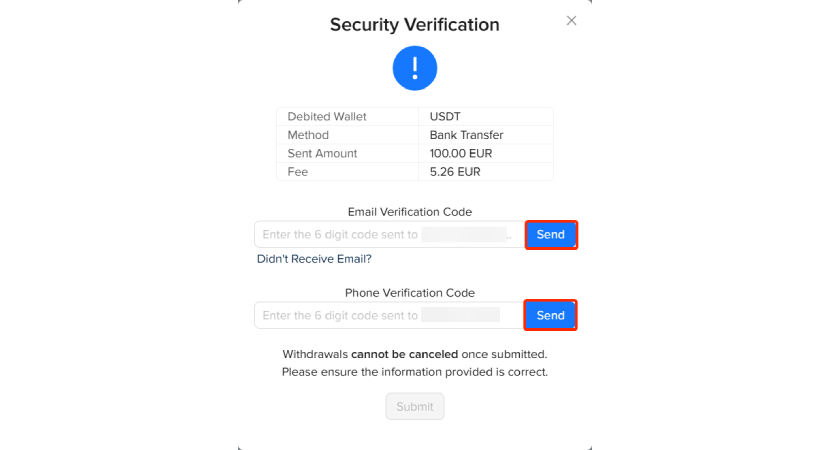

Step 7 — Now, you must go through the security verification. Press [Send] to receive verification codes on your email and phone.

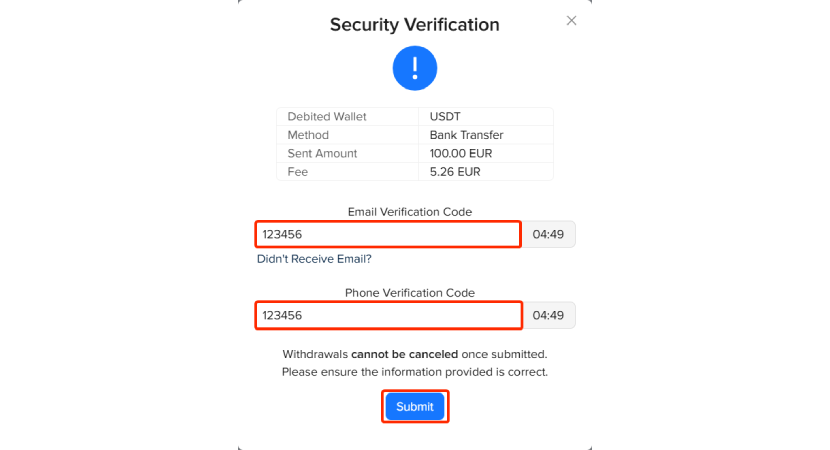

Step 8 — Copy and paste both verification codes after receiving them and click “Submit” to finish.

Note: You have 5 minutes before the codes expire.

Step 9 — After this, you will be automatically redirected to the dashboard and receive an email verifying “Wire Request Submitted.”

After we approve the request, you will receive another email, “Wire Request Approved.”

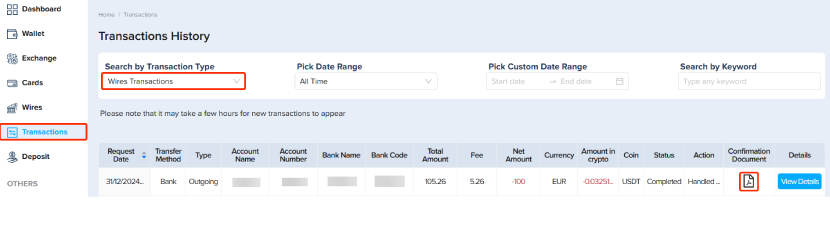

Step 10 — In the “Transactions” section, if you select “Wires transaction” from the drop-down menu, you will be able to see the status of your transfer, and after the transaction is approved, you can download the transaction details in PDF.

By following the steps of this detailed guide you should now have a clear understanding of how to withdraw USDT from MetaMask to bank account.

