Trust.

“Mr. Hadley, do you trust your wife? What I mean is, do you think she would go behind your back and try to hamstring you?” a nervous Andy Dufresne (Tim Robbins) queries an angry Captain Bryon Hadley (Clancy Brown) in the 1994 film The Shawshank Redemption after Dufresne overhears Hadley tell fellow guards that he inherited $35,000 from his dead brother but dreads the taxman. With those words, Dufresne, a banker in prison for killing his wife, saved Hadley his entire inheritance from inheritance tax. It was advice Hadley accepted, not because he trusted the prisoner, but because the arrangement provided both parties with the best outcomes. In other words, it was a trustless agreement. Blockchain is all about casting trust aside and relying on a trustless network - a system of cryptographic checks and balances designed to protect your transactions. Those transactions are verified by faceless nodes devoted to maintaining the integrity of the blockchain. All you need to participate is a cryptocurrency wallet.

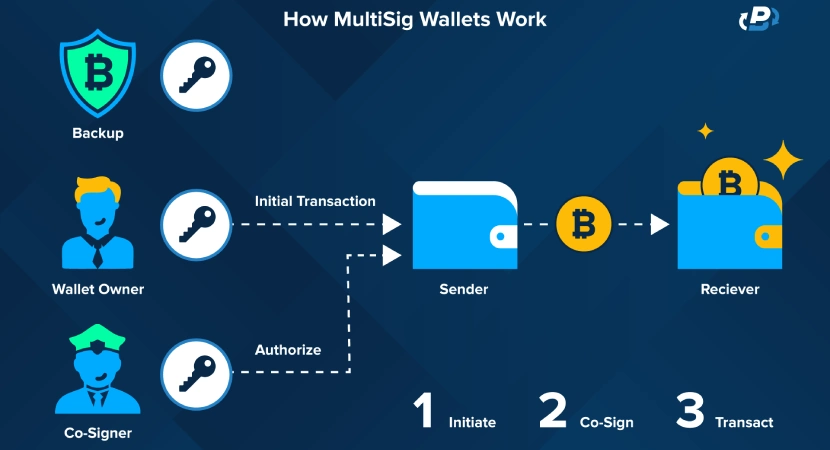

But, as they say, nothing is foolproof. Despite their best efforts, crypto wallets can be compromised. For one, there are the bad actors eager to find cracks in your security to steal those assets by gaining access to your wallet. They are the ones who make the news if the amounts are substantial. Then there are those who could hurt you most – your “friends” or “trusted associates” — people who ultimately take advantage of your naïveté, steal your private key, and your money. The stakes grow even higher when those assets belong to a large group or business entity holding millions in crypto assets monitored and protected by just one individual. We’ll touch on one such story later in this article. What the Plasbit team wants you to know is that there is an obvious solution to allow more than one person to protect that account. Using multi-sig, or multi-signature technology provides that solution. But what is multisig in crypto? It’s a type of transaction that stays pending until more than one person who has the private key approves it, making it more secure than common single-sig transactions, especially for high-value or business-related transfers. Multisig wallet types vary, including 2-of-3 (any two of three people/private keys must sign), 3-of-5, and even all-signature (N-of-N) models.

Trust in a single person is unnecessary, replaced by a system that requires additional parties to be satisfied while protecting crypto assets from being lost or stolen. Now then, this system isn’t necessary for everyone. In fact, the majority of cryptocurrency users don’t/ won’t need this because they don’t share their wallets. But if you are a family, small business, corporation, or an organization that allows payment through traditional methods, or operate as a decentralized autonomous organization (DAO), this could be your way to help safeguard those assets. It depends on your needs. Be aware that you will need a certain level of technical expertise to set this up, as it is more complex than setting up a single-user wallet. But if you’ve come this far and want the added security, you might want to come a little bit further.

