Both beginner and advanced traders rely on well-defined strategies to maximize profits in the crypto market. You can learn many crypto day trading strategies, such as scalping which means quick in and out trades, arbitrage takes advantage of small price differences across exchanges, reversal trading focuses on predicting trend reversals early, and high-frequency trading (HFT) uses algorithms to execute frequent trades in seconds or minutes or momentum trading that follows price trends and making trades based on the direction of the market.

Momentum trading can be easily implemented by using two simple moving averages, one set on a 13-period and the second on a 26-period SMA. When the 13-period moving average crosses above the 26-period, it signals an uptrend, indicating a good opportunity to open a long position, and if the 13-period crosses below the 26-period, it suggests a downtrend and signals opening a short position. Another more advanced one is the MTR strategy, in which you identify trends by monitoring trend lines and look for moments when the price breaks the trend line, which will create breakout levels where you can spot specific candle patterns, like pin bars and key bars which can signal that a trend reversal is on the way and indicate that it is a good time to open a trade according to the reversed trend.

In this PlasBit article, we look into the critical aspects of crypto trading that every trader should understand, from learning effective day trading strategies to selecting the approach that best suits your unique goals. Furthermore, we also give you some tips on refining your techniques which leads to more consistent results. These concepts are essential in building a strong trading foundation and help you navigate the market with precision.

Day Trading Strategies

This guide covers six popular crypto day trading strategies; momentum trading strategy, MTR trading, Scalping, . Each strategy offers unique methods to approach the market and enables you to make informed trades.

Momentum Trading Strategy

A momentum tries to make profits by setting his trade in the direction of the strong price movement, whether upward or downward. Momentum traders check for trend strength and entry and exit points using technical indicators. For instance, if the price of a cryptocurrency stays above its moving average, this indicates that an uptrend might be forming; therefore, traders start a buy trade. In contrast, the market price below the moving average level could mean a downtrend, which will be a great opportunity to open a sell position.

The momentum trading strategy is good for beginners as it’s straightforward and versatile and can be used across different market conditions. However, one drawback of this method is that it requires patience and careful research before finding proper trends. For example, some trends may be weakening and be near reversal. If traders carelessly enter such trades, they can suffer possible losses. To overcome this drawback and protect themselves against possible losses, many momentum traders use stop-loss orders to limit losses if the trend reverses. Stop-loss orders automatically close a trade at a selected price point.

Using Simple Moving Averages in Momentum Trading

Mastering the use of Simple Moving Averages can significantly enhance your trading approach by enabling you to track upward and downward trends. Furthermore, by learning the visual signals for market trends and shifts, you can better time your trades and make more calculated decisions.

Find the indicators page

First, open the chart of the cryptocurrency you want to review. You will now be able to find the Indicators menu at the top of your screen, which contains the tools that are used for technical analysis.

Add Two Simple Moving Averages

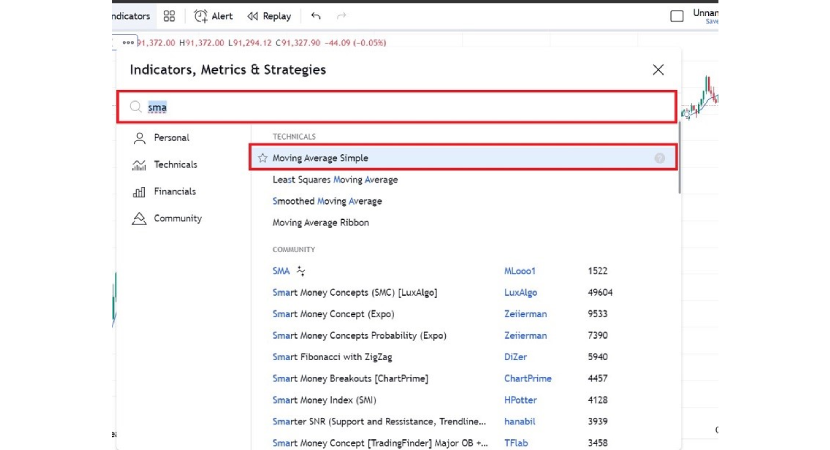

Inside the Indicators menu, search for Simple Moving Average by typing SMA in the search bar. Select it and add this indicator to your chart twice, as you’ll need two separate moving averages for this method.

