Exchanging cryptocurrencies such as Bitcoin for fiat currency can be tricky for UK residents. So, if you are wondering how to sell Bitcoin in the United Kingdom, go to the Wallet section and deposit Bitcoin, then navigate to the Wires section, enter your receiving bank account details, and submit the wire request. You should receive the bank transfer within the same day or the day after, and there's a 5% fee for every transfer.

In this article we will walk you through the process of creating a PlasBit account step-by-step, as well as cover rules and regulations, tax, and other relevant information that UK residents might find interesting. Enjoy!

How to Use Bank Wire on Plasbit

One of the easiest and quickest ways to withdraw your Bitcoin and get the money transferred to your bank account, is by using our wire feature. This guide will answer the question of how do I sell Bitcoin in the United Kingdom.

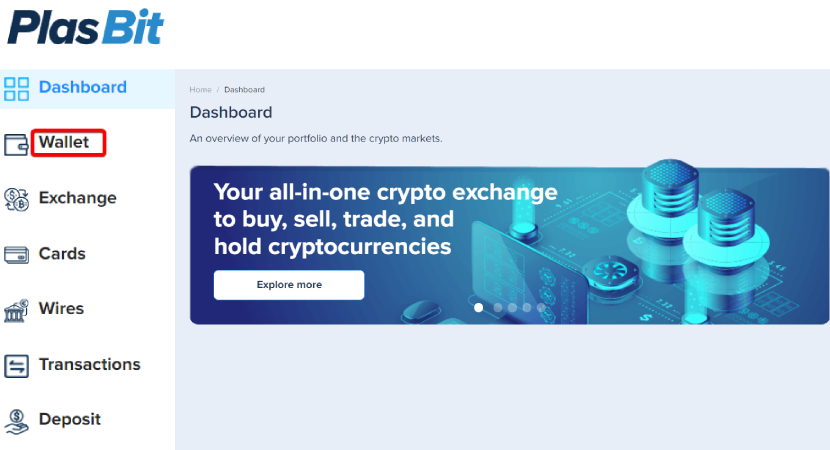

1. Log in to your account on PlasBit and click on [Wallet] on the left side.

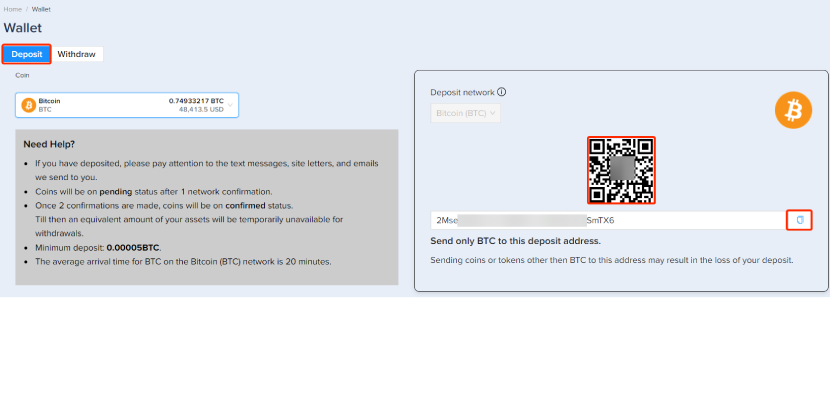

2. Next, transfer your Bitcoin to the PlasBit wallet. You can copy the wallet address, or use the QR code on the right side.

