Technological advancement has created many opportunities for investment for people all over the world. Latin America is no exception, as many countries, like El Salvador, have decided to adopt cryptocurrencies, particularly Bitcoin, as legal currency. In the case of Peru, while still not a legal currency, Bitcoin is widely used by its population, thanks to the fact that it is not legally enforced or banned. However, for people wanting to delve into Bitcoin trading in Peru, PlasBit answers the question: How do I sell Bitcoin in Peru? You can cash out your Bitcoin for Peruvian Sol using our bank wire feature. First, deposit cryptocurrencies into your PlasBit wallet, and then you can exchange them for Peruvian Sol, and the money will be sent to your bank account.

In this opportunity, let's take a quick look at how you can use our services to sell Bitcoin in Peru and the evolution of Bitcoin usage and adaptation in the country.

A Step-by-Step Guide

The bank wiring process is simple and secure. Let's now check the steps needed to carry out a bank wire.

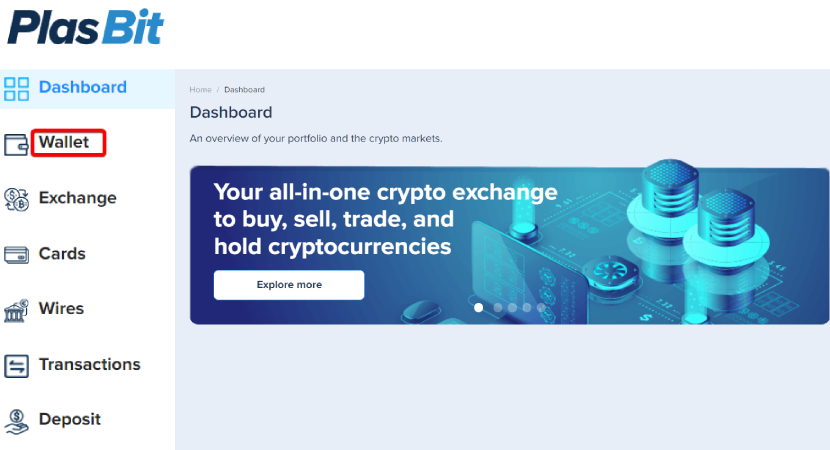

1. Log in to your PlasBit account and click on the [Wallet] tab.

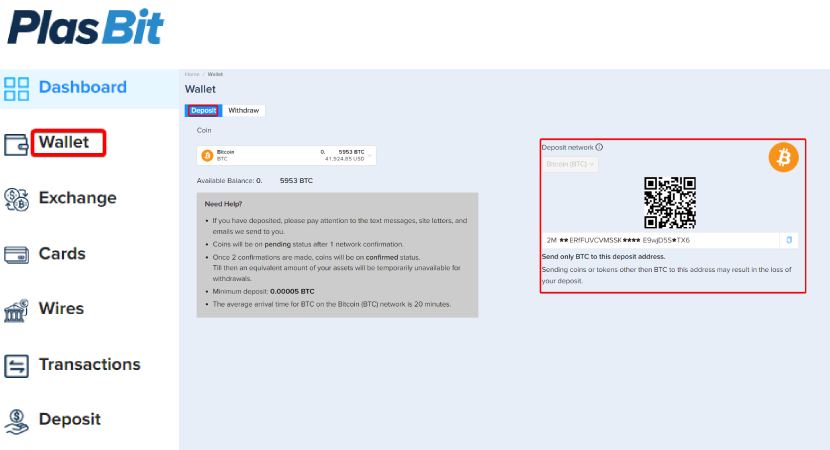

2. Deposit Bitcoin into your PlasBit wallet.

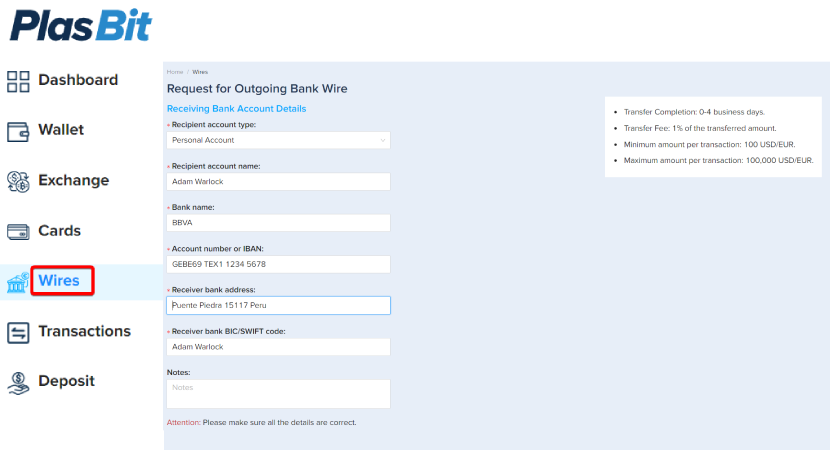

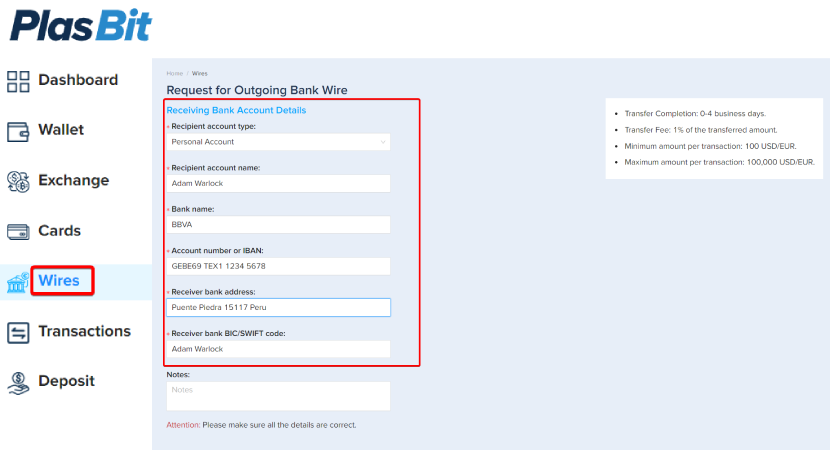

3. Once the Bitcoin has been deposited to your wallet, click on the [Wires] tab.

4. Enter your receiving bank account details. Please ensure that the name of the account matches the name of your PlasBit account.

