In the fast-evolving ecosystem of cryptocurrencies, mining remains a pivotal and potentially lucrative avenue for acquiring digital assets. While the heyday of efficiently mining Bitcoin with a run-of-the-mill desktop computer is long past, numerous cryptocurrencies can still be effectively mined using Graphics Processing Units (GPUs). We will serve as a comprehensive introduction to GPU mining, exploring the key elements that can help you get started with the most profitable crypto to mine.

The Potency of Mining

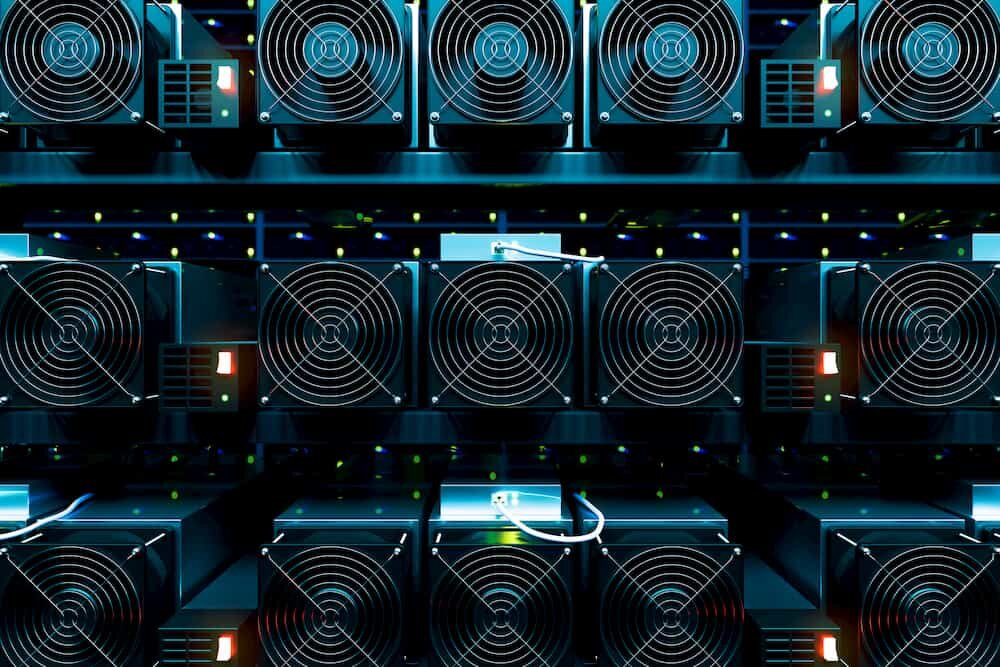

Graphics Processing Units, or GPUs, are the unsung heroes within modern computing, initially designed for rendering graphics and videos with unparalleled speed and efficiency. However, their prowess extends far beyond mere visual tasks, making them a fundamental tool for cryptocurrency mining. In contrast to Central Processing Units (CPUs), which are versatile, general-purpose processors, GPUs shine in performing parallel calculations. This inherent parallelism allows GPUs to handle the complex mathematical computations for cryptocurrency mining efficiently. The ability to process a multitude of hash calculations simultaneously positions GPUs as the workhorses of the mining world.

Navigating the Cryptocurrency Terrain

As the cryptocurrency ecosystem expands, an ever-increasing number of digital currencies are accessible for mining with GPUs. Notable options include Bitcoin, Monero, Ravencoin, Bitcoin Gold, and many others, each offering unique opportunities for miners to reap rewards by contributing their computational might to the network. Varying mining algorithms underpin these diverse coins, each demanding a specific approach and hardware configuration. Proficiency in understanding the intricacies of your chosen cryptocurrency's algorithm and prerequisites is paramount for optimizing your mining operations.

Unpacking Profitability

The profitability of GPU mining is a multifaceted equation influenced by several pivotal factors:

Mining Difficulty: Cryptocurrencies adjust their mining difficulty dynamically to ensure that blocks are consistently mined. A higher mining difficulty can intensify the reward competition, potentially impacting profitability.

Hardware Costs: The upfront investment in GPUs and mining rigs significantly impacts profitability. Striking a balance between hardware expenses and potential earnings is essential.

Electricity Costs: The power consumption of your mining equipment directly impacts your bottom line. Mining can be profitable in regions with low electricity costs but less in areas with exorbitant rates.