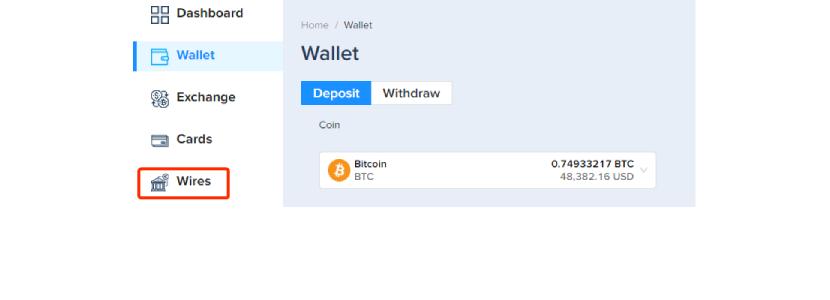

3. Once your Bitcoin has been transferred successfully, then navigate to the "Wire" section that can be found in our dashboard

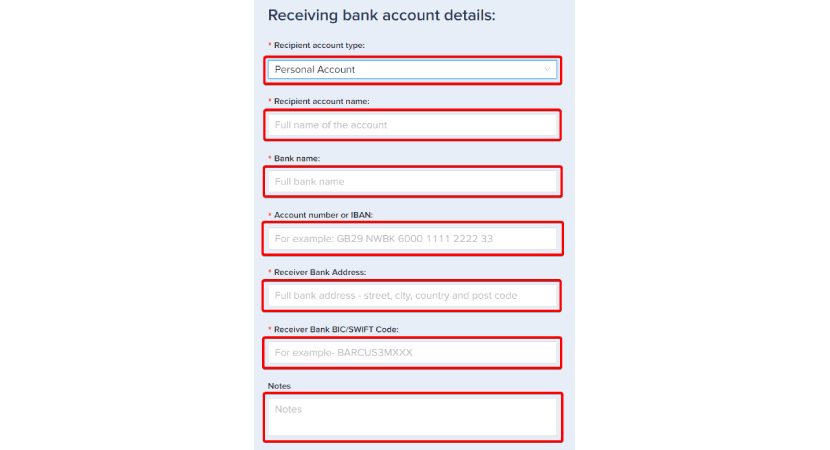

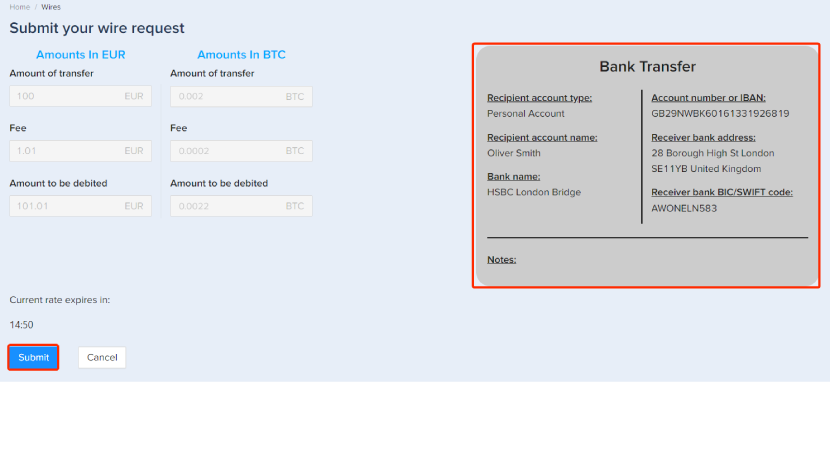

4. Enter the bank details in the fields that the wire transfer should be sent to, and double-check to make sure everything is correct. Be sure to confirm that the name of the bank account owner matches the name on your PlasBit account.