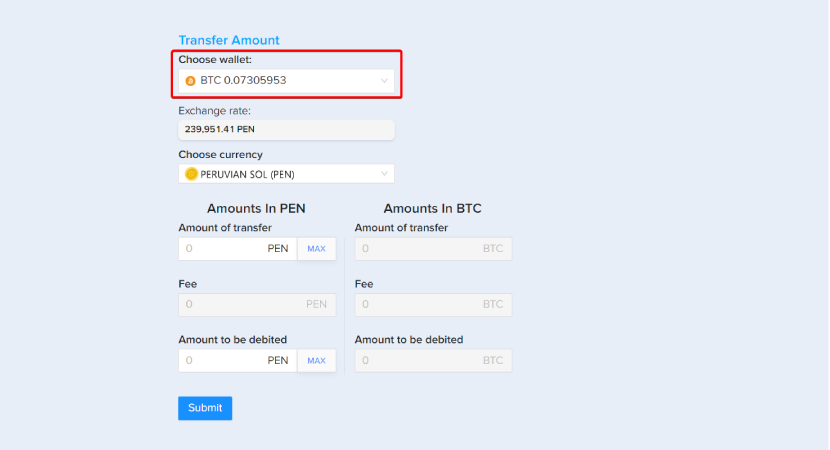

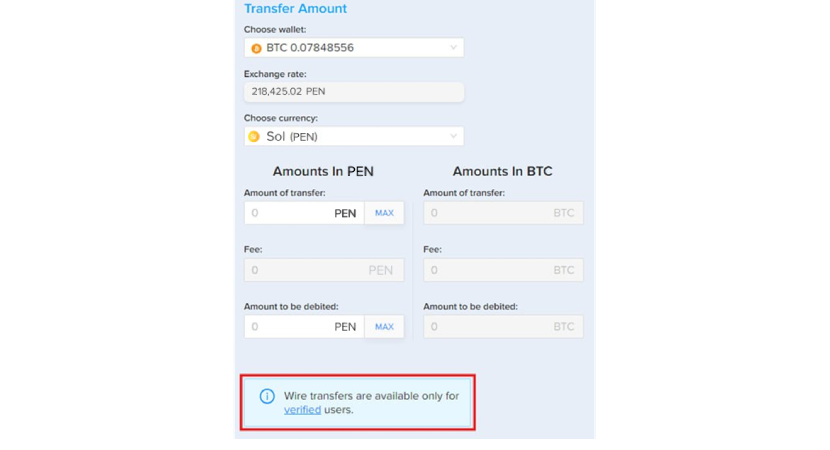

5. Choose the BTC wallet from the list of wallets.

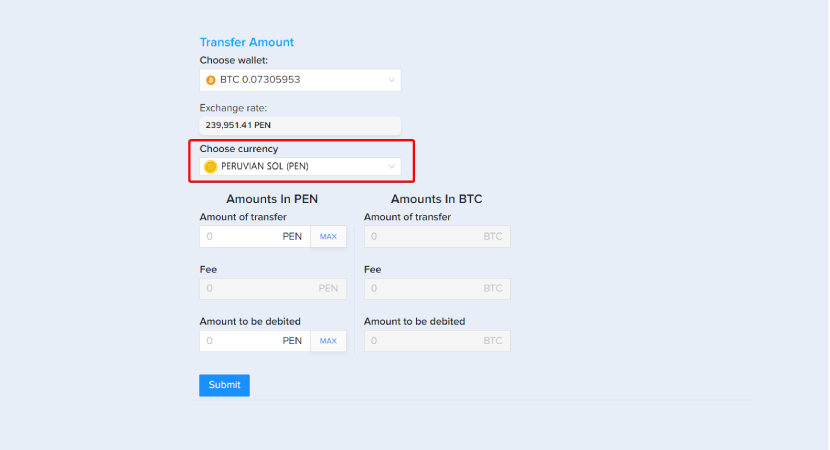

6. Select Sol (PEN) as the chosen currency.

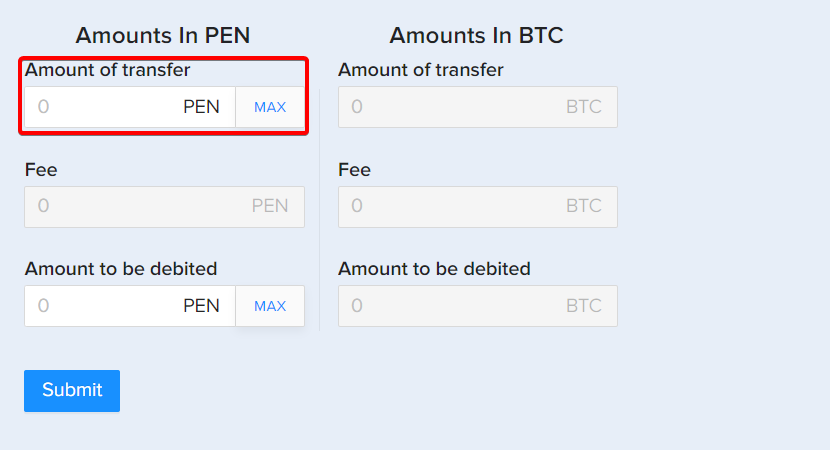

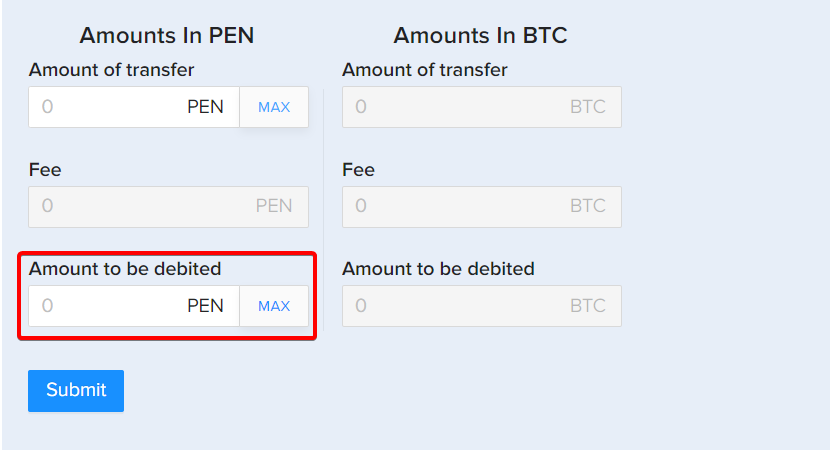

7. Fill in the amount you want to transfer to your account.

- You can enter the amount you want to transfer, and the fees will be added automatically if you fill the “Amount of transfer” field.