The Difference Between DEX and CEX

A decentralized exchange (DEX) is a type of exchange that specializes in peer-to-peer transactions of cryptocurrencies and digital assets. Unlike centralized exchanges (CEXs), DEXs do not require a trusted third party (i.e. an intermediary) to facilitate the exchange of crypto assets. Examples include Uniswap, SushiSwap, and dYdX.

How do DEXs work?

DEXs have evolved significantly since their inception in the early 2010s. One of the major breakthroughs in DEX technology came with the launch of Uniswap in 2018, which introduced the concept of Automated Market Makers (AMMs). AMMs use algorithmic protocols to match buyers and sellers without relying on an order book like traditional exchanges. Instead, liquidity is provided by users who contribute funds to liquidity pools, and in return, they receive a share of the fees generated from trades on the platform. Prior to AMMs, DEXs faced liquidity issues, and trading on these platforms was slow and often costly. However, the introduction of AMMs solved these problems by encouraging users to add funds to liquidity pools and using algorithms to ensure smooth trading experiences. Compared to the centralized one, a decentralized exchange has some pros and cons:

Advantages

- Decentralization: The absence of a central authority gives users complete control over their funds, providing greater economic freedom. DEXs do not require users to trust a third party with their assets, making them more resistant to hacks and manipulations.

- Access to New Crypto Assets: New tokens often launch first on DEXs before they are listed on CEXs. This gives early adopters the opportunity to trade newer, potentially lucrative assets without waiting for approval from a centralized exchange.

- Privacy and Anonymity: DEXs typically do not require Know Your Customer (KYC) or Anti-Money Laundering (AML) procedures, allowing users to trade anonymously. This is particularly useful for individuals who value privacy or are located in regions with underdeveloped financial systems.

- Global Access: With a lack of regulatory barriers and permissionless access, anyone with an internet connection can trade on a DEX. This is especially valuable in regions where traditional financial infrastructure is lacking, allowing underserved populations to participate in the global economy.

- Earn Passive Income: By providing liquidity to a DEX, users can earn a portion of the trading fees as passive income. Many DEXs also offer additional rewards through governance tokens, incentivizing liquidity provision.

Disadvantages

- User Interface (UI) Challenges: Navigating a DEX can be difficult for beginners. Unlike CEXs, which are designed to be user-friendly, DEXs often have complex interfaces, and transactions can fail due to various reasons such as insufficient gas fees or network congestion.

- Risk of Scams: Because anyone can add a token to a DEX, there is a high risk of encountering fraudulent or scam projects. To protect themselves, users need to conduct thorough research before trading new tokens.

- High Transaction Fees (Gas Fees): On popular blockchains like Ethereum, the gas fees associated with trading on a DEX can be significant, especially during times of high network congestion. These fees can make small trades expensive and reduce overall profitability.

- Slippage: Slippage occurs when the price of a cryptocurrency changes between the time an order is placed and when it is executed. This is more common on DEXs with lower liquidity, where large trades can result in significant price movements.

- Less Support and Tools: While DEXs offer a lot of flexibility, they also require more technical knowledge. Managing liquidity pools, for example, can be complex, and users may need more advanced tools to track and manage their investments compared to CEXs.

- Transaction Speed: Since DEX transactions are conducted on-chain, they can take longer to process compared to off-chain transactions on CEXs. Additionally, some DEXs may experience slower speeds due to network congestion or other technical limitations.

What is a CEX?

On the other hand, if you are wondering how to withdraw USDT from MetaMask to bank account, the easiest way is to go through a CEX. Centralized exchanges, like the New York Stock Exchange and the London Metal Exchange, are asset trading platforms operated by a central authority that manages the funds of their users. They offer high liquidity, fast trade execution, and user-friendly interfaces but require users to trust the exchange with their assets. In the cryptocurrency world, some of the most famous centralized exchanges are Binance, Coinbase, and Kraken. These platforms typically keep digital order books, which are lists of open buy and sell orders consisting of volumes and prices. They match up buyers and sellers and announce current market prices based on the last price an asset sells for. Unlike a DEX, a CEX has to implement KYC regulations to comply with financial authorities. Users have to trust the centralized exchange to keep full control of the private keys of their cryptocurrencies. Operating with a decentralized exchange requires a deeper knowledge of the user, as users who trade assets on the centralized counterpart can rely on the platform for security and transaction execution.

