As Bitcoin continues to reshape the global financial landscape, countries around the world are taking drastically different approaches to its adoption. Some embrace it as a path toward innovation and financial freedom, while others seek to suppress it in an effort to maintain tighter control over their own financial systems. For instance, China has banned Bitcoin trading and mining while pushing forward with its central bank digital currency (CBDC), which is a fully state-controlled alternative. On the other hand, the US, under President Donald Trump’s renewed pro-crypto stance, has declared its ambition to become the crypto capital of the world. The administration has rolled back several lawsuits against blockchain companies (like Ripple) and introduced new legislation to help the crypto industry grow.

If you're curious about how Bitcoin is really catching on, just take a look at the stats on Bitcoin adoption by country, where India leads with 93.5 million users, followed by China with 59.1 million, the U.S. with 52.9 million, Brazil with 26 million, and Vietnam with 20.9 million. These are the top five countries with the highest number of Bitcoin holders.

Top 10 countries with the most Bitcoin owners

Before we go deeper into the topic, we at PlasBit made this simple table showcasing countries with the most Bitcoin owners.

| Rank | Country | BTC owners | % of population |

|---|---|---|---|

| 1 | India | 93.5 million | 6.55% |

| 2 | China | 59.1 million | 4.15% |

| 3 | United States | 52.9 million | 15.56% |

| 4 | Brazil | 26.9 million | 11.99% |

| 5 | Vietnam | 20.9 million | 21.19% |

| 6 | Pakistan | 15.9 million | 6.60% |

| 7 | Philippines | 15.9 million | 13.43% |

| 8 | Nigeria | 13.2 million | 5.93% |

| 9 | Indonesia | 12.3 million | 4.40% |

| 10 | Iran | 12.0 million | 13.46% |

Looking at the Bitcoin adoption by country, India sits at the very top, mainly because millions of its citizens live and work abroad. As such, they send money home regularly, but traditional financial services and banks often charge high fees and take days to process transfers. Bitcoin provides a faster, cheaper, and more direct way for this massive community to transfer funds across borders.

Even though China's government has repeatedly banned Bitcoin, many of its citizens continue to use it. This is largely due to strict rules that prevent people from moving more than $50,000 out of the country each year, without providing a bunch of documents first. Bitcoin offers a way to get around this particular issue and protect savings.

Contrary to the first two countries, in the US, Bitcoin's rise is powered by a strong national interest in investing and seeking high returns. That isn’t much of a surprise, since Americans are always looking for new ways to build wealth. Bitcoin's potential for rapid growth has attracted a broad range of people, from everyday traders to large financial firms. With the Trump administration's friendly approach to crypto, the country is now pushing to be the world's leading hub for cryptocurrencies.

Brazil’s long history of inflation and economic instability has made Bitcoin a practical hedge against devaluation. The fear of past financial crises is still strong, leading Brazilians to see Bitcoin as a way to keep their savings safe from price hikes and government errors. The increase of local financial tech apps and active person-to-person trading has also made it much easier for regular people to buy Bitcoin and move their wealth out of the unpredictable Brazilian real.

Vietnam consistently ranks near the top of global crypto adoption indexes. The country’s underdeveloped banking infrastructure leaves millions without access to traditional financial services, while a large portion of its workforce is employed overseas. As a result, Bitcoin provides a fast and cheap way to send these payments, representing a dependable option compared to the limited local banking services. With minimal government regulation on cryptocurrencies, Vietnam has naturally evolved into one of the most welcoming countries for crypto in Asia.

Pakistan's growing interest in Bitcoin is driven by its young population, where roughly 70% of the population is under 30 years old. Younger generations are more open to digital innovation and view crypto as both a technological revolution and an opportunity for financial gain. In a country where many lack access to banks and the local currency is often unstable, Bitcoin offers a sense of control and a way to connect to the world's digital economy without depending on the traditional system.

The Philippines has become one of Asia's most forward-thinking countries for crypto, thanks to clear and supportive government rules. These regulations have made people feel secure in using cryptocurrencies, especially Filipino workers in foreign countries who send funds home cheaply and reliably using Bitcoin. The government's active push to embrace new financial technology has made the public even more confident in using crypto.

