Cryptocurrency enthusiasts often wonder "Can I transfer Bitcoin to my bank account?" This article will delve into the topic and provide a comprehensive guide on how to transfer bitcoins to bank account. We will discuss the various methods available, the potential challenges, and the overall process of converting your Bitcoin to cash.

Understanding Bitcoin and Fiat Currency

Most and foremost, can I transfer Bitcoin to my bank account? The answer is yes, and to understand the process of transferring Bitcoin to a bank account, it is essential to grasp the differences between Bitcoin and fiat currency. Bitcoin is a decentralized currency operating on a peer-to-peer network. In contrast, fiat currency refers to traditional currencies issued and regulated by governments. Let's explore these concepts in detail.

Bitcoin:

Bitcoin was the first cryptocurrency to gain broad recognition. It is based on blockchain, a decentralized and transparent ledger that records all transactions made with the currency. Bitcoin operates independently of any central authority or government, immune to traditional banking systems and regulatory bodies.

Decentralization:

Bitcoin functions on a decentralized network of computers known as nodes, which collectively validate and record transactions on the blockchain. This decentralized nature ensures that no single entity controls the currency.

Limited Supply:

Unlike fiat currencies that can be printed or regulated by central banks, Bitcoin has a finite supply. The total number of Bitcoins that can ever exist is capped at 21 million, making it a deflationary asset.

Anonymity and Transparency:

While Bitcoin transactions are documented on the blockchain, the participants' identities are pseudonymous. Users are identified by their unique Bitcoin addresses, offering a certain level of privacy. However, the transparent nature of the blockchain allows anyone to view the transaction history and balances associated with these addresses.

Security:

Bitcoin utilizes cryptographic techniques to secure transactions and prevent fraud. The decentralized network and consensus mechanism ensures the integrity of the blockchain, making it difficult for malicious actors to manipulate or alter transaction records.

Fiat Currency:

Fiat currency is a medium of exchange issued by governments and is widely accepted as a medium of exchange for goods and services. It derives its value from the trust and confidence placed in the government that issues it and the stability of the underlying economy. Central banks regulate and control Fiat currencies, which have the authority to print or withdraw money from circulation.

1. Centralized Control:

Fiat currencies are regulated by central banks, which have the power to influence the money supply, interest rates, and economic policies. These institutions are crucial in managing inflation, maintaining financial stability, and fostering economic growth.

2. Legal Tender:

Fiat currency is recognized by law as a valid form of payment within a specific jurisdiction. It must be accepted to settle debts, taxes, and other financial obligations.

3. Unlimited Supply:

Central banks can increase or decrease the money supply through various mechanisms, such as printing new banknotes or adjusting interest rates. This flexibility allows governments to respond to economic conditions and monetary policy goals.

4. Dependency on Trust:

The value of fiat currency relies on the trust and confidence of individuals and institutions. Stability in government, economic conditions, and monetary policies are crucial factors that influence the perception of fiat currency's value.

Bitcoin Wallets: A Brief Overview

A secure wallet is a fundamental requirement when transferring Bitcoin to a bank account. Bitcoin wallets are software or hardware tools that enable users to store, manage, and transact with their Bitcoin holdings. This section will briefly overview Bitcoin wallets, their classifications, and their importance in the transfer process.

Software Wallets:

Software wallets, also known as digital wallets, are applications that can be installed on various devices, including desktop computers, smartphones, and web browsers. They are the most common type of Bitcoin wallet and offer convenience and accessibility for day-to-day transactions.

A. Desktop Wallets:

Desktop wallets are software applications installed on personal computers. They give users complete control over their private keys and offer higher security than web-based wallets.

B. Mobile Wallets:

Mobile wallets are designed specifically for smartphones and offer a convenient way to manage Bitcoin. They are often user-friendly and support features like QR code scanning for easy transactions.

C. Web-based Wallets:

Web-based wallets, also known as online wallets or hosted wallets, operate on web browsers. They are convenient for quick and easy access to Bitcoin but come with potential security risks, as users rely on the security measures implemented by the wallet provider.