How to Withdraw USDT From Wallet to Bank

As mentioned above, with the full KYC process completed, you can move funds from any crypto wallet you have funds into the bank of your choice. This is our simple solution on how to withdraw USDT from wallet to bank: Transfer the USDT from your DeFi wallet to an exchange wallet, then head to the “Wires” section, enter your bank account details, and submit a transfer request. After you submit the request, the USDT will be exchanged to your chosen currency and your bank account will be credited within the same day.

Common Scams Related to Decentralized Exchanges

As mentioned before, although decentralized exchanges are not regulated as centralized exchanges and offer more freedom to negotiate crypto assets, these types of trading platforms also open the door to scams that have harmed many users. Here are some famous scams related to DEX and how to protect yourself from them:

1. Phishing scam - The user is led to enter a fake website that imitates a legitimate DEX and inserts their private keys, allowing the scammers access to the funds.

How to protect yourself:

- Always double-check the URL of the website you are visiting to ensure it is correct

- Use bookmarks to access your DEX rather than searching for it through Google

- Avoid clicking on links from unsolicited emails or messages

- Enable two-factor authentication (2FA) whenever possible to add an extra layer of security

2. Pump and dump - In this scheme, fraudsters promote a recently created token and artificially inflate its price by creating a buzz around it, usually through X/Twitter, Discord groups, or Telegram channels. Once the price is pumped up, the scammers “dump their bags” (sell all the coins they own all at once), crashing the price and leaving other investors with worthless tokens.

How to protect yourself:

- Avoid buying tokens that suddenly gain attention without a clear reason or fundamentals

- Research every token you might want to buy beforehand. Always check the official website, developer team, project repository activity, whitepaper, and the people around it

- Base your investment decisions on reason instead of FOMO emotions

3. Wallet Drainers - These are malicious scripts hidden within fake websites that pose as legitimate crypto projects. As soon as the user connects their wallet, the script is triggered, draining all assets from the wallet. One of the most notorious cases was Inferno Drainer, which operated as a scam-as-a-service and was responsible for stealing over US$ 80 million across more than 16,000 phishing domains.

How to protect yourself:

- Never connect your wallet to a site unless you are sure it is legitimate

- Verify Token Sources: trust only official websites for tokens and check them at CoinMarketCap.

- Be Cautious with Wallet Connections: Avoid connecting your wallet to unfamiliar sites or chasing free tokens and NFT giveaways, as these are often phishing scams.

4. Airdrop Scams - These scams exploit the widespread appeal of free tokens in the cryptocurrency market. Scammers appear as legitimate crypto projects and offer fake airdrops through social media, email, or fraudulent websites. Victims are asked to connect, provide private information, or even pay a small “processing fee”. Once the user interacts with the malicious site, the scammers may steal their funds directly or trick them into authorizing harmful transactions. Airdrop scams and wallet drainers can come together, as many fake airdrop sites use drainer scripts that activate once a wallet is connected.

How to protect yourself:

- Always verify the legitimacy of an airdrop before participating.

- When interacting with any airdrop, use a dedicated wallet with limited funds to minimize potential losses.

- Avoid sharing sensitive information, such as private keys, passwords, or seed phrases, under any circumstances.

- Use trusted browser extensions or anti-phishing tools that can help you detect and avoid malicious websites.

- Enable two-factor authentication (2FA) on your cryptocurrency accounts to add an extra layer of security.

Conclusion

Understanding how to withdraw USDT from MetaMask to bank account is essential for users who want to use their crypto funds as fiat money. By using PlasBit’s banking services, you can easily convert your tokens while keeping your transactions secure. Whether choosing to withdraw from a centralized or decentralized exchange, it is important to know the details of the whole process and be aware of scams so as not to be harmed financially.