Just a few days ago, I was saying to my friend that crypto isn't the underground movement it once was. While it may not have entered full mainstream use yet, countries around the world are paying closer attention to it, which means that crypto caught the eye of tax agencies. Now, the main point here is that trading crypto is a lot like trading stocks, so when you make a profit, you’re expected to report it and pay your taxes. As I was trying to explain to my amigo, there are no buts or ifs, regardless of your principles on this. You either pay the taxman or end up getting heavy fines, maybe even some prison time. With that in mind, what are the penalties for not paying taxes on crypto? You may face fines and interest on the unpaid balance and tax evasion can lead to criminal charges and even jail time. In some cases, the judge may order you to provide access to your crypto wallets. Each case is reviewed individually to determine whether it was an honest mistake or a deliberate attempt to evade taxes.

What crypto tax evasion actually looks like

Crypto tax evasion occurs when:

- Someone knowingly chooses not to declare or pay taxes on their crypto gains. The most common form of evasion is simply not reporting taxable events, which can include selling crypto for fiat currency, swapping one cryptocurrency for another, using crypto to purchase goods or services, and earning crypto through staking, mining, or airdrops

- Filing deliberately wrong information is another method of tax evasion, like reporting only a small part of actual earnings to lower the tax bill.

- Hiding your crypto’s ownership also qualifies as evasion, like holding funds in a relative’s wallet while maintaining control, for instance.

- Cashing out the crypto for cash via untraceable, in-person deals, believing it leaves no digital footprint. However, all these actions are legally considered tax evasion and, if uncovered, can result in big fines or more severe legal consequences.

Not every crypto tax slip up means someone was trying to do something wrong, a lot of it comes down to confusion or genuine misunderstandings. Many well-meaning users find themselves in trouble simply because they made an honest mistake, especially in a space that changes as fast as crypto does. Still, even honest mistakes can lead to audits, fines, or letters from the tax office asking for explanations. Maybe not surprisingly, it all often starts with bad record-keeping. When you're moving between wallets and exchanges, it’s easy to lose track of trades or overlook fees. Without a clear paper trail, figuring out your gains or losses at tax time becomes guesswork, and guesses can land you in hot water.

Similarly, confusion over what's taxable is another common mistake. Laws differ by country, and many people assume you only owe taxes when you cash out into fiat. In truth, swapping tokens, spending crypto, earning staking rewards, mining, and airdrops can all be taxable events. If you miss one because you didn’t know, the tax authorities might still come knocking. Like I’ve told my friends and family who are looking to get into crypto, ignorance isn’t always a legal shield. Staying informed and keeping detailed records are the best ways to avoid penalties for not paying taxes on crypto.

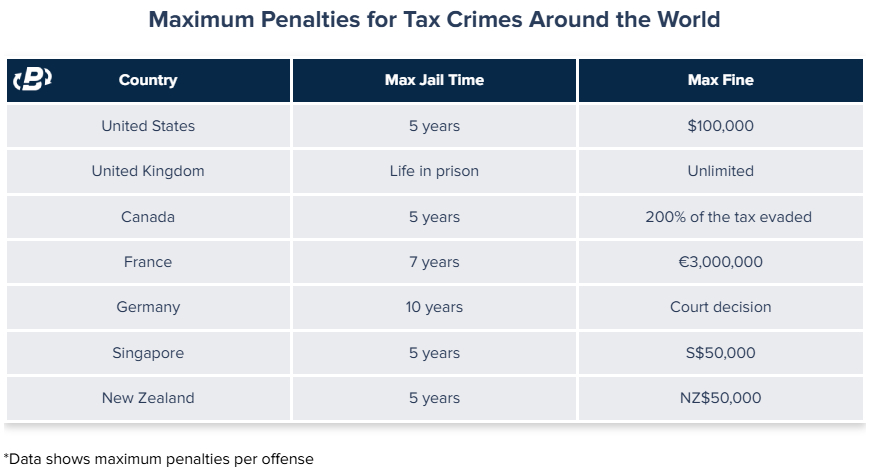

Maximum penalties for tax crimes by country

Courtesy of the PlasBit team, the table below shows the maximum possible penalties for tax offenses that can lead to criminal charges, such as evasion and fraud, in several leading countries. These numbers are the worst-case scenario that awaits you or anyone else who commits a crypto tax violation. Once again, I’d like to stress that these are the maximum penalties and not what most people are actually sentenced to, as it depends on the full picture, like your specific circumstances, any prior convictions or history, what the authorities can actually prove, and how strong the evidence is. The judge will base the decision on all of that, and the penalties might end up as a fine, or in extreme cases, years behind bars.