Hardware Wallets:

Hardware wallets are physical gadgets designed to store offline Bitcoin private keys securely. They offer the highest level of security and are considered one of the safest options for long-term storage of Bitcoin holdings. Hardware wallets are typically USB-like devices that connect to a computer or smartphone. They generate and store private keys offline, protecting against malware and hacking attempts.

Importance of Wallet Security:

The security of a Bitcoin wallet is of utmost importance as it protects the user's funds and ensures the integrity of transactions. Regardless of the type of wallet chosen, there are essential security measures to consider:

Private Key Management:

Private keys are cryptographic codes that grant ownership and control over Bitcoin. It is crucial to store private keys securely and keep them confidential. Whether software or hardware, wallets provide mechanisms for securely managing private keys.

Backup and Recovery:

Users should regularly back up their wallet's private keys or seed phrases. In case of device damage, loss, or theft, having a backup ensures the ability to recover funds.

Two-Factor Authentication (2FA):

Enabling two-factor authentication adds a layer of security to a wallet by requiring an additional verification step, such as a unique code sent to a user's mobile device, to access the wallet.

Regular Software Updates:

Wallet software should be updated to incorporate the latest security patches and improvements.

Choosing the Right Wallet:

When selecting a Bitcoin wallet, it is crucial to consider security features, user-friendliness, platform compatibility, and community reputation. Our wallet is ISO/IEC 27001 certified and adheres to the strictest security policies, conducts impeccable risk assessments, ensures robust data protection, and implements state-of-the-art cybersecurity measures. It leverages private key encryption with Secure Enclave, is equipped with PINs, and incorporates biometric authentication for enhanced security. It is advisable to conduct thorough research, read user reviews, and consider the specific needs and preferences of the user.

Crypto Exchange: The Gateway to Fiat Conversion

Through crypto exchanges, can I transfer Bitcoin to my bank account? Crypto exchanges are the primary gateway for individuals seeking to convert their Bitcoin holdings into traditional fiat currency. These platforms facilitate the buying, selling, and trading of cryptocurrencies, including Bitcoin, and enable users to convert their digital assets into cash that can be deposited into a bank account. In this section, we will delve deeper into the role of exchanges in transferring Bitcoin to a bank account.

Buying and Selling Bitcoin:

Cryptocurrency exchanges allow users to buy Bitcoin by exchanging fiat currency, such as USD, EUR, or other supported currencies. This process typically involves creating an account on the exchange, completing identity verification procedures, and depositing funds into the account. Once the account is funded, users can place buy orders for Bitcoin at the prevailing market price. The purchased Bitcoin is then credited to the user's exchange account. Similarly, users can sell their Bitcoin holdings on exchanges. They can create sell orders indicating the amount of Bitcoin they wish to sell and the desired price. Once a buyer matches their sell order, the Bitcoin is transferred from the user's exchange account to the buyer, and the corresponding fiat currency is credited to the seller's account balance.

Fiat Withdrawals:

To transfer Bitcoin to a bank account, users must convert their Bitcoin holdings into fiat currency and initiate a withdrawal from the exchange. Most reputable exchanges provide withdrawal options that allow users to transfer their funds directly to a linked bank account. The withdrawal process typically involves specifying the desired amount, selecting the linked bank account, and confirming the transaction. It is important to note that not all exchanges offer direct fiat withdrawals. Some exchanges only support cryptocurrency-to-cryptocurrency trading and do not facilitate fiat transactions. In such cases, users need to transfer their Bitcoin to an exchange that supports fiat withdrawals or utilize other methods to convert their Bitcoin into cash.

Exchange Verification and Security:

Cryptocurrency exchanges adhere to strict Know Your Customer (KYC) and Anti-Money Launderi ng (AML) regulations in many jurisdictions. These regulations require users to provide identity verification documents, such as government-issued IDs or passports, proof of address, and sometimes additional information, to comply with legal requirements and prevent illicit activities. Verification processes vary among exchanges, with some implementing tiered systems that allow users to access different features and withdrawal limits based on their verification level. It is essential to choose reputable exchanges that prioritize user security and comply with regulatory standards to ensure the safety of personal information and funds.

