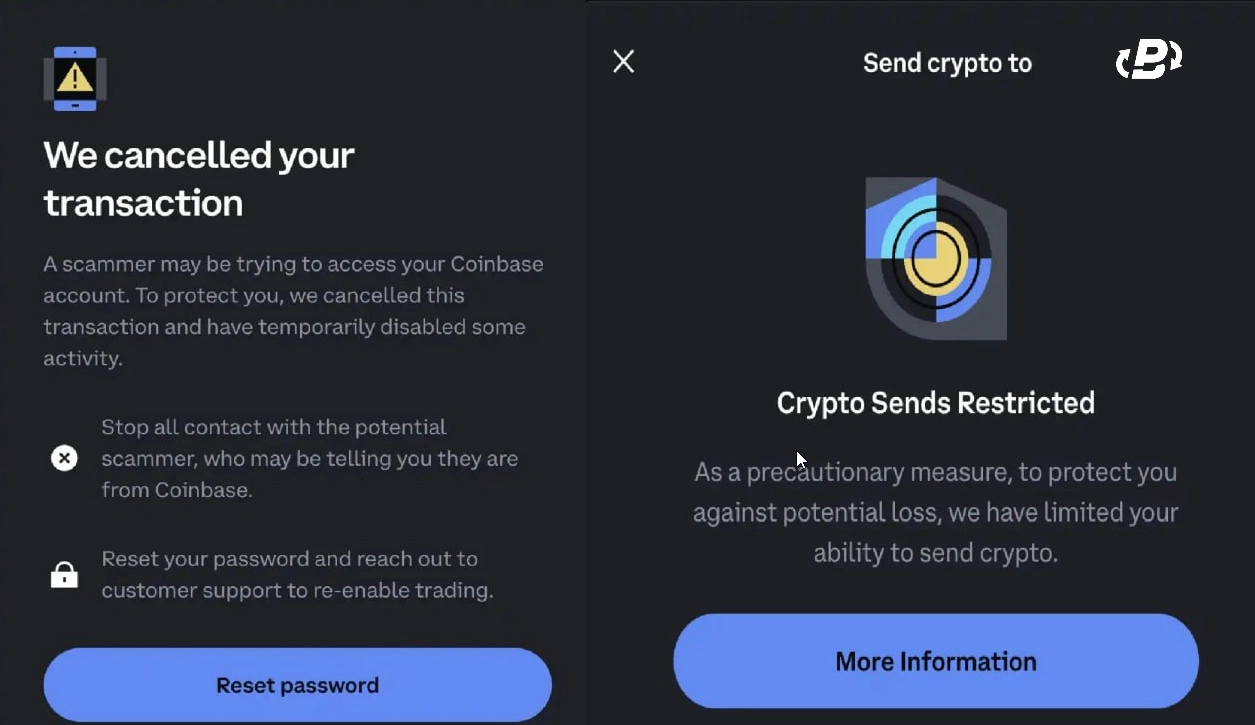

Imagine that you’re using a well-known centralized crypto exchange, and suddenly, you find you can’t move your funds. It can come as a shock, but it’s not random, as there’s usually a reason. You should know that these platforms are watched over by regulators, much like a bank. Centralized exchanges need to follow strict rules, and if something flags in their system, exchanges will investigate. This could happen during security reviews or when they need to verify where your crypto came from. Now, at PlasBit, things are different, since in the event that crypto gets flagged, you will not get your funds frozen. Instead, the funds will be sent back directly to the original address, and the account will be closed afterwards.

That being said, why do crypto exchanges freeze accounts? One common trigger is when the funds you send are flagged as potentially linked to a scam or to wallets tied to terrorism. If you log in using a VPN from a different country's IPs or from a new device that the system doesn’t recognize. These can appear as hacking attempts and trigger a freeze to protect your account. We know how unfair the process can be for users, so PlasBit never freezes user funds, and if an account must be closed, we return the funds to the original address and only then close the account permanently.