Coin Price: The market price of your mining cryptocurrency plays a pivotal role. A higher coin price can amplify your earnings, while a slump in price can curtail profitability.

Mining Pool: Participating in a mining pool allows miners to pool their computational resources and share rewards. Pool mining provides a more stable income stream, even for smaller-scale miners.

The Path Ahead

As we explore the world of GPU mining, we will delve deeper into the most profitable crypto to mine in 2023, demystify the technical aspects of setting up your mining rig, and provide nuanced insights into this dynamic venture's multifaceted risks and rewards. Whether you're a seasoned miner seeking to fine-tune your operations or a newcomer eager to immerse yourself in cryptocurrency mining, this guide is designed to equip you with the knowledge and tools necessary to maximize your earnings and make informed decisions in this exhilarating realm. Join us on this enriching journey as we unearth the wealth of opportunities within the exciting world of cryptocurrency mining. Let's begin our profitable odyssey together.

Unlocking the Potential: Top Cryptocurrencies for GPU Miners

In the previous chapter, we delved into the fundamentals of GPU mining and its profitability factors. Now, let's dive deeper into the heart of GPU mining by exploring the top cryptocurrencies that offer compelling opportunities for miners in 2023. Which is the most profitable crypto to mine? These digital assets not only present the potential for significant earnings but also encompass diverse mining algorithms and characteristics that cater to a wide range of mining preferences. If you are trying to predict the profitability of mining, PlasBit comes to your aid with our mining calculator. How to use this tool?

Step 1: Enter the Bitcoin Mining Hashrate as the first parameter. You can enter it in GH/s, TH/s, or PH/s.

Step 2: Enter the Power Consumptions in Watts to calculate the output appropriately

Step 3: Enter the cost of electricity in $/kWh. It depends on your country of residence and contract with your energy provider.

Step 4: Enter the cost of Pool/maintenance fees in percent.

Step 5: After filling out the tool with this data, you can easily check the profit, fees, and costs you would have for mining cryptocurrency.

Now, let's delve into the specifics of the most profitable cryptocurrencies.

Bitcoin (BTC)

Algorithm: SHA-256

Block Time: 10 minutes

Block Reward: 6.25 BTC

ROI since launch: 3%

Current Price: $25,570.01

Bitcoin, often called digital gold, remains the benchmark in cryptocurrencies. While it's widely recognized as a digital store of value and a medium of exchange, Bitcoin mining continues to be a lucrative venture for GPU miners. Although ASIC miners have taken over the network's hash rate, Bitcoin can still be profitably mined with high-performance GPUs, particularly Nvidia GeForce RTX series cards.

Monero (XMR)

Algorithm: RandomX

Block Time: 2.5 minutes

Block Reward: 1.16 XMR

ROI since launch: 5,887%

Current Price: $136.88

Monero takes privacy to the next level, offering private and censorship-resistant transactions. It's among the easiest and most profitable crypto to mine with GPUs. Monero's unique features, such as ring signatures, make it nearly impossible to trace transactions. GPU mining Monero is an appealing choice for those who value privacy in their cryptocurrency activities.

Ravencoin (RVN)

Algorithm: KAWPOW

Block Time:1 minute

Block Reward: 5,000 RVN

ROI since launch: 39%

Current Price: $0.01416

Ravencoin is designed to transfer digital assets and offers a straightforward GPU mining experience. It can be mined efficiently with consumer-grade GPU hardware, making it a cost-effective choice for individual miners. Ravencoin's blockchain supports asset creation and transfer, catering to those interested in tokenization.

Bitcoin Gold (BTG)

Algorithm: Equihash-BTG

Block Time: 10 minutes

Block Reward: 6.25 BTG

ROI since launch: 96.93%

Current Price: $12.33

Bitcoin Gold is an open-source digital currency that allows miners to use common GPUs instead of ASICs. It emphasizes decentralization and enables mining with a simple computer setup. Bitcoin Gold is an attractive option for those looking to get into mining without significant upfront investments. These five cryptocurrencies represent just the tip of the iceberg in GPU mining. We will delve into the specific steps to mine these coins, exploring the intricacies of setting up your mining rig and optimizing your earnings. Whether you're drawn to the allure of Bitcoin's historical significance, Ethereum's smart contract capabilities, Monero's privacy features, Ravencoin's asset transfer functionality, or Bitcoin Gold's accessibility, there's a wealth of opportunity awaiting GPU miners in 2023.

