This is the mysterious tale of Michael Mancil Brown, also known as KnightMB Bitcoin who was an early bitcoin adopter and influential figure on bitcointalk.org who became filthy rich after amassing 371,000 BTC way back in 2010 for just under $0.01 per coin, but in 2016, he was convicted of wire fraud and extortion because he threatened to publish the tax returns of presidential nominee at the time Mitt Romney. His Bitcoin holdings were confiscated. As of November 2024, if he did manage to hold onto his former holdings, they would be worth just over $36 billion.

How Did KnightMB, Bitcoin Pioneer Become So Influential?

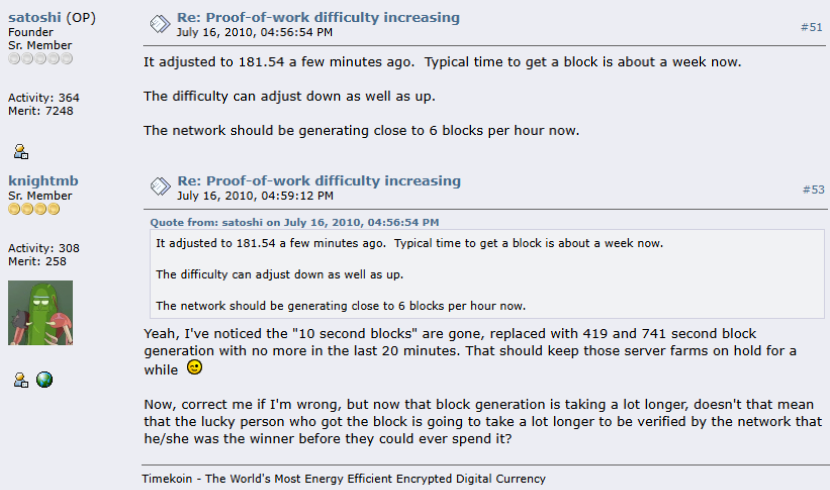

The simple answer is Michael Brown signed up to the Bitcointalk forum right back in the earliest days of Bitcoin. KnightMB even had conversations with the elusive Bitcoin OG, Satoshi Nakamoto. The conversations took place on the forum in 2010, just a year after Bitcoin (BTC) was invented.

KnightMB Bitcoin early adopter, and others such as Michael Marquardt, had a larger than life influence simply because the crypto community was tiny at the time. We’re talking dozens or hundreds of enthusiasts, rather than the millions it is today. Back then, cryptocurrency was still a very niche thing and the value of one BTC was less than $0.01, compared to $92,679 at the time of writing. The fact KnightMB was much more than just a casual Bitcoin fan helped too. He was like a walking encyclopedia when it came to Bitcoin and how blockchain technology and cryptocurrencies worked. That meant people respected his insights and he quickly became one of the go-to people for tech questions in the bitcointalk.org forum. He was even there for the first commercial Bitcoin transaction, known as “Laszlo’s pizza transaction”. But so far as we can tell, there’s nothing to say he was there for the first ever Bitcoin transaction which was between Hal Finney and Satoshi back in January 2009. Later down the line, Brown became a moderator, then admin on the bitcointalk forum. This meant he had a fair bit of power, helping to manage discussions, settle disputes, and direct topics of conversation. Some say he abused this power and took advantage. We’ll let you be the judge of that.

