If you’re anything like us here at PlasBit, then you’re surely intrigued by the cryptocurrency rebels and innovators who dared to reimagine finance. One of these popular and fascinating crypto risk-takers is Erik Voorhees, an American cryptocurrency entrepreneur known for his influential projects like SatoshiDice, a revolutionary Bitcoin gambling platform that he sold in 2013 for $11.5 million in BTC, and ShapeShift, an exchange that allowed users to trade crypto without KYC, although some of his projects folded under regulatory pressure and he battled (and settled with) the SEC twice over alleged sales of unregistered securities mainly through SatoshiDice and ShapeShift. His public spat with Sam Bankman-Fried (SBF) demonstrated a clear divide between decentralized purists and centralization advocates. Today, Erik isn’t slowing down and has turned his attention to projects like Venice AI, a decentralized platform that aims to enable uncensored yet still private AI experience.

Early Life and the Bitcoin Epiphany

Before becoming a Bitcoin rockstar, the Danbury, Connecticut-born Erik lived a conventional life that gave away no indication of the disruptive innovator he would become. Raised in a libertarian household in the middle of the Colorado forest, Erik’s childhood and youth were nonetheless interesting. His father, Jacques Voorhees, who sold the diamond-trading platform Polygon for $8.4 million in 2004, is a reputable and honored member of the libertarian community. This is primarily thanks to his extensive writing on libertarian ideas and the way he managed his business. It was these ideas that shaped young Erik’s mind toward economics and entrepreneurship, even at the tender age of four. It was around this time that he and his buddy, Justin Blincoe, started their first business together, selling… wait for it… pine cones. And not just any pine cones - ‘awesome’ pine cones, according to Justin. Sadly, the venture was doomed to fail as their target market (i.e. other kids) wasn’t as impressed. Still, it provided an important lesson in supply, demand, and scarcity, as Blincoe (who later joined Voorhees to become the chief financial officer at his company ShapeShift) explained, further describing a lecture on economics by Erik’s father.

Fast forward to 2003, when Erik enrolled at the University of Puget Sound to study business leadership and political economics. There, he met Nic Cary, who would later go on to establish Blockchain.com, the world’s largest Bitcoin wallet provider. After he graduated, Voorhees relocated to Dubai, working there as a communications manager at a real estate company, where he was joined by his friend Blincoe four months later. It was here that Voorhees and Blincoe lived and worked when the Great Recession hit in 2008. As they watched the U.S. economy collapse and start a domino effect on the rest of the world, the two friends (and now colleagues, too) saw it as a defining moment in their lives. In Blincoe’s words, it became clear to them that governments should not have any control of money. To keep true to his beliefs that the power of governments and banking institutions should be limited, Voorhees moved again. This time it was to New Hampshire, also known as the “Live Free or Die” state, as per its official motto. Anyway, in New Hampshire, Voorhees joined the Free State Project, a political migration movement towards establishing a society with as little government meddling as possible in a single low-population state.

This is where he met Keith Ammon, a rising local politician, who introduced him to Bitcoin in May 2011. Bitcoin’s appeal was that, unlike the pine cones of his childhood, it was limited in supply, and unlike the U.S. dollar, it was not minted and controlled by the government, which was enough to make Erik interested. According to Voorhees, he read an article that Ammon posted on Facebook and thought crypto “was sort of weird,” but upon further reading, suddenly it all made sense to him. In addition to its limited nature, he also liked the fact that it was powered by the open-source blockchain technology owned by nobody. As such, a government couldn’t shut it down and it allowed money to be transferred basically anywhere on the planet at minimal cost. Erik believed that if enough people would start using crypto, the influence of traditional banks would begin to falter. “This had to be the most obviously useful invention that I’d ever seen. And I just totally fell in love with it.” Although Erik Voorhees was a bit late to join the Bitcoin party, he didn’t share some of the other latecomers’ irritation (or perhaps envy?) at the early adopters who jumped on the bandwagon at $2. Instead, he was happy to just be there, sharing his enthusiasm over at the Bitcointalk forum, even as he joined when Bitcoin was already nearing $30 - patiently waiting to buy the dip.