Nigeria has emerged as the dominant cryptocurrency market in Africa, a status driven by persistent annual inflation of approximately 20% and restrictive central bank policies. With it being difficult to get US dollars, many people have turned to Bitcoin to protect their savings from losing value. The country's large, young, and tech-savvy population also uses the most popular cryptocurrency for everyday online business and direct transactions, putting Nigeria at the forefront of crypto adoption on the continent.

Indonesia's adoption of Bitcoin has grown dramatically since it started the world's first government-backed crypto exchange in 2023. This official stamp of approval made the market seem safer and more trustworthy, attracting many new users and investors. As confidence grew, the number of people using Bitcoin rose by 21% in a year (for 2024), and the total value of trades skyrocketed by 352% in 2024.

Because of years of international sanctions, Iran is largely cut off from the global banking system. This has forced many Iranians and companies to use Bitcoin as a workaround for international business, since it allows them to make transactions with other countries that regular banks would block. At the same time, the constant decline in value of the Iranian rial has made Bitcoin a rather important tool for people to protect their savings from the country's economic problems.

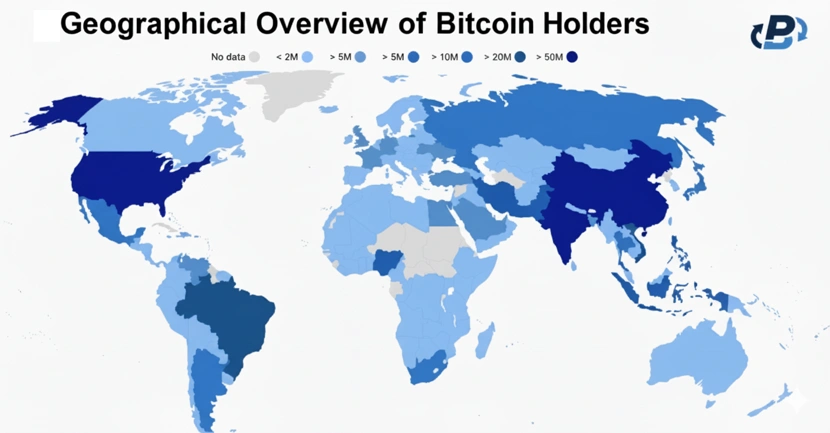

Map of places with the most Bitcoin holders

The image below provides a geographical overview of Bitcoin adoption by country around the world, showing areas where the highest numbers of people own Bitcoin.

It’s important to note that this visualization doesn’t necessarily measure Bitcoin adoption rates or usage intensity, but simply the total number of individuals holding Bitcoin in each country. Unsurprisingly, the largest concentrations of Bitcoin holders align closely with the world’s most populous nations. As such, countries like India, China, and the US have tens of millions of people who own Bitcoin, thanks to their huge populations and growing interest in crypto. There is an interesting contrast as well, since nations with smaller populations have considerably lower numbers of Bitcoin holders, compared to the top 3, for instance. Still, this doesn’t mean that the lighter-colored countries on the map in Europe, Southeast Asia, and Africa have low adoption by default. For example, Vietnam or Nigeria have one of the world’s highest adoption rates relative to their populations, but they can't compete with the sheer total numbers of countries such as India or China.

Also, as you can see, some areas on the map are gray, which means there is no accurate information about how many people own Bitcoin there. This doesn't always mean no one is using it, since it could simply be because data isn't collected, people can't easily access crypto, or the government has banned it, as is the case in North Korea. In the end, it can easily be concluded that the population size plays a big role in the total number of Bitcoin holders. Larger nations naturally have more holders, while smaller countries (even those that are crypto-friendly) contribute fewer individuals overall.

Bitcoin owners in Europe

When it comes to the Old Continent, countries with the biggest population usually dominate among Bitcoin owners. There are some exceptions, as shown in the image below, courtesy of the PlasBit team.