The Truth About KnightMB’s Bitcoin Fortune

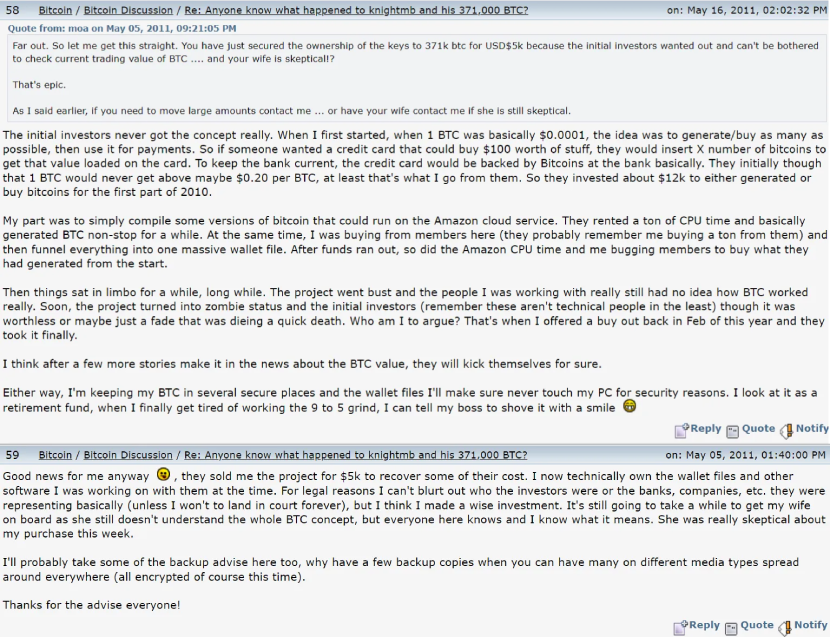

Did KnightMB’s Bitcoin fortune eclipse those of other big players like the Winklevoss twins and Roger Ver? It’s a bone of contention in the crypto community. Many believe that KnightMB built his fortune by intensively mining Bitcoin when it was easier to do and fewer people were involved. Back then, mining rewards were high, competition was almost non-existent, and Bitcoin's value was next to nothing. This all added up to the perfect conditions for stashing away a ton of BTC if you knew what you were doing. KnightMB Bitcoin forum posts from 2010 boasted that he had built a stash of 371,000 BTC. Here’s how he said he did it. As the story goes, Brown was involved in a project that planned to offer pre-charged credit cards you could load with real money, all backed by Bitcoin. These reloadable cards would be similar to Visa or Mastercard, but could be refilled with Bitcoin rather than fiat currency like US dollars or Euros. To finance the project, Brown used Amazon’s cloud service to mine 100,000’s worth of Bitcoin which he then tucked away in several secure personal wallets. To cut a long story short, the project ran out of steam as investors thought Bitcoin was going to remain worthless. They saw it as a "quick death" and wanted out. Brown saw this as a golden opportunity to cream off some profit for himself. He believed Bitcoin would take off in the near future, so he bought out the project and 371k Bitcoin for just $5,000. In a 2011 forum post, KnightMB said he was keeping the Bitcoin stash as a retirement fund. He also joked about quitting his 9 to 5 and telling his boss to “shove it with a smile”!

Some people in the crypto community don’t buy into KnightMB’s claims. He’s always been secretive about the details, saying he couldn’t disclose the details of investors, banks, or companies involved for “legal reasons”. Others in the community question whether Brown’s wallet was really one of the largest wallets in the world, as he claimed. The whole thing is based on anecdotal evidence and nobody has provided any concrete proof. The man himself, KnightMB, has never proven the claims, so it’s hard to know what’s true and what isn’t. One thing we do know for sure – KnightMB (Michael Mancil Brown) will be talked about in Bitcoin forums and crypto communities for many years to come. Whether his fortune is real or not, the perception of his wealth gave him gravitas in the crypto world. Many looked up to him. But some view him as a fraud and conman. We’ll let you decide after reading the next couple of sections.

What Happened To KnightMB & His Alleged Bitcoin Fortune?

KnightMB's BitcoinTalk exit is a bit of a mystery. From posts that are publicly available, it seems his departure wasn’t tied to any major controversy, at least not one that’s well-documented. The controversies came later, as we’ll explore in just a moment. We know he left Bitcointalk around the time Bitcoin was starting to gain serious mainstream attention, which might suggest he’d already reached his goals. Maybe he simply wanted to step away from the increasing scrutiny after amassing such a big Bitcoin fortune. Remember, back in the early days, the crypto community was small and tight-knit. As Bitcoin gained traction, the community suddenly exploded and came under an intense global spotlight. Not everyone was comfortable with that level of exposure. In a prelude of things to come, Brown was involved in a shadowy incident back in 2009. Video footage and news reports show his home being raided by the US Secret Service for allegedly hacking the website of a farmer’s insurance company and stealing the private details of customers. Charges were never filed in this case but, as you’ll find out in a moment, Brown was arrested and found guilty of a more serious crime just a few years later. As for his fortune, it’s anybody’s guess. If the claims are true, he could well be one of the wealthiest people in crypto history. But there’s no clear evidence of him cashing out or making waves with his fortune, so the truth might well be different. One thing we do know here at Plasbit, the story of KnightMB Bitcoin fortune is one of the great unsolved mysteries of the crypto world.