Multisig Wallets: A Deep Dive

What is multisig in crypto and how does it really work? Multisig allows for two, three, or even five people to digitally sign off on a transaction. The number of private keys one chooses to sign a transaction is based on the size and needs of the group. There can be as few as two, or as many as five key holders assigned to a wallet, represented by the letter “N.” The minimum number of people necessary to approve the transaction is represented by the letter “M.” Combinations can run as low as 1-of-2, or as high as 3-of-5, depending on the security needs of the group or organization. It could be that the organization requires unanimity, referred to as N-of-N. If two people control a wallet, like two partners, it is a 2-of-2 modal.

Pretty simple if you ask me

Multisig not only requires multiple signatures to move assets from within, reducing the possibility of fraud and embezzlement, it also discourages hackers who, instead of one key, must locate and break into multiple sites and secure a majority of keys to steal those assets. Like any security system, no one can guarantee 100 percent security, but in this case, the perpetrator would need to locate and have access to multiple private keys tied to one wallet to carry out a heist. Another benefit of multisig is that if one member of the group loses their private key, assets remain accessible to others. Recovering a key for a multisig wallet is similar to key recovery for a single-holder wallet. How does recovery work? When setting up a multisig wallet, the user has two options.

One is to allow the program to generate a phrase which it then stores on that computer. If you have your own single-user wallet, you have to write down the seed or recovery phrase yourself. If the key to the multisig wallet is lost, or damaged and beyond repair, all you need is your recovery phrase. So, make sure to write it down and put it in a safe place. Now then, because it is stored on your computer, it can be stolen if your computer is hacked. A second option during setup is to go “seedless” where the user doesn't handle a visible recovery phrase and relies on alternative key management methods. It’s too early to speculate, but perhaps a seedless option could be incorporated for single-use wallets, where today, if one loses their key and recovery phrase, their assets are lost forever.

Things to Consider Before Jumping on the Multisig Train

Pros

- Added Security: Multisig wallets offer an added layer of security and transparency for those looking to share a crypto wallet, The responsibility for that wallet and its assets can be shared equally among those in the group.

- Reliability: If someone loses their private key, others in the group can still go forward with their transactions.

- Key Recovery: Lost keys are easily recoverable either by using the specific recovery phrase generated at the time of the wallet’s creation or from other personal information.

- Fraud Protection: Multisig wallets provide a level of fraud protection, preventing a single bad actor in the group from improperly directing the group’s assets.

Cons

- Inconvenience: Using multisig wallets for daily transactions could prove difficult as multiple keyholders are required to approve transactions, keyholders who may or may not always be available to initiate that approval

- Lost Keys: If two people control a wallet and transactions require both to approve a transaction, if one key is lost and cannot be recovered, the content of that wallet cannot be accessed.

- Ease of Use: One needs some technical expertise to set up a multisig wallet.

- Hacking: Wallets can be breached if private keys are stored improperly.

How to Set Up a Multisig Wallet

Now that you know the answer to the question of what is multisig in crypto, it’s time to set one up. Here’s a handy guide to get you on your way.

