The answer is yes, you can pay with cryptocurrency for things. This article will explore whether can you pay for things with crypto, examine the products and services that can be purchased directly with crypto, and explore innovative solutions for those who still need to accept digital currencies.

Which Companies Accept Crypto Directly?

Utilizing crypto for real-world transactions has been a topic of increasing interest. While major institutions are gradually opening their doors to cryptocurrency, a diverse range of products and services exemplifies the practicality of using crypto for everyday purchases. In this guide, we will explore the various categories where crypto transactions are gaining traction, shedding light on the evolving ecosystem of cryptocurrency-enabled commerce.

Car Dealerships:

The automotive industry has demonstrated a keen embrace of digital currencies as a legitimate form of payment. Luxury car dealerships, renowned for their association with iconic brands such as Lamborghini, have emerged as pioneers in accepting Bitcoin as a means of transaction. This progressive shift extends beyond traditional luxury, with even Tesla , the electric car giant led by the crypto enthusiast Elon Musk, making headlines in March 2021 by announcing its acceptance of Bitcoin for their electric vehicles. This move marked a significant stride toward mainstream acceptance of cryptocurrency in tangible, high-value assets. However, the journey has not been without hurdles, as environmental concerns prompted Tesla to suspend this payment method a few months later temporarily. This episode underscored the evolving nature of integrating cryptocurrency into traditional industries, shedding light on the intricate challenges and considerations accompanying such groundbreaking initiatives within the automotive sector.

Technology and E-commerce Products:

Leading tech companies and e-commerce platforms have integrated crypto into their payment options. Companies like Newegg, AT&T, and Microsoft allow customers to purchase cryptocurrency. Microsoft, for instance, accepts Bitcoin on its online store, contributing to the expansion of cryptocurrency use beyond traditional boundaries. Overstock, a pioneer in accepting cryptocurrency since 2014, paved the way for other major platforms like Shopify and Rakuten to follow suit. While significant progress has been made in accepting crypto, some notable platforms, including Amazon and eBay, still need to be bold in engaging with cryptocurrency transactions. Despite Twitch, owned by Amazon, endorsing Bitcoin, the e-commerce giant has not integrated crypto payments. EBay, though exploring the future of various payment forms, has not committed to cryptocurrency-based transactions. These industry giants' cautious approach raises questions about the future trajectory of cryptocurrency integration in mainstream commerce.

Jewelry and Expensive Watches:

Luxury goods makers and retailers have embraced cryptocurrency as a mode of payment, opening avenues for acquiring high-end items with digital assets. A notable player in this convergence is BitDials . This online luxury retailer has carved a niche by facilitating cryptocurrency transactions for exclusive watches like Rolex and Patek Philippe. This innovative approach extends beyond online platforms, with traditional jewelry stores entering the realm through strategic partnerships with payment processors, streamlining the process of cryptocurrency-based transactions. This growing alliance between luxury and cryptocurrency serves as a testament to the broader acceptance of digital assets, offering a glimpse into the evolving landscape where individuals can leverage cryptocurrency to access the pinnacle of craftsmanship and elegance in the world of high-end goods.

News Media:

The media industry, including cryptocurrency-focused outlets and mainstream publications, has ventured into crypto transactions. The Chicago Sun-Times made headlines in 2014 by becoming an early adopter, accepting Bitcoin as a legitimate form of payment on its platform. This pioneering move was followed by Time Inc., a prominent player in the media landscape, incorporating cryptocurrency for digital subscriptions in the same year. The foray of media entities into cryptocurrency transactions underscores a broader acceptance of digital currencies as viable mediums of exchange within the media landscape, bridging traditional financial systems and cryptocurrencies. This trend signifies a willingness to embrace innovation and recognize the evolving preferences and opportunities presented by decentralized digital assets in the ever-changing media landscape.

