Back in 2020, PayPal was one of the first major companies to embrace Bitcoin and the crypto industry, bringing it into the mainstream. This allowed PayPal users to buy, hold, and use Bitcoin while the price was still under $10,000 per BTC. Fast forward to 2025, and most merchants still do not accept Bitcoin as a direct payment method. Instead, they remain reliant on traditional options like credit cards, bank wires, and PayPal. For Bitcoin holders looking to spend their crypto with businesses that only accept PayPal, one solution is to exchange Bitcoin for a PayPal balance. This allows you to bypass the limitation of merchants not accepting Bitcoin directly while still making purchases seamlessly. If you’re looking to what is the easiest way to exchange Bitcoin for Paypal? You can deposit bitcoin to your wallet, go to the wire s section, enter your PayPal account details and submit a request, and your PayPal balance will be credited within minutes. We will provide a practical step by step guide on how to exchange Bitcoin for PayPal balance, ensuring you can complete the process easily and efficiently.

Using Bitcoin to Pay via PayPal

Let’s say you want to buy a fridge from an online electronics website, but there’s a problem, the website doesn’t accept Bitcoin directly but they do accept PayPal. To bypass it, you log into your exchange account, deposit Bitcoin, and exchange it for a PayPal balance. Once the funds appear in your PayPal account, you can connect your PayPal account and complete the purchase on the electronics website using PayPal. The merchant receives their payment as usual, completely unaware that you initially used Bitcoin. This is just one of many ways to utilize Bitcoin to purchase stuff in the real world through PayPal. As long as the business accepts PayPal, you have an easy and effective way to spend your crypto.