Exchange Fees and Rates:

Exchanges charge fees, which can include trading fees, deposit fees, withdrawal fees, and conversion fees. These fees vary among exchanges and can significantly impact the cost of transferring Bitcoin to a bank account. Researching and comparing fee structures across different exchanges is advisable to choose the option that aligns with your requirements and budget. Moreover, exchange rates are crucial in determining the amount of fiat currency received when converting Bitcoin. Exchange rates are factored by supply and demand dynamics on the platform and can fluctuate depending on market conditions. It is vital to consider exchange rates when transferring Bitcoin to a bank account to ensure the best possible conversion value.

Geographic Availability:

The availability of exchange services and withdrawal options may vary depending on your geographic location. Certain exchanges have restrictions on specific countries or regions due to regulatory considerations. It is essential to check the supported jurisdictions and available withdrawal options on an exchange before creating an account to ensure compatibility with your location and banking requirements.

Bitcoin to Bank: Cash Out with PlasBit Transfer

It is essential to follow several steps to ensure a secure and successful transaction when cashing out Bitcoin using our Transfer Service. Use this step-by-step guide as a helpful resource to navigate through the process:

Step 1: Log in to Your PlasBit Account

Head to the PlasBit login page and input your designated username and password to initiate the login process. After logging in, you will be granted access to various features and services within your account.

Step 2: Access the "Wires" Section

After logging in, locate on the left side menu and click on your "Wires" section. By doing so, you will be directed to a page specifically designed to handle and manage bank wire transfers, providing you with the necessary tools and information.

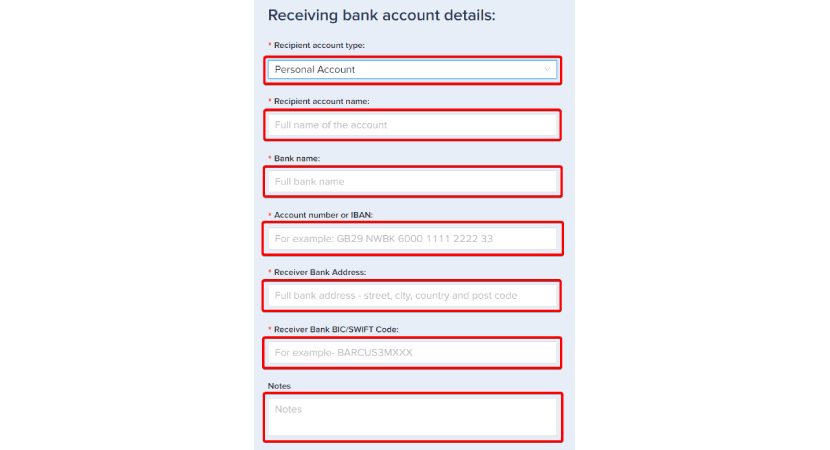

Step 3: Provide Details of Receiving Bank Account

Access the Bank Wire Transfer section and accurately provide the relevant information of the receiving bank account. Ensure to enter the recipient's account name, account type, bank name, account number or IBAN, receiver bank address, and receiver bank BIC/SWIFT code, and feel free to add any additional notes pertinent to the transfer.

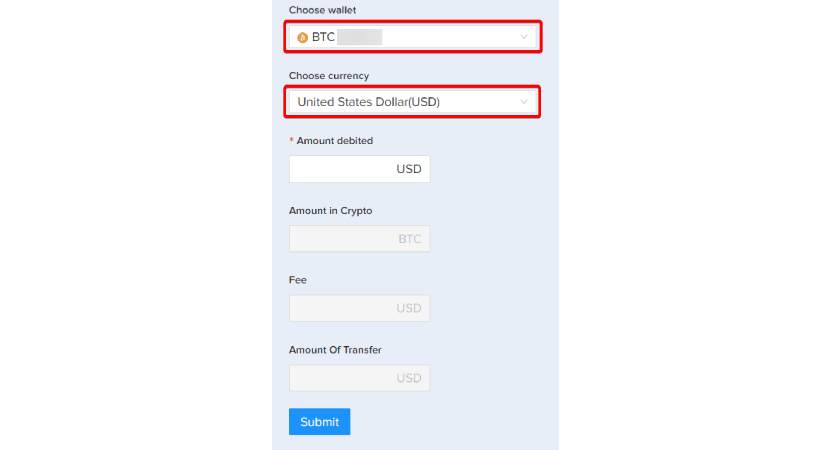

Step 4: Choose Bitcoin to Fiat Conversion

Indicate your preference to convert Bitcoin into fiat currency. Opting for Bitcoin conversion will prompt our system to calculate the equivalent fiat currency amount, determine the corresponding quantity of Bitcoin to be converted, assess the applicable fee, and provide you with the total transfer amount after deducting the fees.