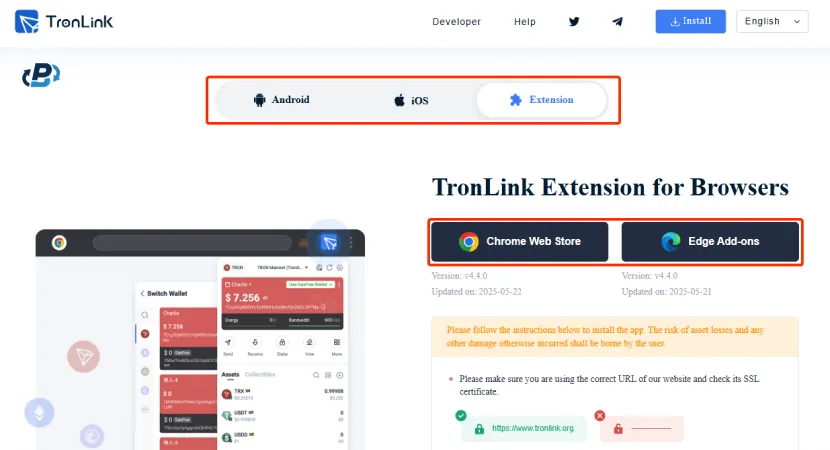

1. Download the TronLink extension for your browser (or the application if you are using a phone)

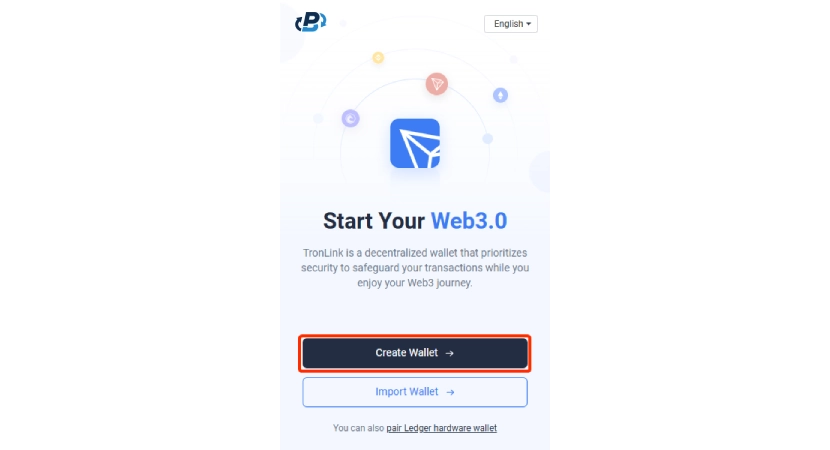

2. Open the extension, click on "Create Wallet" and follow the steps

*Before starting the process, make sure the wallet you have just created has at least 100 TRX, which is the fee for setting up the multisig wallet