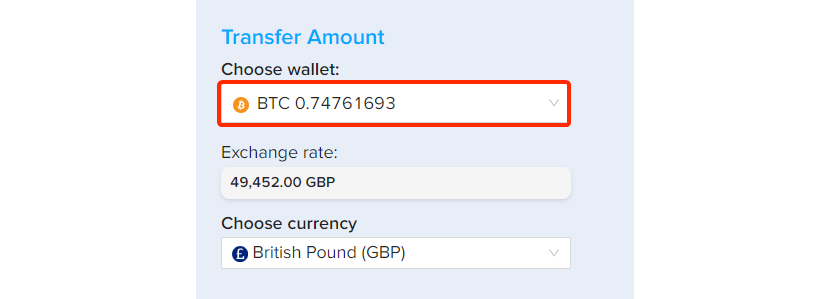

5. Next, choose the specific wallet you wish to withdraw from.

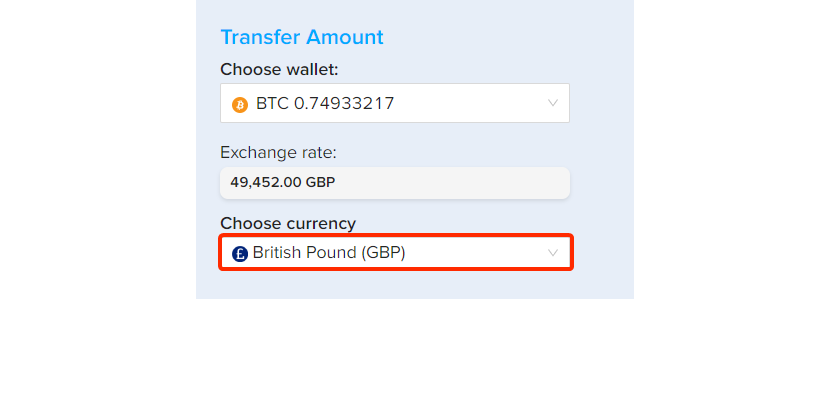

6. Now you can select British Pound (GBP) to be used for the transaction.

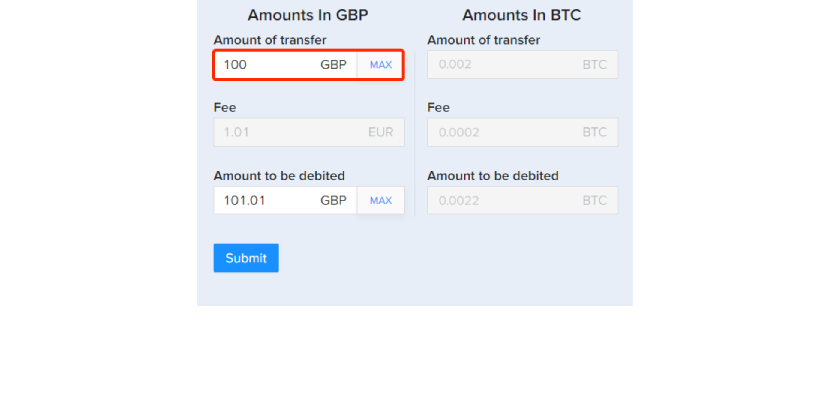

7. Now you can specify the exact amount in the chosen fiat currency. If you select "Amount of transfer", the fees for the transaction will be added automatically. This lets you choose exactly how much money ends up in your bank account.

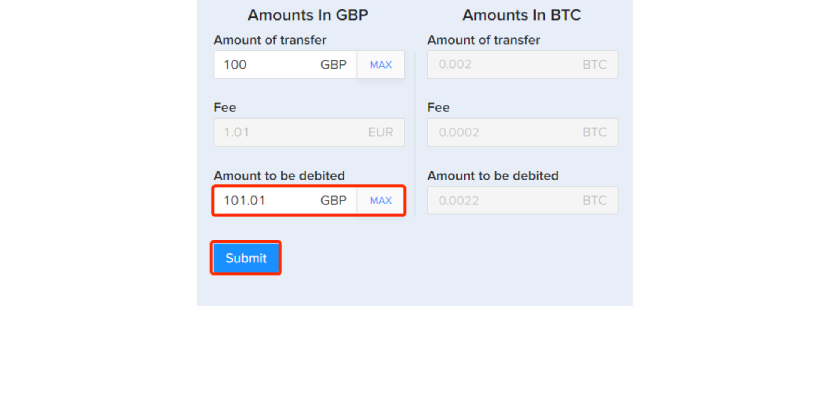

You can also enter the total amount you wish to be debited from your wallet, and we will deduct the fees if you fill in the "Amount to be debited" field. After you are done, click submit.