Step-by-Step Guide: How to Exchange Bitcoin for PayPal Balance

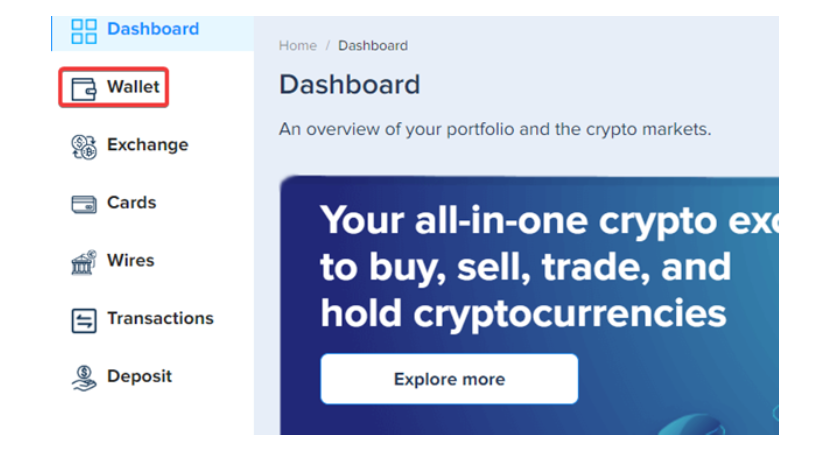

1. Head to the [Wallet] tab on your dashboard.

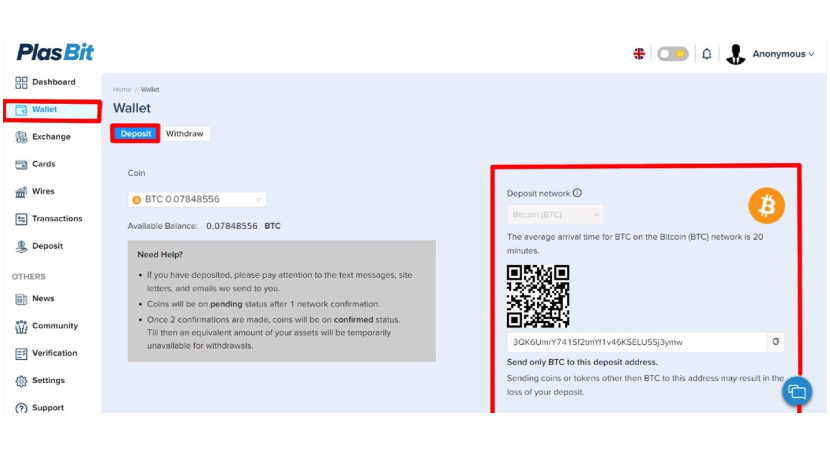

2. Deposit Bitcoin into your PlasBit wallet.

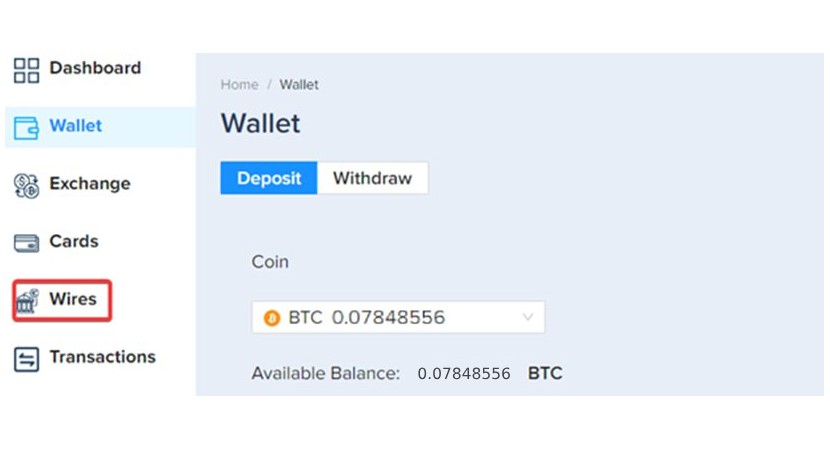

3. Once the Bitcoin has been deposited to your wallet, click on the [Wires] tab.

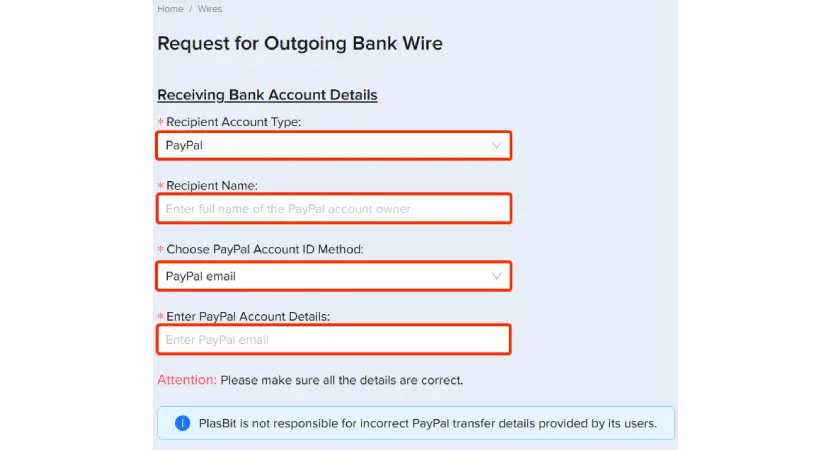

4. Choose the option to receive via PayPal and fill in your PayPal account details.

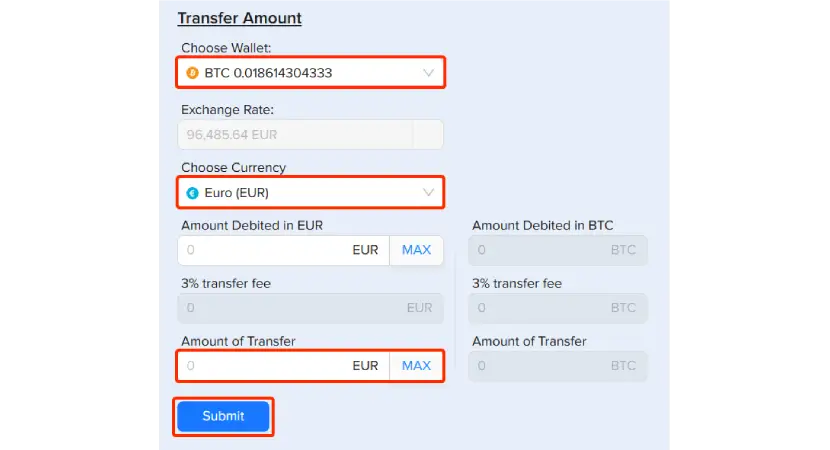

5. Choose to charge the BTC wallet and select the currency you wish to receive.

Fill in the amount you want to transfer to your account, and the fees will be automatically calculated for you.

* Important – Please note that you must enable two-factor verification first, otherwise you will not be able to process the wire request.