(Image credit: Bitcointalk)

To further understand the pivotal early days of Bitcoin, check out Martti Malmi and Satoshi Emails.

Trailblazing the Bitcoin Frontier

Discovering a new mission for himself, Erik feverishly studied Satoshi Nakamoto’s Bitcoin white paper. Being well-read on classics by Friedrich Hayek, Ludwig von Mises, and others, he started a blog where he referred to Bitcoin as the tool for “the separation of money and state.”

Around this time, he joined BitInstant and became its head of communications and marketing. Back then, this was a still fairly unknown crypto exchange led by Charlie Shrem and supported by Tyler and Cameron Winklevoss, who had just received a massive settlement from Facebook. Voorhees’ arrival made the company’s business explode, making it the fastest-growing Bitcoin exchange. Sitting behind BitInstant’s booth at PorcFest 2012, one of the world’s largest freedom conferences, Erik made many believers, selling thousands of Bitcoins for less than $7.

(Image credit: Will Martin’s Medium)

In early 2013, however, Voorhees had what he called a “big falling out” with BitInstant investors Tyler and Cameron Winklevoss, who now run the Gemini crypto exchange. Not long after their falling out, he left BitInstant, and later in 2013, the company was shut down due to problems with the law. Indeed, regulatory issues, some of which were connected to the infamous Silk Road marketplace, a dark web market for illicit goods, marked the end of this crypto exchange. According to some interpretations, BitInstant had aided in the sales of drugs - yikes! Shrem was convicted of helping launder money for Silk Road users and served almost two years in federal prison. By the end of 2013, the Silk Road market itself was shut down and its founder, Ross Ulbricht, was sentenced to life imprisonment. However, Erik Voorhees wasn’t accused of any wrongdoing in connection with the Silk Road but has named its closure as the single most important event in the Bitcoin space since Satoshi wrote its fateful white paper. And this wasn’t because he believed the Silk Road’s reputation was bad for Bitcoin.

In fact, he argued that the site “had every right to exist.” What he actually singled out was the fact that, until that very moment, most people would associate Bitcoin with black markets. In his view, the Silk Road’s closure was “really profoundly important for people to see that this was something real that did not rely on any specific service.” In the meantime, Erik became one of the most recognized spokespersons for Bitcoin. Among the more influential moments happened in the winter of 2011, when he was fishing with an old college friend Nic Cary in Long Island. As Cary retells it, Voorhees casually cracked open a cheap Budweiser as he explained how the open-source code behind Bitcoin could at one point become the future of money. Down the road, Cary would go on to raise $70 million for Blockchain Inc., inspired by Erik’s speech.