Insurance:

While traditionally cautious, the insurance industry has begun to explore the integration of crypto payments. A groundbreaking move came from Swiss insurer AXA in April 2021, as it embraced Bitcoin for premium payments across all its insurance lines, excluding life insurance due to regulatory considerations. This marked a significant departure from the industry's conservative stance, demonstrating a willingness to adapt to the changing financial landscape facilitated by digital currencies. Metromile, an innovative "pay-per-mile" auto insurance provider, has also joined the foray by facilitating premium payments in Bitcoin. This dual initiative by AXA and Metromile reflects an evolving attitude within the insurance sector. This indicates a growing recognition of cryptocurrency's potential advantages and broader acceptance within the traditionally risk-averse industry. As crypto continues to carve its niche in diverse sectors, the insurance industry's foray into crypto payments showcases a willingness to explore new frontiers and embrace the transformative potential of digital assets in insurance services.

Paying with Crypto Using a Debit Card

Can you pay for things with crypto? Acquiring goods or services with cryptocurrency has become increasingly convenient, especially with the advent of crypto debit cards. These cards, preloaded with your preferred converted digital currency, streamline the purchase process. In this guide, we'll walk through the steps of using a crypto debit card to buy items seamlessly, ensuring a smooth transaction from crypto to fiat.

Crypto debit cards are a practical bridge between digital currencies and traditional transactions, enabling users to indirectly use cryptocurrency for purchases at companies and services that don't accept crypto directly. This functionality expands the utility of cryptocurrencies, allowing for seamless transactions in both local and online settings. The crypto debit card transforms digital holdings into a versatile financial tool, fostering greater adoption and integration of cryptocurrencies into everyday life.

The process involves exchanging crypto for USD and loading your debit card with USD. With your card loaded with USD, you can now use it like a traditional debit card. To initiate the process of converting your cryptocurrency to USD using the PlasBit debit card, follow these steps:

