Whenever you want to convert crypto into a bank transfer, you can't simply cash it out, especially if the amount is higher than €10,000. In that situation, you’ll need to move your crypto to a centralized exchange, request a bank wire, and then provide Source of Funds documents. The reason for this procedure is that when you deposit crypto, exchanges are required by law to ask where it originally came from. So, the paperwork helps both the exchange and your bank make sure the money is clean and wasn't obtained illicitly. That's why banks won’t process large crypto-related transfers unless you can present clear proof of how you got the funds to begin with.

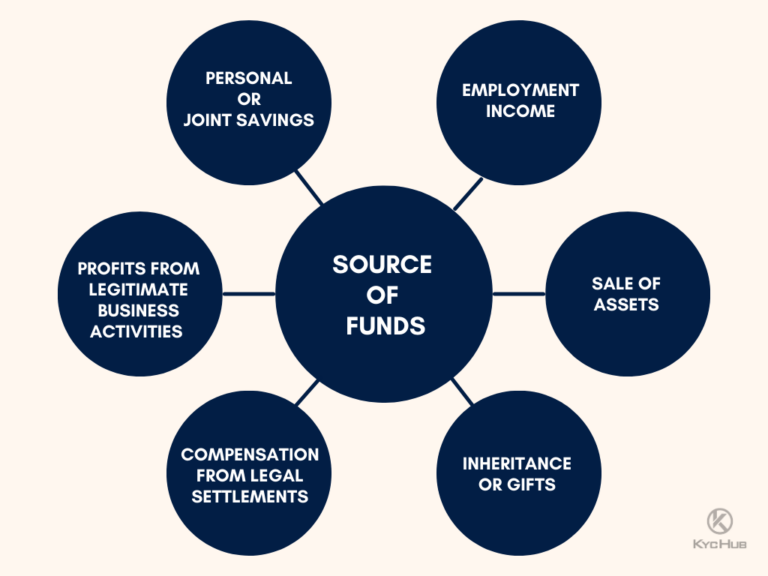

That being said, what is Source of Funds in crypto? It refers to the documents that show the origin of the funds and the financial trail leading to the crypto purchase, in order to prove that the funds or crypto are legitimate and not linked to illegal activity. To follow the entire trail from fiat to the purchase of crypto, you need to provide proof of how the fiat was obtained, such as payslips, a property sale contract, inheritance documents, or a loan agreement, along with bank statements showing the wire transfer to the crypto exchange. Finally, you must provide the exchange’s transaction history to prove the actual crypto token purchase.

How to Pass SoF Checks

As we’ve mentioned, centralized exchanges and banks have to follow strict government rules. This means they are only allowed to process funds that come from lawful and verifiable sources. To stay on the right side of the law and avoid trouble, they need to check that every large transaction, especially when cashing out crypto, has a clean origin. For that purpose, they ask for documents and run their checks before they let you withdraw your money to a bank. Apart from knowing what is Source of Funds in crypto, you’ll also need several documents listed below, sorted by the PlasBit team from most likely to be accepted to least likely:

- Employer or business income statements (fiat or crypto). These show how you earn your money, whether through a salary or business operations. Documents such as tax returns, salary statements, or reports of crypto business profits are highly trusted by exchanges and banks because they are official and irrefutable. As such, they are considered the most reliable way to prove your funds are legit.

- Inheritance paperwork and a bank statement showing receipt of funds. If your funds come from an inheritance, you’ll need the legal inheritance documents, along with a bank statement confirming the money was transferred to your account. Together, these records confirm that the money is legally yours and that you have received it.

- Loan contract from a bank. This agreement demonstrates that the money you are using is borrowed from an official and regulated lender, which makes its source easy to trace.

- Proof from selling a property. If your funds come from selling real estate, you'll need to provide three key documents: the official sale contract, your bank statement showing the money from the sale, and proof that the bank account is yours. This paperwork trail lets the exchange or bank confirm the entire transaction from start to finish.