Setting Up Your GPU Mining Operation for Success

In this comprehensive chapter, we'll walk you through the intricate process of preparing your GPU mining rig, from selecting the right hardware components to configuring your software and fine-tuning your mining settings. You'll be well-prepared to embark on your mining journey with confidence. Selecting the best wallet and the hardware is the foundation of any successful operation. Here's a closer look at the key considerations:

Settings and Set up

The choice of GPUs significantly impacts your mining power and efficiency. Due to their robust computational capabilities, Nvidia GeForce and AMD Radeon GPUs are the most popular options among miners. When evaluating GPUs, consider:

- Hash Rate: This metric denotes the speed at which your GPU can calculate mining. Higher hash rates equate to more mining power.

- Power Efficiency: The hash-to-power ratio is a critical factor. GPUs that offer higher hash rates while consuming less electricity are more cost-effective.

- Compatibility: Ensure your chosen GPUs are compatible with your mining software and motherboard.

- Cooling Solutions: Proper cooling is essential to prevent overheating, which can damage hardware. Invest in efficient cooling solutions, such as fans or liquid cooling systems.

Select a motherboard that can accommodate the number of GPUs you plan to use. Ensure it has sufficient PCIe slots and power connectors for your GPUs. A reliable and efficient power supply is crucial. Calculate your total power requirements, factoring in the power consumption of all components, and select a PSU that can deliver the necessary wattage. Overloading a PSU can lead to instability and reduced mining performance. Once you've gathered your hardware components, it's time to set up your mining rig. Consider using a lightweight and stable OS such as Linux or Windows. Linux is often favored for its resource efficiency. Install the chosen OS on your rig, ensuring it's compatible with your hardware.

Mining Software Configuration

Selecting the correct mining software is pivotal. Different cryptocurrencies require specific mining software, so choose one that aligns with your mining goals. Some common mining software options include:

- CGMiner: Known for its versatility and configurability.

- Ethminer: Explicitly designed for Ethereum mining.

- PhoenixMiner: Popular for Ethereum mining with additional features.

- XMRig: Ideal for mining Monero and other CryptoNight-based coins.

Install your chosen mining software on your rig and configure it to connect to a mining pool. Ensure you enter the correct pool address, port number, and wallet address. Fine-tune your settings based on your hardware and the cryptocurrency you're mining. While solo mining is possible, joining a mining pool is generally more profitable for small-scale miners. Mining pools allow miners to combine their computational power, increasing the likelihood of earning consistent rewards. Choose a reputable mining pool for your chosen cryptocurrency. Popular options include Slush Pool, Ethermine, and F2Pool.

Optimization, Monitoring, and Earnings

Optimizing your mining rig is an ongoing process. Regularly monitor your rig's performance and temperature to ensure it's running efficiently. Keep your mining software up to date and make necessary adjustments to maximize hash rates while minimizing power consumption. Maintenance involves cleaning dust from your hardware components and ensuring proper airflow and cooling. Overheating can lead to hardware degradation and reduced lifespan. Keep a close eye on your mining operations through your mining pool's dashboard or your mining software. Track your earnings and monitor the progress of your rig. Payouts from the pool will be deposited into your wallet once you reach the pool's minimum payout threshold, which varies from one pool to another.

Security and Backup

Implement robust security measures to protect your mining earnings. Enable two-factor authentication (2FA) for your wallet and mining pool accounts. Consider using a hardware wallet for added security. Regularly back up your wallet's private keys to prevent data loss. By following these detailed steps and maintaining your mining rig diligently, you'll be well-prepared to navigate the complexities of GPU mining. We'll delve into the specific mining procedures for some top cryptocurrencies, including Bitcoin, Monero, Ravencoin, and Bitcoin Gold. These cryptocurrencies have unique mining methods and considerations that we will explore thoroughly. Your journey to becoming a proficient GPU miner continues, and by the end of this guide, you'll be equipped with the knowledge and skills to thrive in the exciting world of cryptocurrency mining. It is worth remembering that asset security is one of the prerequisites for getting started in Web3. PlasBit gives you a confidential wallet with which you can have peace of mind, as users' funds are stored in cold wallets, ensuring security and preventing hacks and scams.