Customize the First Simple Moving Average to a 13-period

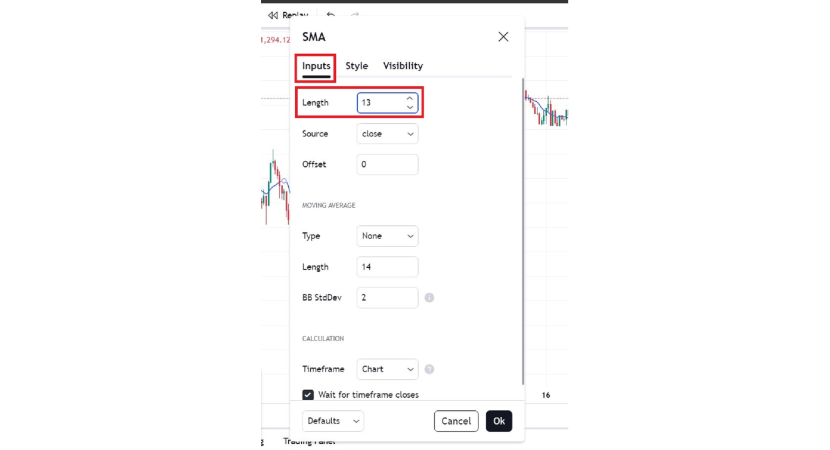

You’ll find a small cog icon near the SMA label on your chart. Click this icon to open customization options for the first SMA.

In the Inputs page, set the Length to 13 days by entering 13 in the appropriate box.

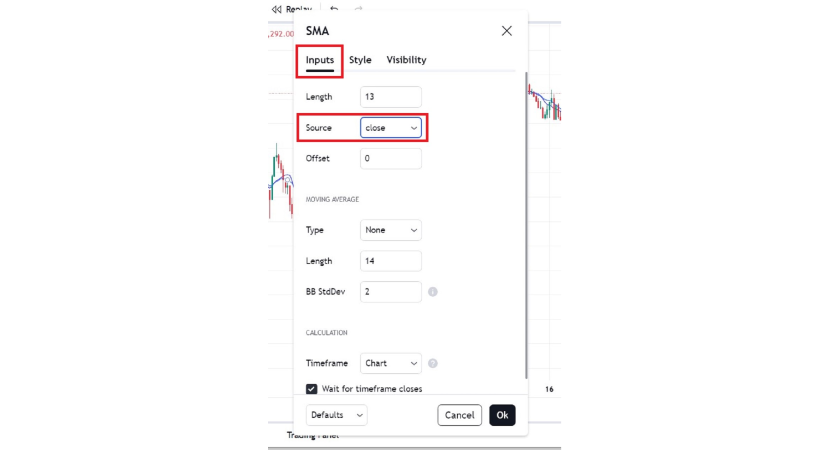

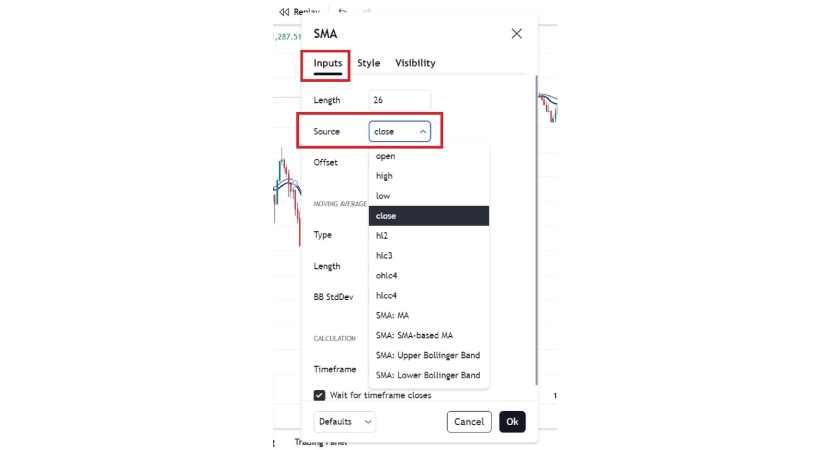

We’ll be using the closing price as the source for our SMA calculation.