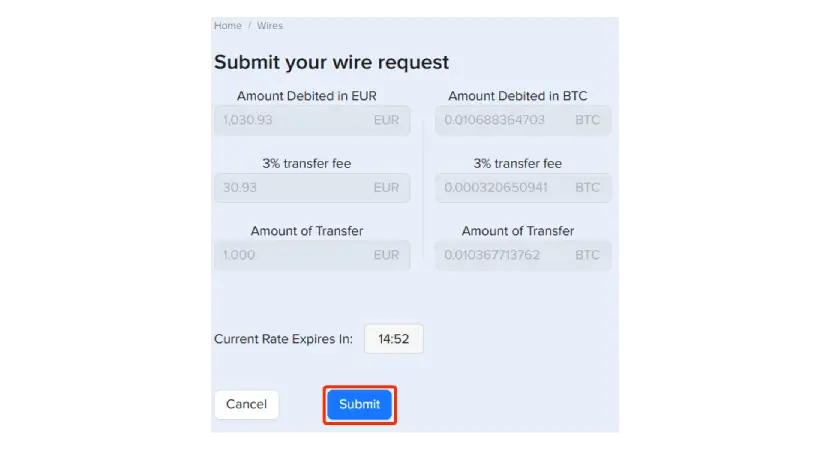

6. Go over the request details and make sure everything is correct, then click [Submit]

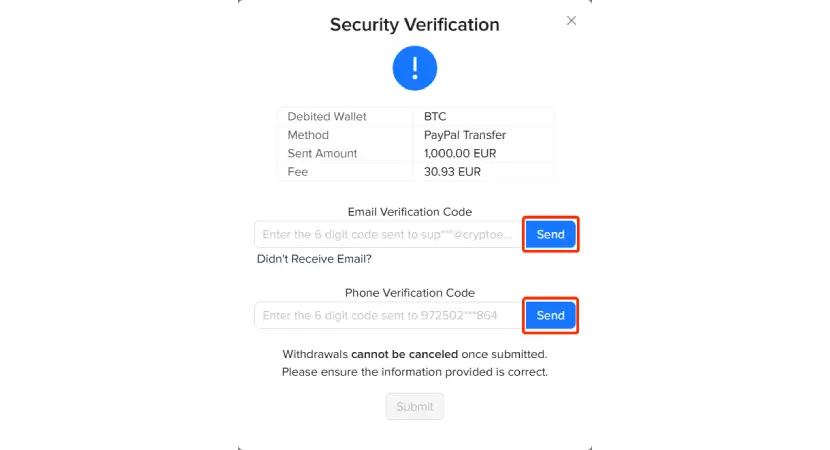

7. In the security verification section, click the [Send] button to receive verification codes to your phone and email.

Input both verification codes, then click [Submit] to complete the wire transfer request.