- Statements of crypto purchases on regulated exchanges. Transaction records from regulated, KYC-compliant crypto exchanges serve as valid proof for Source of Funds verification. Your account statements determine exactly when you bought your crypto and how much you paid, which gives exchanges and banks a clear, trustworthy history of where it came from.

- Transfer confirmations from other exchanges or self-custody wallets. If you moved your crypto from another exchange or a personal wallet, you'll need to show the transfer receipts or transaction history. Doing so helps the new exchange verify that your funds originally came from a legitimate source.

- Proof of profits from trading. You can use profits from crypto trading as proof of funds by showing your full trading history from the exchange. It should include your starting deposits, every trade you made, and a final statement displaying your profits.

- Mining or staking proofs. You'll need to provide documents that prove you were actively involved. This can include things like your electricity bills, receipts for mining rigs, payment records from a mining pool or validator, and timestamps that match your transaction history.

- Documentation for over-the-counter (OTC) transactions. Buying your crypto through a private, OTC deal requires a receipt from the transaction. These documents should ideally come from a licensed and regulated OTC provider.

- Peer-to-peer (P2P) exchange documentation. In a situation where you bought crypto directly from another person, you'll need to present bank statements proving you made the payment, in addition to authentication of where the money you used came from. Because there is no official company involved, this type of proof is checked very carefully.

- Airdrops. When receiving crypto from an airdrop, you must supply proof from the organizers, on-chain transaction history showing you received the tokens, and supporting screenshots such as confirmation messages. Having all of these details will help verify that the assets were legitimately earned.

Graph showing examples of Source of Funds (Image credit: kychub.com)

It’s worth adding that each exchange might have some special requirements in regards to how these documents are presented. For instance, Crypto.com asks that the documents be delivered in one of the following formats: .pdf, .png, .jpg, or .jpeg.

When do exchanges ask for a Source of Funds?

There are two main situations where crypto exchanges will ask for it:

1. When you want to convert crypto to fiat and send it to your bank.

You can actually send any amount of crypto to an exchange without immediately having to prove where it came from. The request for Source of Funds only comes up when you try to cash out to your bank account, usually via bank wire. At that point, the exchange must verify where your crypto originally came from so the bank can confirm the funds are legitimate. Assuming you can’t provide the right paperwork explaining how you got the crypto, the transfer to your bank will be blocked. In simple terms, this means you won’t be able to move your funds into the traditional banking system until the Source of Funds check is completed.

2. When your crypto is flagged as high risk during an AML screening

Every time you transfer crypto to an exchange, the transaction automatically runs through an anti-money laundering (AML) screening tool. This software analyzes your wallet’s transaction history and checks whether the funds have ever been linked to suspicious or illegal activity, such as darknet marketplaces, sanctioned addresses, hacks, or mixing services. On condition that the system flags your deposit as high risk, the exchange will immediately freeze the deposit (sometimes your entire account as well) until you provide a Source of Funds. The aim is to prove that you obtained the crypto legally, even if someone else in the transaction’s past didn’t.

Real-world consequences of failing to provide a Source of Funds

The PlasBit team would like to give you a better idea of what could happen if you fail to provide a Source of Funds, so look no further than the real case investigated by the Financial Ombudsman Service in the UK. In this situation, a Revolut customer named Mr. B had his account blocked, reviewed, and ultimately closed because he refused to provide the documents the company required to verify the origin of his money. Back in May 2020, Revolut placed Mr. B's account under review and temporarily froze his funds, asking him to prove where they came from. The customer said the money was from renting out a property and sent his bank statements to show the payments, but Revolut wasn't satisfied and asked for his latest tax return as extra proof. Mr. B refused, saying the request was too intrusive, and because of his failure to provide the documents Revolut required, his account was closed in line with the company’s terms and AML obligations.

