In 2020, PayPal announced that it would allow its customers to buy, hold, and sell cryptocurrency, specifically Bitcoin, directly from their PayPal account. In 2023, PayPal announced the launch of a U.S. dollar-denominated stablecoin called PayPal USD (PYUSD), and in April 2024, they allowed users to pay no transaction fees when using PYUSD to fund transfers to friends and family abroad.

On the other hand, there are still plenty of Bitcoin holders who hold Bitcoin and want to convert it into a PayPal balance, so if you wish to transfer Bitcoin to PayPal, deposit Bitcoin into your wallet and then go to the wire section, select PayPal as your preferred payment method, and enter your PayPal username, email, or phone number and all is left to initiate an outgoing transfer to your PayPal account, and you will receive it in a manner of hours.

We wrote two comprehensive guides that explore the way to transfer Bitcoin to PayPal, the step-by-step process, and how to exchange Bitcoin and get it as a PayPal balance. You should follow the guide that suits you. We added insights into associated fees and exchange rates, an examination of PayPal's protective measures, and a critical assessment of the safety of Bitcoin within the PayPal ecosystem.

How to Transfer Bitcoin to PayPal Balance?

If you wish to transfer Bitcoin and receive PayPal balance in your Paypal account, follow these steps:

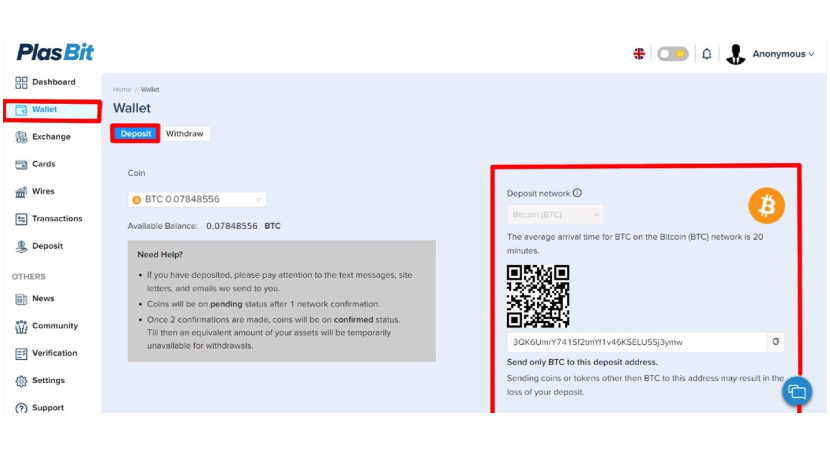

1. Log in to your PlasBit Dashboard, navigate to the wallet section, and select Bitcoin to receive your account Bitcoin address, then deposit the amount of Bitcoin you wish to exchange