.webp)

Germany is at the forefront of Bitcoin adoption in Europe, thanks to clear and supportive government rules and tax guidelines. The country's financial authority, BaFin, gives official licenses to crypto companies, raising greater public trust in Bitcoin investment. This legal landscape, along with Germany's strong financial sector, has made it one of the most welcoming countries for crypto in Europe.

In France, Bitcoin's growth is mostly due to strong retail interest and the country's tech-savvy culture. Additionally, France is home to Ledger, one of the world’s largest manufacturers of hardware wallets, which has substantially raised public awareness and trust in cryptocurrency security. The country's strong focus on technology and innovation has also made more people curious and willing to try cryptocurrencies.

Spain's interest in Bitcoin started after the big European financial crisis over a decade ago. Many people lost trust in banks at that time and began to see Bitcoin as a financial system that operates outside of institutional control. This deep-seated skepticism toward traditional banks still powers much of the country's crypto activity.

Italy's position among the top countries for Bitcoin ownership is primarily due to its population (the sixth most populous country in Europe). While more Italians are getting interested in crypto, the country is still slower to adopt it than some of its European neighbors. However, because the population is so large, even a small fraction of people buying Bitcoin means millions of holders, which keeps Italy in the upper part of the list.

Poland's growing Bitcoin market is helped by its simple tax rules and business-friendly government policies. With straightforward regulations on how to trade and report crypto, many international firms have chosen Poland as their base for EU operations. As a result, the country has become a growing hotspot for new blockchain companies and everyday Bitcoin use.

The Netherlands regularly ranks among the top countries in Europe for Bitcoin use per person. Even with a smaller population, the Dutch are very digital-friendly and open to new financial technologies. A strong internet-based economy, a history of innovation in financial tech, and a general willingness to use digital payments have all helped Bitcoin become well-liked with everyday people.

Romania's strong Bitcoin community comes from its large number of tech workers and freelancers. Many of these professionals are paid in crypto by companies abroad, using Bitcoin for their paychecks. Because it's used as a practical tool for earning a living and not just as an investment, Romania has become one of the most active crypto markets in its region.

Portugal is known as one of Europe's most welcoming countries for crypto users, thanks mostly to its friendly tax rules. While there have been some changes in recent years (such as the implementation of a 28% tax if you sell your cryptocurrency less than a year after buying it), its relaxed approach to regulation continues to make it a popular choice for Bitcoin owners who want a safe place to manage and grow their wealth.

Even though it's not a big country, the Czech Republic has a very active Bitcoin scene. In fact, it was one of the first places in Europe to have real-world spots like Bitcoin-only cafes and ATMs. However, because the total number of people is smaller, the Czech Republic doesn't rank as high in the total count of holders, despite having a community that is very passionate about crypto.

Finally, Sweden ranks lower because its own digital payment app, Swish, is so popular and successful that people don't need a solution like Bitcoin for everyday purchases. The country is very tech-oriented, yet Bitcoin is seen more as a speculative investment than a currency for daily life, which is why the total number of users is relatively small.