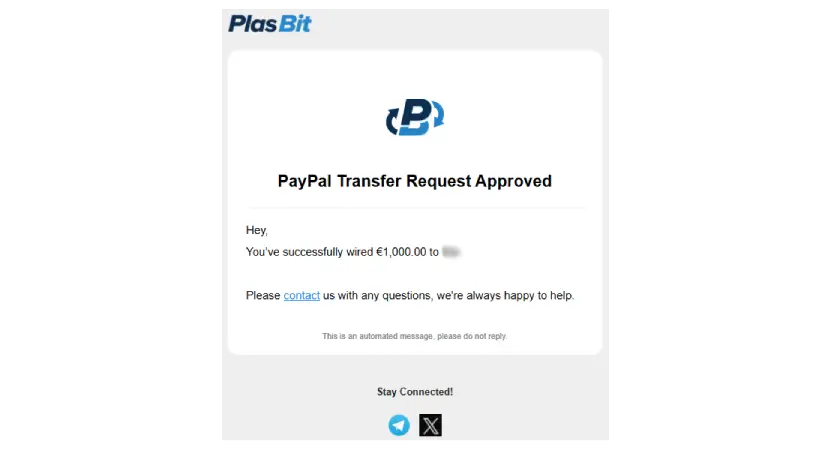

8. After we approve the request on our side, you will get another email that says “Wire Request Approved”

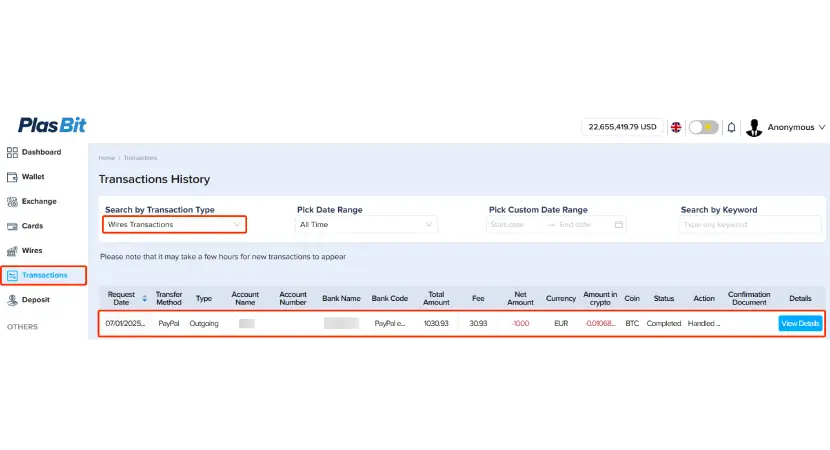

9. In order to monitor your transfer process, enter the [Transactions] section, and select [Wires transaction] from the drop-down menu.

Once the transaction has been approved, you can also download the Bank wire PDF.

Why Bitcoin Payments Aren’t Widespread?

Businesses that support direct Bitcoin payments are still rare, mainly due to regulatory uncertainty and price volatility. The lack of clear regulations makes companies hesitant to accept Bitcoin, while its fluctuating value complicates pricing. For example, 0.01 BTC might be worth $1,000 today but only $800 tomorrow, making it difficult for businesses to set stable prices. To bridge this gap, many payment solution providers have emerged, offering tools that instantly convert Bitcoin into fiat currencies like euros or dollars. These services allow businesses to accept Bitcoin without dealing with volatility, they receive fiat directly in their bank accounts, minus a small processing fee. This model mirrors traditional credit card networks like Visa and Mastercard, which process payments and transfer funds to businesses after deducting fees. Despite these solutions, the demand for Bitcoin payments remains low. Cryptocurrency is still primarily used by investors and the crypto community, while the average consumer continues to prefer familiar payment methods like credit cards and PayPal. As a result, businesses have little incentive to adopt Bitcoin payments on a large scale.

Popular Brands That Accept Paypal but Not Bitcoin

Although there aren’t many brands that support Bitcoin payments, Paypal has experienced widespread adoption. Since you now know what is the easiest way to exchange Bitcoin for Paypal, you can easily make Paypal purchases indirectly with Bitcoin. Here are some of the popular brands that accept Paypal:

Airbnb

Airbnb, a popular lodging platform, allows you to book your stay using Paypal without any hassle. As a global lodging marketplace, Airbnb deals with different regulatory requirements across multiple countries. Since Bitcoin’s status is uncertain in many regions, they consider it a risky payment option. Besides the legal framework, the previously mentioned network congestion and potential high fees could negatively impact the experience of Airbnb users. Paypal, while also unavailable in certain countries, has significantly higher coverage, and doesn’t carry other risks associated with Bitcoin.

Steam

One of the largest gaming platforms initially supported Bitcoin payments but discontinued them in 2017. The reason behind this was stated in an announcement, where they mentioned volatility and high fees as the most important problems. Volatility and high fees during certain periods led to Valve receiving less money than they were supposed to, which obviously didn’t suit them. On the other hand, Paypal offers instant payments without any of the downsides associated with crypto payments. Another reason for allowing Paypal payments is that it offers fraud prevention measures. This is extremely important in situations where someone’s Steam account gets stolen.

Adidas

As mentioned in the few examples below, Adidas is likely resistant to adopting Bitcoin as a payment option, as it's volatile and has unpredictable fees. A company that’s as large and reputable as Adidas doesn’t want to risk losing reputation or funds because of the nature of the payment method. Paypal’s worldwide recognition and reliability, on the other hand, are good reasons why Adidas uses this payment method.

Amazon

Amazon didn’t show a lot of interest in cryptocurrencies in the past. Furthermore, the company’s founder, Jeff Bezos, isn’t a big fan of them. It’s considered that Amazon doesn’t want to use cryptocurrencies, such as Bitcoin, due to the unpredictable price and regulations. However, some people speculate that Amazon is preparing to launch its own cryptocurrency in the future. Regardless of whether the predictions are true, Amazon has great deals with credit card companies and Paypal. It’s possible to purchase Amazon gift cards using Bitcoin on third-party platforms, but this is unrelated to Amazon’s policies and operations.

Wish

Wish is a major e-commerce platform. It doesn’t offer Bitcoin payments, probably due to the possibility of chargeback fraud and regulatory challenges. Instead, Wish supports PayPal, which offers more stability and instant transactions. Of course, you can exchange Bitcoin for Paypal, and make the purchases in that manner instead.

eBay

eBay has explored the idea of cryptocurrency payments, but it has not officially adopted Bitcoin due to concerns over fraud, transaction security, and regulatory compliance. E-commerce platforms are at a higher risk of problems like chargeback fraud, which makes it harder for them to embrace systems that don’t offer the support like Paypal does.