Before proceeding, please confirm that your PlasBit wallet contains enough Bitcoin to cover the intended transfer amount.

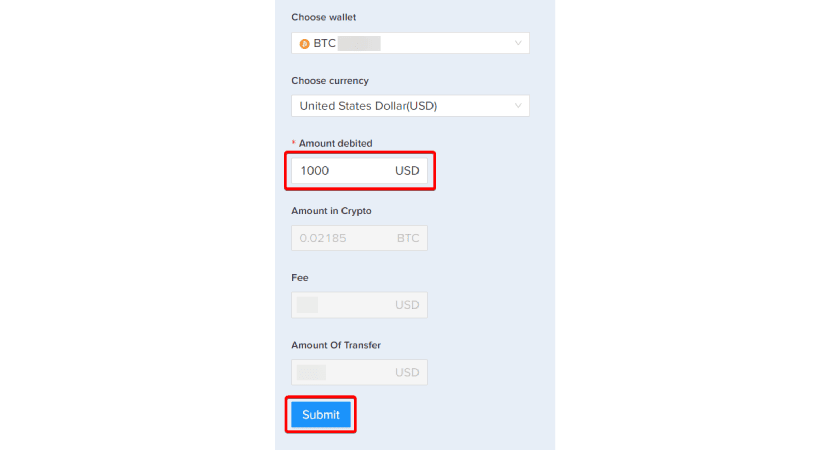

Step 5: Inspect Transfer Details

Take a moment to review relevant information, such as the estimated completion time, which generally falls within 0 to 3 business days. Additionally, note the applicable transfer fee, set at 5% of the transferred amount, as well as the minimum transfer amount of USD 1,000 and the maximum transfer amount per transaction, which is capped at USD 50,000.

Step 6: Confirm Transfer Parameters

Double-check that your transfer abides by the established constraints. Our platform maintains a maximum daily transfer threshold of USD 50,000 and a cumulative limit of USD 300,000 over a rolling 30-day period. It's important to note that a transfer confirmation fee of USD 50 is applicable.

Step 7: Validate Transfer Summary

Upon successfully enabling the security verification, meticulously examine the transfer summary provided. The summary will encompass details such as the debited amount of cryptocurrency, the applicable fee, and the total fiat currency amount being transferred. It is crucial to carefully review this information for accuracy before proceeding. Once you have carefully reviewed and verified the transfer summary, proceed by clicking the "Submit" button to commence the transfer.