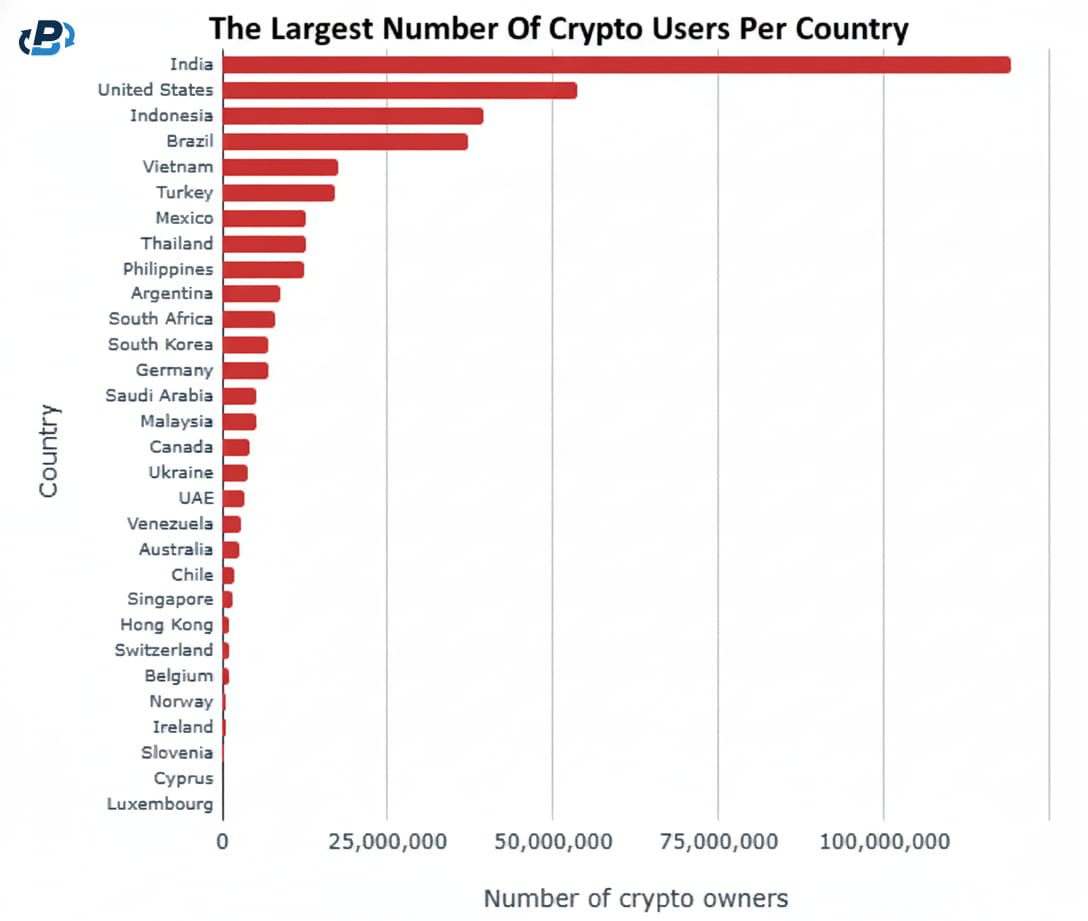

Which country has the largest number of crypto users?

The PlasBit team did a little digging and found several trustworthy sources that have the correct information regarding crypto usage. So, which country has the largest number of crypto users? India ranks first worldwide in cryptocurrency ownership with 119 million holders, followed by the United States at about 53.5 million, Indonesia at around 39.4 million, Brazil with 37.1 million, and Vietnam at 17.5 million.

Top crypto adoption ranking by countries (Image credit: coinledger.io)

Where the facts and figures on Bitcoin adoption come from

Regarding the origin of the statistics, it’s a mix of several websites, platforms, and analytic company data.

- Chainalysis is a blockchain analytics firm that scans activity across public blockchains and tracks transaction patterns. It’s one of the most widely used sources throughout the crypto industry. Chainalysis creates software that can connect anonymous cryptocurrency wallets to real-world activity, which is why agencies, banks, and exchanges use its data to watch for suspicious behavior and trace stolen funds. Because it tracks transactions across the globe, its reports give one of the clearest and most reliable views of where and how crypto is actually being used.

- Another important source is TripleA, a crypto payment processing company from Singapore. It estimates crypto adoption by combining exchange sign-up data, traffic to crypto platforms, peer-to-peer transaction volumes, and payments made through its own network of online and physical stores. TripleA also conducts large public surveys and checks the results against actual blockchain data to estimate what percentage of each country’s population owns or uses cryptocurrency.

- WorldPopulationReview helps turn percentage estimates into actual user counts. It collects data on crypto ownership from groups like TripleA and Chainalysis, then multiplies these percentages by the latest population numbers for each country. This creates ranked lists showing how many users are in each country, even though the original research comes from other companies.

- Among popular data sources is CoinLedger, a US company that makes tax software for crypto. It brings together adoption data from Chainalysis, ownership percentages from TripleA, and population numbers from Worldometer. The company then uses growth patterns from past technologies (similar to early internet adoption) to predict how the total number of crypto users is growing.