- You can also enter the total amount you wish to be debited from your wallet, and we will deduct the fees if you fill in the "Amount to be debited” field.

- Then, click the [Submit] button.

Important – Please note that you must complete your identity verification first. Otherwise, you will not be able to process the wire request.

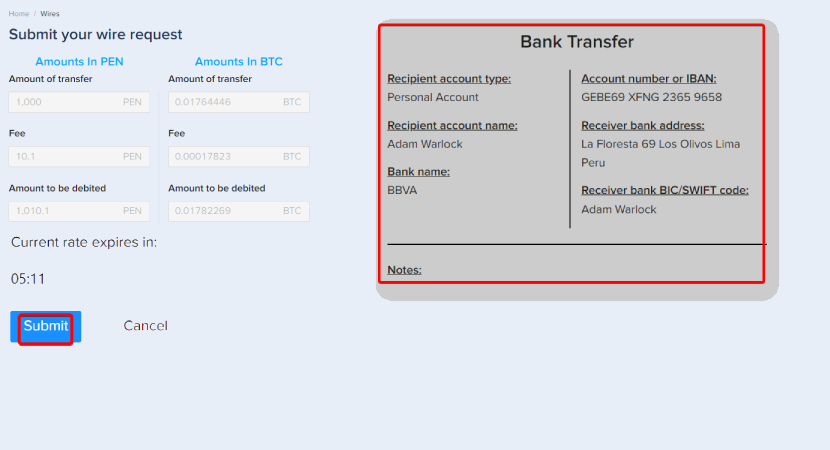

8. Go over the wire request details and make sure everything is correct, then click [Submit]

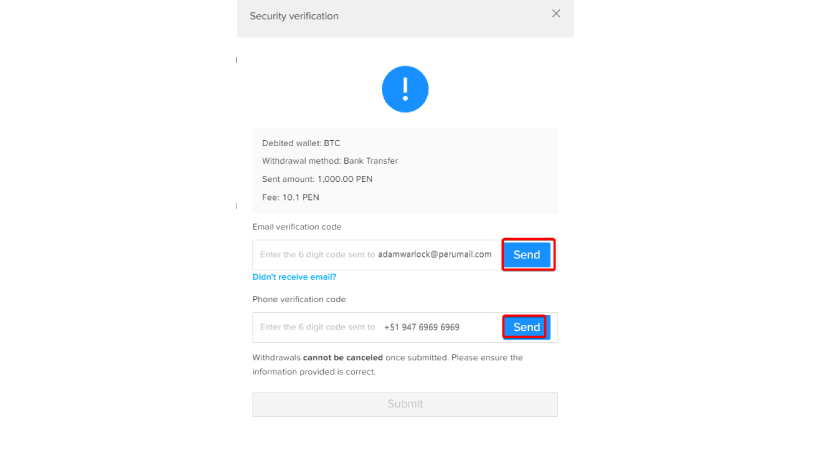

9. In the security verification section, please click the [Send] button to receive verification codes to your phone and email.