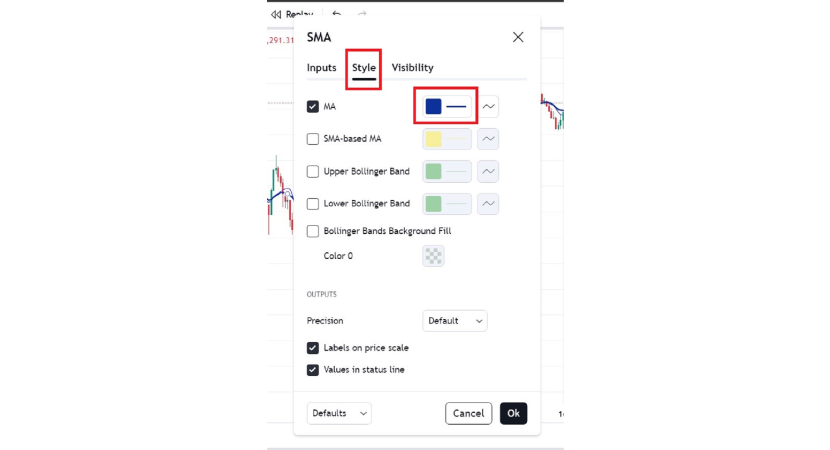

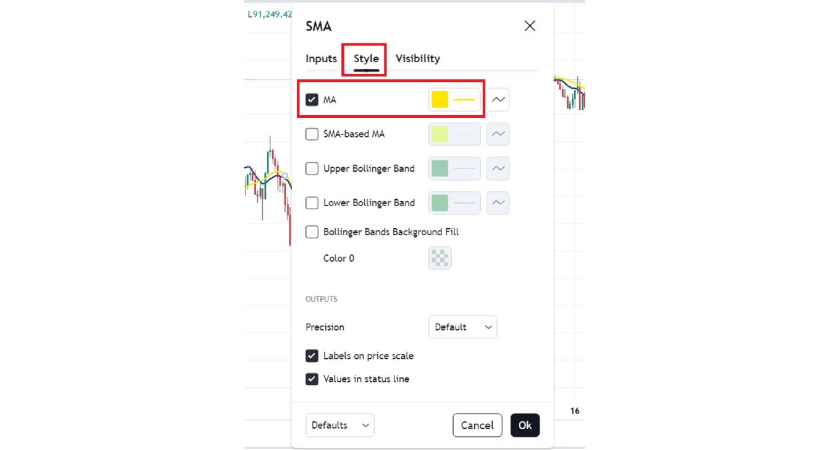

For easier visibility, you can also choose a distinct color for this SMA line by adjusting options under the Style tab; in this case, we’ve chosen dark blue for our 13-day SMA.

Adjust the Second Moving Average to a 26-period

Next, locate the settings for the second SMA.