*Important – Please note that you must complete your identity verification first. Otherwise, you will not be able to complete the wire request.

8. Before you click submit again, please double-check that all the information is correct so that the bank transfer will go through correctly.

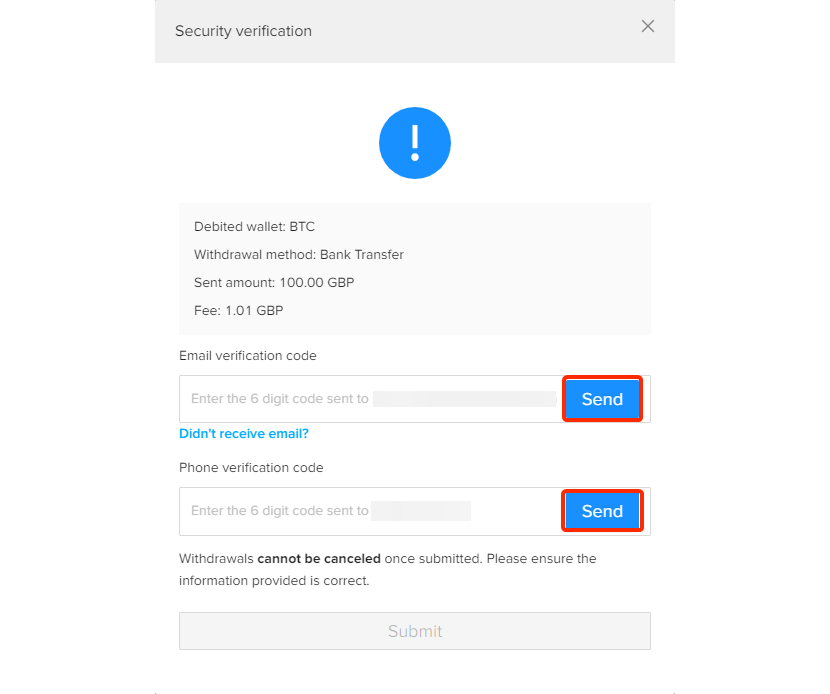

9. Before any money is transferred out of your PlasBit wallet, we will perform a verification process via email and phone, to make sure you have authorized the transfer. Click the blue [Send] buttons for both email and phone to receive the verification codes.

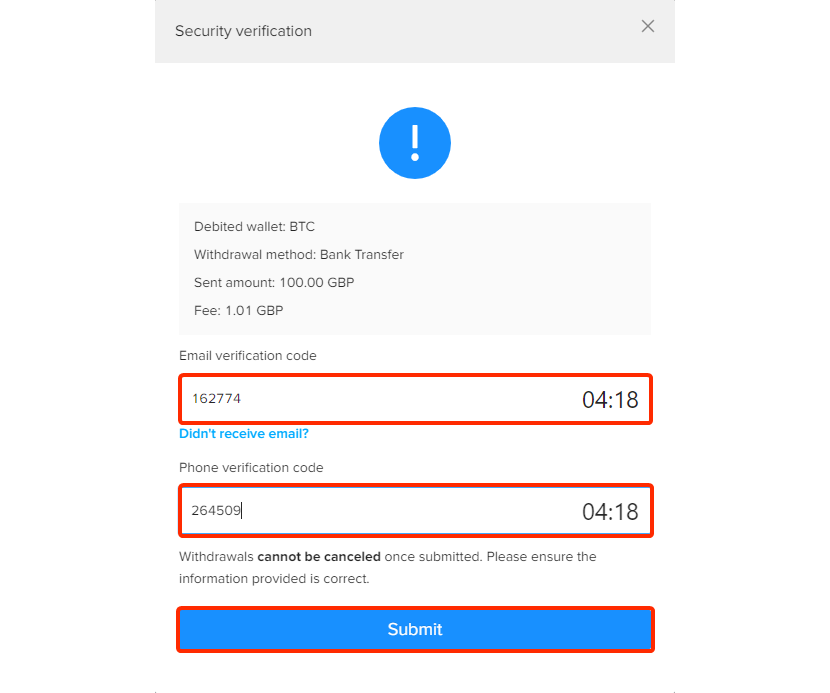

10. Once you receive these codes, fill them into the respective fields, and then click the [Submit] button. Note that you have 5 minutes from inputting the information until the codes expire.