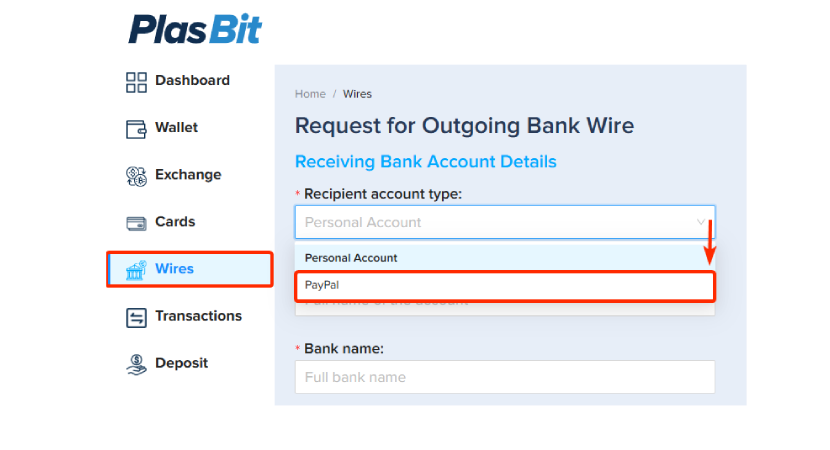

2. Head to the 'Wires' section and select PayPal in the 'Recipient account type'

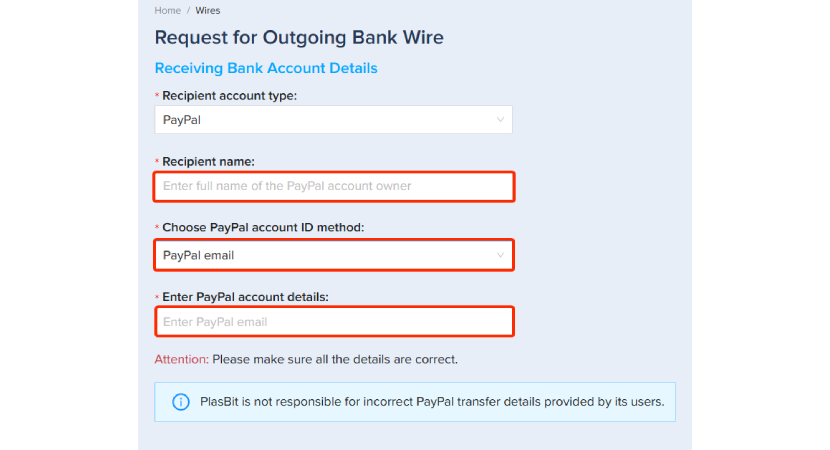

3. Choose your PayPal account ID method, whether it's your PayPal email, username, or phone number, and enter the account full details

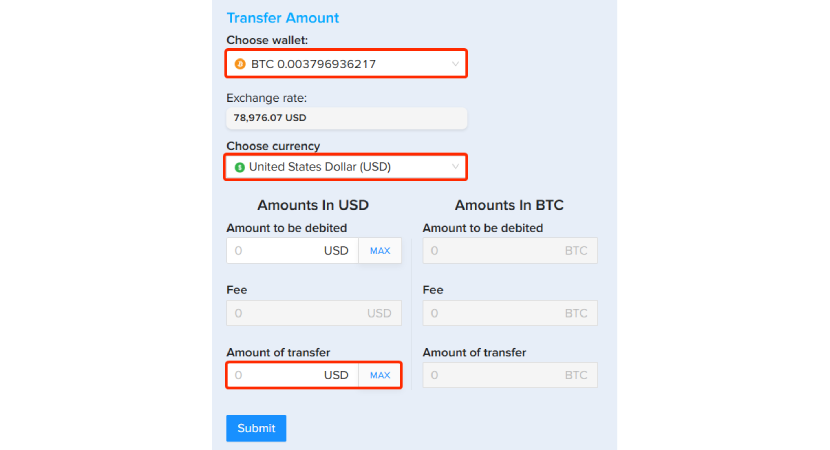

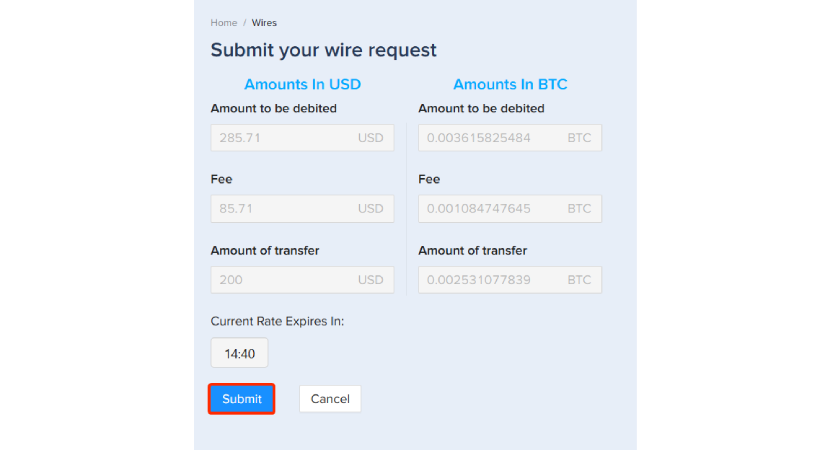

4. Then choose Bitcoin as your wallet and enter the amount you wish to transfer to your PayPal balance

5. You will have a 15 minute time frame to approve your transfer, and once you submit it, the transfer will be completed within a few hours, and you will get credited to your PayPal balance.