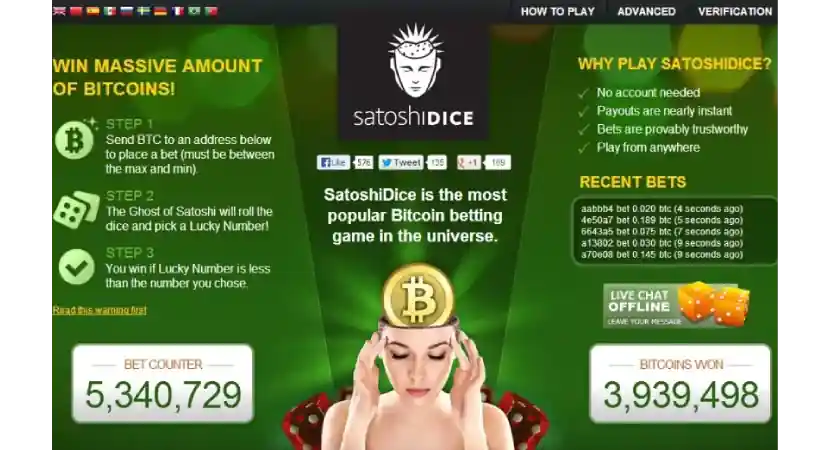

According to him “We’re all sharing a world that was structured in advance of our participation in it. And if we have even a shot at building an economic frame that lets all people exchange value regardless of where they were born, that is worth spending a career on.” Who needs a PowerPoint presentation when you’ve got charisma and a Budweiser? Doom-scrolling Reddit, Erik stumbled upon a few simple lines of code that mimicked the behavior of dice. Little did he know at that time that it would make him one of the first people to earn a living in crypto and one of crypto’s first multimillionaires. Upon testing it thoroughly, Voorhees realized the code could become the basis for a casino dice game with Bitcoin. It was ideal as it would facilitate anonymous participation from anywhere in the world and feature cryptographically verifiable odds, eliminating the chances of rigging the dice. Seeing the potential, Erik purchased the code for 40 BTC, worth about $350 at the time, according to his estimates. He then launched SatoshiDice in 2012, an online casino available to anyone with an Internet connection, when Bitcoin was trading at a median price of around $9. More than a gambling site, this platform probably mad e some Vegas casinos nervously clutch their dice.

(Image credit: Will Martin’s Medium)

As he told the crowd during a conference in May 2013, the platform was responsible for half of all Bitcoin transactions ever carried out and over half of all the fees paid to miners helping audit the blockchain. But he didn’t want to take full credit for it, stating it was a “beautiful demonstration of how powerful Bitcoin itself was.” It was around this time that Erik Voorhees made his first big compromise to achieve widespread Bitcoin adoption. Notably, he sold SatoshiDice to an anonymous buyer in July 2013 (around the same time when BitInstant was shut down) for 126,315 BTC, then worth $11.5 million. Today, it would be worth $13.5 billion, a 117,291% increase. “Ultimately, I realized, I could either go underground and keep running this very lucrative casino, which was pretty compelling and interesting to me, or I would need to sell it so I could continue being a public voice for Bitcoin, but I couldn’t do both.” Commenting on the sale, he argued that his shareholders profited much more than he did “It should go down as one of the greatest investments of any person, any time ever.”

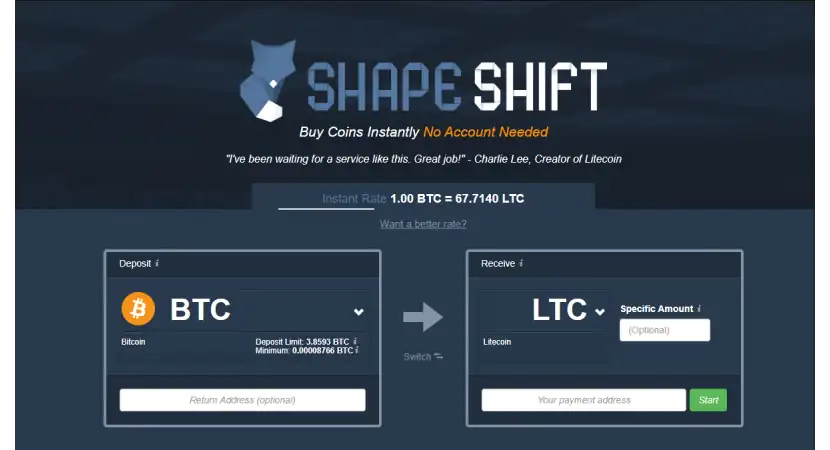

Per the U.S. Securities and Exchange Commission (SEC) data, in the period from August 2012 to February 2013, Erik raised 50,600 BTC at an average price of $14, which means it was worth around $722,659 at the time. He pulled this off by selling 13 million unregistered shares on the now-defunct MPEX exchange. Seeing his former friends and colleagues being sent to prison set Voorhees on a path to create an ecosystem that would exist beyond regulators’ reach, so he invested profits from SatoshiDice into a whole bunch of new crypto projects. One of them was Coinapult, a startup that aimed to allow customers to send Bitcoin more easily with a mobile device, but it failed shortly after. ShapeShift was a different story. Created in July 2014 in response to the downfall of Mt.Gox, it stood out among other crypto by not requiring user identification, fostering anonymous transactions (and also criminal activity). “This was right in the wake of the Mt. Gox catastrophe where $400 million of investor money got lost.