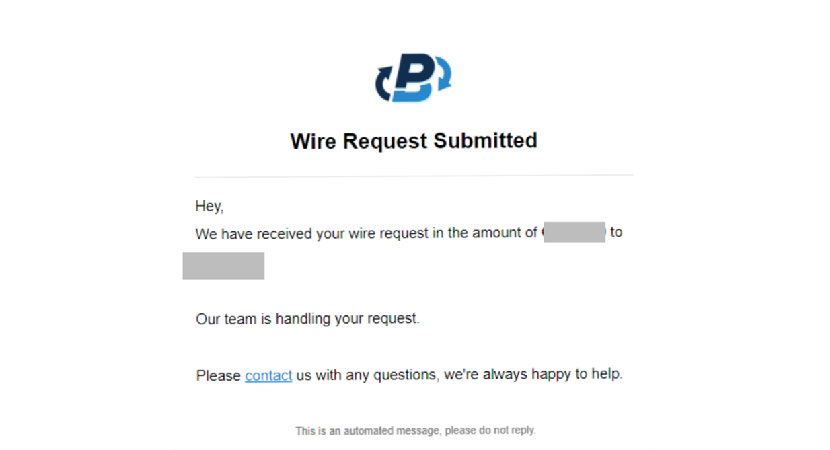

11. After submitting your bank wire transfer request, we will automatically redirect you back to your dashboard. You will also get an email confirmation of your wire request.

12. Once all the details have been confirmed and the transaction is processed, you will receive another email confirmation, stating that the wire request was approved.

Usually, our transfer completion time is between 0 to 4 business days.

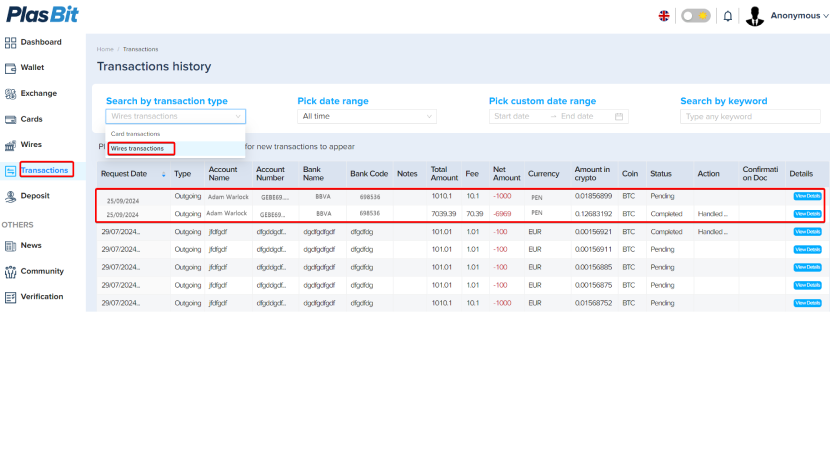

13. In order to monitor your transfer process, enter the Transactions section using the navigation menu on the left side, and then select Wires transaction from the drop-down menu. Once the transaction has been approved, you can also download the Bank wire confirmation doc for additional confirmation.

Fees, Rules & Regulations for UK Residents

In general, UK residents are required to consider taxes on cryptocurrency when buying or selling cryptocurrency for speculation or investing purposes. This means, that if you have sold your crypto for more than you paid for it, you will be subject to the capital gains tax for any profit you have made.