Michael Mancil Brown’s Arrest & Trial for Extortion & Fraud

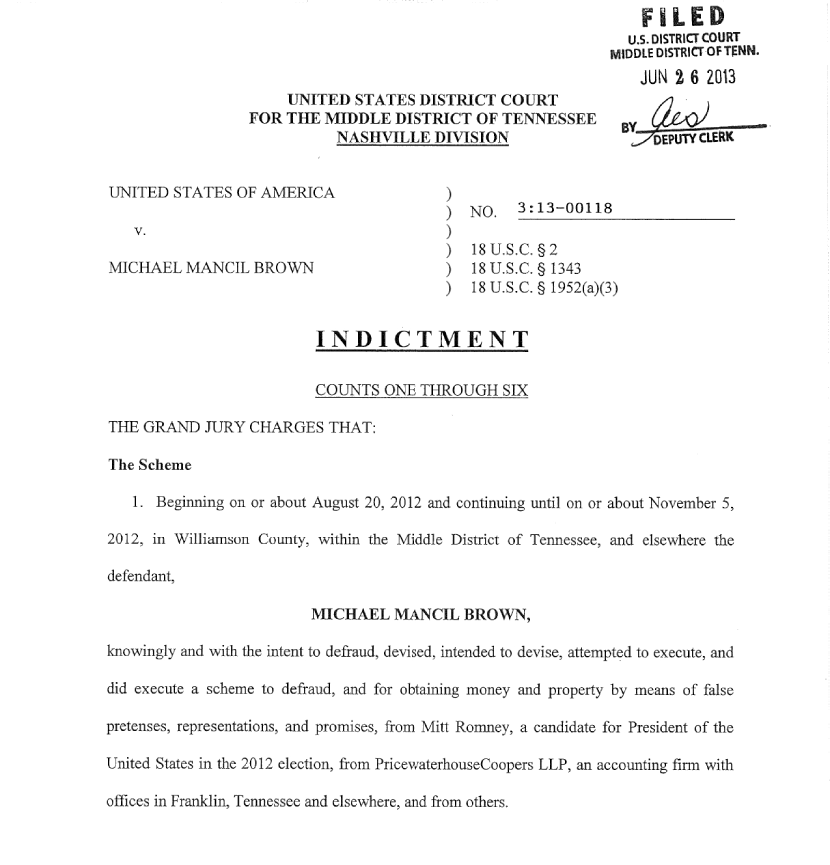

In a twist to the Michael Mancil Brown (KnightMB) Bitcoin story, he was arrested and found guilty of a serious cybercrime in 2012. Here are the details. Brown claimed he’d hacked into PricewaterhouseCoopers (PwC) and stolen Mitt Romney’s tax returns. He sent letters to Romney demanding $1 million in Bitcoin to keep the documents private. He also offered the documents for sale to anyone willing to pay the same amount in Bitcoin. Things escalated when he sent similar letters to both the Democratic and Republican offices in Franklin and even posted about it on Pastebin, trying to stir up attention in the run-up to the 2012 election. As a result, Michael Mancil Brown, then aged 34, was indicted on June 26, 2013 for extortion and wire fraud.