I wanted to build a way for people to convert one token into another without an exchange holding the funds. To me, that seemed really important to be able to do that. That doesn't work for dollars, but it does work for crypto assets. So that was the impetus for ShapeShift.” Interestingly, the CEO of ShapeShift was identified as ‘Beorn Gonthier’ - the first name Beorn referring to a character from J.R.R. Tolkien’s The Hobbit - a man who could shapeshift and assume the form of a great black bear. This was because Voorhees wanted to retain his anonymity, but he dropped the pseudonym in 2015 after the exchange’s monthly volume reached $11.7 million and he was pitching established investors.

(Image credit: ShapeShift | The fastest way to swap cryptocurrencies. No account required.)

Originally, Voorhees was so adamant about not collecting user data that he blocked New Yorkers from using ShapeShift rather than comply with New York state regulations demanding it to collect customer information. However, an investigation by the Wall Street Journal, published in September 2018, alleging that ShapeShift had facilitated the laundering of $90 million over a two-year period, forced the company to reconsider its policies regarding the collection of user data. Indeed, WSJ claimed that, among other criminals, hackers believed to be from North Korea had used ShapeShift to convert Bitcoin they extorted in the WannaCry ransomware attack into an untraceable cryptocurrency called Monero. In October, the company started requiring personal identification from its users, as well as asking them to link their accounts to a hardware wallet. It transitioned into a decentralized autonomous organization (DAO) several years later.

Showdowns with the SEC

While we’re on the subject of the SEC, Voorhees’s libertarian stance has often put him at odds with this regulatory body. In 2014, he settled with the agency over allegations that he had sold unregistered securities through SatoshiDice and another venture, FeedZeBirds.

(Image credit: Feed Ze Birds | retweet for bitcoin)

As part of the settlement, he was forced to pay $50,000 in penalties (not taking into account legal fees and taxes) and agree to halt any such activities. In his characteristically defiant style, Erik told them at the time that their actions stifled innovation and punished entrepreneurs for operating in a regulatory gray area. Remembering this whole ordeal, he described it as a “terrifying experience” which, after he tried so hard to build “something that cool and useful and revolutionary and that made investors a bunch of money, seemed like such an obvious injustice to me that it was really validating.” Referring to a series of compromises he had to make to stay on the law’s good side, he expressed regret over them, calling them a “horrible decision.” In his words, it was “Not because it’s wrong to sell to people but because of all the problems it led to with the SEC and because of the decisions I made after that, which ended up being horrible financial decisions that I was forced into doing.”

In March 2024, Erik was again charged by the SEC for ShapeShift “acting as an unregistered dealer in connection with its operation of an online crypto asset trading platform.” He settled for a $275,000 penalty and officially agreed to a cease-and-desist order. One of the fiercest critics of ShapeShift was Elizabeth Warren, who said that platforms like ShapeShift wanted “a giant loophole for DeFi written into the law, so they can launder money whenever a drug lord or a terrorist pays them to do so. Now, that is exactly what a Colorado-based crypto exchange ShapeShift did when it deliberately restructured itself as a DeFi platform, and here’s what it told its customers - ‘we’re making the shift to remove itself from regulated activity.’ In translation, ‘launder your money here.’”

Clashing with SBF

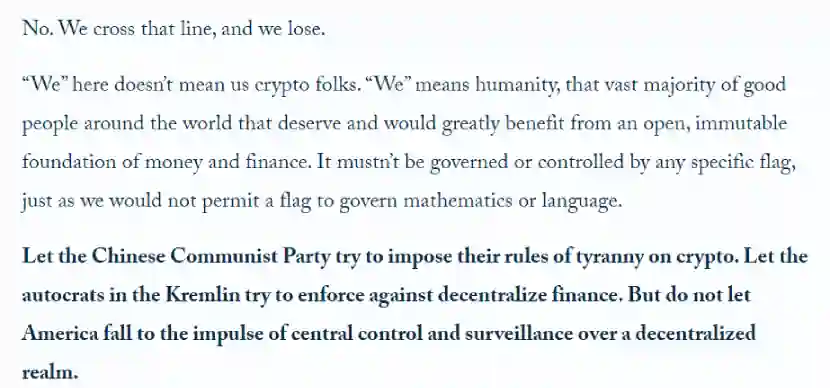

Perhaps one of the most memorable situations related to Voorhees is his spat with Sam Bankman-Fried, the founder of the now-dead crypto exchange FTX, in 2022. The argument between the two centered on the future of the crypto industry, with SBF advocating for increased regulatory oversight to ensure mainstream adoption. As it happens, SBF caused a commotion in the crypto sphere with a blog post in which he called for restrictions on who should access DeFi platforms and for cooperation with the Treasury Department’s powerful sanctions agency, Office of Foreign Assets Control (OFAC). Erik, on the other hand, argued that such measures would undermine the basic principles of decentralization and financial freedom. In his retort, he stated that submitting to OFAC would pave the way to embracing tyranny, referring to the organization’s practice of sanctioning entire nations.