How to Transfer Bitcoin to PayPal?

Transfer your Bitcoin to your PayPal account with these steps:

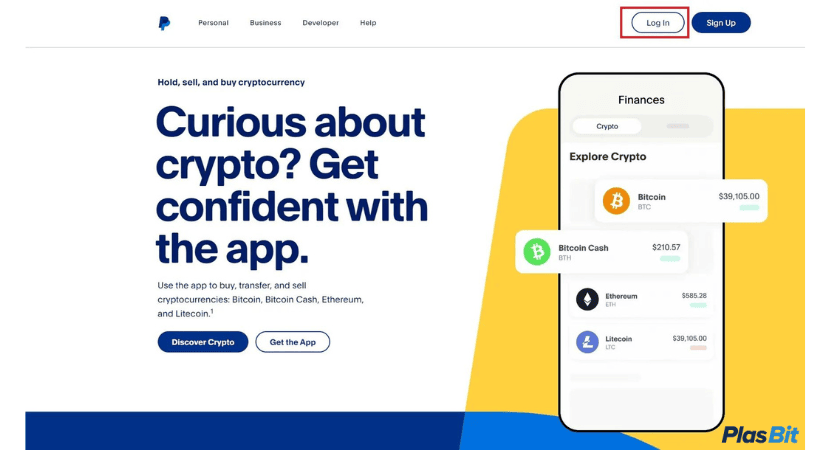

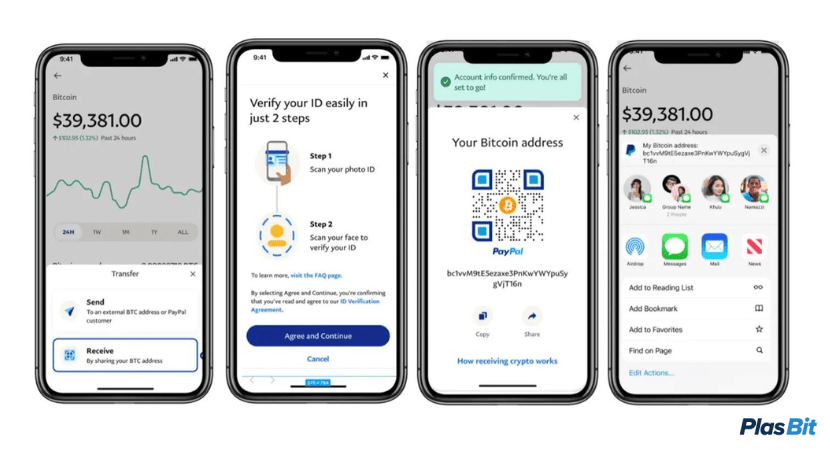

1. Open your PayPal account.

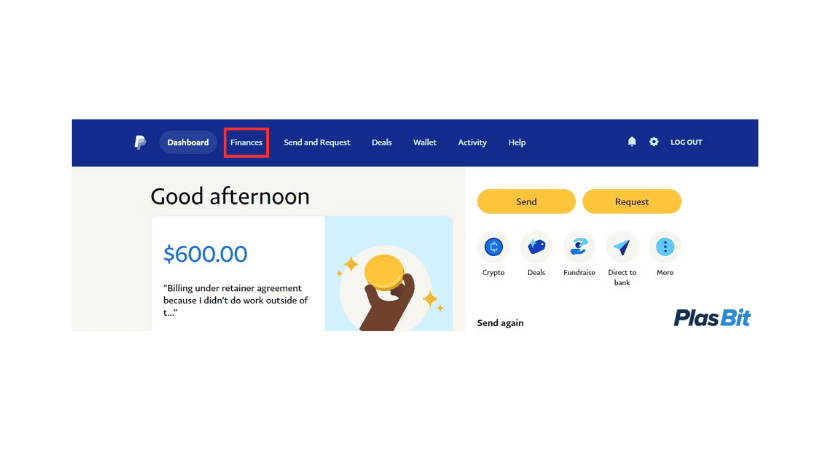

2. On your home screen, click the "Finances" button.

3. Once clicked, you will see three options. Choose the "Crypto" option.

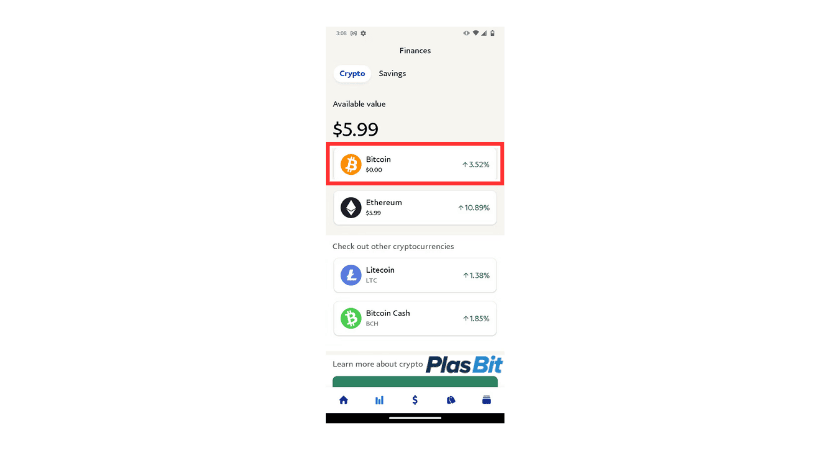

4. You will then see the available cryptocurrencies you hold with PayPal. If you want to receive Bitcoin to PayPal, select "Bitcoin."

5. Upon clicking, you will see the option to "Receive BTC." Copy the provided Bitcoin wallet address.

6. Open your crypto wallet and find the "Withdraw" or “Send” option.

7. Select "Bitcoin" as the currency you want to withdraw.

8. Paste the recipient's Bitcoin wallet address (in this case, your PayPal Bitcoin wallet address).

9. Enter the amount of BTC you wish to withdraw.

10. Review the withdrawal details, including the total amount and fees.

11. Confirm the transaction to proceed with the withdrawal.

Why Transfer Bitcoin to PayPal?

Transferring Bitcoin to PayPal is a strategic move motivated by the desire for liquidity, financial flexibility, and risk mitigation. In this section, we'll explore the multifaceted reasons behind choosing this conversion, highlighting five key aspects that make this transition both practical and beneficial.

Unlocking Everyday Usability:

Transferring Bitcoin to PayPal provides a gateway to unlocking the everyday usability of your digital assets. While Bitcoin operates within the decentralized cryptocurrencies, its conversion to fiat currency through PayPal allows you to engage in daily transactions seamlessly. Whether you're paying for groceries, utilities, or other essentials, converting Bitcoin to local currency enhances its practicality and widens its scope of utility.

Seamless Online Transactions:

PayPal's integration with numerous online platforms and merchants makes it an attractive option for those seeking seamless online transactions. By transferring Bitcoin to PayPal, you gain access to a widely accepted payment option, expanding your purchasing power in the digital landscape. This flexibility proves invaluable in a world where online transactions play an increasingly significant role in our daily lives.