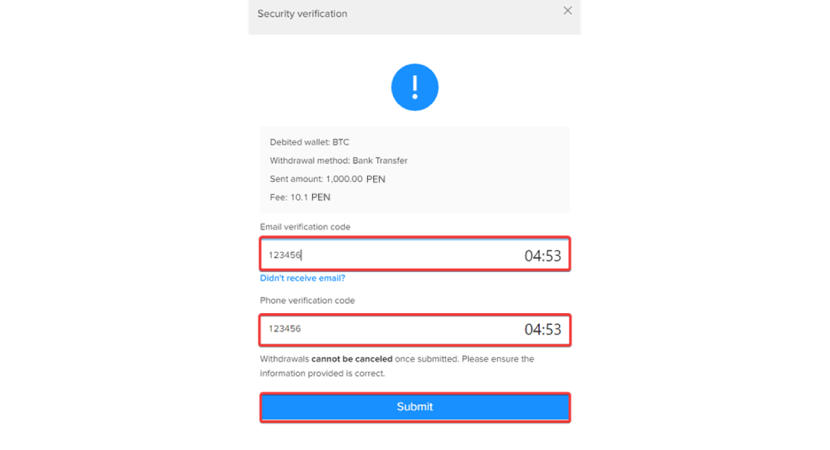

10. Input both verification codes, then click [Submit] to complete the wire transfer request.

11. You will be automatically redirected to your dashboard, and you will immediately receive an email verifying “Wire Request Submitted.”

After we approve the request from our side, you will get another email that says “Wire Request Approved”

Usually, the transfer completion time is 0-5 business days.

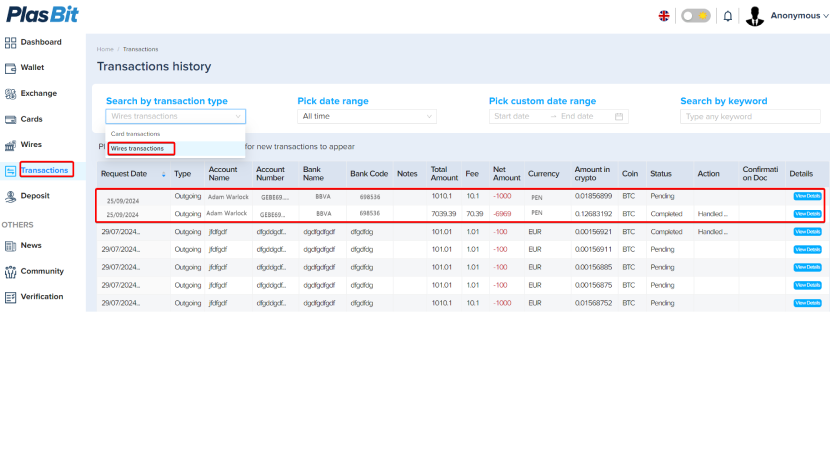

12. In order to monitor your transfer process, enter the [Transactions] section, and select [Wires transaction] from the drop-down menu. Once the transaction has been approved, you can also download the Bank wire PDF.

As you can see, the process is pretty simple, fast and secure.

Peru and Bitcoin, a Grey Area

The topic of crypto assets in Peru is still a gray area. In 2021, Peru introduced a new bill to define and regulate crypto transactions for the first time; Peru's major financial institutions do not back these digital currencies. This creates a sort of loophole: while you can buy and trade crypto in the country, the advertisement of crypto-related financial services is entirely restricted unless you are a regulated financial institution. The Peruvian government has also taken steps to prevent money laundering operations using digital assets.