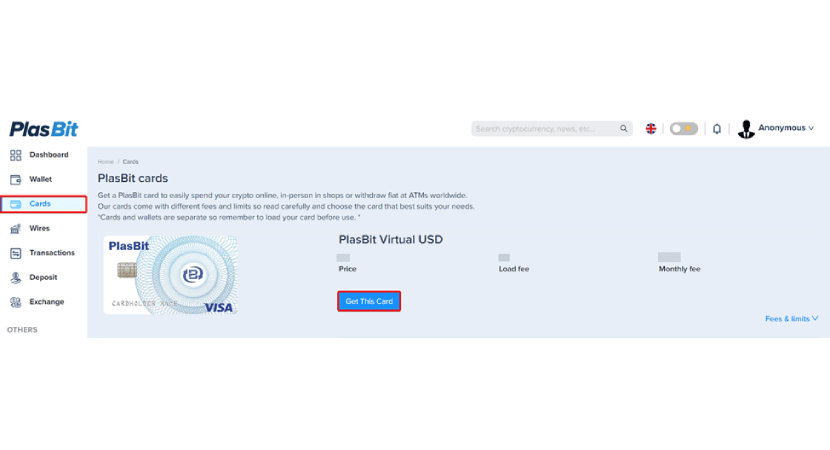

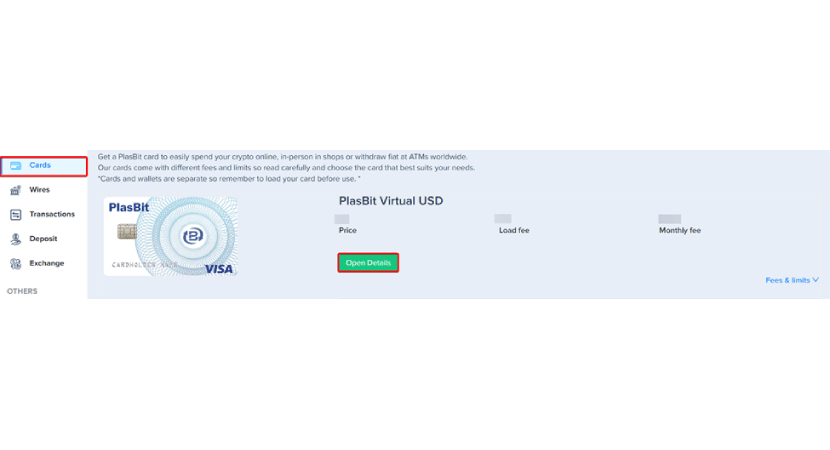

1. Head to our platform's 'Cards' section to begin exchanging your cryptocurrency for USD.

2. Select the type of card that suits your needs – Virtual USD, Plastic USD, or Metal USD. Each card type comes with its corresponding pricing and fees. Once decided, click 'Get This Card' to proceed with the exchange.

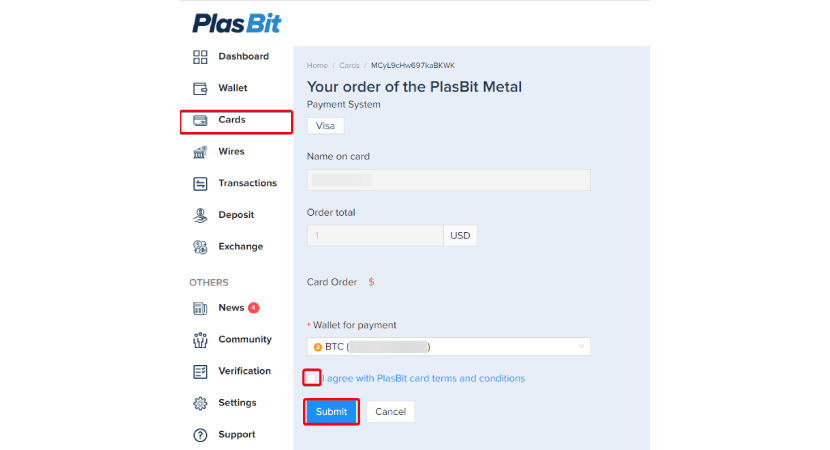

3. Enter the necessary payment details, including your card name. Review and agree to the terms provided, and then click 'Submit' to confirm the transaction.