It was later revealed that Brown hadn’t actually accessed PwC’s network or obtained the documents. It all appeared to be a high-stakes bluff with KnightMB playing on political intrigue and public curiosity to line his pockets. Ultimately, the plan backfired. In 2016, Brown was convicted of wire fraud and extortion. He faced up to 20 years in prison, as well as the possibility of big fines. Brown was forced to pay $200,000 and had his original sentence of four years imprisonment vacated. Nobody really knows how long he spent in jail. As seems to be the case with most things involving KnightMB, Bitcoin early adopter, the whole aftermath is a mystery. What’s he up to now? Where is he? Does he still have all the BTC? Anybody’s guess. He’s flying under the radar and might be living a quiet life in his home state of Tennessee. Or perhaps he’s working on other tech projects. He might still be in jail. Or maybe he was enlisted by the Secret Service as a cybersecurity expert. Maybe he’s just kicking back and enjoying the fruits of his early Bitcoin investments. Here at Plasbit, we recommend that you always keep your crypto dealings above board and in line with the rules of your local government. If you don’t, then expect to pay the price at some point, just as KnightMB did.

What Was TimeKoin and How Was KnightMB Involved?

KnightMB was supposedly involved in a crypto project called “TimeKoin”. TimeKoin was an alternative cryptocurrency project that set out to address some of the problems with Bitcoin, including energy efficiency and complexity.

What Problem Was TimeKoin Trying to Solve?

TimeKoin aimed to address two main issues with Bitcoin.

- Energy Consumption: Bitcoin’s proof-of-work (PoW) system was based on earlier ideas adapted by figures in the cypherpunkmovement and is pretty energy-intensive. It needs tons of computational power to validate transactions and mine new coins.

- Accessibility: The creators wanted to make crypto easier to use, especially for non-techy people, to participate in Bitcoin’s mining ecosystem.

TimeKoin Features

- Energy Efficiency: Instead of Bitcoin’s PoW, TimeKoin used "transaction rotation" which used uptime as a measure of contribution to the network.

- Uptime-Based Rewards: Participants earned TimeKoins based on uptime spent in the network. New users would earn one coin per cycle (5 minutes) for the first week, with this reward creeping up over time. If a user went offline for more than two hours, they were removed from the rotation and had to reapply.

- RSA Encryption: TimeKoin used 1536-bit RSA encryption for securing transactions, which was six times more than Bitcoin’s 256-bit encryption at the time.

- No Mining Competition: Unlike Bitcoin’s competitive mining process, TimeKoin used a shared currency creation system. This was meant to avoid the "arms race" of computations and create a fairer distribution of coins.

- Whole Numbers Only: Unlike Bitcoin’s divisibility into satoshis, TimeKoin used whole numbers only. This simplified transactions and reduced the database size.

- Decentralization: TimeKoin was decentralized in a similar way to Bitcoin, with a public ledger available for anyone to inspect.

TimeKoin Criticism

- Lack of Clarity: Critics at the time noted the project didn’t fully explain how TimeKoin would stop abuse like botnets or users gaming the uptime system with multiple devices to simulate “independent” nodes. There were also concerns that people could use lots of static IP addresses to create multiple “high uptime” nodes. This lack of detail led many to question the validity of the project.

- Centralization Risks: Although TimeKoin claimed to be decentralized, its reliance on uptime and static IPs raised concerns that big organizations with large server resources could dominate the network and take control of it.

- Limited Adoption: TimeKoin didn’t gain traction as it lacked community support.

- Unclear Utility: Many believed that TimeKoin didn’t really solve any problems that Bitcoin hadn’t already addressed, apart from energy efficiency.

What Happened to TimeKoin?

TimeKoin faded away over time due to a lack of adoption and question marks hanging over the project. The crypto markets quickly became saturated with similar and more innovative projects. Some people speculate the failure of TimeKoin might have had a negative impact on KnightMB’s ego and in some way led to the Mitt Romney fiasco.

Other Crypto Giants Who Wound Up Behind Bars

With great wealth comes great temptation, which might explain why so many crypto big players have found themselves on the wrong side of the law. Let’s take a look at some of their stories of wrongdoing.

Ross Ulbricht (Silk Road)

Texas native, Ross Ulbricht created Silk Road, a dark web market that used Bitcoin for anonymous transactions. Under the alias “Dread Pirate Roberts,” Ulbricht built the platform for trading drugs, weapons, and other illegal goods. Over the years it was in operation, Ulbricht “earned” an estimated $28 million in Bitcoin commissions. At its prime, the Silk Road platform handled over $1.2 billion worth of transactions. In 2013, the FBI shut down the site, arresting Ulbricht in a San Francisco library. Rumors of “murder-for-hire” allegations against Ulbricht also flew around in the forums, but charges were never formally pursued for that. Ulbricht was given a life sentence without parole.