How Private are Paypal Payments?

Paypal doesn’t provide nearly as much privacy as cryptocurrencies. You can create your crypto wallet on certain platforms without conducting any know-your-customer process. This allows private transactions anywhere in the world. While all transactions can be tracked on the blockchain, cryptocurrencies are unmatched when it comes to privacy. Cryptocurrencies are considered pseudo-anonymous, as users do not provide their real names or bank details, but they have a unique Bitcoin address. And while all transactions are public, they can’t be tied to a single user as the transactions do not directly reveal the identity of the user. Creating an account on PayPal requires linking personal information, such as your name, email address, and bank account or credit card details, to your account. This can affect the privacy that some users look for when using crypto. Furthermore, PayPal transactions are centralized and can be monitored by the authorities. Where PayPal is more convenient than cryptocurrencies is reversibility. While Bitcoin transactions are immutable, PayPal allows chargebacks and transaction reversals. This is why many businesses allow PayPal payments but not crypto. Compared to cryptocurrencies, PayPal also offers support for its users if a problem occurs. Yet, PayPal has the right to change its terms, ban users, or prevent them from making transactions. These problems simply cannot happen on a decentralized blockchain.

Why Use Paypal?

Paypal is one of the most popular online payment methods, and it has a good reason. It offers convenience and security for both customers and businesses. It’s a convenient way of sending and receiving money, as you’ll only need an email and password for each transaction. This is an advantage compared to bank and card transfers, as you don’t have to worry about typing in your details, and compared to cryptocurrencies, you won’t have to worry about picking the right network and accurate wallet info. Buyer’s Protection, which is a program that ensures security if a transaction goes wrong, is another strong point for Paypal. If a purchase goes wrong, whether due to an undelivered item or if the product or service doesn’t match the description, PayPal’s Buyer Protection helps users dispute the transaction and potentially get a refund. Paypal is popular for businesses worldwide as it’s recognized and trusted, and it’s been around for decades. Besides the notable brands we’ve mentioned, millions of online stores and service providers worldwide accept PayPal, making it convenient for customers to use it. When purchasing something, Paypal serves as a middleman between the customer and the bank, reducing the risk of sharing sensitive financial information with stores. Paypal also supports multiple currencies and automatic conversion when necessary.

It’s preferred by businesses, small and large, as even for them, the setup is easy, and they won’t need a special merchant account with your bank. Major e-commerce platforms like Shopify, WooCommerce, and BigCommerce offer built-in PayPal support, which allows anyone to start an online store and receive payments. However, there are some disadvantages, like with any other platform. Paypal can charge fees for numerous reasons. For example, sending money to individuals from other countries will include some fees, which isn’t the case with cryptocurrencies. Similarly, conversion rates are often unfavorable compared to exchanges and banks. As already mentioned, PayPal has the right to freeze and restrict accounts if suspicious activities are observed, sometimes without the proper basis. For businesses, PayPal carries the risk of chargeback fraud. While Buyer Protection benefits consumers, it can be misused by dishonest buyers who falsely claim disputes. This can potentially hurt the sellers to a significant extent, depending on the transaction amounts.

Common Scams Targetting Paypal Users

In addition to the few disadvantages mentioned before, merchants and buyers who use PayPal can become victims of numerous frauds. The following list has some of the recognizable examples:

● Advance-fee scams: In this classic scam, the fraudster promises the victim a large sum of money that will be released after paying scammers a fee in advance. The scammer disappears after the sum is received, and the payment is never sent back.

● Tech support or customer service scam: Similarly to phishing, scammers can pretend that they’re PayPal’s employees. They pretend that the victim needs to conduct a certain action as an authority. They might request remote access to your device. You should never accept this, as real customer support teams will only offer you their support if you ask them.

● Phishing scam: This type of scam is present in all industries. Here, an email or an SMS is sent to trick you into sending personal data or clicking a link to a fake website that could infect your device with viruses or other malware.

● Overpayment scams: The overpayment scam targets businesses rather than customers. Here, the scam buyer sends more money than the seller asks for. Then, they contact the seller, asking for refunds via different methods. If the seller falls for this, the scam buyer cancels the Paypal payment and gets away with the funds received through a different method.