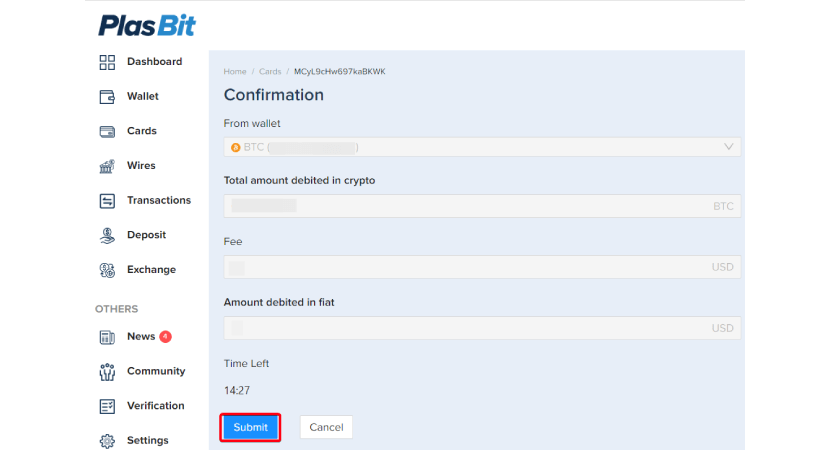

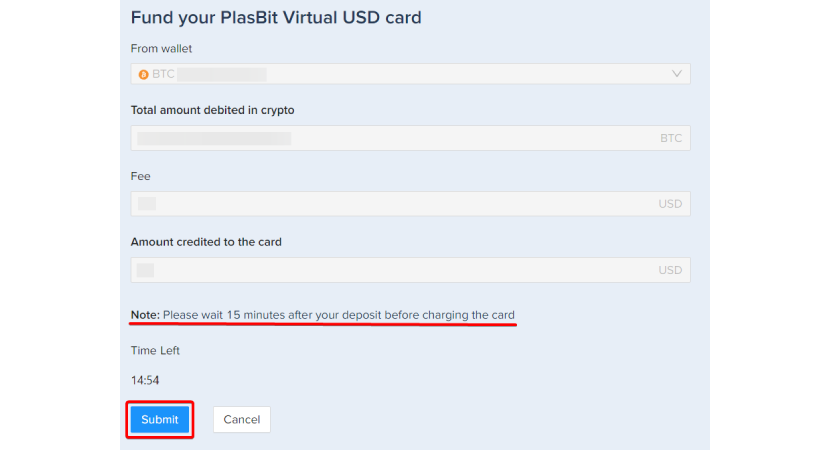

4. Take a moment to review crucial information such as your wallet balance, total crypto debited, associated fees, and the fiat amount. Click 'Submit' once you've verified these details.

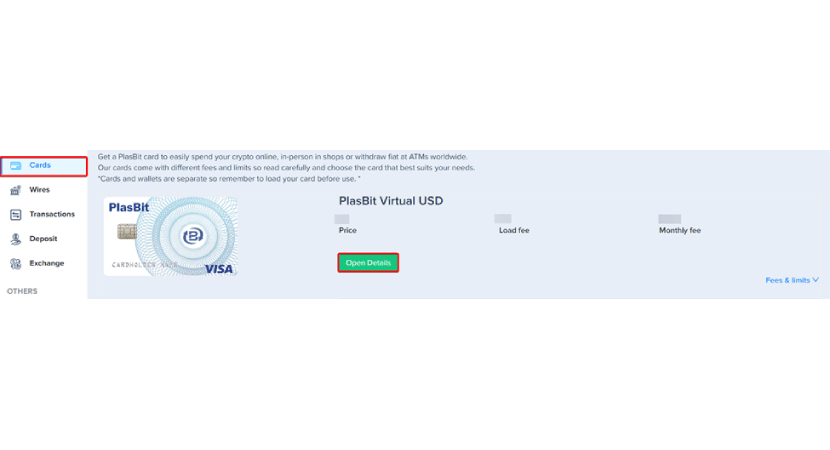

5. For a more detailed overview, click the 'Open Details' button. This section provides comprehensive information about your selected card, including limits, transaction history, validity, CVV, and signature. Note that virtual cards used exclusively online may not have a PIN code.

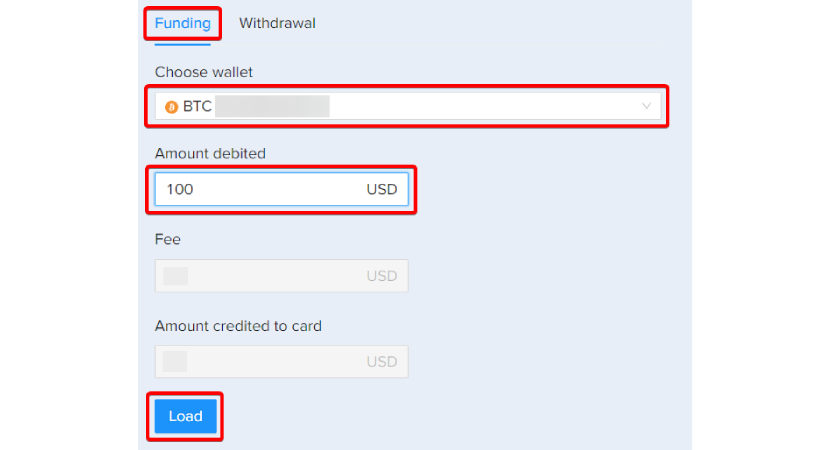

6. Choose to fund your debit card with USD through your preferred crypto wallet. Specify the amount, review associated fees, and observe the final amount to be received on your debit card.