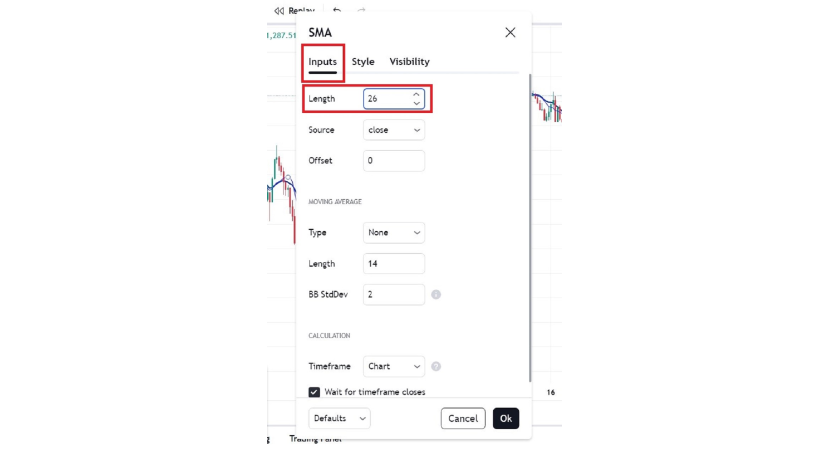

In the Inputs tab, set its length to 26 by entering 26 in the highlighted area in the picture.

Our SMA is based on the closing price.

To distinguish this SMA, select a different color under the "Style" tab. Here, we’ve used yellow for clarity.

Identify an Upward Crossover as a Signal to Buy

The upward crossover happens when the 13-day SMA crosses over the 26-day SMA. This can be viewed as a potential buy signal and that the market might be gathering upward momentum. Remember to look for a future downward crossover that could signal a trend reversal, which provides a good point to sell or close the buy position.

Recognize a Downward Crossover as a Signal to Sell or Exit

When the 13-day SMA crosses below the 26-day SMA, it suggests the start of a downward trend. This may be a signal to consider opening a sell trade. A future upward crossover might indicate a reversal, providing an opportunity to close a sell position.

The SMA crossover method is a straightforward way to read the market, especially for those new to technical analysis. With this tool in your trading toolkit, you’re now more equipped to spot potential buy and sell opportunities confidently.

MTR Trading Strategy

The MTR trading strategy helps traders identify market trends and enables traders to predict market movements. It also follows a strategic market approach based on trendlines, price action, and certain candlestick patterns that give traders the information needed to find good entry and exit points.

Identify the Trend

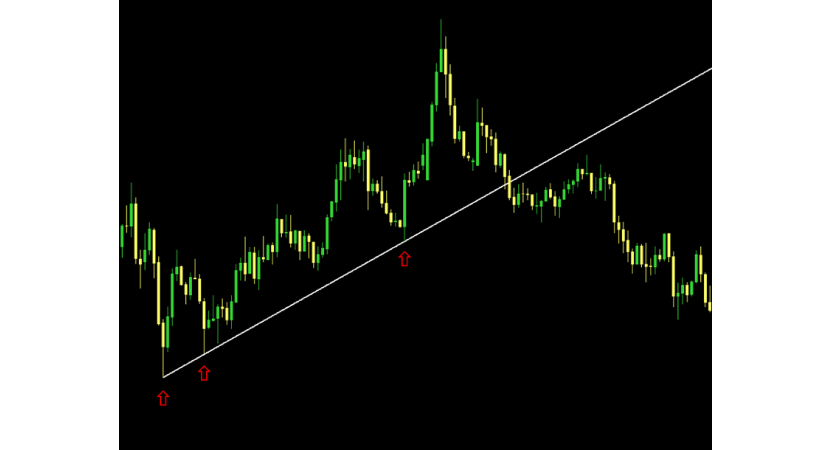

The MTR strategy begins with finding out whether the market is in an uptrend or a downtrend. This is achieved by connecting key price points on the price chart. For this guide, we are finding an uptrend. We look for at least two higher lows on the price chart and draw a trend line connecting them.

If the price stays above this line without breaking it, the market is in an uptrend. In a downtrend, you will need at least two lower highs and connect these with a trend line. As long as the price is below the line, the market is in a downtrend.

Watch for the Breaking Point

Once you’ve drawn the trendline, extend it to include more price points. This continuation allows you to monitor for a break in the trendline, which signals a potential change in trend. In our example, which is an uptrend, a breaking point occurs when the price stops climbing and begins to fall, creating a lower low that breaks through the upward trend line. In a downtrend, the breaking point happens when the price stops falling and forms a higher high.