● Fake invoice or billing scams: Scammers send PayPal users a fake invoice or payment request, making it appear as if they owe money for a service or product they never purchased. The invoices are created to contain urgent language, pressuring the victim to pay immediately.

● Fake shipping confirmation: Some scammers send fake shipping or delivery notifications claiming to be from a courier service. They instruct the victim to click a link for tracking updates, which leads to a malicious website designed to steal login credentials and money or infect devices with malware. This is similar to phishing, but it’s specific to the shipping process.

● Having your account stolen: Your PayPal account can be stolen through other means. For example, a hacker can obtain the credentials for your Paypal account through phishing, data leaks, or social engineering. Then, they use your Paypal account to conduct payments or scam businesses.

How to Spot and Avoid Common Paypal Scams

Phishing

Phishing scams can be recognized by analyzing the sender and the message that you’ve received. A good red flag to recognize in fraudulent emails is that they’ll have a sense of urgency. Overall, a good rule is that you never send your credentials and login information to anyone on the internet. One of the first measures you should take when getting contacted by someone who claims to work for PayPal is to check their email. PayPal emails come from "@paypal.com," and the employees would never ask you for passwords or personal or financial information.

Tech support and social engineering scams

If you receive an email or an SMS that contains suspicious links, you shouldn’t click on them. Instead, go to PayPal’s website directly and check whether you truly require action. The best way to protect against numerous frauds, such as stolen credentials, is to implement multi-factor authentication. So, even if your account is exposed to hackers, they won’t be able to access it without your email, SMS, or one-time token confirmation.

Overpayment scams

If you’re a merchant and a buyer sends you a higher amount than they’re supposed to, reject requests to send them money outside of PayPal. Both sellers and buyers should do their research and only deal with reputable sellers or buyers by checking reviews and transaction history. When making transactions with unknown individuals on the internet, avoid sending payments as “Friends and Family” for purchases, as this method isn’t covered by PayPal’s Buyer Protection program. Instead, use "Goods & Services" when buying or selling items from unknown individuals and organizations.

Invoice scams

The invoice and billing scams can be avoided by confirming the legitimacy of the sender. Make sure that you’re only paying invoices and billing requests to individuals and organizations that you’ve collaborated with in the past. However, it’s best that you additionally confirm the email of the sender and the details, as sometimes your past collaborators might suffer a security breach as well.

How to Transfer Crypto to Paypal Account

Besides Bitcoin, people are interested in transferring other cryptocurrencies to a Paypal account. While the supported cryptocurrencies are limited, let’s answer the question how to transfer crypto to Paypal account? Deposit bitcoin to your wallet, go to the wires section, enter your PayPal account details, follow the instructions, and your PayPal balance will be credited within minutes. Once your Paypal balance is credited, you’ll be able to make purchases right away. When it comes to Bitcoin or Ethereum, there won’t be any problems with making payments as long as the business with whom you’re making a transaction supports Paypal.

Can I Transfer From Bitcoin Wallet to Paypal?

Besides purchasing cryptocurrencies directly from Plasbit, people have asked the question can I transfer from Bitcoin wallet to Paypal? Yes, you can. Go to the deposit section, deposit the required amount of Bitcoin, and follow the instructions. Then, navigate to the Wires section, select PayPal, follow the instructions, and you will then receive the crypto in your Paypal account. This is convenient for individuals who are holding Bitcoin in their wallets or on exchanges. For example, if you have a cold hardware wallet where you’ve kept Bitcoins for years, you can easily deposit some of them to PlasBit and then use Paypal to make daily payments.

How to Transfer Money From Trust Wallet to Paypal?

If you’re using a software wallet like Trust Wallet for holding crypto and you want to use it for purchases, the process is simple. The answer to the question of how to transfer money from Trust Wallet to Paypal? is to send the crypto from your Trust Wallet to your PlasBit wallet, go to the Wires section, select PayPal, follow the instructions, and you will then receive the crypto in your wallet. A similar process can work for basically any other software wallet. However, you should ensure that the wallet you’re using is a legitimate platform and that you’re picking the right networks when depositing your cryptocurrencies. Failing to send crypto to the correct type of network can lead to lost funds.

Conclusion

If you’re a crypto enthusiast, streamlining your purchases is quite important. Bitcoin offers privacy and decentralization from financial institutions. While Paypal does have some limitations, combining them is a great way of making the most of your cryptocurrencies. Hopefully, this article has helped you understand what is the easiest way to exchange Bitcoin for Paypal, and make purchases anywhere, as long as the business supports Paypal payments.