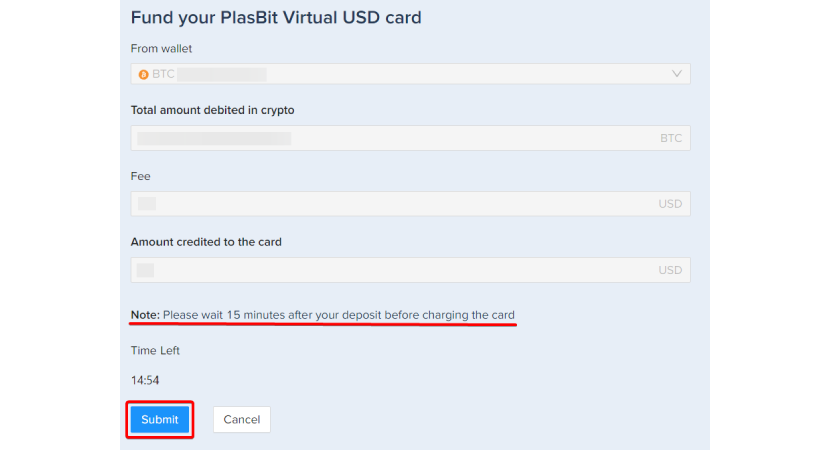

7. Observe the deduction of your cryptocurrency, automatic fee subtraction, and the display of the total amount your debit card will receive. After a final review, click 'Submit' to proceed.

8. Your debit card is now successfully loaded with funds, providing a seamless way to pay for goods and services, even at businesses that do not traditionally accept cryptocurrencies. Your debit card can be used like a traditional one for convenient transactions.

.png)

Pros and Cons of Paying with Crypto

In financial technology, cryptocurrency adoption for everyday transactions has become a topic of significant debate. While the advantages of using digital currencies are evident, weighing them against the potential drawbacks is essential. In this comprehensive exploration, we'll delve into the pros and cons of paying with cryptocurrency, shedding light on the multifaceted nature of this evolving financial landscape.

Pros of Paying with Crypto:

Pay from Anywhere:

Can you pay for things with crypto? Cryptocurrency enables you to make or receive payments anywhere with an internet connection. This global accessibility is a transformative force, providing individuals the freedom to engage in financial transactions seamlessly. The inherent flexibility not only dismantles the barriers imposed by conventional banking systems but also provides convenience and efficiency in financial interactions. Whether you find yourself in a bustling metropolis or a remote rural village, the universal accessibility of cryptocurrency ensures that financial transactions can be executed with unparalleled ease, fostering a truly borderless and interconnected financial landscape. As the world embraces this technological leap, making payments from anywhere becomes a cornerstone of financial empowerment facilitated by the global reach of cryptocurrency.

Peer-to-Peer Transactions:

Cryptocurrency introduces a paradigm in financial transactions by embracing a peer-to-peer framework. This intrinsic design minimizes reliance on intermediaries, streamlining the sending and receiving of funds directly between users. In contrast to traditional financial systems, where transactions often pass through banks or payment processors, cryptocurrency's peer-to-peer nature fosters a more direct and efficient exchange. This innovation empowers you with autonomy and control over your financial interactions, as the need for involvement from traditional financial institutions is significantly diminished. By eliminating these intermediaries, cryptocurrency enhances the speed, transparency, and accessibility of transactions, ushering in a new era where you can engage in direct financial exchanges, unburdened by the complexities of traditional banking structures or intermediary approval processes.

Fewer Fees:

One of the notable advantages of cryptocurrency transactions is the reduction in fees. In conventional transactions, consumers and businesses often find themselves subject to various fees levied by banks or payment processors. However, the peer-to-peer nature of cryptocurrency transactions transforms this landscape by minimizing fees, providing a cost-effective alternative for all parties involved. The decentralized framework of cryptocurrencies, which operates without intermediaries, inherently diminishes the need for the fee-laden structures prevalent in traditional financial systems. This translates into tangible savings for consumers and fosters an environment where businesses can engage in transactions with reduced financial overheads, contributing to the appeal and efficiency of cryptocurrency as a versatile and economical medium of exchange.