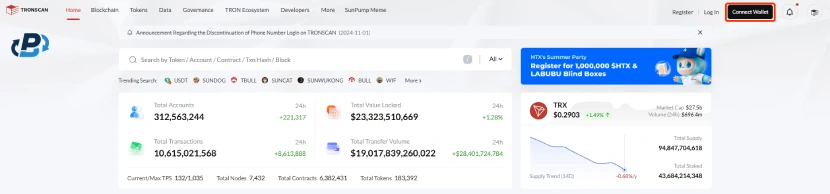

3. Go to the tronscan website and click on "Connect Wallet" in the top right corner

4. Select TronLink as your connection method and click "Connect"

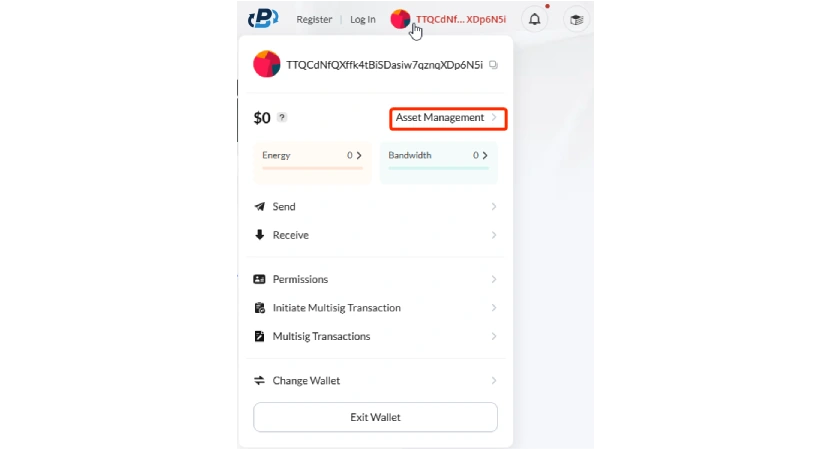

5. Click on "Asset Management" in your wallet

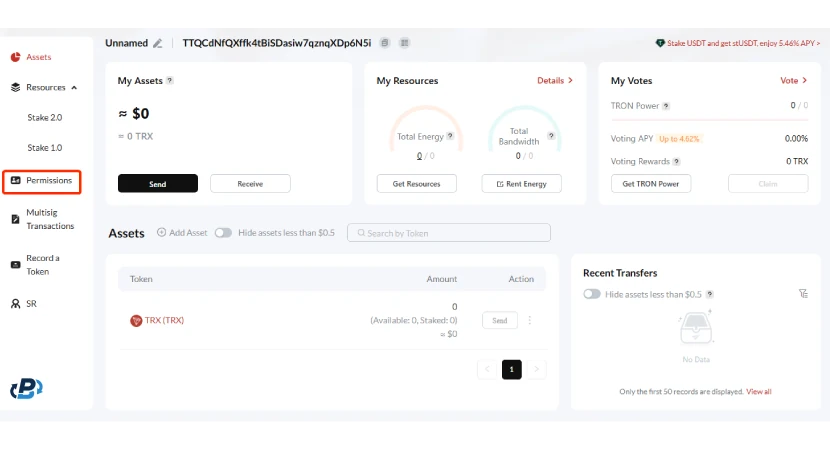

6. Now, go to the "Permissions" tab

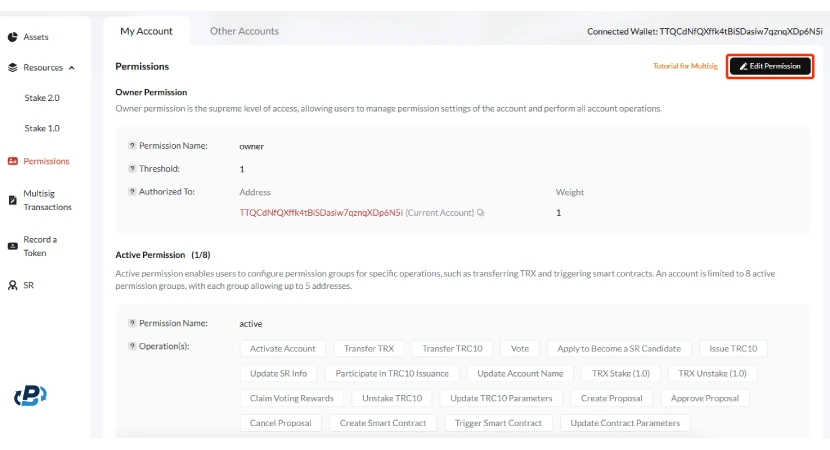

7. Click on "Edit Permissions"

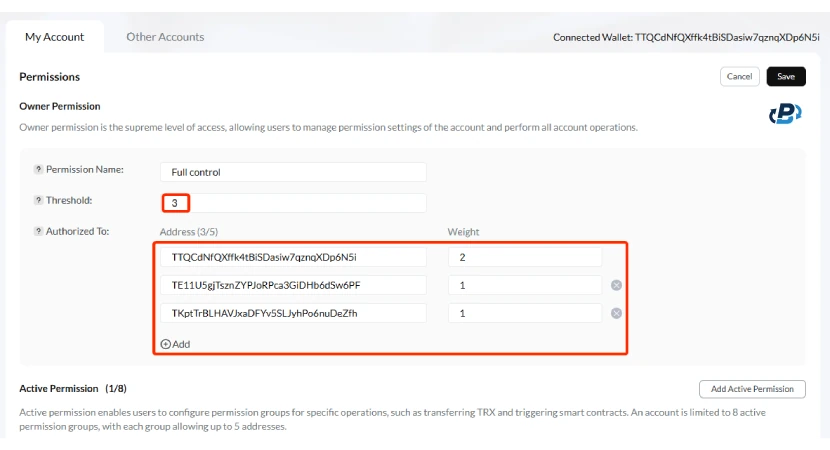

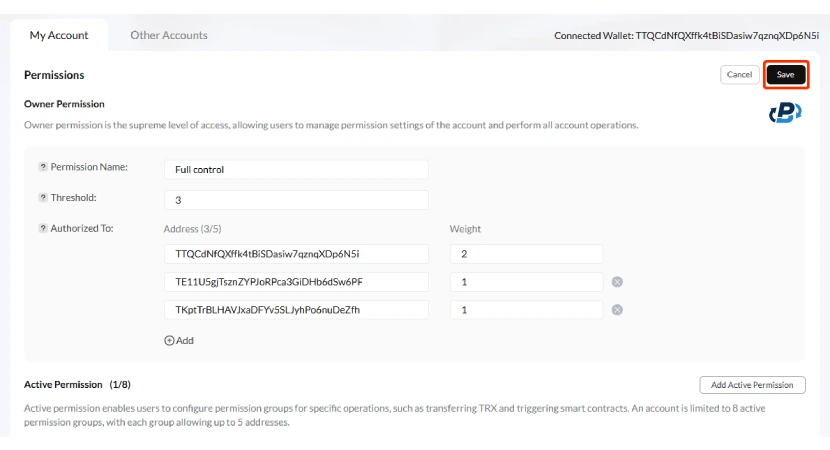