Hedging Against Cryptocurrency Volatility:

The crypto market is known for its volatility, with the value of digital assets subject to rapid fluctuations. Transferring Bitcoin to PayPal enables you to mitigate this risk by converting some of your Bitcoin holdings into a more stable fiat currency. This strategic move allows you to safeguard your financial interests and protect your assets from unpredictable market dynamics, providing a level of risk management not inherent in the cryptocurrency space.

Enhanced Financial Privacy:

While BTC transactions are stored on a public blockchain, transferring Bitcoin to PayPal introduces another layer of financial privacy. PayPal transactions are conducted within the platform, reducing the direct visibility of your cryptocurrency holdings in the public domain. This can be particularly favorable for users who prioritize financial discretion.

Global Accessibility:

PayPal's widespread global reach makes it an ideal platform for you seeking enhanced global accessibility for your Bitcoin holdings. By converting Bitcoin to PayPal, you can access a financial platform that operates in multiple currencies and facilitates cross-border transactions. This global accessibility is valuable for individuals engaging in international commerce or those with diverse financial interests across different regions.

Tips and Considerations

Navigating how to transfer Bitcoin to PayPal involves more than just the technical steps; it requires thoughtful consideration of several factors that can impact the overall success and security of the transaction. Here are additional tips and considerations that delve into the intricacies of this process, providing a comprehensive guide to ensure a smooth and informed experience:

Market Analysis for Optimal Timing:

Before initiating the transfer, conduct a thorough cryptocurrency market analysis to determine optimal timing. Cryptocurrency prices can be highly volatile, and understanding market trends can help you select the right moment to convert your Bitcoin. PlasBit price charts offer concise data on price changes across different time frames—24 hours, weekly, monthly, and yearly. Information like 24-hour trading volume, market cap, and circulating supply is readily available for effective market analysis. A user-friendly price calculator is conveniently positioned next to the charts to assess various crypto tokens quickly. Utilize reputable financial news sources, market indicators, and historical data to make informed decisions about when to execute your transfer for maximum value.

Diversification Strategy:

Diversifying your portfolio is a strategic imperative, and within this overarching approach, the role of Bitcoin becomes pivotal. Transferring Bitcoin to PayPal can be a deliberate move in executing a comprehensive diversification strategy. By converting a portion of your Bitcoin holdings into fiat currency, you introduce a layer of balance and versatility to your portfolio. Assessing risk tolerance, aligning with specific asset goals, and considering the broader economic landscape is paramount in making informed and strategic decisions. This process goes beyond a mere transaction; it becomes a thoughtful maneuver in sculpting a portfolio that not only harnesses the potential of digital assets but also adapts dynamically to the fluctuations and uncertainties of the financial markets.

Evaluate Exchange and PayPal Fees:

Evaluating exchange and PayPal fees is an indispensable facet of any strategic approach to transferring Bitcoin. In this intricate financial landscape, diverse exchange platforms and financial services wield the authority to impose a spectrum of fees, encompassing deposit, conversion, and withdrawal charges. To embark on this journey with financial prudence, it is imperative to dedicate time to a comprehensive assessment of these fees. Scrutinizing the fee structure with diligence empowers individuals to make well-informed and cost-effective decisions, thereby optimizing the overall value of their Bitcoin during the intricate transfer process. This multifaceted evaluation involves understanding the direct costs associated with the transaction and delving into the nuanced dynamics of how these fees may vary across platforms.

Transaction Speed and Confirmation Times:

The judicious consideration of transaction speed and confirmation times is crucial in the intricate process of transferring Bitcoin to PayPal. Cryptocurrency transactions, with their decentralized nature, inherently exhibit variability in processing times, contingent upon factors like network congestion and blockchain consensus mechanisms. Similarly, the dynamics of PayPal transactions introduce their processing timelines. Understanding and factoring in these time considerations become paramount, especially when confronted with specific time-sensitive financial needs or obligations. Navigating the convergence of these two distinct systems necessitates a thoughtful approach, where traders must anticipate the potential delays associated with cryptocurrency transactions and account for the processing efficiency within the PayPal ecosystem.