After identifying the breaking point, wait for the next high in the price line to confirm the trend. The price line represents the movement of an asset's value over time, helping to visualize trends.

Between this new price point and the last low, a horizontal breakout level is created where you should monitor for reactions to the price breakout. Reactions to the price breakout refer to how traders respond to the breakout level, indicating whether the trend will continue or reverse. In a downtrend, you can find the breakout level between the new low and the last high.

Confirm the trend with Key Candlestick Patterns

Within this range, look for key candlestick patterns, such as the Pin Bar candle, which has a long shadow that shows market resistance. In uptrends, the shadow points upward, indicating that buyers tried to stop the price drop but were ultimately defeated, signaling continued bearish momentum. In downtrends, the shadow points downward, showing failed resistance and signaling bullish momentum.

Another important signal is the Key Bar, which is the candle that follows the pin bar and confirms the trend. If the key bar’s direction aligns with the new trend and signifies that it will continue, which acts as your signal to enter a trade.

The combination of the pin bar and key bar provides a strong indication of a trend, giving you confidence in your entry point.

Set Risk and Profit Target

A stop-loss order is a risk management strategy that automatically closes your trade at the point when the price goes against you and reaches the pre-selected point. For example, in the picture below, we have opened a sell trade, and we set a stop-loss at the top of the shadow of the pin bar, which limits possible losses when the price begins to climb. In a buy trade, you set the stop-loss at the lowest point of the pin bar’s shadow.

The take-profit order locks in your profit by closing the trade when a profit target has been achieved. The take-profit level is set to ensure that your trade is closed at an optimum point. This prevents your profits from being wiped out just in case the market suddenly reverses. In our guide, we have opened a sell position and used the lowest point of the last uptrend as our profit limit. In a buy trade, you can use the highest price point in the last downtrend.

Scalping

One of the fastest and most demanding crypto day trading strategies is scalping. When using this approach, traders find small movements in price and use these movements to perform many trades in a short period of time. A scalper holds a position for minutes or even seconds. This is because in scalping trading strategy the frequency is more important than the size of profit. So, while the benefit of every trade may be small, doing hundreds of trades during the day can give you a good amount of profit. This method is effective in highly volatile markets like cryptocurrency.

Scalpers typically use short-term charts like one or five-minute charts to monitor market prices closely. So, to use this trading strategy successfully, you need a good reaction time to price changes. Scalpers also use technical indicators, moving averages, Bollinger Bands, resistance, and support levels to find good entry and exit points. Furthermore, Scalping requires markets with high liquidity, as high liquidity allows traders to enter and exit a position without significantly affecting the asset’s price. This characteristic makes Bitcoin and Ethereum perfect for scalpers, as they have the largest trading volume and liquidity among cryptocurrencies.

One of the drawbacks of scalping is that it requires strict discipline. Because there are small profits from each trade, transaction costs have a high impact on the final gains. As a result, scalpers need to stay calm and be careful not to make any emotional trades since each wrong transaction is a loss.

Arbitrage

Arbitrage is a trading strategy where traders take advantage of differences in the prices of cryptocurrency on different markets or exchanges. When a cryptocurrency is cheaper on one exchange and more expensive on another, a trader buys it cheaper and immediately sells it at the more expensive exchange.

To increase their rate of success, Arbitrage traders often use advanced technology. For instance, sophisticated algorithms and high-speed trading platforms can help traders to identify and act on price differences. Without the help of such tools, the price difference might get fixed before the completion of trades. Furthermore, to successfully use arbitrage strategy, traders need to have a lot of capital to make meaningful profits, as the margins from each trade are often small.

While using arbitrage can seem low risk, it certainly isn't without its challenges. For example, Profits can be reduced by high exchange fees or transfer fees. Market volatility is another important risk, as surprise changes in the price of an asset during the trade can cause losses. Without proper risk management and careful planning, you cannot achieve consistent success from arbitrage.