Altcoins Mining: Exploring Diverse Opportunities

We'll shift our focus from specific cryptocurrencies to the broader world of mining other types of cryptocurrencies. Altcoins, short for "alternative coins," encompass all cryptocurrencies besides Bitcoin. Mining altcoins presents numerous opportunities and challenges for GPU miners, and understanding these diverse implications is essential.

Choosing the Right Altcoin

Altcoins come in various forms, each with unique features, use cases, and mining algorithms. Some altcoins aim to improve Bitcoin's limitations, while others introduce novel functionalities such as smart contracts or privacy features. Selecting the right altcoin to mine requires careful consideration of factors such as:

- Mining Algorithm: Different altcoins use distinct mining algorithms, which may be more or less suited to GPU mining.

- Market Potential: Assess the altcoin's market capitalization, trading volume, and potential for future growth.

- Mining Difficulty: Research the altcoin's mining difficulty and the competition among miners.

- Use Case: Understand the altcoin's purpose and whether it aligns with your mining goals.

Setting Up for Altcoin Mining

While the specifics may vary, the general setup for altcoin mining involves:

- Hardware: Ensure you have the appropriate GPUs, motherboards, and PSUs for the chosen altcoin.

- Mining Software: Find and install mining software compatible with the altcoin's algorithm.

- Mining Pool: Join a mining pool relevant to your chosen altcoin for better chances of earning rewards.

Security, Profitability, and Risks

Always prioritize security when mining altcoins. Use secure wallets to store your altcoin earnings and enable necessary security features to protect your assets. Altcoin mining profitability can fluctuate significantly. Monitor factors such as the altcoin's price, network difficulty, and electricity costs. Be prepared to switch between altcoins based on market conditions. Mining altcoins involves risks, including market volatility, technological changes, and the potential for project failures. Stay informed about developments in the altcoin space and be adaptable in your mining strategy. Understand the regulatory environment in your jurisdiction regarding cryptocurrency mining and ensure compliance with tax obligations related to mining income.

Future Prospects

The world of altcoins is dynamic, with new projects constantly emerging. Stay curious and open to exploring new altcoins and technologies as they develop. Mining altcoins expands your horizons as a cryptocurrency miner, offering diverse opportunities beyond the more established cryptocurrencies. Whether you're attracted to innovative technologies, unique use cases, or potential growth, the world of altcoin mining is rich with possibilities. We'll delve into cloud mining, a different approach to cryptocurrency mining that doesn't require you to own and operate your mining hardware.

Cloud Mining: A Comprehensive Overview

The intriguing world of cloud mining is a popular alternative to traditional cryptocurrency mining. We will explore cloud mining, its advantages and disadvantages, selecting a reliable provider, and getting started. Cloud mining represents a service provided by specialized companies that enable individuals to participate in cryptocurrency mining without investing in, maintaining, or operating mining hardware. Instead of setting up your mining rig at home, you purchase mining contracts from cloud mining providers, who host and manage the necessary hardware on your behalf.

Advantages of Cloud Mining

The advantages are:

No Hardware Costs: A significant advantage of cloud mining is that it eliminates the need for substantial hardware investments. You can participate in mining without purchasing GPUs, ASICs, or other equipment.

Maintenance-Free: Cloud mining providers take care of hardware maintenance, including cooling, repairs, and hardware upgrades. It relieves you of the responsibility for keeping your mining equipment operational.

Accessibility: Cloud mining is beginner-friendly and does not require extensive technical expertise. It provides an accessible entry point for individuals interested in cryptocurrency mining.

Diversification: Many cloud mining providers offer contracts for various cryptocurrencies, allowing you to diversify your mining portfolio and potentially increase your overall returns.

Disadvantages of Cloud Mining

The disadvantages are:

Limited Control: When opting for cloud mining, you relinquish a degree of control over the mining process and hardware selection. The cloud mining provider determines the choice of mining equipment and strategies.

Scam Risks: The cloud mining industry has been plagued by fraudulent providers and scams. It is crucial to conduct thorough research and select a reputable and trustworthy cloud mining company.

Potential for Lower Profits: While cloud mining eliminates hardware and maintenance costs, it may result in lower overall profits due to fees associated with mining contracts. These fees can impact your profitability over time.

Selecting a Reliable Cloud Mining Provider

Choosing the right cloud mining provider is critical in your cloud mining journey. Consider the following factors:

Reputation and History: Research the provider's reputation and track record within the industry. Look for user reviews and feedback from other cloud miners.