Maintain Updated Software and Security Protocols:

Ensuring the security of your assets during the Bitcoin to PayPal transfer involves maintaining up-to-date software and security protocols. Keep your cryptocurrency exchange and PayPal accounts running on the latest software versions, regularly checking for security updates and patches to mitigate potential vulnerabilities. This proactive approach enhances the overall safety of your assets throughout the transfer process, providing a robust defense against evolving cyber threats. Stay current to safeguard your digital wealth as it navigates the transition from the cryptocurrency exchange to the PayPal ecosystem.

Consideration of Transaction Limits:

When contemplating the transfer of Bitcoin to PayPal, it's essential to be mindful of potential transaction limits imposed by your chosen cryptocurrency exchange and PayPal. These limits may vary, affecting the maximum or minimum amounts you can transfer within a specified timeframe. Anticipating and understanding these restrictions beforehand is key to planning your transfers effectively and avoiding unforeseen complications. By proactively navigating transaction limits, you ensure a smooth transition of assets from the cryptocurrency exchange to PayPal, aligning your strategy with platform parameters and mitigating potential hurdles associated with these limitations. This strategic awareness is crucial for optimizing the seamless transfer of Bitcoin within the dynamic landscape of digital financial transactions.

Documentation and Record-Keeping:

Maintaining detailed documentation of your Bitcoin-to-PayPal transactions, including transaction IDs, dates, and amounts, is crucial. This record is a key asset for tax reporting, ensuring accurate compliance with regulatory requirements in your jurisdiction. By organizing and retaining this information, you not only create a transparent financial record but also streamline your financial activities within the landscape of cryptocurrency regulations.

Educate Yourself on PayPal Policies:

To navigate the process of converting Bitcoin to PayPal seamlessly, it's crucial to familiarize yourself with PayPal's policies on cryptocurrency transactions. Understand the terms of service, any restrictions, and specific guidelines for using PayPal to convert Bitcoin. Staying informed about these policies ensures that your actions align with the platform's guidelines, minimizing the risk of encountering account-related issues. This proactive approach contributes to a compliant user experience and empowers you to make informed decisions within the parameters set by PayPal for a secure and smooth integration of Bitcoin transactions.

What are the Fees and Exchange Rates?

Understanding the financial implications of transferring Bitcoin to PayPal involves a comprehensive awareness of the associated fees and exchange rates. This section delves into the intricacies of these factors, providing valuable insights to optimize the value of your transaction and make informed decisions.

Transaction Fees:

PayPal Transaction Fees:

PayPal typically imposes transaction fees for processing cryptocurrency transactions. These fees can vary based on transaction amount, currency pairs, and the specific nature of the transaction. Before initiating a Bitcoin to PayPal transfer, it is crucial to familiarize yourself with the current fee structure. Navigate to the PayPal website and explore the dedicated cryptocurrency section to find detailed information on transaction fees.

Fee Structure Clarification:

Delve into the breakdown of fees associated with different transaction types. Some transactions may incur a flat fee, while others might be subject to a percentage of the transaction amount. Understanding the fee structure enables you to anticipate and calculate the costs of your Bitcoin-to-PayPal transfer accurately.

Potential Fee Fluctuations:

Be aware that fee structures may be subject to change based on market dynamics, regulatory adjustments, or policy updates by PayPal. Regularly check for announcements or updates on the PayPal platform to stay informed about any potential changes in transaction fees that could impact your transfer.

Consideration of Additional Charges:

In addition to transaction fees, consider any additional charges that may apply to your Bitcoin to PayPal transfer. These could include deposit, withdrawal, or conversion fees imposed by the cryptocurrency exchange or financial institution facilitating the transaction. A thorough understanding of the entire fee landscape ensures transparency in the cost structure.