After finishing the investigation, Revolut sent the money left in Mr. B's account back to his card. However, because his app was already locked, he missed the notification about the transfer, and later realized that although most of the money was sent back, €1,000 was missing. The ombudsman investigating the complaint later ordered Revolut to pay back the missing €1,000 plus 8% interest. What’s more, they also instructed Revolut to pay £100 (roughly €114) in compensation due to poor customer service, as Mr. B had no way to contact them once they blocked his app access. The ombudsman's decision stated that Revolut was legally required to check where the money came from, and since Mr. B would not provide the proof they asked for, the company had the right to freeze his account, shut it down, and send the money back. In the end, the frustration and problems Mr. B faced show why it’s so important to cooperate with these checks. So, knowing what is Source of Funds in crypto is a one thing, but remember that if you can’t prove how you obtained your crypto or fiat funds, the exchange or other financial institutions may freeze your account, refuse your withdrawal, close your account, and return the funds to their original source.

Why do crypto exchanges ask for Source of Funds?

This requirement is not unique to the crypto industry, since it became a standard regulatory obligation for pretty much all and any financial institutions, but why do crypto exchanges ask for Source of Funds? Because crypto exchanges have to follow the same rules as traditional banks, which means that any money you transfer from exchanges has to go through AML checks and be provided with a source of funds to process money transfers, just like regular banks do.

What to do if you don’t have any Source of Funds?

As you’ve likely gathered by now, failing to provide the required documents after an exchange asks for Source of Funds will make you unable to cash out your crypto through a regular centralized exchange. However, not all is lost, as there are several alternative methods that don’t rely on old transaction history or missing documentation. These are:

- P2P transfers with bank payment are one of the most used because a P2P exchange allows you to sell your crypto directly to another person instead of going through a centralized exchange. The buyer pays directly into your bank account, and once you see the money has arrived, you send the crypto to their wallet. Since the money comes from a private individual and not from a crypto exchange, banks typically treat it like any normal transfer. Also, if the amount is not large, the bank usually won’t ask for any Source of Funds documents. This gives you a clean, new “paper” trail, while the bank just sees a regular transfer from a friend or contact, not a crypto sale. Users often utilize this method for cashing out smaller amounts.

- OTC dealers are a good option in case you need to cash out a large amount of crypto. OTC services usually operate through in-person meetings or private arrangements, specializing in handling large trades that regular exchanges might delay, freeze, or decline. An OTC dealer can help you swap your crypto either for a different crypto with a clean and verifiable history or for cash sent to your bank. Some OTC desks also handle the paperwork, creating the Source of Funds documents for the bank transfer on your behalf, which makes cashing out large amounts simpler as the dealer takes care of the compliance checks the bank requires. This service is most commonly used for very large transactions that would almost certainly get flagged for extra review on a regular exchange.

What is proof of funds for crypto?

As we’ve said, when moving large sums of money, exchanges and banks are legally required to verify the legitimacy of your funds, and it’s the same for crypto. So, what is proof of funds for crypto? It refers to documents that show how people bought their crypto with fiat in the first place, so the bank can check the crypto's financial trail and verify it wasn’t connected to any illegal activity. The accepted documents as proof of funds include payslips, property sale, loan contract, inheritance paperwork, or bank statements

How to provide a source of funds for your crypto?

Knowing what paperwork to have ready will make your cashouts go through much faster and without any hold ups. So, how to provide a source of funds for your crypto? You need to show the origin of the money you used to purchase your crypto by providing paperwork that shows where the original funds came from, like a loan agreement, property sale, or inheritance and the bank statement that shows the transfers to the exchange that you bought the crypto from.

Be prepared before you cash out

Before wiring a large amount of money from a crypto exchange to your bank account, we at PlasBit advise you to be prepared and get your documents ready first. Keep in mind that exchanges must follow the law and check where your money came from, so they can't approve a big withdrawal unless you show proof. It enables the exchange to provide the bank with the necessary paperwork that the crypto assets were lawfully acquired, ensuring that the transfer follows the AML rules and goes through without any issues. In the event you are unable to provide the required details, the exchange will block your withdrawal, even if the crypto is already sitting in your balance, as shown in that ombudsman use case. That's why it's a smart move to collect your documents ahead of time, especially for a large cashout. Understanding what is Source of Funds in crypto and being ready in advance helps avoid delays, freezes, or extra checks, and ensures your money moves from the exchange to your bank smoothly.