8. First, set the threshold, which is the combined weight that needs to be reached to approve a vote. Then, add the wallet addresses and assign the weight for each one.

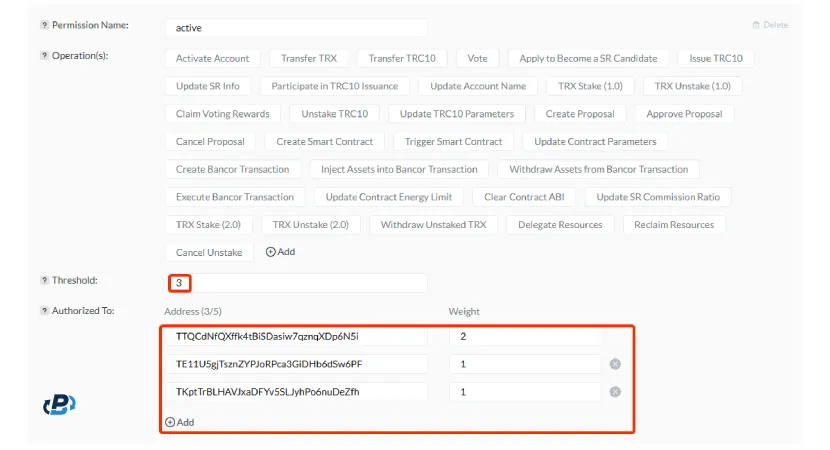

* The next section is called 'Active Permissions,' where you’ll define what actions the wallets can perform besides signing transactions

9. Under the "Operations" Section, decide which actions can be voted on. Then, under the "Authorized To" section, fill in the same addresses from the last step and their weight.