Crypto users are moving away from centralized exchanges

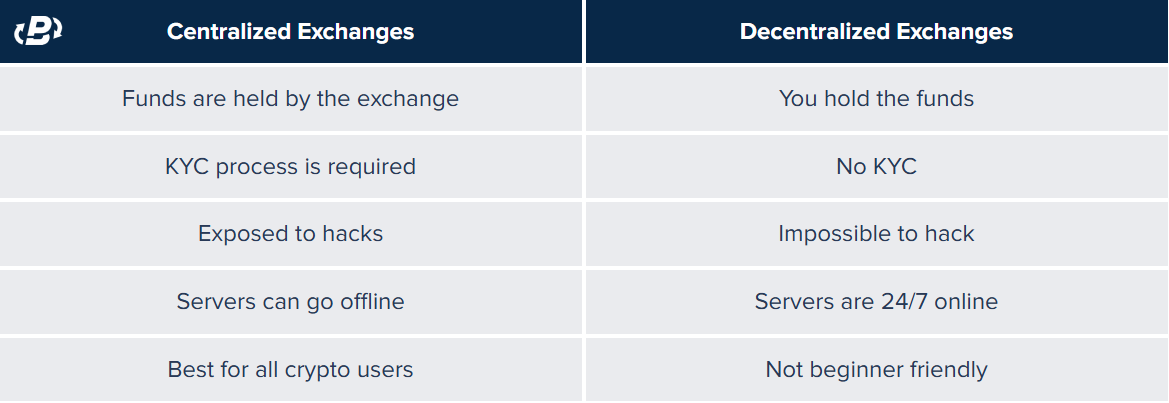

Because of the frozen funds and bank-like regulations, users turned to decentralized exchanges (DEXs). You can treat these less as a company and more as an open marketplace. The biggest difference is that you never deposit your crypto with a third party, as you trade directly from your own wallet and keep control 100% of the time. Think of it as the difference between storing your gold in a bank vault, where they hold the key, and keeping it in your own safe at home. Plus, DEXs changed for the better over the last few years. Faster blockchains and smooth interfaces now make it easier for them to rival centralized exchanges. They also don’t have any regulatory pressure as their centralized versions do. People started noticing this, with the DEX trading volume growing from around 9% of spot crypto trading in early 2024 to over 30% by mid-2025. Don’t get me wrong, big centralized exchanges aren't going anywhere, and they’re great for certain things. They still offer deep liquidity and easy ways to convert cash to crypto. However, the tide is turning, and an increasing number of users are choosing freedom to control their assets without the risk of them being suddenly frozen.

Most common reasons centralized exchanges freeze accounts

Here are the most common reasons why do crypto exchanges freeze accounts, and why you might find yourself in such a situation:

- Flagged Funds - whenever you deposit crypto, its whole history is checked by the exchange’s software. If that crypto was ever involved in a hack, scam, or any other illegal activity, it gets a big red flag. The exchange will then hold it until you can explain where it really came from. You can think of this as depositing a marked banknote, where your funds get locked down until you can clarify their origin.

- Living in a Sanctioned Region - in case you're from a country under international sanctions, exchanges can't serve you, and you often can't even sign up. Even worse, if sanctions are placed on your country after you've already funded your account, the platform has no choice but to freeze it immediately to comply with global laws.

- Suspicious Account Activity - I’ll give you an example for this one. You normally log in from home on your device, but suddenly, there’s a login from a different country, then another, all in minutes. To the exchange, this points to a hacker, so they’ll lock your account, thinking they’re protecting you from a cybercriminal. Also, if you use a VPN or your account is logged in from different devices, the exchange’s system may still flag your account.

- Suspicious Deposits or Withdrawals - remember when you shared your income and trading plans during sign-up? If you suddenly start moving sums that are wildly larger or more frequent than you said, it raises suspicion. This mismatch can signal fraud or money laundering, making the exchange freeze your account.

- Government or Law Enforcement Direct Involvement - on rare occasions, the exchange gets a formal request from police or a government agency. In case authorities are investigating where certain funds came from, the exchange has to follow the order and freeze the account.

- Suspicion of Identity Theft - if your ID is used to open multiple accounts, or if your personal details appear to be used by someone else, the system will suspect identity theft. In this case, the exchange will freeze all linked accounts to sort out who’s the real you.

- Suspicious Recovery Attempts - even trying to recover your account can backfire. If you or someone else makes several failed attempts with incorrect information, the security system thinks a fraudster is trying to break in. It responds by freezing the account to keep your funds safe.