Charlie Shrem

Charlie Shrem was one of Bitcoin’s early winners, co-founding BitInstant and quickly becoming a millionaire. Things took a dark turn in 2014 when he was arrested for helping launder $1 million of Bitcoin that ended up on Silk Road. Shrem admitted to knowingly facilitating illegal transactions, landing him a two-year prison sentence. In the end he served just over a year. Later, in 2018, Shrem also faced a lawsuit from the Winklevoss twins, who accused him of stealing thousands of Bitcoins back in 2012. The case was dismissed in 2019, when a judge ruled in Shrem’s favor and ordered the twins to cover his legal fees.

Mark Karpelès (Mt. Gox)

CEO of Mt. Gox, Mark Karpelès, ran the world’s largest Bitcoin exchange that handled 70% of all Bitcoin transactions at its peak. But in 2014, Mt. Gox collapsed after 850,000 BTC vanished, a loss worth billions in today’s money. The scandal, tied to alleged theft and mismanagement, led to accusations of embezzlement and data manipulation against Karpelès. In 2019, he was convicted of data manipulation in Japan and got a suspended sentence. He narrowly avoided prison but was ordered to pay some big fines.

Alexander Vinnik (BTC-e)

Alexander Vinnik, the operator of the now-defunct crypto exchange BTC-e, was involved in one of the biggest crypto money laundering operations. Arrested in Greece in 2017, Vinnik was accused of laundering billions of dollars worth of Bitcoin, including funds stolen during the infamous Mt. Gox hack. His arrest marked the start of a global legal battle, leading to his extradition to France, where he was sentenced to five years in prison. There are still charges pending against him in the U.S.

Sam Bankman-Fried (FTX Collapse)

Sam Bankman-Fried oversaw FTX, one of the most widely trusted crypto exchanges. But in late 2022, FTX collapsed when it was revealed that billions of dollars in customer funds had been mismanaged or stolen. Arrested in the Bahamas in 2023 and extradited to the U.S., Bankman-Fried now faces multiple charges. He might spend decades behind bars if convicted.

Stefan He Qin (Virgil Sigma Fund)

Stefan He Qin was the founder of the Virgil Sigma Fund and built up an image of success, boasting consistently high returns in crypto markets. In reality, he was running a Ponzi scheme, using millions of dollars worth of investor funds to bankroll a luxurious lifestyle, the whole time lying about the fund's performance. The scheme fell apart when people tried to withdraw their funds. In 2021, Qin was sentenced to seven and a half years in prison.

Ruja Ignatova (OneCoin)

Ruja Ignatova was dubbed the "Cryptoqueen" and co-founded OneCoin, a so-called cryptocurrency that turned out to be another Ponzi scheme. Promising big returns, OneCoin pulled in billions of dollars from investors worldwide, despite never actually functioning as a legit cryptocurrency. In 2017, Ignatova vanished without a trace as investigators started closing in. To this day, she remains on the FBI's Most Wanted list.

Carl Mark Force IV (Silk Road Corruption)

Carl Mark Force IV was a DEA agent who crossed the line from law enforcer to outlaw. During the Silk Road investigation, Force stole Bitcoin and extorted Ross Ulbricht, the Silk Road founder, for personal gain. His actions tarnished the credibility of the investigation. In 2015, Force was sentenced to 78 months in prison.

Staying Safe In The Crypto Space

At Plasbit, we uphold high ethical standards. The crypto world offers great opportunities, but also has more than its fair share of risks. As we've seen in the stories of KnightMB Bitcoin and others, even those who rise to positions of power can fall prey to greed, poor judgment, or outright criminality. That’s why we emphasize the importance of transparency and regulatory compliance. We strive to keep you informed about the potential pitfalls and challenges of crypto investing. Whether you're trading or simply exploring the exciting world of crypto, always make sure to do thorough research and use reputable platforms. And above all – remember to avoid anything that seems too good to be true, because it usually is.