Current Regulations

In February and May of the current year, the Peruvian government announced plans to use an AI-regulated framework for crypto trading. The Lima Stock Exchange added three Exchange-Traded Funds (ETF) to incentivize and diversify investment options. In May, the country's Council of Ministers released the draft of a regulation for AI promotion, highlighting the potential benefits of AI. More recently, in June, the Central Bank of Peru partnered with India's National Payments Corporation to create a system similar to their UPI. The central goal is boosting financial inclusion and enhancing payment interoperability.

Taxation Framework

According to Peruvian law, crypto assets are non-physical items that can be transferred or sold, like trademarks or copyrights. As such, they are subject to the following tax framework:

· For Peruvian companies, crypto assets are considered capital gains and are taxed at 29.5%.

· In the case of Value-Added Taxes (VAT), crypto transactions are not subject to it as they are not listed as taxable transactions.

· Financial Transaction Taxes (FTT) wouldn't apply in most cases because crypto is often transferred via digital wallets. Nonetheless, crypto cash exchanges and deposits in a local bank apply the FTT.

The Evolution of Peruvian Crypto Regulations

The first steps in Peruvian crypto adaptation and regulations were taken in 2018 when the country announced PeruCoin, a digital currency estimated to be worth 10 USD. However, the project was constantly stalled, and suspicions of being a scam were raised, causing an increase in general concern about cryptocurrencies. In December 2021, a law was drafted and introduced to regulate cryptocurrency activities in the country.

Almost two years later, in March 2023, the Central Reserve Bank of Peru published a report highlighting the benefits and risks of creating a digital currency. Four months later, in July, the government released a supreme decree declaring that crypto exchange platforms should be virtual asset service providers and requiring them to report to the Financial Intelligence Unit.

Bitcoin Adoption by the Unbanked

In Peru, many remote-located communities don't have access to regular banking options, and traditional finance services are practically nonexistent. Here, Bitcoin came into play with these communities' financial options and environment. Motiv, an NGO formed in 2019 and has been helping reliable Peruvian communities since then, has taken the initiative to teach the residents of these communities about the value of Bitcoin and its possibilities for the future.

Since late 2020, when the project began, the NGO has managed to create 16 Bitcoin-based microeconomies, in simple terms, where Bitcoin is used as the primary currency for both buying and selling. This has also improved the mindset of the people in the communities, as according to team members of the NGO, people have started to understand the actual value of Bitcoin and started thinking about saving money for future housing or even cars. People have begun to wonder how do I sell Bitcoin in Peru? Wondering how they can build on the opportunities that Bitcoin brings.

Bitcoin and the Unbanked

One of the biggest benefits of Bitcoin inflow into the country is, as mentioned before, the opportunities it presents for the unbanked communities of Peru. Currently, Peru holds one of the highest percentages of unbanked citizens in the whole world; more than 50% of its population doesn't have a bank account, meaning that the general population has no means of saving for the future, and most transactions are carried out in cash with the national currency, the Peruvian Sol. This has created financial problems in many communities because inflation has heavily affected Sol's value, lowering the general population's acquisitive power.

However, using Bitcoin and creating these microeconomies have brought stability and hopes for a financial future.

Motiv and Bitcoin Adoption

Founded by Rich Swisher and Vali Popescu, this organization helps people neglected by the Peruvian government in remote regions of the country by building schools, creating circular economies, and supporting people with different business models. While Bitcoin can bring many positive effects to communities, building people's trust in Bitcoin takes time and dedication.

This is why the NGO finds and trains community leaders to provide the help they don't receive from the government. The organization's main challenges are the people's exclusion from the country's financial systems, their lack of knowledge of Spanish thanks to their isolation and Quechua roots, illiteracy, and lack of contact and knowledge with technology, as most of them don't have access to a smartphone.

The Investment Pays Off

The process of having people understand the advantages of Bitcoin and the potential alternatives it brought to improve their living conditions was not without its own challenges. It has taken a long investment of time and patience from the President and his collaborators to make people trust Bitcoin and abandon their cultural beliefs. For example, women's position in the economy was one of the biggest obstacles to overcome during the process. In Quechua culture, the woman's role was relegated only to house chores, such as taking care of the children, cooking, etc.