Avoiding a crypto account freeze

Now that I’ve covered the reasons why do crypto exchanges freeze accounts, it’s time for me to talk about solutions. To be precise, I’ll tell you how to avoid triggering the above or how to unfreeze your account if that occurs.

- For flagged funds and suspicious deposits or withdrawals, you’ll need to prove where your crypto came from. This means showing documents like bank statements, purchase receipts, or transfer records. Here’s a pro tip for you to save all of your funds from being frozen. Try sending a small transaction first as a test, and if it gets flagged, you’ll know there’s an issue with your funds. You can also use online AML tools to check if your money has been linked to any criminal activities.

- For sanctions, unfortunately, there’s not much you can do. In case you have a dual citizenship or live somewhere else legally, some exchanges might let you update your residency details with official proof. Just know there is no guarantee this will work.

- Government or law enforcement direct involvement can only be lifted by the said authorities, since the exchange is just following the law here. If your funds get frozen this way, you will have to prove to the authorities that your funds are clean by showing the necessary documents.

- For suspicious account activity, suspicion of identity theft, and suspicious recovery attempts, you will need to send a photo with your ID or do a quick video check to prove your identity. To prevent this from happening in the first place, you should use two-factor authentication. This makes your account less likely to be flagged and much easier to recover.

That said, I do want to point out once again that PlasBit won’t ever freeze your funds. Instead, in case of flagged crypto activity, your funds will be sent back to the original wallet addresswhere they originally came from. Following this, the account will be closed.

When exchanges freeze funds without warning

I just had a discussion recently with a few of my friends, and like with the increasing number of users, the very idea of a centralized exchange freezing funds is enough to make them think twice. You never know if the exchange will suddenly call your funds “risky” and freeze them. Then comes the part where you get annoyed trying the above solutions, which sometimes just aren’t enough.

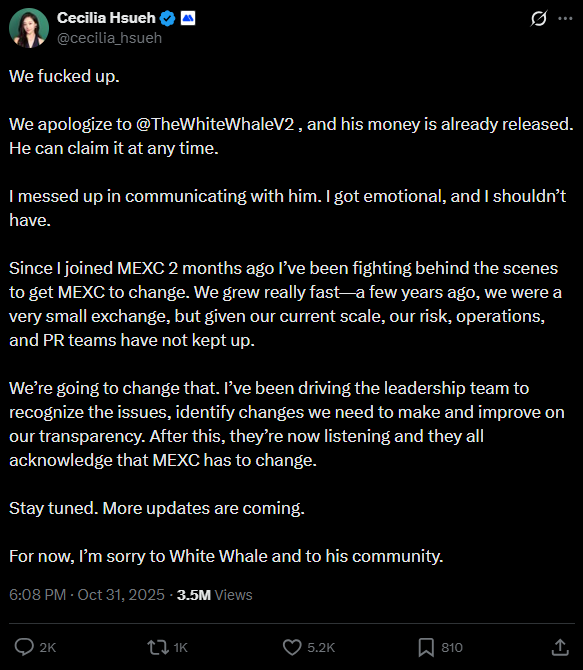

Let me tell you a tale of a trader called The White Whale. In mid-2025, he woke up to find $3 million frozen on MEXC. The reason? Making too much profit, too fast, as MEXC's computers thought it might be bots. The reality was that The White Whale just traded large amounts of crypto and, as a result, gained big profits. The trader then got on a call with a MEXC representative, Cecilia Hsueh, hoping for a fix. However, that didn’t do much as he was just told their risk system had triggered the freeze. Without many options left, he went public on X to his followers. The trader made a lot of noise in the upcoming days, and his story spread across social media. It even got picked up by big names in crypto like ZachXBT, who then also shared it on both X and Telegram. Eventually, the story blew up, and the pressure was huge, forcing MEXC to finally release the funds. Cecilia Hsueh even issued a public apology admitting the mistake. Stories like this are why a growing number of people are starting to avoid centralized exchanges. When you have full control of your crypto at all times, you’re not in constant fear of getting your funds frozen for whatever reason.