On the other hand, if you have incurred a net loss on your investment or speculation, you can deduct this from your capital gain taxes, meaning they can offset any other profits from the same tax period.

Tax Implications for UK Cryptocurrency Traders

For individuals that deal with large amounts of cryptocurrency on a regular basis, the HMRC can consider you a trader, and thus require your profits or losses to be taxed as income tax instead of capital gains taxes.

Reporting Cryptocurrency Income

If you are operating an online business, work as a freelancer, or in other ways get paid in cryptocurrency, you will need to report the income and pay income tax and national insurance, as with any other type of currency. But you will not be subject to capital gains tax on this type of income.

Rules for Cryptocurrency Mining

When it comes to mining cryptocurrency, the HMRC can either classify you as an individual that pursues mining as a hobby, or as a legitimate business. This classification will be based on how organized your operation is, the amount of risk involved, the scale of your operation and how commercial your setup is.

For individuals or businesses involved in mining, it is advisable to contact an accountant or lawyer, in order to figure out the correct classification, and avoid any potential issues.

Businesses that mine crypto will be considered trading profits, whereas individuals who mine crypto as a hobby will need to declare their profit under the section titled miscellaneous income on their tax returns.

Trading Cryptocurrency in the UK

Finally, individuals who are trading crypto such as Bitcoin on a daily basis can either be taxed under the laws of income tax or capital gains tax, based on the volume and value that they are trading. Typically individuals will be subject to capital gains tax unless they hit large numbers. The definitions of these categorizations can vary depending on which official department you ask, so we advise you to consult with a licensed professional if in doubt.

Crypto Communities in the United Kingdom

If you are interested in connecting with other like minded people in the UK, then there are many different communities and groups available, depending on your preferences. Whether you wish to search for answers to popular questions, such as how do I sell Bitcoin in the United Kingdom, or start a discussion about preferred implementations, there are plenty of reasons to find a community filled with crypto enthusiasts. But in order to make things easier for you, we at PlasBit have hand-picked some of our favorite groups and communities for your leisure. So let's explore them together.

CryptoMondays London

One of the larger groups for in-person meetups is known as CryptoMondays. It is a decentralized community with members from all over the world, and their London section attracts a number of interesting people from the industry, as well as other individuals with a passion for crypto. CryptoMondays London has close to 5,000 members as of writing, and a monthly meetup, where participants can listen to talks and lectures, network with investors, traders and enthusiasts, as well as discuss the latest developments with industry experts.

CryptoUK

Next on our list is a relatively new initiative, known as CryptoUK. This group is a self-regulatory trade association, with the goal of furthering the use and awareness of cryptocurrency, while also adhering to a strict policy and code of conduct. CryptoUK works closely with politicians and regulators, to develop a framework for anyone in the UK involved with cryptocurrency, making the group a vital cog in the larger scheme of things. They are representing a number of large corporations and businesses, but also work on behalf of private citizens.

BitcoinUK Reddit Group

If neither of these groups sounds like what you are looking for, then you might be more interested in a more casual community. Reddit.com hosts the subreddit r/BitcoinUK, which is comprised of more than 26,000 members. This is a great resource for asking specific questions pertaining to UK law, as well as other local enquiries. Whether you wish to learn more about Bitcoin ETFs, get tips and tricks for submitting your tax return, or just having a casual discussion about the currency, this subreddit can be an easy way to get involved without a steep barrier of entry.

The British Blockchain Association

Finally, our last entry on this list is known as the British Blockchain Association. Like CryptoUK, this is a group of serious advocates for cryptocurrencies, with ties to many large organizations and companies. They have even been in audience with the royal family, and hosts prestigious events year round.

The British Blockchain Association was established in 2017, and has since grown to be collaborating with the House of Lords, the British Embassy, the UK Parliament and even BBC News Global, resulting in an expansive network and significant influence. They work with everything from research and development, to financing and regulations, as well as provide think-tanks and case studies, while also contributing to the overall UK crypto community via their collaboration platform and public services.