(Image credit: Money & State)

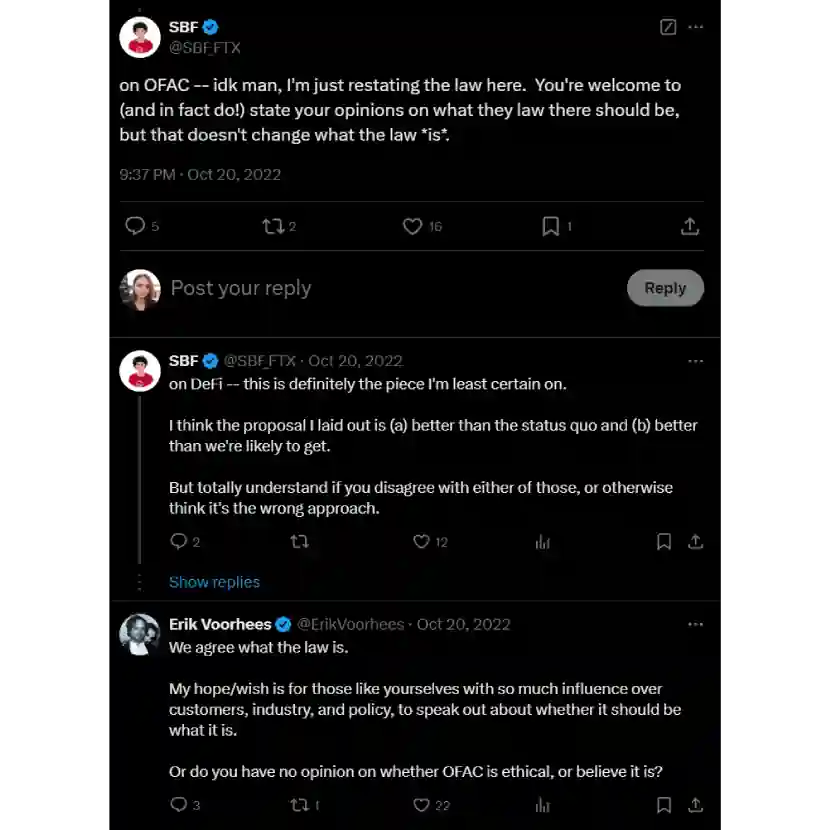

The two then carried on their debate on Twitter (now X), where SBF stated he didn’t support the OFAC regime but was simply acknowledging the realities of the existing law.

https://x.com/SBF_FTX/status/1583195766704599040

Still not reaching an agreement, they had an ultimate and extensive showdown on a podcast. The tl;dr version of the discussion from S BF’s side was that regulation was inevitable but also that nuanced interaction with regulators was moving things in a positive direction. He also believed that sacrificing smaller aspects of the ecosystem (such as licensing frontends for DeFi and GUIs targeting U.S. retail users) might be necessary or at least acceptable to protect the more critical components like immutability of smart contracts, validators, and decentralized backends. In response, Erik challenged his view, asking him what his position would be if, for instance, in email communication, “every email frontend provider required KYC from its users under the justification that we do not want people sending information back and forth to terrorists.” SBF replied that he would be strongly against this as it would go against freedom of speech, disenfranchise many people, and he wouldn’t trust it, but that the analogy didn’t stand. However, he couldn’t unambiguously explain in what way financial transactions would be different from email.