Available to Everyone:

Cryptocurrency provides financial inclusivity by offering accessible financial services to individuals without quick access to traditional banking systems. Cryptocurrency technology has significantly democratized financial services, breaking down geographical and institutional barriers that might impede individuals from participating in economic activities. Particularly impactful is that even those without swift access to conventional banking systems can partake in a spectrum of financial activities, from transactions to loans. The widespread prevalence of internet connectivity, particularly through the ubiquity of mobile devices, acts as a catalyst in enabling this inclusivity. Cryptocurrency transcends the limitations imposed by physical proximity to banks or financial institutions, empowering individuals globally to engage in financial interactions, thus fostering a more inclusive and equitable financial landscape.

Cons of Paying with Crypto:

Transaction Fees:

In cryptocurrency transactions, a distinguishing factor is the generally reduced fees compared to traditional financial services. However, you must understand that transaction fees are still part of the equation. Engaging in cryptocurrency transactions may encounter fees imposed by the cryptocurrency network, introducing a consideration in the overall cost-effectiveness of utilizing digital currencies. Despite ongoing initiatives within the cryptocurrency community to mitigate and address this concern, you should remain aware of the potential impact that transaction fees can have on the economic efficiency of digital currency transactions. Striking a balance between the benefits of reduced fees and the existence of transaction costs remains a pivotal aspect in navigating the evolving landscape of cryptocurrency transactions.

Price Volatility:

Cryptocurrency prices are notorious for their volatility. The value of a digital asset can undergo significant fluctuations from the initiation to the approval of a transaction on the network. Cryptocurrency prices pose a dual challenge for users, as there is a risk of sending insufficient funds or, conversely, sending an excess amount due to sudden price changes. This volatility underscores the importance of careful consideration and real-time monitoring during transactions, urging you to be mindful of potential price shifts that might impact the final value of your digital assets. Navigating cryptocurrency transactions requires an awareness of market dynamics and a strategic approach to mitigate the impact of price volatility on the overall transactional experience.

Risk of Loss:

You are responsible for safeguarding your private keys, which grant access to your cryptocurrency holdings. The loss of these private keys, whether due to negligence or technical mishaps, poses a critical risk, leading to irreversible consequences and the permanent loss of cryptocurrency holdings. Furthermore, the inherently volatile nature of cryptocurrency markets introduces an additional layer of risk for users. Holding cryptocurrency exposes individuals to the potential for financial loss if market prices undergo a downturn. This dual risk aspect underscores the importance of robust security measures to safeguard private keys. It highlights your need to stay vigilant in managing your cryptocurrency holdings' technical and market-related facets. As participants in the dynamic landscape of digital assets, you must navigate the delicate balance between security measures and market fluctuations to mitigate the potential risks associated with the loss of private keys and market volatility.

Not Reversible:

Once a cryptocurrency transaction is completed and recorded on the blockchain, it is irreversible. Unlike conventional methods, where transactions can be undone or corrected through established mechanisms, cryptocurrency transactions lack this reversibility feature. Once recorded on the immutable blockchain, transactions become permanent and cannot be altered or revoked. This poses a unique challenge, as errors or mistakes in a transaction necessitate a separate and distinct corrective transaction. Rectifying such errors relies on the voluntary cooperation of the recipient, adding a layer of complexity to the process. This irreversibility underscores the importance of precision and caution in cryptocurrency transactions, emphasizing the need to double-check details before confirming transactions, as any errors made are not easily correctable through the conventional means familiar in traditional payment systems. The immutable nature of the blockchain contributes to the security and transparency of cryptocurrency transactions while introducing a distinctive aspect that you must consider in your engagement with digital assets.