People forget that Crypto isn’t untraceable

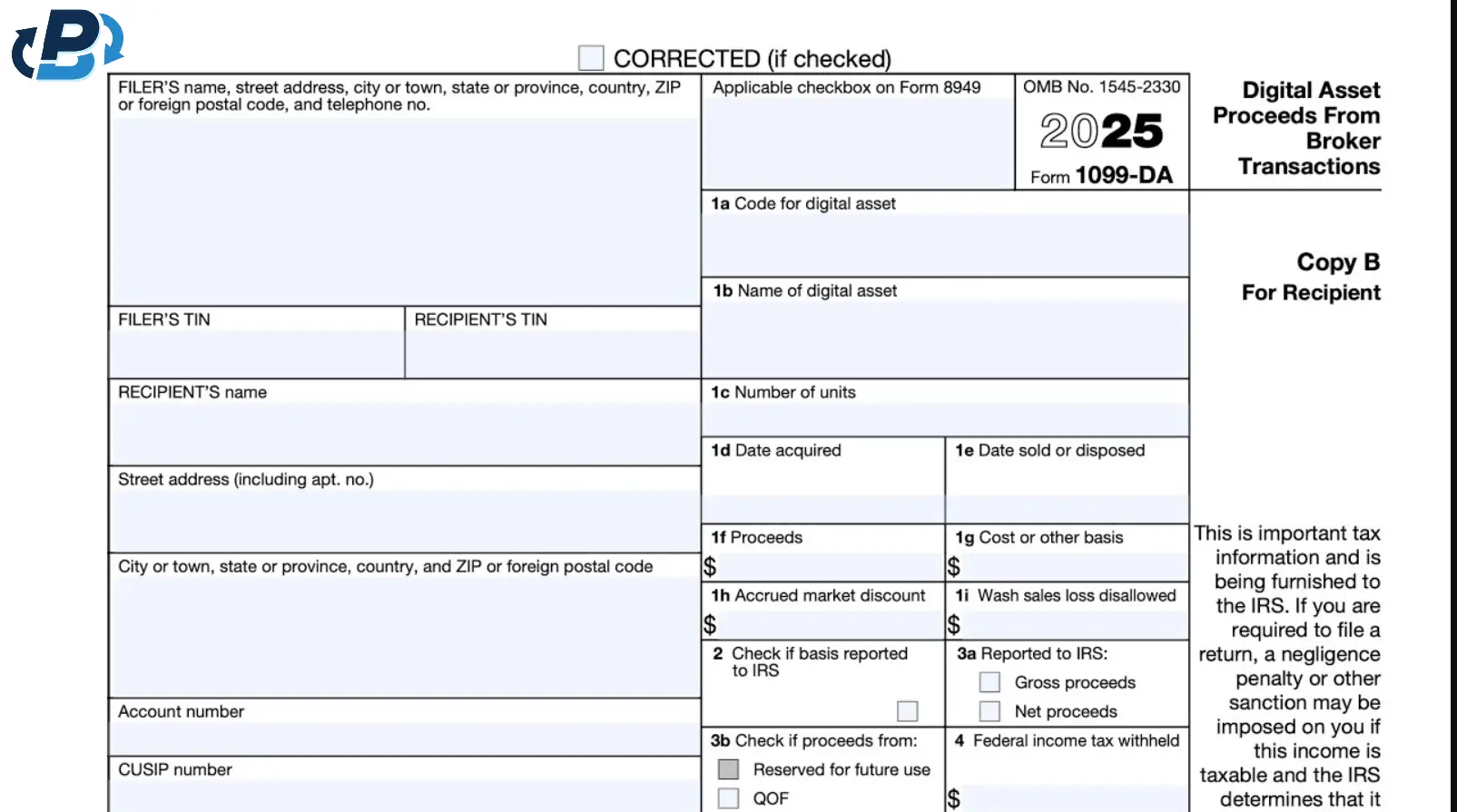

I was discussing this topic with a few colleagues, and we all agreed it would be foolish to think your crypto activity can’t be traced. Governments are getting better at monitoring crypto transactions and ownership by requiring the platforms to report every transaction and declare who the owner is for every address. It all starts with mandatory KYC rules, where centralized exchanges now have to collect and verify your personal details, from your legal name and address to your official ID. This creates a direct link between your real-world identity and every transaction made from your account. However, in some countries, this goes even further. For example, in the US, exchanges must file Form 1099 with the IRS, which details users’ trades and gains. When it’s time to file your taxes, authorities can automatically cross check those records against what you reported and quickly spot any discrepancies. It’s worth remembering that trading on big exchanges isn’t as anonymous as it used to be, and that digital paper trail is exactly why leaving crypto off your taxes is becoming much riskier. If you do ignore it, you can end up with serious penalties for unpaid crypto taxes.

A snapshot of Form 1099-DA

What is DAC8 and why should EU crypto users care

If you’re not familiar, DAC8 is a new regulation in the EU designed to bring greater transparency to crypto taxation and make it much harder to hide crypto transactions . Think of it as a transparency upgrade that requires crypto exchanges to automatically send user transaction details to tax authorities across the EU. This goes beyond basic account details and includes specific transaction information, such as trades, transfers, deposits, and withdrawals. The law was approved in late 2023 and officially kicked in across the EU at the start of 2026. While on the topic, I should mention that as a regulated EU exchange, PlasBit follows these rules too. That means verifying who you are and reporting your transactions, just like any other financial institution is required. Yes, it’s another layer of compliance, but it’s also a sign of the times that crypto isn’t the wild west anymore. Nowadays, it’s a significant part of the financial mainstream, and with that comes transparency.

I’ll get slightly more technical and go a bit deeper into this, so bear with me. According to the EU officials, the main reasoning for DAC8 is the decentralized nature of crypto. Since crypto assets are basically cross-border in nature, one country can’t track them alone. That’s why the EU believes that strong cooperation between governments is the best way to assess and collect taxes on crypto profits. With DAC8, Reporting Crypto-Asset Service Providers (RCASPs) now need to collect transaction records for any of their customers who live outside the provider’s home country. They gather all this information during each reporting year. Then, the year after, RCASPs pass those records along to their local tax office. From there, the tax office has up to nine months to send the details to the investor’s home country within the EU. As a result, information for the first reporting year will be exchanged by September 30, 2027.