Exchange Rates:

Importance of Exchange Rates:

Exchange rates play a role in dictating the value of Bitcoin when converted to your preferred fiat currency. Market dynamics, supply and demand, geopolitical factors, and the overall health of the global economy influence these rates. Monitoring exchange rates is crucial for optimizing the value of your Bitcoin during the conversion process.

Real-Time Rate Monitoring:

Adopt a proactive approach by monitoring exchange rates in real time. Numerous financial platforms and cryptocurrency exchanges provide live updates on exchange rates. Utilize reputable sources to stay informed about fluctuations, trends, and historical performance, empowering you to choose an opportune moment for your Bitcoin to PayPal transfer.

Impact of Volatility:

Recognize the impact of cryptocurrency market volatility on exchange rates. Bitcoin prices can experience rapid fluctuations, affecting the overall value of your transfer. Consider factors such as daily market trends, news events, and macroeconomic indicators to decide when to initiate your transfer for maximum value.

Currency Conversion Considerations:

If your Bitcoin holdings are denominated in a different currency than your desired fiat currency, factor in the additional considerations of currency conversion. Understand how exchange rates between your Bitcoin denomination and the target fiat currency may influence the final amount you receive in your PayPal account.

What Protections Does PayPal Offer?

In online transactions, PayPal stands as a trusted financial intermediary, offering a suite of robust protections for both buyers and sellers. This section illuminates the layers of security and assurance that PayPal provides, ensuring a secure and reliable environment for your financial interactions.

Buyer Protection:

In online commerce, uncertainties can arise, but with PayPal's Buyer Protection, you gain a formidable ally. If, for any reason, you receive an incorrect item or nothing at all, PayPal pledges to reimburse you for the full payment amount, encompassing shipping costs, on eligible transactions. This comprehensive coverage extends a safety net, fostering confidence and peace of mind for buyers engaged in diverse transactions.

Seller Protection:

Sellers, too, find resolute support within PayPal's ecosystem through Seller Protection. In an unauthorized payment or a dispute claiming non-receipt of an item on an eligible sale, sellers can retain the full amount, ensuring their efforts and integrity are duly acknowledged and safeguarded. This layer of protection cultivates a fair and secure environment for sellers to thrive and confidently conduct transactions.

Data Encryption:

PayPal employs data encryption protocols such as TLS and HTTPS connections, key pinning on mobile applications, and PCI compliance. These measures collectively fortify the safety of payments, creating a resilient shield against potential threats. Whether you are a buyer or a seller, implementing these encryption technologies ensures that your sensitive financial information remains confidential and secure.

Fraud Prevention:

Every transaction conducted through PayPal undergoes vigilant scrutiny in real-time. The sophisticated fraud prevention mechanisms in place analyze accounts and activities to identify and thwart fraudulent behavior preemptively. This proactive approach protects individual users and contributes to the overall integrity of the PayPal network, creating a safer environment for all participants.

Refunds:

PayPal recognizes the importance of customer satisfaction and fairness in transactions. If an ordered item fails to arrive or does not match the provided description, PayPal commits to reimbursing the full cost of eligible purchases and any associated delivery costs. This policy acts as a safety net for buyers, ensuring they are not financially compromised when expectations are unmet.

Is Bitcoin Safe on PayPal?

Integrating Bitcoin into PayPal's platform has shown new opportunities for you to engage with the cryptocurrency. However, the safety of your Bitcoin holdings within this digital financial ecosystem requires careful consideration. In this exploration, we study the intricacies of Bitcoin safety on PayPal, emphasizing the protective features and potential areas of concern.

Security Features:

As a leading online payment platform, PayPal prioritizes the security of your accounts and transactions. Leveraging industry-standard security features, PayPal incorporates robust encryption protocols to shield information from unauthorized access. Additionally, implementing 2FA adds an extra layer of defense, requiring you to provide two forms of identification before accessing your accounts. These security measures collectively form a fortified defense, instilling confidence in entrusting your Bitcoin to the PayPal platform.