Not Regulated:

Cryptocurrencies operate in a decentralized and unregulated environment. Although this absence of centralized regulation provides a sense of independence, you are vulnerable to scams and fraudulent activities. Furthermore, if the cryptocurrency exchange where you store your keys faces financial difficulties, the lack of regulatory mechanisms may leave you without proper recourse or legal avenues for recovery. This aspect highlights the importance of users exercising heightened diligence and adopting robust security measures as they navigate the uncharted waters of a decentralized financial landscape. On the other hand, some platforms receive regulatory licenses from governments. Choose platforms that adhere to regulatory standards. We operate under the oversight of the Polish government, holding a crypto exchange license and adhering to the regulations set by the Ministry of Finance. As a registered company in Poland (NIP 5214002884), we take pride in our adherence to regulatory standards, ensuring transparency, legality, and the highest standards in our operations. PlasBit Sp z.o.o is dedicated to providing a secure environment for cryptocurrency transactions, with comprehensive regulatory oversight reflected in our licensing, making us a trustworthy choice for your digital currency needs. The evolving nature of cryptocurrency regulation worldwide continues to shape the level of protection available to users, reinforcing the need for a balanced approach that embraces the opportunities presented by decentralization while acknowledging the potential risks associated with the lack of centralized oversight.

The Future of Cryptocurrency Payments

Can you pay for things with crypto? Yes, cryptocurrency payments are characterized by promising prospects, marked by ongoing developments that actively address the challenges faced by the financial ecosystem. One pivotal factor contributing to this optimistic outlook is the gradual but steady increase in merchants accepting digital currencies as a valid form of payment. This trend indicates a broader shift towards mainstream acceptance and usability of cryptocurrencies in everyday transactions. Integrating digital assets into the payment sphere not only bolsters the credibility of cryptocurrencies but also expands their utility beyond the confines of traditional financial systems.

A key determinant shaping the future of cryptocurrency payments lies in the maturation of regulatory frameworks governing digital currencies. As regulatory bodies worldwide actively engage with the complexities of this evolving landscape, the resultant frameworks are expected to provide a more secure and stable environment for users and businesses alike. Clarity in regulations can mitigate fraud, security, and legal compliance concerns, fostering an environment conducive to the widespread adoption of cryptos for day-to-day transactions. Moreover, technological advancements are pivotal in enhancing the user experience and solving the challenges associated with cryptocurrency payments. Innovations in blockchain technology, the underlying foundation of most cryptocurrencies, are continuously improving transaction speed, scalability, and overall efficiency. This technological evolution creates user-friendly platforms and solutions, making cryptocurrency transactions more accessible and user-oriented.

The introduction of Central Bank Digital Currencies. Further amplifies the transformative potential of cryptocurrency payments. As governments explore the development and implementation of CBDCs, they contribute to the normalization of digital currencies and provide a bridge between traditional fiat currencies and the decentralized world of cryptocurrencies. The coexistence of CBDCs with private cryptocurrencies could create a symbiotic relationship that addresses regulatory compliance, stability, and government acceptance concerns.

Conclusion

Cryptocurrency payments are evolving rapidly, marked by both challenges and opportunities. Can you pay for things with crypto? The increasing acceptance of cryptocurrencies by merchants across various industries signals a move towards mainstream integration, emphasizing that while some companies embrace cryptocurrency payments, others may still need to be ready. PlasBit cards emerged as an innovative solution, allowing you to enjoy the benefits of cryptocurrency in situations where direct payments are not yet possible. Regulatory developments are vital in shaping the future, providing a secure environment for users and businesses. Technological advancements, including innovations in blockchain technology, continue to enhance the user experience, making cryptocurrency transactions more accessible and efficient. The emergence of CBDCs adds another layer to the evolving narrative, creating potential synergies between traditional fiat currencies and decentralized cryptocurrencies. As the industry navigates through issues like price volatility, security concerns, and regulatory uncertainties, the promise of seamlessly integrating cryptocurrencies into everyday transactions remains high. The future of cryptocurrency payments can redefine how we engage with financial transactions, offering a more inclusive, efficient, and borderless financial landscape.