What to do when the exchange support team isn’t helping

If a similar situation happens to you and none of the solutions work, don’t panic. While there's no magic wand, most centralized exchanges follow a similar review process that you can initiate. You'll need a little patience, but start by playing detective and looking for clues. Check your account dashboard, email inbox, and any in-platform notifications, as the exchange may have already sent a message explaining the freeze. The message can be unclear or generic, but knowing their reasons for the freeze is your starting point. Next, reach out directly through the exchange's official support channels, such as its help desk, email, or live chat. Don’t use any third-party contacts and make sure you’re using the official exchange website to avoid any scams. Once you're talking to a human, they'll ask you to prove your case. Support will typically ask for ID, details of the affected transactions, and documents that prove where your funds came from. Screenshots, receipts, or bank statements are your best friends here. Then, you wait, since the review process isn't fast. The exchange might come back with more questions, but if everything checks out, your account will eventually be unlocked.

Large transactions will trigger source of funds checks

As is the case with The White Whale story, sometimes funds get frozen simply because you moved a large amount of crypto. It is just one of several reasons why do crypto exchanges freeze accounts. Many exchanges are required to perform deep verification when a transaction hits a specific amount, often above €10,000. Go above this mark, and the exchange’s compliance system triggers. It’s much like a bank asking questions about a large cash deposit. When this happens, you’ll need to present a paper trail showing your crypto’s origin. The source of funds can be either of these:

- Your recent pay slips

- A loan document

- Paperwork for an inheritance or a large gift

- A contract showing you sold something valuable, like a car or property

When you submit one or more of these documents, the freeze lifts. While this is a routine step, it is exactly one of the reasons why users are moving to non-custodial options, where you're always in control.

How do I unfreeze my crypto?

Finding your crypto frozen can be a real headache. It usually happens because of safety rules or required legal checks, as I explained earlier. So, take a look at the following steps if you’re wondering how do I unfreeze my crypto ? Open a support ticket and follow the instructions given to you by the exchange, for some cases you will have to verify your identity by providing documents like your ID or proof of address, as well as videos that prove you are indeed the person that appears on the ID, and in other cases you will have to prove that the crypto is yours by providing a source of funds like bank statements which prove you bought the crypto legally with a bank transfer, or provide your transaction history which shows your crypto did not pass through wallets connected to illegal activities.

While on the topic, I’ll add some stats too. In early 2025 alone, US authorities froze or took about $1.8 billion in cryptocurrency tied to OFAC (Office of Foreign Assets Control) sanctions. As of the start of last year, the US sanctions list included around 1,245 crypto wallets, with more than 50 individuals and groups added for crypto-specific violations. This number is rising each year, proving that sanctions targeting crypto are becoming more common. For example, in 2024, 23% of all new sanctions involved crypto, which is an increase from 17% in 2023.

Why was my wallet flagged?

As you likely know by now, crypto trading platforms have automatic security checks that watch for unusual activity to keep your crypto safe. If your account has recently been restricted and you're unsure why, you might be asking why was my wallet flagged? It could happen for multiple reasons, maybe the funds you deposited to the exchange are flagged as stolen in a hack, or they passed through wallets connected to criminal groups. Also, if signed to your account from different devices not recognized by the system, or from different locations, and a security alert was triggered because this resembles hacking attempts, so the exchange locked your account to protect your funds.

Why has my account been restricted by the crypto exchange?

Finding yourself unable to trade or take money out of your account is a real worry. I’ve mentioned that this happens because the exchange’s automatic safety systems have been triggered. I often heard my friends ask, why has my account been restricted by the crypto exchange? A common reason can be that the funds you deposited were flagged as high-risk, which means the system found them to be connected to illegal activities such as frauds, or they were transferred from wallets connected to terror organisations. Another reason could be that you signed in from different devices or IP addresses, which triggered suspicious login activity, and to protect your account, the exchange restricted it.

Reduce the risk of your crypto getting frozen

If I did a good job, you should know by now why do crypto exchanges freeze accounts. Common reasons include the system detecting something unusual, transactions that raise security concerns, or new government sanctions. Routine checks on where your money came from are another reason, too. All centralized exchanges follow strict financial rules, and as such, will act quickly to investigate any potential issue flagged by their systems. Bear in mind that you can take steps to lower your risk of a freeze. Avoid making sudden, large transactions that look different from your normal pattern. Most importantly, keep good records (like bank statements or pay slips) that show how you obtained your funds. Having this proof ready can turn a long, complicated freeze into a quick verification. Knowing the common causes and being prepared gives you the best shot at keeping access to your crypto and resolving any issues faster.