Centralized Control of Private Keys:

Unlike private wallets, where you retain control over your private keys, PayPal operates with a centralized approach, managing the private keys associated with your Bitcoin holdings. This centralized control brings both advantages and potential risks to the forefront.

User-Friendly Experience:

Centralized control simplifies the user experience, especially for those new to the intricacies of private key management. PayPal streamlines the process, making it more accessible to a broader audience.

Account Recovery:

With lost passwords or account access issues, PayPal's centralized control allows smoother account recovery procedures. This can be a significant advantage for your concern about potential security lapses.

Dependence on Third-Party Security:

Entrusting PayPal with private key management means relying on the platform's security infrastructure. While PayPal has a robust track record, you must consider the inherent risks associated with centralization, including the possibility of system vulnerabilities or targeted attacks.

Limited Control:

You relinquish control over your Bitcoin holdings by not managing your private keys. Direct control is needed among users who value the decentralized nature of cryptocurrencies.

Safest Way to Store Your Bitcoin

The security of your Bitcoin holdings is essential in digital assets. As the popularity of cryptos continues to rise, safeguarding your Bitcoin involves a strategic and informed approach. This comprehensive guide explores various storage methods and security practices to help you navigate the intricate terrain of securing digital wealth.

Hardware Wallets:

Hardware wallets stand out as bastions of security in Bitcoin storage, providing unparalleled protection by keeping private keys entirely offline, thereby mitigating the risks associated with online vulnerabilities. Facilitating cold storage, these physical devices significantly reduce exposure to online threats. Many hardware wallets boast tamper-proof designs, enhancing your resilience against physical attacks or unauthorized access attempts. However, it's important to note that this heightened security comes with a cost. While hardware wallets offer robust protection for digital assets, you should view the associated expense as a worthwhile purchase in your valuable Bitcoin holdings' overall security and safeguarding.

Software Wallets:

Software wallets, encompassing mobile, desktop, and online variants, balance convenience and security in Bitcoin storage. They offer a user-friendly interface that caters to a broad user base, providing accessibility for novice and experienced traders. This convenience, however, comes with the responsibility for you to remain vigilant about online threats. Despite this, software wallets often come equipped with backup and recovery options, enhancing security layers and providing you with tools to safeguard your Bitcoin holdings. PlasBit's crypto wallet is a secure fortress for various cryptocurrencies, featuring encrypted private keys, biometric authentication, and offline storage. We prioritize trust, adapt dynamically to real-time risks, and adhere to payment industry best practices. From secure storage to seamless asset management, we ensure the highest security standards, reinforced by ISO/IEC 27001 certification, providing a haven for your crypto assets. The user-friendly experience and additional security features make software wallets popular for those seeking a convenient yet secure method for managing their digital assets.

Paper Wallets:

Paper wallets embody an analog approach to Bitcoin storage, introducing a heightened level of security through a unique set of characteristics. By generating and printing private and public keys, paper wallets ensure complete offline storage, implementing the practice of cold storage that keeps private keys entirely offline for enhanced security. Additionally, the absence of a digital footprint makes paper wallets immune to cyber threats targeting online storage solutions, adding an extra layer of protection. However, it would help if you remained mindful of the physical vulnerabilities associated with paper, such as susceptibility to damage or loss. Careful storage and protection against environmental factors become crucial considerations in maintaining the integrity of paper wallets and ensuring the enduring security of stored Bitcoin assets.

Conclusion

Transferring Bitcoin to PayPal opens up a gateway to enhanced financial flexibility and practicality. Whether you seek everyday usability, seamless online transactions, or a strategic approach to managing cryptocurrency market volatility, this conversion offers many benefits. Understanding the step-by-step guide, evaluating fees and exchange rates, and recognizing the protective measures provided by PayPal ensures a secure and informed experience.