- Some country-specific numbers come from direct surveys, such as from Security.org (a US research and product review platform). It conducted an online survey of 1,969 US adults and adjusted the results to match the national population. From this, it is estimated that around 65 million Americans currently own cryptocurrency.

Lastly, Crypto Crunch, a mobile data analytics platform, tracks how many people install crypto wallets, complete identity verification (KYC) on exchanges, and access crypto services through mobile devices. This approach is how the figure of more than 26 million crypto users in Vietnam was calculated, a number that has been cited by media outlets in the country.

Which country has the highest percentage of Bitcoin ownership?

If we just look at the percentages of the population when it comes to Bitcoin ownership, the list changes considerably compared to the one above. So, which country has the highest percentage of Bitcoin ownership? United Arab Emirates reports that 29.3% of its population owns Bitcoin, followed by Singapore with 24.4%, Turkey ranked third with 19.3%, Argentina registers 18.9%, and Thailand stands at 17.6%.

Who owns the most Bitcoin among global governments?

As for the governments themselves, several already own a substantial amount of Bitcoin, with the US leading. The US government has about 200,000 BTC, most of it acquired through seizures in criminal investigations, such as the Silk Road darknet marketplace case or the Bitfinex hack recovery.

China also holds BTC, with the country’s government estimated to hold approximately 190,000. Similar to the US, Bitcoin was also acquired through criminal activity seizures, particularly from the PlusToken Ponzi scheme in 2019. One of the more interesting cases is El Salvador, since the country became the first to officially adopt Bitcoin as legal tender in 2021 (though it eventually abolished that decision in 2025). Unlike China and the US, its holdings come from direct government purchases and public treasury investment. While not a huge number, El Salvador is estimated to hold over 6,000 BTC.

Countries where Bitcoin is banned

In some parts of the world, Bitcoin adoption by country is growing, while it’s outright banned or heavily restricted in others. These are:

- China maintains a full ban on Bitcoin trading, mining, and payment services. The government wants to protect the digital yuan and prevent citizens from moving money out of the country.

- Bangladesh’s central bank treats all crypto use as unlawful due to concerns regarding money laundering and unregulated financial activity, as the banking system in Bangladesh is tightly controlled by the government.

- Egypt doesn’t allow issuing, trading, and promoting crypto without a license, and a religious decree has also labeled it haram (forbidden or prohibited).

- Algeria has a complete ban on cryptocurrency trading and use under its Finance Law. The government wants to retain control over currency flows and prevent the use of crypto for cross-border transactions in an economy with strict foreign exchange rules.

- Iraq - the country’s central bank prohibits banks and payment services from dealing in crypto. The main concern is that crypto transactions are harder for the state to keep track of.

- Afghanistan - since the Taliban regained control in 2021, crypto use has been criminalized because the regime views Bitcoin as a threat to government control over the monetary system.

- Morocco outlawed crypto transactions way back in 2017, with the goal to stop the money from leaving the country and to protect the value of its own currency (dirham).

- Nepal’s central bank (the Nepal Rastra Bank) declared all crypto trading and mining illegal, with the main reasons said to be risks of fraud, scams, and currency instability.

- Kuwait completely outlawed the use of cryptocurrency for payments, investing, and mining in 2023. The country wants to make sure that all financial movements happen through official, government-controlled channels.

Which country has the most Bitcoin holders?

As we’re reaching the end of this article, let’s recap everything and answer the question which country has the most Bitcoin holders? India is at the top with 93.5 million of its population holding Bitcoin, followed by China with 59.1 million users, the United States has 52.9 million holders, Brazil at 26 million, and Vietnam with 20.9 million.

One technology, many realities

In the end, Bitcoin adoption by country differs heavily depending on where people live. In countries with broken economies and hyperinflation, like Venezuela or Argentina, people use Bitcoin as a safe method to keep their savings when their local money is losing value fast and banks are unreliable. On the other hand, in wealthier and stable countries like the US or in Western Europe, Bitcoin is used more like an investment, something people buy hoping its price will go up. One could say that when the economy is failing, Bitcoin is a shield, but when the economy is strong, Bitcoin is a tool of opportunity.