Reversal Trading

Reversal traders try to take advantage of a change in the direction of an asset's price trend. To use this method, Traders can look for an upward price trend turning into a falling trend or a downward price trend changing into an uptrend. Traders need to find these turning points early enough to enter the new trend and benefit from the following price movement.

Reversal Traders use technical tools and patterns to find a reversal. Indicators like RSI and MACD show overbought or oversold conditions in an asset, which signal a likely trend reversal. Additionally, chart and candlestick patterns are also used for predicting a reversal in the trend. Furthermore, traders typically manage risk by getting multiple confirmations using a number of indicators and chart patterns. Other risk management strategies involve placing stop-loss orders and planning clear entry and exit points.

High-Frequency Trading (HFT)

High-frequency trading is a sophisticated method where powerful computers and complex algorithms execute trades in seconds. HFT traders gain frequent profits by trading based on tiny price differences across markets. High-Frequency Trading (HFT) strategy includes market-making, where traders quickly buy and sell assets to profit from small price differences between buying and selling prices. Another method is to use math and algorithms to find and exploit temporary pricing errors. These strategies depend on fast data connections, low delays, and advanced software to execute trades successfully.

Although HFT has benefits, it also has drawbacks. Setting up the required technology is very expensive, so it’s mostly used by large firms rather than individual traders. Critics say that HFT gives an unfair edge to those with better tools and can make markets more unstable. Because of these concerns, regulators closely monitor HFT to ensure fairness and stability in the markets.

Whatever strategy you choose, remember that consistency, patience, and a strong commitment to learning are crucial to make your way through this dynamic world of cryptocurrency trading and achieve your aims.

How to Choose the Right Crypto Trading Strategy for You

The best choice among various crypto day trading strategies for you depends on your goals, experience, risk tolerance, and availability to actively monitor the market.

Clarify Your Trading Goals and Risk Tolerance

If you want to make quick and consistent profits by performing trades throughout the day, Scalping or Breakout Trading may be the better choice for you, as both styles aim for frequent profits. If your goal involves fewer trades with higher returns per trade, it is better to use momentum trading strategy as it aims for larger profits over longer periods. When clarifying your goal, you also need to consider your risk tolerance. Scalping and breakout trading are fast-paced methods and also need fast reaction time, so you need to have a higher risk tolerance to use them. If you prefer less volatility and more time to analyze each trade, then momentum Trading may work better since it allows for longer consideration before each trade and tends to be less stressful.

Assess Your Availability and Patience

Scalping requires complete attention to the market, fast reaction, and the ability to monitor the market 24/7. So, if your schedule does not allow for full-time monitoring, then momentum Trading is the better choice as it offers more flexibility and does not require minute-to-minute observation. Furthermore, if you are patient and like to let trades play out over several hours or even for a few days, momentum trading may be ideal for you.

Factor in Your Level of Experience and Comfort with Tools

Scalping and Breakout Trading strategies typically rely on multiple technical indicators, including candlestick patterns and volume analysis, making them better suited for traders comfortable with complex charting tools. Based on our research in PlasBit, for new traders, momentum trading can be more approachable, as it involves using simpler indicators like moving averages to identify trends.

Take into consideration your objectives, tolerance for risk, availability, patience, and level of comfort with trading tools, and you'll be able to analyze crypto day trading strategies and identify one that suits your unique profile and enhances your trading experience.

Mastering a Trading Strategy

Mastering crypto day trading strategies requires dedication, practice, and consistent effort. Here are some effective tips to help traders fully develop and optimize their selected strategy:

Stick to Your Strategy and Avoid Strategy-Hopping

Stick with one strategy rather than always switching from one to another. Remember that consistency breeds mastery, and instead of jumping ships and changing methods at the first loss, perfect your strategy. Constant switching will prevent you from understanding strategies properly and lead to inconsistent results. Allow your strategy time to perform under different market conditions before you judge its effectiveness.