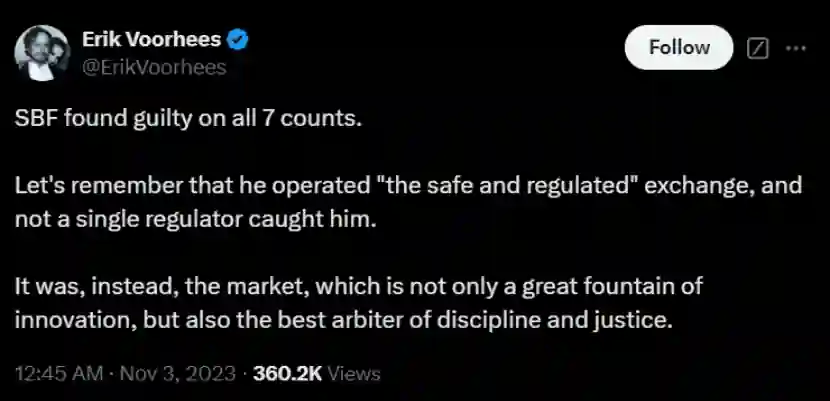

Voorhees also opined that any compromise restricting access to DeFi would lead to just another form of traditional finance rather than a complete overhaul of the system. He also argued it would stifle innovation and bring about gatekeeping, and he urged for deferring regulation entirely until public understanding of the technology solidified. While no clear resolution emerged, the debate nonetheless highlighted the ideological rift between centralized and decentralized visions for crypto’s future. At the same time, Erik’s unwavering stance, which some see as victory over SBF, earned him widespread support among crypto purists. Meanwhile, SBF, who was the founder of the later crashed crypto exchange FTX, was found guilty on seven counts of fraud committed via FTX, sentenced to 25 years in prison, and forced to pay $11 billion in fines. Voorhees in particular found such a turn of events exceptionally ironic, pointing out that SBF had operated “the safe and regulated” exchange he so fervently fought for, and it was the market that caught him in the act, not the regulators.

https://x.com/ErikVoorhees/status/1720240731711844561

Erik Voorhees Today: Venice AI and Beyond

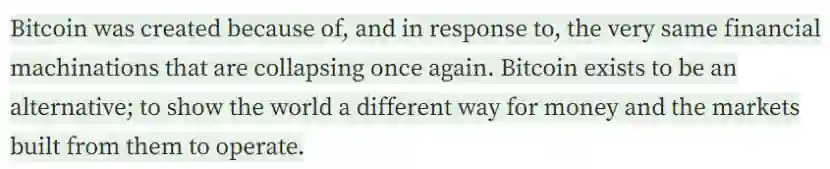

Nowadays, Erik Voorhees remains one of the most influential voices in the crypto community. His focus has shifted toward emerging technologies that intersect with blockchain, such as artificial intelligence (AI). His new venture, Venice AI, is a decentralized AI platform that seeks to provide a private and uncensored AI experience, whether through text queries, analyses, image creation, or code writing. In recent interviews, Erik has expressed optimism about the future, emphasizing that the principles of decentralization and individual liberty remain as relevant as ever. His work aligns with our beliefs at PlasBit, which underscore the importance of technological innovation in achieving financial empowerment. Beyond Venice AI, he continues to engage in public discourse, sharing his insights on platforms like Medium and YouTube. For example, in 2020, he wrote about the effect of the coronavirus on Bitcoin, highlighting the digital asset’s resilience and the fact that:

(Image credit: Erik Voorhees’ Medium)

Erik’s ideals are a reminder of the importance of sticking to decentralized values even as the crypto industry evolves and governments are out to get you.

From pine cones to Bitcoins

Erik Voorhees has gone a long way from selling pine cones in Colorado to becoming a big shot in the cryptoverse. From BitInstant and SatoshiDice to ShapeShift, his projects have left a permanent mark in the blockchain landscape and its colorful history. Even amidst SEC confrontations and public debates, Voorhees has remained a fervent advocate for financial freedom. Now, with ventures like Venice AI, he continues to promote Bitcoin as a path to sound money and true autonomy. His story is not just one of resilience and vision, but of pushing the boundaries in pursuit of a more decentralized future. This pursuit aligns closely with the core tenets expressed in PlasBit’s manifesto, which champions economic freedom, innovation, and decentralized values.