10. Scroll back up and click on "Save"

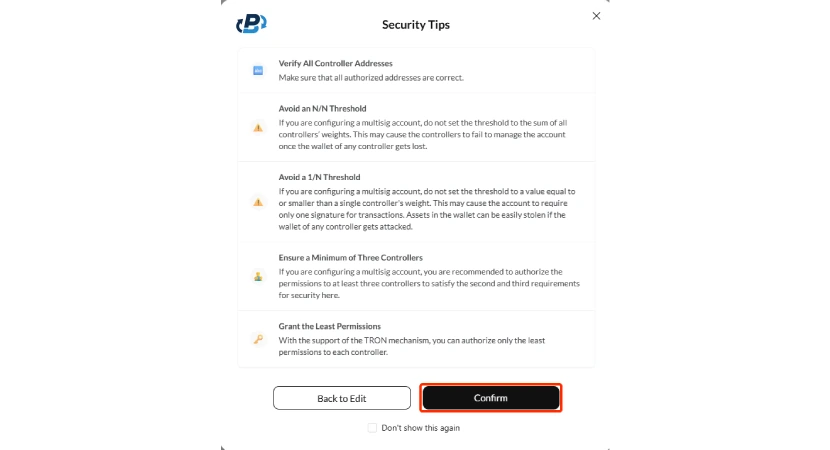

11. Read the Security Tips and click on "Confirm"

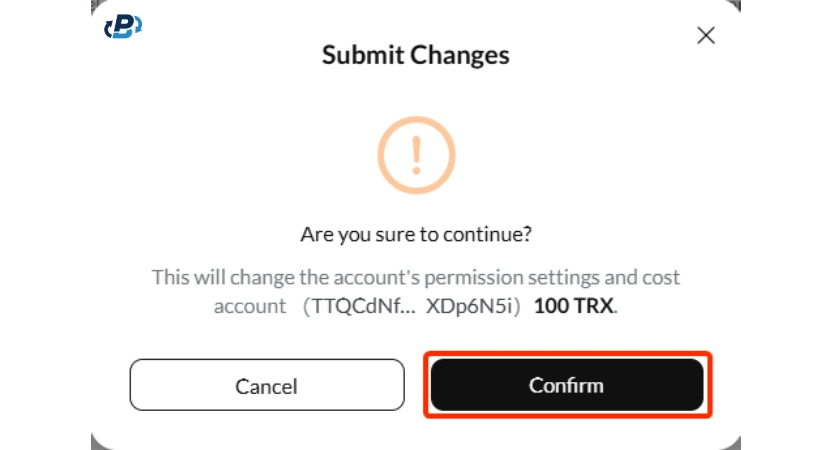

12. Click on "Confirm" once again, note that the wallet will be charged 100 TRX

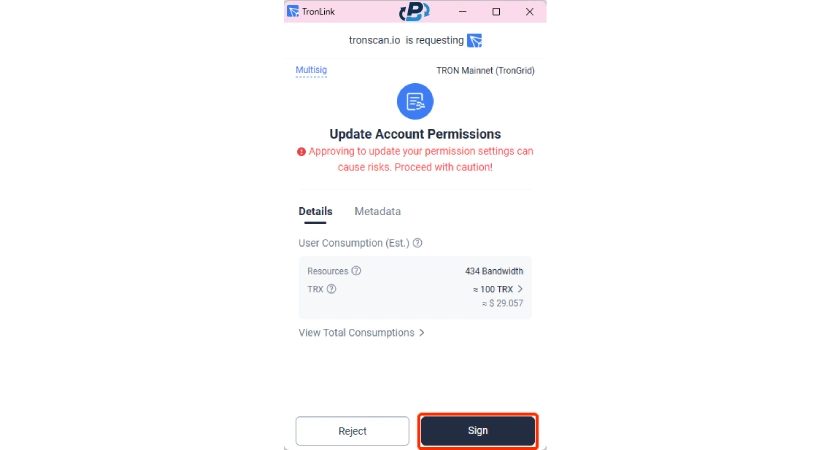

13. You will be redirected to the TronLink wallet. Click "Sign"

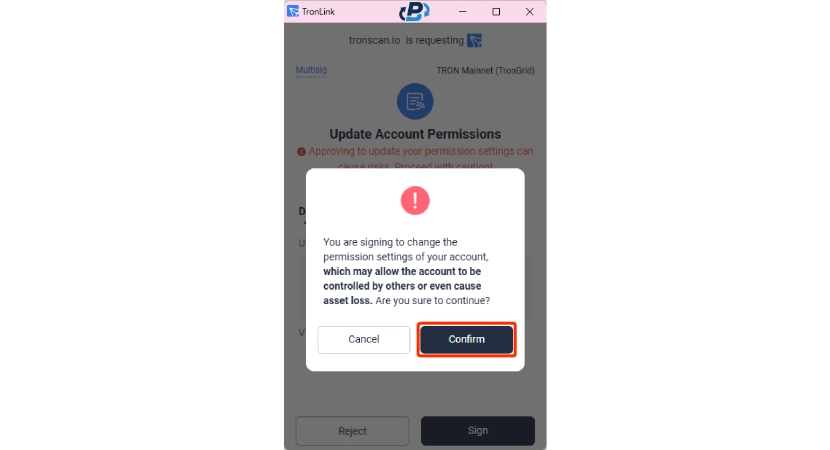

14. Click "Confirm"

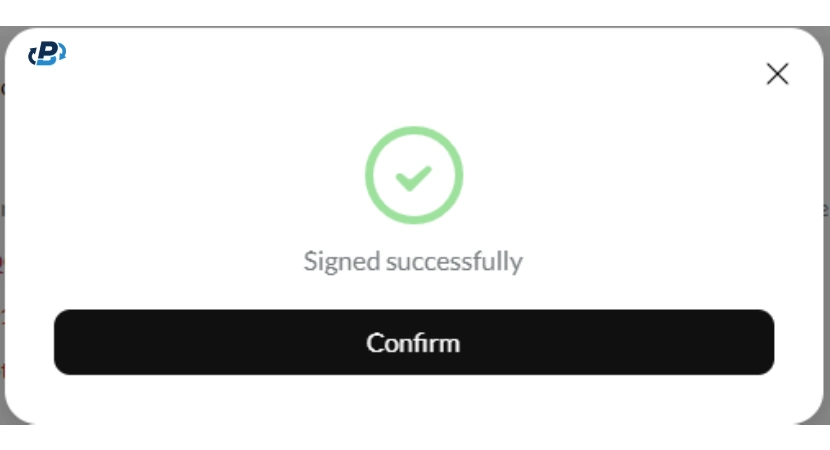

15. That's it, you had successfully created the multisig wallet, click confirm one last time.

Bitcoin Multisig Transaction Examples and How Multisig Wallets are Used

Bitcoin multisig transactions can be used for any number of purposes that require more than one person to approve a transaction.Let’s look at a few examples. A common bitcoin multisig transaction example is a 2-of-2 wallet used by a married couple for joint savings, where both must approve spending. Another example is a 2-of-3 wallet for a child’s savings, allowing the child to spend only after one parent's approval. In escrow, a 2-of-3 wallet between buyer, seller, and arbitrator ensures funds are only released when two of the three approve, preventing misuse or theft. For businesses, a 2-of-3 wallet boosts security by involving the company that utilizes a third-party security firm that verifies each transaction before signing. Imagine the Three Stooges pooling their bitcoin stash together. They set up a 3-for-3 multisig, which requires