The History of Bitcoin in the United Kingdom

The UK government has been officially involved with Bitcoin and cryptocurrencies for more than a decade by now. While Bitcoin saw its inception back in 2008-2009, it did take a few years until the first acknowledgement of Bitcoin was publicly announced in 2013 by the UK government.

The Shift Towards Government Acknowledgement

Up until 2013 all the dialogue and discussions were formed by individuals, as well as businesses in the UK fintech industry, and the cryptocurrency was not widely known to the public, nor was it well integrated as a payment option or investment opportunity. However, around 2013 the UK government showed a positive outlook on the concept of blockchain and Bitcoin in particular, making early adopters and investors feel more at ease exploring the relatively new phenomenon in earnest.

The Beginning of Cryptocurrency Regulation

The UK government also began a chain of events that led to several different departments beginning to explore possible legislation, and even began a series of studies pertaining to the risk and viability of Bitcoin, starting a serious and public dialogue on the topic.

It would take a number of years from this initial acknowledgement, until something concrete would take form. In the years that followed, the Financial Conduct Authority, began issuing warnings to individuals about potential risks of cryptocurrency, sparked in part by the Mt. Gox scandal that wiped many wallets of investors and speculators at the time.

This put Bitcoin and cryptocurrency as a whole into the media spotlight, where it has stayed ever since. Many individuals and fintech companies began exploring the possibilities and opportunities associated with Bitcoin in particular, leading to new startups and a massive surge in adoption.

The Crypto Assets Taskforce and Regulatory Development

In the following years, the UK government began to plan a comprehensive package for regulating cryptocurrency, starting with establishing a crypto assets taskforce in 2018, designed to evaluate the current policy. This taskforce combined the efforts of the HM Treasury, the FCA and the Bank of England.

Of particular note, they released a detailed paper, outlining the possible pros and cons of adopting Bitcoin, both for individuals and on a larger scale for companies and even public services. Since then, this paper has become an important centerpiece in the current regulations that the UK follows to this day.

The Financial Services and Markets Bill

However, it would not be until 2022 that the lower house of the British Parliament publicly announced that crypto assets should be regulated as financial instruments, similar to many other assets of a similar class. This is known as the Financial Services and Markets bill, which passed into current law in 2023. This law requires a number of similar standards to the more established Fintech industry, such as AML and KYC to name a few, and making it clear to both individuals and businesses how to consider profits for taxable income. Critics have said that the UK government has taken too long to come up with a concrete set of laws and regulations, while proponents have applauded the effort, and the fact that it seems to be a well thought out system, that takes many details into account that other governments and institutions do not.

Bitcoin Vendors in the United Kingdom

The United Kingdom has become somewhat of a hotspot when it comes to Bitcoin ownership, in particular due to the concentration of wealthy investors based in London. But no matter where you look in the UK, there are crypto enthusiasts of every level to be found. This has also led to a number of different vendors accepting Bitcoin directly as payment methods for goods and services, allowing crypto owners to purchase daily necessities without having to exchange to fiat or worry about conversion rates. There are plenty of businesses that allow Bitcoin as a form of payment, and the industries include everything from Law Firms to Home & Garden stores.

London: The Hotspot of Bitcoin Vendors

London has one of the largest concentrations of such vendors, where large and respected companies such as the law firm Sheridans is one, as well as a number of pubs and restaurants who see an increased number of patrons due to their payment options.

Some noteworthy companies include Fifth Dimension Tattoo & Piercing, Henry Electrical Services, London Speed Therapy, Multichannel Studios, Rathbone News, Rentadesk, Sawmill Cafe and Bakery, Sika Oriental Express and Your Sushi London, just to name a few. In fact, there are so many vendors accepting Bitcoin just in London alone, that we are certain you will be able to find whatever service or goods you are looking for.