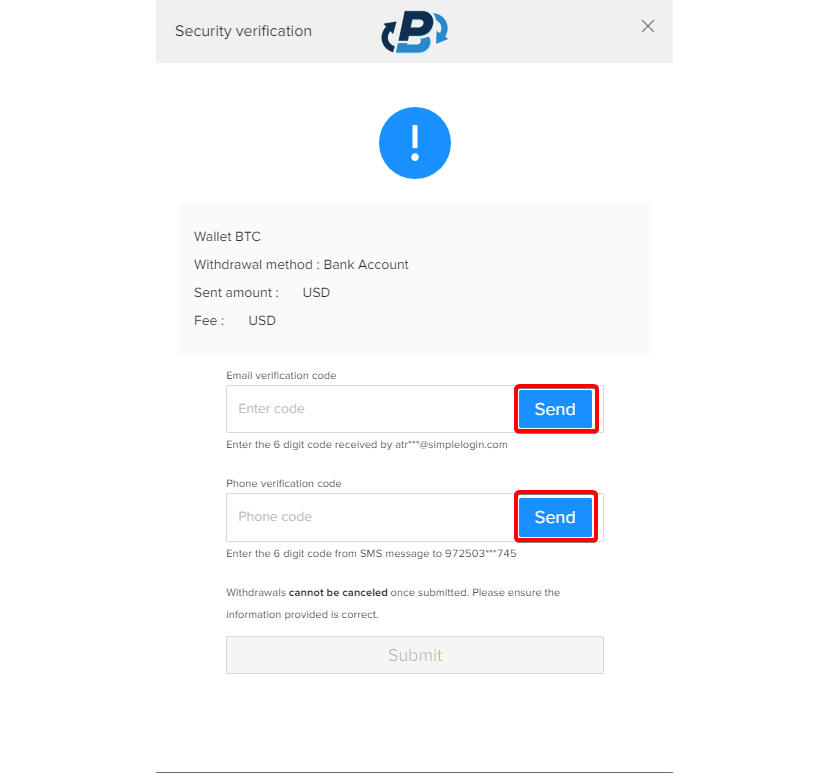

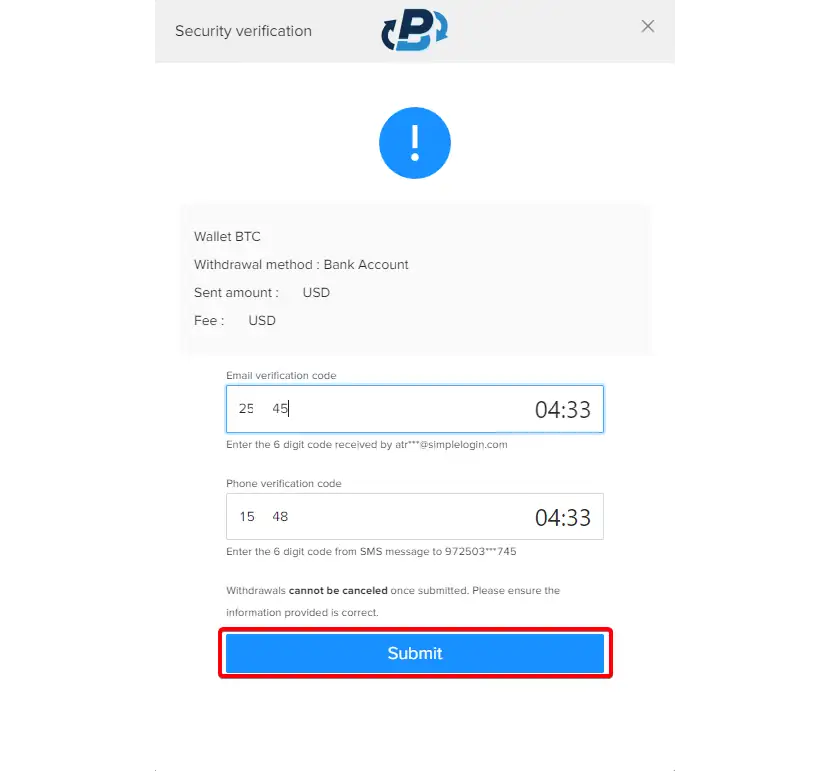

Step 8: Enable Security Verification

To bolster the security of your account, it is crucial to enable the security verification process. You can choose from email verification, phone verification.

Step 9: Conclude Security Verification

Depending on the security verification measures you enable, you will acquire a verification code through your selected method. This can include an email verification code or a code sent to your phone number. Retrieve the verification code and accurately input it into the provided field on the verification page. Once entered, click "Submit" to proceed with the wire transfer request.

Step 10: Request Successfully Submitted

A confirmation prompt will be shown after the transfer request has been submitted successfully and the requisite security verification steps have been completed. You will also observe the deducted cryptocurrency amount reflected in your wallet, and the transaction will be listed as a pending wire request. Following the earlier steps, you successfully initiated a crypto to fiat bank wire transfer using PlasBit Service. Please be advised that the transfer will be processed under the specified timeframe. You can easily keep track of the transfer's progress by logging into your PlasBit account.

Final Thoughts

To sum it up, can I transfer Bitcoin to my bank account? Yes. Transferring Bitcoin to a bank account is possible, albeit with specific considerations and challenges. Following the methods and guidelines outlined in this article, you can navigate the process effectively and securely convert Bitcoin to cash.