Image credit: Taxation-customs.ec.europa.eu

Keep your crypto records clean

When you’re filing crypto taxes and reporting capital gains, it mostly comes down to what you can actually prove, so you want a clean trail showing how you bought the crypto, what you paid, and what you did with it after. Keep things like bank wire confirmations or card purchase receipts, exchange statements so you have the full trade and swap history, and keep the wallet addresses where you held the funds, because that’s what backs up your numbers when the taxman asks. Think of it like bookkeeping for a small business, you don’t try to recreate everything from memory at the end, you keep the receipts and records as you go, because once you can’t show where funds came from or where they went, it gets complicated fast, so save it all and keep it in one place.

Save your full trade history from exchanges, including dates, prices, amounts, and fees. You should also hang onto records of any deposits or withdrawals, complete with their unique transaction IDs, so you can trace every step. If you used your bank account or credit card to buy or cash out crypto, make sure you keep those statements since they’re the proof to back up what you report. Once you’ve got all the paperwork together, your best move is to talk to an accountant who actually knows crypto and understands your local rules. Tax requirements change from country to country and it can get complicated fast if you try to file everything yourself, so having an accountant handle it is usually the safest way to get it done right. It’s the easiest way to stay on the right side of the law and avoid penalties for not paying taxes on crypto.

What counts as a taxable event in crypto?

Figuring out when you owe taxes on crypto all comes down to what’s called a taxable event. Knowing what qualifies as a taxable event helps you keep the right records and stay out of trouble. Here’s a simple rule I try to go by. If a transaction results in a gain, income, or counts as disposing of crypto in the eyes of the tax office, it’s likely taxable. Let’s say you are sending crypto from your own wallet to another one you control. That isn’t taxable since you just moved it and its value didn't change. But if you swap one crypto for another, that's often a taxable sale in most places. Selling crypto for cash, spending it online, earning it from staking, mining, or free airdrops also count. Rules change depending on where you live, and they can shift over time. To stay safe, I’d advise you to check your local tax authority’s website or chat with an accountant who specializes in crypto. Understanding exactly what counts in your country can save you from facing criminal charges and fines later on.