Transparency: Reputable cloud mining providers should be transparent about their fees, contract terms, and the hardware they use for mining.

Security Measures: Assess the security measures to protect your account and assets. Strong authentication options and encryption protocols are essential.

Getting Started with Cloud Mining

Initiating your cloud mining experience involves several key steps:

Sign-Up: Register with your chosen cloud mining provider by creating an account.

Contract Selection: Choose a mining contract that aligns with your budget and objectives. Contracts may vary in terms of duration, fees, and supported cryptocurrencies.

Payment: Make the necessary payment for your selected mining contract, typically using cryptocurrencies or fiat currency.

Monitoring: Access your mining performance data through the cloud provider's dashboard. It enables you to track your mining operation's progress.

Understanding Fees in Cloud Mining

Cloud mining contracts often entail various fees:

Maintenance Fees: These fees cover operating and maintaining the mining hardware.

Electricity Fees: Some cloud mining providers charge for the electricity used during mining operations.

Contract Length: Longer contract durations often incur lower fees but may require a more substantial upfront payment.

Security Considerations and Profitability

Security should be a top priority when participating in cloud mining. Protect your cloud mining account with solid and unique passwords and enable two-factor authentication (2FA) if available. Be vigilant against phishing attempts and only use verified and secure cloud mining providers. Assessing the potential profitability of your cloud mining venture involves considering factors such as the contract duration, associated fees, the current price of the cryptocurrency being mined, and network difficulty. Online calculators can aid in estimating potential returns.

Long-Term Considerations

While cloud mining offers a convenient entry point into cryptocurrency mining, it is essential to consider your long-term objectives. As you gain experience, you may explore other mining options, such as self-mining with dedicated hardware or GPU mining. In conclusion, cloud mining provides a hassle-free avenue for individuals to engage in cryptocurrency mining without the complexities of hardware management. By conducting thorough research, selecting a reputable provider, and understanding the associated risks, you can decide whether cloud mining aligns with your cryptocurrency mining goals.

Navigating the World of Crypto Mining

In this comprehensive guide, we've embarked on a journey through the exciting and dynamic world of cryptocurrency mining, understanding the most profitable crypto to mine. We've explored the fundamental concepts, hardware requirements, software options, and various cryptocurrencies suitable for mining with GPUs. We've also delved into cloud mining, providing an alternative approach to cryptocurrency mining.

As you conclude your exploration of this guide, it's important to highlight some key takeaways:

Diverse Opportunities: Cryptocurrency mining offers many opportunities, from Bitcoin and Ethereum to lesser-known altcoins. Choosing cryptocurrency to mine should align with your goals, resources, and risk tolerance.

Hardware Matters: The selection of mining hardware, including GPUs and ASICs, significantly impacts your mining success. Monitor hardware trends and choose equipment that best suits your needs.

Software and Pools: Utilize mining software and join mining pools to maximize your mining efficiency and rewards. Stay informed about the latest software updates and pool choices.

Cloud Mining: Cloud mining can provide a convenient entry into mining, but it requires careful research to identify reputable providers and evaluate contract terms.

Security Is Paramount: Safeguard your mined cryptocurrencies by using secure wallets and following best practices for wallet security. Protect your accounts with strong passwords and 2FA.

Profitability and Risk: Understand that profitability in cryptocurrency mining can vary due to hardware costs, electricity expenses, and cryptocurrency price fluctuations. Be prepared for potential risks and challenges.

Long-Term Vision: Consider your long-term goals in cryptocurrency mining. Whether you aim to accumulate digital assets, support blockchain networks, or explore mining as a business venture, planning for the future is essential.

Cryptocurrency mining is a dynamic and evolving field, and staying informed about industry developments is crucial to success. Continue to educate yourself, explore new opportunities, and adapt your mining strategy to navigate the ever-changing crypto world. As you embark on your cryptocurrency mining journey, remember that knowledge and prudent decision-making are your greatest assets. By following the principles and insights presented in this guide, you are well-equipped to embark on a rewarding and fulfilling mining experience. PlasBit is glad to help you on your Web3 journey by providing free educational content and all the services you need for a confidential and secure experience. Thank you for joining us on this mining expedition, and may your crypto-mining endeavors be both profitable and enlightening. Happy mining!

.jpg)