three signatures to initiate any transfer. We all know Moe is the short-tempered, headstrong leader and schemer, while Larry is more thoughtful. Let’s say Curly, a sweet simpleton and a sucker for a sob story, wants to use the crypto in the fund to buy a race horse, a nag (an old worn-out horse) he saw at the track and was tricked into buying. He tells the story to his two partners, but while Larry is more sympathetic, Moe is skeptical. Without unanimous consent, there is no deal. Even if Curly initiated the sale, the owners of the horse are left in limbo as the transfer remains pending.

Nobody is getting that horse until they all agree on it

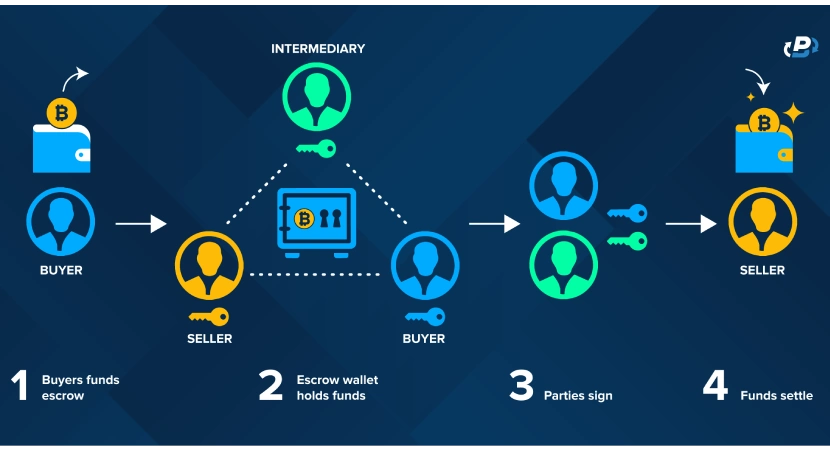

Multisig wallets provide greater security for companies that hold cryptocurrency or other digital assets like NFTs (non-fungible tokens), requiring multiple executives to approve transactions. Multisig wallets offer extra protection for those needing to create an escrow account, a third-party account that holds funds or assets until all terms and conditions of a transaction are met. Using smart contracts, funds can only be released if the terms and conditions of the agreement are met. A good example is a case where a car is up for sale, and there is the potential for a dispute between the two parties, then a third neutral person could be added to that process to hear both sides. After hearing both sides, this third person would decide whether the transaction would go forward or not.