Yet, this investment proved to be worthwhile. After years of patience and work, various business models were adapted to the different regions, such as tutoring or cooking sessions for children, drinking water treatment plants, cultural businesses like traditional clothing and food, and learning opportunities such as different language courses.

The Role of Bitcoin

Bitcoin is the cornerstone of this process, as it is the primary means of payment in circular economies, and the role of Motiv in this process is teaching how to use it correctly. The community leaders trained by Motiv volunteers helped promote the emancipation and empowerment of women in the communities, paving the way for prosperity and changing the communities for the better. Nowadays, Peru has one of the highest percentages of population interest in Bitcoin and cryptocurrency in general, as close to 60% of the population have expressed curiosity in Bitcoin investment or are already investing in it.

Examples of Growth

As mentioned, adopting Bitcoin has helped many remote communities in Peru improve their financial situation. Let's look at some regions where Bitcoin has helped the local population improve.

Quebrada Verde

In this region, Motiv has helped change the people's mentality, awakening their entrepreneurial spirit by showing everyone that it is possible to create value and earn money with Bitcoin. A perfect example is Sandra, who managed to set up a bakery and currently sells goods worth around 38,000 USD when writing this article. Additionally, tutoring courses for children have been created to incentivize and teach the cultivation of regional crops.

The catalyst that has made all of this possible is Bitcoin, on one side financing agricultural technology, and on the other, as a payment method for all products and services.

Barrio Florido, Iquitos

Barrio Florido is a district of Iquitos, one of the few cities in the world that cannot be reached by road, only by plane or boat. This district doesn't have any ATMs or banks, so every transaction is carried out face-to-face, and Bitcoin has now become a permanent means of payment. In Barrio Florido, the preferred payment methods are not Peruvian Soles or gold; it's Bitcoin.

This digital asset has helped people in their region overcome the negative cycle of poverty, lower education levels, drinking water problems, corruption, child labor, violent crimes, and different kinds of addiction. Bitcoin has given this community the opportunity for independence and personal responsibility; it has given them freedom.

Juan Guerra

This remote region in the Amazon jungle has suffered neglect from the government. Different foods are grown in this region and sold to Tarapoto city in northeastern Peru. Yet the government prefers to support more extensive projects, which has created difficult situations in Juan Guerra. In particular, the drinking water supply in the region is inferior. But where the government failed, Bitcoin and Motiv delivered. The NGO set up a water treatment plant along with a recycling system. The plant extracts water from the nearby rivers, which is then treated and made drinkable, then it is delivered to the different houses in the region, and the people pay for it with Bitcoin. The lack of banks or ATMs has been overcome with smartphone usage. A favorable situation was created with the help of Bitcoin.

Ohuay and Huayllapata

Bitcoin has also left its mark in these two small Quechua communities in the mountainous range of the Andes. Equipped with satellite Internet, a group of women have put their faith in the manufacturing and selling clothes. These women are paid in Bitcoin and spend it on food, shoes for their children, and medicine. According to Motiv, this support has dramatically reduced the mortality rate of children in the region, which was initially the organization's primary goal.

The Dangers of Crypto Scams in Peru

While it is true that Bitcoin has helped many communities in Peru improve their way of life, it is also true that there are many cyber criminals on the lookout for potential victims. Crypto scams are common in the country, and we can find several strategies thieves employ to deceive people who wonder, How do I sell Bitcoin in Peru? Let's look at one of the latest cases of a crypto Ponzi scheme in the country.

A Scam in Stages

Close to 200 people have lost thousands of Soles after being victims of a criminal group that asks for money deposits in a crypto exchange platform with the promise of huge profits and then refuses to return the money. According to reports, an alleged company first offers victims the opportunity for a higher income level if they accomplish a series of tasks. The first tasks were simple, like subscribing to YouTube channels, and the last ones were dedicated to buying and selling cryptocurrencies. This strategy is a slow way of gaining their victim’s trust in the first few weeks.