Bitcoin Related News from the United Kingdom

There is no shortage on interesting news about Bitcoin and the blockchain when it comes to the United Kingdom. From adopting new technologies, highlighting new startups, or uncovering scams and fraud, the UK is filled with intrigue and potential, just like any other country heavily invested into Bitcoin.

UK Finance Trials Blockchain Ledger for $14 Trillion Transactions

One new development we'd like to focus on, is an experiment spearheaded by the Trade Group known as UK Finance. They have been trialing a blockchain ledger to be used for settlements and payments, which they hope can capture a significant portion of the more than $14 trillion worth of transactions every single year.

While it is still early days, UK Finance has seen what they call a successful experiment take place, with the Regulated Liability Network that allows for centralized bank currencies to be used as asset tokens. This could be the next step in using Bitcoin and other cryptocurrencies in unison with fiat to develop a financial backbone that makes programmable payments possible in the wider Fintech industry.

And what is more, the Regulated Liability Network already functions within the regulatory guidelines and legal framework put forth by the UK government, meaning that it meets one of the more difficult requirements already. A number of banks are potentially interested in developing this further, based on the successful initial experiment, and discussions are now taking place to finalize details and enhance the logistics of such a large project.

Bitcoin ATM Network CEO Faces Criminal Charges

In less positive news, the CEO of Gidiplus Limited, which is known for operating a network of Bitcoin ATMs are now facing criminal charges over missing registration papers. Olumide Osunkoya is named as the person in charge of Gidiplus Limited, which has been processing more than 2.5 million British pounds between 2022 and 2023.

However, it appears that these ATMs have not been operating fully legally, as the authorities suspect there might have been money laundering involved, as well as forgery due to some irregularity with the paperworks. This marks the first time a person is charged for operating ATMs without the legal authority to do so in the UK, but as of now, Olumide Osunkoya is out on bail while awaiting his court appearance. The issue stems from the company applying to become a legal ATM provider for cryptocurrency, but having their application rejected, including the following appeal, yet still operating the network of ATMs regardless of the conclusion.

Alternative Methods for Selling Bitcoin in the United Kingdom

While bank transfer is a popular method for most individuals in the United Kingdom, there are also alternatives. If you have searched for how do I sell Bitcoin in the United Kingdom and found this article, then you might be interested in other quick ways, such as using our PlasBit debit card, or one of the many Bitcoin ATMs located in the UK.

Using Bitcoin ATMs

Bitcoin ATMs are physical machines set up in various places around the United Kingdom. They typically charge around 8-12% per transaction, which can end up costing you quite a bit of money, especially if you use the service on a regular basis. The upside is that they are quite convenient, and do not require any initial setup.

Using PlasBit Debit Cards

If you do not wish to use the Bitcoin ATMs, or if you prefer to use your Bitcoin in stores that do not accept cryptocurrency directly, then we have developed our PlasBit debit cards for you. Choose between a virtual card that can be used online, or the PlasBit Plastic and PlasBit Metal cards that are physical cards, which you can use in stores accepting debit cards.

Simply load your Bitcoin onto your PlasBit wallet, then order the card you want, and then you can shop like you want. If you already have a card issued, then the load time when topping up your balance is instant. Depending on the plan you choose, you can withdraw up to $10.000 from an ATM on a daily basis, or purchase items or services up to $30.000 per day using the PlasBit metal debit card. And you can even use the PlasBit debit cards to convert into foreign currencies, check your balance in an ATM and much more.

Conclusion

Now you can see just how easy selling Bitcoin in the United Kingdom can be with our PlasBit bank wire service, or alternatively, our PlasBit debit cards, and we have also answered popular questions, such as "How do I sell Bitcoin in the United Kingdom", or "Is Bitcoin taxed in the UK". Also remember that this guide is aimed at UK citizens, but even if you are a tourist visiting, we are certain you will be able to get some valuable information from the content above. Thanks for reading!