An example of how escrow services work with a multisig wallet

A growing number of cryptocurrency exchanges are now employing multisig technology to offer their customers added protection to guard against hackers and fraud. Multisig wallets offer ideal protection to decentralized autonomous organizations (DAOs) that operate on the blockchain and are run from the bottom up rather than the top down. They are governed by smart contracts and provide transparency. Types of DAOs include organizations devoted to philanthropy and investment. As such, large amounts of digital capital typically flow in and out of the DAO. Having multiple signatories requiring consensus not only further ensures the integrity of the DAO but also protects its assets from bad actors. For example, in an investment DAO, before any investment is made, the appropriate number of members would need enough signatures to go forward.

Is Ledger a Multisig Wallet?

A ledger wallet is already trusted by many for its strong security and is often used to store large amounts of crypto, but its protection can be taken a step further. Those who are looking to improve their wallet’s security should consider the multisig option. However, there is a common misconception around this issue leaving people to ask themselves is Ledger a multisig wallet? No, but you can connect it to a third-party multisig wallet provider such as Electrum, Sparrow Wallet, or Safe (for Ethereum-based wallets), One of the first steps if you want to set up your own multisig wallet is to find a wallet with multisig capabilities.

What is a Multisig Wallet Crypto?

Typical one-on-one crypto transactions only require one sender who initiates a transaction between themselves and a second party. Multisig wallets operate differently. What is a Multisig Wallet Crypto? It’s a type of wallet that requires multiple signatures to authorize transactions, adding an extra layer of security. Multisig wallets especially useful for shared accounts, escrow services, DAOs, businesses, or high-value transactions. There are different types of wallets based on how many people need to approve the transaction, such as 2-of-3 (two of three must sign), 3-of-5, or even all-signature (N-of-N) models requiring all keyholders of a wallet to agree.

Gone With the Keys: How Multisig Could Have Saved $190M in Crypto

Cryptocurrency today represents promises of opportunity to passively grow assets. Finding they don’t have the time or the expertise to manage their own assets, many institutional and retail investors turn to centralized exchanges to manage those assets for them, which means the wallets and private keys are under the sole control of the exchange. Using a multisig wallet could help protect investors’ assets from shady exchanges. Here’s why. The exploding growth of cryptocurrency and its promise of sudden wealth have opened the door for schemes as old as time – hucksters, charlatans, and con artists who know their marks (individuals targeted by these thieves, they believe they can easily take advantage of). With a smile and bravado, these vultures prey on gullibility, wooing their victims with promises of instant wealth. Their guard down, would-be investors gladly surrender their assets to a stranger who talks the talk.

Take the example of Gerald Cotten, founder of QuadrigaCX, Canada’s largest cryptocurrency exchange, whose sudden death in 2018 unveiled a massive fraud costing U.S. customers $190 million. Cotten, who took over and ran the company alone from his laptop following a series of business failures, the last reported in 2016 after a failed attempt to take the company public, amassed millions in holdings from investors. When Cotton suddenly died in India during his honeymoon, due to complications of Crohn’s disease (allegedly, no formal autopsy was done, death certificate had flaws, and creditors even pushed for exhumation), there was no way to access the account as he had sole custody of the wallets holding those assets and apparently made no provisions to provide the key if he died.

A tragic and mysterious story

Although access to the account was locked, investigators were able to track all transactions from accounts held by QuadrigaCX using a blockchain explorer. Remember, blockchain is by definition a digital public ledger holding the records of all transactions conducted on a blockchain. In this case, it was discovered that most wallets were empty or near empty as crypto was shuffled from customer wallets to wallets controlled by Cotten, who used those funds to benefit himself. If this had been a multisig wallet operating with say a 2-of-3 modal where an independent custodian was included, those assets could not have been moved without appropriate approval, saving investors from huge losses.

Summing Up

So, what is mutlisig in crypto? Simply put, it’s a crypto wallet that allows more than one person to approve a transaction. In fact, a wallet can provide private keys to up to five people. For added asset protection, the wallet is set up to require either full agreement by all key holders, or a minimum number of key holders to agree on a transaction. The downside to this is that it can result in lag time, as all signatories need to be reached to initiate any particular transaction. Ultimately, you must decide if this is the right tool for you.