Initially, the victim receives a message with a proposal and small missions in exchange for money, such as subscribing to YouTube channels or interacting with posts to generate support on social media profiles. By accomplishing these small tasks, the victims start receiving their first payments. After a while, the tasks turn into depositing a certain amount of money in a crypto exchange platform. Nonetheless, the amount that needs to be deposited to continue the business constantly grows, reaching the point where the victim cannot pay anymore.

At that moment, the scammer tells the victim they won't receive their investment back.

The Scheme

After some investigations by the authorities, it was found that Telegram was the primary weapon used by scammers. They would contact their potential victims with a quick, direct message on Telegram and then make them join a Telegram group where they could follow up on their activities. When the victim received any money, it came from another victim who also made a deposit. Scammers play around with their victims' money to gain the trust of other victims, creating a vicious cycle of fake trust and deception. This scam became so sophisticated that scammers had an online platform where users could see how their crypto investment grew in real-time.

The Story of July Jacay

July, one of the reported scam victims, told in an interview that she allegedly received 18 Soles for subscribing to different YouTube profiles on the first day to make them grow. But after passing the first four stages, everything changed. She was told that to continue the business, she would have to make payments. They told her that the 5th task would need a deposit of 88 Soles, which would then be transferred to a crypto storage platform. After that, she would receive 121 Soles in her bank account.

July deposited it into an Interbank account, and then her handler, Jessica, sent her a link to check the cryptocurrency she had accumulated. However, the amount of money she had to deposit grew progressively, and on task 15, she had to deposit 6000 Soles. She asked her friends and family members for extra cash to make the deposit. Yet once the deposit was done, the handlers told her there was an error in the process, and the deposit didn't go through, so she would have to deposit another 6000.

She tried to withdraw her money from the crypto platform, but the web page told her it was impossible because her credit score was insufficient. They told her that to withdraw the money, she would have to deposit 10,000 more. She didn't accept and decided to go to the police. July has lost 13,800 Soles in supposed crypto, which she can't withdraw. That's why she decided to go to the Department of Criminal Investigations of Cajamarca to make a scam report. The authorities promised her they would do everything possible to find these scammers, as July lost virtually all her money in her bank account.

Millions Lost to Scammers

According to reports, victims of this kind of scam can transfer up to 30,000 Soles in the hopes of making it big. By August 2023, over 81 cases were reported. Yet these were not isolated cases but groups of victims. Each case had around 20 to 30 victims. Just in the capital city of Lima, the losses go up to almost one million three hundred thousand Soles.

More Options for You

While we have provided some tools for Bitcoin trading, they are far from the only tools available to both veteran and beginner investors. Let's look at some of the other options available for crypto trading in Peru.

Bitcoin ATMs

It might surprise some to learn that Bitcoin has its ATMs, yet here we are. These kinds of ATMs allow people to purchase Bitcoin or other cryptocurrencies by using cash or debit cards. Some of them offer bidirectional functionality, allowing for both purchases and sales of Bitcoin for cash. Bitcoin ATMs are entirely secure, but you must always be on the lookout for scammers, as they tend to use them as tools to scam their victims. A watchful eye and a little research will go a long way in protecting your digital assets.

PlasBit Debit Card

Besides our bank wiring options, we offer all our users the option of acquiring a PlasBit debit card. This allows our users to pay in local currency worldwide using their cryptocurrencies. To better protect your digital assets, we offer you the option of locking or unlocking your debit card instantly and controlling your expenses.

Conclusion

As we have seen, including Bitcoin in the Peruvian economy has helped many communities improve their lifestyles and hope for a better future. While crypto regulation in Peru is still a long way off, the correct steps are being taken by the government to try and adopt cryptocurrencies, particularly Bitcoin, as part of their economy. Also, crypto scams are a current problem in the country. Nevertheless, the Peruvian authorities are doing all they can to protect present and potential victims. In the case of PlasBit, we offer all of our services to Peru users who wonder how do I sell Bitcoin in Peru, as it is possible by using our wiring and card services.