Track Every Trade in a Detailed Trading Journal

A trading journal is a great tool for growing and improving. Record every trade’s entry and exit points, reasons for exits and entries, and their outcomes. Furthermore, including minor details allows you to analyze your successes and mistakes more effectively and gives you real-time insights. This helps you identify minor adjustments that can improve your trading performance.

Practice with a Demo Account First

Using a demo account, you can practice different strategies and perfect your entry and exit timing without the pressure of your capital being on the line. Once you're confident that you can execute the strategy consistently, then it's time to move into the live markets. But remember that you should always start with small investments regardless of your practice time.

Master Your Technical Tools and Indicators

Most trading strategies use technical tools and indicators, so take your time and properly learn them. As an example, If you are using momentum trading strategy, study different types of moving averages and learn how you can interpret crossover signals. You should also learn to read trend lines and study support and resistance levels. Practicing and studying technical indicators will make you faster and more efficient in identifying opportunities and help you to fully realize your strategy's potential.

By maintaining consistency, tracking results, managing risk, and adapting to changing conditions, you can slowly work toward mastering your chosen trading strategy and achieve lasting success.

Stock vs Crypto Trading Strategies

Be it stocks, crypto, or both, when you invest in a market, you need to learn the strategies used in each sector, and you need to be fully aware of their drawbacks and strengths to be able to make decisions and ensure full profit in your trades.

Similarities of Stock and Crypto Trading

Both stock and crypto trading strategies rely on technical analysis and utilize indicators like moving averages, RSI, and MACD to track market trends and find the best points to enter and exit a position. Strategies like momentum trading work well in both markets. Moreover, strategies like scalping that use frequent fluctuations in price can be used both in stock and crypto trading, as both are volatile in nature. Finally, both markets can be researched using fundamental analysis. Stock traders focus more on company performance, while crypto traders pay more attention to such aspects as the project's goals, partnerships, and regulatory news.

Differences Between Stock and Crypto Trading

Three important differences between stock and crypto markets are operating hours, volatility, and liquidity. While stocks operate on fixed hours, crypto is a 24/7 market, and crypto traders need to take into account the non-stop price movement. The cryptocurrency market also has a higher volatility than traditional stocks, requiring stronger risk management measures. Crypto assets are also more sentiment-sensitive, and news or event-based trends are more common in the crypto market than in stocks. Lastly, stock markets have high liquidity, whereas cryptocurrency liquidity can be unstable.

Strategies Suitable for Each Sector

Index trading involves investing in a group of assets bundled together in a single index, which represents the performance of that segment of the market. In traditional finance, indices like the S&P 500 track the performance of top companies, giving investors exposure to an entire market sector rather than individual stocks. This reduces risk, as gains in some assets can offset losses in others. In the crypto market, index trading is limited mainly due to the crypto industry’s relatively young and volatile nature. Cryptocurrencies often experience significant price swings, and the market lacks stability, making it harder to create a balanced, long-term index.

Staking in the crypto market is a way for holders of certain cryptocurrencies to earn rewards by "locking up" their coins to support the operations of a blockchain network, like verifying transactions. It’s similar to earning interest, as holders are rewarded for helping to secure the network. Staking isn’t used in the stock market because stocks represent ownership in a company and don’t require network validation or transaction processing as blockchains do.

Stock and cryptocurrency trading are two different sectors where traders can invest money. While both sectors of investment have similarities in their strategies and analytical approaches, there are also differences in their market operations and dynamics.

Conclusion

In this PlasBit article, we have covered important knowledge and hope that we have provided you with a clear understanding of how different trading strategies can be used in different markets and investment sectors. Furthermore, we tried to familiarize you with different techniques to perfect your trading strategy. Using this knowledge, you can refine your techniques for consistent success and profit in various financial markets.

Day trading, at first glance, can seem to be a way to easily and quickly make money, but relying on pure luck is no different from gambling, where the chance of success is slim. While the learning process may overwhelm you, investing your time in understanding various strategies of trading will pay off and get you closer to success. With continuous learning and a disciplined approach, you can develop the necessary skills required to confidently make strategic decisions that better your chances of long-term profitability.