What is the penalty for not reporting crypto gains?

Neglecting to report your crypto gains to tax authorities can result in huge legal trouble and high financial penalties. So, what is the penalty for not reporting crypto gains? Paying fines and interest on the unpaid amount and tax evasion can turn into a criminal case and time in prison. In certain cases, the court may require you to give access to your crypto wallets. Each offense is examined to decide if it happened by mistake or intentional attempt to avoid paying taxes.

One of the highest-profile crypto tax cases in recent history involved Frank Richard Ahlgren III, also known as Paco Ahlgren. In 2024, he admitted in court that he lied on his taxes, hiding the full amount he made from trading. Rather than pay what he legally owed, he deliberately gave the tax authorities false numbers. As you may have guessed by now, his penalties were harsh. Ahlgren was sent to prison for two years, ordered to pay a $1 million fine, and was forced to surrender the private keys to his crypto wallets. That last part meant investigators could see every hidden asset he thought was safe. His story is a loud and clear message that trying to hide crypto profits from the government can cost you your freedom and your fortune. PlasBit actually covered this story much more in depth, so if you want to learn more about it, you can check it on our blog.

What is the penalty for not declaring profits from crypto?

Tax agencies around the world are now watching crypto more closely. I hope you realized by now that keeping your financial records completely transparent is the most reliable strategy for not getting into serious legal and regulatory trouble down the line. So, what is the penalty for not declaring profits from crypto<!--td {border: 1px solid #cccccc;}br {mso-data-placement:same-cell;}-->What are the penalties for not paying taxes on crypto?? You can end up owing the tax plus fines and interest that keep adding up over time, and if authorities treat it as tax evasion, it can turn into criminal charges and even jail in serious cases. The outcome depends on the details, especially whether it was an honest mistake or a deliberate attempt to evade taxes and like Frank, you may be ordered to provide the key phrase to your crypto wallets.

In case you do get a penalty based on what you did, you may get a notice or a letter about it. There are more than a few, so to give you a better idea, I’ll list some of them:

- Late or incorrect info forms - missing the deadline or making errors on forms (like the 1099 form) that you send to the government.

- Late return - simply not filing your tax return by the due date, even if you don't owe.

- Late payment - failing to pay the tax you owe by the deadline.

- Inaccurate return - leaving income off your return or taking deductions or credits you don’t qualify for.

- Inflated refund - claiming a tax refund that’s way too high without a good explanation.

- Late payroll taxes - as a business, missing a deadline or making an error with employment tax deposits.

- Tax preparer penalty - when a paid tax preparer cuts corners or breaks the rules.

- Bounced payment - when your bank rejects your check or electronic tax payment.

- Corporate estimated tax penalty - when a corporation doesn't pay enough in quarterly estimated tax payments.

- Individual estimated tax penalty - when an individual doesn't pay enough in quarterly estimated tax payments.

- International reporting penalty - failing to properly report foreign bank accounts or financial assets.

These are most of the penalties you can get, depending on where you are from. In some cases, you may even dispute a penalty if you disagree with the amount you have to pay. Also, some penalties can be reduced or even removed if you can show you acted in good faith and had a reasonable reason for falling short on your tax obligations.

Ignoring crypto taxes comes with serious risks

Nowadays, with all the latest tracing tech and reporting systems, paying crypto taxes isn’t just a rule on paper anymore, it’s something authorities can actually enforce. That said, it’s not just about calculating what you owe, but also knowing what tax authorities consider a violation and how they’ll act on it. If you make a simple mistake or even have a missing transaction you didn’t realize was taxable, that’s all tax investigators need to show up at your door. Additionally, you’d do well to remember that crypto isn’t completely untraceable anymore. Regulators have sophisticated tools to trace your activity and match your identity. The new tracking software can compare what you report with what information they see online. If you ignore that, you’ll be taking a gamble that the government won’t notice something is missing. As such, take my advice and be sure to keep your records clean and inform yourself on what triggers taxes. Of course, don’t forget to file on time and accurately and preferably with an accountant that specializes in crypto filing. Doing so helps you stay compliant, protect yourself from legal trouble, and steer clear of any penalties for not paying taxes on crypto.